Hiya is a fast-growing, emerging leader of high-quality

children’s health & wellness products.

Broadens USANA’s reach into the highly attractive

direct-to-consumer channel driven by Hiya’s powerful subscription

model with runway for sustainable future growth.

Expected to be immediately accretive to 2025 adjusted

EBITDA.

9/30/2024 LTM net sales of $103 million, LTM net income of $19

million, and LTM adjusted EBITDA of $22 million.

The Company will discuss the transaction during a conference

call on Monday, December 23, 2024, at 5:00 PM ET.

USANA Health Sciences, Inc. (NYSE: USNA) (the “Company,”

“USANA”), today announced its acquisition of a 78.8% controlling

ownership stake in Hiya Health Products, LLC (“Hiya”), a leading

direct-to-consumer provider of high-quality children’s health &

wellness products. The $205 million cash transaction closed on

December 23, 2024 and is anticipated to be accretive to USANA’s

2025 adjusted EBITDA. For the last twelve months ended September

30, 2024 (unaudited), Hiya generated net sales of $103 million, net

income of $19 million, and adjusted EBITDA of $22 million. As of

September 30, 2024, Hiya had more than 200,000 customers.

“The Hiya brand is a natural fit for USANA and this acquisition

represents a key strategic milestone for our business,” said Jim

Brown, President and Chief Executive Officer of USANA Health

Sciences, Inc. “Hiya’s co-founders, Darren Litt and Adam Gillman,

have disrupted the children’s health and wellness market by

building a high quality, better-for-you brand that aligns with our

vision of creating the healthiest family on Earth. This strategic

acquisition adds a diversified layer of growth to USANA’s overall

business, while maintaining our commitment to our core direct sales

business, where we continue to invest in initiatives to drive

growth. Notably, this acquisition will allow USANA to reach a

broader audience by diversifying distribution channels through

Hiya, which we believe will enhance our ability to generate

sustainable long-term growth and deliver value for our

stakeholders. Darren and Adam will continue to lead Hiya through

its next phase of growth. Their leadership and expertise is

instrumental to Hiya’s business, which is now part of USANA’s

mission and strategic objectives.”

Darren Litt, co-founder and CEO of Hiya, commented, “Today

represents an exciting chapter for Hiya and we are thrilled to join

the USANA family. As parents ourselves, we recognized that so many

wellness companies did not prioritize our children’s health

interests, so we created Hiya to give families the very best in

clean, honest nutrition. With the help of USANA's extensive

capabilities, support and international expertise, we can now

extend that commitment to create healthy products for more families

in more countries. USANA and Hiya share a deep commitment to

improving the lives of families everywhere by providing the best

nutritional products possible, and we look forward to continuing

this exciting journey as part of USANA.”

Strategic Rationale

- Fast-Growing, Emerging Leader in the Children’s Health and

Wellness Market. The acquisition of Hiya provides the

opportunity for USANA to expand its presence in the children’s

health & wellness market through Hiya. For the last twelve

months ended September 30, 2024, Hiya’s net sales of $103 million

grew 50% as compared to fiscal year 2023. For fiscal year 2025, the

Company currently anticipates Hiya’s net sales growth to approach

30% year-over-year.

- Strengthens USANA’s Financial Profile. Hiya offers a

compelling subscription model with attractive margins,

profitability, and cash flow generation, which is expected to

enhance the Company’s ability to deliver long-term growth and drive

shareholder value. Hiya’s domestic profitability diversifies

USANA’s geographic sales mix and is anticipated to lower the

Company’s consolidated effective tax rate and create a more

tax-efficient structure.

- Presents Opportunity to Accelerate Growth and Enhance

Profitability by Leveraging Synergies. Over the next several

years, USANA and Hiya will work together to take advantage of

identified synergies, assets and expertise across both companies to

create efficiencies, and to accelerate growth and profitability.

For example, there are opportunities for Hiya to leverage USANA’s

significant manufacturing and international expansion expertise.

Similarly, USANA may leverage Hiya’s market data insights,

marketing expertise, and children-focused products within its

direct sales channel.

