Divestitures Announced to Date to Generate up

to $3.9 Billion in Gross Proceeds

Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM)

(“Newmont” or the “Company”) announced today that it has agreed to

sell its Cripple Creek & Victor (“CC&V”) operation in

Colorado, USA, to SSR Mining Inc. (“SSR”) for up to $275 million in

cash consideration. Upon closing the announced transactions,

Newmont will have delivered up to $3.9 billion in gross proceeds

from non-core asset divestitures and investment sales.1 The

transaction is expected to close in the first quarter of 2025,

subject to certain conditions being satisfied.2

Under the terms of the agreement, Newmont expects to receive

gross proceeds of up to $275 million, which includes:

- Cash consideration of $100 million, due upon closing

- Deferred contingent cash consideration of $87.5 million upon

receipt of pending regulatory approvals3

- Deferred contingent cash consideration of $87.5 million upon

resolution of regulatory applications relating to the Carlton

Tunnel4

Upon completion of an updated regulator-approved closure plan

and in the event aggregate closure costs at CC&V exceed $500

million, Newmont will be responsible for funding 90% of the

incremental closure costs in such updated closure plan, either on

an as-incurred basis or pursuant to a net present value lump sum

payment option.

“We are excited to announce the continuation of our divestment

program to streamline the Newmont portfolio as the leading operator

of Tier 1 gold and copper assets,” said Tom Palmer, Newmont's

President and Chief Executive Officer. “We are confident that

SSR has the capability to deliver the next phase of life for

CC&V, the employees who work there, and local

stakeholders.”

Divestiture Program Progress

In February 2024, Newmont announced the intent to divest its

non-core assets, including six operations and two projects from its

Australian, Ghanaian, and North American business units. The sale

of Telfer operation and Newmont's 70% interest in the Havieron

project closed on December 4, 2024. With definitive agreements in

place to divest four other operations, the Company is focused on

completing the divesture program for its non-core assets, which are

expected to conclude in the first quarter of 2025.5

Total gross proceeds from transactions announced in 2024 to date

are expected to be up to $3.9 billion. This includes $3.4 billion

from non-core divestitures and $527 million from the sale of other

investments, detailed as follows:

- Up to $475 million from the sale of the Telfer operation and

Newmont's 70% interest in the Havieron project;

- Up to $1.0 billion from the sale of the Akyem operation;

- Up to $850 million from the sale of the Musselwhite

operation;

- $795 million from the sale of the Éléonore operation;

- Up to $275 million for the sale of the CC&V operation;

and

- $527 million from the completed sale of other investments,

including the sale of the Lundin Gold stream credit facility and

offtake agreement, and the monetization of Newmont's Batu Hijau

contingent payments.

Advisers and Counsel

In connection with the CC&V transaction, BMO Capital Markets

acted as financial adviser and Davis Graham & Stubbs LLP acted

as legal adviser.

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, zinc, lead, and silver. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in Africa, Australia, Latin America & Caribbean,

North America, and Papua New Guinea. Newmont is the only gold

producer listed in the S&P 500 Index and is widely recognized

for its principled environmental, social, and governance practices.

Newmont is an industry leader in value creation, supported by

robust safety standards, superior execution, and technical

expertise. Founded in 1921, the Company has been publicly traded

since 1925.

At Newmont, our purpose is to create value and improve lives

through sustainable and responsible mining. To learn more about

Newmont’s sustainability strategy and initiatives, go to

www.newmont.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements in this

news release include, without limitation, (i) expectations

regarding outlook; (ii) statements regarding the sales of CC&V,

Éléonore, Musselwhite, Telfer and Havieron, and Akyem, including,

without limitation, expectations regarding timing and closing of

the pending transactions, including receipt of required approvals

and satisfaction of closing conditions; (iii) expectations

regarding receipt of consideration upon closing and receipt of any

deferred contingent cash consideration in the future; and (iv)

expectations regarding receipt of gross consideration; and (v)

other statements regarding future events or results. Estimates or

expectations of future events or results are based upon certain

assumptions, which may prove to be incorrect. Assumptions include,

but are not limited to: (i) certain exchange rate assumptions

approximately consistent with current levels; (ii) certain price

assumptions for gold, copper, silver, zinc, lead and oil; and (iii)

all closing conditions being satisfied.

