0001492691false00014926912024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Knight-Swift Transportation Holdings Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-35007 | | 20-5589597 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2002 West Wahalla Lane

Phoenix, Arizona 85027

(Address of principal executive offices and zip code)

(602) 269-2000

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

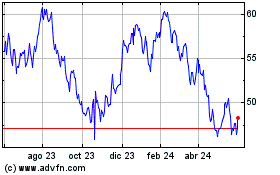

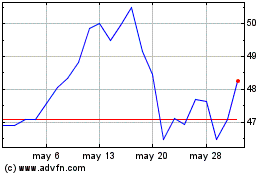

| Common Stock $0.01 Par Value | | KNX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On July 24, 2024, Knight-Swift Transportation Holdings Inc. (the "Company") issued a press release (the "Press Release") announcing its financial results for the quarter ended June 30, 2024. A copy of the Press Release is attached to this Current Report on Form 8-K ("Current Report") as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report that is furnished under Item 2.02, including the exhibits hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

| | |

Exhibit 104 | | Cover Page Interactive Data File |

The information in Items 2.02 and 9.01 of this report and the exhibits hereto may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by the forward-looking statements. Please refer to the paragraphs at the end of the attached press release and at the beginning of the attached earnings presentation, as well as various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risks, uncertainties, and other factors that may affect future results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | Knight-Swift Transportation Holdings Inc. |

| | | | (Registrant) |

| | | | | |

| Date: | July 24, 2024 | | /s/ Andrew Hess |

| | | | Andrew Hess |

| | | | Chief Financial Officer |

July 24, 2024

Phoenix, Arizona

| | |

Knight-Swift Transportation Holdings Inc. Reports Second Quarter 2024 Revenue and Earnings •Results include a $12.5 million charge for the settlement of an auto liability claim from 2020 |

Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or "the Company"), one of the largest and most diversified freight transportation companies, operating the largest full truckload fleet in North America, today reported second quarter 2024 net income attributable to Knight-Swift of $20.3 million and Adjusted Net Income Attributable to Knight-Swift2 of $39.4 million. GAAP earnings per diluted share for the second quarter of 2024 were $0.13, compared to $0.39 for the second quarter of 2023. The Adjusted EPS was $0.24 for the second quarter of 2024, compared to $0.49 for the second quarter of 2023. Both the GAAP and adjusted results for the current quarter include a $12.5 million pre-tax charge for the settlement of an auto liability claim from 2020. This settlement negatively impacted our Adjusted EPS by $0.06 per share. Excluding the settlement, our Adjusted EPS would have been $0.30.

During the second quarter of 2024, consolidated total revenue was $1.8 billion, which is an 18.9% increase from the second quarter of 2023 largely due to the acquisition of U.S. Xpress Enterprises, Inc. ("U.S. Xpress") effective July 1, 2023. Consolidated operating income was $63.5 million, reflecting a decrease of 32.5% as compared to the same quarter last year.

•Truckload — 97.2% Adjusted Operating Ratio, which was negatively impacted by 120 basis points for the settlement of the 2020 auto liability claim noted above. Revenue, excluding fuel surcharge and intersegment transactions, increased 33.0% year-over-year as a result of the inclusion of the truckload business of U.S. Xpress. The year-over-year decline in revenue per loaded mile, excluding fuel surcharge and intersegment transactions, narrowed to 5.5% in the current quarter as rate held stable with the first quarter.

•LTL — 85.9% Adjusted Operating Ratio, with a 15.1% year-over-year increase in revenues, excluding fuel surcharge. Shipments per day increased 8.4%, and revenue per hundredweight excluding fuel surcharge increased 13.4% year-over-year, contributing to Adjusted Operating Income growing by 8.2%. We opened 11 new locations during the quarter as we continue to grow our network.

•Logistics — 95.5% Adjusted Operating Ratio with a gross margin of 17.9%. Revenue, excluding intersegment transactions, grew 11.8% year-over-year, including the U.S. Xpress logistics business. Load count was flat year-over-year while revenue per load increased 10.8%.

•Intermodal — 101.8% operating ratio with load count down 1.7% and revenue per load down 4.9% year-over-year. The operating ratio improved 380 basis points sequentially as volumes grew 10.8% while revenue per load held steady as compared to the first quarter.

•All Other Segments — Operating income of $3.9 million as this category generated an operating profit for the first time in seven quarters.

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, 1 |

| 2024 | | 2023 | | Change |

| (Dollars in thousands, except per share data) |

| Total revenue | $ | 1,846,654 | | | $ | 1,552,979 | | | 18.9 | % |

| Revenue, excluding truckload and LTL fuel surcharge | $ | 1,641,701 | | | $ | 1,390,448 | | | 18.1 | % |

| Operating income | $ | 63,460 | | | $ | 94,030 | | | (32.5) | % |

Adjusted Operating Income 2 | $ | 88,519 | | | $ | 114,667 | | | (22.8) | % |

| Net income attributable to Knight-Swift | $ | 20,300 | | | $ | 63,326 | | | (67.9) | % |

Adjusted Net Income Attributable to Knight-Swift 2 | $ | 39,375 | | | $ | 78,618 | | | (49.9) | % |

| Earnings per diluted share | $ | 0.13 | | | $ | 0.39 | | | (66.7) | % |

Adjusted EPS 2 | $ | 0.24 | | | $ | 0.49 | | | (51.0) | % |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our GAAP and non-GAAP results for the quarter include certain items that impact the comparability of year-over-year results. These items include the $12.5 million charge related to the auto liability claim settlement in the current quarter noted above as well as the $17.8 million increase in net interest expense and the increase in the effective tax rate of 11.3% on our GAAP results and 5.2% on our non-GAAP results, year-over-year. Severance, legal accrual, and impairment charges totaling $6.5 million are also excluded from our non-GAAP results.

Adam Miller, CEO of Knight-Swift, commented, "Our Truckload, Logistics, and Intermodal segments continue to navigate a challenging full truckload market. For much of the quarter, freight demand remained steady, and the excess capacity added during the upcycle has been slowly eroding. We saw a seasonal uptick in June, as a number of customers looked to secure additional capacity to support elevated volumes, but it is too early to call this a trend or for it to drive earnings results. These factors have allowed freight rates to largely stabilize but at unsustainable levels. We remain focused on disciplined pricing, cost control, operational excellence, and collaborating across our unique suite of brands to bring all resources to bear in creatively solving problems. We are preparing our businesses in the trough to maximize the benefits of operating leverage when the cycle turns.

"The LTL market continues to be healthy, and we remain encouraged with the ongoing growth of our LTL segment. We opened 18 new facilities in the first half of 2024, with plans to open 20 more over the remainder of the year. This will bring us to 32% growth in door count as compared to the end of 2021 when we first entered the LTL sector. While this expansion will initially be a headwind to improving operating margins, opening new service territories and increasing market density should allow us to grow our relationships with current customers, open opportunities with new customers, and unlock new levels of operating performance in the long run.

“Looking ahead, we remain confident in our business model and our team’s ability to execute in a difficult environment while preparing for the anticipated inflection. The market is giving more and more signs of being balanced, acute customer needs are increasingly noticeable, trailer pools are starting to be valued again, and scale and service are becoming more of a differentiator. These are all signs that align with the unique value that we are positioned to create for our customers.”

Other Income (Expense), net — We recorded $4.9 million of income within "Other income (expense), net" in the second quarter of 2024, compared to $9.7 million of income in the second quarter of 2023.

Income Taxes — The effective tax rate was 37.2% for the second quarter of 2024, compared to 25.9% for the second quarter of 2023. We now project that our expected full year 2024 effective tax rate will be approximately 29% to 30%, with the effective tax rate in the current quarter being higher than this range due to the impact of certain discrete items in the quarter.

