Whitbread Shareholders Approve Sale of Costa to Coca-Cola

11 Octubre 2018 - 2:34AM

Noticias Dow Jones

By Adam Clark

Whitbread PLC (WTB.LN) said Thursday that its shareholders voted

in favor of selling the Costa Coffee chain to Coca-Cola Co. (KO)

for 3.9 billion pounds ($5.1 billion).

About 99.3% of votes were cast in favor of the disposal at a

general meeting held on Wednesday.

The FTSE 100 company, which also owns the Premier Inn Hotel

brand, had said previously it intends to return the majority of the

proceeds to its shareholders.

The sale is the biggest brand acquisition in the history of

Coca-Cola, and marks the soda giant's entry into the competitive

world of coffee. Costa has nearly 4,000 stores in 32 countries,

including a growing presence in China.

The deal is a victory for hedge funds Sachem Head and Elliott

Management Corp., which both pushed Whitbread to spin off Costa.

Sources familiar with the situation previously told Dow Jones that

Elliott now plans to push Whitbread to consider strategic options

for Premier Inn.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

October 11, 2018 03:19 ET (07:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

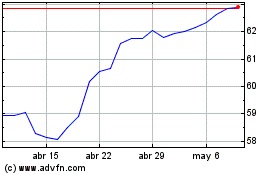

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

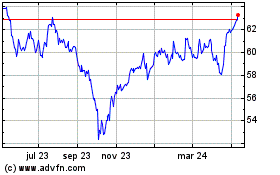

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024