Mike Steib to succeed David Lougee as President, CEO and

Director, effective August 12, 2024

Achieved second quarter key guidance metrics and reaffirms

full-year guidance

Returned $93 million of capital to shareholders, on track to

meet commitment to return approximately $350 million of capital in

2024

Appointed two new independent Directors to the Board of

Directors

TEGNA Inc. (NYSE: TGNA) today announced financial results for

the second quarter ended June 30, 2024.

SECOND QUARTER FINANCIAL HIGHLIGHTS:

All Year-Over-Year Comparisons Unless Otherwise Noted:

- Total company revenue decreased 3% to $710 million, at the

midpoint of our guidance range, primarily due to lower subscription

and advertising and marketing services (“AMS”) revenues partially

offset by higher political advertising dollars.

- Subscription revenue decreased 7% to $367 million, primarily

due to subscriber declines partially offset by contractual rate

increases.

- AMS revenue decreased 5% to $301 million due to softness in

demand from national accounts.

- GAAP operating expenses increased 26% to $569 million primarily

due to the receipt of a $136 million merger termination fee

reflected in last year’s results. Non-GAAP operating expenses1 were

flat benefiting from our initial set of cost transformation

initiatives.

- GAAP and non-GAAP operating income1 totaled $142 million and

$147 million, respectively.

- GAAP net income attributable to TEGNA Inc. was $82 million and

non-GAAP net income attributable to TEGNA Inc.1 was $86

million.

- GAAP and non-GAAP earnings per diluted share1 were $0.48 and

$0.50, respectively.

- Total company Adjusted EBITDA2 decreased 10% to $176 million

primarily due to lower subscription and AMS revenue partially

offset by higher political revenues.

___________________________________________

1 See Table 3 for details

2 See Table 4 for details

“Results for the second quarter fell within our guidance range,

underscoring TEGNA’s ability to effectively manage what we can

control in the current macroeconomic environment,” said Dave

Lougee, president and chief executive officer. “As we look ahead to

the back half of the year, it is shaping up to be another robust

political cycle. We are encouraged by the unprecedented energy and

additional fundraising taking place that could result in record

spending following the Democratic National Convention through

election day. The substantial cash raised from both sides of the

ticket thus far gives us high confidence that ad spending will be

very healthy this election season. Our footprint and scale provide

us with a competitive advantage during election years, particularly

those with tight races in key battleground states. In addition,

Premion is also experiencing growing demand from political

advertisers for a multi-faceted programmatic and managed service

approach to executing data-driven and outcomes-based CTV

campaigns.”

Mr. Lougee continued, “Aiding our confidence in the second half

of the year is the early success of the Summer Olympics in Paris as

well as the expanded distribution of the WNBA Indiana Fever and NHL

Seattle Kraken games. We built on our relationship with the Seattle

Kraken and are now slated to broadcast the team’s games

over-the-air not only on our Seattle, Portland and Spokane stations

beginning in October, but also in Alaska through a partnership with

Gray Media Group. Our continued expansion in sports broadcasting

further highlights our strong station brands and distribution

capabilities in key markets. Looking ahead, we remain focused on

utilizing our disciplined capital allocation framework and organic

growth engine to maximize long-term value for our shareholders and

execute strategic initiatives to drive profitable growth.”

Mr. Lougee concluded, “As I approach my final days as CEO, I

want to thank all our TEGNA stakeholders for making the last seven

years leading this great organization the highlight of my career. I

am extremely enthused about the addition of Mike Steib as my

successor, with his strong track record of performance and results.

Mike has hands-on experience developing high-performing teams that

build industry-defining products and brands, which have delivered

extraordinary shareholder returns. His passion for the vital role

we play in local communities across this country will help the team

build on our purpose-driven focus as a company. I look forward to

following Mike’s journey closely and to being a trusted advisor to

him through this transition.”

KEY STRATEGIC UPDATES:

- Mike Steib to Succeed David Lougee as President, CEO and a

Director as of August 12, 2024 – Steib is the former CEO of Artsy,

the world’s largest online platform for discovering and collecting

art, and previously served as president and CEO of XO Group (NYSE:

XOXO), parent company of The Knot. Prior to those roles, he spent

10 years in executive positions at NBCUniversal and Google

launching, scaling, and acquiring advertising-supported businesses.

