Net revenue increased 13.3% year over year to

$192.4 million; Company raises FY outlook

Active Customers increased 5.6% on a trailing

12-month basis; Average Revenue per Customer increased 7.5%

Warby Parker Inc. (NYSE: WRBY) (“Warby Parker” or the

“Company”), a direct-to-consumer lifestyle brand focused on vision

for all, today announced financial results for the third quarter

ended September 30, 2024.

“Warby Parker’s Q3 performance is a direct result of our team’s

commitment to making progress on our strategic initiatives, in

particular expanding our marketing efforts, investing in store

expansion, and enhancing our holistic vision care offering,” shared

Co-Founder and Co-CEO Neil Blumenthal.

“We’re particularly encouraged by the momentum we’re seeing in

early Q4. As we close out the year, we’re focused on continuing to

capture market share, bring new customers to the brand, and deliver

on our commitment to accelerate growth and improve profitability

year over year,” said Co-Founder and Co-CEO Dave Gilboa.

Third Quarter 2024

Highlights

- Net revenue increased $22.6 million, or 13.3%, to $192.4

million, as compared to the prior year period.

- Active Customers increased 5.6% to 2.43 million on a trailing

12-month basis, and Average Revenue per Customer increased 7.5% to

$305.

- GAAP net loss of $4.1 million.

- Adjusted EBITDA Margin(1) increased 2.5 points to 9.0%.

- Net cash provided by operating activities of $27.3

million.

- Free Cash Flow(1) of $13.1 million.

- Opened 13 net new stores during the quarter, ending Q3 with 269

stores.

Third Quarter 2024 Year Over Year

Financial Results

- Net revenue increased $22.6 million, or 13.3%, to $192.4

million.

- Active Customers increased 5.6% to 2.43 million on a trailing

12-month basis, and Average Revenue per Customer increased 7.5% to

$305.

- Gross margin was 54.5% compared to 54.6% in the prior year. The

decrease in gross margin was primarily driven by the sales growth

of contact lenses and increased doctor headcount, partially offset

by efficiencies in our owned optical laboratories and lower

outbound customer shipping costs as a percent of revenue, which

were both driven by higher glasses growth.

- Selling, general, and administrative expenses (“SG&A”) were

$111.5 million, down $1.0 million from the prior year, and

represented 57.9% of revenue, down from 66.2% in the prior year.

The primary drivers of decreased SG&A were reduced stock-based

compensation costs and lower corporate expenses, partially offset

by higher payroll-related costs from growth in our retail team

associated with store expansion, and investments in marketing.

Adjusted SG&A(1) was $100.6 million, or 52.3% of revenue,

compared to $93.4 million, or 55.0% of revenue in the prior

year.

- GAAP net loss improved $13.3 million to $4.1 million, primarily

as a result of leveraging our expense base on higher revenue.

- Adjusted EBITDA(1) increased $6.3 million to $17.3 million, and

Adjusted EBITDA Margin(1) increased 2.5 points to 9.0%.

Balance Sheet Highlights

Warby Parker ended the third quarter of 2024 with $251.0 million

in cash and cash equivalents.

2024 Outlook

For the full year 2024, Warby Parker is raising its guidance as

follows:

- Net revenue of $765 to $768 million, representing growth

of approximately 14% to 15% versus full year 2023.

- Adjusted EBITDA(1) of approximately $73 million at the midpoint

of our revenue range, based on an Adjusted EBITDA Margin(1) of

9.5%.

- On track to open 40 new stores this year.

“We’re pleased that we delivered continued revenue growth and

adjusted EBITDA margin expansion in the third quarter. Given

outperformance year-to-date, we are raising our full year revenue

and adjusted EBITDA guidance, which we anticipate will set the

stage for a strong 2025,” said Chief Financial Officer Steve

Miller.

The guidance and forward-looking statements made in this press

release and on our conference call are based on management's

expectations as of the date of this press release.

(1) Please see the reconciliation of non-GAAP financial measures

to the most comparable GAAP financial measure in the section titled

“Non-GAAP Financial Measures” below.

Webcast and Conference

Call

A conference call to discuss Warby Parker’s third quarter 2024

results, as well as fourth quarter and full year 2024 outlook, is

scheduled for 8:00 a.m. ET on November 7, 2024. To participate,

please dial 833-470-1428 from the U.S. or 404-975-4839 from

international locations. The conference passcode is 681992. A live

webcast of the conference call will be available on the investors

section of the Company’s website at investors.warbyparker.com where

presentation materials will also be posted prior to the conference

call. A replay will be made available online approximately two

hours following the live call for a period of 90 days.