- Channel Expansion into Direct-to-Consumer Wellness Market

with a Leading and Proven Brand. Hiya currently holds a leading

position in children’s Vitamins, Minerals & Supplements brand

sales in the United Statesⁱ and has a clear pathway and strong

growth strategy to become the #1 children’s wellness platform

through new product introductions, channel expansion, and

geographic expansion. Hiya’s commitment to being the most trusted

and preferred brand for wellness products in the 0-18 age range is

an additive category for the Company and is complimentary to

USANA’s vision of the healthiest family on Earth.

- Expands the Company’s United States Operations. The

transaction meaningfully expands and diversifies the Company’s

revenue mix as Hiya’s net sales are generated in the United States

through their direct-to-consumer subscription model, with plans to

enter other sales channels. This will allow USANA to reach a

broader audience of health-conscious consumers to grow the

enterprise’s overall customer base.

ⁱ Source: Nielsen

Transaction Highlights

- The Company made an initial cash investment of approximately

$205 million (subject to customary closing and post-closing

purchase price adjustments) in exchange for a 78.8% ownership stake

in Hiya.

- Transaction structure includes a put/call feature that provides

for USANA’s acquisition of the remaining rollover equity at a

pre-negotiated valuation scale, which is based on Hiya’s financial

performance.

- The transaction was financed with $200 million cash on hand

with the balance covered by the Company’s existing credit

facility.

BofA Securities acted as exclusive financial advisor to the

Company in connection with the transaction. Wilson Sonsini Goodrich

& Rosati, P.C. served as the Company’s legal advisor. William

Hood & Company, LLC acted as exclusive financial advisor to

Hiya. Bodman PLC acted as Hiya’s legal advisor.

Conference Call

The Company will provide a supplemental presentation and discuss

the transaction on a conference call on Monday, December 23, 2024

at 5:00 PM Eastern Time. The supplemental presentation and live

audio webcast of the conference call will be available on the

Company’s investor relations website at http://ir.usana.com.

Non-GAAP Financial Measures

This press release contains the non-GAAP financial measure LTM

adjusted EBITDA of Hiya. Adjusted EBITDA is a Non-GAAP financial

measure of earnings before interest, taxes, depreciation, and

amortization that also excludes certain adjustments as indicated

below in the reconciliation from net income.

The Company prepares its financial statements using U.S.

generally accepted accounting principles (“GAAP”) and investors

should not directly compare with or infer relationship from any of

the Company’s operating results presented in accordance with GAAP

to the LTM adjusted EBITDA of Hiya. We believe that this non-GAAP

financial information of Hiya may be helpful to investors as an

indication of future cash flow generation. Non-GAAP financial

measures have limitations in their usefulness to investors because

they have no standardized meaning prescribed by GAAP and are not

prepared under any comprehensive set of accounting rules or

principles. In addition, other companies, including companies in

our industry, may calculate similarly titled non-GAAP financial

measures differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of non-GAAP

financial information as a tool for comparison. As a result, the

non-GAAP financial information of Hiya is presented for

supplemental informational purposes only and should not be

considered in isolation from, or as a substitute for financial

information presented in accordance with GAAP.

The following is a reconciliation of net income, presented and

reported in accordance with GAAP, to Adjusted EBITDA:

(Unaudited)

Last Twelve Months Ended

($000's)

30-Sep-24

Net income

$

19,416

Definitional

Adjustments:

Interest expense

143

Depreciation and amortization

38

Income tax expense

80

EBITDA before Adjustments

19,677

Adjustments to

EBITDA:

Transaction expenses and other

non-recurring items

760

Non-operational costs

566

Normalizations

321

Timing adjustments

212

Management compensation

142

Adjusted EBITDA

$

21,678

About USANA

USANA develops and manufactures high-quality nutritional

supplements, functional foods and personal care products that are

sold directly to Associates and Preferred Customers throughout the

United States, Canada, Australia, New Zealand, Hong Kong, China,

Japan, Taiwan, South Korea, Singapore, Mexico, Malaysia, the

Philippines, the Netherlands, the United Kingdom, Thailand, France,

Belgium, Colombia, Indonesia, Germany, Spain, Romania, Italy, and

India. More information on USANA can be found at

www.usana.com.

About Hiya

Hiya is the leading children's health brand, re-imagining kids'

wellness with an inspired range of clean-label products. Offering a

delicious and high-quality line of powders and chewables, Hiya is

at the forefront of wellness with a focused assortment of

better-for-you products. Since its founding in 2020, Hiya has

established itself as a trusted name in the industry and is loved

by both parents and children with adherence to the highest clean

nutrition standards, ingredient transparency, and commitment to

continuous improvement through ongoing collaborations with experts.

