All conditions have now been satisfied for Rio Tinto’s

investment to develop the Simandou high-grade iron ore deposit in

Guinea, including the completion of necessary Guinean and Chinese

regulatory approvals. The transaction is expected to complete

during the week of 15 July 2024.

Along with the recent approval by the Board of Simfer1, this

allows Simfer to invest in and fund its share of co-developed rail

and port infrastructure being progressed in partnership with

Winning Consortium Simandou2 (WCS), Baowu and the Republic of

Guinea.

More than 600 kilometres of new multi-use trans-Guinean railway

together with port facilities will allow the export of up to 120

million tonnes per year of mined iron ore by Simfer and WCS from

their respective Simandou mining concessions in the southeast of

the country3. Together, this will be the largest greenfield

integrated mine and infrastructure investment in Africa.

Rio Tinto Executive Committee lead for Guinea and Copper Chief

Executive Bold Baatar said: “We thank the Government of Guinea,

Chinalco, Baowu and WCS for their partnership in reaching this

milestone towards developing the world class Simandou project.

“Simandou will deliver a significant new source of high-grade

iron ore that will strengthen Rio Tinto’s portfolio for the

decarbonisation of the steel industry, along with trans-Guinean

rail and port infrastructure that can make a significant

contribution to the country’s economic development.”

Under the terms of the transaction, Simfer will acquire a

participation in the WCS project companies constructing rail and

port infrastructure, commit to perform a portion of the

construction works itself and commit to funding its share of the

overall co-developed infrastructure cost, in an aggregate amount of

approximately $6.5 billion (Rio Tinto share approximately $3.5

billion)4.

Chalco Iron Ore Holdings Ltd (CIOH) has now paid its share of

capital expenditures incurred or required by Simfer to progress

critical works up to completion. A first payment of approximately

$410 million, for expenditures until the end of 2023, was made on

28 June 2024, and a second payment of approximately $575 million,

for 2024 expenditures, was made on 11 July 2024. These amounts

settle all expenditures incurred up to date.

The co-developed infrastructure capacity and associated cost

will be shared equally between Simfer, which will develop, own and

operate a 60 million tonne per year5 mine in blocks 3 and 4 of the

Simandou Project, and WCS, which is developing blocks 1 and 2.

Under the co-development arrangement, Simfer and WCS will

deliver separate infrastructure scopes to leverage expertise.

Simfer will construct the approximately 70 kilometre Simfer spur

rail line and a 60 million tonne per year transhipment vessel (TSV)

port, while WCS will construct the dual track approximately 536

kilometre main rail line, the approximately 16 kilometre WCS spur

rail line and a 60 million tonne per year barge port.

Once complete, all co-developed infrastructure and rolling stock

will be transferred to and operated by the Compagnie du

Transguinéen (CTG) joint venture, in which Simfer and WCS each hold

a 42.5% equity stake and the Guinean State a 15% equity stake6.

First production from the Simfer mine is expected in 2025,

ramping up over 30 months to an annualised capacity of 60 million

tonnes per year5 (27 million tonnes Rio Tinto share). The mine will

initially deliver a single fines product before transitioning to a

dual fines product of blast furnace and direct reduction ready

ore.

Simfer's capital funding requirement for the Simandou project as

a whole is estimated to be approximately $11.6 billion, of which

Rio Tinto's share is approximately $6.2 billion, broken down as

follows.

US dollars in billions (nominal

terms)

Simfer

capex

Rio Tinto share

Mine and TSVs, owned and operated by

Simfer

Development of an initial 60Mt/a mine at

Simandou South (blocks 3 & 4), to be constructed by Simfer

$5.1

$2.7

Co-developed infrastructure, owned and

operated by CTG once complete

Simfer scope (funded 100% by Simfer

during construction)

Rail: a 70 km rail-spur from Simfer mine

to the mainline, including rolling stock Port: construction of a

60Mt/a TSV port

$3.5

$1.9

WCS scope (funded 34% by Simfer

during construction)

Port and rail infrastructure including an

approximately 552 km trans-Guinean heavy haul rail system,

comprised of a 536 km mainline and a 16 km WCS rail spur

$3.0

$1.6

Total capital expenditure (nominal

terms)

$11.6

$6.27

Rio Tinto's share of expected capital investment remaining to be

spent from 1 January 2024 is to be $5.7 billion. Rio Tinto's

expected funding requirements for 2024 and 2025 are included in its

share of capital investment guidance for this period, with project

funding expected to extend beyond this timeframe.

