Statement of Ownership (sc 13g)

21 Noviembre 2019 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

Vista Oil & Gas, S.A.B. de C.V.

(Name of issuer)

Series A Shares, no par value per share

American Depositary Shares, each representing one Series A Share

(Title of class of securities)

Series A Shares: BYXGC1909

American Depositary Shares: 92837L109

(CUSIP number)

November 8, 2019

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☒ Rule 13d-1(c)

☐ Rule 13d-1(d)

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. BYXGC1909

CUSIP No. 92837L109 (ADS)

|

13G

|

|

1

|

Name of reporting persons

Kensington Investments B.V.

|

|

2

|

Check the appropriate box if a member of a group. (See instructions)

(a)

(b)

|

|

3

|

SEC use only.

|

|

4

|

Citizenship or place of organization.

Netherlands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

Sole Voting Power

|

0

|

|

6

|

Shares Voting Power

|

15,833,333 (1)

|

|

7

|

Sole Dispositive Power

|

0

|

|

8

|

Shared Dispositive Power

|

15,833,333 (1)

|

|

9

|

Aggregate amount beneficially owned by each reporting person.

15,833,333 (1)

|

|

10

|

Check if the aggregate amount in row (9) excludes certain shares (see instructions).

|

|

11

|

Percent of class represented by amount in row (9).

17.7% (2)

|

|

12

|

Type of reporting person.

CO

|

|

(1)

|

Kensington is the direct beneficial owner of: (1) 12,500,000 American Depositary Shares (“ADSs”) (representing 12,500,000 Series A shares of the Vista Oil & Gas, S.A.B. de C.V. (the “Issuer”)) and (2) 10,000,000 warrants currently exercisable for 3,333,333 Series A shares of the Issuer.

|

|

(2)

|

The percentage was calculated based upon 85,929,000 Series A shares of the Issuer issued and outstanding as reported in the Issuer’s Prospectus (File No. 333-232516) filed with the Securities and Exchange Commission on July 26, 2019 and assuming the exercise of the warrants into Series A shares.

|

|

CUSIP No. BYXGC1909

CUSIP No. 92837L109 (ADS)

|

13G

|

|

1

|

Name of reporting persons

Abu Dhabi Investment Council Company P.J.S.C.

|

|

2

|

Check the appropriate box if a member of a group. (See instructions)

(a)

(b)

|

|

3

|

SEC use only.

|

|

4

|

Citizenship or place of organization.

United Arab Emirates

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

Sole Voting Power

|

0

|

|

6

|

Shared Voting Power

|

15,833,333 (1)

|

|

7

|

Sole Dispositive Power

|

0

|

|

8

|

Shared Dispositive Power

|

15,833,333 (1)

|

|

9

|

Aggregate amount beneficially owned by each reporting person.

15,833,333 (1)

|

|

10

|

Check if the aggregate amount in row (9) excludes certain shares (see instructions).

|

|

11

|

Percent of class represented by amount in row (9).

17.7% (2)

|

|

12

|

Type of reporting person.

CO

|

|

(1)

|

Abu Dhabi Investment Council Company P.J.S.C. (the “Council”) is the parent company of Kensington Investments B.V. (“Kensington”) and, as a result of the Council’s ownership of Kensington, it may be deemed to be an indirect beneficial owner of: (1) 12,500,000 ADSs (representing 12,500,000 Series A shares of the Issuer) and (2) 10,000,000 warrants currently exercisable for 3,333,333 Series A shares of the Issuer. Kensington, however, maintains separate corporate formalities, management and final decision making with respect to its business and operations, including its ownership of the Issuer’s securities.

|

|

(2)

|

The percentage was calculated based upon 85,929,000 shares of the Issuer issued and outstanding as reported in the Issuer’s Prospectus (File No. 333-232516) filed with the Securities and Exchange Commission on July 26, 2019 and assuming the exercise of the warrants into Series A shares.

|

|

Item 1

|

(a) Name of Issuer:

|

|

|

|

|

Vista Oil & Gas, S.A.B. de C.V. (the “Issuer”)

|

|

|

|

|

|

|

(b)

|

Address Of Issuer’s Principal Executive Offices:

|

|

|

|

Calle Volcán 150, Floor 5

Colonia Lomas de Chapultepec, Alcaldía Miguel Hidalgo

Mexico City, Mexico 11000

|

|

|

|

|

|

Item 2

|

(a)

|

Name of Person Filing:

|

|

|

|

This Schedule 13G is jointly filed by Kensington Investments B.V. (“Kensington”) and Abu Dhabi Investment Council Company P.J.S.C. (the “Council”). The Council is the sole owner of Kensington.

|

|

|

|

|

|

|

(b)

|

Address of Principal Business Office, or, if none, Residence:

|

|

|

|

The principal business address for Kensington is: Prins Bernhardplein 200, 1097 JB, Amsterdam, Netherlands

The principal business address for the Council is: Al Bahr Towers, Sheikh Zayed Bin Sullan, Street 19, Abu Dhabi, United Arab Emirates 61999.

|

|

|

|

|

|

|

(c)

|

Citizenship:

|

|

|

|

Kensington is organized in the Netherlands and the Council is organized in the United Arab Emirates.

|

|

|

|

|

|

|

(d)

|

Title of Class of Securities:

|

|

|

|

Series A Shares, no par value per share

American Depositary Shares, each representing one Series A Share

|

|

|

|

|

|

|

(e)

|

CUSIP Number:

|

|

|

|

BYXGC1909 (Series A Shares)

