DARDEN RESTAURANTS INC0000940944false00009409442024-10-112024-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: 10/11/2024

(Date of earliest event reported)

DARDEN RESTAURANTS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 1-13666

| | | | | | | | |

| | |

| Florida | | 59-3305930 |

| (State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

1000 Darden Center Drive, Orlando, Florida 32837

(Address of principal executive offices, including zip code)

(407) 245-4000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, without par value | DRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October 11, 2024 (the “Closing Date”), Darden Restaurants, Inc., a Florida corporation (“Darden”), completed the transactions contemplated by the previously announced Agreement and Plan of Merger, dated as of July 17, 2024 (the “Merger Agreement”), by and among Chuy’s Holdings, Inc., a Delaware corporation, (“Chuy’s”), Darden and Cheetah Merger Sub Inc., a Delaware corporation and an indirect, wholly-owned subsidiary of Darden (“Merger Sub”). Pursuant to the Merger Agreement, on the Closing Date, Merger Sub was merged with and into Chuy’s (the “Merger”) with Chuy’s surviving the Merger as an indirect, wholly-owned subsidiary of Darden (the “Surviving Corporation”).

As a result of the Merger, at the effective time of the Merger (the “Effective Time”), each share of Chuy’s common stock, par value $0.01 per share, (“Chuy’s Common Stock”) was automatically canceled and (other than shares of Chuy’s Common Stock that were (1) owned or held in treasury by Chuy’s, (2) owned by Darden or Merger Sub (or any of their respective affiliates) or (3) owned by stockholders who properly exercised appraisal rights for such shares in accordance with Section 262 of the Delaware General Corporation Law, as amended) converted into the right to receive $37.50 in cash, without interest (the “Merger Consideration”).

Each restricted stock unit (the “Chuy’s RSUs”) outstanding as of immediately prior to the Effective Time was deemed to have been earned and became fully vested and was cancelled in exchange for the right to receive from Darden or the Surviving Corporation an amount in cash equal to the product obtained by multiplying (1) the number of shares of Chuy’s Common Stock subject to such Chuy’s RSU by (2) the Merger Consideration. There were no options to purchase shares of Chuy’s Common Stock outstanding as of the Effective Time.

The aggregate consideration paid by Darden to acquire the Chuy’s Common Stock was approximately $660 million (including amounts payable to the holders of the Chuy’s RSUs, as described above), which was financed with a portion of the proceeds from Darden’s previously disclosed $400 million offering of 4.350% senior notes due 2027 and a $350 million offering of 4.550% senior notes due 2029, which were issued on October 3, 2024.

On the Closing Date, Darden issued a press release announcing the closing of the Merger, a copy of which is attached hereto as Exhibit 99.1.

The foregoing description of the Merger Agreement and the transactions contemplated thereby, including the Merger, does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| 2.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| DARDEN RESTAURANTS, INC. |

| |

| By: | /s/ Matthew R. Broad |

| Matthew R. Broad |

| Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

Date: October 11, 2024

Darden Restaurants Completes Acquisition of Chuy’s Holdings, Inc.

ORLANDO, Fla., October 11, 2024 -- Darden Restaurants, Inc. (“Darden”) (NYSE:DRI) today announced that it has completed the acquisition of Chuy’s Holdings, Inc. (“Chuy’s Holdings”) in an all-cash transaction with an enterprise value of approximately $605 million. The transaction was approved by a majority of Chuy’s Holdings stockholders on October 10, 2024. This follows the merger agreement that was announced on July 17, 2024.

Darden financed the acquisition with a portion of the proceeds of a $400 million offering of 4.350% senior notes due 2027 and a $350 million offering of 4.550% senior notes due 2029, which were issued on October 3, 2024.

With the acquisition now complete, Chuy’s joins Darden’s portfolio of differentiated brands which also includes Olive Garden, LongHorn Steakhouse, Yard House, Ruth’s Chris Steak House, Cheddar’s Scratch Kitchen, The Capital Grille, Seasons 52, Eddie V’s and Bahama Breeze.

Founded in Austin, Texas in 1982, Chuy’s operates more than 100 restaurants across 15 states serving a distinct menu of authentic, made from scratch Tex-Mex inspired dishes. Chuy’s highly flavorful and freshly prepared fare is served in a fun, eclectic and irreverent atmosphere, while each location offers a unique, “unchained” look and feel, as expressed by Chuy’s motto “If you’ve seen one Chuy’s, you’ve seen one Chuy’s!”

In connection with the completion of the merger, Chuy’s Holdings common stock ceased trading on Nasdaq.

About Darden

Darden is a restaurant company featuring a portfolio of differentiated brands that include Olive Garden, LongHorn Steakhouse, Yard House, Ruth’s Chris Steak House, Cheddar’s Scratch Kitchen, The Capital Grille, Chuy’s, Seasons 52, Eddie V’s and Bahama Breeze. For more information, please visit www.darden.com.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

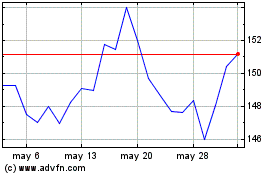

Darden Restaurants (NYSE:DRI)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Darden Restaurants (NYSE:DRI)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024