0001759631FALSE00017596312024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

HYLIION HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38823 | | 83-2538002 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

1202 BMC Drive, Suite 100 Cedar Park,TX | | 78613 |

| (Address of principal executive offices) | | (Zip Code) |

(833) 495-4466

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | HYLN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Hyliion Holdings Corp. (the “Company”) issued a press release announcing certain financial and other results for the quarter ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | HYLIION HOLDINGS CORP. |

| | | | |

| | | By: | /s/ Thomas Healy |

| Date: | August 6, 2024 | | Thomas Healy |

| | | | Chief Executive Officer |

HYLIION HOLDINGS REPORTS SECOND-QUARTER 2024 FINANCIAL RESULTS

AUSTIN, Texas, August 6, 2024 – Hyliion Holdings Corp. (NYSE: HYLN) (“Hyliion”), a developer of sustainable electricity-producing technology, today reported its second-quarter 2024 financial results.

Key Business Highlights

•Secured customer commitments for all 2024 early adopter production capacity and for more than 50% of anticipated 2025 production

•Executed a letter of intent with US Energy, a leading provider of refined products, alternative fuels, and environmental credits, to deploy a KARNOTM generator at an RNG fueling station

•Executed a letter of intent with Flexnode, a producer of advanced high-performance micro data centers, for the purchase of up to 10 KARNO generator units

•Executed a memorandum of understanding with Jardine Engineering Corporation, a leading provider of power systems in Hong Kong and Macau, to collaborate on bringing KARNO technology to Asia Pacific markets

•Awarded a Small Business Innovation Research grant for the proposed development of a multi-megawatt KARNO generator for US Navy applications

•Repurchased 1.9 million shares for $2.7 million as part of the company’s $20 million Stock Repurchase Program

•Ended the quarter with $249 million of cash and investments

•Updated guidance to approximately $55 million in cash expenditures in 2024 for KARNO development including capital investments for additional additive printing machines

Executive Commentary

"Hyliion remains on track to deliver the first KARNO generator units to early adopter customers later this year," stated Thomas Healy, Hyliion’s Founder and CEO. "I am also pleased to share that more than half of our anticipated deliveries for next year have already been secured by customers. We are seeing growing interest across use cases and particularly in data center applications where grid constraints are driving the need for additional power generation capacity."

KARNO Commercial Updates

Hyliion is developing a locally deployable 200kW generator system which it intends to deliver to initial early adopter customers in late 2024. Target markets in the commercial power space include EV Charging, Data Centers, Waste Gas & Heat, Prime Power, and Mobility applications. Initial customer deployments will target these markets to demonstrate the versatility of the KARNO generator as well as key product attributes and differentiators versus competing technologies, including efficiency, emissions, fuel flexibility, and operating and maintenance costs. The company will also garner useful feedback and information on the performance of the generator in these early deployments.

Over the past quarter, customer interest in the KARNO generator has been growing, with commitments secured for all anticipated 2024 deliveries and more than half of expected

production capacity in 2025. A significant increase in interest has come from data center companies as growth in artificial intelligence strains the power grid. The KARNO generator will be well-positioned to meet these needs by delivering megawatt-scale power solutions.

Hyliion announced the execution of a letter of intent (LOI) with US Energy for a KARNO generator to be located at a renewable natural gas fueling station, aiming to provide reliable power at a lower cost than existing grid electricity and to reduce demand charges. Hyliion also executed an LOI with Flexnode, a builder of bespoke liquid-cooling-enabled data centers, for the deployment of up to 10 KARNO generators with anticipated deployments starting in 2025.

Additionally, Hyliion entered a non-binding memorandum of understanding with Jardine Engineering Corporation (JEC) to explore market potential in the Asia Pacific region and to collaborate on select power generation projects, introducing the KARNO generator in other international markets. JEC is a leading provider of power generation solutions, representing leading electric generator suppliers from the US and Europe.

The US government also awarded Hyliion a Small Business Innovation Research grant for development of a multi-megawatt KARNO generator system for US Navy applications. The company expects to share further information about this opportunity and the collaboration with JEC later in the year.

Customer commitments are executed as non-binding LOIs and are subject to the execution of definitive sales agreements prior to deliveries.

KARNO Generator Development

Development of the KARNO generator remains on track for deliveries later this year. As work to commercialize the BETA version of the KARNO generator progresses, Hyliion is continuing to test the ALPHA version and incorporating BETA design changes to ensure functionality.

During the quarter, Hyliion installed multiple additive printing machines at its Austin, Texas manufacturing facility and has begun printing components, nearly doubling overall printing capacity. Additional machines are on order and will be installed later this year and in 2025. These machines operate 24/7 and are currently producing BETA components for this year’s deliveries.

