MORNING UPDATE: Man Securities Inc. Issues Alerts for RIMM, AXP, VZ, COH, and FNF

27 Abril 2005 - 10:08AM

PR Newswire (US)

MORNING UPDATE: Man Securities Inc. Issues Alerts for RIMM, AXP,

VZ, COH, and FNF CHICAGO, April 27 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for RIMM, AXP, VZ, COH, and FNF,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "We have seen earnings for the past three

weeks and the market is down -- that's a sign the market is more

worried about the next three to six months rather than 'old news'

first-quarter earnings." -- Peter Boockvar, equity strategist,

Miller Tabak & Co. New PriceWatch Alerts for RIMM, AXP, VZ,

COH, and FNF... PRICEWATCH ALERTS - HIGH RETURN COVERED CALL

OPTIONS -- Research In Motion (NASDAQ:RIMM) Last Price 65.52 - JUN

60.00 CALL OPTION@ $8.10 -> 4.5 % Return assigned* -- American

Express Co. (NYSE:AXP) Last Price 51.55 - OCT 50.00 CALL OPTION@

$4.20 -> 5.6 % Return assigned* -- Verizon Communications Inc.

(NYSE:VZ) Last Price 34.00 - JUL 35.00 CALL OPTION@ $0.75 -> 5.3

% Return assigned* -- Coach Inc. (NYSE:COH) Last Price 27.76 - AUG

27.50 CALL OPTION@ $2.10 -> 7.2 % Return assigned* -- Fidelity

National Financial, Inc. (NYSE:FNF) Last Price 31.35 - OCT 30.00

CALL OPTION@ $3.00 -> 5.8 % Return assigned* * To learn more

about how to use these alerts and for our FREE report, "The 18

Warning Signs That Tell You When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "Is Your Investment Portfolio Disaster Proof? -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Wellpoint Inc., Amerada Hess Corp., and Express Scripts Inc. lead

the list of companies with the most news stories while Headwaters

Inc. and Becton, Dickinson & Co. are showing a spike in news.

Colgate-Palmolive Co., Baker Hughes Inc., and Praxair Inc. have the

highest srtIndex scores to top the list of companies with positive

news while Sony Corp. and Amazon.com Inc. lead the list of

companies with negative news reports. Ultra Petroleum Inc. has

popped up with a high positive news sraIndex score. For the FREE

article titled, "Earnings Season Decoded - An Essential 15 Point

Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW All

of the foreign markets that we track are lower this morning.

European shares declined earlier today, thanks to a second straight

session of poor results from chip stocks. Leading the chip parade

lower was STMicroelectronics, which reported a quarterly loss of

three cents per share due to stronger price competition. Analysts

had expected earnings of seven cents per share. London's FTSE 100

index dropped 0.3 percent, falling to 4,829, while the German DAX

30 also saw a drop of 0.4 percent, landing at 4,216. France's CAC

40 index dropped 0.5 percent to finish the day at 3,975. On the

earnings front, watch Amazon.com for weakness after reporting

first-quarter earnings that missed the Street's estimate. In

Amazon.com's defense, this year's results include a tax expense of

$56 million in the first quarter, negating the $26-million gain for

an accounting charge. Be prepared for the investing week ahead with

Bernie Schaeffer's FREE Monday Morning Outlook. For more details

and to sign up, go to: http://www.investorsobserver.com/freemo

DYNAMIC MARKET OPPORTUNITIES As the first quarter earnings season

continues at a fierce pace, indications from Thomson Financial show

that 2005 has begun strongly for many of the companies in the

S&P500. Calculating the earnings reports so far, plus the

current forecasts of those companies yet to release earnings,

Thomson comes out with overall profit growth of 12.1% compared with

Q1 2004. That's up significantly from the 8.6% earnings growth the

company projected just last week. While this is undoubtedly good

news, it's worth remembering that these figures are based on

companies beating analysts' earnings forecasts -- a gauge that the

Baltimore-based 247Profits investment group says can often be a

somewhat unreliable measure of the market. Nevertheless, results

through April 22 show two-thirds of S&P500 companies beating

their earnings estimates -- about 7% higher than average. Of those

estimate-beaters, they're surpassing projections by 6.5% -- more

than double the average normal figure of 3.1%. With over 160

companies reporting first quarter results this week, it's highly

likely that the combined profit figure is liable to fluctuate. Over

in Britain, the corporate news is less upbeat. A report from

accountants Ernst & Young shows that first quarter profit

warnings jumped 20% compared with a year ago. The main strugglers

included firms from the media and retail sectors, as market forces

within both have recently become ultra-competitive. Bellwether

retailers such as Marks and Spencer and Boots are among the

heavyweights who have reported a slide in profits. Such news flies

contrary to what is an otherwise healthy UK economy, with GDP

growth this year projected to fall between 3% and 3.5%, and the job

market still very strong. However, rising inflation (with the March

rate hitting a seven-year high of 1.9%), several interest rate

hikes from the Bank of England, and a slowing housing market have

contributed to slower spending. Brits are also waiting for the

outcome of the general election on May 5. Read more analysis from

the 247Profits Group every trading day with the FREE 247Profits

e-Dispatch, featuring insightful economic commentary, profitable

investment recommendations, and full access to a leading team of

financial experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR 7:00

A.M. April 23 MBA Refinancing Index 8:30 A.M. March Durable Goods

9:00 A.M. Fed Gov. Gramlich speaks on federalizing the laws against

predatory lending in Philadelphia 12:00 P.M. March Chicago Fed

Midwest Mfg Index 4:30 P.M. Fed Vice Chairman Ferguson speaks on

the evolution of the central bank in the U.S. at the ECB Colloquium

in Frankfurt Man Securities Inc. is one of the world's leading

option order execution firms. Man's in-house broker team offers a

level of personal service and experience unavailable from no-frills

discount brokers. To improve your understanding of option pricing

get Man's FREE Margin/Option Wizard software at:

http://www.investorsobserver.com/mancd. Member CBOE/NASD/SPIC. CRD#

6731 This Morning Update was prepared with data and information

provided by: InvestorsObserver.com - Better Strategies for Making

Money -> For Investors With a Sense of Humor. Only $1 for your

first month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must Quote.com QCharts- Real time

quotes and streaming technical charts to keep you up with the

market. Analyze, predict, and stay ahead. for a Free 30 day trial

go to: http://www.investorsobserver.com/MUQuote2 247profits.com:

You'll get exclusive financial commentary, access to a global

network of experts and undiscovered stock alerts. Register NOW for

the FREE 247profits e-Dispatch. Go to:

http://www.247profits.com/enter.html Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

John Gannon of Man Securities Inc., +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

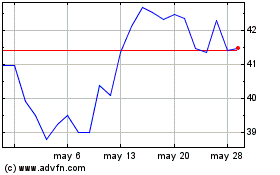

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

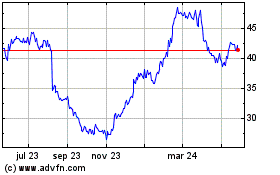

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024