Dividend — On April 30, 2024, our board of directors declared a quarterly cash dividend of $0.16 per share of our common stock. The dividend was payable to the Company's stockholders of record as of June 10, 2024, and was paid on June 24, 2024.

| | |

| Segment Financial Performance |

Truckload Segment 1

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 | | Change |

| (Dollars in thousands) |

| Revenue, excluding fuel surcharge and intersegment transactions | $ | 1,102,790 | | | $ | 829,373 | | | 33.0 | % |

| Operating income | $ | 23,483 | | | $ | 67,911 | | | (65.4 | %) |

Adjusted Operating Income 2 | $ | 31,156 | | | $ | 68,210 | | | (54.3 | %) |

| Operating ratio | 98.1 | % | | 92.9 | % | | 520 | bps |

Adjusted Operating Ratio 2 | 97.2 | % | | 91.8 | % | | 540 | bps |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our diverse Truckload segment consists of our irregular route truckload, dedicated truckload, refrigerated, expedited, flatbed, and cross-border operations across our brands with approximately 16,400 irregular route tractors and nearly 6,500 dedicated tractors.

Truckload segment revenue, excluding fuel surcharge and intersegment transactions, was $1.1 billion, an increase of 33.0% year-over-year, reflecting a 5.7% decline in the legacy truckload business prior to the inclusion of U.S. Xpress. This segment continues to experience a difficult environment, operating with a 97.2% Adjusted Operating Ratio in the second quarter, which was negatively impacted by 120 basis points from the settlement of the 2020 auto liability claim noted above. The Adjusted Operating Ratio was essentially flat with the first quarter as the seasonal demand patterns that improved late in the second quarter were largely offset by the claim settlement. Further, the inclusion of U.S. Xpress negatively impacted the Adjusted Operating Ratio by 130 basis points as this brand maintained breakeven results for the quarter. The year-over-year decline in revenue per loaded mile, excluding fuel surcharge and intersegment transactions, narrowed to 5.5% in the current quarter as rate held stable with the first quarter. Cost per mile increased 1.8% year-over-year and was also flat with the first quarter, including the impact of the claim settlement in the current quarter. We remain disciplined on pricing and are unwilling to commit our capacity on what we view as unsustainable contractual rates.

Truckload segment miles per tractor increased 8.5% year-over-year, largely driven by our earlier decision to reduce the number of unseated tractors in the legacy businesses to reduce cost. We have been intentionally trimming our capital equipment over the past few quarters to improve our cost structure through the freight recession but without cutting so far as to sacrifice our ability to flex when the market improves. Excluding U.S. Xpress, revenue, excluding fuel surcharge, per tractor increased 3.5% year-over-year, which was the first year-over-year increase in six quarters as we improve miles per tractor while the decline in pricing decelerates. We are diligently focused on improving our cost structure and equipment utilization to mitigate pressure on margins through the bottom of this prolonged freight cycle with the intention of maximizing the benefits of operating leverage as the cycle turns.

LTL Segment

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 | | Change |

| (Dollars in thousands) |

| Revenue, excluding fuel surcharge | $ | 263,095 | | | $ | 228,578 | | | 15.1 | % |

| Operating income | $ | 33,049 | | | $ | 30,238 | | | 9.3 | % |

Adjusted Operating Income 1 | $ | 36,969 | | | $ | 34,158 | | | 8.2 | % |

| Operating ratio | 89.2 | % | | 88.7 | % | | 50 | bps |

Adjusted Operating Ratio 1 | 85.9 | % | | 85.1 | % | | 80 | bps |

| | | | | |

1See GAAP to non-GAAP reconciliation in the schedules following this release.

Our LTL segment produced an 85.9% Adjusted Operating Ratio during the second quarter of 2024, as revenue, excluding fuel surcharge, grew 15.1% and Adjusted Operating Income increased 8.2% year-over-year. Average shipments per day increased 8.4% year-over-year for the quarter. Revenue per hundredweight, excluding fuel surcharge, increased 13.4%, while revenue per shipment, excluding fuel surcharge, increased by 8.0%, reflecting a 4.7% decrease in weight per shipment.

During the quarter, we opened 11 additional terminals and now expect to open another 20 terminals by the end of 2024. Overall, the 38 locations planned to open in 2024 will represent an addition of over 1,000 doors this year, for a 22.1% increase to our door count from the beginning of the year, which we believe will meaningfully impact the reach of our service offering and increase the density of our network. We expect these investments will bring opportunities to service additional freight and customers. While these new locations initially bring set up costs and operational inefficiencies, we expect that as the locations continue to scale, and particularly as they participate in the next bid cycle, they will help drive growth and margin expansion in the business. We remain encouraged by the strong performance within our LTL segment, and we continue to look for both organic and inorganic opportunities to geographically expand our footprint within the LTL market.

Logistics Segment 1

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 | | Change |

| (Dollars in thousands) |

| Revenue, excluding intersegment transactions | $ | 131,700 | | | $ | 117,782 | | | 11.8 | % |

| Operating income | $ | 4,759 | | | $ | 9,566 | | | (50.3 | %) |

Adjusted Operating Income 2 | $ | 5,923 | | | $ | 9,900 | | | (40.2 | %) |

| Operating ratio | 96.4 | % | | 92.0 | % | | 440 | bps |

Adjusted Operating Ratio 2 | 95.5 | % | | 91.6 | % | | 390 | bps |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

The Logistics segment Adjusted Operating Ratio was 95.5%, with a gross margin of 17.9% in the second quarter of 2024, down from 19.4% in the second quarter of 2023. The second quarter was challenged by the persistently soft demand environment as well as increases in purchased transportation costs later in the quarter that pressured gross margins. Logistics load count for the quarter was flat year-over-year, reflecting the inclusion of U.S. Xpress logistics volumes in the current period. We remain disciplined on price, which allowed our Logistics business to maintain profitability but is a headwind to volumes. After first turning modestly positive last quarter, revenue per load increased by 10.8% year-over-year in the second quarter, representing a 4.6% increase from the prior quarter. The year-over-year increase in revenue per load is largely driven by the inclusion of U.S. Xpress logistics in the current quarter, as it has a different business mix. We continue to leverage our power-only capabilities to complement our asset business, build a broader and more diversified freight portfolio, and to enhance the returns on our capital assets.

Intermodal Segment

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 | | Change |

| (Dollars in thousands) |

| Revenue, excluding intersegment transactions | $ | 97,528 | | | $ | 104,327 | | | (6.5 | %) |

| Operating loss | $ | (1,717) | | | $ | (6,632) | | | 74.1 | % |

| | | | | |

| Operating ratio | 101.8 | % | | 106.4 | % | | (460 | bps) |

| | | | | |

| | | | | |

The Intermodal segment improved its operating ratio to 101.8%, while the year-over-year decline in total revenue slowed to 6.5%, resulting in $97.5 million in revenue for the quarter. The drop in revenue was driven by a 4.9% decline in revenue per load, and a 1.7% decline in load count year-over-year as a result of soft demand and competitive truck capacity. We grew load count sequentially by 10.8% while maintaining stable revenue per load as compared to the first quarter, which helped improve the operating ratio by 380 basis points over the first quarter. We remain focused on growing our load count with disciplined pricing across a diverse group of customers and expect load count to continue to grow sequentially into the back half of the year.

All Other Segments

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 | | Change |

| (Dollars in thousands) |

| Total revenue | $ | 68,279 | | | $ | 130,110 | | | (47.5 | %) |

| | | | | |

| Operating income (loss) | $ | 3,886 | | | $ | (7,053) | | | 155.1 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

All Other Segments include support services provided to our customers, independent contractors, and third-party carriers, including equipment leasing, warehousing, trailer parts manufacturing, insurance, equipment maintenance, and warranty services. All Other Segments also include certain corporate expenses (such as legal settlements and accruals, as well as $11.7 million in quarterly amortization of intangibles related to the 2017 merger between Knight and Swift and certain acquisitions).