(Press Release)

- TEGNA Board of Directors Appoints Two New Independent Directors

as of July 1, 2024 – As part of its regular refreshment process,

the Board appointed two new independent directors, Catherine

Dunleavy, the incoming COO and CFO of Olaplex, who also has

experience as a media and finance executive with Away, NIKE and

NBCUniversal, and Denmark West, who heads Market Intelligence and

Strategic Engagements at X, The Moonshot Factory, a division of

Alphabet. (Press Release)

- TEGNA’s NBC Stations Head to the Paris 2024 Olympics – TEGNA

journalists traveled to Paris to bring the emotion and excitement

of 100 local athletes participating in the Summer Olympic Games

home to our local communities. TEGNA stations are producing

“Olympic Zone,” airing before primetime NBC coverage and featuring

stations’ top personalities who provide an inspiring look at the

games, local athletes and their families.

- Indiana Fever Broadcasts in 12 Markets Grows Advertiser and

Sponsorship Opportunities – In the second quarter, on the heels of

our initial WTHR (Indianapolis) deal to carry Indiana Fever games

in April, TEGNA expanded distribution of free over-the-air

broadcasts of Fever games to 11 additional markets in May, which

include TEGNA stations WOI (Des Moines), WQAD (Quad Cities) and

WHAS (Louisville) and stations owned by Gray Media, Sinclair,

Nexstar Media Group, Inc., Coastal Television Broadcasting Group

and Weigel Broadcasting Co. Games aired on TEGNA stations during

the quarter have experienced excellent audience and sponsor

reaction. (Press Release)

- TEGNA Signs Multi-Year Distribution Agreement with NHL’s

Seattle Kraken for Upcoming Season – TEGNA’s partnership with the

Seattle Kraken to air games for free over-the-air begins in October

across Washington, Oregon, and Alaska, marking a significant

expansion in access for fans throughout the Pacific Northwest.

(Press Release)

- TEGNA Named 2024 Honoree of The Civic 50 and Telecommunications

Sector Leader – The Civic 50 by Points of Light named TEGNA one of

the most community-minded companies in the U.S. for a fifth

consecutive year and Telecommunications Sector Leader for a fourth

year. (Press Release)

- TEGNA Stations Honored with 73 Regional Edward R. Murrow Awards

– TEGNA stations garnered six overall excellence, seven diversity,

equity and inclusion and five innovation awards. TEGNA stations

received more honors in these categories than any other local

broadcast station group. (Press Release)

CAPITAL ALLOCATION, LEVERAGE, AND LIQUIDITY:

- The company continues to expect to return 40-60% of Adjusted

free cash flow3 generated in 2024-2025 to shareholders through

share repurchases and dividends, including approximately $350

million in 2024 through dividends and share repurchases.

- During the second quarter, the company returned $93 million of

capital to shareholders, with $72 million in share repurchases,

representing 5.1 million shares, and $21 million in dividends.

- Interest expense fell slightly to $42 million due to decreased

undrawn fees on the company’s revolving credit facility.

- As noted last quarter, the company’s Board approved a 10%

increase to the company’s regular quarterly dividend, from 11.375

to 12.5 cents per share. This increase was reflected for the first

time in dividends paid to eligible shareholders in July.

- Cash flow from operating activities was $125 million for the

quarter and $225 million for the first six months.

- Adjusted free cash flow was $131 million for the quarter and

$230 million for the first six months.

- The company is reaffirming its expectation of 2024-2025

two-year Adjusted free cash flow guidance range of $900

million-$1.1 billion.

- Cash and cash equivalents totaled $446 million at the end of

the second quarter. Net leverage finished the second quarter at

2.9x4.