Financial Highlights and Guidance

Second quarter operating expenses totaled $14.0 million, compared to $38.5 million in the prior-year quarter. Expenses include a credit of $556 thousand driven by sales of certain assets of the discontinued powertrain business. Net loss in the second quarter was $10.9 million, compared to $35.2 million in the second quarter of 2023. Net losses for the first half of 2024 were $26.4 million, down significantly from $64.1 million in the first half of 2023. Losses in 2023 were primarily driven by spending related to Hyliion’s discontinued powertrain business.

The company repurchased 1.9 million shares of its common stock in the second quarter for $2.7 million as part of the $20 million share repurchase program announced in late 2023. A total of 10.6 million shares of common stock have been repurchased since the inception of the program at an aggregate cost of $14.0 million. Based on current market conditions, the company does not expect to execute upon further repurchases under the program in the near term but will retain the authority to execute the remaining $6 million if and as deemed appropriate.

Total changes in cash and investment balances for the quarter were $15.2 million, driven by net operating losses, share repurchases, capital expenditures, and cash generated from powertrain asset sales, net of shutdown expenditures. Total cash and investments at the end of the quarter were $249 million.

For 2024, total cash consumed for KARNO development and capital investments is expected to be approximately $55 million, up compared to the prior estimate of $40 to $50 million due to higher capital expenditures that support a more rapid build-out of additive printing capacity in Austin. This estimate excludes cash payments associated with share repurchases that have already been conducted during 2024, and payments and asset sales associated with the wind down of powertrain operations. Hyliion continues to expect it will achieve commercialization of the KARNO generator with capital on hand.

Projections for 2025 include growth of KARNO generator deliveries, with proceeds from sales in the low double-digit millions of dollars. The company is also targeting approximately break-even gross margins on a cash basis by late 2025 or early 2026, and cash spending to grow modestly compared to 2024.

About Hyliion

Hyliion is committed to creating innovative solutions that enable clean, flexible and affordable electricity production. The Company’s primary focus is to provide distributed power generators that can operate on various fuel sources to future-proof against an ever-changing energy economy. Headquartered in Austin, Texas, and with research and development in Cincinnati, Ohio, Hyliion is initially targeting the commercial and waste management industries with a locally deployable generator that can offer prime power as well as energy arbitrage opportunities. Beyond stationary power, Hyliion will address mobile applications such as vehicles and marine. The KARNO generator is a fuel-agnostic solution, enabled by additive manufacturing, that leverages a linear heat generator architecture. The Company aims to offer innovative, yet practical solutions that contribute positively to the environment in the energy economy. For further information, please visit www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Hyliion and its future financial and operational performance, as well as its strategy, future operations, estimated financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyliion expressly disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements herein, to reflect events or circumstances after the date of this press release. Hyliion cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyliion. These risks include,

but are not limited to, our status as an early stage company with a history of losses, and our expectation of incurring significant expenses and continuing losses for the foreseeable future; our ability to develop to develop key commercial relationships with suppliers and customers; our ability to retain the services of Thomas Healy, our Chief Executive Officer; the expected performance of the KARNO generator and system; the execution of the strategic shift from our powertrain business to our KARNO business, and the other risks and uncertainties described under the heading “Risk Factors” in our SEC filings including in our Annual Report (See item 1A. Risk Factors) on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 13, 2024 for the year ended December 31, 2023. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Hyliion’s operations and projections can be found in its filings with the SEC. Hyliion’s SEC Filings are available publicly on the SEC’s website at www.sec.gov, and readers are urged to carefully review and consider the various disclosures made in such filings.

Contacts

Hyliion Holdings Corp.

press@hyliion.com

Investor Relations

ir@hyliion.com

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Product sales and other | $ | — | | | $ | 266 | | | $ | — | | | $ | 576 | |

| Total revenues | — | | | 266 | | | — | | | 576 | |

| Cost of revenues | | | | | | | |

| Product sales and other | — | | | 307 | | | — | | | 998 | |

| Total cost of revenues | — | | | 307 | | | — | | | 998 | |

| Gross loss | — | | | (41) | | | — | | | (422) | |

| Operating expenses | | | | | | | |

| Research and development | 8,311 | | | 27,439 | | | 16,279 | | | 48,357 | |

| Selling, general and administrative | 6,262 | | | 11,098 | | | 12,854 | | | 22,079 | |

| Exit and termination costs | (556) | | | — | | | 3,875 | | | — | |

| Total operating expenses | 14,017 | | | 38,537 | | | 33,008 | | | 70,436 | |

| Loss from operations | (14,017) | | | (38,578) | | | (33,008) | | | (70,858) | |

| | | | | | | |

| Interest income | 3,129 | | | 3,349 | | | 6,525 | | | 6,811 | |

| Gain (loss) on disposal of assets | — | | | (1) | | | 3 | | | 1 | |

| Other income (expense), net | 32 | | | 3 | | | 32 | | | (12) | |

| Net loss | $ | (10,856) | | | $ | (35,227) | | | $ | (26,448) | | | $ | (64,058) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.06) | | | $ | (0.19) | | | $ | (0.15) | | | $ | (0.35) | |

| | | | | | | |

| Weighted-average shares outstanding, basic and diluted | 173,829,107 | | | 180,966,908 | | | 176,156,001 | | | 180,544,821 | |