The $3.9 million operating income within our All Other Segments is primarily driven by the warehousing and equipment leasing businesses. Revenue within our All Other Segments declined 47.5% year-over-year, largely as a result of winding down our third-party insurance program, which ceased operation at the end of the first quarter.

| | |

| Consolidated Liquidity, Capital Resources, and Earnings Guidance |

Cash Flow Sources (Uses) 1

| | | | | | | | | | | | | | | | | |

| | Year-to-Date June 30, |

| | 2024 | | 2023 | | Change |

| (In thousands) |

| Net cash provided by operating activities | $ | 310,700 | | | $ | 722,190 | | | $ | (411,490) | |

| Net cash used in investing activities | (258,841) | | | (415,990) | | | 157,149 | |

| Net cash (used in) provided by financing activities | (182,288) | | | 236,624 | | | (418,912) | |

Net (decrease) increase in cash, restricted cash, and equivalents 2 | $ | (130,429) | | | $ | 542,824 | | | $ | (673,253) | |

| Net capital expenditures | $ | (258,628) | | | $ | (419,101) | | | $ | 160,473 | |

| | | | | |

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2"Net increase in cash, restricted cash, and equivalents" is derived from changes within "Cash and cash equivalents," "Cash and cash equivalents – restricted," and the long-term portion of restricted cash included in "Other long-term assets" in the condensed consolidated balance sheets.

Liquidity and Capitalization — As of June 30, 2024, we had a balance of $1.1 billion of unrestricted cash and available liquidity and $7.1 billion of stockholders' equity. The face value of our debt, net of unrestricted cash ("Net Debt") was $2.5 billion as of June 30, 2024. Free Cash Flow3 for the year-to-date period ended June 30, 2024 was $52.1 million, which was negatively impacted by our decision to transfer $161.1 million of third-party insurance claim liabilities to another insurance company as discussed during the previous quarter, which was funded by transferring the corresponding restricted cash held in trust for payment of the third-party insurance claims. The use of restricted cash in this transaction does not impact the availability of operating cash for the needs of our ongoing businesses. During the year-to-date period ending June 30, 2024, we generated $310.7 million in operating cash flows, paid down $39.7 million in finance lease liabilities, $91.4 million on our operating lease liabilities, and made $21.6 million of net repayments on our 2021 Revolver and accounts receivable securitization.

Equipment and Capital Expenditures — Gain on sale of revenue equipment was $6.0 million in the second quarter of 2024, compared to $14.3 million in the same quarter of 2023. The average age of the tractor fleet within our Truckload segment was 2.7 years in the second quarter of 2024, compared to 2.6 years in the same quarter of 2023. The average age of the tractor fleet within our LTL segment was 4.2 years in both the second quarter of 2024 and the second quarter of 2023. Cash capital expenditures, net of disposal proceeds, were $258.6 million for the year-to-date June 30, 2024. We expect net cash capital expenditures will be in the range of $600 million – $650 million for full-year 2024, which is a reduction from our previous range of $625 million – $675 million. Our expected net cash capital expenditures primarily represent replacements of existing tractors and trailers and investments in our terminal network, driver amenities, and technology, and excludes acquisitions.

________

3See GAAP to non-GAAP reconciliations in the schedules following this release.

Guidance — We expect that Adjusted EPS1 will range from $0.31 to $0.35 for the third quarter of 2024 and that Adjusted EPS1 for the fourth quarter of 2024 will range from $0.32 to $0.36. Because the timing of an inflection in market conditions has proven especially difficult to predict during this cycle, we are not reflecting an inflection in market conditions for the purposes of these forecasts but are rather basing these ranges on expected seasonality and a continuation of existing market conditions. Our expected Adjusted EPS1 ranges are based on the current truckload, LTL, and general market conditions, recent trends, and the current beliefs, assumptions, and expectations of management, as follows:

Truckload

•Truckload Segment revenue up slightly sequentially in the third quarter and again into the fourth quarter with sequential improvements in operating margins each quarter resulting in adjusted operating ratios steadily improving into the low to mid-90’s,

•Truckload tractor count down modestly sequentially into the third quarter before stabilizing for the fourth quarter,

•Truckload miles per tractor increasing low-single digit percent year-over-year in the third quarter and fourth quarters as the prior year comparisons begin to include U.S. Xpress,

LTL

•LTL low double-digit percent growth in revenue, excluding fuel surcharge, year-over-year as shipment count in the third and fourth quarters improves mid single-digit percent year-over-year and revenue per hundredweight, excluding fuel surcharge, improves high single-digit percent year-over-year,

•Adjusted operating ratios in the mid-to-high 80's as a result of normal seasonal progression and as we continue to expand the network,

Logistics

•Logistics load count sequentially growing mid single-digit percent in the third quarter and stabilizing in the fourth quarter, with adjusted operating ratios in the mid-90’s,

Intermodal

•Intermodal load count sequentially growing high single-digit percent in the third quarter and stabilizing in the fourth quarter with an operating ratio modestly below breakeven by the fourth quarter,

All Other

•All Other segments operating income, before including the $11.7 million quarterly intangible asset amortization, of approximately $10-15 million for the third quarter and modestly negative for the fourth quarter as some of these services experience their typical seasonal slowdown,

Additional

•Equipment gains to be in the range of $5 million to $10 million per quarter,

•Net interest expense up modestly sequentially in the third quarter and fourth quarter,

•Net cash capital expenditures for the full year 2024 expected range of $600 million - $650 million,

•Expected effective tax rate of approximately 29% to 30% for the year.

The factors described under "Forward-Looking Statements," among others, could cause actual results to materially vary from this guidance. Further, we cannot estimate on a forward-looking basis, the impact of certain income and expense items on our earnings per share, because these items, which could be significant, may be infrequent, are difficult to predict, and may be highly variable. As a result, we do not provide a corresponding GAAP measure for, or reconciliation to, our Adjusted EPS1 guidance.

________

1Our calculation of Adjusted EPS starts with GAAP diluted earnings per share and adds back the after-tax impact of intangible asset amortization (which is expected to be approximately $0.35 for full-year 2024), as well as non-cash impairments and certain other unusual items, if any.

Knight-Swift will host a live conference call with analysts and investors to discuss the earnings release, the results of operations, and other matters following its earnings press release on Wednesday, July 24, 2024, at 4:30 p.m. EDT. The conference dial-in information is +1 (800) 717-1738 (Conference ID: 10669). Please note that since the call is expected to begin promptly as scheduled, you will need to join a few minutes before that time. Slides to accompany this call will be posted on the Company’s website and will be available to download just before the scheduled conference call. To view the presentation, please visit https://investor.knight-swift.com/, "Second Quarter 2024 Conference Call Presentation."

Knight-Swift Transportation Holdings Inc. is one of North America's largest and most diversified freight transportation companies, providing multiple full truckload, LTL, intermodal, and logistics services. Knight-Swift uses a nationwide network of business units and terminals in the United States and Mexico to serve customers throughout North America. In addition to operating one of the country's largest tractor fleet, Knight-Swift also contracts with third-party equipment providers to provide a broad range of transportation services to our customers while creating quality driving jobs for our driving associates and successful business opportunities for independent contractors.

| | |

| Investor Relations Contact Information |

Adam W. Miller, Chief Executive Officer, Andrew Hess, Chief Financial Officer, or Brad Stewart, Treasurer & SVP Investor Relations: (602) 606-6349

| | |

| Forward-Looking Statements |

This press release contains statements that may constitute forward-looking statements, which are based on information currently available, usually identified by words such as "anticipates," "believes," "estimates," "plans,'' "projects," "expects," "hopes," "intends," "strategy," "design", ''focus," "outlook," "foresee," "will," "could," "should," "may," "feel", "goal," "continue," or similar expressions, which speak only as of the date the statement was made. Such statements are forward-looking statements and are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of or guidance regarding earnings, earnings per share, revenues, cash flows, dividends, share repurchases, leverage ratio, capital expenditures, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed acquisition plans, new services or developments; any statements regarding future economic, industry, or Company conditions or performance, including, without limitation, expectations regarding future supply or demand, volume, or truckload capacity, and any statements of belief and any statement of assumptions underlying any of the foregoing. In this press release, such statements include, but are not limited to, statements concerning:

•any projections of or guidance regarding earnings, earnings per share, Adjusted EPS, revenues, cash flows, dividends, share repurchases, capital expenditures, or other financial items,

•expected freight environment, including freight demand, capacity, volumes, rates, costs, seasonality, and shipper inventory levels,

•future dividends,

•future effective tax rates,

•future performance or growth of our reportable segments, including expected revenues, utilization, and truck counts within our Truckload segment; expected network, customer relationships, door count, volumes, and revenue within our LTL segment; expected load volumes, demand, gross margin, pricing, and technology with our Logistics segment; and expected asset efficiency, pricing, and volumes within our Intermodal segment,

•future capital structure, capital allocation, growth strategies and opportunities, costs, inflation, and liquidity,

•future capital expenditures, including nature and funding of capital expenditures and gain on sale, and

•the U.S. Xpress transaction, including future integration efforts and synergies and future operating performance and profitability.