___________________________________________ 3 See Table 5 for

details

FULL-YEAR AND THIRD QUARTER 2024 OUTLOOK:

Full-Year 2024 Key Guidance

Metrics

TEGNA is reaffirming its guidance metrics

for the full year of 2024 and improving the effective tax rate

2024/2025 Two-Year Adjusted FCF

$900 million – 1.1 billion

Net Leverage Ratio

Below 3x at year end

Corporate Expenses

$40 – 45 million

Depreciation

$56 – 60 million

Amortization

$51 – 55 million

Interest Expense

$170 – 173 million

Capital Expenditures

$62 – 67 million

Effective Tax Rate

22.5 – 23.5%

Third Quarter 2024 Key Guidance

Metrics

Reflects expectations relative to third

quarter 2023 results

Total company GAAP Revenue

Up 9% to 12%

Total Non-GAAP Operating Expenses

Flat to down slightly

CONFERENCE CALL

TEGNA will host a conference call and webcast on Wednesday,

August 7, 2024, to discuss the company’s financial results and

other business matters. The teleconference will begin at 10:00 a.m.

Eastern Time and will be hosted by Dave Lougee, Chief Executive

Officer, and Julie Heskett, Chief Financial Officer.

The conference call will be webcast through the company’s

website, and is open to investors, the financial community, the

media and other members of the public. To access the meeting by

phone, please visit investors.TEGNA.com at least 10 minutes prior

to the scheduled start time to access the links and register before

the conference call begins. Once registered, phone participants

will receive dial-in numbers and a unique PIN to seamlessly access

the call.

________________________

4 See Table 6 for details

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements within

the meaning of the “safe harbor” provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. When used in this

communication, the words “believes,” “estimates,” “plans,”

“expects,” “should,” “could,” “outlook,” and “anticipates” and

similar expressions as they relate to the company or its financial

results are intended to identify forward-looking statements.

Forward-looking statements in this communication may include,

without limitation, statements regarding anticipated growth rates

and the company’s plans, objectives and expectations.

Forward-looking statements are based on a number of assumptions

about future events and are subject to various risks, uncertainties

and other factors that may cause actual results to differ

materially from the views, beliefs, projections and estimates

expressed in such statements, many of which are outside the

company’s control. These risks, uncertainties and other factors

include, but are not limited to, risks and uncertainties related

to: changes in the market price of the company’s shares, general

market conditions, constraints, volatility, or disruptions in the

capital markets; the possibility that the company’s capital

allocation plan, including dividends, share repurchases, and/or

strategic acquisitions, investments, and partnerships may not

enhance long-term stockholder value; legal proceedings, judgments

or settlements; the company’s ability to re-price or renew

subscribers; potential regulatory actions; changes in consumer

behaviors and impacts on and modifications to TEGNA’s operations

and business relating thereto; and economic, competitive,

governmental, technological and other factors and risks that may

affect the company’s operations or financial results, which are

discussed in our Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q. Any forward-looking statements in this communication

should be evaluated in light of these important risk factors. The

company is not responsible for updating the information contained

in this communication beyond the published date, or for changes

made to this press release by wire services, Internet service

providers or other media.

Readers are cautioned not to place undue reliance on

forward-looking statements made by or on behalf of the company.

Each such statement speaks only as of the day it was made. The

company undertakes no obligation to update or to revise any

forward-looking statements.

ADDITIONAL INFORMATION

TEGNA Inc. (NYSE: TGNA) is an innovative media company that

serves the greater good of our communities. Across platforms, TEGNA

tells empowering stories, conducts impactful investigations and

delivers innovative marketing solutions. With 64 television

stations in 51 U.S. markets, TEGNA is the largest owner of top 4

network affiliates in the top 25 markets among independent station

groups, reaching approximately 39 percent of all television

households nationwide. TEGNA also owns leading multicast networks

True Crime Network and Quest. TEGNA offers innovative solutions to

help businesses reach consumers across television, digital and

over-the-top (OTT) platforms, including Premion, TEGNA’s OTT

advertising service. For more information, visit www.TEGNA.com.

