false0000216228Indiana00002162282024-08-012024-08-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: August 1, 2024

(Date of earliest event reported)

ITT INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Indiana | 001-05672 | 81-1197930 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Washington Boulevard

6th Floor

Stamford, CT 06902

(Address of principal executive offices)

(914) 641-2000

(Registrant's telephone number, including area code)

Not Applicable

Former name or former address, if changed since last report Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $1 per share | ITT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 under the Securities Exchange Act of 1934 (17 CFR 240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 1, 2024, ITT Inc. (the “Company”) issued a press release reporting the financial results for the second fiscal quarter ended June 29, 2024. A copy of the press release is attached to this Current Report on Form 8-K (“Current Report”) as Exhibit 99.1 and is incorporated by reference herein solely for purposes of this Item 2.02 disclosure.

The information in Item 2.02 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. The information in Item 2.02 of this Current Report, including Exhibit 99.1 attached hereto, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ITT Inc. |

| (Registrant) |

| | | |

August 1, 2024 | By: | /s/ Lori B. Marino |

| | Name: | Lori B. Marino |

| | Title: | Senior Vice President, General Counsel and Corporate Secretary |

| | | (Authorized Officer of Registrant) |

ITT REPORTS 2024 SECOND QUARTER EARNINGS PER SHARE (EPS) OF $1.45, ADJUSTED EPS OF $1.49; ANNOUNCES PORTFOLIO RESHAPING WITH ACQUISITION OF INTERCONNECT SOLUTIONS PROVIDER kSARIA AND DIVESTITURE OF AUTOMOTIVE COMPONENTS SUPPLIER WOLVERINE

▪9% revenue growth (6% organic) driven by higher sales volumes across all segments and the acquisition of Svanehøj

▪60 basis points operating margin expansion to 17.6%; 100 basis points adjusted operating margin expansion to 18.0%

▪11% EPS growth (12% adjusted) driven by volume, productivity and value pricing

▪Signed definitive agreement to acquire kSARIA, leading provider of highly engineered, mission critical interconnect solutions for the defense and aerospace markets and divested Wolverine Advanced Materials (Wolverine) business, manufacturer of automotive components, in July

▪Maintaining full year revenue, operating margin, EPS and cash flow guidance despite $0.15 impact from divestiture

STAMFORD, Conn., Aug. 1, 2024 – ITT Inc. (NYSE: ITT) today reported financial results for the second quarter ended June 29, 2024 and announced a reshaping of its portfolio to shift focus to higher growth and margin businesses.

In the second quarter, revenue increased 9% versus prior year (6% organic) primarily driven by Friction original equipment (OE) outperformance and aftermarket demand in Motion Technologies (MT), short cycle demand in Industrial Process (IP) and industrial connectors growth in Connect & Control Technologies (CCT). The Svanehøj and Micro-Mode acquisitions contributed 4% to total revenue growth while foreign currency translation was a 1% negative impact.

Second quarter operating income of $159 million increased 12% versus prior year (15% adjusted) primarily due to higher sales volume and productivity actions, partially offset by higher labor costs, strategic growth investments and the $7 million prior year gain on a product line sale.

EPS for the second quarter of $1.45 increased 11% versus prior year and 8% on a sequential basis primarily driven by higher operating income, partially offset by higher interest expense and acquisition amortization. Adjusted EPS of $1.49 increased 12% compared to prior year and 5% on a

sequential basis. The difference between reported and adjusted EPS is primarily due to restructuring charges and acquisition-related costs.

Net cash from operating activities for the second quarter of $158 million increased 13% versus prior year primarily driven by higher operating income and improved accounts receivable collections, partially offset by higher tax payments. Free cash flow for the quarter of $135 million increased 10% versus prior year and increased $104 million on a sequential basis.

Table 1. Second Quarter Performance

| | | | | | | | | | | | | | | | | | | | |

| Q2 2024 | | Q2 2023 | | Change |

Revenue | $ | 905.9 | | | $ | 833.9 | | | 8.6 | | % |

| Organic Growth | | | | | 6.0 | | % |

| Operating Income | $ | 159.0 | | | $ | 142.0 | | | 12.0 | | % |

| Operating Margin | 17.6 | % | | 17.0 | % | | 60 | | bps |

| Adjusted Operating Income | $ | 163.2 | | | $ | 142.0 | | | 14.9 | | % |

| Adjusted Operating Margin | 18.0 | % | | 17.0 | % | | 100 | | bps |

| Earnings Per Share | $ | 1.45 | | | $ | 1.31 | | | 10.7 | | % |

| Adjusted Earnings Per Share | $ | 1.49 | | | $ | 1.33 | | | 12.0 | | % |

Net Cash from Operating Activities | $ | 157.7 | | | $ | 139.7 | | | 12.9 | | % |

| Free Cash Flow | $ | 134.5 | | | $ | 122.1 | | | 10.2 | | % |

Note: all results unaudited; dollars in millions except for per share amounts

Management Commentary

“Once again, ITT delivered a strong performance in the second quarter, growing EPS both year-over-year and sequentially, driven by 9% sales growth with each segment contributing. Our focus on profitable growth generated 60 basis points of margin expansion whilst free cash flow improved sequentially by more than $100 million. Our recent acquisition Svanehøj grew orders by nearly 40% this quarter and won two significant awards, including pumps on the first ammonia-fueled bulk carriers and on a large European carbon capture project. Friction also continued to outperform in all regions and, in China, we grew revenue double-digits for the fifth consecutive quarter.