Forward-Looking

Statements

This press release and the related conference call, webcast and

presentation contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These statements may relate to, but are not limited to,

expectations of future operating results or financial performance,

including expectations regarding achieving profitability and growth

in our e-commerce channel, delivering stakeholder value, growing

market share, and our guidance for the quarter and year ending

December 31, 2024; expectations regarding the number of new store

openings during the year ending December 31, 2024; management’s

plans, priorities, initiatives and strategies; and expectations

regarding growth of our business. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “toward,” “will,” or

“would,” or the negative of these words or other similar terms or

expressions. You should not put undue reliance on any

forward-looking statements. Forward-looking statements should not

be read as a guarantee of future performance or results and will

not necessarily be accurate indications of the times at, or by,

which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at

the time those statements are made and are based on current

expectations, estimates, forecasts, and projections as well as the

beliefs and assumptions of management as of that time with respect

to future events. These statements are subject to risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control, that could cause actual performance or

results to differ materially from those expressed in or suggested

by the forward-looking statements. In light of these risks and

uncertainties, the forward-looking events and circumstances

discussed in this press release may not occur and actual results

could differ materially from those anticipated or implied in the

forward-looking statements. These risks and uncertainties include

our ability to manage our future growth effectively; our

expectations regarding cost of goods sold, gross margin, channel

mix, customer mix, and selling, general, and administrative

expenses; increases in component and shipping costs and changes in

supply chain; our reliance on our information technology systems

and enterprise resource planning systems for our business to

effectively operate and safeguard confidential information; our

ability to invest in and incorporate new technologies into our

products and services; our ability to engage our existing customers

and obtain new customers; our ability to expand in-network access

with insurance providers; planned new retail stores in 2024 and

going forward; an overall decline in the health of the economy and

other factors impacting consumer spending, such as recessionary

conditions, inflation, government instability, and geopolitical

unrest; our ability to compete successfully; our ability to manage

our inventory balances and shrinkage; the growth of our brand

awareness; our ability to recruit and retain optometrists,

opticians, and other vision care professionals; the spread of new

infectious diseases; the effects of seasonal trends on our results

of operations; our ability to stay in compliance with extensive

laws and regulations that apply to our business and operations; our

ability to adequately maintain and protect our intellectual

property and proprietary rights; our reliance on third parties for

our products, operation and infrastructure; our duties related to

being a public benefit corporation; the ability of our Co-Founders

and Co-CEOs to exercise significant influence over all matters

submitted to stockholders for approval; the effect of our

multi-class structure on the trading price of our Class A common

stock; and the increased expenses associated with being a public

company. Additional information regarding these and other risks and

uncertainties that could cause actual results to differ materially

from the Company's expectations is included in our most recent

reports filed with the SEC on Form 10-K and Form 10-Q. Except as

required by law, we do not undertake any obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future developments, or otherwise.

Additional information regarding these and other factors that

could affect the Company’s results is included in the Company’s SEC

filings, which may be obtained by visiting the SEC's website at

www.sec.gov. Information contained on, or that is referenced or can

be accessed through, our website does not constitute part of this

document and inclusions of any website addresses herein are

inactive textual references only.

Glossary

Active Customers is defined as unique customer accounts that

have made at least one purchase in the preceding 12-month

period.

Average Revenue per Customer is defined as the sum of the total

net revenues in the preceding 12-month period divided by the

current period Active Customers.

Non-GAAP Financial

Measures

We use Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Cost of

Goods Sold (“Adjusted COGS”), Adjusted Gross Margin, Adjusted Gross

Profit, Adjusted Selling, General, and Administrative Expenses

(“Adjusted SG&A”), and Free Cash Flow as important indicators

of our operating performance. Collectively, we refer to these

non-GAAP financial measures as our “Non-GAAP Measures.” The

Non-GAAP Measures, when taken collectively with our GAAP results,

may be helpful to investors because they provide consistency and

comparability with past financial performance and assist in

comparisons with other companies, some of which use similar

non-GAAP financial information to supplement their GAAP

results.

Adjusted EBITDA is defined as net income (loss) before interest

and other income, taxes, and depreciation and amortization as

further adjusted for asset impairment costs, stock-based

compensation expense and related employer payroll taxes,

amortization of cloud-based software implementation costs, non-cash

charitable donations, charges for certain legal matters outside the

ordinary course of business, and non-recurring costs such as

restructuring costs, major system implementation costs, and

transaction costs. Adjusted EBITDA Margin is defined as Adjusted

EBITDA divided by net revenue.

Adjusted COGS is defined as cost of goods sold adjusted for

stock-based compensation expense and related employer payroll

taxes.

