Form N-2/A - Registration statement for closed-end investment companies: [Amend]

13 Noviembre 2024 - 11:50AM

Edgar (US Regulatory)

As filed with

the Securities and Exchange Commission on November 13, 2024.

Registration Nos. 333-280485

811-22328

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Form N-2

REGISTRATION STATEMENT

THE SECURITIES ACT OF 1933

☒

Pre-Effective Amendment No. 2

Post-Effective Amendment No. ___

☐

and/or

THE

INVESTMENT COMPANY ACT OF 1940

☒

(Check Appropriate Box or Boxes)

COLUMBIA SELIGMAN PREMIUM TECHNOLOGY GROWTH FUND, INC.

(Exact Name of Registrant as Specified in Charter)

290 Congress Street, Boston, Massachusetts 02110

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (866) 666-1532

Daniel J. Beckman c/o Columbia Management Investment Advisers, LLC 290 Congress Street Boston, Massachusetts 02110 |

Ryan C. Larrenaga, Esq. c/o Columbia Management Investment Advisers, LLC 290 Congress Street Boston, Massachusetts 02110 |

(Name and Address of Agents for Service)

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states this

Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the Registration Statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement

☐ Check box if the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans.

☒ Check box if any securities being registered on

this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities

offered in connection with a dividend reinvestment plan.

☒ Check box if this Form is a registration

statement pursuant to General Instruction A.2 or a post-effective amendment thereto.

☐ Check box if this Form is a registration statement pursuant to General

Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities

Act.

☐ Check box if this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act

It is proposed that this filing will become effective (check appropriate box)

☐ when declared effective pursuant to section 8(c)

The following boxes should only be included and completed if the

registrant is making this filing in accordance with Rule 486 under the Securities Act.

☐ immediately upon filing pursuant to paragraph (b)

☐ on (date) pursuant to paragraph (b)

☐ 60 days after filing pursuant to paragraph (a)

☐ on (date) pursuant to paragraph (a)

If appropriate, check the following box:

☐ This [post-effective] amendment designates a new effective date for a

previously filed [post-effective amendment][registration statement].

☐ This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the Securities Act registration number of the earlier effective registration statement for the same offering is _____.

☐ This Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is:

______.

☐ This Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is:

______.

Check each box that appropriately characterizes the

Registrant:

☒ Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)).

☐ Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act).

☐ Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

☒ A.2 Qualified (qualified to register securities

pursuant to General Instruction A.2 of this Form).

☐ Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

☐ Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”).

☐ If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

☐ New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing).

PART C. OTHER

INFORMATION

Item 25. Financial Statements and

Exhibits

Part A. Financial Highlights for the ten years ended December 31, 2023 and for the six months ended June 30, 2024.

Part B. The required financial statements are included in the

Fund’s 2023 Annual Report and in the Fund’s 2024 Semiannual Report, which are incorporated by reference into the Statement of Additional Information. These

statements include: Portfolio of Investments at December 31, 2023 and June 30, 2024; Statement of Assets and Liabilities at December 31, 2023 and June 30, 2024; Statement of Operations for the year ended December 31, 2023 and for the six-month period ended June 30, 2024; Statements of Changes in Net Assets for the years ended December 31, 2023 and 2022 and for the six-month period ended June 30, 2024; Notes to Financial Statements; Financial Highlights for the ten years ended December 31, 2023 and for the semiannual period ended June 30, 2024; Report of Independent Registered Public Accounting Firm.