This quarter we have also taken a significant step in reshaping the ITT portfolio, shifting towards attractive defense and aerospace interconnect markets while reducing our automotive exposure. Today we announced both the acquisition of kSARIA and the divestiture of Wolverine. This follows three previous acquisitions to expand our flow and connector portfolios and the sale of two non-core product lines. In total, over the past two years, we have committed over $1 billion towards acquisitions. On top of that, in Q2 we repurchased $79 million of ITT shares and paid down nearly $40 million of debt. With our strong execution, portfolio actions and effective capital deployment, we continue to grow our core businesses and enhance the ITT portfolio further through M&A,” said ITT’s Chief Executive Officer and President Luca Savi.

Table 2. Second Quarter Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | | Operating Income | | Operating Margin | |

| | Q2 2024 | Reported Change | Organic Growth | | Q2 2024 | Reported Change | Adjusted Change | | Q2 2024 | Reported Change | Adjusted Change | |

| Motion Technologies | 384.5 | | 4.3 | % | 6.3 | % | | 71.2 | | 23.4 | % | 22.9 | % | | 18.5 | % | 290 bps | 280 bps | |

| Industrial Process | 330.7 | | 12.6 | % | 2.6 | % | | 65.8 | | (0.9) | % | 1.5 | % | | 19.9 | % | (270) bps | (230) bps | |

| Connect & Control Technologies | 191.8 | | 11.4 | % | 11.1 | % | | 35.4 | | 24.6 | % | 19.5 | % | | 18.5 | % | 200 bps | 130 bps | |

| | | | | | | | | | | | | |

Note: all results unaudited; excludes intercompany eliminations of $1.1; comparisons to Q2 2023

Motion Technologies revenue increased $16 million primarily due to higher sales volume in Friction OE and rail demand in KONI, partially offset by unfavorable foreign currency translation. Operating income increased $14 million primarily due to higher sales volume and lower materials cost.

Industrial Process revenue increased $37 million primarily due to the acquisition of Svanehøj, which closed in January 2024, and growth in baseline pumps and aftermarket parts and service. This was partially offset by foreign currency translation. Operating income decreased by approximately $0.6 million primarily due to higher restructuring costs, partially offset by higher sales volume and pricing.

Connect & Control Technologies revenue increased $20 million primarily driven by higher sales volumes in connectors, components for aerospace and defense, and pricing actions. Operating income increased $7 million primarily due to higher sales volume, pricing and productivity actions, partially offset by a prior year gain on sale of $7 million and higher material costs.

Strategic Portfolio Actions

ITT today announced it has signed an agreement to acquire privately held kSARIA Parent, Inc. (kSARIA) for a purchase price of approximately $475 million. The acquisition is expected to close during the third quarter of 2024, subject to the satisfaction of customary closing conditions.

kSARIA is a leading producer and supplier of mission-critical connectivity solutions for the defense and aerospace markets. The company’s products support applications for avionics, sensors, communications and networking on coveted platforms with defense prime contractors and commercial aerospace leaders. The majority of their positions are sole or primary source. kSARIA offers a combination of ruggedized fiber optic and electrical solutions with complementary service offerings. kSARIA’s proprietary engineering and manufacturing capabilities in both fiber and electrical interconnect technologies enable it to deliver mission-critical, engineered products which must survive and function in harsh environments.

“kSARIA is a great addition to CCT’s connector portfolio. The company has leading positions on marquee defense programs and long-standing relationships with its customers. kSARIA has a proven history of high teens organic growth at attractive EBITDA margins, and multiple tailwinds to drive long-term sustainable growth, including defense modernization. Like ITT, kSARIA develops customized solutions for harsh environments, which are highly complementary to our existing connector portfolio. kSARIA is also uniquely positioned to capitalize on the industry transition from electrical to fiber required for high bandwidth data transmission and weight reduction. On behalf of

everyone at ITT, I’d like to welcome kSARIA’s entire team to the ITT and Connect & Control family,” said Luca Savi, Chief Executive Officer and President of ITT.

Headquartered in New Hampshire, kSARIA has approximately 1,000 employees across six manufacturing sites in North America, and generated approximately $175 million in sales in 2023.