CONSOLIDATED STATEMENTS OF

INCOME

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 1

Quarters ended June

30,

2024

2023

Change

Revenues

$

710,363

$

731,506

(3

%)

Operating expenses:

Cost of revenues

432,044

430,528

0

%

Business units - Selling, general and

administrative expenses

94,938

97,231

(2

%)

Corporate - General and administrative

expenses

12,685

26,506

(52

%)

Depreciation

15,173

14,987

1

%

Amortization of intangible assets

13,663

13,296

3

%

Asset impairment and other

—

3,359

***

Merger termination fee

—

(136,000

)

***

Total

568,503

449,907

26

%

Operating income

141,860

281,599

(50

%)

Non-operating (expense) income:

Interest expense

(41,748

)

(42,797

)

(2

%)

Interest income

5,873

8,536

(31

%)

Other non-operating items, net

(2,749

)

(3,038

)

(10

%)

Total

(38,624

)

(37,299

)

4

%

Income before income taxes

103,236

244,300

(58

%)

Provision for income taxes

21,207

44,207

(52

%)

Net income

82,029

200,093

(59

%)

Net loss attributable to redeemable

noncontrolling interest

115

12

***

Net income attributable to TEGNA

Inc.

$

82,144

$

200,105

(59

%)

Earnings per share:

Basic

$

0.48

$

0.92

(48

%)

Diluted

$

0.48

$

0.92

(48

%)

Weighted average number of common

shares outstanding:

Basic shares

169,512

217,830

(22

%)

Diluted shares

169,880

217,979

(22

%)

*** Not meaningful

CONSOLIDATED STATEMENTS OF

INCOME

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 1 (continued)

Six months ended June

30,

2024

2023

Change

Revenues

$

1,424,615

$

1,471,833

(3

%)

Operating expenses:

Cost of revenues

862,611

857,460

1

%

Business units - Selling, general and

administrative expenses

197,198

196,340

0

%

Corporate - General and administrative

expenses

27,483

38,606

(29

%)

Depreciation

29,483

30,036

(2

%)

Amortization of intangible assets

27,323

26,878

2

%

Asset impairment and other

1,097

3,359

(67

%)

Merger termination fee

—

(136,000

)

***

Total

1,145,195

1,016,679

13

%

Operating income

279,420

455,154

(39

%)

Non-operating (expense) income:

Interest expense

(84,116

)

(85,703

)

(2

%)

Interest income

11,446

16,109

(29

%)

Other non-operating items, net

147,009

(5,437

)

***

Total

74,339

(75,031

)

***

Income before income taxes

353,759

380,123

(7

%)

Provision for income taxes

82,468

76,026

8

%

Net income

271,291

304,097

(11

%)

Net loss attributable to redeemable

noncontrolling interest

413

311

33

%

Net income attributable to TEGNA

Inc.

$

271,704

$

304,408

(11

%)

Earnings per share:

Basic

$

1.56

$

1.37

14

%

Diluted

$

1.55

$

1.37

13

%

Weighted average number of common

shares outstanding:

Basic shares

173,668

221,168

(21

%)

Diluted shares

174,158

221,391

(21

%)

*** Not meaningful

REVENUE CATEGORIES

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 2

Below is a detail of our primary sources

of revenue:

Quarters ended June

30,

2024

2023

Change

Subscription

$

367,025

$

396,126

(7%)

Advertising & Marketing Services

300,977

317,726

(5%)

Political

31,643

5,991

***

Other

10,718

11,663

(8%)

Total revenues

$

710,363

$

731,506

(3%)

Six months ended June

30,

2024

2023

Change

Subscription

$

742,349

$

810,406

(8%)

Advertising & Marketing Services

599,669

625,571

(4%)

Political

59,471

11,282

***

Other

23,126

24,574

(6%)

Total revenues

$

1,424,615

$

1,471,833

(3%)

*** Not meaningful

USE OF NON-GAAP

INFORMATION

The company uses non-GAAP financial performance and liquidity

measures to supplement the financial information presented on a

GAAP basis. These non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, the related

GAAP measures, nor should they be considered superior to the

related GAAP measures and should be read together with financial

information presented on a GAAP basis. Also, our non-GAAP measures

may not be comparable to similarly titled measures of other

companies.

