false0000893949Q2--12-310.010.010.010.010000893949md:UnnamedCorporateJointVentureOneMember2024-06-300000893949md:ContractedManagedCareMember2023-04-012023-06-300000893949us-gaap:CommonStockMember2024-03-310000893949us-gaap:CommonStockMember2024-04-012024-06-300000893949us-gaap:USStatesAndPoliticalSubdivisionsMember2024-06-300000893949us-gaap:HealthCarePatientServiceMember2024-04-012024-06-300000893949us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2024-06-300000893949us-gaap:ThirdPartyPayorMember2024-04-012024-06-300000893949us-gaap:RevolvingCreditFacilityMember2024-01-012024-06-300000893949us-gaap:AllOtherCorporateBondsMember2023-12-310000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2024-03-310000893949us-gaap:GovernmentMember2023-04-012023-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000893949md:TwoZeroThreeZeroMember2023-12-310000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000893949md:FivePointThreeSevenFivePercentUnsecuredSeniorNotesDueTwoThousandThirtyMember2024-06-300000893949md:ContractedManagedCareMember2024-04-012024-06-300000893949us-gaap:CommonStockMember2024-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000893949us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100008939492023-03-310000893949us-gaap:CashEquivalentsMember2023-12-310000893949md:MaternalFetalMedicinePracticeMember2024-06-300000893949us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2024-06-300000893949us-gaap:EmployeeStockOptionMember2024-01-012024-06-300000893949md:ContractedManagedCareMember2023-01-012023-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000893949us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000893949us-gaap:ProductAndServiceOtherMember2024-01-012024-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2023-12-310000893949us-gaap:CommonStockMember2023-03-310000893949us-gaap:CommonStockMember2023-12-310000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2023-06-3000008939492018-08-310000893949us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000893949us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2023-03-310000893949us-gaap:USTreasurySecuritiesMember2023-12-310000893949us-gaap:SelfPayMember2023-04-012023-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000893949us-gaap:ProductAndServiceOtherMember2024-04-012024-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000893949us-gaap:RevolvingCreditFacilityMembermd:CreditAgreementMember2024-06-300000893949us-gaap:CommonStockMember2022-12-310000893949us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2023-12-310000893949md:HospitalsContractsMember2023-01-012023-06-300000893949us-gaap:AdditionalPaidInCapitalMember2024-03-310000893949md:NineteenNinetySixNonQualifiedEmployeeStockPurchasePlanMember2024-01-012024-06-300000893949us-gaap:HealthCarePatientServiceMember2023-04-012023-06-300000893949md:FivePointThreeSevenFivePercentUnsecuredSeniorNotesDueTwoThousandThirtyMember2022-02-112022-02-110000893949us-gaap:RevolvingCreditFacilityMembermd:CreditAgreementMember2024-01-012024-06-300000893949us-gaap:CashEquivalentsMember2024-06-300000893949us-gaap:GovernmentMember2024-04-012024-06-300000893949us-gaap:SelfPayMember2024-04-012024-06-300000893949us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000893949us-gaap:RevolvingCreditFacilityMemberus-gaap:LongTermDebtMember2024-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000893949us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000893949us-gaap:RestrictedStockMember2024-06-3000008939492024-03-3100008939492024-04-012024-06-300000893949us-gaap:AdditionalPaidInCapitalMember2022-12-310000893949us-gaap:AdditionalPaidInCapitalMember2023-12-3100008939492024-01-012024-06-3000008939492024-01-012024-03-3100008939492023-12-310000893949us-gaap:CommonStockMember2024-01-012024-03-310000893949us-gaap:CommonStockMember2024-01-012024-06-3000008939492022-12-310000893949us-gaap:RevolvingCreditFacilityMember2022-02-112022-02-110000893949md:AmendedAndRestatedTwoThousandEightPlanMemberus-gaap:RestrictedStockMember2024-01-012024-06-300000893949us-gaap:HealthCarePatientServiceMember2023-01-012023-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000893949md:FivePointThreeSevenFivePercentUnsecuredSeniorNotesDueTwoThousandThirtyMember2024-01-012024-06-300000893949us-gaap:ThirdPartyPayorMember2023-04-012023-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000893949us-gaap:ThirdPartyPayorMember2024-01-012024-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000893949us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000893949us-gaap:ProductAndServiceOtherMember2023-01-012023-06-300000893949us-gaap:LongTermDebtMember2022-02-110000893949us-gaap:USTreasurySecuritiesMember2024-06-300000893949md:HospitalsContractsMember2024-04-012024-06-300000893949us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300000893949us-gaap:ProductAndServiceOtherMember2023-04-012023-06-300000893949md:NineteenNinetySixNonQualifiedEmployeeStockPurchasePlanAndTwoThousandFifteenNonQualifiedStockPurchasePlanMember2024-01-012024-06-3000008939492023-01-012023-03-310000893949md:ContractedManagedCareMember2024-01-012024-06-300000893949md:TwoThousandFifteenNonQualifiedStockPurchasePlanMember2024-01-012024-06-300000893949us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000893949us-gaap:AdditionalPaidInCapitalMember2023-06-3000008939492024-06-300000893949us-gaap:GovernmentMember2023-01-012023-06-300000893949us-gaap:CertificatesOfDepositMember2023-12-310000893949us-gaap:HealthCarePatientServiceMember2024-01-012024-06-300000893949md:HospitalsContractsMember2023-04-012023-06-300000893949md:SixPointTwoFivePercentSeniorUnsecuredNotesDueTwoThousandTwentySevenMember2022-02-110000893949us-gaap:AllOtherCorporateBondsMember2024-06-300000893949md:CreditAgreementMember2024-06-300000893949us-gaap:CommonStockMember2023-06-300000893949us-gaap:CertificatesOfDepositMember2024-06-300000893949us-gaap:CommonStockMember2023-04-012023-06-300000893949md:RetainedEarningsAndAccumulatedOtherComprehensiveIncomeMember2022-12-310000893949md:MaternalFetalMedicinePracticeMember2024-01-012024-06-300000893949md:FivePointThreeSevenFivePercentUnsecuredSeniorNotesDueTwoThousandThirtyMember2022-02-110000893949us-gaap:AdditionalPaidInCapitalMember2024-06-3000008939492023-01-012023-06-300000893949us-gaap:AdditionalPaidInCapitalMember2023-03-310000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-3000008939492023-04-012023-06-300000893949us-gaap:SelfPayMember2023-01-012023-06-300000893949md:NineteenNinetySixNonQualifiedEmployeeStockPurchasePlanMember2024-06-300000893949us-gaap:CommonStockMember2023-01-012023-03-3100008939492024-08-0200008939492023-06-300000893949us-gaap:ThirdPartyPayorMember2023-01-012023-06-300000893949md:NineteenNinetySixNonQualifiedEmployeeStockPurchasePlanAndTwoThousandFifteenNonQualifiedStockPurchasePlanMember2024-06-300000893949us-gaap:GovernmentMember2024-01-012024-06-300000893949us-gaap:SelfPayMember2024-01-012024-06-300000893949md:AmendedAndRestatedTwoThousandEightPlanMemberus-gaap:EmployeeStockOptionMember2024-06-300000893949md:HospitalsContractsMember2024-01-012024-06-300000893949md:TwoZeroThreeZeroMember2024-06-300000893949us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000893949us-gaap:RestrictedStockMember2024-01-012024-06-30xbrli:purexbrli:sharesiso4217:USDxbrli:sharesmd:Numberiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number: 001-12111

