FALSE000089626400008962642024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 23, 2024

USANA HEALTH SCIENCES, INC.

(Exact name of registrant as specified in its charter)

Utah

(State or other jurisdiction of incorporation)

| | | | | |

| 001-35024 | 87-0500306 |

| (Commission File No.) | (IRS Employer

Identification No.) |

3838 West Parkway Boulevard

Salt Lake City, Utah 84120

(Address of principal executive offices, Zip Code)

Registrant's telephone number, including area code: (801) 954-7100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | USNA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2024, USANA Health Sciences, Inc. (the “Company” or “USANA”) issued a press release announcing its financial results for the second quarter ended June 29, 2024. The release also announced that the Company will post a document titled “Management Commentary” on the Company’s website and that executives of the Company will hold a conference call with investors, to be broadcast over the World Wide Web and by telephone and provided access information, date and time for the conference call. The Company noted that the call will consist of brief remarks by the Company’s management team, before moving directly into questions and answers. A copy of the press release, and the Management Commentary, are furnished herewith as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K and are incorporated herein by reference. These documents will be posted on the Company’s corporate website, www.usana.com.

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report, including the exhibits, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended. The furnishing of the information in this Current Report is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information this Current Report contains is material investor information that is not otherwise publicly available.

Item 7.01 Regulation FD Disclosure

The information disclosed above under Item 2.02, as well as the exhibits attached under Item 9.01 below are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| USANA HEALTH SCIENCES, INC. |

| | |

| By: | /s/ G. Douglas Hekking |

| G. Douglas Hekking, Chief Financial Officer |

| | |

| Date: July 23, 2024 | | |

USANA Health Sciences Reports Second Quarter 2024 Results

SALT LAKE CITY, July 23, 2024 (BUSINESS WIRE)—USANA Health Sciences, Inc. (NYSE: USNA) today announced financial results for its fiscal second quarter ended June 29, 2024.

Key Financial & Operating Results

•Second quarter net sales were $213 million versus $238 million during Q2 2023.

•Second quarter diluted EPS was $0.54 as compared with $0.89 during Q2 2023.

•Company updates fiscal year 2024 net sales and diluted EPS outlook to $850 million to $880 million and $2.40 to $2.55 (previously $850 million to $920 million and $2.40 to $3.00).

Q2 2024 Financial Performance

| | | | | | | | |

| Consolidated Results |

| Net Sales | $213 million | •-11% vs. Q2 2023 |

| | •-8% constant currency vs. Q2 2023 |

| | •-7% sequentially |

| | •-6% constant currency sequentially |

| | •-$5 million YOY FX impact, or -2% |

| Diluted EPS | $0.54 | •-39% vs. Q2 2023 |

| | •-37% sequentially |

| Active Customers | 468,000 | •-4% vs. Q2 2023 |

| | •-5% sequentially |

“Second quarter operating results were below our expectations,” said Jim Brown, President and Chief Executive Officer.

“Ongoing macroeconomic pressures in several of our key markets continue to impact consumer spending. This in turn creates challenges in our ability to attract and engage new customers and

generate sales momentum. To counter these challenges, we have made several strategic changes in our business over the past few quarters, including (i) restructuring our commercial team, (ii) heightening our focus on product innovation, (iii) increasing our efforts to engage our sales leaders with an Associate-first approach, (iv) expanding into India, and (v) evaluating more business development activities.

“Next month, we will be hosting our Americas & Europe Convention in Las Vegas, Nevada along with other Associate engagement-focused events in the back half of the year. We are also planning to offer a more robust promotional calendar throughout the remainder of the year.”

Q2 2024 Regional Results:

| | | | | | | | |

| Asia Pacific Region |

| Net Sales | $171 million | •-12% vs. Q2 2023 |

| | •-9% constant currency vs. Q2 2023 |

| | •-8% sequentially |

| | •80% of consolidated net sales |

| Active Customers | 369,000 | •-4% vs. Q2 2023 |

| | •-7% sequentially |

| Asia Pacific Sub-Regions |

| Greater China |

| Net Sales | $116 million | •-10% vs. Q2 2023 |

| | •-8% constant currency vs. Q2 2023 |

| | •-9% sequentially |

| Active Customers | 250,000 | •Flat vs. Q2 2023 |

| | •-9% sequentially |

| North Asia |

| Net Sales | $20 million | •-23% vs. Q2 2023 |

| | •-19% constant currency vs. Q2 2023 |

| | •-8% sequentially |

| Active Customers | 42,000 | •-18% vs. Q2 2023 |

| | •-7% sequentially |

| Southeast Asia Pacific |

| Net Sales | $35 million | •-10% vs. Q2 2023 |

| | •-7% constant currency vs. Q2 2023 |

| | •-2% sequentially |

| Active Customers | 77,000 | •-6% vs. Q2 2023 |

| | •+1% sequentially |

| | | | | | | | |

| Americas and Europe Region |

| Net Sales | $42 million | •-5% vs. Q2 2023 |

| | •-5% constant currency vs. Q2 2023 |

| | •-1% sequentially |

| | •20% of consolidated net sales |

| Active Customers | 99,000 | •-4% vs. Q2 2023 |

| | •Flat sequentially |

Balance Sheet and Share Repurchase Activity

The Company generated $8 million in operating cash flow during second quarter and ended the quarter with $332 million in cash and cash equivalents while remaining debt-free. The Company did not repurchase any shares during the quarter. As of June 29, 2024, the Company had approximately $62 million remaining under the current share repurchase authorization.

Fiscal Year 2024 Outlook

The Company is updating its net sales and earnings per share outlook for fiscal year 2024, as follows:

| | | | | | | | |

Fiscal Year 2024 Outlook |

| Revised Range | Previous Range |

| Consolidated Net Sales | $850 - $880 million | $850 - $920 million |

| Diluted EPS | $2.40 - $2.55 | $2.40 - $3.00 |

“While we anticipated lower sequential operating results following a successful promotional period in the first quarter, lower than anticipated active customer counts negatively impacted our second quarter results,” said Doug Hekking, Chief Financial Officer. “Additionally, the strengthening of the U.S. dollar created downward pressure on both net sales and operating margin during the quarter.”

Mr. Hekking continued, “We are revising our fiscal 2024 outlook to reflect year-to-date operating results, our expectation for a continued challenging operating environment across many of our markets, higher than anticipated unfavorable currency exchange rate impact on operating results, and an increased effective tax rate. We recognize the need to continue investing in strategic initiatives while also aligning costs with sales performance. Our balance

sheet remains strong with $332 million of cash, zero debt, and we continue to generate solid cash flow.”

Management Commentary Document and Conference Call

For further information on the USANA’s operating results, please see the Management Commentary document, which has been posted on the Company’s website (http://ir.usana.com) under the Investor Relations section. USANA’s management team will hold a conference call and webcast to discuss today’s announcement with investors on Wednesday, July 24, 2024 at 11:00 AM Eastern Time. Investors may listen to the call by accessing USANA’s website at http://ir.usana.com. The call will consist of brief opening remarks by the Company’s management team, followed by a questions and answers session.

Non-GAAP Financial Measures

The Company prepares its financial statements using U.S. generally accepted accounting principles (“GAAP”). Constant currency net sales, earnings, EPS and other currency-related financial information (collectively, “Financial Results”) are non-GAAP financial measures that remove the impact of fluctuations in foreign-currency exchange rates (“FX”) and help facilitate period-to-period comparisons of the Company’s Financial Results that we believe provide investors an additional perspective on trends and underlying business results. Constant currency Financial Results are calculated by translating the current period's Financial Results at the same average exchange rates in effect during the applicable prior-year period and then comparing this amount to the prior-year period's Financial Results.

About USANA

USANA develops and manufactures high-quality nutritional supplements, functional foods and personal care products that are sold directly to Associates and Preferred Customers throughout the United States, Canada, Australia, New Zealand, Hong Kong, China, Japan, Taiwan, South Korea, Singapore, Mexico, Malaysia, the Philippines, the Netherlands, the United Kingdom, Thailand, France, Belgium, Colombia, Indonesia, Germany, Spain, Romania, Italy, and India. More information on USANA can be found at www.usana.com.

