As filed with the U.S. Securities and Exchange Commission on August 9, 2024

Registration Statement No. ___

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FREYR Battery, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 93-3205681 |

(State or other jurisdiction of incorporation) | | (IRS Employer

Identification No.) |

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263

(678) 632-3112

(Address of principal executive offices, including zip code)

2021 Equity Incentive Plan (as amended and restated)

(Full title of the plan)

Tom Einar Jensen

FREYR Battery, Inc.

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263

(678) 632-3112

(Name, address and telephone number, including area code, of agent for service)

With copies to:

Denis Klimentchenko, Esq.

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

22 Bishopsgate, London EC2N 4BQ

United Kingdom

+44 (20) 7519 7000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

FREYR Battery, Inc. (the “Company” or “Registrant”) is filing this registration statement on Form S-8 (“Registration Statement”) to register 9,900,000 shares of Common Stock, par value $0.01 per share (the “Common Stock”), issuable pursuant to the Company’s 2021 Equity Incentive Plan (amended and restated as of April 22, 2024) (the “2021 Equity Incentive Plan (as amended and restated)”). At the 2024 Annual Meeting of Stockholders of the Registrant held on June 13, 2024, the Company’s stockholders approved the 2021 Equity Incentive Plan (as amended and restated), which, among other things, increased by 9,900,000 the total number of shares of Common Stock available for grant under the 2021 Equity Incentive Plan (as amended and restated) to 34,900,000.

This Registration Statement relates to securities of the same class as that to which the registration statements on (i) Form S-8 filed by FREYR Battery on December 17, 2021 and Post-Effective Amendment No. 1 to Form S-8 (Commission File No. 333-267125) and (ii) Form S-8 filed by FREYR Battery on August 10, 2023 and Post-Effective Amendment No. 1 to Form S-8 (Commission File No. 333-273862) (collectively, the “Prior Registration Statements”) relate and is submitted in accordance with General Instruction E to Form S-8 regarding the Registration of Additional Securities. Pursuant to General Instruction E of Form S-8, the contents of the Prior Registration Statements, to the extent relating to the registration of the shares of Common Stock issuable under the 2021 Equity Incentive Plan (as amended and restated), are incorporated herein by reference and made part of this Registration Statement, except as amended hereby.

PART I.

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I of the instructions to the Registration Statement will be sent or given to participants in the Incentive Plan as required by Rule 428(b)(1) of the rules promulgated under the Securities Act of 1933, as amended (the “Securities Act”). These documents are not being filed with the Securities and Exchange Commission (the “SEC”) as a part of this Registration Statement in accordance with Rule 428(b) and the Note to Part I of Form S-8.

PART II.

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

We are incorporating by reference certain information that we have filed with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The information contained in the documents that we are incorporating by reference is considered to be part of this Registration Statement, and the information that we later file with the SEC will automatically update and supersede the information contained or incorporated by reference into this Registration Statement.

a.The Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “Annual Report”). b.The portions of the Company’s Definitive Proxy Statement on Schedule 14A as filed with the SEC on April 29, 2024, that are incorporated by reference into the Annual Report. c.The Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 8, 2024. d.The Company’s Current Reports on Form 8-K, as applicable, filed with the SEC on February 29, 2024, March 21, 2024, April 18, 2024, April 19, 2024, May 8, 2024, June 6, 2024 and June 14, 2024 (excluding “furnished” and not “filed” information). e.The Company’s Current Report on Form 8-K12B filed with the SEC on January 2, 2024. f.The description of the Company’s Common Stock which is contained in Exhibit 4.5 of the Annual Report, and any report or amendment filed for the purpose of updating such description. All reports and definitive proxy or information statements filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents. Unless expressly incorporated into this Registration Statement, a report furnished but not filed on Form 8-K under the Exchange Act shall not be incorporated by reference into this Registration Statement. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

Under the Delaware General Corporation Law (the “DGCL”), a corporation must indemnify its present or former directors and officers against expenses (including attorneys’ fees) actually and reasonably incurred to the extent that the officer or director has been successful on the merits or otherwise in defense of any action, suit or proceeding brought against him or her by reason of the fact that he or she is or was a director or officer of the corporation.

The DGCL generally permits a Delaware corporation to indemnify directors and officers against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement of any action or suit for actions taken in good faith and in a manner they reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal action, which they had no reasonable cause to believe was unlawful; provided, that in an action by or in the right of the corporation such indemnification is limited to expenses (including attorneys’ fees).

The Company’s Amended and Restated Certificate of Incorporation provides that no director will be personally liable to the Company or its stockholders for monetary damages for any breach of fiduciary duty as a director. Notwithstanding the foregoing, a director shall be liable to the extent provided by applicable law (i) for any breach of the director’s or officer’s duty of loyalty to the Company or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) pursuant to Section 174 of the DGCL; or (iv) for any transaction from which the director derived an improper personal benefit.

The Company’s Amended and Restated Bylaws provides that the Company shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Company), by reason of the fact that such person is or was a director or officer of the Company, as the latter term is defined in Section 16 of the Exchange Act, or any person who is or was a director or officer of the Company serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person's conduct was unlawful.

The Company shall pay expenses (including attorneys’ fees) incurred by a director or officer of the Company in defending any civil, criminal, administrative or investigative action, suit or proceeding in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the Company. Such expenses (including attorneys’ fees) incurred by former directors and officers or other employees and agents of the Company or by persons serving at the request of the Company as directors, officers, employees or agents of another corporation, partnership, joint venture, trust or other enterprise may be so paid upon such terms and conditions, if any, as the Company deems appropriate.

