Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 Noviembre 2024 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File No. 001-40387

THE LION ELECTRIC COMPANY

(Translation of registrant’s name into English)

921 chemin de la Rivière-du-Nord

Saint-Jérôme (Québec) J7Y 5G2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| THE LION ELECTRIC COMPANY |

| Date: November 20, 2024 | By: | /s/ Dominique Perron |

| Name: | Dominique Perron |

| Title: | Chief Legal Officer and Corporate Secretary |

NYSE to Commence Delisting Proceedings

with Respect to the Warrants of Lion Electric (LEV.WS)

MONTREAL, QUEBEC - November 20, 2024 – The Lion Electric Company (NYSE: LEV) (TSX: LEV) (“Lion” or the “Company”), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today that the staff of NYSE Regulation of the New York Stock Exchange (“NYSE”) has determined to commence proceedings to delist the Company’s warrants with an expiration date of May 6, 2026 — ticker symbol LEV.WS — to purchase common shares of the Company from the NYSE. Trading in the warrants was suspended immediately. Trading in the Company’s common shares — ticker symbol LEV — and another series of warrants with an expiration date of December 15, 2027 – ticker symbol LEV.WS.A – will continue on the NYSE.

NYSE Regulation has determined that the warrants are no longer suitable for listing based on “abnormally low selling price” levels, pursuant to Section 802.01D of the NYSE Listed Company Manual.

The Company is considering whether it will require a review of this determination by a Committee of the Board of Directors of the NYSE. The NYSE will apply to the Securities and Exchange Commission to delist the warrants upon completion of all applicable procedures, including any appeal by the Company of the NYSE Regulation staff’s decision.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”), including statements about Lion’s beliefs and expectations and other statements that are not statements of historical facts. Forward-looking statements may be identified by the use of words such as “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “potential,” “seem,” “seek,” “future,” “target” or other similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements may contain such identifying words. The forward-looking statements contained in this press release are based on a number of estimates and assumptions that Lion believes are reasonable when made. Such estimates and assumptions are made by Lion in light of the experience of management and their perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. For additional information on estimates, assumptions, risks and uncertainties underlying certain of the forward-looking statements made in this press release, please consult section 23.0 entitled "Risk Factors" of the Company's annual management's discussion and analysis of financial condition and results of operations (MD&A) for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission, including the Company's interim MD&As. Many of these risks are beyond Lion's management's ability to control or predict. All forward-looking statements attributable to Lion or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained and risk factors identified in the Company's annual MD&A for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under applicable securities laws, Lion undertakes no obligation, and expressly disclaims any duty, to update, revise or review any forward-looking information, whether as a result of new information, future events or otherwise.

For further information:

MEDIA/INVESTORS

Patrick Gervais

Vice President, Truck & Public Affairs

patrick.gervais@thelionelectric.com

514-992-1060

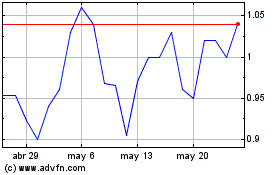

Lion Electric (NYSE:LEV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

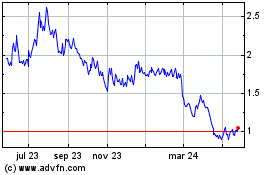

Lion Electric (NYSE:LEV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024