Adjusted Gross Profit is defined as net revenue minus Adjusted

COGS. Adjusted Gross Margin is defined as Adjusted Gross Profit

divided by net revenue.

Adjusted SG&A is defined as SG&A adjusted for

stock-based compensation expense and related employer payroll

taxes, non-cash charitable donations, charges for certain legal

matters outside the ordinary course of business, and non-recurring

costs such as restructuring costs, major system implementation

costs, and transaction costs.

Free Cash Flow is defined as net cash provided by operating

activities minus purchases of property and equipment.

The Non-GAAP Measures are presented for supplemental

informational purposes only. A reconciliation of historical GAAP to

Non-GAAP financial information is included under “Selected

Financial Information” below.

We have not reconciled our Adjusted EBITDA Margin guidance to

GAAP net income (loss) margin, or net margin, or Adjusted EBITDA

guidance to GAAP net income (loss) because we do not provide

guidance for GAAP net margin or GAAP net income (loss) due to the

uncertainty and potential variability of stock-based compensation

and taxes, which are reconciling items between GAAP net margin and

Adjusted EBITDA Margin and GAAP net income (loss) and Adjusted

EBITDA, respectively. Because such items cannot be reasonably

provided without unreasonable efforts, we are unable to provide a

reconciliation of the Adjusted EBITDA Margin guidance to GAAP net

margin and Adjusted EBITDA guidance to GAAP net income (loss).

However, such items could have a significant impact on GAAP net

margin and GAAP net income (loss).

About Warby Parker

Warby Parker (NYSE: WRBY) was founded in 2010 with a mission to

inspire and impact the world with vision, purpose, and

style–without charging a premium for it. Headquartered in New York

City, the co-founder-led lifestyle brand pioneers ideas, designs

products, and develops technologies that help people see, from

designer-quality prescription glasses (starting at $95) and

contacts, to eye exams and vision tests available online and in our

269 retail stores across the U.S. and Canada.

Warby Parker aims to demonstrate that businesses can scale, do

well, and do good in the world. Ultimately, the Company believes in

vision for all, which is why for every pair of glasses or

sunglasses sold, it distributes a pair to someone in need through

its Buy a Pair, Give a Pair program. To date, Warby Parker has

worked alongside its nonprofit partners to distribute more than 15

million glasses to people in need.

Selected Financial Information

Warby Parker Inc. and

Subsidiaries Consolidated Balance Sheets (Unaudited)

(Amounts in thousands, except share data)

September 30,

2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

251,032

$

216,894

Accounts receivable, net

1,094

1,779

Inventory

52,766

62,234

Prepaid expenses and other current

assets

16,317

17,712

Total current assets

321,209

298,619

Property and equipment, net

166,500

152,332

Right-of-use lease assets

141,552

122,305

Other assets

8,729

7,056

Total assets

$

637,990

$

580,312

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

36,663

$

22,456

Accrued expenses

46,015

46,320

Deferred revenue

19,216

31,617

Current lease liabilities

26,068

24,286

Other current liabilities

2,155

2,411

Total current liabilities

130,117

127,090

Non-current lease liabilities

170,104

150,171

Other liabilities

1,019

1,264

Total liabilities

301,240

278,525

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.0001 par value; Class A:

750,000,000 shares authorized at September 30, 2024 and December

31, 2023, 101,590,781 and 98,368,239 issued and outstanding at

September 30, 2024 and December 31, 2023, respectively; Class B:

150,000,000 shares authorized at September 30, 2024 and December

31, 2023, 18,674,743 and 19,788,682 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively,

convertible to Class A on a one-to-one basis

12

12

Additional paid-in capital

1,018,751

970,135

Accumulated deficit

(680,344

)

(666,831

)

Accumulated other comprehensive loss

(1,669

)

(1,529

)

Total stockholders’ equity

336,750

301,787

Total liabilities and stockholders’

equity

$

637,990

$

580,312

Warby Parker Inc. and

Subsidiaries Consolidated Statements of Operations

(Unaudited) (Amounts in thousands, except share and per

share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenue

$

192,447

$

169,849

$

580,672

$

507,910

Cost of goods sold

87,580

77,117

256,964

229,752

Gross profit

104,867

92,732

323,708

278,158

Selling, general, and administrative

expenses

111,480

112,499

344,404

328,585

Loss from operations

(6,613

)

(19,767

)

(20,696

)

(50,427

)

Interest and other income, net

2,842

2,655

7,965

6,815

Loss before income taxes

(3,771

)

(17,112

)

(12,731

)

(43,612

)

Provision for income taxes

301

301

782

538

Net loss

$

(4,072

)