The Company may purchase and maintain insurance to protect any person who is or was a director or officer of the Company, or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, or other enterprise, whether or not the Company would have the power or the obligation to indemnify him against such liability under the indemnification provisions of the Company’s Amended and Restated Bylaws.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

* Filed herewith

Item 9. Undertakings

(a) The undersigned registrant hereby undertakes:

(1). To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change

in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee”, as applicable, table in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that paragraphs (i) and (ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement

(2). That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3). To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4). The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(5). Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Oslo, Norway, on August 9, 2024.

| | | | | | | | |

| | FREYR BATTERY |

| | |

| By: | /s/ Tom Einar Jensen |

| | Name: | Tom Einar Jensen |

| | Title: | Chief Executive Officer and Director |

KNOWN TO ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Tom Einar Jensen and Joseph Evan Calio, and each of them his true and lawful attorneys-in-fact and agents, with full power of substitution and re-substitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) and supplements to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC, and hereby grants to such attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ Tom Einar Jensen | | Chief Executive Officer and Director | | August 9, 2024 |

| Tom Einar Jensen | | (Principal Executive Officer) | | |

| | | | | |

| /s/ Joseph Evan Calio | | Group Chief Financial Officer | | August 9, 2024 |

| Joseph Evan Calio | | (Principal Financial Officer) | | |

| | | | |

| | | | |

| | | | |

| | | | |

| /s/ Daniel Barcelo | | Chairman | | August 9, 2024 |

| Daniel Barcelo | | | | |

| | | | |

| /s/ Todd Jason Kantor | | Director | | August 9, 2024 |

| Todd Jason Kantor | | | | |

| | | | |

| /s/ Peter Matrai | | Director | | August 9, 2024 |

| Peter Matrai | | | | |

| | | | |

| /s/ David J. Manners | | Director | | August 9, 2024 |

| David J. Manners | | | | |

| | | | |

| /s/ Tore Ivar Slettemoen | | Director | | August 9, 2024 |

| Tore Ivar Slettemoen | | | | |

| | | | |

| /s/ Daniel Aremus Steingart | | Director | | August 9, 2024 |

| Daniel Aremus Steingart | | | | |

| | | | |

| /s/ Jessica Wirth Strine | | Director | | August 9, 2024 |

| Jessica Wirth Strine | | | | |

| | | | |

S-8

S-8

EX-FILING FEES

0001992243

FREYR Battery, Inc. /DE/

Fees to be Paid

0001992243

2024-08-07

2024-08-07

0001992243

1

2024-08-07

2024-08-07

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

FREYR Battery, Inc. /DE/

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock, par value $0.01 per share (the "Common Stock"), issuable pursuant to the Company's 2021 Equity Incentive Plan (as amended and restated).

|

Other

|

9,900,000

|

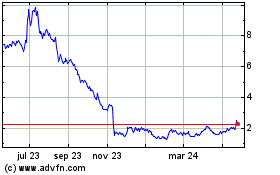

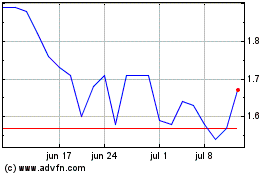

$

1.43

|

$

14,157,000.00

|

0.0001476

|

$

2,089.57

|

|

Total Offering Amounts:

|

|

$

14,157,000.00

|

|

$

2,089.57

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

2,089.57

|

|

1

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this registration statement shall also cover an indeterminate number of additional shares of Common Stock, par value $0.01 per share (the "Common Stock"), of FREYR Battery (the "Registrant") that may, with respect to the Common Stock registered hereunder, become issuable under the Registrant's 2021 Equity Incentive Plan (amended and restated as of April 22, 2024) (the "2021 Equity Incentive Plan (as amended and restated)") by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration, which results in an increase in the number of the Registrant's outstanding shares of Common Stock.

Estimated to the nearest penny.

Represents an additional 9,900,000 shares of Common Stock of the Registrant issuable under the 2021 Equity Incentive Plan (as amended and restated). The Registrant previously filed registration statements on Form S-8 (No. 333-267125 and No. 333-273862) with respect to shares of Common Stock issuable under the 2021 Equity Incentive Plan (as amended and restated).

Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and (h) under the Securities Act, on the basis of the average of the high and low prices per share of the shares of Common Stock as reported on the New York Stock Exchange on August 5, 2024.

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. Calculated in accordance with Section 6 of the Securities Act and Rule 457 under the Securities Act by multiplying 0.0001476 and the proposed maximum aggregate offering price.

The Registrant does not have any fee offsets

|

|

|

Exhibit 5.1

SKADDEN, ARPS, SLATE, MEAGHER & FLOM (UK) LLP

22 BISHOPSGATE

LONDON EC2N 4BQ

________

TEL: (020) 7519-7000

FAX: (020) 7519-7070

www.skadden.com

August 9, 2024

FREYR Battery, Inc.

6&8 East Court Square

Suite 300

Newnan, GA 30263

Re: FREYR Battery, Inc.

Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as special United States counsel to FREYR Battery, Inc., a Delaware corporation (the “Company”), in connection with the Company’s Registration Statement on Form S-8 (together with the exhibits thereto, the “Registration Statement”) to be filed on the date hereof with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933 (the “Securities Act”), relating to the registration of 9,900,000 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), issuable pursuant to the FREYR Battery, Inc. 2021 Equity Incentive Plan, amended and restated as of April 22, 2024 (the “Plan”).

This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K of the General Rules and Regulations of the Commission promulgated under the Securities Act (the “Rules and Regulations”).

FREYR Battery, Inc.

August 9, 2024

Page 2

In rendering the opinion stated herein, we have examined the following:

(a) the Registration Statement in the form to be filed with the Commission on the date hereof;

(b) the Plan;

(c) an executed copy of a certificate of Are L. Brautaset, Chief Legal Officer of the Company, dated the date hereof (the “Secretary’s Certificate”);

(d) a copy of the Company’s Amended and Restated Certificate of Incorporation (the “Current Charter”), as in effect from December 31, 2023, certified by the Secretary of State of the State of Delaware as of August 8, 2024, and certified pursuant to the Secretary’s Certificate;

(e) copies of the Company’s Amended and Restated Bylaws (the “Current Bylaws”), as in effect from December 31, 2023, and certified pursuant to the Secretary’s Certificate; and

(f) copies of certain minutes of the Board of Directors of the Company relating to the approval of the Plan and certain related matters and certified pursuant to the Secretary’s Certificate.

We have also examined originals or copies, certified or otherwise identified to our satisfaction, of such records of the Company and such agreements, certificates and receipts of public officials, certificates of officers or other representatives of the Company and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinion stated below, including the facts and conclusions set forth in the Secretary’s Certificate.

In our examination, we have assumed the genuineness of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified or photocopied copies, and the authenticity of the originals of such copies. In making our examination of executed documents, we have assumed that the parties thereto, other than the Company, had the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties. As to any facts relevant to the opinion stated herein that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives of the Company and others and of public officials, including the facts and conclusions set forth in the Secretary’s Certificate.

In rendering the opinion set forth below, we have also assumed that (i) the Shares will be issued in book-entry form and an appropriate account statement evidencing the Shares credited to a recipient’s account maintained with the Company’s transfer agent and registrar will be issued

FREYR Battery, Inc.