The Fund’s future stockholder reports are hereby

incorporated by reference.

| |

|

Filed Herewith or

Incorporated by

Reference |

Information About the Filing that Includes the Document Incorporated by Reference

|

Registrant

that Made

the Filing |

File No.

of Such

Registrant |

|

Exhibit of

Document

in that

Filing |

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Registration

Statement on Form

N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Post-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Post-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

|

|

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Post-Effective

Amendment #2 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by Reference |

Columbia Seligman Premium Technology Growth Fund, Inc. |

|

Pre-Effective Amendment #1 on Form N-2 |

|

|

| |

|

Filed Herewith or

Incorporated by

Reference |

Information About the Filing that Includes the Document Incorporated by Reference

|

Registrant

that Made

the Filing |

File No.

of Such

Registrant |

|

Exhibit of

Document

in that

Filing |

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #4 on

Form N-2 |

|

|

| |

|

Incorporated by

reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Series Trust II |

|

Post-Effective

Amendment #218

on Form N-1A |

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Series Trust |

|

Post-Effective

Amendment #93

on Form N-1A |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #1 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Series Trust II |

|

Post-Effective

Amendment #179

on Form N-1A |

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Series Trust I |

|

Post-Effective

Amendment #418

on Form N-1A |

|

|

| |

|

Incorporated by

Reference |

Tri-Continental

Corporation |

|

Post-Effective

Amendment #2 on

Form N-2 |

|

|

| |

|

Incorporated by Reference |

Tri-Continental Corporation |

|

Post-Effective Amendment #2 on Form N-2 |

|

|

| |

|

Filed Herewith or

Incorporated by

Reference |

Information About the Filing that Includes the Document Incorporated by Reference

|

Registrant

that Made

the Filing |

File No.

of Such

Registrant |

|

Exhibit of

Document

in that

Filing |

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #3 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #3 on

Form N-2 |

|

|

| |

|

|

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #2 on

Form N-2 |

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment No. 1

to Registration

Statement on Form

N-2 |

|

|

| |

|

|

|

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia

Seligman Premium

Technology

Growth Fund, Inc. |

|

Pre-Effective

Amendment #2 on

Form N-2 |

|

|

| |

|

|

|

|

|

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Variable Series

Trust II |

|

Post-Effective

Amendment #68

on Form N-1A |

|

|

| |

|

Incorporated by

Reference |

Columbia Funds

Series Trust II |

|

Post-Effective

Amendment #241

on Form N-1A |

|

|

| |

|

Incorporated by Reference |

Columbia Seligman Premium Technology Growth Fund, Inc. |

|

Pre-Effective Amendment #1 on Form N-2 |

|

|

Item 26. Marketing Arrangements.

See Distribution Agreement with respect to the Rule 415 offering filed by Pre-Effective Amendment.

Item 27. Other Expenses of Issuance and

Distribution.

The following table sets forth the estimated

expenses to be incurred by the Registrant in connection with the offering described in this Registration Statement:

| |

|

| |

|

| |

|

New York Stock Exchange Fees |

|

Costs of Printing (other than stock certificates) |

|

Accounting Fees and Expenses |

|

| |

|

* Columbia Management Investment Advisers, LLC, the Registrant’s Investment Manager, will pay expenses of the Registrant's Rule 415 “at-the-market” offering (other than the applicable commissions).

Item 28. Persons Controlled by or Under Common Control with Registrant.

Item 29. Number of Holders of Securities.

Item 30. Indemnification.

Maryland law permits a Maryland corporation to include in its charter a provision eliminating the liability of its directors and officers to the corporation and its stockholders for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty that is established by a final judgment and is material to the cause of action. The Fund’s charter contains such a provision which eliminates directors’ and officers’ liability to the maximum extent permitted by Maryland law, subject to the requirements of the Investment Company Act.

The Fund’s charter authorizes it, to the maximum extent permitted by Maryland law, to obligate the Fund, and the Fund’s Bylaws so obligate the Fund, to indemnify any present or former Director or officer or any individual who, while a Director or officer of the Fund and at the request of the Fund, serves or has served another corporation, real estate investment trust, partnership, joint venture, trust, employee benefit plan or other enterprise as a director, officer, partner or trustee and who is made, or threatened to be made, a party to the proceeding by reason of his or her service in that capacity, from and against any claim or liability to which that individual may become subject or which that individual may incur by reason of his or her service in that capacity and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding. The Fund’s charter and Bylaws also permit the Fund to indemnify and advance expenses to any individual who served a predecessor of the Fund in any of the capacities described above and any employee or agent of the Fund or a predecessor of the Fund. In accordance with the Investment Company Act, the Fund will not indemnify any person for any liability to which such person would be subject by reason of such person’s willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office.