$

(17,413

)

$

(13,513

)

$

(44,150

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.03

)

$

(0.15

)

$

(0.11

)

$

(0.38

)

Weighted average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

120,885,913

118,003,640

120,041,740

116,995,545

Warby Parker Inc. and

Subsidiaries Consolidated Statements of Cash Flows

(Unaudited) (Amounts in thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities

Net loss

$

(13,513

)

$

(44,150

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

33,533

28,184

Stock-based compensation

38,664

54,083

Non-cash charitable contribution

2,196

3,191

Asset impairment charges

522

1,407

Amortization of cloud-based software

implementation costs

2,862

1,679

Change in operating assets and

liabilities:

Accounts receivable, net

686

714

Inventory

9,468

5,231

Prepaid expenses and other assets

(1,148

)

410

Accounts payable

13,267

2,756

Accrued expenses

2,728

(1,207

)

Deferred revenue

(12,401

)

(8,005

)

Other current liabilities

(256

)

(116

)

Right-of-use lease assets and current and

non-current lease liabilities

2,469

3,458

Other liabilities

(245

)

(309

)

Net cash provided by operating

activities

78,832

47,326

Cash flows from investing activities

Purchases of property and equipment

(46,311

)

(40,098

)

Investment in optical equipment

company

(2,000

)

(1,000

)

Net cash used in investing activities

(48,311

)

(41,098

)

Cash flows from financing activities

Proceeds from stock option exercises

2,686

1,017

Proceeds from shares issued in connection

with employee stock purchase plan

1,068

1,124

Net cash provided by financing

activities

3,754

2,141

Effect of exchange rates on cash

(137

)

(989

)

Net change in cash and cash

equivalents

34,138

7,380

Cash and cash equivalents, beginning of

period

216,894

208,585

Cash and cash equivalents, end of

period

$

251,032

$

215,965

Supplemental disclosures

Cash paid for income taxes

$

782

$

400

Cash paid for interest

169

155

Cash paid for amounts included in the

measurement of lease liabilities

21,668

27,124

Non-cash investing and financing

activities:

Purchases of property and equipment

included in accounts payable and accrued expenses

$

5,553

$

5,941

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table reconciles Adjusted EBITDA and Adjusted

EBITDA Margin to the most directly comparable GAAP measure, which

is net loss:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(unaudited, in

thousands)

(unaudited, in

thousands)

Net loss

$

(4,072

)

$

(17,413

)

$

(13,513

)

$

(44,150

)

Adjusted to exclude the following:

Interest and other income, net

(2,842

)

(2,655

)

(7,965

)

(6,815

)

Provision for income taxes

301

301

782

538

Depreciation and amortization expense

11,829

9,760

33,533

28,184

Asset impairment charges

101

757

522

1,407

Stock-based compensation expense(1)

10,961

16,466

39,373

54,496

Non-cash charitable donation(2)

—

2,591

2,196

3,191

Amortization of cloud-based software

implementation costs(3)

854

853

2,862

1,679

ERP implementation costs(4)

—

371

—

4,413

Other costs(5)

176

—

1,479

—

Adjusted EBITDA

$

17,308

$

11,031

$

59,269

$

42,943

Adjusted EBITDA Margin

9.0

%

6.5

%

10.2

%

8.5

%

(1)

Represents expenses related to the

Company’s equity-based compensation programs and related employer

payroll taxes, which may vary significantly from period to period

depending upon various factors including the timing, number, and

the valuation of awards granted, and vesting of awards including

the satisfaction of performance conditions, as well as the issuance

of 48,486 Class A common stock to charitable donor advised funds in

February 2024. For both of the three months ended September 30,

2024 and 2023, the amount includes $0.2 million of employer payroll

taxes associated with releases of RSUs and option exercises. For

the nine months ended September 30, 2024 and 2023, the amount

includes $0.7 million and $0.4 million, respectively, of employer

payroll taxes associated with releases of RSUs and option

exercises.

(2)

Represents charitable expense recorded in

connection with the donation of 178,572 shares of Class A common

stock in both May 2024 and August 2023 to the Warby Parker Impact

Foundation and 56,938 shares of Class A common stock to charitable

donor advised funds in June 2023.

(3)

Represents the amortization of costs

capitalized in connection with the implementation of cloud-based

software.

(4)

Represents internal and external

non-capitalized costs related to the implementation of our new

Enterprise Resource Planning (“ERP”) system.

(5)

Represents charges for certain legal

matters outside the ordinary course of business.