Safe Harbor

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Our actual results could differ materially from those projected in these forward-looking statements, which involve a number of risks and uncertainties, including: global economic conditions generally, including continued inflationary pressure around the world and negative impact on our operating costs, consumer demand and consumer behavior in general; reliance upon our network of independent Associates; risk associated with governmental regulation of our products, manufacturing and direct selling business model in the United States, China and other key markets; potential negative effects of deteriorating foreign and/or trade relations between or among the United States, China and other key markets; potential negative effects from geopolitical relations and conflicts around the world, including the Russia-Ukraine conflict and the conflict in Israel; compliance with data privacy and security laws and regulations in our markets around the world; potential negative effects of material breaches of our information technology systems to the extent we experience a material breach; material failures of our information technology systems; adverse publicity risks globally; risks associated with commencing operations in India and future international expansion and operations; uncertainty relating to the fluctuation in U.S. and other international currencies; and the potential for a resurgence of COVID-19, or another pandemic, in any of our markets in the future and any related impact on consumer health, domestic and world economies, including any negative impact on discretionary spending, consumer demand, and consumer behavior in general. The contents of this release should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in our most recent filings with the Securities and Exchange Commission. The forward-looking statements in this press release set forth our beliefs as of the date hereof. We do not undertake any obligation to update any forward-looking statement after the date hereof or to conform such statements to actual results or changes in the Company’s expectations, except as required by law.

Investor contact: Andrew Masuda

Investor Relations

(801) 954-7201

investor.relations@usanainc.com

Media contact: Amy Haran

Public Relations

(801) 954-7280

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | |

| Quarter Ended | |

| June 29,

2024 | | July 1,

2023 | |

| Net sales | $ | 212,869 | | | $ | 238,202 | | |

| Cost of sales | 40,333 | | | 43,326 | | |

| Gross profit | 172,536 | | | 194,876 | | |

| Operating expenses: | | | | |

| Associate incentives | 90,371 | | | 102,380 | | |

| Selling, general and administrative | 64,325 | | | 68,096 | | |

| Total operating expenses | 154,696 | | | 170,476 | | |

| Earnings from operations | 17,840 | | | 24,400 | | |

| Other income (expense): | | | | |

| Interest income | 2,763 | | | 2,224 | | |

| Interest expense | (51) | | | (43) | | |

| Other, net | (349) | | | 229 | | |

| Other income (expense), net | 2,363 | | | 2,410 | | |

| Earnings before income taxes | 20,203 | | | 26,810 | | |

| Income taxes | 9,771 | | | 9,518 | | |

| Net earnings | $ | 10,432 | | | $ | 17,292 | | |

| | | | |

| Earnings per common share | | | | |

| Basic | $ | 0.55 | | | $ | 0.89 | | |

| Diluted | $ | 0.54 | | | $ | 0.89 | | |

| | | | |

| Weighted average common shares outstanding | | | | |

| Basic | 19,073 | | 19,321 | |

| Diluted | 19,159 | | 19,427 | |

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| As of

June 29,

2024 | | As of

December 30,

2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 332,423 | | | $ | 330,420 | |

| Inventories | 61,832 | | | 61,454 | |

| Prepaid expenses and other current assets | 24,826 | | | 25,872 | |

| Total current assets | 419,081 | | | 417,746 | |

| Property and equipment, net | 97,686 | | | 99,814 | |

| Goodwill | 16,837 | | | 17,102 | |

| Intangible assets, net | 28,637 | | | 29,919 | |

| Deferred tax assets | 18,190 | | | 13,284 | |

Other assets* | 50,988 | | | 54,892 | |

| Total assets | $ | 631,419 | | | $ | 632,757 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 6,648 | | | $ | 10,070 | |

| Line of credit - short term | — | | | 786 | |

| Other current liabilities | 97,248 | | | 107,989 | |

| Total current liabilities | 103,896 | | | 118,845 | |

| Deferred tax liabilities | 4,653 | | | 4,552 | |

| Other long-term liabilities | 10,662 | | | 12,158 | |

| | | |

| Stockholders' equity | 512,208 | | | 497,202 | |

| Total liabilities and stockholders' equity | $ | 631,419 | | | $ | 632,757 | |

*Other assets include noncurrent inventories of $3,075 and $3,128 as of 29-Jun-24 and 30-Dec-23, respectively. Total inventories were $64,907 and $64,582 as of 29-Jun-24 and 30-Dec-23, respectively.