ITT also announced it completed in July the sale of its Wolverine business to private equity firm Center Rock Capital Partners, LP for a cash purchase price of approximately $171 million.

Wolverine, part of the Motion Technologies segment prior to the divestiture, is a developer and manufacturer of high-performance specialty coatings for critical damping and sealing applications in the automotive market. Following the divestiture, ITT’s automotive exposure will principally be in its Friction braking business, the leading supplier of brake pads for internal combustion engine, hybrid and electric vehicles worldwide, and will represent ~30% of the total ITT portfolio.

“On behalf of all ITTers, I would like to thank the Wolverine team for the value you delivered, and wish you great success in your next chapter,” said Mr. Savi.

Quarterly Dividend

The company announced today a quarterly dividend of $0.319 per share on the company’s outstanding common stock. ITT’s Board of Directors approved the cash dividend for the third quarter of 2024, which will be payable on Sept. 30, 2024, to shareholders of record as of the close of business on Sept. 3, 2024.

2024 Guidance

The company is maintaining its revenue, margin, EPS and free cash flow guidance despite the Wolverine divestiture. We continue to expect revenue growth of 9% to 12%, up 4% to 7% on an organic basis; operating margin of 16.9% to 17.5% and adjusted operating margin of 17.1% to 17.7%, up 20 to 80 bps (up 100 to 160 bps excluding acquisition dilution); full year EPS of $5.51 to $5.76 and adjusted EPS of $5.65 to $5.90, up 8% to 13% for the full year including the ~($0.15) impact from the divestiture; and free cash flow of $435 million to $475 million, representing 12% to 13% free cash flow margin for the full year.

It is not possible, without unreasonable efforts, to estimate the impacts of foreign currency fluctuations, acquisitions and certain other special items that may occur in 2024 as these items are inherently uncertain and difficult to predict. As a result, we are unable to quantify certain amounts that would be included in a reconciliation of organic revenue growth and adjusted segment operating margin to the most directly comparable GAAP financial measures without unreasonable efforts and accordingly we have not provided reconciliations for these forward-looking non-GAAP financial measures. Additionally, forward-looking GAAP operating margin and EPS guidance exclude the impact of the gain on the July 2024 divestiture of the Wolverine business. Such impact will be finalized during the third quarter of 2024.

Investor Conference Call Details

ITT’s management will host a conference call for investors on Thursday, Aug. 1 at 8:30 a.m. Eastern Time. The briefing can be accessed live via a webcast, which is available on the company’s website: https://investors.itt.com. A replay of the webcast will be available beginning two hours after the webcast. Reconciliations of non-GAAP financial performance metrics to their most comparable U.S. GAAP financial performance metrics are defined and presented below and should not be considered a substitute for, nor superior to, the financial data prepared in accordance with U.S. GAAP.

Investor Contact

Mark Macaluso

+1 914-641-2064

mark.macaluso@itt.com

Media Contact

Phil Terrigno

+1 914-641-2143

phil.terrigno@itt.com

Safe Harbor Statement

This release contains “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. In addition, the conference call (including the financial results presentation material) may include, and officers and representatives of ITT may from time to time make and discuss, projections, goals, assumptions, and statements that may constitute “forward-looking statements”. These forward-looking statements are not historical facts, but rather represent only a belief regarding future events based on current expectations, estimates, assumptions and projections about our business, future financial results and the industry in which we operate, and other legal, regulatory, and economic developments. These forward-looking statements include, but are not limited to, future strategic plans and other statements that describe the company’s business strategy, outlook, objectives, plans, intentions or goals, and any discussion of future events and future operating or financial performance.

We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “guidance,” “project,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” and other similar expressions to identify such forward-looking statements. Forward-looking statements are uncertain and, by their nature, many are inherently unpredictable and outside of ITT’s control, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed or implied in, or reasonably inferred from, such forward-looking statements.

Where in any forward-looking statement we express an expectation or belief as to future results or events, such expectation or belief is based on current plans and expectations of our management, expressed in good faith and believed to have a reasonable basis. However, we cannot provide any assurance that the expectation or belief will occur or that anticipated results will be achieved or accomplished.

Among the factors that could cause our results to differ materially from those indicated by forward-looking statements are risks and uncertainties inherent in our business including, without limitation:

•uncertain global economic and capital markets conditions, which have been influenced by heightened geopolitical tensions, inflation, changes in monetary policies, the threat of a possible regional or global economic recession, trade disputes between the U.S. and its trading partners, political and social unrest, and the availability and fluctuations in prices of energy and commodities, including steel, oil, copper and tin;

•fluctuations in interest rates and the impact of such fluctuations on customer behavior and on our cost of debt;

•fluctuations in foreign currency exchange rates and the impact of such fluctuations on our revenues, customer demand for our products and on our hedging arrangements;

•volatility in raw material prices and our suppliers’ ability to meet quality and delivery requirements;