August 9, 2024

Page 3

by the Company’s transfer agent and registrar, (ii) each award agreement under which options, stock appreciation rights, restricted stock, restricted stock units, stock bonuses, other stock-based awards and certain other awards are granted pursuant to the Plan will be consistent with the Plan and will be duly authorized, executed and delivered by the parties thereto, (iii) the Company would continue to have sufficient authorized shares of the Common Stock, and (iv) the issuance of the Shares does not violate or conflict with any agreement or instrument binding on the Company (except that we do not make this assumption with respect to the Current Certificate of Incorporation and the Current Bylaws).

We do not express any opinion with respect to the laws of any jurisdiction other than the General Corporation Law of the State of Delaware (the “DGCL”).

Based upon the foregoing and subject to the qualifications and assumptions stated herein, we are of the opinion that the Shares have been duly authorized by all requisite corporate action on the part of the Company under the DGCL and, when the Shares are issued to the Plan participants in accordance with the terms and conditions of the Plan and the applicable award agreement for consideration in an amount at least equal to the par value of such Shares, the Shares will be validly issued, fully paid and nonassessable.

We hereby consent to the filing of this opinion with the Commission as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations. This opinion is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable laws.

Very truly yours,

/s/ Skadden, Arps, Slate, Meagher & Flom (UK) LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of FREYR Battery, Inc. of our report dated February 29, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in FREYR Battery, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers AS

Oslo, Norway

August 9, 2024

FREYR BATTERY

2021 EQUITY INCENTIVE PLAN

(amended and restated by the Board as of April 22, 2024, and approved by the Company’s shareholders on June 13, 2024)

1.Purposes of the Plan. The purposes of this Plan are (a) to attract and retain the best available personnel to ensure the Company’s success and accomplish the Company’s goals; (b) to incentivize Employees, Directors and Independent Contractors with long-term equity-based compensation to align their interests with the Company’s shareholders; and (c) to promote the success of the Company’s business.

The Plan permits the grant of Incentive Stock Options, Nonqualified Stock Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights and Stock Bonuses.

2.Definitions. As used herein, the following definitions will apply:

a.“Administrator” means the Board or any of its Committees as will be administering the Plan, in accordance with Section 4 of the Plan.

b.“Affiliate” means a Parent, a Subsidiary or any corporation or other entity that, directly or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the Company.

c.“Applicable Laws” means all applicable laws, rules, regulations and requirements, including, but not limited to, all applicable U.S. federal or state laws, rules and regulations, the rules and regulations of any stock exchange or quotation system on which the Shares is listed or quoted, and the applicable laws, rules and regulations of any other country or jurisdiction where Awards are, or will be, granted under the Plan or Participants reside or provide services to the Company or any Affiliate, as such laws, rules, and regulations shall be in effect from time to time.

d.“Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units or Stock Bonuses.

e.“Award Agreement” means the written or electronic agreement setting forth the terms and provisions applicable to each Award granted under the Plan. The Award Agreement is subject to the terms and conditions of the Plan.

f.“Board” means the Board of Directors of the Company.

g.“Cause” means, with respect to the termination of a Participant’s status as a Service Provider, except as otherwise defined in an Award Agreement, (i) in the case where there is no employment agreement, consulting agreement, change in control agreement or similar agreement in effect between the Company or an Affiliate of the Company and the Participant at the time of the grant of the Award (or where there is such an agreement but it does not define “cause” (or words of like import) or where it only applies upon the occurrence of a change in

control and one has not yet taken place): (A) any material breach by Participant of any material written agreement between Participant and the Company; (B) any failure by Participant to comply with the Company’s material written policies or rules as they may be in effect from time to time; (C) neglect or persistent unsatisfactory performance of Participant’s duties; (D) Participant’s repeated failure to follow reasonable and lawful instructions from the Board or Chief Executive Officer; (E) Participant’s indictment for, conviction of, or plea of guilty or nolo contendre to, any felony or a crime involving moral turpitude; (F) Participant’s commission of or participation in an act of fraud, embezzlement, misappropriation, misconduct or breach of fiduciary duty against the Company or any of its Subsidiaries; (G) Participant’s commission of or participation in an act that results in material damage to the Company’s business, property or reputation; or (H) Participant’s unauthorized use or disclosure of any proprietary information or trade secrets of the Company or any other party to whom the Participant owes an obligation of nondisclosure as a result of his or her relationship with the Company; or (ii) in the case where there is an employment agreement, consulting agreement, change in control agreement or similar agreement in effect between the Company or an Affiliate and the Participant at the time of the grant of the Award that defines “cause” (or words of like import), “cause” as defined under such agreement; provided, however, that with regard to any agreement under which the definition of “cause” only applies on occurrence of a change in control, such definition of “cause” shall not apply until a change in control actually takes place and then apply only with regard to a termination thereafter. For purposes of clarity, a termination without “Cause” does not include any termination that occurs solely as a result of Participant’s death or Disability. The determination as to whether a Participant’s status as a Service Provider for purposes of the Plan has been terminated for Cause shall be made in good faith by the Company and shall be final and binding on the Participant. The foregoing definition does not in any way limit the Company’s ability (or that of any Affiliate or any successor thereto, as appropriate) to terminate a Participant’s employment or consulting relationship at any time, subject to Applicable Laws.

h.“Change in Control” except as may otherwise be provided in an Award Agreement or other applicable agreement, means the occurrence of any of the following:

i.The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if the Company’s shareholders immediately prior to such merger, consolidation or reorganization cease to directly or indirectly own immediately after such merger, consolidation or reorganization at least a majority of the combined voting power of the continuing or surviving entity’s securities outstanding immediately after such merger, consolidation or reorganization;

(ii)The consummation of the sale, transfer or other disposition of all or substantially all of the Company’s assets (other than (x) to a corporation or other entity of which at least a majority of its combined voting power is owned directly or indirectly by the Company,

(y) to a corporation or other entity owned directly or indirectly by the shareholders of the Company in substantially the same proportions as their ownership of the Shares of the Company or (z) to a continuing or surviving entity described in Section 2(h)(i) in connection with a merger, consolidation or reorganization which does not result in a Change in Control under Section 2(h)(i));

(iii)A change in the effective control of the Company which occurs on the date that a majority of members of the Board is replaced during any twelve (12) month period by Directors whose appointment or election is not endorsed by a majority of the members of the Board prior to the date of the appointment or election; or

(iv)The consummation of any transaction as a result of which any Person becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing at least fifty percent (50%) of the total voting power represented by the Company’s then outstanding voting securities. For purposes of this Section 2(h), the term “Person” shall have the same meaning as when used in Sections 13(d) and 14(d) of the Exchange Act but shall exclude:

(1)a trustee or other fiduciary holding securities under an employee benefit plan of the Company or an Affiliate;

(2)a corporation or other entity owned directly or indirectly by the shareholders of the Company in substantially the same proportions as their ownership of the Shares of the Company;

(3)the Company; and

(4)a corporation or other entity of which at least a majority of its combined voting power is owned directly or indirectly by the Company.