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

SALES BY REGION

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change from prior

year | | Percent change | | Currency impact on

sales | | % change

excluding currency

impact |

| June 29, 2024 | | July 1, 2023 | | | | |

| Asia Pacific | | | | | | | | | | | | | | | |

| Greater China | $ | 115,513 | | | 54.3 | % | | $ | 128,749 | | | 54.1 | % | | $ | (13,236) | | | (10.3 | %) | | $ | (3,085) | | | (7.9 | %) |

| Southeast Asia Pacific | 35,402 | | | 16.6 | % | | $ | 39,337 | | | 16.5 | % | | (3,935) | | | (10.0 | %) | | (1,221) | | | (6.9 | %) |

| North Asia | 19,710 | | | 9.3 | % | | $ | 25,529 | | | 10.7 | % | | (5,819) | | | (22.8 | %) | | (870) | | | (19.4 | %) |

| Asia Pacific Total | 170,625 | | | 80.2 | % | | 193,615 | | | 81.3 | % | | (22,990) | | | (11.9 | %) | | (5,176) | | | (9.2 | %) |

| Americas and Europe | 42,244 | | | 19.8 | % | | 44,587 | | | 18.7 | % | | (2,343) | | | (5.3 | %) | | (94) | | | (5.0 | %) |

| $ | 212,869 | | | 100.0 | % | | $ | 238,202 | | | 100.0 | % | | $ | (25,333) | | | (10.6 | %) | | $ | (5,270) | | | (8.4 | %) |

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

ACTIVE ASSOCIATES AND ACTIVE PREFERRED CUSTOMERS BY REGION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

Active Associates by Region(1) |

| (unaudited) |

| As of

June 29, 2024 | | As of

July 1, 2023 |

| Asia Pacific: | | | | | | | |

| Greater China | 68,000 | | 35.2 | % | | 71,000 | | 34.1 | % |

| Southeast Asia Pacific | 52,000 | | 27.0 | % | | 57,000 | | 27.4 | % |

| North Asia | 28,000 | | 14.5 | % | | 33,000 | | 15.9 | % |

| Asia Pacific Total | 148,000 | | 76.7 | % | | 161,000 | | 77.4 | % |

| | | | | | | |

| Americas and Europe | 45,000 | | 23.3 | % | | 47,000 | | 22.6 | % |

| 193,000 | | 100.0 | % | | 208,000 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Active Preferred Customers by Region(2) |

| (unaudited) |

| As of

June 29, 2024 | | As of

July 1, 2023 |

| Asia Pacific: | | | | | | | |

| Greater China | 182,000 | | 66.2 | % | | 180,000 | | 64.5 | % |

| Southeast Asia Pacific | 25,000 | | 9.1 | % | | 25,000 | | 9.0 | % |

| North Asia | 14,000 | | 5.1 | % | | 18,000 | | 6.4 | % |

| Asia Pacific Total | 221,000 | | 80.4 | % | | 223,000 | | 79.9 | % |

| | | | | | | |

| Americas and Europe | 54,000 | | 19.6 | % | | 56,000 | | 20.1 | % |

| 275,000 | | 100.0 | % | | 279,000 | | 100.0 | % |

(1) Associates are independent distributors of our products who also purchase our products for their personal use. We only count as active those Associates who have purchased from us any time during the most recent three-month period, either for personal use or resale.

(2) Preferred Customers purchase our products strictly for their personal use and are not permitted to resell or to distribute the products. We only count as active those Preferred Customers who have purchased from us any time during the most recent three-month period. China utilizes a Preferred Customer program that has been implemented specifically for that market.

USANA Health Sciences, Inc. July 23, 2024

Q2 2024 Management Commentary

Key Financial & Operating Results

•Second quarter net sales were $213 million versus $238 million during Q2 2023.

•Second quarter diluted EPS was $0.54 as compared with $0.89 during Q2 2023.

•Company updates fiscal year 2024 net sales and diluted EPS outlook to $850 million to $880 million and $2.40 to $2.55 (previously $850 million to $920 million and $2.40 to $3.00).

Overview

Sales performance in the second quarter was below our expectations as ongoing macroeconomic pressures in several of our key markets continued to impact consumer spending. To maintain the appropriate annual cadence of promotions and incentives for our business, we also offered fewer promotions during the second quarter and experienced lower levels of spend per customer in certain markets. Combined, these factors made it difficult for our sales force to attract new customers and generate positive sales momentum during the quarter.