•impacts and risk of liabilities from recent mergers, acquisitions, or venture investments, and past divestitures and spin-offs;

•our inability to hire or retain key personnel;

•failure to compete successfully and innovate in our markets;

•failure to manage the distribution of products and services effectively;

•failure to protect our intellectual property rights or violations of the intellectual property rights of others;

•the extent to which there are quality problems with respect to manufacturing processes or finished goods;

•the risk of cybersecurity breaches or failure of any information systems used by the Company, including any flaws in the implementation of any enterprise resource planning systems;

•loss of or decrease in sales from our most significant customers;

•risks due to our operations and sales outside the U.S. and in emerging markets, including the imposition of tariffs and trade sanctions;

•fluctuations in demand or customers’ levels of capital investment, maintenance expenditures, production, and market cyclicality;

•the risk of material business interruptions, particularly at our manufacturing facilities;

•risks related to government contracting, including changes in levels of government spending and regulatory and contractual requirements applicable to sales to the U.S. government;

•fluctuations in our effective tax rate, including as a result of changing tax laws and other possible tax reform legislation in the U.S. and other jurisdictions;

•changes in environmental laws or regulations, discovery of previously unknown or more extensive contamination, or the failure of a potentially responsible party to perform;

•failure to comply with the U.S. Foreign Corrupt Practices Act (or other applicable anti-corruption legislation), export controls and trade sanctions; and

•risk of product liability claims and litigation.

More information on factors that could cause actual results or events to differ materially from those anticipated is included in our Annual Report on Form 10-K for the year ended December 31, 2023 (particularly under the caption "Risk Factors"), our Quarterly Reports on Form 10-Q and in other documents we file from time to time with the SEC.

The forward-looking statements included in this release speak only as of the date hereof. We undertake no obligation (and expressly disclaim any obligation) to update any forward-looking statements, whether written or oral or as a result of new information, future events or otherwise.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 29,

2024 | | July 1,

2023 | | June 29,

2024 | | July 1,

2023 |

| Revenue | $ | 905.9 | | | $ | 833.9 | | | $ | 1,816.5 | | | $ | 1,631.8 | |

| Cost of revenue | 589.8 | | | 553.9 | | | 1,199.6 | | | 1,089.9 | |

| Gross profit | 316.1 | | | 280.0 | | | 616.9 | | | 541.9 | |

| General and administrative expenses | 76.8 | | | 68.4 | | | 148.3 | | | 136.7 | |

| Sales and marketing expenses | 50.6 | | | 43.9 | | | 100.7 | | | 86.8 | |

| Research and development expenses | 29.7 | | | 25.7 | | | 59.7 | | | 52.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 159.0 | | | 142.0 | | | 308.2 | | | 266.3 | |

Interest expense | 7.4 | | | 4.5 | | | 15.1 | | | 11.2 | |

Interest income | (1.6) | | | (2.0) | | | (3.4) | | | (4.6) | |

Other non-operating income, net | (0.2) | | | — | | | (1.7) | | | (0.6) | |

Income before income tax expense | 153.4 | | | 139.5 | | | 298.2 | | | 260.3 | |

| Income tax expense | 33.0 | | | 30.6 | | | 65.8 | | | 50.7 | |

| | | | | | | |

| | | | | | | |

| Net income | 120.4 | | | 108.9 | | | 232.4 | | | 209.6 | |

| Less: Income attributable to noncontrolling interests | 1.2 | | | 0.7 | | | 2.2 | | | 1.4 | |

| Net income attributable to ITT Inc. | $ | 119.2 | | | $ | 108.2 | | | $ | 230.2 | | | $ | 208.2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Earnings per share attributable to ITT Inc.: | | | | | | | |

Basic | $ | 1.45 | | | $ | 1.31 | | | $ | 2.80 | | | $ | 2.52 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Diluted | $ | 1.45 | | | $ | 1.31 | | | $ | 2.79 | | | $ | 2.51 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average common shares – basic | 82.0 | | | 82.4 | | | 82.1 | | | 82.5 | |

| Weighted average common shares – diluted | 82.4 | | | 82.6 | | | 82.5 | | | 82.8 | |

CONSOLIDATED CONDENSED BALANCE SHEETS (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | |

| As of the Period Ended | June 29,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 425.5 | | | $ | 489.2 | |

| Receivables, net | 706.3 | | | 675.2 | |

| Inventories | 564.3 | | | 575.4 | |

| Other current assets | 137.3 | | | 117.9 | |

| Current assets held for sale | 92.5 | | | — | |

| Total current assets | 1,925.9 | | | 1,857.7 | |

| Non-current assets: | | | |

| Plant, property and equipment, net | 543.8 | | | 561.0 | |

| Goodwill | 1,200.9 | | | 1,016.3 | |

| Other intangible assets, net | 296.9 | | | 116.6 | |

| Other non-current assets | 382.8 | | | 381.0 | |

| Non-current assets held for sale | 60.0 | | | — | |

| Total non-current assets | 2,484.4 | | | 2,074.9 | |

| Total assets | $ | 4,410.3 | | | $ | 3,932.6 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | 357.5 | | | $ | 187.7 | |