A transaction shall not constitute a Change in Control if its sole purpose is to change the jurisdiction of the Company’s registered office or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s voting securities immediately before such transactions. In addition, if any Person (as defined above) is considered to be in effective control of the Company, the acquisition of additional control of the Company by the same Person will not be considered to cause a Change in Control. If required for compliance with Section 409A of the Code, in no event will a Change in Control be deemed to have occurred if such transaction is not also a “change in the ownership or effective control of” the Company or “a change in the ownership of a substantial portion of the assets of” the Company as determined under Treasury Regulation Section 1.409A-3(i)(5) (without regard to any alternative definition thereunder).

i.“Code” means the Internal Revenue Code of 1986, as amended. Reference to a specific section of the Code or regulation thereunder shall include such section or regulation, any valid regulation promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.

j.“Committee” means a committee of Directors or of other individuals satisfying Applicable Laws appointed by the Board in accordance with Section 4 hereof.

k.“Company” means FREYR Battery, Inc., a Delaware corporation, or any successor thereto.

l.“Determination Date” means any time when the achievement of the Performance Goals associated with the applicable Performance Period remains substantially uncertain; provided, however, that without limiting the foregoing, that if the Determination Date occurs on or before the date on which 25% of the Performance Period has elapsed, the achievement of such Performance Goals shall be deemed to be substantially uncertain.

m.“Director” means a member of the Board.

n.“Disability” means total and permanent disability as defined in Section 22(e)(3) of the Code in the case of Incentive Stock Options, and for all other Awards, means as determined pursuant to the terms of the long-term disability plan maintained by the Company; provided however, that if the Participant resides outside of the United States, “Disability” shall have such meaning as is required by Applicable Laws.

o.“Effective Date” means June 13, 2024.

p.“Employee” means any person, including Officers and Directors, employed by the Company or any Affiliate of the Company. Neither service as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment” by the Company.

q.“Exchange Act” means the Securities Exchange Act of 1934, as amended.

r.“Exchange Program” means a program under which outstanding Awards are amended to provide for a lower exercise price or surrendered or cancelled in exchange for

(i) Awards with a lower exercise price, (ii) a different type of Award or awards under a different equity incentive plan, (iii) cash, or (iv) a combination of (i), (ii) and/or (iii). Notwithstanding the preceding, the term Exchange Program does not include (i) any action described in Section 14 or any action taken in connection with a Change in Control transaction nor (ii) any transfer or other disposition permitted under Section 13. For the purpose of clarity, each of the actions described in the prior sentence, none of which constitute an Exchange Program, may be undertaken (or authorized) by the Administrator in its sole discretion without approval by the Company’s shareholders, subject only to there being sufficient authorised and unissued and not otherwise committed share capital that has not expired.

s.“Fair Market Value” means, as of any date, the value of Shares determined

as follows:

(i)If the Shares are listed on any established stock exchange or a

national market system, its Fair Market Value will be the closing sales price for such shares (or the closing bid, if no sales were reported) as quoted on such exchange or system on the day of determination, as reported in such source as the Administrator deems reliable or on the prior trading day if such day falls on the date the established stock exchange is closed for trading;

(ii)If the Shares are regularly quoted by a recognized securities dealer

but selling prices are not reported, the Fair Market Value of a Share will be the mean between the high bid and low asked prices for the Shares on the day of determination, as reported in such source as the Administrator deems reliable; or

(iii)In the absence of an established market for the Shares, the Fair

Market Value will be determined in good faith by the Administrator in compliance with Applicable Laws and regulations and in a manner that complies with Section 409A of the Code.

t.“Fiscal Year” means the fiscal year of the Company.

u.“Incentive Stock Option” means an Option that by its terms qualifies and is intended to qualify as an incentive stock option within the meaning of Section 422 of the Code and the regulations promulgated thereunder.

v.“Independent Contractor” means any person, including an advisor, consultant or agent, engaged by the Company or an Affiliate to render services to such entity or who renders, or has rendered, services to the Company, or any Affiliate and is compensated for such services.

w.“Insider” means an officer or director of the Company or any other person whose transactions in Shares are subject to Section 16 of the Exchange Act.

x.“Nonqualified Stock Option” means an Option that by its terms does not qualify or is not intended to qualify as an Incentive Stock Option.

y.“Officer” means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

z. “Option” means a stock option granted pursuant to the Plan.

aa.“Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company if each of the corporations other than the Company owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the adoption of the Plan shall be considered a Parent commencing as of such date.

bb.“Participant” means the holder of an outstanding Award.

cc.“Performance Goal” means a formula or standard determined by the Administrator with respect to each Performance Period, which may include any of the following criteria (or any other criteria determined by the Administrator in its sole discretion), with any adjustment(s) to such criteria established by the Administrator: (1) sales or non-sales revenue;

(2) return on revenues; (3) operating income; (4) income or earnings including operating income;

(5) income or earnings before or after taxes, interest, depreciation and/or amortization; (6) income or earnings from continuing operations; (7) net income; (8) pre-tax income or after-tax income; (9) net income excluding amortization of intangible assets, depreciation and impairment of goodwill and intangible assets and/or excluding charges attributable to the adoption of new accounting pronouncements; (10) raising of financing or fundraising; (11) project financing; (12)

