Green Dot Debuts Embedded Finance Brand and Platform of Services, Arc by Green Dot

22 Octubre 2024 - 7:00AM

Business Wire

As Embedded Finance Investments Rise, Arc

Delivers End-to-End Banking and Money Movement Solutions from a

Single-Source, Seamless, Scalable Platform

New Study Sheds Light on Growth, Benefits &

Risks of Embedded Finance

Green Dot Corporation (NYSE: GDOT) today announced the launch of

Arc by Green Dot, representing a comprehensive set of embedded

finance, including banking as a service (“BaaS”), capabilities

designed to fuel engagement and growth for businesses. Arc combines

Green Dot’s secure banking and money processing solutions on a

modern, single-source platform – delivering flexible, end-to-end

solutions that can boost retention, value and expansion for

companies at every stage of growth.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241022846127/en/

“Over the past several years, we’ve invested heavily in our

platform, enabling us to build and deliver banking and payment

tools more securely and efficiently,” said George Gresham, CEO,

Green Dot. “Introducing Arc to Green Dot’s portfolio of brands

marks an exciting milestone as we continue improving and

differentiating our embedded finance platform and capabilities, and

as we power more companies with seamless banking and payment

solutions.”

A recent survey of 250 industry leaders and decision makers1

found 82% plan to increase investments in embedded finance

over the next three years, with nearly a quarter (24%) saying they

will significantly increase investments. The study also explored

key benefits and potential risks of embedded finance,

revealing:

- Top drivers of embedded finance:

nearly all decision-makers (98%) hold that embedded finance and

BaaS are key drivers of revenue and growth for their businesses; a

vast majority (91%) of leaders say it helps retain, attract or

improve customer experiences; and 66% say it improves employee

experiences and retention;

- Top risks of embedded finance:

half (50%) say increasing regulations and failure to comply is a

top risk, while more than half (58%) see increasing regulation as a

positive development for the industry. Security is also a top

concern, with 48% citing security as a top risk that comes with

investing in embedded finance.

Arc by Green Dot powers some of the world’s most trusted brands

and thousands of other businesses at all stages of growth with

seamless, secure and useful banking and payment tools and

experiences. Among its most valued services and differentiators,

Arc offers:

- Direct integration with Green Dot

Bank: providing partners with leading FDIC-insured banking

products and tools, plus regulatory and compliance expertise,

oversight and peace of mind;

- Cloud-based, modular and scalable

technology by design: flexible and configurable to meet a

wide range of business needs and goals, and to adapt as our

partners grow; and

- End-to-end banking services and program

management: supported by enterprise-grade APIs, giving

partners access to comprehensive customer support, fraud

protection, one of the largest retail deposit and ATM networks in

the U.S., and much more.

“Embedded finance is transforming banking as we know it,

offering consumers greater value and convenience while enabling

businesses to engage customers in more meaningful ways,” said

Renata Caine, GM of Banking as a Service, Green Dot. “With Arc, our

partners and their customers can benefit from the stability and

security of a registered bank, decades of experience in banking and

embedded finance, and a flexible platform that can adapt as they

grow.”

For more information on Arc and the embedded finance study,

visit greendot.com/arc.

About Arc by Green Dot

Arc is the embedded finance platform of services featuring all

of Green Dot’s secure banking and money processing capabilities

designed to fuel value, loyalty and growth for consumers and

businesses. Arc by Green Dot powers some of the world’s most

trusted brands and thousands of other businesses with seamless,

secure and useful financial tools and experiences.

Integrated with Green Dot Bank, Arc provides partners with

leading FDIC-insured banking products and tools, plus regulatory

and compliance expertise, oversight and support. The Arc platform

is cloud-based, modular and scalable by design – configurable to

meet a wide range of business needs and goals, and flexible to

adapt as our partners grow. Arc’s end-to-end banking services are

powered by enterprise-grade APIs and offer partners access to

comprehensive customer support, fraud protection, the largest

retail deposit and ATM network in the U.S., and much more. For more

information, visit greendot.com/arc.

About Green Dot

Green Dot Corporation (NYSE: GDOT) is a financial technology

platform and registered bank holding company that builds banking

and payment solutions to create value, retain and reward customers,

and accelerate growth for businesses of all sizes. For more than

two decades, Green Dot has delivered financial tools and services

that address the most pressing financial needs of consumers and

businesses, and that transform the way people and businesses manage

and move money.

Green Dot delivers a broad spectrum of financial products to

consumers and businesses through its portfolio of brands,

including: GO2bank, a leading digital and mobile bank account

offering simple, secure and useful banking for Americans living

paycheck to paycheck; the Green Dot Network (“GDN”) of more than

90,000 retail distribution and cash access locations nationwide;

Arc by Green Dot, the single-source embedded finance platform

combining all of Green Dot’s secure banking and money processing

capabilities to power businesses at all stages of growth; rapid!

wage and disbursements solutions, providing pay card and earned

wage access services to more than 6,000 businesses and their

employees; and Santa Barbara TPG (“SBTPG”), the company’s tax

division, which processes more than 14 million tax refunds

annually.

Founded in 1999, Green Dot has managed more than 80 million

accounts to date both directly and through its partners. Green Dot

Bank is a subsidiary of Green Dot Corporation and member of the

FDIC2. For more information about Green Dot’s products and

services, please visit www.greendot.com.

1 Survey was conducted by Wakefield Research among 250

decision-makers regarding embedded finance, between August 22 and

September 5, 2024, using an email invitation and an online

survey.

2 Green Dot Bank also operates under the following registered

trade names: GO2bank, GoBank and Bonneville Bank. All of these

registered trade names are used by, and refer to, a single

FDIC-insured bank, Green Dot Bank. Deposits under any of these

trade names are deposits with Green Dot Bank and are aggregated for

deposit insurance coverage up to the allowable limits.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022846127/en/

Media Contact: Alison Lubert alubert@greendotcorp.com

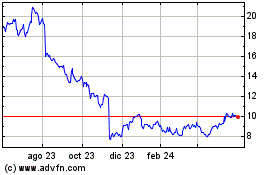

Green Dot (NYSE:GDOT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

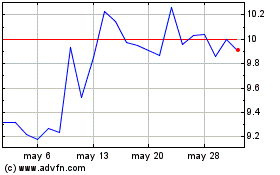

Green Dot (NYSE:GDOT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024