Pediatrix Medical Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Florida |

|

26-3667538 |

(State or other jurisdiction of Incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

1301 Concord Terrace Sunrise, Florida |

|

33323 |

(Address of principal executive offices) |

|

(Zip Code) |

(954) 384-0175

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, par value $.01 per share |

|

MD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☑ |

|

Accelerated filer |

☐ |

|

|

|

|

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

On August 2, 2024, the registrant had outstanding 85,865,841 shares of Common Stock, par value $.01 per share.

Pediatrix Medical Group, Inc.

INDEX

Pediatrix Medical Group, Inc.

Consolidated Balance Sheets

(in thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

19,402 |

|

|

$ |

73,258 |

|

Short-term investments |

|

|

113,795 |

|

|

|

104,485 |

|

Accounts receivable, net |

|

|

274,164 |

|

|

|

272,313 |

|

Prepaid expenses |

|

|

11,910 |

|

|

|

13,525 |

|

Income taxes receivable |

|

|

— |

|

|

|

7,565 |

|

Other current assets |

|

|

9,941 |

|

|

|

12,308 |

|

Total current assets |

|

|

429,212 |

|

|

|

483,454 |

|

Property and equipment, net |

|

|

47,893 |

|

|

|

75,639 |

|

Goodwill |

|

|

1,239,007 |

|

|

|

1,384,166 |

|

Intangible assets, net |

|

|

10,193 |

|

|

|

21,240 |

|

Operating and finance lease right-of-use assets |

|

|

65,392 |

|

|

|

70,294 |

|

Deferred income tax assets |

|

|

124,115 |

|

|

|

102,852 |

|

Other assets |

|

|

79,539 |

|

|

|

82,165 |

|

Total assets |

|

$ |

1,995,351 |

|

|

$ |

2,219,810 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

267,333 |

|

|

$ |

350,798 |

|

Current portion of debt and finance lease liabilities, net |

|

|

17,730 |

|

|

|

14,913 |

|

Current portion of operating lease liabilities |

|

|

18,764 |

|

|

|

21,076 |

|

Income taxes payable |

|

|

6,329 |

|

|

|

2,159 |

|

Total current liabilities |

|

|

310,156 |

|

|

|

388,946 |

|

Long-term debt and finance lease liabilities, net |

|

|

612,640 |

|

|

|

618,421 |

|

Long-term operating lease liabilities |

|

|

49,176 |

|

|

|

47,238 |

|

Long-term professional liabilities |

|

|

254,770 |

|

|

|

251,284 |

|

Deferred income tax liabilities |

|

|

30,627 |

|

|

|

34,308 |

|

Other liabilities |

|

|

31,521 |

|

|

|

30,552 |

|

Total liabilities |

|

|

1,288,890 |

|

|

|

1,370,749 |

|

Commitments and contingencies |

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Preferred stock; $.01 par value; 1,000,000 shares authorized; none issued |

|

|

— |

|

|

|

— |

|

Common stock; $.01 par value; 200,000,000 shares authorized; 85,753,258 and 84,018,023 shares

issued and outstanding, respectively |

|

|

858 |

|

|

|

840 |

|

Additional paid-in capital |

|

|

1,006,018 |

|

|

|

999,906 |

|

Accumulated other comprehensive loss |

|

|

(1,954 |

) |

|

|

(2,214 |

) |

Retained deficit |

|

|

(298,461 |

) |

|

|

(149,471 |

) |

Total shareholders’ equity |

|

|

706,461 |

|

|

|

849,061 |

|

Total liabilities and shareholders' equity |

|

$ |

1,995,351 |

|

|

$ |

2,219,810 |

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

Pediatrix Medical Group, Inc.

Consolidated Statements of Income and Comprehensive Income

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

504,296 |

|

|

$ |

500,577 |

|

|

$ |

999,397 |

|

|

$ |

991,585 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Practice salaries and benefits |