Notwithstanding the near-term challenges facing our business, we continue to generate solid cash flow and our balance sheet sheet remains robust with zero debt and $332 million of cash. This enables us the flexibility to continue to invest in strategic initiatives throughout the peaks and troughs of the business cycle, further strengthening USANA's position to drive sustainable long-term growth. We have invested in several strategic areas of our business over the past few quarters, including (i) restructuring our commercial team, (ii) heightening our focus on product innovation, (iii) increasing our efforts to engage our sales leaders with an Associate-first approach, (iv) expanding into India, and (v) continuing to pursue accretive M&A activities.

Our sales, marketing, and communications departments have been reorganized into one cohesive commercial team. This team is focused on delivering three fundamental benefits to our Associates: (1) best-in-class products, (2) an income opportunity that is simple and motivates the entrepreneur with a rewarding compensation plan, and (3) messaging that conveys product benefits and income opportunity in a simple and compelling manner. This new structure will also enable USANA to:

•Increase the value proposition of USANA to our Associates and customers by enhancing our already best-in-class products.

•Become faster and more agile in developing and releasing new products.

•Better understand specific Associate and customer needs in each of our markets to deliver a more tailored customer experience for them.

•Provide increased opportunities for Associate engagement including events, meetings, and reward trips.

•Improve USANA's compensation offering for both part and full-time entrepreneurs.

Next month, we will be hosting our Americas & Europe Convention in Las Vegas, Nevada where we plan to announce new product launches and upgrades. Strategic events going forward will continue to serve as the platform for introducing and launching our new and innovative products.

Our Associate engagement efforts during the quarter were focused on in-person events that we held throughout various markets in our Asia Pacific region. These events provide valuable educational forums for our Associates and are focused on business-building best practices. We have additional engagement-focused events in the back half of the year and plan to offer a more robust promotional calendar throughout the remainder of the year.

We will also continue to invest in building our brand and increasing our presence in India. Our brand and product offering have been embraced by customers in this new market during our first six months of operations, which has helped us attract many sales leaders, including health and business professionals, who will be instrumental to our success in India. We are encouraged by

the meaningful long-term opportunity this market offers and by the strong foundation we are building there.

Our business development team also remains highly active in evaluating potential M&A opportunities within the broader health and wellness space that would be additive to USANA's long-term growth strategy. Specifically, we are looking for opportunities that provide: 1) products and/or services centered on health and wellness; 2) vertical integration; 3) product and category expansion; 4) channel expansion; and 5) expansion of USANA's core competencies.

Q2 2024 Financial Performance

| | | | | | | | |

| Consolidated Results |

| Net Sales | $213 million | •-11% vs. Q2 2023 |

| | •-8% constant currency vs. Q2 2023 |

| | •-$5 million YOY FX impact, or -2% |

| | •-7% sequentially |

| | •-6% constant currency sequentially |

| Diluted EPS | $0.54 | •-39% vs. Q2 2023 |

| | •-37% sequentially |

| Active Customers | 468,000 | •-4% vs. Q2 2023 |

| | •-5% sequentially |

Balance Sheet and Share Repurchase Activity

We generated $8 million in operating cash flow during the second quarter and ended the quarter with $332 million in cash and cash equivalents while remaining debt-free.

As of June 29, 2024, inventories were $65 million, flat compared to the year end balance in fiscal 2023. Our in-house sourcing and manufacturing capabilities provide us with better control of inventory levels and help to mitigate supply chain risks while providing a meaningful contribution to delivering the highest quality nutritional products.

We did not repurchase any shares during the quarter. As of June 29, 2024, we had approximately $62 million remaining under the current share repurchase authorization.

Quarterly Income Statement Discussion

Gross margin decreased 70 basis points from the prior year to 81.1% of net sales. The decrease can largely be attributed to the negative impact of foreign currency exchange rates and the loss of leverage on fixed-period costs due to lower net sales.

Associate Incentives decreased 50 basis points from the prior year to 42.5% of net sales. The decrease largely reflects lower incentive and promotional expenses in the current year quarter.

Selling, General and Administrative expenses increased 160 basis points from the prior year to 30.2% as a percentage of net sales. The relative increase is primarily due to a loss of leverage on lower year-over-year net sales. On an absolute basis, SG&A expenses, decreased $3.8 million compared to the second quarter of 2023 due, in part, to lower event and advertising-related expenses.