| Accounts payable | 430.9 | | | 437.0 | |

| Accrued and other current liabilities | 423.6 | | | 413.1 | |

| Current liabilities held for sale | 29.4 | | | — | |

| Total current liabilities | 1,241.4 | | | 1,037.8 | |

| Non-current liabilities: | | | |

| Long-term debt | 190.0 | | | 5.7 | |

| Postretirement benefits | 131.8 | | | 138.7 | |

| Other non-current liabilities | 252.4 | | | 211.3 | |

| Non-current liabilities held for sale | 5.5 | | | — | |

| Total non-current liabilities | 579.7 | | | 355.7 | |

| Total liabilities | 1,821.1 | | | 1,393.5 | |

| Shareholders’ equity: | | | |

| Common stock: | | | |

Authorized – 250.0 shares, $1 par value per share | | | |

Issued and outstanding – 81.7 shares and 82.1 shares, respectively | 81.7 | | | 82.1 | |

| Retained earnings | 2,877.7 | | | 2,778.0 | |

| Accumulated other comprehensive income (loss): | | | |

| Postretirement benefits | (3.3) | | | (1.6) | |

| Cumulative translation adjustments | (379.5) | | | (330.3) | |

| Total accumulated other comprehensive loss | (382.8) | | | (331.9) | |

| Total ITT Inc. shareholders’ equity | 2,576.6 | | | 2,528.2 | |

| Noncontrolling interests | 12.6 | | | 10.9 | |

| Total shareholders’ equity | 2,589.2 | | | 2,539.1 | |

| Total liabilities and shareholders’ equity | $ | 4,410.3 | | | $ | 3,932.6 | |

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

(IN MILLIONS)

| | | | | | | | | | | |

For the Six Months Ended | June 29,

2024 | | July 1,

2023 |

| Operating Activities | | | |

| Income from continuing operations attributable to ITT Inc. | $ | 230.2 | | | $ | 208.2 | |

| Adjustments to income from continuing operations: | | | |

| Depreciation and amortization | 66.0 | | | 53.8 | |

| Equity-based compensation | 13.7 | | | 10.1 | |

| Gain on sale of business | — | | | (7.2) | |

| | | |

| | | |

| | | |

| Other non-cash charges, net | 15.7 | | | 16.6 | |

| | | |

| Changes in assets and liabilities: | | | |

| Change in receivables | (60.4) | | | (58.6) | |

| Change in inventories | (5.1) | | | (31.4) | |

| Change in contract assets | (20.7) | | | (2.9) | |

| Change in contract liabilities | 15.5 | | | 12.0 | |

| Change in accounts payable | 8.2 | | | 8.9 | |

| Change in accrued expenses | (26.1) | | | 15.5 | |

| Change in income taxes | (13.6) | | | (8.1) | |

| Other, net | (7.9) | | | (19.1) | |

| Net Cash – Operating Activities | 215.5 | | | 197.8 | |

| Investing Activities | | | |

| Capital expenditures | (50.9) | | | (46.3) | |

| Proceeds from sale of business | — | | | 10.5 | |

| | | |

| Acquisitions, net of cash acquired | (407.5) | | | (79.3) | |

| | | |

| | | |

| Other, net | (2.2) | | | (4.7) | |

| Net Cash – Investing Activities | (460.6) | | | (119.8) | |

| Financing Activities | | | |

| Commercial paper, net borrowings | 169.5 | | | (61.0) | |

| | | |

| | | |

Long-term debt issued, net of debt issuance costs | 299.1 | | | — | |

| Long-term debt, repayments | (109.3) | | | (1.1) | |

| Share repurchases under repurchase plan | (79.0) | | | (60.0) | |

| Payments for taxes related to net share settlement of stock incentive plans | (12.8) | | | (6.4) | |

| Dividends paid | (52.6) | | | (48.1) | |

| Other, net | (1.1) | | | 0.3 | |

| Net Cash – Financing Activities | 213.8 | | | (176.3) | |

| Exchange rate effects on cash and cash equivalents | (17.2) | | | (0.4) | |

| Net cash – operating activities of discontinued operations | (0.1) | | | (0.2) | |

| Net change in cash and cash equivalents | (48.6) | | | (98.9) | |

Less: Cash classified within current assets held for sale | (14.9) | | | — | |

Cash and cash equivalents – beginning of year (includes restricted cash of $0.7 and $0.7, respectively) | 489.9 | | | 561.9 | |

Cash and Cash Equivalents – End of Period (includes restricted cash of $0.9 and $0.9, respectively) | $ | 426.4 | | | $ | 463.0 | |