|

|

357,808 |

|

|

|

354,032 |

|

|

|

726,946 |

|

|

|

716,267 |

|

Practice supplies and other operating expenses |

|

|

32,369 |

|

|

|

31,089 |

|

|

|

63,454 |

|

|

|

61,809 |

|

General and administrative expenses |

|

|

56,565 |

|

|

|

58,013 |

|

|

|

116,763 |

|

|

|

117,072 |

|

Depreciation and amortization |

|

|

8,791 |

|

|

|

8,945 |

|

|

|

19,099 |

|

|

|

17,898 |

|

Transformational and restructuring related expenses |

|

|

13,579 |

|

|

|

— |

|

|

|

22,059 |

|

|

|

— |

|

Goodwill impairment |

|

|

154,243 |

|

|

|

— |

|

|

|

154,243 |

|

|

|

— |

|

Fixed assets impairments |

|

|

20,112 |

|

|

|

— |

|

|

|

20,112 |

|

|

|

— |

|

Intangible assets impairments |

|

|

7,679 |

|

|

|

— |

|

|

|

7,679 |

|

|

|

— |

|

Loss on disposal of businesses |

|

|

10,873 |

|

|

|

— |

|

|

|

10,873 |

|

|

|

— |

|

Total operating expenses |

|

|

662,019 |

|

|

|

452,079 |

|

|

|

1,141,228 |

|

|

|

913,046 |

|

(Loss) income from operations |

|

|

(157,723 |

) |

|

|

48,498 |

|

|

|

(141,831 |

) |

|

|

78,539 |

|

Investment and other (loss) income |

|

|

(161 |

) |

|

|

1,189 |

|

|

|

1,852 |

|

|

|

1,823 |

|

Interest expense |

|

|

(10,308 |

) |

|

|

(11,230 |

) |

|

|

(20,907 |

) |

|

|

(21,620 |

) |

Equity in earnings of unconsolidated affiliate |

|

|

464 |

|

|

|

490 |

|

|

|

982 |

|

|

|

917 |

|

Total non-operating expenses |

|

|

(10,005 |

) |

|

|

(9,551 |

) |

|

|

(18,073 |

) |

|

|

(18,880 |

) |

(Loss) income before income taxes |

|

|

(167,728 |

) |

|

|

38,947 |

|

|

|

(159,904 |

) |

|

|

59,659 |

|

Income tax benefit (provision) |

|

|

14,703 |

|

|

|

(10,665 |

) |

|

|

10,914 |

|

|

|

(17,171 |

) |

Net (loss) income |

|

$ |

(153,025 |

) |

|

$ |

28,282 |

|

|

$ |

(148,990 |

) |

|

$ |

42,488 |

|

Other comprehensive (loss) income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gain (loss) on investments, net of tax of $66, $126, $86 and $353 |

|

|

200 |

|

|

|

(387 |

) |

|

|

260 |

|

|

|

217 |

|

Total comprehensive (loss) income |

|

$ |

(152,825 |

) |

|

$ |

27,895 |

|

|

$ |

(148,730 |

) |

|

$ |

42,705 |

|

Per common and common equivalent share data: |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.84 |

) |

|

$ |

0.34 |

|

|

$ |

(1.79 |

) |

|

$ |

0.52 |

|

Diluted |

|

$ |

(1.84 |

) |

|

$ |

0.34 |

|

|

$ |

(1.79 |

) |

|

$ |

0.52 |

|

Weighted average common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

83,332 |

|

|

|

82,399 |

|

|

|

83,074 |

|

|

|

82,033 |

|

Diluted |

|

|

83,332 |

|

|

|

82,664 |

|

|

|

83,074 |

|

|

|

82,377 |

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

Pediatrix Medical Group, Inc.

Consolidated Statements of Shareholders' Equity

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

|

|

Additional

Paid-in |

|

|

Accumulated

Other

Comprehensive |

|

|

Retained |

|

|

Total

Shareholders' |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Loss |

|

|

Deficit |

|

|

Equity |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2024 |

|

|

84,018 |

|

|

$ |

840 |

|

|

$ |

999,906 |

|

|

$ |

(2,214 |

) |

|

$ |

(149,471 |

) |

|

$ |

849,061 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,035 |

|

|

|

4,035 |

|

Unrealized holding gain on investments, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

60 |

|

|

|

— |

|

|

|

60 |

|

Common stock issued under employee stock purchase plan |

|

|

108 |

|

|

|

1 |

|

|

|

859 |

|

|

|

— |

|

|

|

— |

|

|

|

860 |

|

Forfeitures of restricted stock |

|

|

(21 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

3,067 |

|

|

|

— |

|

|

|

— |

|

|

|

3,067 |

|

Repurchased common stock |

|

|

(97 |

) |

|

|

(1 |

) |

|

|

(886 |

) |

|

|

— |

|

|

|

— |

|

|

|

(887 |

) |

Balance at March 31, 2024 |

|

|

84,008 |

|

|

$ |

840 |

|

|

$ |

1,002,946 |

|

|

$ |

(2,154 |

) |

|

$ |

(145,436 |

) |

|

$ |

856,196 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(153,025 |

) |

|

|

(153,025 |

) |

Unrealized holding gain on investments, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

200 |

|

|

|

— |

|

|

|

200 |

|

Common stock issued under employee stock purchase plan |

|

|

139 |

|

|

|

2 |

|

|

|

1,147 |

|

|

|

— |

|

|

|

— |

|

|

|

1,149 |

|

Issuance of restricted stock |

|

|

1,630 |

|

|

|

16 |

|

|

|

(16 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Forfeitures of restricted stock |

|

|

(22 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

1,952 |

|

|

|

— |

|

|

|

— |

|

|

|

1,952 |

|

Repurchased common stock |

|

|

(2 |

) |

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

|

|

— |

|

|

|

(11 |

) |

Balance at June 30, 2024 |

|

|

85,753 |

|

|

$ |

858 |

|

|

$ |

1,006,018 |

|

|

$ |

(1,954 |

) |

|

$ |

(298,461 |

) |

|

$ |

706,461 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2023 |

|

|

82,947 |

|

|

$ |

829 |

|

|

$ |

983,601 |

|

|

$ |

(3,735 |

) |

|

$ |

(89,063 |

) |

|

$ |

891,632 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,206 |

|

|

|

14,206 |

|

Unrealized holding gain on investments, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

604 |

|

|

|

— |

|

|

|

604 |

|

Common stock issued under employee stock purchase plan |

|

|

86 |

|

|

|

— |

|

|

|

1,095 |

|

|

|

— |

|

|

|

— |

|

|

|

1,095 |

|

Issuance of restricted stock |

|

|

871 |

|

|

|

9 |

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Forfeitures of restricted stock |

|

|

(221 |

) |

|

|

(2 |

) |

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

3,009 |

|

|

|

— |

|

|

|

— |

|

|

|

3,009 |

|

Repurchased common stock |

|

|

(49 |

) |

|

|

— |

|

|

|

(775 |

) |

|

|

— |

|

|

|

— |

|

|

|

(775 |

) |

Balance at March 31, 2023 |

|

|

83,634 |

|

|

$ |

836 |

|

|

$ |

986,923 |

|

|

$ |

(3,131 |

) |

|

$ |

(74,857 |

) |

|

$ |

909,771 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,282 |

|

|

|

28,282 |

|

Unrealized holding loss on investments, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(387 |

) |

|

|

— |

|

|

|

(387 |

) |

Common stock issued under employee stock purchase plan |

|

|

126 |

|

|

|

1 |

|

|

|

1,593 |

|

|

|

— |

|

|

|

— |

|

|

|

1,594 |

|

Issuance of restricted stock |

|

|

93 |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Forfeitures of restricted stock |

|

|

(11 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

3,126 |

|

|

|

— |

|

|

|

— |

|

|

|

3,126 |

|

Repurchased common stock |

|

|

(1 |

) |

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

|

|

— |

|

|

|

(11 |

) |

Balance at June 30, 2023 |

|

|

83,841 |

|

|

$ |

838 |

|

|

$ |

991,630 |

|

|

$ |

(3,518 |

) |

|

$ |

(46,575 |

) |

|

$ |

942,375 |

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

Pediatrix Medical Group, Inc.

Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net (loss) income |

|

$ |

(148,990 |

) |

|

$ |

42,488 |

|

Adjustments to reconcile net income to net cash from operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

19,099 |

|

|

|

17,898 |

|

Amortization of premiums, discounts and issuance costs |

|

|

440 |

|

|

|

733 |

|

Goodwill impairment |

|

|

154,243 |

|

|

|

— |

|

Fixed assets impairments |

|

|

20,112 |

|

|

|

— |

|

Intangible assets impairments |

|

|

7,679 |

|

|

|

— |

|

Loss on disposal of businesses |

|

|

10,873 |

|

|

|

— |

|

Stock-based compensation expense |

|

|

5,019 |

|

|

|

6,135 |

|

Deferred income taxes |

|

|

(25,028 |

) |

|

|

8,376 |

|

Other |

|

|

(1,678 |

) |

|

|

(900 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(934 |

) |

|

|

28,900 |

|

Prepaid expenses and other current assets |

|

|

3,703 |

|

|

|

2,141 |

|

Other long-term assets |

|

|

16,955 |

|

|

|

5,052 |

|

Accounts payable and accrued expenses |

|

|

(82,917 |

) |

|

|

(97,315 |

) |

Income taxes payable |

|

|

11,735 |

|

|

|

(12,028 |

) |

Long-term professional liabilities |

|

|

8,039 |

|

|

|

838 |

|

Other liabilities |

|

|

(11,630 |

) |

|

|

(10,356 |

) |

Net cash used in operating activities – continuing operations |

|

|

(13,280 |

) |

|

|

(8,038 |

) |

Net cash used in operating activities - discontinued operations |

|

|

(4,995 |

) |

|

|

(3,825 |

) |

Net cash used in operating activities |

|

|

(18,275 |

) |

|

|

(11,863 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Acquisition payments, net of cash acquired |

|

|

(8,167 |

) |

|

|

(1,667 |

) |

Purchases of investments |

|

|

(39,915 |

) |

|

|

(17,761 |

) |

Proceeds from maturities or sales of investments |

|

|

31,244 |

|

|

|

12,810 |

|

Purchases of property and equipment |

|

|

(12,292 |

) |

|

|

(15,130 |

) |

Net cash used in investing activities |

|

|

(29,130 |

) |

|

|

(21,748 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings on line of credit |

|

|

235,500 |

|

|

|

421,000 |

|

Payments on line of credit |

|

|

(235,500 |

) |

|

|

(384,000 |

) |

Payments on term loan |

|

|

(6,250 |

) |

|

|

(6,250 |

) |

Payments on finance lease obligations |

|

|

(1,391 |

) |

|

|

(1,404 |

) |

Proceeds from issuance of common stock |

|

|

2,009 |

|

|

|

2,689 |

|

Repurchases of common stock |

|

|

(898 |

) |

|

|

(786 |

) |

Other |

|

|

79 |

|

|

|

(1,613 |

) |

Net cash (used in) provided by financing activities |

|

|

(6,451 |

) |

|

|

29,636 |

|

Net decrease in cash and cash equivalents |

|

|

(53,856 |

) |

|

|

(3,975 |

) |

Cash and cash equivalents at beginning of period |

|

|

73,258 |

|

|

|

9,824 |

|

Cash and cash equivalents at end of period |

|

$ |

19,402 |

|

|

$ |

5,849 |

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

Pediatrix Medical Group, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited)

1. Basis of Presentation:

The accompanying unaudited Consolidated Financial Statements of the Company and the notes thereto presented in this Form 10-Q have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission ("SEC") applicable to interim financial statements, and do not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”) for complete financial statements. In the opinion of management, these financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results of interim periods. The financial statements include all the accounts of Pediatrix Medical Group, Inc. and its consolidated subsidiaries (collectively, “PMG”) together with the accounts of PMG’s affiliated business corporations or professional associations, professional corporations, limited liability companies and partnerships (the “affiliated professional contractors”). Certain subsidiaries of PMG have contractual management arrangements with its affiliated professional contractors, which are separate legal entities that provide physician services in certain states. The terms “Pediatrix” and the “Company” refer collectively to Pediatrix Medical Group Inc., its subsidiaries and the affiliated professional contractors.

The Company is a party to a joint venture in which it owns a 37.5% economic interest. The Company accounts for this joint venture under the equity method of accounting because the Company exercises significant influence over, but does not control, this entity.

The consolidated results of operations for the interim periods presented are not necessarily indicative of the results to be experienced for the entire fiscal year. In addition, the accompanying unaudited Consolidated Financial Statements and the notes thereto should be read in conjunction with the Consolidated Financial Statements and the notes thereto included in the Company’s most recent Annual Report on Form 10-K (the “Form 10-K”).

2. Cash Equivalents and Investments:

As of June 30, 2024 and December 31, 2023, the Company's cash equivalents consisted entirely of money market funds totaling $0.4 million and $2.8 million, respectively.

Investments held are all classified as current and at June 30, 2024 and December 31, 2023 are summarized as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

Corporate securities |

|

$ |

55,777 |

|

|

$ |

57,878 |

|

U.S. Treasury securities |

|

|

31,456 |

|

|

|

22,674 |

|

Municipal debt securities |

|

|

17,377 |

|

|

|

14,649 |

|

Federal home loan securities |

|

|

6,503 |

|

|

|

5,670 |

|

Certificates of deposit |

|

|

2,682 |

|

|

|

3,614 |

|

|

|

$ |

113,795 |

|

|

$ |

104,485 |

|

3. Fair Value Measurements:

The accounting guidance establishes a fair value hierarchy that prioritizes valuation inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of three levels:

Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.

