Howmet Aerospace Inc. Announces Pricing of Debt Offering

08 Agosto 2024 - 3:32PM

Business Wire

Howmet Aerospace Inc. (“Howmet Aerospace” or the “Company”)

(NYSE:HWM) today announced that it has priced its underwritten

public offering of $500 million aggregate principal amount of its

4.850% Notes due 2031 (the “Notes”). The offering is expected to

close on August 22, 2024, subject to customary closing

conditions.

The Company intends to use the net proceeds from the offering,

together with cash on hand, for the redemption of all of the

outstanding principal amount of approximately $577 million of its

6.875% Notes due 2025.

J.P. Morgan Securities LLC, Citigroup Global Markets Inc.,

Morgan Stanley & Co. LLC and SMBC Nikko Securities America,

Inc. are acting as joint book-running managers for the

offering.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the Notes or any other security and

shall not constitute an offer, solicitation or sale in any state or

jurisdiction in which, or to any persons to whom, such an offer,

solicitation or sale would be unlawful. The Notes are being offered

pursuant to an effective shelf registration statement previously

filed with the Securities and Exchange Commission (the “SEC”), and

a prospectus supplement and accompanying prospectus filed with the

SEC as part of the shelf registration statement. The offering is

being made only by means of a preliminary prospectus supplement and

the accompanying prospectus. Copies of these documents can be

obtained by calling J.P. Morgan Securities LLC collect at (212)

834-4533, Citigroup Global Markets Inc. toll-free at (800)

831-9146, Morgan Stanley & Co. LLC toll-free at (866) 718-1649

or SMBC Nikko Securities America, Inc. toll-free at (888) 868-6856

or by email at prospectus@smbcnikko-si.com.

About Howmet Aerospace

Howmet Aerospace Inc., headquartered in Pittsburgh,

Pennsylvania, is a leading global provider of advanced engineered

solutions for the aerospace and transportation industries. The

Company’s primary businesses focus on jet engine components,

aerospace fastening systems, and airframe structural components

necessary for mission-critical performance and efficiency in

aerospace and defense applications, as well as forged aluminum

wheels for commercial transportation.

Forward-Looking Statements

This release contains statements that relate to future events

and expectations and as such constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include those containing such

words as "anticipates", "believes", "could", "envisions",

"estimates", "expects", "forecasts", "goal", "guidance", "intends",

"may", "outlook", "plans", "projects", "seeks", "sees", "should",

"targets", "will", "would", or other words of similar meaning. All

statements that reflect Howmet Aerospace’s expectations,

assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including,

without limitation, statements, forecasts and outlook relating to

the timing and terms of the offering and the use of proceeds

therefrom; the condition of end markets; future financial results

or operating performance; future strategic actions; Howmet

Aerospace's strategies, outlook, and business and financial

prospects; and any future dividends, debt issuances, debt reduction

and repurchases of its common stock. These statements reflect

beliefs and assumptions that are based on Howmet Aerospace’s

perception of historical trends, current conditions and expected

future developments, as well as other factors Howmet Aerospace

believes are appropriate in the circumstances. Forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties and changes in circumstances that are

difficult to predict, which could cause actual results to differ

materially from those indicated by these statements. Such risks and

uncertainties include, but are not limited to: (a) deterioration in

global economic and financial market conditions generally; (b)

adverse changes in the markets served by Howmet Aerospace; (c) the

impact of potential cyber attacks and information technology or

data security breaches; (d) the loss of significant customers or

adverse changes in customers’ business or financial conditions; (e)

manufacturing difficulties or other issues that impact product

performance, quality or safety; (f) inability of suppliers to meet

obligations due to supply chain disruptions or otherwise; (g)

failure to attract and retain a qualified workforce and key

personnel, labor disputes or other employee relations issues; (h)

the inability to achieve anticipated or targeted revenue growth,

cash generation, restructuring plans, cost reductions, improvement

in profitability, or strengthening of competitiveness and

operations; (i) inability to meet increased demand, production

targets or commitments; (j) competition from new product offerings,

disruptive technologies or other developments; (k) geopolitical,

economic, and regulatory risks relating to Howmet Aerospace’s

global operations, including geopolitical and diplomatic tensions,

instabilities, conflicts and wars, as well as compliance with U.S.

and foreign trade and tax laws, sanctions, embargoes and other

regulations; (l) the outcome of contingencies, including legal

proceedings, government or regulatory investigations, and

environmental remediation, which can expose Howmet Aerospace to

substantial costs and liabilities; (m) failure to comply with

government contracting regulations; (n) adverse changes in discount

rates or investment returns on pension assets; and (o) the other

risk factors summarized in Howmet Aerospace’s Form 10-K for the

year ended December 31, 2023 and other reports filed with the SEC.

Market projections are subject to the risks discussed above and

other risks in the market. Credit ratings are not a recommendation

to buy or hold any Howmet Aerospace securities, and they may be

revised or revoked at any time at the sole discretion of the credit

rating organizations. The statements in this release are made as of

the date of this release, even if subsequently made available by

Howmet Aerospace on its website or otherwise. Howmet Aerospace

disclaims any intention or obligation to update publicly any

forward-looking statements, whether in response to new information,

future events, or otherwise, except as required by applicable

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808607735/en/

Investor Contact: Paul T. Luther (412) 553-1950

Paul.Luther@howmet.com

Media Contact: Rob Morrison (412) 553-2666

Rob.Morrison@howmet.com

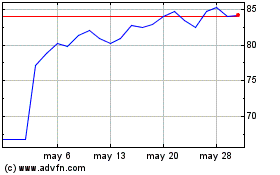

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024