Supplemental Disclosures of Cash Flow and Non-Cash Information: | | | |

| Cash paid for Interest | $ | 13.7 | | | $ | 8.5 | |

| Cash paid for Income taxes, net of refunds received | $ | 69.8 | | | $ | 52.8 | |

| Capital expenditures included in accounts payable | $ | 22.4 | | | $ | 14.0 | |

Key Performance Indicators and Non-GAAP Measures

ITT reviews a variety of key performance indicators including revenue, operating income and margin, earnings per share, order growth, and backlog. In addition, we consider certain measures to be useful to management and investors when evaluating our operating performance for the periods presented. These measures provide a tool for evaluating our ongoing operations and management of assets from period to period. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives, including, but not limited to, acquisitions, dividends, and share repurchases. Some of these metrics, however, are not measures of financial performance under accounting principles generally accepted in the United States of America (GAAP) and should not be considered a substitute for measures determined in accordance with GAAP. We consider the following non-GAAP measures, which may not be comparable to similarly titled measures reported by other companies, to be key performance indicators for purposes of our reconciliation tables.

Organic Revenues and organic orders are defined, respectively, as revenue and orders, excluding the impacts of foreign currency fluctuations and acquisitions. The period-over period change resulting from foreign currency fluctuations is estimated using a fixed exchange rate for both the current and prior periods. We believe that reporting organic revenue and organic orders provides useful information to investors by helping identify underlying trends in our business and facilitating comparisons of our revenue performance with prior and future periods and to our peers.

Adjusted Operating Income is defined as operating income adjusted to exclude special items that include, but are not limited to, restructuring, divestiture-related costs, certain asset impairment charges, certain acquisition-related impacts, and unusual or infrequent operating items. Special items represent charges or credits that impact current results, which management views as unrelated to the Company's ongoing operations and performance. Adjusted Operating Margin is defined as adjusted operating income divided by revenue. We believe these financial measures are useful to investors and other users of our financial statements in evaluating ongoing operating profitability, as well as in evaluating operating performance in relation to our competitors.

Adjusted Income from Continuing Operations is defined as income from continuing operations attributable to ITT Inc. adjusted to exclude special items that include, but are not limited to, restructuring, divestiture-related costs, certain asset impairment charges, certain acquisition-related impacts, income tax settlements or adjustments, and unusual or infrequent items. Special items represent charges or credits, on an after-tax basis, that impact current results, which management views as unrelated to the Company’s ongoing operations and performance. The after-tax basis of each special item is determined using the jurisdictional tax rate of where the expense or benefit occurred. Adjusted Income from Continuing Operations per Diluted Share (Adjusted EPS) is defined as adjusted income from continuing operations divided by diluted weighted average common shares outstanding. We believe that adjusted income from continuing operations and adjusted EPS are useful to investors and other users of our financial statements in evaluating ongoing operating profitability, as well as in evaluating operating performance in relation to our competitors.

Free Cash Flow is defined as net cash provided by operating activities less capital expenditures. Free Cash Flow Margin is defined as free cash flow divided by revenue. We believe that free cash flow and free cash flow margin provides useful information to investors as it provides insight into a primary cash flow metric used by management to monitor and evaluate cash flows generated by our operations.

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Revenue to Organic Revenue | |

| | | | | | | | | | | | | |

| | Second Quarter 2024 | | | |

| | MT | IP | CCT | Elim | Total | | | | | | | |

| Revenue | $ | 384.5 | | $ | 330.7 | | $ | 191.8 | | $ | (1.1) | | $ | 905.9 | | | | | | | | |

| Less: Acquisitions | — | | 33.4 | | 1.6 | | — | | 35.0 | | | | | | | | |

| Less: FX | (7.6) | | (3.9) | | (1.2) | | 0.1 | | (12.6) | | | | | | | | |

| CY Organic Revenue | 392.1 | | 301.2 | | 191.4 | | (1.2) | | 883.5 | | | | | | | | |

| Less: PY Revenue | 368.8 | | 293.6 | | 172.2 | | (0.7) | | 833.9 | | | | | | | | |

| Organic Revenue Growth - $ | $ | 23.3 | | $ | 7.6 | | $ | 19.2 | | $ | (0.5) | | $ | 49.6 | | | | | | | | |

| Organic Revenue Growth - % | 6.3 | % | 2.6 | % | 11.1 | % | | 6.0 | % | | | | | | | |

| | | | | | | | | | | | | |

| Reported Revenue Growth - $ | $ | 15.7 | | $ | 37.1 | | $ | 19.6 | | | $ | 72.0 | | | | | | | | |

| Reported Revenue Growth - % | 4.3 | % | 12.6 | % | 11.4 | % | | 8.6 | % | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Reconciliation of Orders to Organic Orders | |

