0001837014false00018370142025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2025

SmartRent, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39991 |

|

85-4218526 |

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

|

|

|

8665 E. Hartford Drive, Suite 200 Scottsdale, Arizona |

|

85255 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(844) 479-1555

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

Class A Common Stock, par value $0.0001 per share |

|

SMRT |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Executive Officer

On January 27, 2025, SmartRent, Inc. (the “Company”) announced the appointment of Michael Shane Paladin as President and Chief Executive Officer and member of the Board of Directors (the “Board”) of the Company as a Class I director to serve until the Company’s 2025 annual meeting of stockholders, effective as of the date Mr. Paladin’s employment commences with the Company, which is expected to be February 24, 2025 (the “Start Date”). Mr. Paladin will replace Daryl Stemm who had been serving as Interim Principal Executive Officer since July 29, 2024. Mr. Stemm will continue to serve as the Company’s Chief Financial Officer. The Management Committee of SmartRent and the Operating Committee of the Board, both formed to guide the Company through its Chief Executive Officer transition, will dissolve effective as of the Start Date.

Mr. Paladin, age 47, served as Chief Executive Officer of Siteimprove, a private equity-backed Martech SaaS company from July 2021 to January 2025. Prior to Siteimprove, Mr. Paladin held several senior leadership positions at SAP SE (NYSE: SAP), an international enterprise software company. He most recently served as SAP SE President of Services from March 2020 to July 2021. Earlier in his tenure at SAP, Mr. Paladin served as Executive Vice President & Global Head of Services Sales from March 2018 to February 2020; Senior Vice President and Chief Operating Officer of SAP Greater China from January 2017 to February 2018; Senior Vice President & Managing Director, Hong Kong and Macau from April 2016 to February 2018; and earlier in his career, Vice President of Sales for SAP America from June 2007 to October 2013. Prior to SAP, Mr. Paladin was the Vice President and General Manager, Worldwide Field Operations at SignalFx Inc., a SaaS based infrastructure monitoring solution from June 2015 to February 2016; Chief Revenue Officer at Ayasdi Inc., a SaaS based advanced machine learning platform from October 2013 to May 2015, and a Founder and Principal at FocusFrame Inc., a provider of BTO consulting services, from August 2001 to June 2007. Before entering the corporate arena, Mr. Paladin served in the United States Army from August 1996 to May 2001, holding various leadership roles within the 25th Infantry Division at Schofield Barracks and previous postings at Fort Jackson, Louisiana and Fort Eisenhower (previously Fort Gordon), in Augusta, Georgia. Mr. Paladin holds a Bachelor of Arts degree in Business Administration and Management Information Systems from Saint Leo University in Florida and a Master in Strategy and Innovation from the St. Hugh’s College & Saïd Business School at the University of Oxford in the United Kingdom.

There are no arrangements or understandings between Mr. Paladin and any other persons pursuant to which Mr. Paladin was appointed. There are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Paladin and any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer. Additionally, there have been no transactions involving Mr. Paladin that would require disclosure under Item 404(a) of Regulation S-K.

Pursuant to his offer letter with the Company, Mr. Paladin will receive an annual base salary of $650,000 per year and will be eligible for an annual target bonus equal to 100% of base salary, subject to the terms of the Company’s Executive Incentive Compensation Plan, with a maximum potential bonus of 200% of target. Mr. Paladin will also receive a sign-on bonus of up to $650,000 paid in two equal installments, the first in the first pay period following the Start Date and the second in the first pay period following the six (6) month anniversary of the Start Date, subject to Mr. Paladin remaining an employee through the applicable payment date. In addition, Mr. Paladin will receive a grant of time-based restricted stock units (“RSUs”) covering shares of the Company’s Class A common stock (the “Common Stock”) with a total intended value of $2,700,000. The number of shares underlying the RSUs will equal $2,700,000 divided by the simple average of the closing price per share of the Common Stock for the trailing thirty (30)-trading days up to and including the Start Date, rounded down to the nearest whole share of Common Stock. The RSUs will be scheduled to vest at a rate of 1/3rd of the RSUs annually on each anniversary of the Start Date, subject in each case to Mr. Paladin’s continued service as a Company employee through the applicable vesting date. Mr. Paladin will also receive a grant of stock price appreciation performance-based RSUs (the “SP PSUs”). The target number of SP PSUs granted will equal $3,500,000 divided by the simple average of the closing price per share of the Common Stock for the trailing thirty (30)-trading days up to and including the Start Date, rounded down to the nearest whole share of Common Stock. The actual number of shares of Common Stock earned, if any, will be determined based on the achievement of performance goals relating to Company share price during a five (5) year performance period from the Start Date, and vest based on Mr. Paladin’s continued service as a Company employee, with 50% of any shares achieved vesting on the four (4) year anniversary of the Start Date, and 100% of any shares achieved but not yet paid vesting on the five (5) year anniversary of the Start Date. Both the RSUs and the SP PSUs are an inducement material to Mr. Paladin entering into employment with the Company. Mr. Paladin will also receive medical and other benefits consistent with the Company’s standard policies and will be eligible to participate in other Company plans.

