THOR Low Volatility ETF

SUMMARY PROSPECTUS

December 1, 2023

Before you invest, you may want to review the Fund’s

Prospectus, which contains more information about the Fund and its risks. The Fund’s Prospectus and Statement of Additional Information,

both dated December 1, 2023, are incorporated by reference into this Summary Prospectus. You can obtain these documents and other information

about the Fund online at www.thorfunds.com. You can also obtain these documents at no cost by calling 1-800-974-6964 or by sending an

email request to Fulfillment@ultimusfundsolutions.com. Shares of the Fund are listed and traded on the NYSE (the “Exchange”).

Investment Objective: The Fund seeks to provide

investment results that generally correspond, before fees and expenses, to the performance of the THOR Low Volatility Index (the “Index”).

Fees and Expenses of the Fund: This table describes

the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions

and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses

(expenses that you pay each year

as a percentage of the value of your investment) |

|

| Management Fees |

0.55% |

| Distribution and Service (12b-1) Fees |

0.00% |

| Other Expenses |

0.00% |

| Acquired Fund Fees and Expenses(1) |

0.09% |

| Total Annual Fund Operating Expenses(1) |

0.64% |

| (1) | Acquired Fund Fees and Expenses are the indirect costs

of investing in other investment companies. The operating expenses in this fee table will not correlate to the expense ratio in the Fund's

financial highlights because the financial statements include only the direct operating expenses incurred by the Fund. |

Example: This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the

Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher

or lower, based upon these assumptions your costs would be:

| 1 Year |

3 Years |

5 Years |

10 Years |

| $65 |

$205 |

$357 |

$798 |

Portfolio Turnover: The Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal period

ended August 31, 2023, the Fund’s portfolio turnover rate was 440% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks

to achieve its investment objective by investing at least 80% of its total assets in securities included in the Index. The rules-based

index is comprised of U.S. equity exchange traded funds (“ETFs”). The primary goal of the Index is to gain exposure to U.S.

large cap equities while attempting to lower volatility by avoiding sectors that are currently in a down trending cycle.

The Index measures the price trends and historic volatility

of ten U.S. sector ETFs (the “Select List”) over the medium term (three to six months). The Select List includes sector-specific

ETFs in the Materials, Energy, Financial, Industrial, Technology, Healthcare, Utilities, Consumer Discretionary, Real Estate, and Consumer

Staples sectors with a clear sector mandate, low overall expenses, and sufficient trading liquidity. The Index uses a proprietary algorithm

that measures price momentum to evaluate the Select List to determine whether the security is currently “risk on” (buy) or

“risk off” (sell), and the Fund’s portfolio is adjusted weekly based on the algorithm. Only sectors with a risk on signal

are included in the Index.

| · | If all ten sectors are risk

on, the sectors are equally weighted, and the Index consists of a 10% allocation to each sector. |

| · | If a sector is risk off, the

Index is equally weighted to the “risk on” sectors, with a maximum allocation of 20% to each sector. |

| · | The balance of the Index is

allocated to one or more U.S. money market funds or cash. |

| · | The Index may consist 100% of

U.S. money market funds or cash during periods of sustained market declines. |

The Index is owned and was developed by THOR Analytics,

LLC dba THOR Financial Technologies, LLC (the “Adviser”). The Adviser has retained Solactive AG (the “Index Calculation

Agent”) to calculate and maintain the Index. The Index follows a weekly reconstitution and rebalancing schedule. The Index’s

periodic rebalance and reconstitution schedule may cause the Fund to experience a higher rate of portfolio

turnover. To the extent the Fund invests a significant

portion of its assets in a given sector, the Fund will be exposed to the risks associated with that sector. The Adviser will use a replication

strategy to track the Index, rather than a sampling approach, meaning the Fund will generally invest in

all of the component securities of the Index in the same approximate proportions as in the Index.

Principal Investment Risks: The following

describes the risks the Fund bears directly or indirectly through investments in ETFs (“Underlying Funds”). As with all funds,

there is the risk that you could lose money through your investment in the Fund. Many factors affect the Fund’s net asset value

(“NAV”) and performance.

Models and Data Risk. The Index relies heavily

on a proprietary algorithm as well as data and information supplied by third parties that are utilized by such model. To the extent the

algorithm does not perform as designed or as intended, including accurately measuring historic price trends and volatility, the Fund’s

strategy may not be successfully implemented and the Fund may lose value.

Allocation Risk. If the Fund’s strategy

for allocating assets among different sectors does not work as intended, the Fund may not achieve its objective or may underperform other

funds with the same or similar investment strategy.

Authorized Participant Risk. Only an Authorized

Participant (“AP”) may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number

of institutions that may act as APs on an agency basis (i.e., on behalf of other market participants). To the extent that APs exit

the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other AP is able to step forward

to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to net asset value and possibly face

trading halts or delisting. AP concentration risk may be heightened for ETFs that invest in non-U.S. securities or other securities or

instruments that have lower trading volumes.

ETF Structure Risks. The Fund is structured

as an ETF, and as a result, is subject to the special risks, including:

| o | Not Individually Redeemable.