The following table presents information about the Company’s financial instruments that are accounted for at fair value on a recurring basis at June 30, 2024 and December 31, 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value |

|

|

|

Fair Value

Category |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

Assets: |

|

|

|

|

|

|

|

|

Money market funds |

|

Level 1 |

|

$ |

397 |

|

|

$ |

2,814 |

|

Short-term investments |

|

Level 2 |

|

|

113,795 |

|

|

|

104,485 |

|

Mutual Funds |

|

Level 1 |

|

|

19,002 |

|

|

|

17,687 |

|

The following table presents information about the Company’s financial instruments that are not carried at fair value at June 30, 2024 and December 31, 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Carrying

Amount |

|

|

Fair

Value |

|

|

Carrying

Amount |

|

|

Fair

Value |

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

2030 Notes |

|

$ |

400,000 |

|

|

$ |

353,760 |

|

|

$ |

400,000 |

|

|

$ |

357,000 |

|

The carrying amounts of cash equivalents, accounts receivable and accounts payable and accrued expenses approximate fair value due to the short maturities of the respective instruments. The carrying value of the line of credit approximates fair value. If the Company’s line of credit was measured at fair value, it would be categorized as Level 2 in the fair value hierarchy.

4. Accounts Receivable and Net Revenue:

Accounts receivable, net consists of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

Gross accounts receivable |

|

$ |

1,490,865 |

|

|

$ |

1,379,213 |

|

Allowance for contractual adjustments and uncollectibles |

|

|

(1,216,701 |

) |

|

|

(1,106,900 |

) |

|

|

$ |

274,164 |

|

|

$ |

272,313 |

|

Patient service revenue is recognized at the time services are provided by the Company’s affiliated physicians. The Company’s performance obligations related to the delivery of services to patients are satisfied at the time of service. Accordingly, there are no performance obligations that are unsatisfied or partially unsatisfied at the end of the reporting period with respect to patient service revenue. Almost all of the Company’s patient service revenue is reimbursed by government-sponsored healthcare programs (“GHC Programs”) and third-party insurance payors. Payments for services rendered to the Company’s patients are generally less than billed charges. The Company monitors its revenue and receivables from these sources and records an estimated contractual allowance to properly account for the anticipated differences between billed and reimbursed amounts.

Accordingly, patient service revenue is presented net of an estimated provision for contractual adjustments and uncollectibles. The Company estimates allowances for contractual adjustments and uncollectibles on accounts receivable based upon historical experience and other factors, including days sales outstanding (“DSO”) for accounts receivable, evaluation of expected adjustments and delinquency rates, past adjustments and collection experience in relation to amounts billed, an aging of accounts receivable, current contract and reimbursement terms, changes in payor mix and other relevant information. Contractual adjustments result from the difference between the physician rates for services performed and the reimbursements by GHC Programs and third-party insurance payors for such services.

Collection of patient service revenue the Company expects to receive is normally a function of providing complete and correct billing information to the GHC Programs and third-party insurance payors within the various filing deadlines and typically occurs within 30 to 60 days of billing.

Some of the Company’s hospital agreements require hospitals to pay the Company administrative fees. Some agreements provide for fees if the hospital does not generate sufficient patient volume in order to guarantee that the Company receives a specified minimum revenue level. The Company also receives fees from hospitals for administrative services performed by its affiliated physicians providing medical director or other services at the hospital.

The following table summarizes the Company’s net revenue by category (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net patient service revenue |

|

$ |

432,847 |

|

|

$ |

430,383 |

|

|

$ |

854,678 |

|

|

$ |

853,567 |

|

Hospital contract administrative fees |

|

|

70,913 |

|

|

|

69,585 |

|

|

|

142,716 |

|

|

|

135,574 |

|

Other revenue |

|

|

536 |

|

|

|

609 |

|

|

|

2,003 |

|

|

|

2,444 |

|

|

|

$ |

504,296 |

|

|

$ |

500,577 |

|

|

$ |

999,397 |

|

|

$ |

991,585 |

|

The approximate percentage of net patient service revenue by type of payor was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Contracted managed care |

|

|

71 |

% |

|

|

68 |

% |

|

|

71 |

% |

|

|

67 |

% |

Government |

|

|

23 |

|

|

|

25 |

|

|

|

24 |

|

|

|

25 |

|

Other third-parties |

|

|

4 |

|

|

|

5 |

|

|

|

3 |

|

|

|

6 |

|

Private-pay patients |

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

5. Business Combinations

During the six months ended June 30, 2024, the Company completed the acquisition of one maternal-fetal medicine practice for total consideration of $9.7 million, of which $6.5 million was paid in cash at closing and $3.2 million was recorded as a contingent consideration liability. The acquisition expanded the Company’s national network of physician practices across women’s and children’s services. In connection with this acquisition, the Company recorded tax deductible goodwill of $9.1 million, fixed assets of $0.4 million and other intangible assets consisting primarily of physician and hospital agreements of $0.2 million.

6. Goodwill, Long-Lived Asset Impairments and Loss on Disposal of Businesses:

During the second quarter of 2024, the Company formalized its practice portfolio management plans, resulting in a decision to exit almost all of its affiliated office-based practices, other than maternal-fetal medicine. The practice exits are expected to be completed by December 31, 2024. Accordingly, a recoverability assessment for each individual physician practice was performed, and the estimated future cash flows related to the physician practices did not support the carrying value of the specifically identified individual long-lived assets. As a result, the Company recorded fixed asset impairments of $20.1 million, intangible asset impairments of $7.7 million and operating lease right-of-use asset impairments of $8.1 million. The operating lease right-of-use impairments are recorded within the transformational and restructuring related expenses line item.

During the second quarter of 2024, the Company made the decision to exit its primary and urgent care service line based on a review of the cost and time that would be required to build the platform to scale. The Company divested one of its two previously acquired primary and urgent care practices during the second quarter and divested of the second of its two acquired primary and urgent care practices subsequent to the end of the second quarter. The total loss on disposal of these two businesses was $10.9 million, resulting from the loss on sale for one practice and marking the net assets to their fair value less costs to sell for the other practice.