Pursuant to the terms of his offer letter, upon a termination of Mr. Paladin’s employment by the Company without Cause (as defined in the offer letter) or by Mr. Paladin with Good Reason (as defined in the offer letter and each a “Qualifying

Termination”) outside of the period beginning three (3) months prior to ending twenty-four (24) months following a change in control of the Company (the “Change in Control Period”), then, subject to Mr. Paladin’s timely execution and non-revocation of a release of claims and continued compliance with non-competition and non-solicitation covenants, Mr. Paladin will be eligible to receive the following severance benefits: (i) a lump sum payment equal to (A) 100% of Mr. Paladin’s base salary, plus (B) 100% of Mr. Paladin’s target bonus, plus (C) 100% of any prorated annual bonus for the year of termination based on the portion of the year completed prior to termination and actual Company performance for the year of termination (the “Prorated Bonus”), plus (D) 100% of Mr. Paladin’s annual bonus, if any, for the year prior to the year of termination to the extent earned based on actual achievement but not paid as of the time of termination (the “Prior Year Bonus”), (ii) up to12 months of COBRA benefits for Mr. Paladin and any eligible dependents under the Company’s group health plans, and (iii) if such termination occurs on or after the two (2) year anniversary of the Start Date, 100% acceleration of any SP PSUs for which the applicable Company share price goal was achieved prior to such termination.

Further, pursuant to the terms of his offer letter, upon a Qualifying Termination that occurs during the Change in Control Period, then, subject to Mr. Paladin’s timely execution and non-revocation of a release of claims and continued compliance with any non-competition and non-solicitation covenants, Mr. Paladin will be eligible to receive the following severance benefits: (i) a lump sum payment equal to (A) 200% of Mr. Paladin’s base salary, plus (B) 200% of Mr. Paladin’s target bonus, plus (C) 100% of the Prorated Bonus, plus (D) 100% of the Prior Year Bonus, (ii) up to twenty-four (24) months of COBRA benefits for Mr. Paladin and any eligible dependents under the Company’s group health plans, and (iii) 100% accelerated vesting for all then-outstanding and unvested equity awards that vest based solely on continued service, including any SP PSUs for which the applicable Company share price goal was achieved prior to such termination, and any performance-based equity awards will be treated as provided in the applicable award agreement. If any payment or benefit payable to Mr. Paladin constitute “parachute payments” under Section 280G of the U.S. tax code and would be subject to the applicable excise tax, then Mr. Paladin’s payments or benefits will be either (i) delivered in full or (ii) delivered to such lesser extent which would result in no portion of such benefits being subject to the excise tax, whichever results in the receipt by Mr. Paladin on an after-tax basis of the greatest amount of benefits.

In addition, Mr. Paladin will enter into the Company’s standard indemnification agreement, the form of which was referenced as Exhibit 10.8 to the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 5, 2024.

The foregoing is a summary of the material terms of the offer letter and is qualified in its entirety by reference to the complete text of the agreement, a copy of which will be included as an exhibit to the Company’s future SEC filings.

Amendment to Executive Employment Agreements

On January 22, 2025, the Company amended the employment agreements of each of Isaiah DeRose-Wilson, Daryl Stemm, and Robyn Young (each, an “Executive”) to include severance payable to such Executive in the event of a separation from the Company without Cause or for Good Reason, amend the severance payable to such Executive in the event of a separation from the Company without Cause or for Good Reason within a Change of Control Period, and other clarifying changes (collectively, the “Amendments”), as set forth below:

•If the Company terminates an Executive’s employment without Cause (as defined in the Amendments) or the Executive terminates his or her employment with Good Reason (as defined in the Amendments and each a “Qualifying Termination”) outside of the Change in Control Period (as defined in the Amendments), then, subject to the satisfaction of the Severance Conditions (as defined in the Amendments and including Executive timely signing and allowing to become effective a full general release of claims in a form acceptable to the Company), the Executive will be eligible to receive the following severance benefits: (A) a payment equal to twelve (12) months of his or her base salary as of the termination date paid in equal installments over a period of twelve (12) months; (B) an amount sufficient to reimburse Executive for the premiums required to continue Executive’s group health care coverage for a period of up to twelve (12) months (the “COBRA Benefits”); and (C) his or her Prior Year Bonus and Prorated Bonus (each as defined in the Amendments).