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table presents our non-GAAP, or adjusted,

financial measures for the periods presented as a percentage of

revenue. Each cost and operating expense is adjusted for

stock-based compensation expense and related employer payroll

taxes, non-cash charitable donations, charges for certain legal

matters outside the ordinary course of business, and non-recurring

costs such as restructuring costs, major system implementation

costs, and transaction costs.

Reported

Adjusted

Reported

Adjusted

Three Months Ended September

30,

Three Months Ended September

30,

Nine Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

2024

2023

2024

2023

(unaudited, in

thousands)

(unaudited, in

thousands)

(unaudited, in

thousands)

(unaudited, in

thousands)

Cost of goods sold

$

87,580

$

77,117

$

87,299

$

76,835

$

256,964

$

229,752

$

256,154

$

228,976

% of Revenue

45.5

%

45.4

%

45.4

%

45.2

%

44.3

%

45.2

%

44.1

%

45.1

%

Gross profit

$

104,867

$

92,732

$

105,148

$

93,014

$

323,708

$

278,158

$

324,518

$

278,934

% of Revenue

54.5

%

54.6

%

54.6

%

54.8

%

55.7

%

54.8

%

55.9

%

54.9

%

Selling, general, and administrative

expenses

$

111,480

$

112,499

$

100,624

$

93,353

$

344,404

$

328,585

$

302,166

$

267,261

% of Revenue

57.9

%

66.2

%

52.3

%

55.0

%

59.3

%

64.7

%

52.0

%

52.6

%

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table reflects a reconciliation of each non-GAAP,

or adjusted, financial measure to its most directly comparable

financial measure prepared in accordance with GAAP:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(unaudited, in

thousands)

(unaudited, in

thousands)

Cost of goods sold

$

87,580

$

77,117

$

256,964

$

229,752

Adjusted to exclude the following:

Stock-based compensation expense(1)

281

282

810

776

Adjusted Cost of Goods Sold

$

87,299

$

76,835

$

256,154

$

228,976

Gross profit

$

104,867

$

92,732

$

323,708

$

278,158

Adjusted to exclude the following:

Stock-based compensation expense(1)

281

282

810

776

Adjusted Gross Profit

$

105,148

$

93,014

$

324,518

$

278,934

Selling, general, and administrative

expenses

$

111,480

$

112,499

$

344,404

$

328,585

Adjusted to exclude the following:

Stock-based compensation expense(1)

10,680

16,184

38,563

53,720

Non-cash charitable donation(2)

—

2,591

2,196

3,191

ERP implementation costs(3)

—

371

—

4,413

Other costs(4)

176

—

1,479

—

Adjusted Selling, General, and

Administrative Expenses

$

100,624

$

93,353

$

302,166

$

267,261

Net cash provided by operating

activities

$

27,282

$

19,931

$

78,832

$

47,326

Purchases of property and equipment

(14,223

)

(15,488

)

(46,311

)

(40,098

)

Free Cash Flow

$

13,059

$

4,443

$

32,521

$

7,228

(1)

Represents expenses related to the

Company’s equity-based compensation programs and related employer

payroll taxes, which may vary significantly from period to period

depending upon various factors including the timing, number, and

the valuation of awards granted, and vesting of awards including

the satisfaction of performance conditions, as well as the issuance

of 48,486 Class A common stock to charitable donor advised funds in

February 2024. For both of the three months ended September 30,

2024 and 2023, the amount includes $0.2 million of employer payroll

taxes associated with releases of RSUs and option exercises. For

the nine months ended September 30, 2024 and 2023, the amount

includes $0.7 million and $0.4 million, respectively, of employer

payroll taxes associated with releases of RSUs and option

exercises.

(2)

Represents charitable expense recorded in

connection with the donation of 178,572 shares of Class A common

stock in both May 2024 and August 2023 to the Warby Parker Impact

Foundation and 56,938 shares of Class A common stock to charitable

donor advised funds in June 2023.

(3)

Represents internal and external

non-capitalized costs related to the implementation of our new ERP

system.

(4)

Represents charges for certain legal

matters outside the ordinary course of business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107952951/en/

Investor Relations: Jaclyn Berkley, Head of Investor Relations

Brendon Frey, ICR investors@warbyparker.com

Media: Ali Weltman ali@derris.com

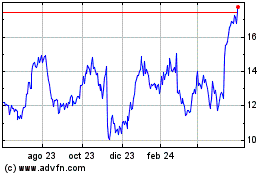

Warby Parker (NYSE:WRBY)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

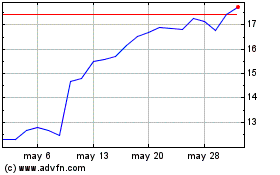

Warby Parker (NYSE:WRBY)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025