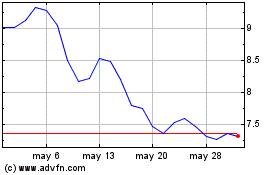

During the second quarter of 2024, the Company experienced a triggering event, due to a sustained decline in its stock price and a market capitalization below the Company's book equity value. As the Company consists of only one reporting unit, and is publicly traded, management estimates the fair value of its reporting unit utilizing the Company’s market capitalization, multiplying the number of actual shares outstanding on June 30, 2024 by its stock price on June 30, 2024 and applying an additional premium to give effect to the Company’s best estimate of a control premium. With respect to the estimated control premium used in its analysis, the Company believes that it is reasonable to expect that a market participant would pay a premium to obtain a controlling interest in the Company. The Company considered information from the public markets for premiums on acquisitions in its industry and also considered other factors, such as the value that may arise from the ability to take advantage of synergies and other benefits that flow from control over another entity.

This assessment resulted in a non-cash impairment charge of $130.0 million, representing the amount by which the Company's book value exceeded its implied fair value, based on its market capitalization plus an estimated control premium. Consideration was first given to other individual and group long-lived assets, and no impairment was considered necessary on such assets.

Recognition of this non-cash charge against goodwill resulted in a tax benefit which generated an additional deferred tax asset of $24.2 million that increased the Company's book value. An incremental non-cash charge was required to reduce the

Company's book value to its previously determined fair value. Accordingly, the Company recorded the incremental non-cash charge of $24.2 million for a total non-cash charge of $154.2 million. A 1% change in the control premium used would have impacted the non-cash impairment charge by approximately $6.5 million.

7. Accounts Payable and Accrued Expenses:

Accounts payable and accrued expenses consist of the following (in thousands):

|

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

Accounts payable |

|

$32,000 |

|

$34,588 |

Accrued salaries and incentive compensation |

|

115,093 |

|

193,112 |

Accrued payroll taxes and benefits |

|

28,034 |

|

36,545 |

Accrued professional liabilities |

|

28,966 |

|

32,039 |

Accrued interest |

|

8,258 |

|

8,262 |

Other accrued expenses |

|

54,982 |

|

46,252 |

|

|

$267,333 |

|

$350,798 |

The net decrease in accrued salaries and incentive compensation of $78.0 million, from December 31, 2023 to June 30, 2024, is primarily due to the payment of performance-based incentive compensation, principally to the Company’s affiliated physicians, partially offset by performance-based incentive compensation accrued during the six months ended June 30, 2024. A majority of the Company’s payments for performance-based incentive compensation is paid annually during the first quarter.

8. Line of Credit and Long-Term Debt:

On February 11, 2022, the Company issued $400.0 million of 5.375% unsecured senior notes due 2030 (the “2030 Notes”). The Company used the net proceeds from the issuance of the 2030 Notes, together with $100.0 million drawn under the Revolving Credit Line (as defined below), $250.0 million of Term A Loan (as defined below) and approximately $308.0 million of cash on hand, to redeem (the “Redemption”) the 2027 Notes, which had an outstanding principal balance of $1.0 billion, and to pay costs, fees and expenses associated with the Redemption and the Credit Agreement Amendment (as defined below).

Interest on the 2030 Notes accrues at the rate of 5.375% per annum, or $21.5 million, and is payable semi-annually in arrears on February 15 and August 15, beginning on August 15, 2022. The Company's obligations under the 2030 Notes are guaranteed on an unsecured senior basis by the same subsidiaries and affiliated professional contractors that guarantee the Amended Credit Agreement (as defined below). The indenture under which the 2030 Notes are issued, among other things, limits the Company's ability to (1) incur liens and (2) enter into sale and lease-back transactions, and also limits the Company's ability to merge or dispose of all or substantially all of its assets, in all cases, subject to a number of customary exceptions. Although the Company is not required to make mandatory redemption or sinking fund payments with respect to the 2030 Notes, upon the occurrence of a change in control, the Company may be required to repurchase the 2030 Notes at a purchase price equal to 101% of the aggregate principal amount of the 2030 Notes repurchased plus accrued and unpaid interest.

Also in connection with the Redemption, the Company amended its credit agreement (the “Credit Agreement”, and such amendment, the "Credit Agreement Amendment"), concurrently with the issuance of the 2030 Notes. The Credit Agreement Amendment, among other things, (i) refinanced the prior unsecured revolving credit facility with a $450 million unsecured revolving credit facility, including a $37.5 million sub-facility for the issuance of letters of credit (the “Revolving Credit Line”), and a $250 million term A loan facility (“Term A Loan”) and (ii) removed JPMorgan Chase Bank, N.A., as the administrative agent under the Credit Agreement and appointed Bank of America, N.A. as the administrative agent for the lenders.

The Credit Agreement, as amended by the Credit Agreement Amendment (the “Amended Credit Agreement”) matures on February 11, 2027 and is guaranteed on an unsecured basis by substantially all of the Company's subsidiaries and affiliated professional contractors. At the Company's option, borrowings under the Amended Credit Agreement bear interest at (i) the Alternate Base Rate (defined as the highest of (a) the prime rate as announced by Bank of America, N.A., (b) the Federal Funds Rate plus 0.50% and (c) Term Secured Overnight Financing Rate ("SOFR") for an interest period of one month plus 1.00% with a 1.00% floor) plus an applicable margin rate of 0.50% for the first two fiscal quarters after the date of the Credit Agreement Amendment, and thereafter at an applicable margin rate ranging from 0.125% to 0.750% based on the Company's consolidated net leverage ratio or (ii) Term SOFR rate (calculated as the Secured Overnight Financing Rate published on the applicable Reuters screen page plus a spread adjustment of 0.10%, 0.15% or 0.25% depending on if the Company selects a one-month, three-month or six-month interest period, respectively, for the applicable loan with a 0% floor), plus an applicable margin rate of 1.50% for the first two full fiscal quarters after the date of the Credit Agreement Amendment, and thereafter at an applicable margin rate ranging from 1.125% to 1.750% based on the Company's consolidated net leverage ratio. The Amended Credit Agreement also provides for other customary fees and charges, including an unused commitment fee with respect to the Revolving Credit Line ranging from 0.150% to 0.200% of the unused lending commitments under the Revolving Credit Line, based on the Company's consolidated net leverage ratio.