92837L109 (ADS)

|

|

Item 3

|

If this statement is filed pursuant to §240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a:

|

|

|

|

|

|

Not applicable.

|

|

|

|

|

Item 4

|

Ownership

|

|

|

(a) Amount beneficially owned:

|

|

|

This Statement is filed by Kensington as the direct beneficial owner of 15,833,333 Series A shares of the Issuer (12,500,000 ADSs (representing 12,500,000 Series A shares) and 10,000,000 warrants currently exercisable for 3,333,333 Series A shares). The Council is the parent company of Kensington and, as a result of the Council’s ownership of Kensington, it may be deemed to be the indirect beneficial owner of the Issuer’s securities, which are directly owned by Kensington. While Kensington is owned by its parent company the Council, it does maintain separate corporate formalities, management and decision making with respect to its business and operations, including its ownership of the Issuer’s securities.

|

|

|

|

|

|

(b) Percent of class:

|

|

|

The Series A shares underlying the Issuer’s ADSs and warrants represent 17.7% of the Issuer’s outstanding Series A shares. Such percentage is calculated based on 85,929,000 shares of the Issuer’s Series A shares as reported in the Issuer’s Prospectus (File No. 333-232516) filed with the Securities and Exchange Commission on July 26, 2019 and assumes the full exercise of the warrants exercisable for Series A shares.

|

|

|

(c) Number of shares as to which the person has:

|

|

|

|

|

|

|

|

(i) Sole power to vote or to direct the vote

|

|

|

|

See response to Item 4(c)(ii) below.

|

|

|

|

|

|

|

|

(ii) Shared power to vote or to direct the vote

|

|

|

|

Kensington is the direct beneficial owner of 15,833,333 Series A shares of the Issuer (12,500,000 ADSs (representing 12,500,000 Series A shares) and 10,000,000 warrants currently exercisable for 3,333,333 Series A shares). The Council, as the parent company of Kensington, may be deemed to be the indirect beneficial owner of the Issuer’s securities directly owned by Kensington. Accordingly, due to this indirect ownership, Kensington and the Council under this Schedule 13G are reporting having shared power to vote or to direct the vote of such Issuer securities. While the Council is Kensington’s parent company, Kensington does maintain separate corporate formalities, management and decision making with respect to its business and operations, including its ownership of the Issuer’s securities.

|

|

|

|

|

|

|

|

(iii) Sole power to dispose or to direct the disposition of

|

|

|

|

See response to Item 4(c)(iv) below.

|

|

|

|

|

|

|

|

(iv) Shared power to dispose or to direct the disposition of

|

|

|

|

Kensington is the direct beneficial owner of 15,833,333 Series A shares of the Issuer (12,500,000 ADSs (representing 12,500,000 Series A shares) and 10,000,000 warrants currently exercisable for 3,333,333 Series A shares). The Council, as the parent company of Kensington, may be deemed to be the indirect beneficial owner of the Issuer’s securities directly owned by Kensington. Accordingly, due to this indirect ownership, Kensington and the Council under this Schedule 13G are reporting having shared power to dispose or to direct the disposition of such Issuer securities. While the Council is Kensington’s parent company, Kensington does maintain separate corporate formalities, management and decision making with respect to its business and operations, including its ownership of the Issuer’s securities.

|

|

|

Item 5

|

Ownership of Five Percent or Less of a Class

|

|

|

|

|

|

Not applicable.

|

|

|

|

|

Item 6

|

Ownership of More Than Five Percent on Behalf Of Another Person

|

|

|

|

|

|

Only Kensington has the right to receive dividends and the proceeds from the sale of the ADSs and warrants and the underlying Series A shares beneficially owned and held by Kensington.

|

|

|

|

|

Item 7

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company

|

|

|

|

|

|

Not applicable.

|

|

|

|

|

Item 8

|

Identification and Classification of Members of The Group

|

|

|

|

|

|

Not applicable.

|

|

|

|

|

Item 9

|

Notice of Dissolution of Group

|

|

|

|

|

|

Not applicable.

|

|

|

|

|

Item 10

|

Certification

|

|

|

|

|

|

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect, other than activities solely in connection with a nomination under § 240.14a-11.

|

EXHIBIT INDEX

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set for in this statement is true, complete and correct.

Date: November 19, 2019

|

|

Kensington Investments B.V.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ C.H.F.D. Karssen

|

|

|

Name:

|

C.H.F.D. Karssen

|

|

|

Title:

|

Director A

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mohamed Ali Al Dhaheri

|

|

|

Name:

|

Mohamed Ali Al Dhaheri

|

|

|

Title:

|

Director B

|

|

|

|

|

|

|

|

|

|

|

Abu Dhabi Investment Council Company P.J.S.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Khalifa Sultan Al Suwaidi

|

|

|

Name:

|

Khalifa Sultan Al Suwaidi

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Omar Liaqat

|

|

|

Name:

|

Omar Liaqat

|

|

|

Title:

|

Authorized Signatory

|

[Signature Page to Schedule 13G]

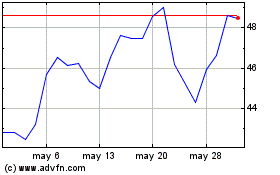

Vista Energy SAB de CV (NYSE:VIST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Vista Energy SAB de CV (NYSE:VIST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024