Expectations regarding the divestment of assets held of sale are

subject to risks and uncertainties. Based on a comprehensive review

of the Company’s portfolio of assets, the Company’s announced a

portfolio optimization program to divest six non-core assets and a

development project in February 2024. The non-core assets to be

divested include CC&V, Musselwhite, Porcupine, Éléonore,

Telfer, and Akyem, and the Coffee development project. While the

Company concluded that these non-core assets and the development

project met the accounting requirements to be presented as held for

sale there is a possibility that the assets held for sale may

exceed one year, or not occur at all, due to events or

circumstances beyond the Company's control. As of the date of this

release, no binding agreements have been entered into with respect

to the sale of the Porcupine Operation or the Coffee development

project. See the September 10, 2024 press release for further

details re the agreement to divest Telfer and Havieron, the October

8, 2024 press release for further details re the agreement to

divest Akyem, the November 18, 2024 press release for further

details re the agreement to divest Musslewhite, and the November

25, 2024 press release for further details re the agreement to

divest Éléonore. Each are available on Newmont’s website. Closing

of such transactions remain subject to certain conditions as

indicated in such releases and notes thereto. No assurances can be

provided with respect to satisfaction of closing conditions, the

timing of closing of the transaction or receipt of contingent

consideration in the future. As noted in the footnotes to this

press release, the closing of the CC&V sale remains subject to

no material adverse change and no transaction-related litigation,

the completion of the pre-closing reorganization, and regulatory

approvals, including the Hart-Scott-Rodino Act review in the United

States.

For a discussion of risks and other factors that might impact

future looking statements and future results, see the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission (the “SEC”)

on February 29, 2024, under the heading “Risk Factors", and other

factors identified in the Company's reports filed with the SEC,

available on the SEC website or at www.newmont.com. The Company

does not undertake any obligation to release publicly revisions to

any “forward-looking statement,” including, without limitation,

outlook, to reflect events or circumstances after the date of this

news release, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

Investors should not assume that any lack of update to a previously

issued “forward-looking statement” constitutes a reaffirmation of

that statement.

1

The estimated aggregate gross proceed

amount is inclusive of both closing consideration and possible

contingent consideration in connection with the sales of CC&V,

Éléonore, Musselwhite, Telfer and Havieron, and Akyem. Actual

results gross proceeds may differ. See cautionary statement at end

of this release regarding forward-looking statements, including

expectations regarding divestments and proceeds.

2

Closing conditions include: (i) no

material adverse change and/or transaction-related litigation and

(ii) regulatory approvals. See cautionary statement at the end of

this release regarding forward-looking statements.

3

Based on receipt of Amendment 14 approval

from applicable Colorado regulatory bodies, at state and county

levels. See cautionary statement at the end of this release

regarding forward-looking statements, including expectations of

regulatory resolutions.

4

Contingent payment upon resolution of

Carlton Tunnel related permit requirements, through

Discharger-Specific Variance (DSV) application or otherwise. See

cautionary statement at the end of this release regarding

forward-looking statements, including expectations of regulatory

resolutions.

5

See cautionary statement at end of this

release regarding forward-looking statements, including

expectations regarding divestments and proceeds.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205865134/en/

Investor Contact – Global Neil Backhouse

investor.relations@newmont.com

Investor Contact – Asia Pacific Natalie Worley

apac.investor.relations@newmont.com

Media Contact – Global Jennifer Pakradooni

globalcommunications@newmont.com

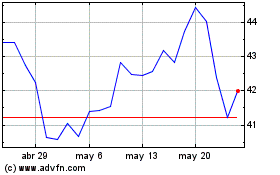

Newmont (NYSE:NEM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

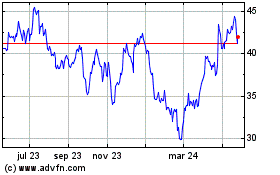

Newmont (NYSE:NEM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024