revenue backlog; (13) gross margin; (14) operating margin or profit margin; (15) capital expenditures, cost targets, reductions and savings and expense management; (16) return on assets (gross or net), return on investment, return on capital, or return on shareholder equity; (17) cash flow, free cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, or cash flow in excess of cost of capital; (18) performance warranty and/or guarantee claims; (19) stock price or total shareholder return; (20) earnings or book value per share (basic or diluted); (21) economic value created; (22) pre-tax profit or after-tax profit; (23) strategic business criteria, consisting of one or more objectives based on meeting specified market penetration or market share, completion of strategic agreements such as licenses, joint ventures, acquisitions, and the like, geographic business expansion, objective customer satisfaction or information technology goals, intellectual property asset metrics; (24) objective goals relating to divestitures, joint ventures, mergers, acquisitions and similar transactions; (25) objective goals relating to staff management, results from staff attitude and/or opinion surveys, staff satisfaction scores, staff safety, staff accident and/or injury rates, compliance, headcount, performance management, completion of critical staff training initiatives; (26) objective goals relating to projects, including project completion, timing and/or achievement of milestones, project budget, technical progress against work plans; and (27) enterprise resource planning. Awards issued to Participants may take into account other criteria (including subjective criteria). Performance Goals may differ from Participant to Participant, Performance Period to Performance Period and from Award to Award. Any criteria used may be measured, as applicable, (i) in absolute terms, (ii) in relative terms (including, but not limited to, any increase (or decrease) over the passage of time and/or any measurement against other companies or financial or business or stock index metrics particular to the Company), (iii) on a per share and/or share per capita basis, (iv) against the performance of the Company as a whole or against any Affiliate(s), or a particular segment(s), a business unit(s) or a product(s) of the Company or individual project company, (v) on a pre-tax or after-tax basis, (vi) on a GAAP or non-GAAP basis, and/or (vii) using an actual foreign exchange rate or on a foreign exchange neutral basis.

(dd) “Performance Period” means the time period during which the Performance Goals or other vesting provisions must be satisfied for Awards. Performance Periods may be of varying and overlapping duration, at the sole discretion of the Administrator.

(ee) “Period of Restriction” means the period during which the transfer of Shares of Restricted Stock is subject to restrictions and therefore, the Shares are subject to a substantial risk of forfeiture. Such restrictions may be based on the passage of time, the achievement of target levels of performance, or the occurrence of other events as determined by the Administrator.

(ff) “Plan” means this 2021 Equity Incentive Plan, as amended.

(gg) “Restricted Stock” means Shares issued pursuant to a Restricted Stock award under Section 7 of the Plan.

(hh) “Restricted Stock Unit” means a bookkeeping entry representing an amount equal to the Fair Market Value of one Share, granted pursuant to Section 8. Each Restricted Stock Unit represents an unfunded and unsecured obligation of the Company.

(ii) “Rule 16b-3” means Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised with respect to the Plan.

(jj) “Section 16(b)” means Section 16(b) of the Exchange Act.

(kk) “Service Provider” means an Employee, Director or Independent

Contractor.

(ll) “Share” means a share of the Company, as adjusted in accordance with

Section 15 of the Plan.

(mm) “Stock Appreciation Right” means an Award, granted alone or in connection with an Option, that pursuant to Section 9 is designated as a Stock Appreciation Right.

(nn) “Stock Bonus Award” means an Award granted pursuant to Section 10 of

the Plan.

(oo) “Subsidiary” means any corporation (other than the Company) in an

unbroken chain of corporations beginning with the Company if each of the corporations other than the last corporation in the unbroken chain owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

(pp) “Tax-Related Items” means income tax, social insurance or other social contributions, national insurance, social security, payroll tax, fringe benefits tax, payment on account or other tax-related items.

3.Shares Subject to the Plan.

a.Shares Subject to the Plan. Subject to the provisions of Section 14 of the Plan, the maximum aggregate number of Shares that may be issued under the Plan is 34,900,000 Shares. The Shares may be authorized, but unissued, or reacquired. Notwithstanding the foregoing, subject to the provisions of Section 14 below, in no event shall the maximum aggregate number of Shares that may be issued under the Plan pursuant to Incentive Stock Options exceed the number set forth in this Section 3(a) plus, to the extent allowable under Section 422 of the Code and the regulations promulgated thereunder, any Shares that become available again for issuance pursuant to Sections 3(b). Subject to adjustment as provided in Section 14(a), (A) each Share with respect to which an Option or Stock Appreciation Right is granted under the Plan shall reduce the aggregate number of Shares that may be delivered under the Plan by one Share and (B) each Share with respect to which any other Award denominated and settled in Shares is granted under the Plan shall reduce the aggregate number of Shares that may be delivered under the Plan by 1.22 Shares.

b.Lapsed Awards. Subject to Applicable Laws, if all or any part of an Award is forfeited, cancelled, exchanged or surrendered, or if an Award otherwise terminates or expires without a distribution of shares to the Participant, the Shares with respect to such Award shall, to

the extent of any such forfeiture, cancellation, exchange, surrender, termination or expiration, again be available for Awards under the Plan. Notwithstanding the foregoing, Shares that are exchanged by a Participant or withheld by the Company as full or partial payment in connection with the exercise of any Option or Stock Appreciation Right under the Plan or the payment of any purchase price with respect to any other Award under the Plan, as well as any Shares exchanged by a Participant or withheld by the Company or any Subsidiary to satisfy the tax withholding obligations related to any Award under the Plan, shall not be available for subsequent Awards under the Plan, and notwithstanding that a Stock Appreciation Right is settled by the delivery of a net number of Shares, the full number of Shares underlying such Stock Appreciation Right shall not be available for subsequent Awards under the Plan.

c.Assumption or Substitution of Awards by the Company. The Administrator, from time to time, may determine to substitute or assume outstanding awards granted by another company, whether in connection with an acquisition of such other company or otherwise, by either: (a) assuming such award under this Plan or (b) granting an Award under this Plan in substitution of such other company’s award. Such assumption or substitution will be permissible if the holder of the substituted or assumed award would have been eligible to be granted an Award under this Plan if the other company had applied the rules of this Plan to such grant. In the event the Administrator elects to assume an award granted by another company, subject to the requirements of Section 409A of the Code, the purchase price or the exercise price, as the case may be, and the number and nature of Shares issuable upon exercise or settlement of any such Award will be adjusted appropriately. In the event the Administrator elects to grant a new Option in substitution rather than assuming an existing option, such new Option may be granted with a similarly adjusted exercise price. Any awards that are assumed or substituted under this Plan shall not reduce the number of Shares authorized for grant under the Plan or authorized for grant to a Participant in any fiscal year.

4.Administration of the Plan.

a.Procedure.

(i)Multiple Administrative Bodies. Subject to compliance with Applicable Law, different Committees with respect to different groups of Service Providers may administer the Plan.

(ii)Rule 16b-3. To the extent desirable to qualify transactions hereunder as exempt under Rule 16b-3, the transactions contemplated hereunder will be structured to satisfy the requirements for exemption under Rule 16b-3.