| | | | | | | | | | | | | |

| | Second Quarter 2024 | | | |

| | MT | IP | CCT | Elim | Total | | | | | | | |

| Orders | $ | 386.6 | | $ | 350.8 | | $ | 192.4 | | $ | (0.5) | | $ | 929.3 | | | | | | | | |

| Less: Acquisitions | — | | 47.1 | | 1.0 | | — | | 48.1 | | | | | | | | |

| Less: FX | (7.2) | | (2.2) | | (1.1) | | — | | (10.5) | | | | | | | | |

| CY Organic Orders | 393.8 | | 305.9 | | 192.5 | | (0.5) | | 891.7 | | | | | | | | |

| Less: PY Orders | 376.7 | | 343.0 | | 198.5 | | (0.7) | | 917.5 | | | | | | | | |

| Organic Orders Growth - $ | $ | 17.1 | | $ | (37.1) | | $ | (6.0) | | | $ | (25.8) | | | | | | | | |

| Organic Orders Growth - % | 4.5 | % | (10.8) | % | (3.0) | % | | (2.8) | % | | | | | | | |

| | | | | | | | | | | | | |

| Reported Orders Growth - $ | $ | 9.9 | | $ | 7.8 | | $ | (6.1) | | | $ | 11.8 | | | | | | | | |

| Reported Orders Growth - % | 2.6 | % | 2.3 | % | (3.1) | % | | 1.3 | % | | | | | | | |

| | | | | | | | | | | | | |

| Note: Immaterial differences due to rounding. | | | | | | | |

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliations of Operating Income/Margin to Adjusted Operating Income/Margin |

| Second Quarter 2024 | | Second Quarter 2023 |

| MT | IP | CCT | Corporate | ITT | | MT | IP | CCT | Corporate | ITT |

| Reported Operating Income | $ | 71.2 | | $ | 65.8 | | $ | 35.4 | | $ | (13.4) | | $ | 159.0 | | | $ | 57.7 | | $ | 66.4 | | $ | 28.4 | | $ | (10.5) | | $ | 142.0 | |

| | | | | | | | | | | |

| Restructuring costs | 1.6 | | 1.6 | | 0.7 | | — | | 3.9 | | | 0.1 | | 0.4 | | 0.1 | | — | | 0.6 | |

| Acquisition-related expenses | — | | 0.7 | | — | | — | | 0.7 | | | — | | — | | 1.8 | | — | | 1.8 | |

Impacts related to Russia-Ukraine war | (0.4) | | — | | — | | — | | (0.4) | | | 1.1 | | 0.3 | | — | | — | | 1.4 | |

Other [a] | — | | — | | — | | — | | — | | | — | | — | | (0.1) | | (3.7) | | (3.8) | |

| Adjusted Operating Income | $ | 72.4 | | $ | 68.1 | | $ | 36.1 | | $ | (13.4) | | $ | 163.2 | | | $ | 58.9 | | $ | 67.1 | | $ | 30.2 | | $ | (14.2) | | $ | 142.0 | |

| Change in Operating Income | 23.4 | % | (0.9) | % | 24.6 | % | 27.6 | % | 12.0 | % | | | | | | |

| Change in Adjusted Operating Income | 22.9 | % | 1.5 | % | 19.5 | % | (5.6) | % | 14.9 | % | | | | | | |

| | | | | | | | | | | |

| Reported Operating Margin | 18.5 | % | 19.9 | % | 18.5 | % | | 17.6 | % | | 15.6 | % | 22.6 | % | 16.5 | % | | 17.0 | % |

| Impact of special item adjustments | 30 bps | 70 bps | 30 bps | | 40 bps | | 40 bps | 30 bps | 100 bps | | 0 bps |

| Adjusted Operating Margin | 18.8 | % | 20.6 | % | 18.8 | % | | 18.0 | % | | 16.0 | % | 22.9 | % | 17.5 | % | | 17.0 | % |

| Change in Operating Margin | 290 bps | -270 bps | 200 bps | | 60 bps | | | | | | |

| Change in Adjusted Operating Margin | 280 bps | -230 bps | 130 bps | | 100 bps | | | | | | |

| | | | | | | | | | | |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | |

Note: Immaterial differences due to rounding. |

| [a] 2023 includes income from a recovery of costs associated with the 2020 lease termination of a legacy site. |

