UPDATE: Coach 2Q Net Rises 15% On Higher Sales; China Grows

24 Enero 2012 - 10:17AM

Noticias Dow Jones

Coach Inc.'s (COH) fiscal second-quarter earnings rose 15%, with

its leather merchandise seeing demand from a growing men's business

and the retailer enjoying strength in the U.S. and China.

The results show that higher-end consumers, domestically and

abroad, are still buying amid an uncertain economy in which fellow

luxury retailer Tiffany & Co. (TIF) issued an earnings warning

earlier this month.

"We've experienced strong response to our new collections and

our pricing and assortment strategy continue to resonate with

consumers world-wide," Coach Chief Executive Lew Frankfort said on

a conference call.

Frankfort said the retailer saw improvement in its customers'

outlook for the economy compared to a quarter ago, with about 60%

of those surveyed now believing that the U.S. economy is stable or

getting better, up from 48%.

Coach's women's handbag and accessory sales rose about 12%

across all channels in North America during the most recent

quarter.

Outside the U.S., China remains a growth vehicle for Coach,

despite indications that its economy is cooling. "We continue to

generate very strong sales growth, significant double-digit

comparable-store sales in China," where the company has 80

locations and believes it can do $300 million in sales in its

current fiscal year, Frankfort said.

The retailer also continues to build out its men's accessories

lines, which Frankfort said is on pace to double in the current

fiscal year to more than $400 million in global sales.

Coach's "product has resonated well with customers and we

believe the higher-end consumer will continue to increase spending"

this year, driving same-store sales, said Christine Chen, retail

analyst at Needham & Co.

For the quarter ended Dec. 31, Coach reported a profit of $347.5

million, or $1.18 a share, up from $303.4 million, or $1 a share, a

year earlier. Sales jumped 15% to $1.45 billion.

Analysts polled by Thomson Reuters had most recently forecast

earnings of $1.15 on revenue of $1.43 billion.

Gross margin slipped to 72.2% from 72.4%, but the decline was

less than analysts expected.

Direct-to-consumer sales, which now include its Singapore

business, increased 17%. Same-store sales rose 8.8% in North

America and were flat in Japan, on a constant-currency basis.

Indirect sales were flat at $166 million, hurt by the timing of

international shipments.

Coach were recently up shares are up 5.1% to $67.52.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

--Melodie Warner contributed to this article.

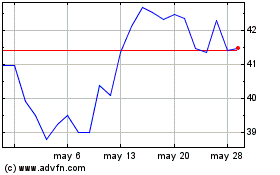

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

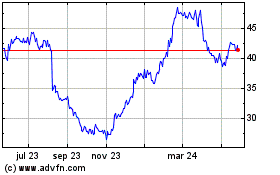

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024