HYLIION HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 19,133 | | | $ | 12,881 | |

| Accounts receivable | 373 | | | 40 | |

| Prepaid expenses and other current assets | 5,449 | | | 18,483 | |

| Short-term investments | 136,091 | | | 150,297 | |

| Assets held for sale | 3,573 | | | — | |

| Total current assets | 164,619 | | | 181,701 | |

| | | |

| Property and equipment, net | 15,781 | | | 9,987 | |

| Operating lease right-of-use assets | 6,221 | | | 7,070 | |

| Other assets | 1,266 | | | 1,439 | |

| Long-term investments | 93,476 | | | 128,186 | |

| Total assets | $ | 281,363 | | | $ | 328,383 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 1,043 | | | $ | 4,224 | |

| Current portion of operating lease liabilities | 985 | | | 847 | |

| Accrued expenses and other current liabilities | 5,485 | | | 10,051 | |

| Total current liabilities | 7,513 | | | 15,122 | |

| | | |

| Operating lease liabilities, net of current portion | 5,610 | | | 6,792 | |

| Other liabilities | 400 | | | 203 | |

| Total liabilities | 13,523 | | | 22,117 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.0001 par value; 250,000,000 shares authorized; 184,155,114 and 183,071,317 shares issued at June 30, 2024 and December 31, 2023, respectively; 173,545,044 and 183,034,255 shares outstanding as of June 30, 2024 and December 31, 2023, respectively | 18 | | | 18 | |

| Additional paid-in capital | 406,175 | | | 404,045 | |

Treasury stock, at cost; 10,610,070 and 37,062 shares as of June 30, 2024 and December 31, 2023, respectively | (14,141) | | | (33) | |

| Accumulated deficit | (124,212) | | | (97,764) | |

| Total stockholders’ equity | 267,840 | | | 306,266 | |

| Total liabilities and stockholders’ equity | $ | 281,363 | | | $ | 328,383 | |

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (26,448) | | | $ | (64,058) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 1,285 | | | 1,132 | |

| Amortization and accretion of investments, net | (1,839) | | | (789) | |

| Noncash lease expense | 849 | | | 658 | |

| Inventory write-down | — | | | 231 | |

| Gain on disposal of assets | (1,078) | | | (1) | |

| Share-based compensation | 2,445 | | | 3,761 | |

| Carrying value adjustment to assets held for sale | 5,564 | | | — | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (333) | | | 332 | |

| Inventory | — | | | (1,049) | |

| Prepaid expenses and other assets | (5,131) | | | (5,763) | |

| Accounts payable | (3,239) | | | (713) | |

| Accrued expenses and other liabilities | (4,427) | | | 3,418 | |

| Operating lease liabilities | (1,044) | | | (748) | |

| Net cash used in operating activities | (33,396) | | | (63,589) | |

| | | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment and other | (8,054) | | | (3,952) | |

| Proceeds from sale of property and equipment | 3,470 | | | 2 | |

| | | |

| Payments for security deposit, net | — | | | (45) | |

| Purchase of investments | (32,623) | | | (99,193) | |

| Proceeds from sale and maturity of investments | 83,234 | | | 95,646 | |

| Net cash provided by (used in) investing activities | 46,027 | | | (7,542) | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Proceeds from exercise of common stock options | 50 | | | 84 | |

| Taxes paid related to net share settlement of equity awards | (365) | | | (216) | |

| Repurchase of treasury stock | (13,982) | | | — | |

| Net cash used in financing activities | (14,297) | | | (132) | |

| | | |

| Net decrease in cash and cash equivalents and restricted cash | (1,666) | | | (71,263) | |

| Cash and cash equivalents and restricted cash, beginning of period | 21,464 | | | 120,133 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 19,798 | | | $ | 48,870 | |

Cover

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

HYLIION HOLDINGS CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38823

|

| Entity Tax Identification Number |

83-2538002

|

| Entity Address, Address Line One |

1202 BMC Drive,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Cedar Park,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78613

|

| City Area Code |

833

|

| Local Phone Number |

495-4466

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HYLN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001759631

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

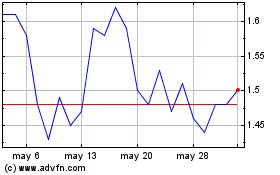

Hyliion (NYSE:HYLN)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Hyliion (NYSE:HYLN)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024