Management and the company’s Board of Directors (the "Board")

regularly use Corporate–General and administrative expenses,

Operating expenses, Operating income, Income before income taxes,

Provision for income taxes, Net income attributable to TEGNA Inc.,

and Diluted earnings per share, each presented on a non-GAAP basis,

for purposes of evaluating company performance. Management and the

Board also use Adjusted EBITDA and Adjusted free cash flow to

evaluate company performance and liquidity, respectively. The

Leadership Development and Compensation Committee of our Board uses

non-GAAP measures such as Adjusted EBITDA, non-GAAP net income,

non-GAAP EPS, and Adjusted free cash flow to evaluate and

compensate senior management. The Board uses Adjusted free cash

flow in its periodic assessments of, among other things,

repurchases of the company’s common stock, the company’s dividends,

strategic opportunities and long-term debt retirement. The company,

therefore, believes that each of the non-GAAP measures presented

provides useful information to investors and other stakeholders by

allowing them to view our business through the eyes of management

and our Board, facilitating comparisons of results across

historical periods and focus on the underlying ongoing operating

performance of our business. The company also believes these

non-GAAP measures are frequently used by investors, securities

analysts and other interested parties in their evaluation of our

business and other companies in the broadcast industry.

The company discusses in this release non-GAAP financial

performance and liquidity measures that exclude from its reported

GAAP results the impact of “special items” consisting of asset

impairment and other, M&A-related costs, Merger termination

fee, retention costs, workforce restructuring, and a gain related

to the sale of the company’s investment in Broadcast Music Inc.

(“BMI”). In addition, we have excluded an income tax special item

associated with a tax benefit associated with previously disallowed

transaction costs. The company believes that such expenses and

gains are not indicative of normal, ongoing operations. While these

items should not be disregarded in evaluation of our earnings or

liquidity performance, it is useful to exclude such items when

analyzing current results and trends compared to other periods as

these items can vary significantly from period to period depending

on specific underlying transactions or events that may occur.

Therefore, while we may incur or recognize these types of expenses,

charges, gains, payments and receipts in the future, the company

believes that removing these items for purposes of calculating the

non-GAAP financial measures provides investors with a more focused

presentation of our ongoing operating performance.

The company also discusses Adjusted EBITDA (with and without

stock-based compensation expense), a non-GAAP financial performance

measure that it believes offers a useful view of the overall

operation of its businesses. The company defines Adjusted EBITDA as

net income attributable to TEGNA before (1) net loss attributable

to redeemable noncontrolling interest, (2) income taxes, (3)

interest expense, (4) interest income, (5) other non-operating

items, net, (6) M&A-related costs, (7) asset impairment and

other, (8) workforce restructuring, (9) employee retention costs,

(10) the Merger termination fee, (11) depreciation and (12)

amortization of intangible assets. The company believes these

adjustments facilitate company-to-company operating performance

comparisons by removing potential differences caused by variations

unrelated to operating performance, such as capital structures

(interest expense), income taxes, and the age and book appreciation

of property and equipment (and related depreciation expense). The

most directly comparable GAAP financial measure to Adjusted EBITDA

is Net income attributable to TEGNA. Users should consider the

limitations of using Adjusted EBITDA, including the fact that this

measure does not provide a complete measure of our operating

performance. Adjusted EBITDA is not intended to purport to be an

alternate to net income as a measure of operating performance or to

cash flows from operating activities as a measure of liquidity. In

particular, Adjusted EBITDA is not intended to be a measure of cash

flow available for management’s discretionary expenditures, as this

measure does not consider certain cash requirements, such as

working capital needs, capital expenditures, contractual

commitments, interest payments, tax payments and other debt service

requirements.