(iii)Other Administration. Other than as provided above, the Plan will be administered by (A) the Board or (B) a Committee, which committee will be constituted to satisfy Applicable Laws and will have the powers specifically delegated to it by the Board.

b.Powers of the Administrator. Subject to the provisions of the Plan and the maximum number of Shares for which issuance authority is delegated to the Administrator by the general shareholders meeting, the Administrator will have the authority, in its discretion:

(i)to determine the Fair Market Value in accordance with

Section 2(t)(iii);

(ii)to select the Service Providers to whom Awards may be granted

hereunder;

(iii) to determine the number of Shares to be covered by each Award

granted hereunder;

(iv) to approve forms of Award Agreements for use under the Plan;

(v)to determine the terms and conditions, not inconsistent with the

terms of the Plan, of any Award granted hereunder; such terms and conditions include, but are not limited to, the exercise price, the time or times when Awards may be exercised (which may be based on Performance Goals), any vesting acceleration or waiver of forfeiture restrictions, and any restriction or limitation regarding any Award or the Shares relating thereto, based in each case on such factors as the Administrator will determine;

(vi)to institute and determine the terms and conditions of an Exchange

Program; provided however, that the Administrator shall not implement an Exchange Program without the approval of the holders of a majority of the Shares that are present in person or by proxy and entitled to vote at any annual or special meeting of the Company’s shareholders subject to any higher requirements as to quorum or majority provided by Delaware Law;

(vii)to construe and interpret the terms of the Plan and Awards granted

pursuant to the Plan;

(viii)correct any defect, supply any omission or reconcile any

inconsistency in this Plan, any Award or any Award Agreement;

(ix)to prescribe, amend and rescind rules and regulations relating to the

Plan, including rules and regulations established for the purpose of satisfying non-U.S. Applicable Laws, for qualifying for favorable tax treatment under applicable non-U.S. Applicable Laws or facilitating compliance with non-U.S. Applicable Laws (sub-plans may be created for any of these purposes);

(x)to modify or amend each Award (subject to Section 21 of the Plan), including but not limited to the discretionary authority to extend the post-termination exercisability period of Awards, to accelerate vesting and to extend the maximum term of an Option (subject to Section 6(b) of the Plan regarding Incentive Stock Options);

(xi)adjust Performance Goals to take into account changes in Applicable Laws or in accounting or tax rules, or such other extraordinary, unforeseeable, nonrecurring or infrequently occurring events or circumstances as the Administrator deems necessary or appropriate to avoid windfalls or hardships;

(xii)to allow Participants to satisfy tax withholding obligations in such manner as prescribed in Section 15 of the Plan;

(xiii)to authorize any person to execute on behalf of the Company any instrument required to effect the grant of an Award previously granted by the Administrator;

(xiv)to allow a Participant to defer the receipt of the payment of cash or the delivery of Shares that would otherwise be due to such Participant under an Award; and

(xv)to make all other determinations deemed necessary or advisable for administering the Plan.

c.Effect of Administrator’s Decision. The Administrator’s decisions, determinations and interpretations will be final and binding on all Participants and any other holders of Awards. Any dispute regarding the interpretation of the Plan or any Award Agreement shall be submitted by the Participant to the Company for review. Subject to compliance with Applicable Law, any officer of the Company designated by the Board, including but not limited to Insiders, shall have the authority to review and resolve disputes with respect to Awards held by Participants who are not Insiders, and such resolution shall be final and binding on the Company and the Participant. Only the Committee shall have the authority to review and resolve disputes with respect to Awards held by Participants who are Insiders, and such resolution subject to complying with the authority given to the Board to issue Shares by the general meeting of shareholders and the delegation given by the Board to the Administrator shall be final and binding on the Company and the Participant.

d.Delegation. To the extent permitted by Applicable Laws, the Board or Committee, in its sole discretion and on such terms and conditions as it may provide, may delegate all or any part of its authority and powers under the Plan to one or more Directors or officers of the Company. To the extent permitted by Applicable Laws, the Board or Committee may delegate to one or more officers of the Company who may be (but are not required to be) Insiders (“Delegation Officers”), the authority to do any of the following (i) designate Employees who are not Insiders to be recipients of Awards, (ii) determine the number of Shares to be subject to such Awards granted to such designated Employees, and (iii) take any and all actions on behalf of the Board or Committee other than any actions that affect the amount or form of compensation of Insiders or have material tax, accounting, financial, human resource or legal consequences to the Company or its Affiliates; provided, however, that the Board or Committee resolutions regarding any delegation with respect to (i) and (ii) will specify the total number of Shares that may be subject to the Awards granted by such Delegation Officer and that such Delegation Officer may not grant an Award to himself or herself. Any Awards will be granted on the form of Award Agreement most recently approved for use by the Board or Committee, unless otherwise provided in the resolutions approving the delegation authority.

e.Administration of Awards Subject to Performance Goals. The Administrator will, in its sole discretion, determine the Performance Goals, if any, applicable to any Award (including any adjustment(s) thereto that will be applied in determining the achievement of such Performance Goals) on or prior to the Determination Date. The Performance Goals may differ from Participant to Participant and from Award to Award. The Administrator shall determine and approve the extent to which such Performance Goals have been timely achieved and the extent to which the Shares subject to such Award have thereby been earned.

f.Section 16 of the Exchange Act. Awards granted to Participants who are Insiders must be approved by two or more “non-employee directors” of the Board (as defined in the regulations promulgated under Section 16 of the Exchange Act).

g.Minimum Vesting Requirement. Notwithstanding any other provision of the Plan to the contrary, Awards granted under the Plan shall vest no earlier than the first anniversary of the date on which the Award is granted; provided, that the following Awards shall not be subject to the foregoing minimum vesting requirement: any (i) substitute Awards, (ii) Awards to Directors that vest on the earlier of the one-year anniversary of the date of grant and the next annual meeting of stockholders which is at least 50 weeks after the immediately preceding year’s annual meeting, (iii) Shares delivered in lieu of fully vested cash obligations, and (iv) any additional Awards the Administrator may grant, up to a maximum of five percent (5%) of the available share reserve authorized for issuance under the Plan pursuant to Section 3(a) (subject to adjustment under Section 14(a)); and, provided, further, that the foregoing restriction does not apply to the Administrator’s discretion to provide for accelerated exercisability or vesting of any Award in accordance with Section 4(b).

5.Award Eligibility. Nonqualified Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units and Stock Bonuses may be granted to Service Providers. Incentive Stock Options may be granted only to Employees.