More information on Hiya can be found at www.hiyahealth.com.

Safe Harbor

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act, including but not limited to

statements that: Hiya is fast growing; the Hiya acquisition will be

accretive to USANA’s 2025 adjusted EBITDA, experience net sales

growth approaching 30% year-over-year in fiscal 2025, allow USANA

to reach a broader audience, generate long-term growth, deliver

value for USANA stakeholders, scale the Hiya brand, bring better

health to children across the country and the world, enhance

USANA’s geographic sales mix and income tax efficiency in the near

and long-term, take advantage of synergies, create efficiencies,

accelerate growth and profitability, expand and diversify USANA’s

revenue mix, grow overall customer base, and strengthen USANA’s

overall financial profile; Mr. Litt and Mr. Gillman will continue

to lead Hiya through its next phase of growth; Hiya will have a

clear pathway and growth strategy to become the #1 children’s

wellness platform through new product introductions, channel

expansion, and geographic expansion; and other forward-looking

statements. These forward-looking statements are based on current

plans, expectations, estimates, forecasts, and projections as well

as the beliefs and assumptions of management. Words such as

“expect,” “vision,” “envision,” “evolving,” “drive,” “anticipate,”

“intend,” “maintain,” “should,” “believe,” “continue,” “plan,”

“goal,” “opportunity,” “estimate,” “predict,” “may,” “will,”

“could,” and “would,” and variations of these terms or the negative

of these terms and similar expressions are intended to identify

these forward-looking statements. Our actual results could differ

materially from those projected in these forward-looking

statements, which involve a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond our

control, including: risks that the acquisition disrupts each

company’s current plans and operations; the diversion of the

attention of the management teams of USANA and Hiya from ongoing

business operations; the ability of to retain key personnel of

Hiya; the ability to realize the benefits of the acquisition,

including efficiencies and cost synergies; the ability to

successfully integrate Hiya’s business with USANA’s business, at

all or in a timely manner; the amount of the costs, fees, expenses

and charges related to the acquisition; global economic conditions

generally, including continued inflationary pressure around the

world and negative impact on our operating costs, consumer demand

and consumer behavior in general; reliance upon our network of

independent Associates; risk that our Associate compensation plan,

or changes that we make to the compensation plan, will not produce

desired results, benefit our business or, in some cases, could harm

our business; risk associated with governmental regulation of our

products, manufacturing and direct selling business model in the

United States, China and other key markets; potential negative

effects of deteriorating foreign and/or trade relations between or

among the United States, China and other key markets; potential

negative effects from geopolitical relations and conflicts around

the world, including the Russia-Ukraine conflict and the conflict

in Israel; compliance with data privacy and security laws and

regulations in our markets around the world; potential negative

effects of material breaches of our information technology systems

to the extent we experience a material breach; material failures of

our information technology systems; adverse publicity risks

globally; risks associated with commencing operations in India and

future international expansion and operations; uncertainty relating

to the fluctuation in U.S. and other international currencies; and

the potential for a resurgence of COVID-19, or another pandemic, in

any of our markets in the future and any related impact on consumer

health, domestic and world economies, including any negative impact

on discretionary spending, consumer demand, and consumer behavior

in general. The contents of this release should be considered in

conjunction with the risk factors, warnings, and cautionary

statements that are contained in our most recent filings with the

Securities and Exchange Commission. The forward-looking statements

in this press release set forth our beliefs as of the date hereof.

We do not undertake any obligation to update any forward-looking

statement after the date hereof or to conform such statements to

actual results or changes in the Company’s expectations, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241222197799/en/

Investor contact: Andrew Masuda Investor Relations (801)

954-7201 investor.relations@usanainc.com

Media contact: Sarah Searle (801) 954-7626

media@usanainc.com

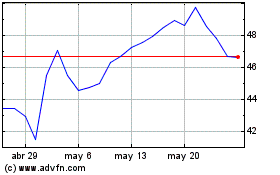

USANA Health Sciences (NYSE:USNA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

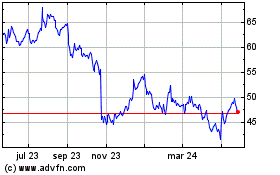

USANA Health Sciences (NYSE:USNA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024