false

0001595527

0001595527

2024-08-09

2024-08-09

0001595527

us-gaap:CommonStockMember

2024-08-09

2024-08-09

0001595527

us-gaap:RightsMember

2024-08-09

2024-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 9, 2024

American Strategic Investment Co.

(Exact Name of Registrant as Specified in Charter)

Maryland |

|

001-39448 |

|

46-4380248 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

222

Bellevue Ave,

Newport, Rhode Island 02840 |

(Address, including zip code, of Principal

Executive Offices) |

| |

| Registrant’s telephone number, including area code: (212)

415-6500 |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class

A common stock, $0.01 par value per share |

|

NYC |

|

New

York Stock Exchange |

| Class

A Preferred Stock Purchase Rights |

|

true |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Common

Stock [Member]

Item 7.01 Regulation FD Disclosure.

Investor Presentation

On August 9, 2024 American

Strategic Investment Co. (the “Company”) prepared an investor presentation that officers and other representatives of the

Company intend to present at conferences and meetings. A copy of the investor presentation is furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

The

information contained in this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that Section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The

statements in this Current Report on Form 8-K that are not historical facts may be forward-looking statements. These forward-looking

statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “may,”

“will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,”

“projects,” “plans,” “intends,” “should” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements

are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could

cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties

include (a) the anticipated benefits of the Company’s election to terminate its status as a real estate investment trust, (b) whether

the Company will be able to successfully acquire new assets or businesses, (c) the ability of the Company to enter into a definitive agreement

for the sale of 9 Times Square on the contemplated terms and consummate such sale, (d) the ability of the Company to execute its business

plan and sell certain of its properties on commercially practicable terms, if at all, (e) the potential adverse effects of the geopolitical

instability due to the ongoing military conflict between Russia and Ukraine and Israel and Hamas, including related sanctions and

other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global

economy and financial markets, (f) the potential adverse effects of inflationary conditions and higher interest rate environment, (g)

that any potential future acquisition is subject to market conditions and capital availability and may not be completed on favorable terms,

or at all, and (h) the Company may not be able to continue to meet the New York Stock Exchange's (“NYSE”) continued listing

requirements and rules, and the NYSE may delist the Company's common stock, which could negatively affect the Company, the price of the

Company's common stock and the Company's shareholders' ability to sell the Company's common stock, as well as those risks and uncertainties

set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed on

April 1, 2024 and all other filings with the Securities and Exchange Commission after that date including but not limited to the subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as such risks, uncertainties and other important factors may be updated

from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made,

and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence

of unanticipated events or changes to future operating results, unless required to do so by law.

Item

9.01 Financial Statements and Exhibits.

(d)