The Amended Credit Agreement contains customary covenants and restrictions, including covenants that require the Company to maintain a minimum interest coverage ratio, a maximum consolidated total consolidated net leverage ratio and to comply with laws, and restrictions on the ability to pay dividends, incur indebtedness or liens and make certain other distributions subject to baskets and exceptions, in each case, as specified therein. Failure to comply with these covenants would constitute an event of default under the Amended Credit Agreement, notwithstanding the ability of the Company to meet its debt service obligations. The Amended Credit Agreement includes various customary remedies for the lenders following an event of default, including the acceleration of repayment of outstanding amounts under the Amended Credit Agreement. In addition, the Company may increase the principal amount of the Revolving Credit Line or incur additional term loans under the Amended Credit Agreement in an aggregate principal amount such that on a pro forma basis after giving effect to such increase or additional term loans, the Company would be in compliance with the financial covenants, subject to the satisfaction of specified conditions and additional caps in the event that the Amended Credit Agreement is secured.

At June 30, 2024, the Company had an outstanding principal balance on the Amended Credit Agreement of $221.9 million, composed of the Term A Loan. There was no outstanding balance under the Revolving Credit Line. The Company had $450.0 million available on its Amended Credit Agreement at June 30, 2024.

At June 30, 2024, the Company had an outstanding principal balance of $400.0 million on the 2030 Notes.

9. Common and Common Equivalent Shares:

Basic net income per common share is calculated by dividing net income by the weighted average number of common shares outstanding during the period. Diluted net income per common share is calculated by dividing net income by the weighted average number of common and potential common shares outstanding during the period. Potential common shares consist of outstanding restricted stock and stock options and is calculated using the treasury stock method.

The calculation of shares used in the basic and diluted net income per common share calculation for the three and six months ended June 30, 2024 and 2023 is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Weighted average number of common shares outstanding |

|

|

83,332 |

|

|

|

82,399 |

|

|

|

83,074 |

|

|

|

82,033 |

|

Weighted average number of dilutive common share

equivalents (a) |

|

|

— |

|

|

|

265 |

|

|

|

— |

|

|

|

344 |

|

Weighted average number of common and common

equivalent shares outstanding |

|

|

83,332 |

|

|

|

82,664 |

|

|

|

83,074 |

|

|

|

82,377 |

|

Antidilutive securities (restricted stock and stock options) not included in the diluted net income per common share calculation |

|

|

916 |

|

|

|

1,338 |

|

|

|

661 |

|

|

|

1,358 |

|

(a) Due to a loss for the three and six months ended June 30, 2024, 0.1 million and 0.3 million incremental shares, respectively, are not included because the effect would be antidilutive.

10. Stock Incentive Plans and Stock Purchase Plans:

The Company’s Amended and Restated 2008 Incentive Compensation Plan (the “Amended and Restated 2008 Incentive Plan”) provides for grants of stock options, stock appreciation rights, restricted stock, deferred stock, and other stock-related awards and performance awards that may be settled in cash, stock or other property.

Under the Amended and Restated 2008 Incentive Plan, options to purchase shares of common stock may be granted at a price not less than the fair market value of the shares on the date of grant. The options must be exercised within 10 years from the date of grant and generally become exercisable on a pro rata basis over a three-year period from the date of grant. The Company issues new shares of its common stock upon exercise of its stock options. Restricted stock awards generally vest over periods of three years upon the fulfillment of specified service-based conditions and in certain instances performance-based conditions. Deferred stock awards generally vest upon the satisfaction of specified performance-based conditions and service-based conditions. The Company recognizes compensation expense related to its restricted stock and deferred stock awards ratably over the corresponding vesting periods. During the six months ended June 30, 2024, the Company granted 1.4 million shares of restricted stock to its employees and non-employee directors under the Amended and Restated 2008 Incentive Plan. At June 30, 2024, the Company had 6.3 million shares available for future grants and awards under the Amended and Restated 2008 Incentive Plan.

Under the Company’s Amended and Restated 1996 Non-Qualified Employee Stock Purchase Plan, as amended (the “ESPP”), employees are permitted to purchase the Company's common stock at 85% of market value on January 1st, April 1st, July 1st and October 1st of each year. Under the Company’s 2015 Non-Qualified Stock Purchase Plan (the “SPP”), certain eligible non-employee service providers are permitted to purchase the Company’s common stock at 90% of market value on January 1st, April 1st, July 1st and October 1st of each year.

The Company recognizes stock-based compensation expense for the discount received by participating employees and non-employee service providers. During the six months ended June 30, 2024, approximately 0.2 million shares were issued under the ESPP. At June 30, 2024, the Company had approximately 1.8 million shares reserved for issuance under the ESPP. At June 30, 2024, the Company had approximately 61,000 shares in the aggregate reserved for issuance under the SPP. No shares have been issued under the SPP since 2020.

During the three and six months ended June 30, 2024 and 2023, the Company recognized stock-based compensation expense of $2.0 million and $4.9 million and $3.1 million and $6.1 million, respectively.

11. Common Stock Repurchase Programs:

In July 2013, the Company’s Board of Directors authorized the repurchase of shares of the Company’s common stock up to an amount sufficient to offset the dilutive impact from the issuance of shares under the Company’s equity compensation programs. The share repurchase program allows the Company to make open market purchases from time-to-time based on general economic and market conditions and trading restrictions. The repurchase program also allows for the repurchase of shares of the Company’s common stock to offset the dilutive impact from the issuance of shares, if any, related to the Company’s acquisition program. No shares were purchased under this program during the six months ended June 30, 2024.

In August 2018, the Company announced that its Board of Directors had authorized the repurchase of up to $500.0 million of the Company’s common stock in addition to its existing share repurchase program, of which $4.6 million remained available for repurchase as of December 31, 2023. Under this share repurchase program, during the six months ended June 30, 2024, the Company purchased a nominal number of shares of its common stock for $0.9 million representing shares withheld to satisfy minimum statutory withholding obligations in connection with the vesting of restricted stock, resulting in $3.7 million remaining available for repurchase under this authorization as of June 30, 2024.