•In the event of a Qualifying Termination within a Change of Control Period, then, subject to the satisfaction of the Severance Conditions, the Executive will be eligible to receive the following severance benefits: (A) a payment equal to twelve (12) months of his or her base salary as of the termination date and 100% of his or her Target Bonus (as defined in the Amendments) paid in equal installments over a period of twelve (12) months; (B) the COBRA Benefits; (C) his or her Prior Year Bonus and Prorated Bonus, and (D) immediate vesting of equity grants.

The foregoing is a summary of the material terms of the Amendments and is qualified in its entirety by reference to the complete text of the Amendments, copies of which will be filed as exhibits to the Company’s future SEC filings.

Adoption of 2025 Inducement Equity Incentive Plan

On January 22, 2025, the Board adopted the SmartRent, Inc. 2025 Inducement Equity Incentive Plan (the “Inducement Plan”), pursuant to which the Company may grant equity awards that are intended to qualify as employment inducement awards under the New York Stock Exchange Listed Company Manual Rule 303A.08 and any applicable interpretive material and other guidance issued under such rule (together, the “Inducement Listing Rule”), from time to time as determined by the Committee (as defined in the Inducement Plan), the Board’s Compensation Committee, or a majority of the Company’s “Independent Directors” (as defined under the applicable rules of the New York Stock Exchange). Upon adoption of the Inducement Plan, and subject to the adjustment provisions therein, the Company reserved 6,500,000 shares of Common Stock for issuance pursuant to equity awards granted under the Inducement Plan.

The Inducement Plan provides for the grant of equity-based awards, including options, stock appreciation rights, restricted stock awards, restricted stock units, performance shares, performance units, cash-based awards and other stock-based awards. Such equity-based awards may be granted under the Inducement Plan only to employees of the Company, so long as the following requirements are met: (i) the employee was not previously an employee or director, or the employee is to become employed by the Participating Company Group (as defined in the Inducement Plan) following a bona fide period of non-employment (within the meaning of the Inducement Listing Rule), and (ii) the grant of the award or awards is an inducement material to the employee’s entering into employment with the Participating Company Group in accordance with the Inducement Listing Rule.

A copy of the Inducement Plan and related form agreements under the Inducement Plan will be included as exhibits to the Company’s future SEC filings. The above description of the Inducement Plan does not purport to be complete and is qualified in its entirety by reference to such exhibit.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 27, 2025

|

|

|

|

|

|

SMARTRENT, INC. |

|

|

By: |

|

/s/ Daryl Stemm |

Name: |

|

Daryl Stemm |

Title: |

|

Interim Principal Executive Officer and Chief Financial Officer |

SmartRent Names Shane Paladin as President and Chief Executive Officer

Transformative Leader and SaaS Veteran to Drive Company’s Next Chapter of Growth and Innovation in Smart Home Technology for the Rental Housing Industry

SCOTTSDALE, Ariz., January 27, 2025 — SmartRent Inc. (NYSE: SMRT) (“SmartRent” or the “Company”), the leading provider of smart communities solutions and smart operations solutions for the rental housing industry, today announced the appointment of Michael Shane Paladin as its President and Chief Executive Officer, with an expected start date of February 24. In this role, Paladin will lead SmartRent’s executive team as the Company strives to advance its market share and strategic vision of delivering smart living and working for the rental housing industry while optimizing service and performance for its customers, site teams and resident users.

With more than two decades of proven experience across SaaS, enterprise software and technology services, Paladin brings an extraordinary track record of delivering strategic transformation, operational excellence and sustainable growth to SmartRent. From revitalizing SaaS businesses to driving innovation in cloud-based solutions, Paladin has a demonstrated history of delivering elevated customer experience, expanding profitable growth and navigating complex market dynamics while delivering tangible value to stakeholders.

“We are delighted to welcome Shane to the SmartRent team. As we integrate his wealth of knowledge, strategic vision and innovation acumen into our Company arsenal, SmartRent embarks on a new turning point while transforming rental housing operations – bringing unmatched value for our customers and their residents,” said John Dorman, Chairman of the SmartRent Board of Directors. “Shane joins us at a moment when we are helping the rental housing industry navigate through one of its most pivotal periods by delivering a holistic enterprise platform that addresses all aspects of portfolio and property management. With Shane’s leadership and our recent $10M innovation investment, we are well positioned to remain at the forefront of innovation in our space, setting the standard and driving the future of property technology.”