Such forward-looking statements are inherently uncertain, and are based upon the current beliefs, assumptions, and expectations of management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factors section of Knight-Swift's Annual Report on Form 10-K for the year ended December 31, 2023, and various disclosures in our press releases, stockholder reports, and Current Reports on Form 8-K.

| | |

Condensed Consolidated Statements of Comprehensive Income (Unaudited) 1 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands, except per share data) |

| Revenue: | | | | | | | |

| Revenue, excluding truckload and LTL fuel surcharge | $ | 1,641,701 | | | $ | 1,390,448 | | | $ | 3,254,515 | | | $ | 2,840,741 | |

| Truckload and LTL fuel surcharge | 204,953 | | | 162,531 | | | 414,606 | | | 349,170 | |

| Total revenue | 1,846,654 | | | 1,552,979 | | | 3,669,121 | | | 3,189,911 | |

| Operating expenses: | | | | | | | |

| Salaries, wages, and benefits | 691,878 | | | 533,237 | | | 1,384,785 | | | 1,069,979 | |

| Fuel | 222,573 | | | 168,300 | | | 457,162 | | | 356,059 | |

| Operations and maintenance | 138,251 | | | 101,380 | | | 272,884 | | | 200,691 | |

| Insurance and claims | 105,438 | | | 137,306 | | | 227,884 | | | 275,345 | |

| Operating taxes and licenses | 30,374 | | | 28,332 | | | 61,703 | | | 54,222 | |

| Communications | 8,264 | | | 6,184 | | | 15,797 | | | 11,933 | |

| Depreciation and amortization of property and equipment | 178,850 | | | 156,381 | | | 360,715 | | | 312,347 | |

| Amortization of intangibles | 18,544 | | | 16,505 | | | 37,087 | | | 32,688 | |

| Rental expense | 43,930 | | | 16,073 | | | 86,926 | | | 31,141 | |

| Purchased transportation | 286,768 | | | 258,259 | | | 564,025 | | | 538,988 | |

| Impairments | 5,877 | | | — | | | 9,859 | | | — | |

| Miscellaneous operating expenses | 52,447 | | | 36,992 | | | 106,279 | | | 67,701 | |

| Total operating expenses | 1,783,194 | | | 1,458,949 | | | 3,585,106 | | | 2,951,094 | |

| Operating income | 63,460 | | | 94,030 | | | 84,015 | | | 238,817 | |

| Other (expenses) income: | | | | | | | |

| Interest income | 3,817 | | | 5,508 | | | 8,839 | | | 10,557 | |

| Interest expense | (40,482) | | | (24,354) | | | (81,718) | | | (47,445) | |

| Other income, net | 4,888 | | | 9,679 | | | 13,880 | | | 19,382 | |

| Total other (expenses) income, net | (31,777) | | | (9,167) | | | (58,999) | | | (17,506) | |

| Income before income taxes | 31,683 | | | 84,863 | | | 25,016 | | | 221,311 | |

| Income tax expense | 11,790 | | | 21,959 | | | 8,116 | | | 54,694 | |

| Net income | 19,893 | | | 62,904 | | | 16,900 | | | 166,617 | |

| Net loss attributable to noncontrolling interest | 407 | | | 422 | | | 765 | | | 993 | |

| Net income attributable to Knight-Swift | $ | 20,300 | | | $ | 63,326 | | | $ | 17,665 | | | $ | 167,610 | |

| Other comprehensive income | 41 | | | 531 | | | 3 | | | 1,621 | |

| Comprehensive income | $ | 20,341 | | | $ | 63,857 | | | $ | 17,668 | | | $ | 169,231 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.13 | | | $ | 0.39 | | | $ | 0.11 | | | $ | 1.04 | |

| Diluted | $ | 0.13 | | | $ | 0.39 | | | $ | 0.11 | | | $ | 1.04 | |

| | | | | | | |

| Dividends declared per share: | $ | 0.16 | | | $ | 0.14 | | | $ | 0.32 | | | $ | 0.28 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 161,689 | | | 161,116 | | | 161,598 | | | 161,018 | |

| Diluted | 162,111 | | | 161,940 | | | 162,089 | | | 161,917 | |

_________

1The reported results do not include the results of operations of U.S. Xpress and its subsidiaries prior to its acquisition by Knight-Swift on July 1, 2023 in accordance with the accounting treatment applicable to the transaction.

| | |

| Condensed Consolidated Balance Sheets (Unaudited) |

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (In thousands) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 186,473 | | | $ | 168,545 | |

| Cash and cash equivalents – restricted | 149,571 | | | 297,275 | |

| Restricted investments, held-to-maturity, amortized cost | — | | | 530 | |

Trade receivables, net of allowance for doubtful accounts of $39,720 and $39,458, respectively | 841,619 | | | 888,603 | |

| Contract balance – revenue in transit | 14,267 | | | 12,246 | |

| Prepaid expenses | 112,998 | | | 148,696 | |

| Assets held for sale | 72,480 | | | 83,366 | |

| Income tax receivable | 39,266 | | | 65,815 | |

| | | |

| Other current assets | 33,541 | | | 43,939 | |

| Total current assets | 1,450,215 | | | 1,709,015 | |

| Property and equipment, net | 4,624,605 | | | 4,616,399 | |

| Operating lease right-of-use assets | 422,433 | | | 484,821 | |

| Goodwill | 3,879,442 | | | 3,848,798 | |

| Intangible assets, net | 2,021,838 | | | 2,058,882 | |

| | | |

| Other long-term assets | 171,792 | | | 152,850 | |

| Total assets | $ | 12,570,325 | | | $ | 12,870,765 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 300,585 | | | $ | 355,173 | |

| Accrued payroll and purchased transportation | 183,858 | | | 164,884 | |

| Accrued liabilities | 197,801 | | | 220,350 | |

| Claims accruals – current portion | 358,553 | | | 480,200 | |

Finance lease liabilities and long-term debt – current portion | 485,907 | | | 459,759 | |

| Operating lease liabilities – current portion | 123,396 | | | 144,921 | |

| | | |

| Total current liabilities | 1,650,100 | | | 1,825,287 | |

| Revolving line of credit | 120,000 | | | 67,000 | |

Long-term debt – less current portion | 1,173,121 | | | 1,223,021 | |

| Finance lease liabilities – less current portion | 434,405 | | | 407,150 | |

| Operating lease liabilities – less current portion | 326,752 | | | 371,407 | |

| Accounts receivable securitization | 452,039 | | | 526,508 | |

| Claims accruals – less current portion | 313,856 | | | 315,476 | |

| Deferred tax liabilities | 910,882 | | | 951,749 | |

| Other long-term liabilities | 118,817 | | | 79,086 | |

| Total liabilities | 5,499,972 | | | 5,766,684 | |

| Stockholders’ equity: | | | |

| Common stock | 1,618 | | | 1,613 | |

| Additional paid-in capital | 4,439,489 | | | 4,426,852 | |

| Accumulated other comprehensive loss | (827) | | | (830) | |

| Retained earnings | 2,613,684 | | | 2,659,755 | |

| Total Knight-Swift stockholders' equity | 7,053,964 | | | 7,087,390 | |

| Noncontrolling interest | 16,389 | | | 16,691 | |

| Total stockholders’ equity | 7,070,353 | | | 7,104,081 | |

| Total liabilities and stockholders’ equity | $ | 12,570,325 | | | $ | 12,870,765 | |

| | |

| Segment Operating Statistics (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