Maryland law requires a corporation (unless its charter provides otherwise, which the Fund’s charter does not) to indemnify a director or officer who has been successful, on the merits or otherwise, in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that personal benefit was improperly received, unless in either case a court orders indemnification and then only for expenses. In addition, Maryland law permits a corporation to advance reasonable expenses to a director or officer upon the corporation’s receipt of (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the standard of conduct was not met.

Reference should be made to the Fund’s charter on file with the SEC for the

full text of these provisions.

Insofar as indemnification for

liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to directors, officers and controlling persons of

Registrant pursuant to the foregoing provisions, or otherwise, Registrant has been advised by the SEC that such indemnification is against public policy as expressed in

the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by Registrant of expenses incurred or paid by a director, officer or controlling person of Registrant in the successful defense of any

action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, Registrant will, unless in the opinion of counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

Item 31. Business and Other Connections of Investment Manager.

The description of the Investment Manager under the caption “Management of

the Fund” in the Prospectus and “Investment Management and Other Services” in the Statement of Additional Information of this Registration Statement are

incorporated by reference herein. The Investment Manager, a limited liability company organized under the laws of Delaware, acts as Investment Manager to the Registrant. The Registrant is fulfilling the requirement of this Item 30 to provide a list of the officers and directors of the Investment Manager, together with information as to any other business, profession, vocation or employment of a substantial nature engaged in by the Investment Manager or those officers and directors during the past two years, by incorporating by reference the information contained in the Form ADV of the Investment Manager filed with the commission pursuant to the Investment Advisers Act of 1940, as amended (Commission File No. 801-25943), and is incorporated by reference herein.

Item 32. Locations of Accounts and Records.

Persons maintaining physical possession of accounts, books and other documents required to be maintained by Section 31(a) of the Investment Company Act of 1940 and the Rules thereunder include:

■

Registrant, 290 Congress Street, Boston, MA, 02210 and 485 Lexington Avenue,12th Fl,

New York, NY 10017;

■

Registrant’s investment adviser and administrator, Columbia Management Investment Advisers, LLC, 290 Congress Street, Boston, MA 02210;

■

Registrant’s stockholder service agent, Equiniti Trust Company, LLC, 6201 15th

Avenue, Brooklyn, NY 11219;

■

Registrant’s custodian, JPMorgan Chase Bank, N.A., 1 Chase Manhattan Plaza, New

York, NY 10005;

In addition, Iron Mountain Records Management is an off-site storage facility housing historical records that are no longer required to be maintained on-site. Records stored at this facility include various trading and accounting records, as well as other miscellaneous records. The address for Iron Mountain Records Management is 920 & 950 Apollo Road, Eagan, MN 55121, 175 Bearfoot Road, Northborough, MA, 01532 and 26 Parkway Drive, Scarborough, ME 04074.

Certain information on the above-referenced physical possession of accounts, books and other documents is also included in the Registrant’s filing on Form N-CEN filed with the Securities and Exchange Commission on March 13, 2024.

Item 33. Management Services.

3.a.

to file, during any period in which offers or sales are being made, a post-effective

amendment to the registration statement:

(1) to include any prospectus required by Section 10(a)(3) of the

Securities Act of 1933;

(2) to reflect in the prospectus any facts or events after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(3) to include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

3.b.

that, for the purpose of determining any liability under the Securities Act of 1933,

each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of those securities at

that time shall be deemed to be the initial bona fide offering thereof;

3.c.

to remove from registration by means of a post-effective amendment any of the

securities being registered which remain unsold at the termination of the offering.