Paladin’s SaaS career spans blue-chip companies and pioneering early-stage ventures where he established strong foundations for scalable growth while enhancing customer retention and operational efficiency. Most recently, Paladin served as Chief Executive

Officer of Siteimprove, a private equity-backed marketing technology SaaS company. There, he led a successful turnaround, driving profitable growth, expanding product offerings and executing strategic mergers and acquisitions. His tenure was marked by innovation and an unwavering commitment to customer success.

Before joining Siteimprove, Paladin held several senior-level roles at SAP SE (NYSE: SAP), one of the world’s largest enterprise software companies. As President of Services, he led a global 19,000-person team, managed a multi-billion-euro P&L and drove SAP’s digital transformation by streamlining its services portfolio and enabling a rapid shift to remote project delivery during the COVID-19 pandemic. Previously, as Chief Operating Officer of SAP Greater China, he modernized operations, accelerated

cloud adoption and transformed the region into one of SAP’s fastest-growing markets. Earlier, in North America, he held several senior leadership roles driving customer-centric growth initiatives and achieved significant improvements in revenue, profitability and market share.

“I’m honored to join SmartRent at a time when the rental housing industry is embracing transformative technology,” said Paladin. “SmartRent’s innovative approach to IoT, data intelligence and resident-centric experiences uniquely positions the Company to lead this evolution. I look forward to working with the talented team at SmartRent to deliver game-changing solutions that empower our customers and redefine what’s possible in property technology.”

About SmartRent

Founded in 2017, SmartRent, Inc. (NYSE: SMRT) is a leading provider of smart communities solutions and smart operations solutions to the rental housing industry. SmartRent’s end-to-end enterprise ecosystem powers smarter living and working in rental housing by automating operations, protecting assets, reducing energy consumption, enhancing the resident experience and more. The Company’s differentiators - purpose-built software and hardware, and end-to-end implementation and support - create an exceptional experience, with 15 of the top 20 multifamily operators and millions of users leveraging SMRT solutions daily. For more information, please visit smartrent.com.

Forward-Looking Statements

This press release contains forward-looking statements which address the Company's executive transition, expected future business and financial performance, areas of focus, including our sales organization, the Company's approach to operational and financial discipline, leadership transition, expected growth, strategy, performance, financial review, stock repurchase program and expected benefits from stock repurchase program, and other future events and forward-looking statements. Forward-looking statements may contain words such as "goal," "target," "future," "estimate," "expect," "anticipate," "intend," "plan," "believe," "seek," "project," "may," "should," "will" or similar expressions. Examples of forward-looking statements include, among others, statements regarding the expected financial results, product portfolio enhancements, expansion plans and opportunities and earnings guidance related to financial and operational metrics. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those currently anticipated. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, among other things, our ability to: (1) accelerate adoption of our products and services; (2) anticipate the uncertainties inherent in the development of new business lines and business strategies; (3) manage risks associated with our third-party suppliers and manufacturers and partners for our products; (4) manage risks associated with adverse macroeconomic conditions, including inflation, slower growth or recession, barriers to trade, changes to fiscal and monetary policy, tighter credit, higher interest rates, high unemployment, and currency fluctuations; (5) attract, train, and retain effective officers, key employees and directors

and manage risks associated with the leadership transition; (6) develop, design, manufacture, and sell products and services that are differentiated from those of competitors; (7) realize the benefits expected from our acquisitions; (8) acquire or make investments in other businesses, patents, technologies, products or services to grow the business; (9) successfully pursue, defend, resolve or anticipate the outcome of pending or future litigation matters; (10) comply with laws and regulations applicable to our business, including privacy regulations; (11) realize the benefits expected from our stock repurchase program; and (12) maintain key strategic relationships with partners and distributors. The forward-looking statements herein represent the judgment of the Company, as of the date of this release, and SmartRent disclaims any intent or obligation to update forward-looking statements. This press release should be read in conjunction with the information included in the Company's other press releases, reports and other filings with the SEC. Understanding the information contained in these filings is important in order to fully understand the Company's reported financial results and our business outlook for future periods.

Media Contact

Amanda Chavez - Vice President, Marketing and Communications

media@smartrent.com

Investor Contact

Kelly Reisdorf - Head of Investor Relations

investors@smartrent.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

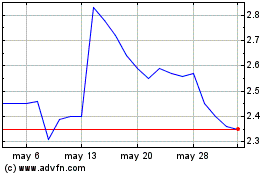

SmartRent (NYSE:SMRT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

SmartRent (NYSE:SMRT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025