Truckload 1 | | | | | | | | | | | |

Average revenue per tractor | $ | 48,309 | | | $ | 46,461 | | | 4.0 | % | | $ | 95,221 | | | $ | 94,176 | | | 1.1 | % |

| Non-paid empty miles percentage | 14.0 | % | | 15.2 | % | | (120 | bps) | | 14.1 | % | | 15.1 | % | | (100) | bps |

| Average length of haul (miles) | 385 | | | 385 | | | — | % | | 390 | | | 388 | | | 0.5 | % |

| Miles per tractor | 20,518 | | | 18,904 | | | 8.5 | % | | 40,405 | | | 37,304 | | | 8.3 | % |

| Average tractors | 22,828 | | | 17,851 | | | 27.9 | % | | 23,071 | | | 18,002 | | | 28.2 | % |

Average trailers 2 | 92,581 | | | 79,911 | | | 15.9 | % | | 93,495 | | | 79,700 | | | 17.3 | % |

| | | | | | | | | | | |

LTL 3 | | | | | | | | | | | |

| Shipments per day | 20,482 | | | 18,898 | | | 8.4 | % | | 19,641 | | | 18,308 | | | 7.3 | % |

| Weight per shipment (pounds) | 1,008 | | | 1,058 | | | (4.7 | %) | | 1,008 | | | 1,059 | | | (4.8 | %) |

| Average length of haul (miles) | 585 | | | 545 | | | 7.3 | % | | 579 | | | 540 | | | 7.2 | % |

| Revenue per shipment | $ | 202.46 | | | $ | 187.92 | | | 7.7 | % | | $ | 201.20 | | | $ | 188.59 | | | 6.7 | % |

| Revenue xFSC per shipment | $ | 173.50 | | | $ | 160.66 | | | 8.0 | % | | $ | 172.02 | | | $ | 159.60 | | | 7.8 | % |

| Revenue per hundredweight | $ | 20.09 | | | $ | 17.77 | | | 13.1 | % | | $ | 19.97 | | | $ | 17.80 | | | 12.2 | % |

| Revenue xFSC per hundredweight | $ | 17.22 | | | $ | 15.19 | | | 13.4 | % | | $ | 17.07 | | | $ | 15.07 | | | 13.3 | % |

Average tractors 4 | 3,429 | | | 3,163 | | | 8.4 | % | | 3,393 | | | 3,163 | | | 7.3 | % |

Average trailers 5 | 8,893 | | | 8,452 | | | 5.2 | % | | 8,796 | | | 8,419 | | | 4.5 | % |

| | | | | | | | | | | |

Logistics 1 | | | | | | | | | | | |

Revenue per load - Brokerage only 6 | $ | 1,831 | | | $ | 1,652 | | | 10.8 | % | | $ | 1,791 | | | $ | 1,685 | | | 6.3 | % |

| Gross margin - Brokerage only | 17.9 | % | | 19.4 | % | | (150 | bps) | | 17.3 | % | | 19.6 | % | | (230) | bps |

| | | | | | | | | | | |

| Intermodal | | | | | | | | | | | |

Average revenue per load 6 | $ | 2,615 | | | $ | 2,749 | | | (4.9 | %) | | $ | 2,615 | | | $ | 2,979 | | | (12.2 | %) |

| Load count | 37,290 | | | 37,945 | | | (1.7 | %) | | 70,937 | | | 72,138 | | | (1.7 | %) |

| Average tractors | 613 | | | 656 | | | (6.6 | %) | | 611 | | | 631 | | | (3.2 | %) |

| Average containers | 12,580 | | | 12,842 | | | (2.0 | %) | | 12,581 | | | 12,835 | | | (2.0 | %) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

2Second quarter 2024 and 2023 includes 8,876 and 8,377 trailers, respectively, related to leasing activities recorded within our All Other Segments. The year-to-date period ending June 30, 2024 and 2023 includes 8,822 and 8,683 trailers, respectively, related to leasing activities recorded within our All Other Segments.

3Operating statistics within the LTL segment exclude dedicated and other businesses.

4Our LTL tractor fleet includes 612 and 604 tractors from ACT's and MME's dedicated and other businesses for the second quarter of 2024 and 2023, respectively. Our LTL tractor fleet includes 612 and 611 tractors from ACT's and MME's dedicated and other businesses for the year-to-date period ending June 30, 2024 and 2023, respectively.

5Our LTL trailer fleet includes 829 and 778 trailers from ACT's and MME's dedicated and other businesses for the second quarter of 2024 and 2023, respectively. Our LTL trailer fleet includes 825 and 778 trailers from ACT's and MME's dedicated and other businesses for the year-to-date period ending June 30, 2024 and 2023, respectively.

6Computed with revenue, excluding intersegment transactions.

| | |

| Non-GAAP Financial Measures and Reconciliations |

The terms "Adjusted Net Income Attributable to Knight-Swift," "Adjusted Operating Income," "Adjusted EPS," "Adjusted Operating Ratio," and "Free Cash Flow," as we define them, are not presented in accordance with GAAP. These financial measures supplement our GAAP results in evaluating certain aspects of our business. We believe that using these measures improves comparability in analyzing our performance because they remove the impact of items from our operating results that, in our opinion, do not reflect our core operating performance. Management and the board of directors focus on Adjusted Net Income Attributable to Knight-Swift, Adjusted EPS, Adjusted Operating Income, and Adjusted Operating Ratio as key measures of our performance, all of which are reconciled to the most comparable GAAP financial measures and further discussed below. Management and the board of directors use Free Cash Flow as a key measure of our liquidity. Free Cash Flow does not represent residual cash flow available for discretionary expenditures. We believe our presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance.

Adjusted Net Income Attributable to Knight-Swift, Adjusted Operating Income, Adjusted EPS, Adjusted Operating Ratio, and Free Cash Flow, are not substitutes for their comparable GAAP financial measures, such as net income, cash flows from operating activities, operating margin, or other measures prescribed by GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

| | |

Non-GAAP Reconciliation (Unaudited): |

Adjusted Operating Income and Adjusted Operating Ratio 1 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 1,846,654 | | | $ | 1,552,979 | | | $ | 3,669,121 | | | $ | 3,189,911 | |

| Total operating expenses | (1,783,194) | | | (1,458,949) | | | (3,585,106) | | | (2,951,094) | |

| Operating income | $ | 63,460 | | | $ | 94,030 | | | $ | 84,015 | | | $ | 238,817 | |

| Operating ratio | 96.6 | % | | 93.9 | % | | 97.7 | % | | 92.5 | % |

| | | | | | | |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 1,846,654 | | | $ | 1,552,979 | | | $ | 3,669,121 | | | $ | 3,189,911 | |

| Truckload and LTL fuel surcharge | (204,953) | | | (162,531) | | | (414,606) | | | (349,170) | |

| Revenue, excluding truckload and LTL fuel surcharge | 1,641,701 | | | 1,390,448 | | | 3,254,515 | | | 2,840,741 | |

| | | | | | | |

| Total operating expenses | 1,783,194 | | | 1,458,949 | | | 3,585,106 | | | 2,951,094 | |

| Adjusted for: | | | | | | | |

| Truckload and LTL fuel surcharge | (204,953) | | | (162,531) | | | (414,606) | | | (349,170) | |

Amortization of intangibles 3 | (18,544) | | | (16,505) | | | (37,087) | | | (32,688) | |

Impairments 4 | (5,877) | | | — | | | (9,859) | | | — | |

Legal accruals 5 | (265) | | | (1,300) | | | (1,828) | | | (1,000) | |

Transaction fees 6 | — | | | (5,332) | | | — | | | (6,868) | |

| | | | | | | |

Severance expense 7 | (373) | | | — | | | (7,219) | | | (1,452) | |

Change in fair value of deferred earnout 8 | — | | | 2,500 | | | — | | | 2,500 | |

| Adjusted Operating Expenses | 1,553,182 | | | 1,275,781 | | | 3,114,507 | | | 2,562,416 | |

| Adjusted Operating Income | $ | 88,519 | | | $ | 114,667 | | | $ | 140,008 | | | $ | 278,325 | |

| Adjusted Operating Ratio | 94.6 | % | | 91.8 | % | | 95.7 | % | | 90.2 | % |

| | | | | | | |

1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger, the ACT acquisition, the U.S. Xpress acquisition, and other acquisitions.