3.d.

that, for the purpose of determining liability under the Securities Act to any

purchaser:

(1) if the Registrant is relying on Rule 430B under the 1933

Act:

(A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus

required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to

Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in

the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(2) if the Registrant is subject to Rule 430C under the Securities Act:

Each prospectus filed pursuant to Rule 424(b) under the

1933 Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance

on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

3.e.

that for the purpose of determining liability of the Registrant under the Securities

Act to any purchaser in the initial distribution of securities:

The undersigned Registrant undertakes that in a primary offering

of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser,

if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(1) any preliminary prospectus or prospectus of the undersigned

Registrant relating to the offering required to be filed pursuant to Rule 424 under the Securities Act;

(2) free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(3) the portion of any other free writing prospectus or

advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing material information about the undersigned Registrant or its securities

provided by or on behalf of the undersigned Registrant; and

(4) any other communication that is an offer in the

offering made by the undersigned Registrant to the purchaser.

5.

that, for purposes of determining any liability under the Securities Act of 1933,

each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference

into the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

6.

Insofar as indemnification for liabilities arising under the Securities Act of 1933

may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

7.

to send by first class mail or other means designed to ensure equally prompt

delivery, within two business days of receipt of a written or oral request, any prospectus or Statement of Additional Information.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and the Investment Company Act of 1940, the Registrant, Columbia Seligman Premium Technology Growth Fund, Inc., has duly caused this Amendment to its Registration Statement to be signed on its behalf by the undersigned, duly authorized, in the City of Boston, and the Commonwealth of Massachusetts on the 13th day of November, 2024.

Columbia Seligman Premium Technology Growth Fund, Inc. |

| |

|

| |

Daniel J. Beckman Director and President |

Pursuant to the requirements of the Securities Act of 1933, this Amendment to the Registration Statement has been signed below by the following persons in the capacities indicated on the 13th day of November,

2024.

| |

|

|

|

| |

Director and President

(Principal Executive Officer) |

|

|

| |

|

| |

Chief Financial Officer,

Principal Financial Officer

and Senior Vice President |

|

|

| |

|

| |

Treasurer, Chief

Accounting Officer (Principal Accounting Officer) and Principal Financial Officer |

|

|

| |

|

| |

Director and Chair of the Board |

|

|

| |

|

| |

|

/s/

Catherine James Paglia* |

|

| |

|

| |

|

|

|

| |

|

/s/

Janet Langford Carrig* |

|

|

|

| |

|

|

| |

|

|

|

Joseph D’Alessandro** Attorney-in-fact |

|

| |

Executed by Joseph D’Alessandro on behalf of Michael G. Clarke pursuant to a Power of Attorney, dated August 28, 2024,

on behalf of Charles H. Chiesa pursuant to a Power of Attorney, dated August 29, 2024 and on

behalf of the Directors pursuant to a Power of Attorney, dated September 27,

2024. |

Columbia Seligman

Premium Technology Growth Fund, Inc.

Each of the undersigned, as directors of the above

listed investment company, constitutes and appoints, Christopher O. Petersen, Michael E. DeFao, Ryan C. Larrenaga, Joseph D’Alessandro, and Megan E. Garcy, each

individually, as his or her true and lawful attorney-in-fact and agent (each an “Attorney-in-Fact”, each with full power of substitution or resubstitution, in

any and all capacities, including without limitation in the undersigned’s capacity as a director of the Registrant, in the furtherance of the business and affairs of the Registrant: (i) to execute any and all Registration Statements of the Fund on Form N-2 under the Securities Act of 1933 and the Investment Company Act of 1940 registering securities of the Fund, including any pre-effective and post-effective amendments thereto, with all exhibits in connection with the at the market offering; and (ii) to execute any and all federal, state or foreign regulatory or other required filings, including all applications with regulatory authorities, state charter or organizational documents and any amendments or supplements thereto, to be executed by, on behalf of, or for the benefit of, the Registrant. The undersigned hereby grants to each Attorney-in-Fact full power and authority to do and perform each and every act and thing contemplated above, as fully and to all intents and purposes as the undersigned might or could do in person, and hereby ratifies and confirms all that said Attorneys-in-Fact, individually or collectively, may lawfully do or cause to be done by virtue hereof.