The year-to-date effective tax rate increased to 43.0% from the 35.5% reported in the comparable period of 2023 or 37.7% for fiscal 2023. The higher effective tax rate can be attributed primarily to: 1) China’s increased relative share of USANA’s sales portfolio, 2) A concentration of infrastructure costs in our corporate headquarters, and 3) generally softer operating performance, including the impact of unfavorable exchange rates in our other markets around the world. The revised effective tax rate for June 2024 year-to-date created a larger impact, or true up, resulting in a tax rate of 48.4% for the second quarter of 2024.

Q2 2024 Regional Results:

| | | | | | | | |

| Asia Pacific Region |

| Net Sales | $171 million | •-12% vs. Q2 2023 |

| | •-9% constant currency vs. Q2 2023 |

| | •-8% sequentially |

| | •80% of consolidated net sales |

| Active Customers | 369,000 | •-4% vs. Q2 2023 |

| | •-7% sequentially |

| Asia Pacific Sub-Regions |

| Greater China |

| Net Sales | $116 million | •-10% vs. Q2 2023 |

| | •-8% constant currency vs. Q2 2023 |

| | | | | | | | |

| | •-9% sequentially |

| Active Customers | 250,000 | •Flat vs. Q2 2023 |

| | •-9% sequentially |

| North Asia |

| Net Sales | $20 million | •-23% vs. Q2 2023 |

| | •-19% constant currency vs. Q2 2023 |

| | •-8% sequentially |

| Active Customers | 42,000 | •-18% vs. Q2 2023 |

| | •-7% sequentially |

| Southeast Asia Pacific |

| Net Sales | $35 million | •-10% vs. Q2 2023 |

| | •-7% constant currency vs. Q2 2023 |

| | •-2% sequentially |

| Active Customers | 77,000 | •-6% vs. Q2 2023 |

| | •+1% sequentially |

Greater China: Net sales and local currency sales in mainland China decreased 11% and 8% year-over-year, respectively. Active Customers in this market were flat year-over-year. Sequentially, regional performance was impacted by our mainland China market, where both net sales and Active Customers decreased 9%. The primary driver of year-over-year and sequential performance is attributable to a lower level of promotional activity during the quarter.

North Asia: Net sales and local currency sales in South Korea declined 23% and 19% year-over-year, respectively, and Active Customers declined 16%. On a sequential basis, net sales and local currency sales declined 8% and 5%, respectively, while Active Customers declined 5%. Both year-over-year and sequential quarter declines reflect ongoing challenges in the local economy, which continue to negatively impacting consumer spending, thus making it difficult to attract new customers.

Southeast Asia Pacific: Net sales and local currency sales in Malaysia increased 1% and 6% year-over-year, respectively, while Active Customers declined 4% year-over-year. Sequentially, net sales and Active Customers in Malaysia increased 6% and 4%, respectively. We are encouraged to see some stabilization in our operating results in Malaysia. In the Philippines, net sales and local currency sales declined 32% and 29% year-over-year, respectively, while Active Customers were 18% lower. Sequentially, net sales and local currency sales in the Philippines

declined 9% and 6%, respectively, while Active Customers were flat. A difficult operating environment, highlighted by economic pressures, continues to negatively impact our operating results in the Philippines.

| | | | | | | | |

| Americas and Europe Region |

| Net Sales | $42 million | •-5% vs. Q2 2023 |

| | •-5% constant currency vs.Q2 2023 |

| | •-1% sequentially |

| | •20% of consolidated net sales |

| Active Customers | 99,000 | •-4% vs. Q2 2023 |

| | •Flat sequentially |

Americas and Europe Region: Net sales in Canada decreased 1% from the prior year while local currency sales grew 1%. Active Customers in this market increased 3%. Net sales in the United States declined 10% and Active Customers decreased 7% on a year-over-year basis. Sequentially, net sales and local currency sales in Canada grew 2% and 3%, respectively, while Active Customers increased 3%. In the United States, net sales declined 3% sequentially while Active Customers were 2% lower. We continue to see price-sensitivity amongst consumer in these two markets, however, we are encouraged by the stabilizing trends over the past few quarters.