4 "Impairments" reflects the non-cash impairments of building improvements, certain revenue equipment held for sale, leases, and other equipment (within the Truckload segment and All Other Segments).

5 "Legal accruals" are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income and reflect the following:

•Second quarter 2024 legal expense reflects the increased estimated exposures for accrued legal matters based on recent settlement agreements. First quarter 2024 legal expense reflects the increased estimated exposures for an accrued legal matter based on a recent settlement agreement.

•Second quarter 2023 legal expense reflects the increased estimated exposure for an accrued legal matter based on a recent settlement agreement. First quarter 2023 legal expense reflects a decrease in the estimated exposure related to an accrued legal matter previously identified as probable and estimable in prior periods based on a recent settlement agreement.

6 "Transaction fees" reflects certain legal and professional fees associated with the July 1, 2023 acquisition of U.S. Xpress. The transaction fees are included within "Miscellaneous operating expenses" in the condensed statements of comprehensive income.

7 "Severance expense" is included within "Salaries, wages, and benefits" in the condensed statements of comprehensive income.

8 "Change in fair value of deferred earnout" reflects the benefit for the change in fair value of a deferred earnout related to the acquisition of UTXL, which is recorded in "Miscellaneous operating expenses".

| | |

Non-GAAP Reconciliation (Unaudited): |

Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (Dollars in thousands, except per share data) |

| GAAP: Net income attributable to Knight-Swift | $ | 20,300 | | | $ | 63,326 | | | $ | 17,665 | | | $ | 167,610 | |

| Adjusted for: | | | | | | | |

| Income tax expense attributable to Knight-Swift | 11,790 | | | 21,959 | | | 8,116 | | | 54,694 | |

| Income before income taxes attributable to Knight-Swift | 32,090 | | | 85,285 | | | 25,781 | | | 222,304 | |

Amortization of intangibles 3 | 18,544 | | | 16,505 | | | 37,087 | | | 32,688 | |

Impairments 4 | 5,877 | | | — | | | 9,859 | | | — | |

Legal accruals 5 | 265 | | | 1,300 | | | 1,828 | | | 1,000 | |

Transaction fees 6 | — | | | 5,332 | | | — | | | 6,868 | |

| | | | | | | |

Severance expense 7 | 373 | | | — | | | 7,219 | | | 1,452 | |

Change in fair value of deferred earnout 8 | — | | | (2,500) | | | — | | | (2,500) | |

| Adjusted income before income taxes | 57,149 | | | 105,922 | | | 81,774 | | | 261,812 | |

Provision for income tax expense at effective rate 9 | (17,774) | | | (27,304) | | | (22,625) | | | (64,703) | |

| Non-GAAP: Adjusted Net Income Attributable to Knight-Swift | $ | 39,375 | | | $ | 78,618 | | | $ | 59,149 | | | $ | 197,109 | |

| | | | | | | |

Note: Because the numbers reflected in the table below are calculated on a per share basis, they may not foot due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP: Earnings per diluted share | $ | 0.13 | | | $ | 0.39 | | | $ | 0.11 | | | $ | 1.04 | |

| Adjusted for: | | | | | | | |

| Income tax expense attributable to Knight-Swift | 0.07 | | | 0.14 | | | 0.05 | | | 0.34 | |

| Income before income taxes attributable to Knight-Swift | 0.20 | | | 0.53 | | | 0.16 | | | 1.37 | |

Amortization of intangibles 3 | 0.11 | | | 0.10 | | | 0.23 | | | 0.20 | |

Impairments 4 | 0.04 | | | — | | | 0.06 | | | — | |

Legal accruals 5 | — | | | 0.01 | | | 0.01 | | | 0.01 | |

Transaction fees 6 | — | | | 0.03 | | | — | | | 0.04 | |

| | | | | | | |

Severance expense 7 | — | | | — | | | 0.04 | | | 0.01 | |

Change in fair value of deferred earnout 8 | — | | | (0.02) | | | — | | | (0.02) | |

| Adjusted income before income taxes | 0.35 | | | 0.65 | | | 0.50 | | | 1.62 | |

Provision for income tax expense at effective rate 9 | (0.11) | | | (0.17) | | | (0.14) | | | (0.40) | |

| Non-GAAP: Adjusted EPS | $ | 0.24 | | | $ | 0.49 | | | $ | 0.36 | | | $ | 1.22 | |

| | | | | | | |

1Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift and consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 5.

6Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 6.

7Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 7.

8Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 8.

9For the second quarter of 2024, an adjusted effective tax rate of 31.1% was applied in our Adjusted EPS calculation to exclude certain discrete items. For the year-to-date period ending June 30, 2024, an adjusted effective tax rate of 27.7% was applied in our Adjusted EPS calculation to exclude certain discrete items.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

Truckload Segment 2 | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 1,264,237 | | | $ | 953,659 | | | $ | 2,527,252 | | | $ | 1,965,904 | |

| Total operating expenses | (1,240,754) | | | (885,748) | | | (2,480,622) | | | (1,782,094) | |

| Operating income | $ | 23,483 | | | $ | 67,911 | | | $ | 46,630 | | | $ | 183,810 | |

| Operating ratio | 98.1 | % | | 92.9 | % | | 98.2 | % | | 90.7 | % |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 1,264,237 | | | $ | 953,659 | | | $ | 2,527,252 | | | $ | 1,965,904 | |

| Fuel surcharge | (161,570) | | | (124,004) | | | (330,091) | | | (269,268) | |

| Intersegment transactions | 123 | | | (282) | | | (320) | | | (1,283) | |

| Revenue, excluding fuel surcharge and intersegment transactions | 1,102,790 | | | 829,373 | | | 2,196,841 | | | 1,695,353 | |

| | | | | | | |

| Total operating expenses | 1,240,754 | | | 885,748 | | | 2,480,622 | | | 1,782,094 | |

| Adjusted for: | | | | | | | |

| Fuel surcharge | (161,570) | | | (124,004) | | | (330,091) | | | (269,268) | |

| Intersegment transactions | 123 | | | (282) | | | (320) | | | (1,283) | |

Amortization of intangibles 3 | (1,775) | | | (299) | | | (3,550) | | | (642) | |

Impairments 4 | (5,555) | | | — | | | (8,654) | | | — | |

| | | | | | | |

Legal accruals 5 | 30 | | | — | | | 30 | | | — | |

Severance 6 | (373) | | | — | | | (1,466) | | | — | |

| Adjusted Operating Expenses | 1,071,634 | | | 761,163 | | | 2,136,571 | | | 1,510,901 | |

| Adjusted Operating Income | $ | 31,156 | | | $ | 68,210 | | | $ | 60,270 | | | $ | 184,452 | |

| Adjusted Operating Ratio | 97.2 | % | | 91.8 | % | | 97.3 | % | | 89.1 | % |

| | | | | | | |

1 Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3"Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in historical Knight acquisitions and the U.S. Xpress acquisition.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 5.

6Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 7.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 — (Continued) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| LTL Segment | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 306,478 | | | $ | 267,105 | | | $ | 588,600 | | | $ | 522,409 | |

| Total operating expenses | (273,429) | | | (236,867) | | | (535,264) | | | (465,589) | |

| Operating income | $ | 33,049 | | | $ | 30,238 | | | $ | 53,336 | | | $ | 56,820 | |

| Operating ratio | 89.2 | % | | 88.7 | % | | 90.9 | % | | 89.1 | % |

| Non-GAAP Presentation | | | | | | | |

| Total revenue | $ | 306,478 | | | $ | 267,105 | | | $ | 588,600 | | | $ | 522,409 | |

| Fuel surcharge | (43,383) | | | (38,527) | | | (84,515) | | | (79,902) | |

| | | | | | | |

| Revenue, excluding fuel surcharge | 263,095 | | | 228,578 | | | 504,085 | | | 442,507 | |

| | | | | | | |

| Total operating expenses | 273,429 | | | 236,867 | | | 535,264 | | | 465,589 | |

| Adjusted for: | | | | | | | |

| Fuel surcharge | (43,383) | | | (38,527) | | | (84,515) | | | (79,902) | |

| | | | | | | |

Amortization of intangibles 2 | (3,920) | | | (3,920) | | | (7,840) | | | (7,840) | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 226,126 | | | 194,420 | | | 442,909 | | | 377,847 | |

| Adjusted Operating Income | $ | 36,969 | | | $ | 34,158 | | | $ | 61,176 | | | $ | 64,660 | |

| Adjusted Operating Ratio | 85.9 | % | | 85.1 | % | | 87.9 | % | | 85.4 | % |

| | | | | | | |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2"Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the ACT and MME acquisitions.

| | |

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income and Adjusted Operating Ratio 1 — (Continued) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

Logistics Segment 2 | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 131,700 | | | $ | 119,943 | | | $ | 258,429 | | | $ | 258,226 | |

| Total operating expenses | (126,941) | | | (110,377) | | | (251,197) | | | (235,840) | |

| Operating income | $ | 4,759 | | | $ | 9,566 | | | $ | 7,232 | | | $ | 22,386 | |

| Operating ratio | 96.4 | % | | 92.0 | % | | 97.2 | % | | 91.3 | % |

| Non-GAAP Presentation | |

| Total revenue | $ | 131,700 | | | $ | 119,943 | | | $ | 258,429 | | | $ | 258,226 | |

| | | | | | | |

| Intersegment transactions | — | | | (2,161) | | | — | | | (3,667) | |

| Revenue, excluding intersegment transactions | 131,700 | | | 117,782 | | | 258,429 | | | 254,559 | |

| | | | | | | |

| Total operating expenses | 126,941 | | | 110,377 | | | 251,197 | | | 235,840 | |

| Adjusted for: | | | | | | | |

| | | | | | | |

| Intersegment transactions | — | | | (2,161) | | | — | | | (3,667) | |

Amortization of intangibles 3 | (1,164) | | | (334) | | | (2,328) | | | (668) | |

| | | | | | | |

| | | | | | | |

| Adjusted Operating Expenses | 125,777 | | | 107,882 | | | 248,869 | | | 231,505 | |

| Adjusted Operating Income | $ | 5,923 | | | $ | 9,900 | | | $ | 9,560 | | | $ | 23,054 | |

| Adjusted Operating Ratio | 95.5 | % | | 91.6 | % | | 96.3 | % | | 90.9 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Year-to-Date June 30, |

| Intermodal Segment | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP Presentation | (Dollars in thousands) |

| Total revenue | $ | 97,528 | | | $ | 104,327 | | | $ | 185,513 | | | $ | 214,899 | |

| Total operating expenses | (99,245) | | | (110,959) | | | (192,138) | | | (216,429) | |

| Operating loss | $ | (1,717) | | | $ | (6,632) | | | $ | (6,625) | | | $ | (1,530) | |

| Operating ratio | 101.8 | % | | 106.4 | % | | 103.6 | % | | 100.7 | % |

| |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the U.S. Xpress and UTXL acquisitions.

| | |

Non-GAAP Reconciliation (Unaudited): |

Free Cash Flow 1 |

| | | | | |

| Year-to-Date June 30, 2024 |

| |

| GAAP: Cash flows from operations | $ | 310,700 | |

| Adjusted for: | |

| Proceeds from sale of property and equipment, including assets held for sale | 114,033 | |

| Purchases of property and equipment | (372,661) | |

| Non-GAAP: Free cash flow | $ | 52,072 | |

| |

1Pursuant to the requirements of Regulation G, this table reconciles GAAP cash flows from operations to non-GAAP Free Cash Flow.

Second Quarter 2024 Earnings Exhibit 99.2

2 This presentation, including documents incorporated herein by reference, will contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Please review our disclosures in filings with the United States Securities and Exchange Commission. Non-GAAP Financial Data This presentation includes the use of adjusted operating income, operating ratio, adjusted operating ratio, adjusted earnings per share, adjusted income before taxes and adjusted operating expenses, which are financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures should not be interpreted as indicating that these or similar items could not occur in future periods. In addition, adjusted operating ratio excludes truckload and LTL segment fuel surcharges from revenue and nets these surcharges against fuel expense. Disclosure

3 Adjusted EPS results include a $0.06 per share charge for the settlement of a TL auto liability claim from 2020 U.S. Xpress roughly break-even adjusted operating results LTL continues to show positive volume and yield trends as we opened additional locations during the quarter Adjustments • $18.5M in Q2 2024 and $16.5M in Q2 2023 of amortization expense from mergers and acquisitions • $5.9M of impairments in Q2 2024 • $0.3M and $1.3M estimate exposure for certain legal matters in Q2 2024 and Q2 2023, respectively • $5.3M in Q2 2023 of transaction fees • $0.4M in severance expense in Q2 2024 • $2.5M decrease in fair value of contingent consideration in Q2 2023 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation Q2 2024 Comparative Results 1,553 1,847 2Q23 2Q24 Total Revenue 18.9% 1,390 1,642 2Q23 2Q24 Revenue xFSC 18.1% 94 63 2Q23 2Q24 Operating Income (32.5%) 115 89 2Q23 2Q24 Adj. Operating Inc. 1 (22.8%) Net Income (67.9%) 79 39 2Q23 2Q24 Adj. Net Income 1 (49.9%) 2Q23 2Q24 Earnings Per Share (66.7%) $0.49 2Q23 2Q24 Adj. EPS 1 (51.0%) In m ill io ns In m ill io ns In m ill io ns $0.39 63 20 2Q23 2Q24 $0.24 Navigating trough, preparing to maximize returns when cycle inflects $0.13

4 $1,102.8M $31.2M 97.2% ~16,400 irregular route and ~6,500 dedicated tractors $263.1M $37.0M 85.9% 133 Service Centers ~5,100 terminal door count $131.7M $5.9M 95.5% Gross Margin 17.9% $97.5M ($1.7M) 101.8% 613 tractors 12,580 containers 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation 2 Excludes Trucking and LTL fuel Surcharge and intersegment transactions Q2 2024 Revenue Diversification Q2 2024 Segment Overview TL experienced seasonal build in demand, LTL continues network expansion OTR 47% / Dedicated 19% LTL 16% Truckload 66% Log isti cs 8 % Intermodal 6% Other 4% Revenue xFSC2 Adjusted Op Income1 Adjusted OR1 Truckload Less-than- Truckload Logistics Intermodal KNX $1.6B2