This earnings release also discusses Adjusted free cash flow, a

non-GAAP liquidity measure. The most directly comparable GAAP

financial measure to Adjusted free cash flow is Net cash flow from

operating activities. Starting in the second quarter of 2024, the

company updated its definition of Adjusted free cash flow. Adjusted

free cash flow is now calculated as net cash flow from operating

activities less payments for purchases of property and equipment

plus or minus special items. The company removes special items

affecting cash flow from operating activities because we do not

consider these items to be indicative of its underlying cash flow

generation for the reporting period. Adjusted free cash flow is not

intended to be a measure of residual cash available for

management’s discretionary use since it omits significant sources

and uses of cash flow including mandatory debt repayments. The

principal difference between the new definition and the former

definition is the inclusion of cash flows driven by changes in

certain working capital accounts (primarily accounts receivable,

accounts payable and accrued expenses) which are now included. The

company’s 2024/2025 Two-Year Adjusted free cash flow guidance of

$900 million to $1.1 billion remains the same.

This earnings release also presents our net leverage ratio which

includes Adjusted EBITDA (without stock-based compensation) as a

component of the computation. Our net leverage ratio is a financial

measure that is used by management to assess the borrowing capacity

of the company and management believes it is useful to investors

for the same reason. The company defines its Net Leverage Ratio as

(a) net debt (total debt less cash and cash equivalents) as of the

balance sheet date divided by (b) Average Annual Adjusted EBITDA

for the trailing two-year period.

The company is furnishing forward-looking guidance with respect

to Adjusted free cash flow for the combined 2024-25 years, net

leverage and corporate expenses for fiscal year 2024 and non-GAAP

operating expenses for the third quarter of 2024. Our future GAAP

financial results will include the impact of special items such as

retention costs including stock-based compensation and cash

payments, M&A-related costs, workforce restructuring, and asset

impairment. The company believes that such expenses are not

indicative of normal, ongoing operations. While these items should

not be disregarded in evaluation of our earnings performance, it is

useful to exclude such items when analyzing current results and

trends compared to other periods. Therefore, while we may incur or

recognize these types of expenses in the future, the company

believes that removing these items for purposes of calculating the

non-GAAP basis financial measures provides investors with a more

focused presentation of our ongoing operating performance.

The company is not able to reconcile these amounts to their

comparable GAAP financial measures without unreasonable efforts

because certain information necessary to calculate such measures on

a GAAP basis is unavailable, dependent on future events outside of

our control and cannot be predicted. An example of such information

is share-based compensation, which is impacted by future share

price movement in the company’s stock price and also dependent on

future hiring and attrition. In addition, the company believes such

reconciliations could imply a degree of precision that might be

confusing or misleading to investors. The actual effect of the

reconciling items that the company may exclude from these non-GAAP

expense numbers, when determined, may be significant to the

calculation of the comparable GAAP measures.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 3

Reconciliations of certain line items

impacted by special items to the most directly comparable financial

measure calculated and presented in accordance with GAAP on the

company’s Consolidated Statements of Income follow:

Special Items

Quarter ended June 30, 2024

GAAP measure

Retention costs - SBC

Retention costs - Cash

Workforce

restructuring

Non-GAAP measure

Corporate - General and administrative

expenses

$

12,685

$

(571

)

$

(654

)

$

(492

)

$

10,968

Operating expenses

568,503

(2,198

)

(1,003

)

(1,830

)

563,472

Operating income

141,860

2,198

1,003

1,830

146,891

Income before income taxes

103,236

2,198

1,003

1,830

108,267

Provision for income taxes

21,207

362

171

445

22,185

Net income attributable to TEGNA Inc.

82,144

1,836

832

1,385

86,197

Earnings per share - diluted

$

0.48

$

0.01

$

—

$

0.01

$

0.50

Special Items

Quarter ended June 30, 2023

GAAP measure

M&A-related costs

Merger termination fee

Asset impairment and

other

Special tax item

Non-GAAP measure

Corporate - General and administrative

expenses

$

26,506

$

(17,082

)

$

—

$

—

$

—

$

9,424

Operating expenses

449,907

(17,082

)

136,000

(3,359

)

—

565,466

Operating income

281,599

17,082

(136,000

)

3,359

—

166,040

Income before income taxes

244,300

17,082

(136,000

)

3,359

—

128,741

Provision for income taxes

44,207

4,371

(24,504

)

860

6,443

31,377

Net income attributable to TEGNA Inc.