This Power of Attorney shall not be revoked with respect to any undersigned director by any subsequent power of attorney the undersigned may execute unless such subsequent power of attorney specifically refers to this Power of Attorney or specifically states that the instrument is intended to revoke all prior general powers of attorney or all prior powers of attorney (and unless otherwise required by a provision of law that cannot be waived). This Power of Attorney shall terminate automatically with respect to the Registrant if the undersigned ceases to hold the above-referenced office of the Registrant.

Dated: September 27, 2024

| |

Director and Chair of the Board |

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

/s/

Catherine James Paglia |

|

| |

|

/s/

Janet Langford Carrig |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Columbia Seligman

Premium Technology Growth Fund, Inc.

The undersigned constitutes and appoints Christopher

O. Petersen, Michael E. DeFao, Ryan C. Larrenaga, Joseph D’Alessandro, and Megan E. Garcy, each individually, his true and lawful attorney-in-fact and agent (each

an “Attorney-in-Fact” with full power of substitution or resubstitution, in any and all capacities, including without limitation in the undersigned’s

capacity as Chief Financial Officer, Principal Financial Officer and Senior Vice President of the Registrant, in the furtherance of the business and affairs of the Registrant: (i) to execute any and all Registration Statements of the Fund on Form N-2 under the Securities Act of 1933 and the Investment Company Act of 1940 registering securities of the Fund, including any pre-effective and post-effective amendments thereto, with all exhibits; and (ii) to execute any and all federal, state or foreign regulatory or other required filings, including all applications with regulatory authorities, state charter or organizational documents and any amendments or supplements thereto, to be executed by, on behalf of, or for the benefit of, the Registrant. The undersigned hereby grants to each Attorney-in-Fact full power and authority to do and perform each and every act and thing contemplated above, as fully and to all intents and purposes as the undersigned might or could do in person, and hereby ratifies and confirms all that said Attorneys-in-Fact, individually or collectively, may lawfully do or cause to be done by virtue hereof.

This Power of Attorney shall not be revoked by any subsequent power of attorney I may execute unless such subsequent power of attorney specifically refers to this Power of Attorney or specifically states that the instrument is intended to revoke all prior general powers of attorney or all prior powers of attorney (and unless otherwise required by a provision of law that cannot be waived). This Power of Attorney shall terminate automatically with respect to the Registrant if the undersigned ceases to hold the above-referenced office of the Registrant.

Columbia Seligman

Premium Technology Growth Fund, Inc.

The undersigned constitutes and appoints Christopher O. Petersen, Michael E. DeFao, Ryan C. Larrenaga, Joseph D’Alessandro, and Megan E. Garcy, each individually, his true and lawful attorney-in-fact and agent (each an “Attorney-in-Fact” with full power of substitution or resubstitution, in any and all capacities, including without limitation in the undersigned’s capacity as Treasurer, Chief Accounting Officer (Principal Accounting Officer) and Principal Financial Officer of the Registrant, in the furtherance of the business and affairs of the Registrant: (i) to execute any and all Registration Statements of the Fund on Form N-2 under the Securities Act of 1933 and the Investment Company Act of 1940 registering securities of the Fund, including any pre-effective and post-effective amendments thereto, with all exhibits; and (ii) to execute any and all federal, state or foreign regulatory or other required filings, including all applications with regulatory authorities, state charter or organizational documents and any amendments or supplements thereto, to be executed by, on behalf of, or for the benefit of, the Registrant. The undersigned hereby grants to each Attorney-in-Fact full power and authority to do and perform each and every act and thing contemplated above, as fully and to all intents and purposes as the undersigned might or could do in person, and hereby ratifies and confirms all that said Attorneys-in-Fact, individually or collectively, may lawfully do or cause to be done by virtue hereof.