Shares of the Fund (“Shares”) are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks

known as “Creation Units.” You may incur brokerage costs purchasing enough Shares to constitute a Creation Unit. |

| o | Trading Issues. An active trading market for the

Shares may not be developed or maintained. Trading in Shares on the New York Stock Exchange (“NYSE” or the “Exchange”)

may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable, such as extraordinary

market volatility. There can be no assurance that Shares will continue to meet the listing requirements of the Exchange. If the Shares

are traded outside a collateralized settlement system, the number of financial institutions that can act as APs that can post collateral

on an agency basis is limited, which may limit the market for the Shares. |

| o | Market Price Variance Risk.

The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and will include a “bid-ask

spread” charged by the exchange specialists, market makers or other participants that trade the particular security. There may be

times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to NAV. |

Index Calculation Agent Risk. The Fund seeks

to achieve returns that generally correspond, before fees and expenses, to the performance of its index, as published by its Index Calculation

Agent. There is no assurance that the Index Calculation Agent will compile the index accurately, or that the index will be determined,

composed or calculated accurately. While the Adviser gives descriptions of what the index is designed to achieve, the Index Calculation

Agent does not provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in the index,

and does not guarantee that its index will be in line with its methodology.

Index Tracking Risk. The Fund’s return

may not match or achieve a high degree of correlation with the return of the Index.

Smaller Fund

Risk. A smaller fund is subject to the risk that its performance may not represent how the fund is expected to or may perform in the

long-term. There can be no assurance that the Fund will achieve an economically viable size, in which case it could ultimately liquidate.

In a liquidation, shareholders of the Fund will receive an amount equal to the Fund’s NAV, after deducting the costs of liquidation.

Receipt of a liquidation distribution may have negative tax consequences for shareholders.

Large Capitalization Stock Risk. The Fund may

invest in large capitalization companies. The securities of such companies may underperform other segments of the market because such

companies may be less responsive to competitive challenges and opportunities and may be unable to attain high growth rates during periods

of economic expansion.

Passive Investment

Risk. The Fund is not actively managed and, therefore, the Fund would not sell a security due to current or projected underperformance

of the security, industry, or sector unless that security is removed from the Index or selling the security is otherwise required upon

a rebalancing of the Index.

Portfolio Turnover Risk. The Fund may buy and

sell investments frequently if the Index constituents change. Such a strategy often involves higher transaction costs, including brokerage

commissions, and may increase the amount of capital gains (in particular, short-term gains) realized by the Fund. Shareholders may pay

tax on such capital gains.

Securities Market Risk. The value of securities

owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting particular companies or the securities

markets generally. A general downturn in the securities market may cause multiple asset classes to decline in value simultaneously.

Underlying Funds Risk. Underlying Funds in

which the Fund invests are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result,

the cost of investing in the Fund is higher than the cost of investing directly in the

Underlying Funds and may be higher than other funds

that invest directly in stocks and bonds. Through its investments in Underlying Funds, the Fund is subject to the risks associated with

the Underlying Funds’ investments. The U.S. money market funds in which the Fund invests seek

to maintain a stable NAV, but money market funds are subject to credit, market and other risks, and are not guaranteed.

Performance: Because the Fund is a new fund

and does not have a full calendar year of investment operations, no performance information is presented for the Fund at this time. In

the future, performance information will be presented in this section of this Prospectus. In addition, shareholder reports containing

financial and performance information will be mailed to shareholders semi-annually. Updated performance information is available at no

cost by visiting www.thorfunds.com or by calling 1-800-974-6964.

Investment Adviser: THOR Financial Technologies,

LLC (the “Adviser”)

Portfolio Managers: Bradley Roth and Cameron

Roth have served the Fund as a Portfolio Manager since September 2022.

Purchase and Sale of Fund Shares: The Fund

issues and redeems Shares at NAV only in large blocks of 10,000 Shares (each block of Shares is called a “Creation Unit”).

Creation Units are issued and redeemed for cash and/or in-kind for securities. Individual Shares may only be purchased and sold in secondary

market transactions through brokers. Except when aggregated in Creation Units, the Shares are not redeemable securities of the Fund.

Shares of the Fund are listed for trading on the Exchange

and trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV.

Tax Information: The Fund’s distributions

generally will be taxable as ordinary income or long-term capital gains. A sale of Shares may result in capital gain or loss.

Payments to Broker-Dealers and Other Financial

Intermediaries: If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its

related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest

by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson

or visit your financial intermediary’s website for more information.

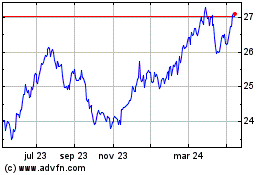

THOR Equal Weight Low Vo... (NYSE:THLV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

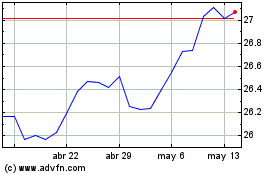

THOR Equal Weight Low Vo... (NYSE:THLV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024