Fiscal Year 2024 Outlook

The Company is updating its net sales and earnings per share outlook for fiscal year 2024, as follows:

| | | | | | | | |

Fiscal Year 2024 Outlook |

| Revised Range | Previous Range |

| Consolidated Net Sales | $850 - $880 million | $850 - $920 million |

| Diluted EPS | $2.40- $2.55 | $2.40 - $3.00 |

Our updated outlook for the year reflects:

•An unfavorable currency exchange rate impact on net sales and operating margin, as the strengthening of the U.S. dollar continued to weigh on our reported top line

performance. We now expect that net sales will be negatively impacted by around $20 million for fiscal 2024.

•An operating margin in the range of 8.0% to 8.8% (previously 8.0% to 9.0%), reflecting lower than previously anticipated sales levels and pressures from the strengthening of the U.S. dollar.

•An annual effective tax rate of approximately 43% to 44% (previously 38% to 40%), due to unfavorable change in the mix of taxable income by market.

•An annualized diluted share count of 19.2 million (previously 19.3 million)

We anticipate a continued challenging operating environment across many of our markets in the back half of the year. We believe the previously outlined strategic initiatives coupled with increased efforts to engage with our Associate leaders, including through events and promotional activity, will help to support our business and counter the difficult operating environment. Overall, we remain committed to investing in our strategies to create long-term value for our stakeholders, and are confident in the long-term prospects for our business.

Jim Brown

President and CEO

Douglas Hekking

CFO

Safe Harbor

This Management Commentary contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Our actual results could differ materially from those projected in these forward-looking statements, which involve a number of risks and uncertainties, including: global economic conditions generally, including continued inflationary pressure around the world and negative impact on our operating costs, consumer demand and consumer behavior in general; reliance upon our network of independent Associates; risk associated with governmental regulation of our products, manufacturing and direct selling business model in the United States, China and other key markets; potential negative effects of deteriorating foreign and/or trade relations between or among the United States, China and other key markets; potential negative effects from geopolitical relations and conflicts around the world, including the Russia-Ukraine conflict and the conflict in Israel; compliance with data privacy and security laws and regulations in our markets around the world; potential negative effects of material breaches of our information technology systems to the extent we experience a material breach; material failures of our information technology systems; adverse publicity risks globally; risks associated with commencing operations in India and future international expansion and operations; uncertainty relating to the fluctuation in U.S. and other international currencies; and the potential for a resurgence of COVID-19, or another pandemic, in any of our markets in the future and any related impact on consumer health, domestic and world economies, including any negative impact on discretionary spending, consumer demand, and consumer behavior in general. The contents of this Management Commentary should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in our most recent filings with the Securities and Exchange Commission. The forward-looking statements in this Management Commentary set forth our beliefs as of the date hereof. We do not undertake any obligation to update any forward-looking statement after the date hereof or to conform such statements to actual results or changes in the Company’s expectations, except as required by law.

Non-GAAP Financial Measures

The Company prepares its financial statements using U.S. generally accepted accounting principles (“U.S. GAAP” or “GAAP”). Constant currency net sales, earnings, EPS and other currency-related financial information (collectively, “Financial Results”) are non-GAAP financial measures that remove the impact of fluctuations in foreign-currency exchange rates (“FX”) and help facilitate period-to-period comparisons of the Company’s Financial Results that we believe provide investors an additional perspective on trends and underlying business results. Constant currency Financial Results are calculated by translating the current period's Financial Results at the same average exchange rates in effect during the applicable prior-year period and then comparing this amount to the prior-year period's Financial Results.

| | | | | |

| |

| Investor contact: | Andrew Masuda |

| Investor Relations |

| (801) 954-7210 |

| investor.relations@usanainc.com |

| |

| Media contact: | Amy Haran |

| Public Relations |

| 801-954-7280 |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

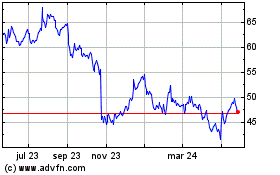

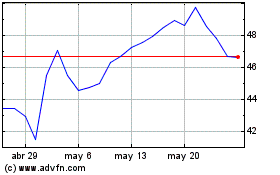

USANA Health Sciences (NYSE:USNA)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

USANA Health Sciences (NYSE:USNA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024