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Reported vs. Adjusted Income from Continuing Operating and Diluted EPS |

| | Income from Continuing Operations | | Diluted Earnings per Share |

| | Q2 2024 | Q2 2023 | % Change | | | | | Q2 2024 | Q2 2023 | % Change | | | |

| Reported | $ | 119.2 | | $ | 108.2 | | 10.2 | % | | | | | $ | 1.45 | | $ | 1.31 | | 10.7 | % | | | |

| Special Items Expense / (Income): | | | | | | | | | | | | | |

| Restructuring costs | 3.9 | | 0.6 | | | | | | | 0.04 | | 0.01 | | | | | |

| Acquisition-related costs [a] | 0.7 | | 1.8 | | | | | | | 0.01 | | 0.02 | | | | | |

| Impacts related to Russia-Ukraine war | (0.4) | | 1.4 | | | | | | | — | | 0.02 | | | | | |

| Other [b] | — | | (3.8) | | | | | | | — | | (0.05) | | | | | |

| Tax (benefit) expense of adjustments [c] | (0.9) | | (0.4) | | | | | | | (0.01) | | — | | | | | |

| Tax-related special items [d] | — | | 2.0 | | | | | | | — | | 0.02 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Adjusted | $ | 122.5 | | $ | 109.8 | | 11.6 | % | | | | | $ | 1.49 | | $ | 1.33 | | 12.0 | % | | | |

| | | | | | | | | | | | | | |

| Note: Amounts may not calculate due to rounding. | | | | | | | |

| Per share amounts are based on diluted weighted average common shares outstanding. | | | | | | | |

| | | | | | | | | | | | | | |

[a] | Acquisition-related costs for 2024 and 2023 are associated with the Svanehøj and Micro Mode acquisitions, respectively. |

[b] | 2023 primarily includes income from a recovery of costs associated with the 2020 lease termination of a legacy site ($3.7M). |

[c] | The tax impact of each adjustment is determined using the jurisdictional tax rate of where the expense or benefit occurred. |

[d] | 2024 includes a tax benefit to record a net operating loss deferred tax asset related to a prior year acquisition ($2.0M), tax expense on distributions of non-U.S. income ($1.0M), and other tax-related special items ($1.0M). 2023 includes tax expense on distributions of non-U.S. income ($1.2M), and other tax-related special items ($0.8M). |

| |

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP vs Adjusted EPS Guidance - Full Year 2024 |

| | | | | | |

| | | | | 2024 Full-Year Guidance |

| | | | | Low | High |

| EPS from Continuing Operations - GAAP [a] | | | | $ | 5.51 | | $ | 5.76 | |

| Estimated restructuring | | | | 0.06 | | 0.06 | |

| Other special items | | | | 0.06 | | 0.06 | |

| Tax on special Items | | | | 0.02 | | 0.02 | |

| EPS from Continuing Operations - Adjusted | | | | $ | 5.65 | | $ | 5.90 | |

| | | | | | |

[a] | This forward-looking information excludes the impact of the gain on the July 2024 divestiture of the Wolverine business. Such impact will be finalized during the third quarter of 2024. |

| | | | | | |

| Note: The Company has provided forward-looking non-GAAP financial measures for organic revenue growth and adjusted operating margin. It is not possible, without unreasonable efforts, to estimate the impacts of foreign currency fluctuations, acquisitions, and certain other special items that may occur in 2024 as these items are inherently uncertain and difficult to predict. As a result, the Company is unable to quantify certain amounts that would be included in a reconciliation of organic revenue growth and adjusted operating margin to the most directly comparable GAAP financial measures without unreasonable efforts and accordingly has not provided reconciliations for these forward looking non-GAAP financial measures. Additionally, forward-looking GAAP operating margin guidance excludes the impact of the gain on the July 2024 divestiture of the Wolverine business. Such impact will be finalized during the third quarter of 2024. |

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Cash from Operating Activities to Free Cash Flow | |

| | | | | | | FY 2024 Guidance | |

| 3M 2024 | 3M 2023 | | 6M 2024 | 6M 2023 | | Low | High | |

| Net Cash - Operating Activities | $ | 157.7 | | $ | 139.7 | | | $ | 215.5 | | $ | 197.8 | | | $ | 590.0 | | $ | 630.0 | | |

| Less: Capital expenditures | 23.2 | | 17.6 | | | 50.9 | | 46.3 | | | 155.0 | | 155.0 | | |

| Free Cash Flow | $ | 134.5 | | $ | 122.1 | | | $ | 164.6 | | $ | 151.5 | | | $ | 435.0 | | $ | 475.0 | | |

| | | | | | | | | |

| Revenue | $ | 905.9 | | $ | 833.9 | | | $ | 1,816.5 | | $ | 1,631.8 | | | $ | 3,625.0 | | $ | 3,625.0 | | [a] |

| Free Cash Flow Margin | 14.8 | % | 14.6 | % | | 9.1 | % | 9.3 | % | | 12 | % | 13 | % | |

| | | | | | | | | |

[a] Revenue included in the full year 2024 free cash flow margin guidance represents the expected revenue growth mid-point. | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

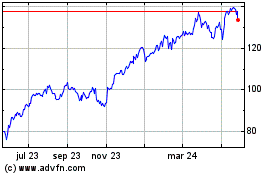

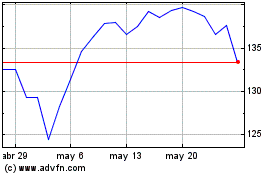

ITT (NYSE:ITT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

ITT (NYSE:ITT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024