INNOVATE Corp. Announces Closing of Rights Offering

24 Abril 2024 - 3:47PM

INNOVATE Corp. (“INNOVATE” or the “Company”) (NYSE: VATE), a

diversified holding company, announced today the closing of its

successful rights offering, which expired at 5:00

p.m., New York City time, on April 19, 2024.

Pursuant to the terms of the rights offering, 5.2 million shares of

common stock are being purchased pursuant to the exercise of basic

subscription rights and 0.1 million additional shares of common

stock are being purchased under the over-subscription privilege.

In accordance with the Investment Agreement (the

“Investment Agreement”) entered into by the Company

with Lancer Capital LLC (“Lancer Capital”), an investment

fund led by Avram Glazer, the Chairman of the Board of

Directors of the Company and the Company’s largest

stockholder, Lancer Capital partially backstopped the

rights offering in the amount of $15.3 million by purchasing

Series C Non-Voting Convertible Participating Preferred Stock, par

value $0.001 per share (the “preferred stock”). In total,

15.3 thousand shares of preferred stock at a price of $1,000 per

share were issued to Lancer Capital. This includes the

approximately 6.3 thousand shares of preferred stock issued in

connection with the closing of the rights offering and the 9.0

thousand shares already purchased as part of an equity advance

arrangement under the Investment Agreement (the “equity advance”).

On March 28, 2024, the Company issued and sold 25.0 thousand shares

of the preferred stock to Lancer Capital for an aggregate purchase

price of $25.0 million under the equity advance. The remaining 16.0

thousand shares of preferred stock purchased under the equity

advance are part of the previously announced concurrent private

placement. The preferred stock can be convertible into common stock

at the price equivalent to the subscription price under the rights

offering contingent on shareholder approval, which will be voted on

at the next annual meeting.

In the aggregate, the Company is issuing 5.3

million new shares of common stock at the subscription price

of $0.70 per whole share for gross proceeds of $3.7

million to the Company, in addition to 31.3 thousand shares of

preferred stock to Lancer Capital for gross proceeds of $31.3

million to the Company. After giving effect to the rights offering,

the Company will have 85.2 million shares of common stock issued

and outstanding. If approved at the annual meeting, the conversion

of the 31.3 thousand shares of preferred stock purchased by Lancer

Capital would result in the issuance of an additional 44.7 million

shares of common stock.

The Company expects to use the proceeds from the

rights offering for general corporate purposes, including debt

service and for working capital.

Investors who have participated in the rights

offering should expect to see the shares of common stock issued to

them in uncertificated book-entry form. Any excess subscription

payments received by Computershare Trust Company,

N.A. (the "subscription agent") will be returned by the

subscription agent to investors, without interest or deduction,

through the same method by which they participated in the rights

offering.

The rights offering was made pursuant to

INNOVATE’s effective shelf registration statement on Form S-3,

filed with the SEC on September 29, 2023 and declared effective on

October 6, 2023, and a prospectus supplement containing the

detailed terms of the rights offering filed with the SEC on March

8, 2024, as amended by that certain Amendment No. 1 to the

prospectus supplement, filed with the SEC on March 25, 2024, and

further amended by that certain Amendment No. 2 to the prospectus

supplement, filed with the SEC on April 9,

2024. This press release shall not

constitute an offer to sell or a solicitation of an offer to buy

any securities (including without limitation the preferred stock

issued and sold in the concurrent private placement), nor shall

there be any offer, solicitation or sale of the securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful under the securities laws of such state or

jurisdiction. The rights offering was made only by means of a

prospectus and a related prospectus supplement, copies of which

were distributed to all eligible rights holders as of the rights

offering record date and may also be obtained free of charge at the

website maintained by the SEC

at www.sec.gov or by

contacting the information agent for the rights

offering.

About INNOVATE

INNOVATE Corp. is a portfolio of

best-in-class assets in three key areas of the new economy –

Infrastructure, Life Sciences and Spectrum. Dedicated to

stakeholder capitalism, INNOVATE employs approximately 4,000 people

across its subsidiaries. For more information, please

visit: www.INNOVATECorp.com.

Cautionary Statement Regarding

Forward-Looking Statements

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995: This press release

contains, and certain oral statements made by our representatives

from time to time may contain, forward-looking statements regarding

the rights offering and concurrent private placement, including,

among others, statements related to the use of proceeds from the

rights offering and other terms of the rights offering, all of

which involve risks, assumptions and uncertainties, many of which

are outside of the Company's control, and are subject to change.

All forward-looking statements speak only as of the date made, and

unless legally required, INNOVATE undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

Contact:

Solebury Strategic CommunicationsAnthony

Rozmusir@innovatecorp.com(212) 235-2691

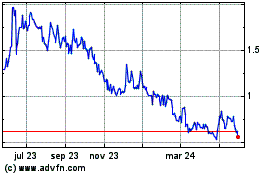

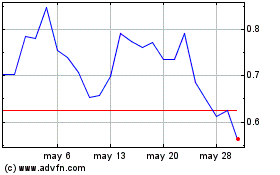

INNOVATE (NYSE:VATE)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

INNOVATE (NYSE:VATE)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024