200,105

12,711

(111,496

)

2,499

(6,443

)

97,376

Earnings per share - diluted (a)

$

0.92

$

0.06

$

(0.51

)

$

0.01

$

(0.03

)

$

0.44

(a) Per share amounts do not sum due to

rounding.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 3 (continued)

Special Items

Six months ended June 30, 2024

GAAP measure

Retention costs - SBC

Retention costs - Cash

M&A- related costs

Workforce

restructuring

Asset impairment and

other

BMI sale gain

Non-GAAP measure

Corporate - General and administrative

expenses

$

27,483

$

(1,323

)

$

(875

)

$

(2,290

)

$

(603

)

$

—

$

—

$

22,392

Operating expenses

1,145,195

(5,091

)

(1,573

)

(2,290

)

(3,637

)

(1,097

)

—

1,131,507

Operating income

279,420

5,091

1,573

2,290

3,637

1,097

—

293,108

Income before income taxes

353,759

5,091

1,573

2,290

3,637

1,097

(152,867

)

214,580

Provision for income taxes

82,468

793

248

593

890

284

(36,621

)

48,655

Net income attributable to TEGNA Inc.

271,704

4,298

1,325

1,697

2,747

813

(116,246

)

166,338

Earnings per share - diluted (a)

$

1.55

$

0.03

$

0.01

$

0.01

$

0.02

$

0.01

$

(0.67

)

$

0.95

(a) Per share amounts do not sum due to

rounding.

Special Items

Six months ended June 30, 2023

GAAP measure

M&A-related costs

Merger termination fee

Asset impairment and

other

Special tax item

Non-GAAP measure

Corporate - General and administrative

expenses

$

38,606

$

(19,848

)

$

—

$

—

$

—

$

18,758

Operating expenses

1,016,679

(19,848

)

136,000

(3,359

)

—

1,129,472

Operating income

455,154

19,848

(136,000

)

3,359

—

342,361

Income before income taxes

380,123

19,848

(136,000

)

3,359

—

267,330

Provision for income taxes

76,026

4,552

(24,504

)

860

6,443

63,377

Net income attributable to TEGNA Inc.

304,408

15,296

(111,496

)

2,499

(6,443

)

204,264

Earnings per share - diluted (a)

$

1.37

$

0.07

$

(0.50

)

$

0.01

$

(0.03

)

$

0.91

(a) Per share amounts do not sum due to

rounding.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 4

Reconciliations of Adjusted EBITDA to net

income presented in accordance with GAAP on the company’s

Consolidated Statements of Income are presented below:

Quarters ended June

30,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

82,144

$

200,105

Less: Net loss attributable to redeemable

noncontrolling interest

(115

)

(12

)

Plus: Provision for income taxes

21,207

44,207

Plus: Interest expense

41,748

42,797

Less: Interest income

(5,873

)

(8,536

)

Plus: Other non-operating items, net

2,749

3,038

Operating income (GAAP basis)

141,860

281,599

Plus: M&A-related costs

—

17,082

Plus: Asset impairment and other

—

3,359

Plus: Workforce restructuring

1,830

—

Plus: Retention costs - Employee

stock-based compensation expenses

2,198

—

Plus: Retention costs - Cash

1,003

—

Less: Merger termination fee

—

(136,000

)

Adjusted operating income (non-GAAP

basis)

146,891

166,040

Plus: Depreciation

15,173

14,987

Plus: Amortization of intangible

assets

13,663

13,296

Adjusted EBITDA

$

175,727

$

194,323

Stock-based compensation expenses:

Employee awards

6,740

5,157

Company stock 401(k) match

contributions

4,787

4,662

Adjusted EBITDA before stock-based

compensation costs

$

187,254

$

204,142

Six months ended June

30,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

271,704

$

304,408

Less: Net loss attributable to redeemable

noncontrolling interest

(413

)

(311

)

Plus: Provision for income taxes

82,468

76,026

Plus: Interest expense

84,116

85,703

Less: Interest income

(11,446

)

(16,109

)

(Less) Plus: Other non-operating items,

net

(147,009

)