The Company intends to utilize various methods to effect any future share repurchases, including, among others, open market purchases and accelerated share repurchase programs. The amount and timing of repurchases will depend upon several factors, including general economic and market conditions and trading restrictions.

12. Commitments and Contingencies:

The Company expects that audits, inquiries and investigations from government authorities and agencies will occur in the ordinary course of business. Such audits, inquiries and investigations and their ultimate resolutions, individually or in the aggregate, could have a material adverse effect on the Company's business, financial condition, results of operations, cash flows and the trading price of its securities. The Company has not included an accrual for these matters as of June 30, 2024 in its Consolidated Financial Statements, as the variables affecting any potential eventual liability depend on the currently unknown facts and circumstances that arise out of, and are specific to, any particular future audit, inquiry and investigation and cannot be reasonably estimated at this time.

In the ordinary course of business, the Company becomes involved in pending and threatened legal actions and proceedings, most of which involve claims of medical malpractice related to medical services provided by the Company's affiliated physicians. The Company's contracts with hospitals generally require the Company to indemnify them and their affiliates for losses resulting from the negligence of the Company's affiliated physicians. The Company may also become subject to other lawsuits which could involve large claims and significant costs. The Company believes, based upon a review of pending actions and proceedings, that the outcome of such legal actions and proceedings will not have a material adverse effect on its business, financial condition, results of operations, cash flows and the trading price of its securities. The outcome of such actions and proceedings, however, cannot be predicted with certainty and an unfavorable resolution of one or more of them could have a material adverse effect on the Company's business, financial condition, results of operations, cash flows and the trading price of its securities.

Although the Company currently maintains liability insurance coverage intended to cover professional liability and certain other claims, the Company cannot assure that its insurance coverage will be adequate to cover liabilities arising out of claims asserted against it in the future where the outcomes of such claims are unfavorable. With respect to professional liability risk, the Company generally self-insures a portion of this risk through its wholly owned captive insurance subsidiary. Liabilities in excess of the Company's insurance coverage, including coverage for professional liability and certain other claims, could have a material adverse effect on the Company's business, financial condition, results of operations, cash flows and the trading price of its securities.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion highlights the principal factors that have affected our financial condition and results of operations, as well as our liquidity and capital resources, for the periods described. This discussion should be read in conjunction with the unaudited Consolidated Financial Statements and the notes thereto included in this Quarterly Report. In addition, reference is made to our audited consolidated financial statements and notes thereto and related Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission on February 20, 2024 (the “2023 Form 10-K”). As used in this Quarterly Report, the terms “Pediatrix”, the “Company”, “we”, “us” and “our” refer to the parent company, Pediatrix Medical Group, Inc., a Florida corporation, and the consolidated subsidiaries through which its businesses are actually conducted (collectively, “PMG”), together with PMG’s affiliated business corporations or professional associations, professional corporations, limited liability companies and partnerships (“affiliated professional contractors”). Certain subsidiaries of PMG have contracts with our affiliated professional contractors, which are separate legal entities that provide physician services in certain states. The following discussion contains forward-looking statements. Please see the Company’s 2023 Form 10-K, including Item 1A, Risk Factors, for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements. In addition, please see “Caution Concerning Forward-Looking Statements” below.

Overview

Pediatrix is a leading provider of physician services including newborn, maternal-fetal, and other pediatric subspecialty care. Our national network is comprised of affiliated physicians who provide clinical care in 37 states. Our affiliated physicians provide neonatal clinical care, primarily within hospital-based neonatal intensive care units (“NICUs”), to babies born prematurely or with medical complications; and maternal-fetal and obstetrical medical care to expectant mothers experiencing complicated pregnancies, primarily in areas where our affiliated neonatal physicians practice. We also provide services across multiple other pediatric subspecialties.

General Economic Conditions and Other Factors

Our operations and performance depend significantly on economic conditions. During the three months ended June 30, 2024, the percentage of our patient service revenue being reimbursed under government-sponsored healthcare programs (“GHC Programs”) decreased as compared to the three months ended June 30, 2023. However, we could experience shifts toward GHC Programs if changes occur in economic behaviors or population demographics within geographic locations in which we provide services, including an increase in unemployment and underemployment as well as losses of commercial health insurance. Payments received from GHC Programs are substantially less for equivalent services than payments received from commercial insurance payors. In addition, costs of managed care premiums and patient responsibility amounts continue to rise, and accordingly, we may experience lower net revenue resulting from increased bad debt due to patients’ inability to pay for certain services.

Practice Portfolio Management Plan and Impairment of Long-Lived Assets

During the second quarter of 2024, we formalized our physician practice optimization plans, resulting in a decision to exit almost all of our affiliated office-based practices, other than maternal-fetal medicine. Over the course of many years, we expanded our pediatric service lines and footprint to provide specialized care to more patients, including through our office-based portfolio of practices. This added complexity to our operations over time and, accordingly, increased costs that resulted in operating challenges primarily for our office-based portfolio of practices. Recognizing this and our need to adapt to the current healthcare climate, during the second quarter, we made the decision to return to a hospital-based and maternal-fetal medicine-focused organization. The exits of our pediatric office-based practices are expected to be completed by December 31, 2024. Accordingly, a recoverability assessment for each impacted individual physician practice was performed, and the estimated future cash flows related to the physician practices did not support the carrying value of the specifically identified individual long-lived assets. As a result, during the second quarter of 2024, we recorded fixed asset impairments of $20.1 million, intangible asset impairments of $7.7 million and operating lease right-of-use asset impairments of $8.1 million. The operating lease right-of-use impairments are recorded within the transformational and restructuring related expenses line item.

Loss on Disposal of Businesses

During the second quarter of 2024, we made the decision to exit our primary and urgent care service line based on a review of the cost and time that would be required to build the platform to scale. We divested one of our two previously acquired primary and urgent care practices during the second quarter and divested of the second of our two acquired primary and urgent care practices subsequent to the end of the second quarter. The total loss on disposal of these two businesses was $10.9 million, resulting from the loss on sale for one practice and marking the net assets to their fair value less costs to sell for the other practice.

Goodwill Impairment