6.Stock Options.

a.Limitations. Each Option will be designated in the Award Agreement as either an Incentive Stock Option or a Nonqualified Stock Option. However, notwithstanding such designation, to the extent that the aggregate Fair Market Value of the Shares with respect to which Incentive Stock Options are exercisable for the first time by the Participant during any calendar year (under all plans of the Company and any Affiliate) exceeds the maximum for Incentive Stock Options per Applicable Law, such Options will be bifurcated and treated as a Nonqualified Stock Option award. For purposes of this Section 6(a), Incentive Stock Options will be taken into account in the order in which they were granted. The Exercise Price of the Shares purchasable under an Option shall be determined by the Administrator in its sole discretion at the time of grant, but in no event shall the exercise price of an Option be less than one hundred percent (100%) of the Fair Market Value of the related Shares on the date of grant. With respect to the Administrator’s authority in Section 4(b)(x), if, at the time of any such extension, the exercise price per Share of the Option is less than the Fair Market Value of a Share, the extension shall, unless otherwise determined by the Administrator, be limited to the earlier of (1) the maximum term of the Option as set by its original terms, or

(2) ten (10) years from the grant date. Unless otherwise determined by the Administrator, any extension of the term of an Option pursuant to this Section 6(a) shall comply with Section 409A of the Code to the extent necessary to avoid taxation thereunder.

b.Term of Option. The term of each Option will be stated in the Award Agreement and will not be more than ten (10) years from the date of grant or such shorter term as may be provided in the Award Agreement or as determined by Applicable Law. Moreover, in the case of an Incentive Stock Option granted to a Participant who, at the time the Incentive Stock

Option is granted, owns stock representing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or any Affiliate, the term of the Incentive Stock Option will be five (5) years from the date of grant or such shorter term as may be provided in the Award Agreement.

c.Option Exercise Price and Consideration.

(i)Exercise Price. The per share exercise price for the Shares to be issued pursuant to exercise of an Option will be determined by the Administrator, subject to the following:

1.In the case of an Incentive Stock Option

A.granted to an Employee who, at the time the Incentive Stock Option is granted, owns stock representing more than ten percent (10%) of the voting power of all classes of stock of the Company or any Affiliate, the per Share exercise price will be no less than one hundred ten percent (110%) of the Fair Market Value per Share on the date of grant.

B.granted to any Employee other than an Employee described in paragraph (A) immediately above, the per Share exercise price will be no less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant.

2.In the case of a Nonqualified Stock Option, the per Share exercise price will be no less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant.

3.Notwithstanding the foregoing, Options may be granted with a per Share exercise price of less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant as determined by the Administrator in its sole and absolute discretion.

(ii)Waiting Period and Exercise Dates. At the time an Option is granted, the Administrator will fix the period within which the Option may be exercised and will determine any conditions that must be satisfied before the Option may be exercised. An Option may become exercisable upon completion of a specified period of service with the Company or an Affiliate and/or based on the achievement of Performance Goals during a Performance Period as set out in advance in the Participant’s Award Agreement. If an Option is exercisable based on the satisfaction of Performance Goals, then the Administrator will: (x) determine the nature, length and starting date of any Performance Period for such Option; (y) select the Performance Goals to be used to measure the performance; and (z) determine what additional vesting conditions, if any, should apply.

(iii)Form of Consideration. The Administrator will determine the acceptable form of consideration for exercising an Option, including the method of payment. In the case of an Incentive Stock Option, the Administrator will determine the acceptable form of consideration at the time of grant. Such consideration for both types of Options may, subject to Applicable Laws, consist entirely of: (1) cash; (2) wire transfer of immediately available funds,

(3) other (already issued and paid for) Shares, provided that such Shares have a Fair Market Value on the date of surrender equal to the aggregate exercise price of the Shares as to which such Option will be exercised and provided that accepting such Shares will not result in any adverse accounting consequences to the Company, as the Administrator determines (i) in its sole discretion and (ii) not be incompatible with Applicable Laws regarding the repurchase by the Company of its own shares; (4) consideration received by the Company under a broker-assisted (or other) cashless exercise program (whether through a broker or otherwise) implemented by the Company in connection with the Plan; (5) by net exercise; (6) such other consideration and method of payment for the issuance of Shares to the extent permitted by Applicable Laws; or (8) any combination of the foregoing methods of payment.

d.Exercise of Option.

(i)Procedure for Exercise; Rights as a Shareholder. Any Option granted hereunder will be exercisable according to the terms of the Plan and at such times and under such conditions as determined by the Administrator and set forth in the Award Agreement. An Option may not be exercised for a fraction of a Share.

An Option will be deemed exercised when the Company receives:

(i) a notice of exercise (in such form as the Administrator may specify from time to time) from the person entitled to exercise the Option, and (ii) full payment for the Shares with respect to which the Option is exercised (together with full payment of any applicable taxes or other amounts required to be withheld or deducted with respect to the Option). Full payment may consist of any consideration and method of payment authorized by the Administrator and permitted by the Award Agreement and the Plan. Shares issued upon exercise of an Option will be issued in the name of the Participant or, if requested by the Participant, in the name of the Participant and his or her spouse. Until the Shares are issued (as evidenced by the appropriate entry on the shareholders register of the Company or of a duly authorized transfer agent of the Company), no right to vote or receive dividends or any other rights as a shareholder will exist with respect to the Shares subject to an Option, notwithstanding the exercise of the Option. The Company will issue (or cause to be issued) such Shares or cash value of such Shares on the exercise date, in accordance with the terms of the Award Agreement, promptly after the Option is exercised. No adjustment will be made for a dividend or other right for which the record date is prior to the date the Shares are issued, except as provided in Section 14 of the Plan.

(ii)Termination of Relationship as a Service Provider. If a Participant ceases to be a Service Provider, other than upon the Participant’s termination as the result of the Participant’s death, Disability or Cause, the Participant may exercise his or her Option within such period of time as is specified in the Award Agreement to the extent that the Option is vested on the date of termination (but in no event later than the expiration of the term of such Option as set forth in the Award Agreement). In the absence of a specified time in the Award Agreement, the Option will remain exercisable for three (3) months following the Participant’s termination. Unless otherwise provided by the Administrator, if on the date of termination the Participant is not vested as to his or her entire Option, the Shares covered by the unvested portion of the Option will revert to the Plan. If after termination the Participant does not exercise his or her Option within the time specified by the Administrator, the Option will terminate, and the Shares covered by such Option will revert to the Plan.