5,437

Operating income (GAAP basis)

279,420

455,154

Plus: M&A-related costs

2,290

19,848

Plus: Asset impairment and other

1,097

3,359

Plus: Workforce restructuring

3,637

—

Plus: Retention costs - Employee

stock-based compensation expenses

5,091

—

Plus: Retention costs - Cash

1,573

—

Less: Merger termination fee

—

(136,000

)

Adjusted operating income (non-GAAP

basis)

293,108

342,361

Plus: Depreciation

29,483

30,036

Plus: Amortization of intangible

assets

27,323

26,878

Adjusted EBITDA

$

349,914

$

399,275

Stock-based compensation expenses:

Employee awards

14,980

8,845

Company stock 401(k) match

contributions

10,216

10,226

Adjusted EBITDA before stock-based

compensation costs

$

375,110

$

418,346

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 5

Reconciliations of Adjusted free cash flow

to net cash flow from operating activities presented in accordance

with GAAP on the company’s Consolidated Statements of Cash Flows

are presented below:

Period ending June 30,

2024

Quarter

Year-to-date

Net cash flow from operating activities

(GAAP basis)

$

124,779

$

225,159

Less: Purchases of property and

equipment

(15,972

)

(20,883

)

Special items:

M&A related costs

356

1,704

Workforce restructuring

1,023

2,062

Retention costs - cash

1,650

1,650

Asset impairment and other

—

1,097

Taxes on BMI gain

18,800

18,800

Total Adjustments

21,829

25,313

Adjusted free cash flow (non-GAAP

basis)

$

130,636

$

229,589

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 6

The following table reconciles long-term

debt, net of current portion to Net debt.

June 30, 2024

Long-term debt, net of current portion

$

3,090,000

Plus: Current portion of long-term

debt

—

Less: Cash and cash equivalents

(445,729

)

Net debt (numerator)

$

2,644,271

The following table shows the calculation

of the average annual Adjusted EBITDA before stock-based

compensation over the trailing two-year period ("T2Y").

Adjusted EBITDA before stock-based

compensation:

Six months ended June 30, 20241

$

375,110

Plus: Year ended December 31, 20232

781,562

Plus: Year ended December 31, 20222

1,181,045

Less: Six months ended June 30, 20223

(532,417

)

Combined T2Y

$

1,805,300

Divided by

2

T2Y Adjusted EBITDA (denominator)

$

902,650

The following table shows the calculation

of the Net Leverage Ratio.

June 30, 2024

Net debt (numerator)

$

2,644,271

T2Y Adjusted EBITDA (denominator)

$

902,650

Net Leverage Ratio

2.9

x

1 A non-GAAP measure detailed in Table

4.

2 Refer to page 39 of the 2023 Form 10-K

for reconciliations of 2023 and 2022 Adjusted EBITDA before

stock-based compensation costs to net income attributable to TEGNA

Inc.

3 Refer to page 27 in our Q2 2022 Form

10-Q for a reconciliation of the first six months ended 2022

Adjusted EBITDA. Note that we did not present Adjusted EBITDA

before stock-based compensation in our Q2 2022 10-Q. Our Adjusted

EBITDA was $505,279 thousand while our stock-based compensation and

company stock 401(k) contribution expenses were $17,209 thousand

and $9,929 thousand, respectively, which sums to the amount shown

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806403969/en/

For media inquiries, contact: Anne Bentley Vice President, Chief

Communications Officer 703-873-6366 abentley@TEGNA.com For investor

inquiries, contact: Julie Heskett Senior Vice President, Chief

Financial Officer 703-873-6747 investorrelations@TEGNA.com

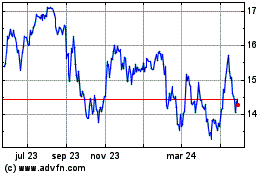

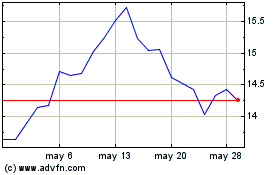

TEGNA (NYSE:TGNA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

TEGNA (NYSE:TGNA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024