This Power of Attorney shall not be revoked by any subsequent power of attorney I may execute unless such subsequent power of attorney specifically refers to this Power of Attorney or specifically states that the instrument is intended to revoke all prior general powers of attorney or all prior powers of attorney (and unless otherwise required by a provision of law that cannot be waived). This Power of Attorney shall terminate automatically with respect to the Registrant if the undersigned ceases to hold the above-referenced office of the Registrant.

Exhibit

Index

Exhibits Related to Item 25 of Part C

| |

Opinion and Consent of Ropes & Gray LLP |

|

|

|

|

|

|

ROPES & GRAY LLP

PRUDENTIAL TOWER

800 BOYLSTON STREET

BOSTON, MA 02199-3600

WWW.ROPESGRAY.COM |

November 12, 2024

Columbia Seligman Premium Technology Growth Fund, Inc.

290 Congress Street

Boston,

Massachusetts 02210

Ladies and Gentlemen:

We have acted as counsel to Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) in connection with

the Registration Statement of the Fund on Form N-2 (File No. 333-280485) under the Securities Act of 1933 and the Investment Company Act of 1940 (File No. 811-22328) (the “Registration Statement”) as amended, with respect to certain of its common shares of beneficial interest (the “Common Shares”). The Common Shares are to be sold pursuant

to a Distribution Agreement substantially in the form filed as an exhibit to the Registration Statement (the “Distribution Agreement”) between the Fund and ALPS Distributors, Inc.

We have examined the Fund’s Articles of Incorporation, as amended, on file with the Maryland State Department of

Assessments & Taxation, and the Fund’s Bylaws, and are familiar with the actions taken by the Fund in connection with the issuance and sale of the Common Shares. We have also examined such other documents and records as we have deemed

necessary for the purposes of this opinion. In rendering the opinions expressed herein, we have relied solely on the opinion, dated as of June 21, 2024, of Venable LLP insofar as such opinion relates to the laws of the State of Maryland

(subject to all of the assumptions and qualifications to which such opinion is subject), and we have made no independent examination of the laws of that jurisdiction. We are providing a copy of that opinion together with this opinion, which is

subject to the same limitations and assumptions as those set forth in the opinion of Venable LLP.

The opinions expressed

herein are limited to matters governed by the laws of the State of Maryland and the federal laws of the United States of America.

Based upon the foregoing, we are of the opinion that:

| |

1. |

The Fund is a corporation duly incorporated and validly existing under and by virtue of the laws of the State

of Maryland. |

| |

2. |

The Common Shares have been duly authorized and, when issued and paid for in accordance with the Distribution

Agreement, will be validly issued, fully paid and, except as described in the following paragraph, nonassessable by the Fund. |

We understand that this opinion is to be used in connection with the registration of the Common Shares for offering and sale

pursuant to the Securities Act of 1933, as amended. We

consent to the filing of this opinion with and as part of the Registration Statement on Form N-2 related to such offering and sale.

|

| Very truly yours, |

|

| /s/ Ropes & Gray LLP |

| Ropes & Gray LLP |

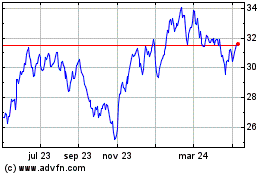

Columbia Seligman Premiu... (NYSE:STK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

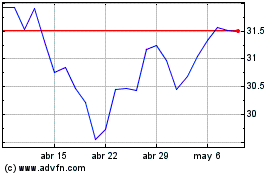

Columbia Seligman Premiu... (NYSE:STK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024