Further details on the Simandou project can be found in the 2023

Investor Seminar presentation at

https://www.riotinto.com/en/invest/investor-seminars.

As Chinalco, Baowu, China Rail Construction Corporation and

China Harbour Engineering Company are Chinese state-owned entities,

and given Chinalco indirectly holds 11.2% of shares in the Rio

Tinto Group, they, and WCS, may be considered to be associates of a

related party of Rio Tinto for the purpose of the UK Listing Rules.

Rio Tinto’s funding commitment pursuant to the infrastructure

co-development arrangement (Rio Tinto share $3.5bn) is a smaller

related party transaction for the purposes of Listing Rule 11.1.10R

and this announcement is, therefore, made in accordance with

Listing Rule 11.1.10R(2)(c).

___________________________

1 Approval has been granted by the Board

of Simfer Jersey Limited, a joint venture between the Rio Tinto

Group (53%) and Chalco Iron Ore Holdings Ltd (CIOH) (47%), a

Chinalco-led joint venture of leading Chinese SOEs (Chinalco (75%),

Baowu (20%), China Rail Construction Corporation (2.5%) and China

Harbour Engineering Company (2.5%)). Simfer Infraco Guinée S.A.U.

will deliver Simfer Jersey’s scope of the co-developed rail and

port infrastructure, and is, on the date of this notice, a

wholly-owned indirect subsidiary of Simfer Jersey Limited, but will

be co-owned by the Guinean State (15%) after closing of the

co-development arrangements. Simfer S.A. is the holder of the

mining concession covering Simandou Blocks 3 & 4, and is owned

by the Guinean State (15%) and Simfer Jersey Limited (85%).

2 WCS is the holder of Simandou North

Blocks 1 & 2 (with the Government of Guinea holding a 15%

interest in the mining vehicle and WCS holding 85%) and associated

infrastructure. WCS was originally held by WCS Holdings, a

consortium of Singaporean company, Winning International Group

(50%) and Weiqiao Aluminium (part of the China Hongqiao Group)

(50%). On 19 June 2024, Baowu Resources completed the acquisition

of a 49% share of WCS mine and infrastructure projects with WCS

Holdings holding the remaining 51%. In the case of the mine, Baowu

also has an option to increase to 51% during operations. After

Closing, Simfer will hold 34% of the shares in the WCS

infrastructure entities during construction with WCS holding the

remaining 66%.

3 WCS holds the mining concession for

Blocks 1 and 2, while Simfer S.A. holds the mining concession for

blocks 3 and 4. Simfer and WCS will independently develop their

mines.

4 A true-up mechanism will apply between

Simfer and WCS to equalise most of their costs of constructing the

co-developed rail and port infrastructure. The figures shown here

are pre-equalisation.

5 The estimated annualised capacity of

approximately 60 million dry tonnes per annum iron ore for the

Simandou life of mine schedule was previously reported in a release

to the Australian Securities Exchange dated 6 December 2023 titled

“Simandou iron ore project update”. Rio Tinto confirms that all

material assumptions underpinning that production target continue

to apply and have not materially changed.

6 Ownership of the rail and port

infrastructure will transfer from CTG to the Guinean State after a

35 year Operations Period, with Simfer retaining access rights on a

non-discriminatory basis and at least equivalent to all Third Party

Users.

7 By the end of 2023, Rio Tinto spent $0.5

billion (Rio Tinto share) to progress critical path works. Rio

Tinto’s share of expected capital investment remaining to be spent

from 1 January 2024 was $5.7 billion.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240621382292/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom Matthew

Klar M +44 7796 630 637 David Outhwaite M

+44 7787 597 493

Media Relations, Australia Matt Chambers M

+61 433 525 739 Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 Michelle

Lee M +61 458 609 322

Media Relations, Americas Simon Letendre M

+1 514 796 4973 Malika Cherry M +1 418 592 7293

Vanessa Damha M +1 514 715 2152

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797

Investor Relations, Australia Tom Gallop M

+61 439 353 948 Amar Jambaa M +61 472 865 948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: Simandou

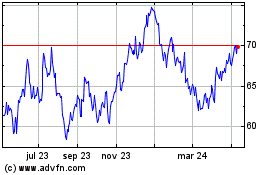

Rio Tinto (NYSE:RIO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

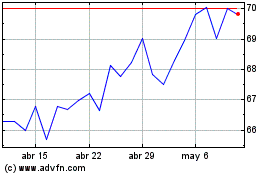

Rio Tinto (NYSE:RIO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024