Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Noviembre 2024 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of November,

2024

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: Letter dated November 25, 2024 entitled “Relevant Event. Credit rating

of the company´s bonds”

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: November 25, 2024

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Buenos Aires, April 25, 2024

COMISIÓN NACIONAL DE VALORES

BOLSAS Y MERCADOS ARGENTINOS S.A.

Ref.: Relevant Event. Credit rating

of the company´s bonds

Dear Sirs,

I am writing to you, in

my capacity as Head of Market Relations of Pampa Energía S.A. (the “Company”) in order to inform that yesterday,

FIX (affiliate of Fitch Ratings) (“FIX”) upgraded its Long-Term Issuer and Company´s outstanding bonds rating

to AAA(arg) from AA+(arg). The credit rating upgrade is primarily based on the consolidation of strong cash flow generation in the Gas

and Power Generation businesses and the future prospects related to the development of shale oil in the Rincón de Aranda block.

You can find the complete

report (in Spanish) here: https://www.fixscr.com/reportes-web/view?id=54657

Sincerely,

________________________________

María Agustina Montes

Head of Market Relations

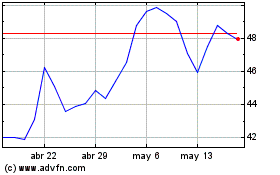

Pampa Energia (NYSE:PAM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

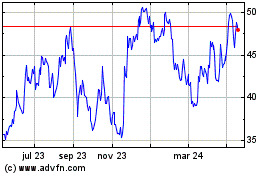

Pampa Energia (NYSE:PAM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024