| Exhibit No |

|

Description |

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

American Strategic Investment Co. |

| |

|

|

| Date: August 9, 2024 |

By: |

/s/ Michael Anderson |

| |

|

Michael Anderson |

| |

|

Chief Executive Officer |

Exhibit 99.1

0 AMERICAN STRATEGIC INVESTMENT CO. Second Quarter Investor Presentation 9 Times Square - New York, NY _

1 Second Quarter 2024 Highlights 1) See appendix for a full description of capitalized terms and Non - GAAP reconciliations. 2) Refer to slide 7 – Top 10 Tenant Investment Grade Profile. Based on Annualized Straight - line Rent and on ratings information as of June 30, 2024. For our purposes, includes both actual investment grade ratings of the tenant or guarantor, if available, o r i mplied investment grade ratings, which includes ratings of the tenant’s parent (regardless of whether the parent has guaranteed the tenant’s obligation under the lease) or lease gua ran tor. See appendix for a full definition of Investment Grade. ASIC’s top 10 tenants are 61% actual Investment Grade (“IG”) rat ed and 20% implied Investment Grade. 3) Refer to slide 8 – Active Portfolio Management for additional information. 4) Refer to slide 10 – Capital Structure and Q2’24 Financial Results for further information regarding our capital structure and liquidity. 5) Based on Annualized Straight - Line Rent as of June 30, 2024. 6) In October 2024, the $49.5 million loan at 9 Times Square matures. The Company has an option to extend the maturity an additional three months subject to certain conditions. The interest rate on 9 Times Square was 8.06% as of June 30, 2024. 7) Data as of June 30, 2024 . 1 Manhattan focused real estate portfolio features an underlying tenant base in core commercial businesses, an attractive top 10 tenant base that is 81% Investment Grade (1)(2) rated and demonstrated leasing platform success x Portfolio Occupancy (1) of 85.9% with a weighted - average Remaining Lease Term (1) of 6.3 years x Solid tenant base featuring government agencies and Investment Grade corporate tenants with core commercial business x Core office properties are well located in desirable submarkets with close proximity to major transportation hubs x Top 10 tenants that are 81% (2) Investment Grade rated and have a Remaining Lease Term of 7.9 years x Well - balanced and long - term lease maturity schedule with 40 % (5) of leases expiring after 2030 x Active portfolio management resulting in new leasing completed during the quarter x Exploring strategic dispositions, signed a definitive agreement to sell 9 Times Square for $63.5 million, marketing process o ngo ing for 123 William St and 196 Orchard St x Completed one new lease and one new license agreement in Q2’24 totaling 5,284 SF and $0.9 million of SLR (1) x Q2’24 forward Leasing Pipeline (1) of three new leases totaling 25,771 SF and $1.2 million of SLR (1) . Upon commencement of these leases, portfolio Occupancy (1) is expected to increase to 86.3%, net of terminations x 88% fixed - debt capital structure with a weighted - average debt maturity of 2.7 years at a 4.9% weighted - average interest rate x Limited near - term debt maturity, with only 12.4% of debt maturing through 2024, and no debt maturing in 2025 (6) x Advisor and affiliates own over 1.4 million (7) shares, demonstrating their commitment to the Company High Quality Manhattan Focused Portfolio Active Portfolio Management (3) Conservative Debt Profile and Advisor - Shareholder Alignment (4)

2 2 Signed definitive agreement to sell 9 Times Square, continuing to field offers on 123 William Street, and 196 Orchard Street Strategic Dispositions 2 Strategic Disposition Highlights x The Company has signed a definitive agreement to sell 9 Times Square at a price of $63.5M x The sale of 9 Times Square would, if completed on the terms contemplated, reduce leverage on the Company’s balance sheet and generate expected net proceeds (1) of $13.5 million, strengthening the Company’s cash position x The marketing process for the sale of 123 William Street and 196 Orchard Street is ongoing x Management believes 123 William Street, and 196 Orchard Street are well - positioned to generate significant proceeds and create excess cash reserves, which would, if completed on the terms contemplated, enable the Company to invest in alternative assets x As previously announced, the Company intends to deploy these proceeds (1) towards higher - yielding investments in assets beyond Manhattan real estate, further diversifying the Company’s business Street view of 9 Times Square Street view of the lobby at 123 William Street Street view of 196 Orchard Street 1) There can be no assurance that ASIC will complete the dispositions of the above referenced properties on commercially reasona ble terms, if at all.

3 Second Quarter 2024 Portfolio Highlights Metric ($ and SF in mm) Q2’24 Real Estate Investments, at Cost $593.0 Number of Properties 7 Total Square Feet 1.2 Annualized Straight - line Rent $58.7 Occupancy 85.9% Weighted - Average Lease Term Remaining 6.3 Years 1) Ratings information is as of June 30, 2024. Weighted based on Annualized Straight - Line Rent as of June 30, 2024. ASIC’s top 10 t enants are 61% actual Investment Grade rated and 20% implied Investment Grade. Refer to slide 6 – Top 10 Tenant Investment Grade Profile and Definitions in the appendix for additional information. 2) Based on Annualized Straight - Line Rent as of June 30, 2024. 3 13% 10% 5% 11% 6% 6% 4% 45% 2024 2025 2026 2027 2028 2029 2030 Thereafter Financial Services 24% Government / Public Administration 13% Retail 12% Non - profit 9% Office 8% Services 7% Healthcare Services 5% Fitness 5% Professional Services 5% Technology 4% Other 8% $593 million portfolio of real estate investments featuring a diverse tenant mix across seven mixed - use office and retail condominium buildings that are primarily located in Manhattan Top 10 Tenants’ Credit Ratings (1) Tenant Industry Diversity (2) Lease Expiration Schedule (2) Portfolio Metrics 81% 19% Investment Grade Not Rated

4 4 Real Estate Portfolio Highlights

5 5 Detailed Property Summary Note: Data as of June 30, 2024. 1) Figures represent real estate assets at cost. 2) Based on Annualized Straight - Line Rent as of June 30, 2024. Portfolio Real Estate Assets (1) ($ mm) Occupancy Remaining Lease Term (2) (in years) % of Annualized Straight - Line Rent % of Portfolio Square Feet 123 William Street $280.5 89% 4.7 37% 47% _ 196 Orchard Street $89.3 100% 10.6 11% 5% _ 400 E. 67th Street $73.6 100% 3.0 8% 5% _ 1140 Avenue of the Americas $60.4 79% 5.9 26% 21% _ 9 Times Square $53.9 71% 7.8 15% 15% _ 200 Riverside Blvd. $19.3 100% 13.0 2% 5% _ 8713 Fifth Avenue $16.0 89% 10.1 2% 2% _ Total Portfolio $593.0 86% 6.3 100% 100% _ Note: Map shows six properties located in Manhattan. Medical office building in Brooklyn not pictured. $593 million portfolio, that is diversified across seven mixed - use office and retail assets that are primarily located in Manhattan with close proximity to major transportation hubs

6 6 Note: Portfolio data as of June 30, 2024, unless otherwise noted. 1) Weighted based on Annualized Straight - Line Rent as of June 30, 2024. 2) Based on Annualized Straight - line Rent and on ratings information as of June 30, 2024. Includes both actual investment grade rat ings of the tenant or guarantor, if available, or implied investment grade ratings, which includes ratings of the tenant’s pa ren t (regardless of whether the parent has guaranteed the tenant’s obligation under the lease) or lease guarantor. See appendix for a full description of Investment Gr ade. ASIC’s top 10 tenants are 61% actual Investment Grade (“IG”) rated and 20% implied Investment Grade. Top 10 Tenant Investment Grade Profile Tenant Space Type Tenant Industry Credit Rating (2) Remaining Lease Term (in years) % of Portfolio SLR % of Portfolio SF City National Bank Office / Retail Financial Services A2 9.0 7.4% 3.6% _ Planned Parenthood Federation of America, Inc. Office Non - Profit A3* 7.0 5.8% 6.9% _ Equinox Retail Fitness Not Rated 14.4 4.9% 3.0% _ Cornell University Office Healthcare Services Aa1 0.2 4.2% 3.0% _ NYC Dept. of Youth & Community Development Office Government Aa2 13.5 3.8% 4.0% _ CVS Retail Retail Baa2 10.2 3.7% 1.0% _ USA General Services Administration Office Government Aaa 3.0 3.5% 4.9% _ I Love NY Gifts Retail Retail Not Rated 11.9 3.3% 0.8% _ NY State Dept. of Licensing Office Government Aa1 3.1 3.1% 4.6% _ Marshalls Retail Retail A2* 4.3 2.8% 2.0% _ *Implied Rating 81% IG Rated 8.0 42.5% 33.8% _ Credit Rating: A2 Credit Rating: Aa1 Credit Rating: Baa2 Credit Rating: Aaa Credit Rating: Aa2 Top 10 tenants (1) feature a balance of Investment Grade corporate tenants with core commercial businesses and government agencies

7 7 Active portfolio management drives new leasing, in conjunction with strategic disposition initiatives to manage capital structure Active Portfolio Management 7 Increased Occupancy at 1140 Ave of Americas x Leasing momentum at the asset continues to build with a new tenant signing a lease for newly - built space, increasing occupancy and adding significant SLR Portfolio Management Highlights x Completed one new lease and one new license agreement in Q2’24 totaling 5,284 SF and $0.9 million of SLR (1) and has a Q2’24 forward Leasing Pipeline (1) of three new leases totaling 25,771 SF and $1.2 million of SLR (1) . Upon commencement of these leases, portfolio Occupancy (1) is expected to increase to 86.3%, net of terminations. x Subsequent to Q2’24, signed a definitive agreement to sell 9 Times Square at a sale price of $63.5 million x Proceeds (2) , if the transaction is executed at the contemplated terms, will be used to pay off the loan on the asset x If the transaction is executed at the contemplated terms, expected to generate net cash proceeds of $13.5 million (2) , allowing the Company to further explore the diversification of the portfolio New Lease Agreement Building 1140 Ave of the Americas Square Feet 5,284 Lease Expiration 8/31/2027 Annual SLR (1) $0.4 million 1) See Definitions in the appendix for a full description. 2) There can be no assurance that ASIC will complete the dispositions of the above referenced properties on commercially reasona ble terms, if at all. Increased SLR at 9 Times Square x New signage operator signs long - term license agreement and meaningfully increases the income at the property New License Agreement Building 9 Times Square Type Signage License Expiration 9/30/2039 Annual SLR (1) $0.6 million

8 Financial Highlights

9 9 Capital Structure and Q2’24 Financial Results Note: We expect to fund our operating expenses and capital requirements over the next 12 months with cash on hand, cash gener ate d from operations and other potential sources. 1) In October 2024, the $49.5 million loan at 9 Times Square matures. The Company has an option to extend the maturity an additional three months subject to certain conditions. The interest rate on 9 Times Square was 8.06% as of June 30, 2024. 2) See Definitions in the appendix for a full description. 3) Calculated as total mortgage notes payable, gross of $399.5 million minus cash and cash equivalents of $5.2 million (excludin g r estricted cash) divided by the carrying value of total assets of $598.9 million plus accumulated depreciation and amortizatio n o f $106.6 million as of June 30, 2024. 4) See appendix for Non - GAAP reconciliations. Debt capital structure features limited debt maturities though 2025 (1) , 88% fixed - rate debt at a 4.9% weighted - average interest rate and Net Leverage (3) of 55.9% Key Capitalization Metrics ($ and shares in mm) Q2’24 Fixed / Floating Debt % 87.6% / 12.4% Weighted Averaged Effective Interest Rate 4.9% Total Debt $399.5 Real estate assets, at cost $593.0 Net Leverage (2)(3) 55.9% Weighted Average Basic and Diluted Shares Outstanding 2.6 88% fixed - rate Debt Maturity Schedule $49.5 $99.0 $140.0 $60.0 $51.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 2024 2025 2026 2027 2028 2029 2030+ Key Financial Results ($ mm) Q2’24 Revenue from Tenants $15.8 Net Loss ($91.9) EBITDA (4) ($81.5) Adjusted EBITDA (4) $4.5 Cash NOI (2)(4) $7.4 Capital Structure and Financial Highlights x Adjusted EBITDA was up 50.0% YoY from $3.0mm in Q2’23 to $4.5mm in Q2’24 x Majority fixed - rate mortgage debt with a weighted - average effective interest rate of 4.9% x Weighted - average debt maturity of 2.7 years with limited debt maturities through 2025 and Net Leverage of 55.9% x Debt maturing in 2024 is on 9 Times Square, which represents 12.4% of total outstanding debt Only ~12% of debt matures thru 2025

10 10 ASIC’s capital structure is composed of majority fixed - rate mortgage debt, limiting adverse effects from rising interests Only ~12% of debt matures through 2025 (2) Compares favorably to prevailing interest rate market Represents modest leverage profile Key Capitalization Metrics 10 Capital structure features limited near - term debt maturities, 88% fixed - rate debt and Net Leverage of 55.9% (1) Capital Structure Highlights 88% Fixed - Rate Capital structure features 88% fixed - rate debt, Net Leverage of 55.9% (1) , a Weighted - Average Interest Rate of 4.9%, and a Weighted - Average Debt Maturity of 2.7 years, continues to contribute to the Company's overall success 2.7 Year Weighted - Average Debt Maturity 4.9% Weighted - Average Interest Rate 55.9% Net Leverage 1) Calculated as total mortgage notes payable, gross of $399.5 million minus cash and cash equivalents of $5.2 million (excludin g r estricted cash) divided by the carrying value of total assets of $598.9 million plus accumulated depreciation and amortizatio n o f $106.6 million as of June 30, 2024. 2) In October 2024, the $49.5 million loan at 9 Times Square matures. The Company has an option to extend the maturity an additional three months subject to certain conditions. The interest rate on 9 Times Square was 8.06% as of June 30, 2024.

11 11 Management and Board of Directors

12 12 Experienced Management Team Boris Korotkin Senior Vice President of Capital Markets ▪ Responsible for leading all debt capital market transactions ▪ Former Executive Vice President of Transaction Structuring for American Financial Realty Trust Christopher Chao Senior Vice President of Asset Management ▪ Responsible for asset management and leasing activity ▪ Former Asset Management and Acquisitions Director for Paramount Group, Inc., a 9 million square foot New York City office portfolio Michael LeSanto Chief Financial Officer ▪ Served as Chief Financial Officer since March 2024 ▪ With a background in public accounting, Mr. LeSanto previously served as Chief Accounting Officer of ASIC and held a number of senior accounting positions prior to joining the Company Michael Anderson Chief Executive Officer ▪ Served as Chief Executive Officer since September 2023 ▪ Mr. Anderson has served as General Counsel of AR Global Investments, where he advised on both public and private debt and equity transactions, mergers and corporate acquisitions, commercial real estate transactions and operational integration of acquired companies

13 13 Board of Directors Michael Weil | Director and Executive Chairman ▪ Founding partner of AR Global and former Chief Executive Officer of ASIC ▪ Prior to being named Chief Executive Officer of ASIC, Mr. Weil served as Executive Vice President of AR Capital, where he supervised the origination of investment opportunities for all AR Capital - sponsored investment programs ▪ Prior to the establishment of AR Capital, Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for an approximately 30 million square foot portfolio ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA) Louis DiPalma | Independent Director and Audit Committee Chairman ▪ Independent director of the Company since December 2022 ▪ Member of the Rhode Island State Senate and served in positions such as the chair of the Senate Committee on Rules, Government Ethics and Oversight, first vice chair of the Senate Committee on Finance and as a member of the Senate Committee on Education Nicholas Radesca | Independent Director ▪ Mr. Radesca has decades of public company experience as chief financial officer of numerous companies, including serving as interim chief financial officer of the Company and as chief financial officer of AR Global and related companies ▪ Mr. Radesca brings to the Company a deep background in real estate, credit, M&A and operating businesses, Elizabeth Tuppeny | Lead Independent Director ▪ Chief Executive Officer and founder of Domus, Inc., since 1993 ▪ 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies ▪ Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games Strong Corporate Governance x Majority independent Board of Directors, with additional oversight provided by committees comprised solely of independent directors x PricewaterhouseCoopers LLP currently acts as the independent auditor for ASIC x ASIC is supported by robust financial accounting and reporting teams, and maintains financial reporting processes, controls and procedures x Advisor and its affiliates own over 1.4 million (1) shares, demonstrating their commitment to Company 1) As of June 30, 2024.

14 14 Appendix

15 15 Definitions Adjusted EBITDA : We define Adjusted EBITDA as EBITDA, as defined below, further excluding ( i ) impairment charges, (ii) interest income and other income or expense, (iii) gains or losses on debt extinguishment, (iv) equity - based compensation expense, (v) acquisition and transaction costs, (vi) gain or loss on asset sales and (vii) and expenses paid with issuances of our common stock in lieu of cash . Annualized Straight - Line Rent or “SLR” : Straight - line rent which is annualized and calculated using most recent available lease terms as of the period end indicated . EBITDA : We define EBITDA as net loss excluding ( i ) interest expense, (ii) income tax expense, (iii) depreciation and amortization expense . Cash NOI : We define Cash NOI as net income (loss), the most directly comparable GAAP financial measure, less income from investment securities and interest, plus general and administrative expenses, acquisition and transaction - related expenses, depreciation and amortization, other non - cash expenses and interest expense . In calculating Cash NOI, we also eliminate the effects of straight - lining of rent and the amortization of above - and below - market leases . Investment Grade : As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade . Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default . Ratings information is as of June 30 , 2024 . Top 10 tenants are 61 % actual investment grade rated and 18 % implied investment grade rated . Leasing Pipeline : Includes ( i ) all leases fully executed by both parties before June 30 , 2024 , where the tenant has yet to take possession as of such date (ii) all leases under negotiation with an executed LOI by both parties as of August 1 , 2024 . This represents two executed lease before June 30 , 2024 , where the tenant has yet to take possession as of such date , totaling 16 , 991 square feet, and one lease under negotiation with an executed LOI by both parties , totaling 8 , 780 square feet . Leasing pipeline should not be considered an indication of future performance . Net Leverage : Calculated as total mortgage notes payable, gross of $ 399 . 5 million minus cash and cash equivalents of $ 5 . 2 million (excluding restricted cash) divided by the carrying value of total assets of $ 598 . 9 million plus accumulated depreciation and amortization of $ 106 . 6 million as of June 30 , 2024 . NOI : Defined as a non - GAAP financial measure used by us to evaluate the operating performance of our real estate . NOI is equal to total revenues, excluding contingent purchase price consideration, less property operating and maintenance expense . NOI excludes all other items of expense and income included in the financial statements in calculating net (loss) . Occupancy : Represents percentage of square footage of which the tenant has taken possession of divided by the respective total rentable square feet as of the date or period end indicated . Remaining Lease Term : Represents the outstanding tenant lease term . Weighted based on Annualized Straight - Line rent as of the date or period end indicated .

16 16 Reconciliation of Non - GAAP Metrics: Cash NOI For the Three Months Ended (in thousands) June 30, 2024 June 30, 2023 Net Loss (in accordance with GAAP) $ (91,851) $ (10,899) Depreciation & Amortization 5,151 6,749 Interest Expense 5,201 4,707 EBITDA (81,499) 557 Impairment of real estate investments 84,724 151 Equity - based compensation 186 2,304 Management fees paid in common stock to the Advisor in lieu of cash 1,077 - Other income (expense) (9) (10) Adjusted EBITDA 4,479 3,002 Asset and property management fees to related parties paid in cash 850 1,988 General & Administrative 1,964 2,439 NOI 7,293 7,429 Accretion of below - and amortization of above - market lease liabilities and assets, net (57) (45) Straight - line rent (revenue as a lessor) 153 120 Straight - line ground rent (expense as lessee) 27 27 Cash NOI $ 7,416 $ 7,531 Cash Net Operating Income (Cash NOI) Reconciliation Schedule

17 17 Legal Notices

18 18 Important Additional Information and Where to Find It References in this presentation to the “Company,” “we,” “us” and “our” refer to American Strategic Investment Co. (“ASIC”) an d i ts consolidated subsidiaries. This presentation contains estimates and information concerning the Company's industry that are based on industry publication s a nd reports. The Company has not independently verified the accuracy of the data contained in these industry publications and reports. Est ima tes and information in this presentation involve a number of assumptions and limitations, and you are cautioned not to rely on or giv e u ndue weight to this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of fact ors , including those described in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” s ect ions of the Company's Annual Report on Form 10 - K for the year ended December 31, 2023 filed on April 1, 2024 and the Company’s Quarterly Rep ort on on Form 10 - Q for the quarter ended June 30, 2024 filed on August 9, 2024 with the Securities and Exchange Commission (the "SEC") a nd all other filings filed with the SEC after that date including but not limited to the subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, as such risks, uncertainties and other important factors may be updated from time to time in the Company's subseque nt reports. These and other factors could cause results to differ materially from those expressed in these publications and reports. The majority of the concessions granted to our tenants as a result of the COVID - 19 pandemic were rent deferrals or temporary ren t abatements with the original lease term unchanged and collection of deferred rent deemed probable. As a result of relief granted by the Fin ancial Accounting Standards Board and the SEC related to lease modification accounting, rental revenue used to calculate Net Income, NO I, Cash NOI, EBITDA, and Adjusted EBITDA has not been, and we do not expect it to be, significantly impacted by these types of deferrals. Non - GAAP Financial Measures We disclose certain non - GAAP financial measures we use to evaluate our performance, such as Cash Net Operating Income (“Cash NOI ”). A description of these non - GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income (lo ss), is provided on slide 16. None of these non - GAAP financial measures should be considered as a substitute for net income or any other financial measure presented in accordance with generally accepted accounting principles in the United States ("GAAP"). Because non - GAAP fi nancial measures are not standardized, such as Cash NOI, as defined by the Company, may not be comparable to similarly titled measure s r eported by other companies. It therefore may not be possible to compare the Company's use of these non - GAAP financial measures with those u sed by other companies. A reconciliation of all non - GAAP measures disclosed in this presentation to their nearest respective GAAP measu res can be found on slide 15 of this presentation. 18

19 19 Forward Looking Statements 19 This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any securities of American S tra tegic Investment Co. (“We” or the “Company”). Any offer or sale of securities will be made only by means of a prospectus and related documentation meeting the req uirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which s uch offer, solicitation or sale would be unlawful. This presentation contains statements that are not historical facts and may be forward - looking statements, including statements regarding the intent, belief or current expectations of us, our operating partnership and members of our management team, as well as the assumptions on wh ich such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates ,” “projects,” “potential,” “predicts,” “expects,” “plans,” “intends,” “would,” “could,” “should” or similar expressions are intended to identify forward - looking statem ents, although not all forward - looking statements contain these identifying words. Actual results may differ materially from those contemplated by such forw ard - looking statements. Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unle ss required by law. These forward - looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward - looking statements. These ris ks and uncertainties include (a) the anticipated benefits of the Company’s election to terminate its status as a real estate investment trust, (b) whether th e Company will be able to successfully acquire new assets or businesses, (c) the ability of the Company to consummate the sale of 9 Times Square (d) th e a bility of the Company to execute its business plan and sell certain of its properties on commercially practicable terms, if at all; (e) the potential adv erse effects of the geopolitical instability due to the ongoing military conflict between Russia and Ukraine and Israel and Hamas, including related sanctions an d other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global economy and financi al markets, (f) the potential adverse effects of inflationary conditions and higher interest rate environment, (g) that any potential future acquisition or di sposition is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, and (h) the Company may not be ab le to continue to meet the New York Stock Exchange's (“NYSE”) continued listing requirements and rules, and the NYSE may delist the Company's common stock, whi ch could negatively affect the Company, the price of the Company's common stock and the Company's shareholders' ability to sell the Company's com mon stock, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10 - K for the year ended Dec ember 31, 2023 filed on April 1, 2024 and all other filings with the Securities and Exchange Commission after that date including but not limited to the subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward - looking statements speak only as of the date they are made, and the Company undertakes no o bligation to update or revise any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

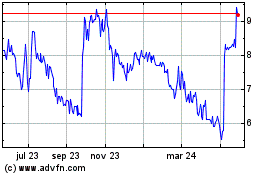

American Strategic Inves... (NYSE:NYC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

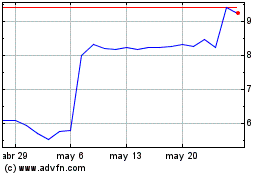

American Strategic Inves... (NYSE:NYC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024