5 (Dollars in millions) Revenue xFSC $1,102.8 $829.4 33.0 % Operating income $23.5 $67.9 (65.4 %) Adjusted Operating Income 1 $31.2 $68.2 (54.3 %) Operating ratio 98.1% 92.9% 520 bps Adjusted Operating Ratio 1 97.2% 91.8% 540 bps Truckload Financial Metrics • 97.2% Adjusted Operating Ratio1 in Q2 2024 compared to 91.8% the previous year • Claim settlement negatively impacted OR by ~120bps • Miles per tractor continues to improve, revenue per mile remains stable quarter over quarter • Remain disciplined on pricing and are unwilling to commit our capacity on unsustainable contractual rates • U.S. Xpress maintains roughly break-even operating results in second quarter • Inclusion of U.S. Xpress truckload business negatively impacted the Adjusted Operating Ratio by 130 bps 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. Average revenue per tractor $48,309 $46,461 4.0 % Average tractors 22,828 17,851 27.9 % Average trailers 92,581 79,911 15.9 % Miles per tractor 20,518 18,904 8.5 % Operating Performance - Truckload Revenue per tractor increases year over year as utilization improves Q2 2024 Q2 2023 Change Truckload Operating Statistics Q2 2024 Q2 2023 Change

6 • 85.9% Adjusted Operating Ratio1 in Q2 2024 ◦ 13.4% year-over-year increase in LTL Revenue xFSC per hundredweight • Continue executing on organic growth strategy in LTL network ◦ 56 properties acquired since 2021 entry into LTL ◦ Brought 11 new locations online in Q2 ◦ Expect to activate 20 additional service centers by year end ◦ Continue adding to expansion opportunities pipeline Operating Performance - Less-Than-Truckload LTL market continues to be healthy as we execute network expansion 1. See GAAP to non-GAAP reconciliation in the schedules following this presentation. (Dollars in millions) Revenue xFSC $263.1 $228.6 15.1 % Operating income $33.0 $30.2 9.3 % Adjusted Operating Income 1 $37.0 $34.2 8.2 % Operating ratio 89.2% 88.7% 50 bps Adjusted Operating Ratio 1 85.9% 85.1% 80 bps LTL Financial Metrics Q2 2024 Q2 2023 Change LTL shipments per day 20,482 18,898 8.4 % LTL weight per shipment 1,008 1,058 (4.7 %) LTL revenue xFSC per hundredweight $17.22 $15.19 13.4 % LTL revenue xFSC per shipment $173.50 $160.66 8.0 % LTL Operating Statistics Q2 2024 Q2 2023 Change OPERATIONAL IN DEVELOPMENT

7 • 95.5% Adjusted Operating Ratio1 during the quarter, 160 bps improvement from prior quarter • 17.9% Gross margin, 150 bps decrease from prior year, increased 110 bps from prior quarter • Revenue per load was up 10.8% with the inclusion of U.S. Xpress vs prior year and increased by 4.6% from the prior quarter • Continue to leverage power-only to complement our asset business, build a broader and more diversified freight portfolio Operating Performance - Logistics Disciplined pricing and sequentially stable volumes help improve profitability in 2Q 1. See GAAP to non-GAAP reconciliation in the schedules following this presentation. (Dollars in millions) Revenue ex intersegment $131.7 $117.8 11.8 % Operating income $4.8 $9.6 (50.3 %) Adjusted Operating Income 1 $5.9 $9.9 (40.2 %) Operating ratio 96.4% 92.0% 440 bps Adjusted Operating Ratio 1 95.5% 91.6% 390 bps Logistics Financial Metrics Q2 2024 Q2 2023 Change Revenue per load $1,831 $1,652 10.8 % Gross margin 17.9% 19.4% (150 bps) Logistics Operating Statistics Q2 2024 Q2 2023 Change

8 • 101.8% operating ratio during Q2 2024 compared with 106.4% the prior year • Average revenue per load was flat vs Q1 2024 and down 4.9% year-over-year due to less project business in current year • Load counts up 10.8% vs Q1 • Pipeline for new business awards looks encouraging Operating Performance - Intermodal 460 bps improvement in Intermodal Operating Ratio as we push path toward profitability (Dollars in millions) Revenue ex intersegment $97.5 $104.3 (6.5 %) Operating (loss) ($1.7) $(6.6) 74.1 % Operating ratio 101.8% 106.4% (460 bps) Intermodal Financial Metrics Q2 2024 Q2 2023 Change Average revenue per load $2,615 $2,749 (4.9 %) Load count 37,290 37,945 (1.7 %) Average tractors 613 656 (6.6 %) Average containers 12,580 12,842 (2.0 %) Intermodal Operating Statistics Q2 2024 Q2 2023 Change ROUTES TERMINAL

9 • Revenue decline largely as a result of winding down our third-party insurance program at the end of Q1 2024 • Operating profit of $3.9M in Q1 primarily driven by our warehousing and equipment leasing businesses. • Includes $11.7M in quarterly amortization of intangibles related to the 2017 merger with Knight and Swift and certain acquisitions Operating Performance - All Other Segments All other segments profitable after 3rd party insurance exit in 1Q (Dollars in millions) Revenue $68.3 $130.1 (47.5 %) Operating income / (loss) $3.9 ($7.1) 155.1 % All Other Financial Metrics Q2 2024 Q2 2023 Change

10 EPS Guidance Expect Adjusted EPS to be in the range of $0.31 - $0.35 in Q3 and $0.32 - $0.36 in Q4 Truckload •Revenue up slightly sequentially into Q3 and again into Q4; Adjusted OR steadily improving into the low to mid-90's in Q3 and Q4 •Tractor count down modestly sequentially in Q3 and stable into Q4 •Miles per Tractor up YoY low-single digit % in Q3 and Q4 Guidance Assumptions Less-than- Truckload •Revenue growth up low double-digit % YoY in Q3 and Q4; •Adjusted OR in the mid-to-high 80's as we continue to expand the network •Shipment count improves YoY mid-single digit % in Q3 and Q4 •Revenue per hundredweight, excluding fuel surcharge, improves YoY high single digit % Q3 and Q4 Logistics •Volume up high single-digit % sequentially in Q3 and holding flat in Q4 •OR modestly below breakeven by Q4 •Volume up mid-single digit % sequentially in Q3 and flat in Q4 •Adjusted OR in the mid-90's Intermodal •All Other segments operating income of ~$10-15M for Q3 and modestly negative in Q4 before including the $11.7M quarterly intangibles asset amortization •Equipment gains to be in the range of $5M to $10M per quarter •Net interest expense up modestly sequentially in Q3 and Q4 •Net cash capital expenditures for the full year 2024 expected range of $600M - $650M •Effective tax rate of approximately 29% to 30% for the year Other Areas

Appendix

12 Adjusted Operating Income and Adjusted Operating Ratio 1 2 (Unaudited) Quarter Ended June 30, Year-to-Date June 30, 2024 2023 2024 2023 GAAP Presentation (Dollars in thousands) Total revenue $ 1,846,654 $ 1,552,979 $ 3,669,121 $ 3,189,911 Total operating expenses (1,783,194) (1,458,949) (3,585,106) (2,951,094) Operating income $ 63,460 $ 94,030 $ 84,015 $ 238,817 Operating ratio 96.6 % 93.9 % 97.7 % 92.5 % Non-GAAP Presentation Total revenue $ 1,846,654 $ 1,552,979 $ 3,669,121 $ 3,189,911 Truckload fuel surcharge (204,953) (162,531) (414,606) (349,170) Revenue, excluding truckload fuel surcharge 1,641,701 1,390,448 3,254,515 2,840,741 Total operating expenses 1,783,194 1,458,949 3,585,106 2,951,094 Adjusted for: Truckload fuel surcharge (204,953) (162,531) (414,606) (349,170) Amortization of intangibles 3 (18,544) (16,505) (37,087) (32,688) Impairments 4 (5,877) — (9,859) — Legal accruals 5 (265) (1,300) (1,828) (1,000) Transaction fees 6 — (5,332) — (6,868) Severance expense 7 (373) — (7,219) (1,452) Change in fair value of deferred earnout 8 — 2,500 — 2,500 Adjusted Operating Expenses 1,553,182 1,275,781 3,114,507 2,562,416 Adjusted Operating Income $ 88,519 $ 114,667 $ 140,008 $ 278,325 Adjusted Operating Ratio 94.6 % 91.8 % 95.7 % 90.2 % Non-GAAP Reconciliation