(iii)Disability of Participant. If a Participant ceases to be a Service Provider as a result of the Participant’s Disability, the Participant may exercise his or her Option within such period of time as is specified in the Award Agreement to the extent the Option is vested on the date of termination (but in no event later than the expiration of the term of such Option as set forth in the Award Agreement). In the absence of a specified time in the Award Agreement, the Option will remain exercisable for twelve (12) months following the Participant’s termination. Unless otherwise provided by the Administrator, if on the date of termination the Participant is not vested as to his or her entire Option, the Shares covered by the unvested portion of the Option will revert to the Plan. If after termination the Participant does not exercise his or her Option within the time specified herein, the Option will terminate, and the Shares covered by such Option will revert to the Plan.

(iv)Death of Participant. If a Participant dies while a Service Provider, the Option may be exercised following the Participant’s death within such period of time as is specified in the Award Agreement to the extent that the Option is vested on the date of death (but in no event may the Option be exercised later than the expiration of the term of such Option as set forth in the Award Agreement), by the Participant’s designated beneficiary, provided such beneficiary has been designated prior to Participant’s death in a form acceptable to the Administrator. If no such beneficiary has been designated by the Participant, then such Option may be exercised by the personal representative of the Participant’s estate or by the person(s) to whom the Option is transferred pursuant to the Participant’s will or in accordance with the laws of descent and distribution. In the absence of a specified time in the Award Agreement, the Option will remain exercisable for twelve (12) months following Participant’s death. Unless otherwise provided by the Administrator, if on the date of termination the Participant is not vested as to his or her entire Option, the Shares covered by the unvested portion of the Option will revert to the Plan. If the Option is not so exercised within the time specified herein, the Option will terminate, and the Shares covered by such Option will revert to the Plan.

(v)Termination for Cause. If a Participant ceases to be a Service Provider as a result of being terminated for Cause, any outstanding Option (including any vested portion thereof) held by such Participant shall immediately terminate in its entirety upon the Participant being first notified of his or her termination for Cause and the Participant will be prohibited from exercising his or her Option from and after the date of such termination. All the Participant’s rights under any Option, including the right to exercise the Option, may be suspended pending an investigation of whether Participant will be terminated for Cause.

e.Tolling Expiration. If the exercise of an Option would violate an applicable Federal, state, local, or foreign law, or result in liability under Section 16(b), then the Option will terminate on the earlier of (i) the expiration of the term of the Option set forth in the Award Agreement or (ii) the tenth (10th) day after the last day on which such exercise would violate such applicable Federal, state, local, or foreign law or result in liability under 16(b).

f.No Dividends or Dividend Equivalents. Subject to Section 14(a), no dividends, dividend equivalents, or other distributions will be paid or accrued in connection with an unexercised Option.

7.Restricted Stock.

a.Grant of Restricted Stock. Subject to the terms and provisions of the Plan, the Administrator, at any time and from time to time, may grant Shares of Restricted Stock to Service Providers in such amounts as the Administrator, in its sole discretion, will determine.

b.Restricted Stock Agreement. Each Award of Restricted Stock will be evidenced by an Award Agreement that will specify the Period of Restriction, the number of Shares granted, and such other terms and conditions as the Administrator, in its sole discretion, will determine. Unless the Administrator determines otherwise, the Company or a direct or indirect fully owned subsidiary of the Company as escrow agent will hold Shares of Restricted Stock until the restrictions on such Shares have lapsed. These restrictions may lapse upon the completion of a specified period of service with the Company or an Affiliate and/or based on the achievement of Performance Goals during a Performance Period as set out in advance in the Participant’s Award Agreement. If the unvested Shares of Restricted Stock are being earned upon the satisfaction of Performance Goals, then the Administrator will: (x) determine the nature, length and starting date of any Performance Period for each unvested Share; (y) select the Performance Goals to be used to measure the performance; and (z) determine what additional vesting conditions, if any, should apply.

c.Transferability. Except as provided in this Section 7 or the Award Agreement, Shares of Restricted Stock may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated until the end of the applicable Period of Restriction.

d.Other Restrictions. The Administrator, in its sole discretion, may impose such other restrictions on Shares of Restricted Stock as it may deem advisable or appropriate.

e.Removal of Restrictions. Except as otherwise provided in this Section 7, Shares of Restricted Stock covered by each Restricted Stock grant made under the Plan will be released from escrow as soon as practicable after the last day of the Period of Restriction or at such other time as the Administrator may determine. The Administrator, in its discretion, may accelerate the time at which any restrictions will lapse or be removed.

f.Voting Rights. During the Period of Restriction, Service Providers holding Shares of Restricted Stock granted hereunder may exercise full voting rights with respect to those Shares, unless the Administrator determines otherwise.

g.Dividends and Other Distributions. During the Period of Restriction, Service Providers holding Shares of Restricted Stock will be entitled to receive all dividends and other distributions paid with respect to such Shares, unless the Administrator provides otherwise. Any such dividends or distributions will be subject to the same restrictions, including, without limitation, vesting and restrictions on transferability and forfeitability, as the Shares of Restricted Stock with respect to which they were paid. For the avoidance of doubt, no dividend shall be paid in connection with a Share of Restricted Stock prior to its vesting.

h.Return of Restricted Stock to Company. On the date set forth in the Award Agreement, the Restricted Stock for which restrictions have not lapsed will be forfeited and

returned without consideration as (i) treasury Shares or (ii) cancelled and the share capital of the Company decreased accordingly, in each case subject to Applicable Laws and such shares will become available for grant under the Plan.

8.Restricted Stock Units.

a.Grant. Restricted Stock Units may be granted at any time and from time to time as determined by the Administrator subject to Applicable Laws. After the Administrator determines that it will grant Restricted Stock Units under the Plan, it will advise the Participant in an Award Agreement of the terms, conditions, and restrictions (if any) related to the grant, including the number of Restricted Stock Units.

b.Vesting Criteria and Other Terms. Subject to Section 4(g) of the Plan, the Administrator will set vesting criteria in its discretion, which, depending on the extent to which the criteria are met, will determine the number of Restricted Stock Units that will be paid out to the Participant. A Restricted Stock Unit Award may vest upon completion of a specified period of service with the Company or an Affiliate and/or based on the achievement of Performance Goals during a Performance Period as set out in advance in the Participant’s Award Agreement. If Restricted Stock Units vest based upon satisfaction of Performance Goals, then the Administrator will: