FALSE00000340882024Q2--12-31http://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#ReceivablesNetCurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#ReceivablesNetCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesutr:acreutr:Boexbrli:pureutr:bblutr:MMBTU00000340882024-01-012024-06-300000034088us-gaap:CommonStockMember2024-01-012024-06-300000034088xom:ZeroPointFiveTwoFourPercentNotesDue2028Member2024-01-012024-06-300000034088xom:ZeroPointEightThreeFivePercentNotesDue2032Member2024-01-012024-06-300000034088xom:OnePointFourZeroEightPercentNotesDue2039Member2024-01-012024-06-3000000340882024-06-300000034088xom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:IncomeFromEquityAffiliatesMember2024-04-012024-06-300000034088xom:IncomeFromEquityAffiliatesMember2023-04-012023-06-300000034088xom:IncomeFromEquityAffiliatesMember2024-01-012024-06-300000034088xom:IncomeFromEquityAffiliatesMember2023-01-012023-06-300000034088xom:OtherRevenueMember2024-04-012024-06-300000034088xom:OtherRevenueMember2023-04-012023-06-300000034088xom:OtherRevenueMember2024-01-012024-06-300000034088xom:OtherRevenueMember2023-01-012023-06-3000000340882024-04-012024-06-3000000340882023-04-012023-06-3000000340882023-01-012023-06-3000000340882023-12-310000034088us-gaap:RelatedPartyMember2024-06-300000034088us-gaap:RelatedPartyMember2023-12-310000034088us-gaap:NonrelatedPartyMember2024-06-300000034088us-gaap:NonrelatedPartyMember2023-12-3100000340882022-12-3100000340882023-06-300000034088xom:PioneerNaturalResourcesMergerMember2024-05-032024-05-030000034088us-gaap:CommonStockMember2023-03-310000034088us-gaap:RetainedEarningsMember2023-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000034088us-gaap:TreasuryStockCommonMember2023-03-310000034088us-gaap:ParentMember2023-03-310000034088us-gaap:NoncontrollingInterestMember2023-03-3100000340882023-03-310000034088us-gaap:CommonStockMember2023-04-012023-06-300000034088us-gaap:ParentMember2023-04-012023-06-300000034088us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000034088us-gaap:RetainedEarningsMember2023-04-012023-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000034088us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000034088us-gaap:CommonStockMember2023-06-300000034088us-gaap:RetainedEarningsMember2023-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000034088us-gaap:TreasuryStockCommonMember2023-06-300000034088us-gaap:ParentMember2023-06-300000034088us-gaap:NoncontrollingInterestMember2023-06-300000034088us-gaap:CommonStockMember2024-03-310000034088us-gaap:RetainedEarningsMember2024-03-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000034088us-gaap:TreasuryStockCommonMember2024-03-310000034088us-gaap:ParentMember2024-03-310000034088us-gaap:NoncontrollingInterestMember2024-03-3100000340882024-03-310000034088us-gaap:CommonStockMember2024-04-012024-06-300000034088us-gaap:ParentMember2024-04-012024-06-300000034088us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000034088us-gaap:RetainedEarningsMember2024-04-012024-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000034088us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000034088us-gaap:CommonStockMember2024-06-300000034088us-gaap:RetainedEarningsMember2024-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000034088us-gaap:TreasuryStockCommonMember2024-06-300000034088us-gaap:ParentMember2024-06-300000034088us-gaap:NoncontrollingInterestMember2024-06-300000034088us-gaap:CommonStockMember2022-12-310000034088us-gaap:RetainedEarningsMember2022-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000034088us-gaap:TreasuryStockCommonMember2022-12-310000034088us-gaap:ParentMember2022-12-310000034088us-gaap:NoncontrollingInterestMember2022-12-310000034088us-gaap:CommonStockMember2023-01-012023-06-300000034088us-gaap:ParentMember2023-01-012023-06-300000034088us-gaap:NoncontrollingInterestMember2023-01-012023-06-300000034088us-gaap:RetainedEarningsMember2023-01-012023-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300000034088us-gaap:TreasuryStockCommonMember2023-01-012023-06-300000034088us-gaap:CommonStockMember2023-12-310000034088us-gaap:RetainedEarningsMember2023-12-310000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000034088us-gaap:TreasuryStockCommonMember2023-12-310000034088us-gaap:ParentMember2023-12-310000034088us-gaap:NoncontrollingInterestMember2023-12-310000034088us-gaap:CommonStockMember2024-01-012024-06-300000034088us-gaap:ParentMember2024-01-012024-06-300000034088us-gaap:NoncontrollingInterestMember2024-01-012024-06-300000034088us-gaap:RetainedEarningsMember2024-01-012024-06-300000034088us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300000034088us-gaap:TreasuryStockCommonMember2024-01-012024-06-300000034088xom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:ZeroPointTwoFiveNotesDueMay2025Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:ZeroPointTwoFiveNotesDueMay2025Member2024-05-020000034088xom:OnePointOneTwoFiveNotesDueJanuary2026Memberxom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:OnePointOneTwoFiveNotesDueJanuary2026Memberxom:PioneerNaturalResourcesMergerMember2024-05-020000034088xom:FivePointOneNotesDueMarch2026Memberxom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:FivePointOneNotesDueMarch2026Memberxom:PioneerNaturalResourcesMergerMember2024-05-020000034088xom:SevenPointTwoNotesDueJanuary2028Memberxom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:SevenPointTwoNotesDueJanuary2028Memberxom:PioneerNaturalResourcesMergerMember2024-05-020000034088xom:FourPointOneTwoFiveNotesDueFebruary2028Memberxom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:FourPointOneTwoFiveNotesDueFebruary2028Memberxom:PioneerNaturalResourcesMergerMember2024-05-020000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointNineNotesDueAugust2023Member2024-05-030000034088xom:PioneerNaturalResourcesMergerMemberxom:OnePointNineNotesDueAugust2023Member2024-05-020000034088xom:TwoPointOneFiveNotesDueJanuary2031Memberxom:PioneerNaturalResourcesMergerMember2024-05-030000034088xom:TwoPointOneFiveNotesDueJanuary2031Memberxom:PioneerNaturalResourcesMergerMember2024-05-020000034088xom:PioneerNaturalResourcesMergerMember2024-04-012024-06-300000034088xom:PioneerNaturalResourcesMergerMember2024-01-012024-06-300000034088xom:PioneerNaturalResourcesMergerMember2023-04-012023-06-300000034088xom:PioneerNaturalResourcesMergerMember2023-01-012023-06-300000034088xom:DebtRelatedGuaranteesMemberxom:EquityCompanyObligationsMember2024-06-300000034088xom:DebtRelatedGuaranteesMemberxom:OtherThirdPartyObligationsMember2024-06-300000034088xom:DebtRelatedGuaranteesMember2024-06-300000034088xom:OtherGuaranteesMemberxom:EquityCompanyObligationsMember2024-06-300000034088xom:OtherThirdPartyObligationsMemberxom:OtherGuaranteesMember2024-06-300000034088xom:OtherGuaranteesMember2024-06-300000034088xom:EquityCompanyObligationsMember2024-06-300000034088xom:OtherThirdPartyObligationsMember2024-06-300000034088srt:ParentCompanyMember2022-12-310000034088srt:ParentCompanyMember2023-01-012023-06-300000034088srt:ParentCompanyMember2023-06-300000034088srt:ParentCompanyMember2023-12-310000034088srt:ParentCompanyMember2024-01-012024-06-300000034088srt:ParentCompanyMember2024-06-300000034088us-gaap:PensionPlansDefinedBenefitMembercountry:US2024-04-012024-06-300000034088us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-04-012023-06-300000034088us-gaap:PensionPlansDefinedBenefitMembercountry:US2024-01-012024-06-300000034088us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-01-012023-06-300000034088us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2024-04-012024-06-300000034088us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-04-012023-06-300000034088us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2024-01-012024-06-300000034088us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-01-012023-06-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-04-012024-06-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-04-012023-06-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-06-300000034088us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-06-300000034088us-gaap:FairValueInputsLevel1Member2024-06-300000034088us-gaap:FairValueInputsLevel2Member2024-06-300000034088us-gaap:FairValueDisclosureItemAmountsDomain2024-06-300000034088xom:EffectOfCounterpartyNettingMember2024-06-300000034088xom:EffectOfCollateralNettingMember2024-06-300000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300000034088us-gaap:FairValueInputsLevel3Member2024-06-300000034088xom:DifferenceInCarryingValueAndFairValueMember2024-06-300000034088us-gaap:FairValueInputsLevel1Member2023-12-310000034088us-gaap:FairValueInputsLevel2Member2023-12-310000034088us-gaap:FairValueDisclosureItemAmountsDomain2023-12-310000034088xom:EffectOfCounterpartyNettingMember2023-12-310000034088xom:EffectOfCollateralNettingMember2023-12-310000034088us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000034088us-gaap:FairValueInputsLevel3Member2023-12-310000034088xom:DifferenceInCarryingValueAndFairValueMember2023-12-310000034088xom:LineOfCreditShortTermMember2024-06-300000034088xom:LineOfCreditLongTermMember2024-06-300000034088us-gaap:LongMembersrt:CrudeOilMember2024-01-012024-06-300000034088us-gaap:ShortMembersrt:CrudeOilMember2023-01-012023-12-310000034088us-gaap:ShortMemberxom:ProductsMember2024-01-012024-06-300000034088us-gaap:ShortMemberxom:ProductsMember2023-01-012023-12-310000034088xom:NaturalGasMemberus-gaap:ShortMember2024-01-012024-06-300000034088xom:NaturalGasMemberus-gaap:ShortMember2023-01-012023-12-310000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2024-04-012024-06-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2023-04-012023-06-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2024-01-012024-06-300000034088us-gaap:NotDesignatedAsHedgingInstrumentTradingMember2023-01-012023-06-300000034088country:USxom:UpstreamMember2024-04-012024-06-300000034088country:USxom:UpstreamMember2023-04-012023-06-300000034088country:USxom:UpstreamMember2024-01-012024-06-300000034088country:USxom:UpstreamMember2023-01-012023-06-300000034088xom:UpstreamMemberus-gaap:NonUsMember2024-04-012024-06-300000034088xom:UpstreamMemberus-gaap:NonUsMember2023-04-012023-06-300000034088xom:UpstreamMemberus-gaap:NonUsMember2024-01-012024-06-300000034088xom:UpstreamMemberus-gaap:NonUsMember2023-01-012023-06-300000034088xom:EnergyProductsMembercountry:US2024-04-012024-06-300000034088xom:EnergyProductsMembercountry:US2023-04-012023-06-300000034088xom:EnergyProductsMembercountry:US2024-01-012024-06-300000034088xom:EnergyProductsMembercountry:US2023-01-012023-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMember2024-04-012024-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMember2023-04-012023-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMember2024-01-012024-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMember2023-01-012023-06-300000034088country:USxom:ChemicalProductsMember2024-04-012024-06-300000034088country:USxom:ChemicalProductsMember2023-04-012023-06-300000034088country:USxom:ChemicalProductsMember2024-01-012024-06-300000034088country:USxom:ChemicalProductsMember2023-01-012023-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMember2024-04-012024-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMember2023-04-012023-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMember2024-01-012024-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMember2023-01-012023-06-300000034088xom:SpecialtyProductsMembercountry:US2024-04-012024-06-300000034088xom:SpecialtyProductsMembercountry:US2023-04-012023-06-300000034088xom:SpecialtyProductsMembercountry:US2024-01-012024-06-300000034088xom:SpecialtyProductsMembercountry:US2023-01-012023-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMember2024-04-012024-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMember2023-04-012023-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMember2024-01-012024-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMember2023-01-012023-06-300000034088xom:CorporateAndFinancingMember2024-04-012024-06-300000034088xom:CorporateAndFinancingMember2023-04-012023-06-300000034088xom:CorporateAndFinancingMember2024-01-012024-06-300000034088xom:CorporateAndFinancingMember2023-01-012023-06-300000034088country:USxom:UpstreamMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:USxom:UpstreamMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:USxom:UpstreamMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:USxom:UpstreamMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:UpstreamMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:UpstreamMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:UpstreamMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:UpstreamMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:EnergyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:EnergyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:EnergyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:EnergyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:EnergyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:USxom:ChemicalProductsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:USxom:ChemicalProductsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:USxom:ChemicalProductsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:USxom:ChemicalProductsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:ChemicalProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:SpecialtyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:SpecialtyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:SpecialtyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:SpecialtyProductsMembercountry:USxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:SpecialtyProductsMemberus-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:CorporateAndFinancingMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088xom:CorporateAndFinancingMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088xom:CorporateAndFinancingMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088xom:CorporateAndFinancingMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:USxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:USxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:USxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:USxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088us-gaap:NonUsMemberxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:CAxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:CAxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:CAxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:CAxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:GBxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:GBxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:GBxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:GBxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:SGxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:SGxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:SGxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:SGxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:FRxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:FRxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:FRxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:FRxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088country:AUxom:SalesAndOtherOperatingRevenueMember2024-04-012024-06-300000034088country:AUxom:SalesAndOtherOperatingRevenueMember2023-04-012023-06-300000034088country:AUxom:SalesAndOtherOperatingRevenueMember2024-01-012024-06-300000034088country:AUxom:SalesAndOtherOperatingRevenueMember2023-01-012023-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:DE2024-04-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:DE2023-04-012023-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:DE2024-01-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:DE2023-01-012023-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:BE2024-04-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:BE2023-04-012023-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:BE2024-01-012024-06-300000034088xom:SalesAndOtherOperatingRevenueMembercountry:BE2023-01-012023-06-300000034088us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-01-012024-06-300000034088us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to__________

Commission File Number 1-2256

Exxon Mobil Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | | 13-5409005 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

22777 Springwoods Village Parkway, Spring, Texas 77389-1425

(Address of principal executive offices) (Zip Code)

(972) 940-6000

(Registrant's telephone number, including area code)

_______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, without par value | | XOM | | New York Stock Exchange |

| 0.524% Notes due 2028 | | XOM28 | | New York Stock Exchange |

| 0.835% Notes due 2032 | | XOM32 | | New York Stock Exchange |

| 1.408% Notes due 2039 | | XOM39A | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding as of June 30, 2024 |

| Common stock, without par value | | 4,442,826,580 |

EXXON MOBIL CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2024

TABLE OF CONTENTS

| | | | | |

| PART I. FINANCIAL INFORMATION |

| | |

| Item 1. Financial Statements | |

| | |

Condensed Consolidated Statement of Income - Three and six months ended June 30, 2024 and 2023 | |

| | |

Condensed Consolidated Statement of Comprehensive Income - Three and six months ended June 30, 2024 and 2023 | |

| | |

Condensed Consolidated Balance Sheet - As of June 30, 2024 and December 31, 2023 | |

| | |

Condensed Consolidated Statement of Cash Flows - Six months ended June 30, 2024 and 2023 | |

| | |

Condensed Consolidated Statement of Changes in Equity - Three months ended June 30, 2024 and 2023 | |

| |

Condensed Consolidated Statement of Changes in Equity - Six months ended June 30, 2024 and 2023 | |

| |

| |

| | |

| Notes to Condensed Consolidated Financial Statements | |

| | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

| | |

| Item 4. Controls and Procedures | |

| | |

| | |

| PART II. OTHER INFORMATION |

| |

| Item 1. Legal Proceedings | |

| |

| |

| | |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| | |

| Item 5. Other Information | |

| |

Item 6. Exhibits | |

| | |

| Index to Exhibits | |

| | |

| Signature | |

| | |

PART I. FINANCIAL INFORMATION

| | | | | | | | | | | | | | |

| ITEM 1. FINANCIAL STATEMENTS | | |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| | | | | | | | | | | | | | | | | | | | |

(millions of dollars, unless noted) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenues and other income | | | | | | |

| Sales and other operating revenue | | 89,986 | | 80,795 | | | 170,397 | | 164,439 | |

| Income from equity affiliates | | 1,744 | | 1,382 | | | 3,586 | | 3,763 | |

| Other income | | 1,330 | | 737 | | | 2,160 | | 1,276 | |

| Total revenues and other income | | 93,060 | | 82,914 | | | 176,143 | | 169,478 | |

| Costs and other deductions | | | | | | |

| Crude oil and product purchases | | 54,199 | | 47,598 | | | 101,800 | | 93,601 | |

| Production and manufacturing expenses | | 9,804 | | 8,860 | | | 18,895 | | 18,296 | |

| Selling, general and administrative expenses | | 2,568 | | 2,449 | | | 5,063 | | 4,839 | |

| Depreciation and depletion (includes impairments) | | 5,787 | | 4,242 | | | 10,599 | | 8,486 | |

| Exploration expenses, including dry holes | | 153 | | 133 | | | 301 | | 274 | |

| Non-service pension and postretirement benefit expense | | 34 | | 164 | | | 57 | | 331 | |

| Interest expense | | 271 | | 249 | | | 492 | | 408 | |

| Other taxes and duties | | 6,579 | | 7,563 | | | 12,902 | | 14,784 | |

| Total costs and other deductions | | 79,395 | | 71,258 | | | 150,109 | | 141,019 | |

| Income (loss) before income taxes | | 13,665 | | 11,656 | | | 26,034 | | 28,459 | |

| Income tax expense (benefit) | | 4,094 | | 3,503 | | | 7,897 | | 8,463 | |

| Net income (loss) including noncontrolling interests | | 9,571 | | 8,153 | | | 18,137 | | 19,996 | |

| Net income (loss) attributable to noncontrolling interests | | 331 | | 273 | | | 677 | | 686 | |

| Net income (loss) attributable to ExxonMobil | | 9,240 | | 7,880 | | | 17,460 | | 19,310 | |

| | | | | | |

Earnings (loss) per common share (dollars) | | 2.14 | | 1.94 | | | 4.20 | | 4.73 | |

| | | | | | |

Earnings (loss) per common share - assuming dilution (dollars) | | 2.14 | | 1.94 | | | 4.20 | | 4.73 | |

| | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME |

| | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Net income (loss) including noncontrolling interests | | 9,571 | | 8,153 | | | 18,137 | | 19,996 | |

| | | | | | |

| Other comprehensive income (net of income taxes) | | | | | | |

| Foreign exchange translation adjustment | | (115) | | 514 | | | (1,382) | | 687 | |

| | | | | | |

| Postretirement benefits reserves adjustment (excluding amortization) | | 29 | | 17 | | | (13) | | 36 | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | 17 | | 7 | | | 26 | | 13 | |

| Total other comprehensive income (loss) | | (69) | | 538 | | | (1,369) | | 736 | |

| Comprehensive income (loss) including noncontrolling interests | | 9,502 | | 8,691 | | | 16,768 | | 20,732 | |

| Comprehensive income (loss) attributable to noncontrolling interests | | 280 | | 373 | | | 506 | | 809 | |

| Comprehensive income (loss) attributable to ExxonMobil | | 9,222 | | 8,318 | | | 16,262 | | 19,923 | |

| | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| | | | | | | | | | | | | | | |

(millions of dollars, unless noted) | | June 30, 2024 | | December 31, 2023 | | | |

| | | | | | | |

| ASSETS | | | | | | | |

| Current assets | | | | | | | |

| Cash and cash equivalents | | 26,460 | | | 31,539 | | | | |

| Cash and cash equivalents – restricted | | 28 | | | 29 | | | | |

| Notes and accounts receivable – net | | 43,071 | | | 38,015 | | | | |

| Inventories | | | | | | | |

| Crude oil, products and merchandise | | 19,685 | | | 20,528 | | | | |

| Materials and supplies | | 4,818 | | | 4,592 | | | | |

| Other current assets | | 2,176 | | | 1,906 | | | | |

| Total current assets | | 96,238 | | | 96,609 | | | | |

| Investments, advances and long-term receivables | | 47,948 | | | 47,630 | | | | |

| Property, plant and equipment – net | | 298,283 | | | 214,940 | | | | |

| Other assets, including intangibles – net | | 18,238 | | | 17,138 | | | | |

| Total Assets | | 460,707 | | | 376,317 | | | | |

| | | | | | | |

| LIABILITIES | | | | | | | |

| Current liabilities | | | | | | | |

| Notes and loans payable | | 6,621 | | | 4,090 | | | | |

| Accounts payable and accrued liabilities | | 60,107 | | | 58,037 | | | | |

| Income taxes payable | | 4,035 | | | 3,189 | | | | |

| Total current liabilities | | 70,763 | | | 65,316 | | | | |

| Long-term debt | | 36,565 | | | 37,483 | | | | |

| Postretirement benefits reserves | | 10,398 | | | 10,496 | | | | |

| Deferred income tax liabilities | | 40,080 | | | 24,452 | | | | |

| Long-term obligations to equity companies | | 1,612 | | | 1,804 | | | | |

| Other long-term obligations | | 25,023 | | | 24,228 | | | | |

| Total Liabilities | | 184,441 | | | 163,779 | | | | |

| | | | | | | |

| Commitments and contingencies (Note 3) | | | | | | | |

| | | | | | | |

| EQUITY | | | | | | | |

Common stock without par value (9,000 million shares authorized, 8,019 million shares issued) | | 46,781 | | | 17,781 | | | | |

| Earnings reinvested | | 463,294 | | | 453,927 | | | | |

| Accumulated other comprehensive income | | (13,187) | | | (11,989) | | | | |

Common stock held in treasury (3,576 million shares at June 30, 2024 and 4,048 million shares at December 31, 2023) | | (228,483) | | | (254,917) | | | | |

| ExxonMobil share of equity | | 268,405 | | | 204,802 | | | | |

| Noncontrolling interests | | 7,861 | | | 7,736 | | | | |

| Total Equity | | 276,266 | | | 212,538 | | | | |

| Total Liabilities and Equity | | 460,707 | | | 376,317 | | | | |

| | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. | | | |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | | | | | | | |

| (millions of dollars) | | Six Months Ended

June 30, |

| 2024 | 2023 |

| | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) including noncontrolling interests | | 18,137 | | 19,996 | |

| Depreciation and depletion (includes impairments) | | 10,599 | | 8,486 | |

| | | |

| Changes in operational working capital, excluding cash and debt | | (2,608) | | (3,885) | |

| All other items – net | | (904) | | 1,127 | |

| Net cash provided by operating activities | | 25,224 | | 25,724 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Additions to property, plant and equipment | | (11,309) | | (10,771) | |

| Proceeds from asset sales and returns of investments | | 1,629 | | 2,141 | |

| Additional investments and advances | | (744) | | (834) | |

| Other investing activities including collection of advances | | 224 | | 183 | |

| Cash acquired from mergers and acquisitions | | 754 | | 0 | |

| Net cash used in investing activities | | (9,446) | | (9,281) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Additions to long-term debt | | 217 | | 136 | |

| Reductions in long-term debt | | (1,142) | | (6) | |

| | | |

Reductions in short-term debt | | (2,771) | | (172) | |

| Additions/(reductions) in debt with three months or less maturity | | (6) | | (172) | |

| Contingent consideration payments | | (27) | | (68) | |

| Cash dividends to ExxonMobil shareholders | | (8,093) | | (7,439) | |

| Cash dividends to noncontrolling interests | | (397) | | (293) | |

| Changes in noncontrolling interests | | 16 | | 11 | |

| Common stock acquired | | (8,337) | | (8,680) | |

| Net cash used in financing activities | | (20,540) | | (16,683) | |

| | | |

| Effects of exchange rate changes on cash | | (318) | | 132 | |

| Increase/(decrease) in cash and cash equivalents | | (5,080) | | (108) | |

| Cash and cash equivalents at beginning of period | | 31,568 | | 29,665 | |

| Cash and cash equivalents at end of period | | 26,488 | | 29,557 | |

| | | |

| SUPPLEMENTAL DISCLOSURES | | | |

| Income taxes paid | | 6,968 | | 8,841 | |

| Cash interest paid | | | |

| Included in cash flows from operating activities | | 321 | | 295 | |

| Capitalized, included in cash flows from investing activities | | 590 | | 561 | |

| Total cash interest paid | | 911 | | 856 | |

| | | |

| Noncash right of use assets recorded in exchange for lease liabilities | | | |

| Operating leases | | 647 | | 1,036 | |

| Finance leases | | 53 | | 438 | |

| | | |

Non-Cash Transaction: The Corporation acquired Pioneer Natural Resources in an all-stock transaction on May 3, 2024, having issued 545 million shares of ExxonMobil common stock having a fair value of $63 billion and assumed debt with a fair value of $5 billion. See Note 2 for additional information. |

| | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | ExxonMobil Share of Equity | | |

| | | | | | | | |

(millions of dollars, unless noted) | | Common Stock | Earnings Reinvested | Accumulated Other Comprehensive Income | Common Stock Held in Treasury | ExxonMobil Share of Equity | Non-controlling Interests | Total Equity |

| | | | | | | | |

| Balance as of March 31, 2023 | | 15,904 | | 440,552 | | (13,095) | | (244,676) | | 198,685 | | 7,729 | | 206,414 | |

| Amortization of stock-based awards | | 130 | | — | | — | | — | | 130 | | — | | 130 | |

| Other | | (5) | | — | | — | | — | | (5) | | 27 | | 22 | |

| Net income (loss) for the period | | — | | 7,880 | | — | | — | | 7,880 | | 273 | | 8,153 | |

| Dividends - common shares | | — | | (3,701) | | — | | — | | (3,701) | | (178) | | (3,879) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | 438 | | — | | 438 | | 100 | | 538 | |

| Share repurchases, at cost | | — | | — | | — | | (4,383) | | (4,383) | | — | | (4,383) | |

| | | | | | | | |

| Dispositions | | — | | — | | — | | 2 | | 2 | | — | | 2 | |

| Balance as of June 30, 2023 | | 16,029 | | 444,731 | | (12,657) | | (249,057) | | 199,046 | | 7,951 | | 206,997 | |

| | | | | | | | |

| Balance as of March 31, 2024 | | 17,971 | | 458,339 | | (13,169) | | (257,891) | | 205,250 | | 7,802 | | 213,052 | |

| Amortization of stock-based awards | | 178 | | — | | — | | — | | 178 | | — | | 178 | |

| Other | | (117) | | — | | — | | — | | (117) | | 10 | | (107) | |

| Net income (loss) for the period | | — | | 9,240 | | — | | — | | 9,240 | | 331 | | 9,571 | |

| Dividends - common shares | | — | | (4,285) | | — | | — | | (4,285) | | (231) | | (4,516) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | (18) | | — | | (18) | | (51) | | (69) | |

| Share repurchases, at cost | | — | | — | | — | | (5,310) | | (5,310) | | — | | (5,310) | |

| Issued for acquisitions | | 28,749 | | — | | — | | 34,603 | | 63,352 | | — | | 63,352 | |

| Dispositions | | — | | — | | — | | 115 | | 115 | | — | | 115 | |

| Balance as of June 30, 2024 | | 46,781 | | 463,294 | | (13,187) | | (228,483) | | 268,405 | | 7,861 | | 276,266 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| | | | | | | | |

Common Stock Share Activity (millions of shares) | | Issued | Held in Treasury | Outstanding | | Issued | Held in Treasury | Outstanding |

| Balance as of March 31 | | 8,019 | | (4,076) | | 3,943 | | | 8,019 | | (3,976) | | 4,043 | |

| Share repurchases, at cost | | — | | (45) | | (45) | | | — | | (40) | | (40) | |

| Issued for acquisitions | | — | | 545 | | 545 | | | — | | — | | — | |

| Dispositions | | — | | — | | — | | | — | | — | | — | |

| Balance as of June 30 | | 8,019 | | (3,576) | | 4,443 | | | 8,019 | | (4,016) | | 4,003 | |

| | | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | ExxonMobil Share of Equity | | |

| | | | | | | | |

(millions of dollars, unless noted) | | Common Stock | Earnings Reinvested | Accumulated Other Comprehensive Income | Common Stock Held

in Treasury | ExxonMobil Share of Equity | Non-controlling Interests | Total

Equity |

| | | | | | | | |

| Balance as of December 31, 2022 | | 15,752 | | 432,860 | | (13,270) | | (240,293) | | 195,049 | | 7,424 | | 202,473 | |

| Amortization of stock-based awards | | 288 | | — | | — | | — | | 288 | | — | | 288 | |

| Other | | (11) | | — | | — | | — | | (11) | | 11 | | — | |

| Net income (loss) for the period | | — | | 19,310 | | — | | — | | 19,310 | | 686 | | 19,996 | |

| Dividends - common shares | | — | | (7,439) | | — | | — | | (7,439) | | (293) | | (7,732) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | 613 | | — | | 613 | | 123 | | 736 | |

| Share repurchases, at cost | | — | | — | | — | | (8,768) | | (8,768) | | — | | (8,768) | |

| Dispositions | | — | | — | | — | | 4 | | 4 | | — | | 4 | |

| Balance as of June 30, 2023 | | 16,029 | | 444,731 | | (12,657) | | (249,057) | | 199,046 | | 7,951 | | 206,997 | |

| | | | | | | | |

| Balance as of December 31, 2023 | | 17,781 | | 453,927 | | (11,989) | | (254,917) | | 204,802 | | 7,736 | | 212,538 | |

| Amortization of stock-based awards | | 375 | | — | | — | | — | | 375 | | — | | 375 | |

| Other | | (124) | | — | | — | | — | | (124) | | 16 | | (108) | |

| Net income (loss) for the period | | — | | 17,460 | | — | | — | | 17,460 | | 677 | | 18,137 | |

| Dividends - common shares | | — | | (8,093) | | — | | — | | (8,093) | | (397) | | (8,490) | |

| | | | | | | | |

| Other comprehensive income (loss) | | — | | — | | (1,198) | | — | | (1,198) | | (171) | | (1,369) | |

| Share repurchases, at cost | | — | | — | | — | | (8,288) | | (8,288) | | — | | (8,288) | |

| Issued for acquisitions | | 28,749 | | — | | — | | 34,603 | | 63,352 | | — | | 63,352 | |

| Dispositions | | — | | — | | — | | 119 | | 119 | | — | | 119 | |

| Balance as of June 30, 2024 | | 46,781 | | 463,294 | | (13,187) | | (228,483) | | 268,405 | | 7,861 | | 276,266 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| | | | | | | | |

Common Stock Share Activity (millions of shares) | | Issued | Held in Treasury | Outstanding | | Issued | Held in Treasury | Outstanding |

| Balance as of December 31 | | 8,019 | | (4,048) | | 3,971 | | | 8,019 | | (3,937) | | 4,082 | |

| Share repurchases, at cost | | — | | (73) | | (73) | | | — | | (79) | | (79) | |

| Issued for acquisitions | | — | | 545 | | 545 | | | — | | — | | — | |

| Dispositions | | — | | — | | — | | | — | | — | | — | |

| Balance as of June 30 | | 8,019 | | (3,576) | | 4,443 | | | 8,019 | | (4,016) | | 4,003 | |

| | | | | | | | |

| The information in the Notes to Condensed Consolidated Financial Statements is an integral part of these statements. |

| | | | | |

| |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

Note 1. Basis of Financial Statement Preparation

These unaudited condensed consolidated financial statements should be read in the context of the consolidated financial statements and notes thereto filed with the Securities and Exchange Commission in the Corporation's 2023 Annual Report on Form 10-K. In the opinion of the Corporation, the information furnished herein reflects all known accruals and adjustments necessary for a fair statement of the results for the periods reported herein. All such adjustments are of a normal recurring nature.

The Corporation's exploration and production activities are accounted for under the "successful efforts" method.

Note 2. Pioneer Natural Resources Merger

On May 3, 2024, the Corporation acquired Pioneer Natural Resources Company ("Pioneer"), an independent oil and gas exploration and production company. The acquisition included over 850 thousand net acres in the Midland Basin of West Texas and proved reserves in excess of 2 billion oil-equivalent barrels. In connection with the acquisition, we issued 545 million shares of ExxonMobil common stock having a fair value of $63 billion on the acquisition date, and assumed debt with a fair value of $5 billion.

The transaction was accounted for as a business combination in accordance with ASC 805, which requires that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date. The following table summarizes the provisional fair values of the assets acquired and liabilities assumed.

| | | | | |

| (billions of dollars) | Pioneer |

Current assets (1) | 3 | |

| Other non-current assets | 1 | |

Property, plant & equipment (2) | 84 | |

| Total identifiable assets acquired | 88 | |

| |

Current liabilities (1) | 3 | |

Long-term debt (3) | 5 | |

Deferred income tax liabilities (4) | 16 | |

| Other non-current liabilities | 2 | |

| Total liabilities assumed | 26 | |

| |

| Net identifiable assets acquired | 62 | |

| |

Goodwill (5) | 1 | |

| |

Net assets (6) | 63 | |

| |

(1) Current assets and current liabilities consist primarily of accounts receivable and payable, with their respective fair values approximating historical values given their short-term duration, expectation of insignificant bad debt expense, and our credit rating. |

(2) Property, plant and equipment was preliminarily valued using the income approach. Significant inputs and assumptions used in the income approach included estimates for commodity prices, future oil and gas production profiles, operating expenses, capital expenditures, and a risk-adjusted discount rate. Collectively, these inputs are Level 3 inputs. |

(3) Long-term debt was valued using market prices as of the acquisition date, which reflects the use of Level 1 inputs. |

(4) Deferred income taxes represent the tax effects of differences in the tax basis and acquisition date fair values of assets acquired and liabilities assumed. |

(5) Goodwill was allocated to the Upstream segment. |

(6) Provisional fair value measurements were made for assets acquired and liabilities assumed. Adjustments to those measurements may be made in subsequent periods, up to one year from the date of acquisition, as we continue to evaluate the information necessary to complete the analysis. |

Debt Assumed in the Merger

The following table presents long-term debt assumed at closing:

| | | | | | | | | | | | | | |

(millions of dollars) | | Par Value | | Fair Value

as of May 2, 2024 |

0.250% Convertible Senior Notes due May 2025 (1) | | 450 | | | 1,327 | |

1.125% Senior Notes due January 2026 | | 750 | | | 699 | |

5.100% Senior Notes due March 2026 | | 1,100 | | | 1,096 | |

7.200% Senior Notes due January 2028 | | 241 | | | 252 | |

4.125% Senior Notes due February 2028 | | 138 | | | 130 | |

1.900% Senior Notes due August 2030 | | 1,100 | | | 914 | |

2.150% Senior Notes due January 2031 | | 1,000 | | | 832 | |

(1) In June 2024, the Corporation redeemed in full all of the Convertible Senior Notes assumed from Pioneer for an amount consistent with the acquisition date fair value. |

Actual and Pro Forma Impact of Merger

The following table presents revenues and earnings for Pioneer since the acquisition date (May 3, 2024), for the periods presented:

| | | | | | | | | | | | | | |

(millions of dollars) | | Three Months Ended

June 30, 2024 | | Six Months Ended

June 30, 2024 |

| Sales and other operating revenues | | 4,372 | | | 4,372 | |

| | | | |

| Net income (loss) attributable to ExxonMobil | | 398 | | | 398 | |

The following table presents unaudited pro forma information for the Corporation as if the merger with Pioneer had occurred at the beginning of January 1, 2023:

| | | | | | | | | | | | | | | | | | | | |

Unaudited (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Sales and other operating revenues | | 92,167 | | 86,076 | | | 178,557 | | 175,425 | |

| | | | | | |

| Net income (loss) attributable to ExxonMobil | | 9,265 | | 8,577 | | | 18,256 | | 20,663 | |

The historical financial information was adjusted to give effect to the pro forma events that were directly attributable to the merger and factually supportable. The unaudited pro forma consolidated results are not necessarily indicative of what the consolidated results of operations actually would have been had the merger been completed on January 1, 2023. In addition, the unaudited pro forma consolidated results reflect pro forma adjustments primarily related to conforming Pioneer's accounting policies to ExxonMobil, additional depreciation expense related to the fair value adjustment of the acquired property, plant and equipment, our capital structure, Pioneer's transaction-related costs, and applicable income tax impacts of the pro forma adjustments.

Our transaction costs to effect the acquisition were immaterial.

Note 3. Litigation and Other Contingencies

Litigation

A variety of claims have been made against ExxonMobil and certain of its consolidated subsidiaries in a number of pending lawsuits. Management has regular litigation reviews, including updates from corporate and outside counsel, to assess the need for accounting recognition or disclosure of these contingencies. The Corporation accrues an undiscounted liability for those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated. If a range of amounts can be reasonably estimated and no amount within the range is a better estimate than any other amount, then the minimum of the range is accrued. The Corporation does not record liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated or when the liability is believed to be only reasonably possible or remote. For contingencies where an unfavorable outcome is reasonably possible and which are significant, the Corporation discloses the nature of the contingency and, where feasible, an estimate of the possible loss. For purposes of our contingency disclosures, “significant” includes material matters, as well as other matters which management believes should be disclosed.

State and local governments and other entities in various jurisdictions across the United States and its territories have filed a number of legal proceedings against several oil and gas companies, including ExxonMobil, requesting unprecedented legal and equitable relief for various alleged injuries purportedly connected to climate change. These lawsuits assert a variety of novel, untested claims under statutory and common law. Additional such lawsuits may be filed. We believe the legal and factual theories set forth in these proceedings are meritless and represent an inappropriate attempt to use the court system to usurp the proper role of policymakers in addressing the societal challenges of climate change.

Local governments in Louisiana have filed unprecedented legal proceedings against a number of oil and gas companies, including ExxonMobil, requesting compensation for the restoration of coastal marsh erosion in the state. We believe the factual and legal theories set forth in these proceedings are meritless.

While the outcome of any litigation can be unpredictable, we believe the likelihood is remote that the ultimate outcomes of these lawsuits will have a material adverse effect on the Corporation’s operations, financial condition, or financial statements taken as a whole. We will continue to defend vigorously against these claims.

Other Contingencies

The Corporation and certain of its consolidated subsidiaries were contingently liable at June 30, 2024, for guarantees relating to notes, loans and performance under contracts. Where guarantees for environmental remediation and other similar matters do not include a stated cap, the amounts reflect management’s estimate of the maximum potential exposure. Where it is not possible to make a reasonable estimation of the maximum potential amount of future payments, future performance is expected to be either immaterial or have only a remote chance of occurrence.

| | | | | | | | | | | |

| | June 30, 2024 |

| | | |

| (millions of dollars) | Equity Company Obligations (1) | Other Third-Party Obligations | Total |

| Guarantees | | | |

| Debt-related | 1,070 | | 135 | | 1,205 | |

| Other | 678 | | 5,896 | | 6,574 | |

| Total | 1,748 | | 6,031 | | 7,779 | |

| | | |

(1) ExxonMobil share | | | |

Additionally, the Corporation and its affiliates have numerous long-term sales and purchase commitments in their various business activities, all of which are expected to be fulfilled with no adverse consequences material to the Corporation’s operations or financial condition.

Note 4. Other Comprehensive Income Information

| | | | | | | | | | | |

ExxonMobil Share of Accumulated Other Comprehensive Income (millions of dollars) | Cumulative Foreign

Exchange

Translation

Adjustment | Postretirement

Benefits Reserves

Adjustment | Total |

| Balance as of December 31, 2022 | (14,591) | | 1,321 | | (13,270) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (1) | 570 | | 35 | | 605 | |

| Amounts reclassified from accumulated other comprehensive income | — | | 8 | | 8 | |

| Total change in accumulated other comprehensive income | 570 | | 43 | | 613 | |

| Balance as of June 30, 2023 | (14,021) | | 1,364 | | (12,657) | |

| | | |

| Balance as of December 31, 2023 | (13,056) | | 1,067 | | (11,989) | |

Current period change excluding amounts reclassified from accumulated other comprehensive income (1) | (1,197) | | (21) | | (1,218) | |

| Amounts reclassified from accumulated other comprehensive income | — | | 20 | | 20 | |

| Total change in accumulated other comprehensive income | (1,197) | | (1) | | (1,198) | |

| Balance as of June 30, 2024 | (14,253) | | 1,066 | | (13,187) | |

| | | |

(1) Cumulative Foreign Exchange Translation Adjustment includes net investment hedge gain/(loss) net of taxes of $123 million and $(70) million in 2024 and 2023, respectively. |

| | | | | | | | | | | | | | | | | | | | |

Amounts Reclassified Out of Accumulated Other Comprehensive Income - Before-tax Income/(Expense) (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| | | | | | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | | | | | |

| (Statement of Income line: Non-service pension and postretirement benefit expense) | | (22) | | (6) | | | (34) | | (14) | |

| | | | | | | | | | | | | | | | | | | | |

Income Tax (Expense)/Credit For Components of Other Comprehensive Income (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Foreign exchange translation adjustment | | 69 | | 85 | | | (6) | | 133 | |

| Postretirement benefits reserves adjustment (excluding amortization) | | (10) | | 20 | | | (6) | | 31 | |

| Amortization and settlement of postretirement benefits reserves adjustment included in net periodic benefit costs | | (5) | | 1 | | | (8) | | (1) | |

| Total | | 54 | | 106 | | | (20) | | 163 | |

Note 5. Earnings Per Share

| | | | | | | | | | | | | | | | | | | | |

| Earnings per common share | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

Net income (loss) attributable to ExxonMobil (millions of dollars) | | 9,240 | | 7,880 | | | 17,460 | | 19,310 | |

Weighted-average number of common shares outstanding (millions of shares) (1) | | 4,317 | | 4,066 | | | 4,158 | | 4,084 | |

Earnings (loss) per common share (dollars) (2) | | 2.14 | | 1.94 | | | 4.20 | | 4.73 | |

Dividends paid per common share (dollars) | | 0.95 | | 0.91 | | | 1.90 | | 1.82 | |

| | | | | | |

(1) Includes restricted shares not vested as well as 545 million shares issued for the Pioneer merger on May 3, 2024. |

(2) Earnings (loss) per common share and earnings (loss) per common share – assuming dilution are the same in each period shown. |

Note 6. Pension and Other Postretirement Benefits

| | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Components of net benefit cost | | | | | | |

| Pension Benefits - U.S. | | | | | | |

| Service cost | | 117 | | 122 | | | 230 | | 242 | |

| Interest cost | | 168 | | 165 | | | 336 | | 331 | |

| Expected return on plan assets | | (181) | | (133) | | | (362) | | (266) | |

| Amortization of actuarial loss/(gain) | | 21 | | 21 | | | 42 | | 42 | |

| Amortization of prior service cost | | (8) | | (7) | | | (16) | | (14) | |

| Net pension enhancement and curtailment/settlement cost | | 14 | | 7 | | | 17 | | 15 | |

| Net benefit cost | | 131 | | 175 | | | 247 | | 350 | |

| | | | | | |

| Pension Benefits - Non-U.S. | | | | | | |

| Service cost | | 86 | | 81 | | | 169 | | 163 | |

| Interest cost | | 198 | | 232 | | | 425 | | 466 | |

| Expected return on plan assets | | (230) | | (172) | | | (491) | | (346) | |

| Amortization of actuarial loss/(gain) | | 24 | | 14 | | | 49 | | 28 | |

| Amortization of prior service cost | | 12 | | 13 | | | 25 | | 25 | |

| | | | | | |

| Net benefit cost | | 90 | | 168 | | | 177 | | 336 | |

| | | | | | |

| Other Postretirement Benefits | | | | | | |

| Service cost | | 19 | | 20 | | | 37 | | 40 | |

| Interest cost | | 62 | | 69 | | | 125 | | 139 | |

| Expected return on plan assets | | (5) | | (3) | | | (10) | | (7) | |

| Amortization of actuarial loss/(gain) | | (26) | | (31) | | | (52) | | (61) | |

| Amortization of prior service cost | | (15) | | (11) | | | (31) | | (21) | |

| Net benefit cost | | 35 | | 44 | | | 69 | | 90 | |

Note 7. Financial Instruments and Derivatives

The estimated fair value of financial instruments and derivatives at June 30, 2024 and December 31, 2023, and the related hierarchy level for the fair value measurement was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 |

| | | | | | | | |

| | | | | | | | |

| | Fair Value | | | | |

| (millions of dollars) | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | |

Derivative assets (1) | 4,790 | | 1,187 | | — | | 5,977 | | (5,510) | | (24) | | — | | 443 | |

| | | | | | | | |

Advances to/receivables from equity companies (2)(6) | — | | 2,475 | | 4,206 | | 6,681 | | — | | — | | 476 | | 7,157 | |

| | | | | | | | |

Other long-term financial assets (3) | 1,400 | | — | | 1,515 | | 2,915 | | — | | — | | 237 | | 3,152 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Derivative liabilities (4) | 4,996 | | 1,457 | | — | | 6,453 | | (5,510) | | (230) | | — | | 713 | |

Long-term debt (5) | 28,874 | | 1,469 | | — | | 30,343 | | — | | — | | 4,063 | | 34,406 | |

| | | | | | | | |

Long-term obligations to equity companies (6) | — | | — | | 1,680 | | 1,680 | | — | | — | | (68) | | 1,612 | |

| | | | | | | | |

Other long-term financial liabilities (7) | — | | — | | 516 | | 516 | | — | | — | | 49 | | 565 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2023 |

| | | | | | | | | |

| | | Fair Value | | | | |

| (millions of dollars) | | Level 1 | Level 2 | Level 3 | Total Gross Assets

& Liabilities | Effect of

Counterparty Netting | Effect of

Collateral

Netting | Difference in Carrying Value and Fair Value | Net

Carrying

Value |

| Assets | | | | | | | | | |

Derivative assets (1) | | 4,544 | | 1,731 | | — | | 6,275 | | (5,177) | | (528) | | — | | 570 | |

| | | | | | | | | |

Advances to/receivables from equity companies (2)(6) | | — | | 2,517 | | 4,491 | | 7,008 | | — | | — | | 519 | | 7,527 | |

| | | | | | | | | |

Other long-term financial assets (3) | | 1,389 | | — | | 944 | | 2,333 | | — | | — | | 202 | | 2,535 | |

| | | | | | | | | |

| Liabilities | | | | | | | | | |

Derivative liabilities (4) | | 4,056 | | 1,608 | | — | | 5,664 | | (5,177) | | (40) | | — | | 447 | |

Long-term debt (5) | | 30,556 | | 2,004 | | — | | 32,560 | | — | | — | | 3,102 | | 35,662 | |

| | | | | | | | | |

Long-term obligations to equity companies (6) | | — | | — | | 1,896 | | 1,896 | | — | | — | | (92) | | 1,804 | |

| | | | | | | | | |

Other long-term financial liabilities (7) | | — | | — | | 697 | | 697 | | — | | — | | 45 | | 742 | |

| | |

(1) Included in the Balance Sheet lines: Notes and accounts receivable - net and Other assets, including intangibles - net. |

(2) Included in the Balance Sheet line: Investments, advances and long-term receivables. |

(3) Included in the Balance Sheet lines: Investments, advances and long-term receivables and Other assets, including intangibles - net. |

(4) Included in the Balance Sheet lines: Accounts payable and accrued liabilities and Other long-term obligations. |

(5) Excluding finance lease obligations. |

(6) Advances to/receivables from equity companies and long-term obligations to equity companies are mainly designated as hierarchy level 3 inputs. The fair value is calculated by discounting the remaining obligations by a rate consistent with the credit quality and industry of the company. |

(7) Included in the Balance Sheet line: Other long-term obligations. Includes contingent consideration related to a prior year acquisition where fair value is based on expected drilling activities and discount rates. |

At June 30, 2024 and December 31, 2023, respectively, the Corporation had $675 million and $800 million of collateral under master netting arrangements not offset against the derivatives on the Condensed Consolidated Balance Sheet, primarily related to initial margin requirements.

The Corporation may use non-derivative financial instruments, such as its foreign currency-denominated debt, as hedges of its net investments in certain foreign subsidiaries. Under this method, the change in the carrying value of the financial instruments due to foreign exchange fluctuations is reported in accumulated other comprehensive income. As of June 30, 2024, the Corporation has designated $3.2 billion of its Euro-denominated debt and related accrued interest as a net investment hedge of its European business. The net investment hedge is deemed to be perfectly effective.

The Corporation had undrawn short-term committed lines of credit of $237 million and undrawn long-term committed lines of credit of $1,795 million as of second quarter 2024.

Derivative Instruments

The Corporation’s size, strong capital structure, geographic diversity, and the complementary nature of its business segments reduce the Corporation’s enterprise-wide risk from changes in commodity prices, currency rates and interest rates. In addition, the Corporation uses commodity-based contracts, including derivatives, to manage commodity price risk and to generate returns from trading. Commodity contracts held for trading purposes are presented in the Condensed Consolidated Statement of Income on a net basis in the line “Sales and other operating revenue" and in the Consolidated Statement of Cash Flows in “Cash Flows from Operating Activities”. The Corporation’s commodity derivatives are not accounted for under hedge accounting. At times, the Corporation also enters into currency and interest rate derivatives, none of which are material to the Corporation’s financial position as of June 30, 2024 and December 31, 2023, or results of operations for the periods ended June 30, 2024 and 2023.

Credit risk associated with the Corporation’s derivative position is mitigated by several factors, including the use of derivative clearing exchanges and the quality of and financial limits placed on derivative counterparties. The Corporation maintains a system of controls that includes the authorization, reporting, and monitoring of derivative activity.

The net notional long/(short) position of derivative instruments at June 30, 2024 and December 31, 2023, was as follows:

| | | | | | | | |

| (millions) | June 30, 2024 | December 31, 2023 |

| Crude oil (barrels) | 6 | | (7) | |

| Petroleum products (barrels) | (44) | | (43) | |

| Natural gas (MMBTUs) | (568) | | (560) | |

| | |

Realized and unrealized gains/(losses) on derivative instruments that were recognized in the Condensed Consolidated Statement of Income are included in the following lines on a before-tax basis:

| | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Sales and other operating revenue | | (103) | | 332 | | | (895) | | 983 | |

| Crude oil and product purchases | | (5) | | 5 | | | (2) | | (20) | |

| Total | | (108) | | 337 | | | (897) | | 963 | |

Note 8. Disclosures about Segments and Related Information

| | | | | | | | | | | | | | | | | | | | |

| (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Earnings (Loss) After Income Tax | | | | | | |

| Upstream | | | | | | |

| United States | | 2,430 | | 920 | | | 3,484 | | 2,552 | |

| Non-U.S. | | 4,644 | | 3,657 | | | 9,250 | | 8,482 | |

| Energy Products | | | | | | |

| United States | | 450 | | 1,528 | | | 1,286 | | 3,438 | |

| Non-U.S. | | 496 | | 782 | | | 1,036 | | 3,055 | |

| Chemical Products | | | | | | |

| United States | | 526 | | 486 | | | 1,030 | | 810 | |

| Non-U.S. | | 253 | | 342 | | | 534 | | 389 | |

| Specialty Products | | | | | | |

| United States | | 447 | | 373 | | | 851 | | 824 | |

| Non-U.S. | | 304 | | 298 | | | 661 | | 621 | |

| Corporate and Financing | | (310) | | (506) | | | (672) | | (861) | |

| Corporate total | | 9,240 | | 7,880 | | | 17,460 | | 19,310 | |

| | | | | | |

| Sales and Other Operating Revenue | | | | | | |

| Upstream | | | | | | |

| United States | | 6,729 | | 1,673 | | | 8,919 | | 4,443 | |

| Non-U.S. | | 3,317 | | 3,739 | | | 6,843 | | 9,126 | |

| Energy Products | | | | | | |

| United States | | 26,415 | | 26,128 | | | 51,218 | | 51,052 | |

| Non-U.S. | | 43,014 | | 38,945 | | | 82,423 | | 78,921 | |

| Chemical Products | | | | | | |

| United States | | 2,213 | | 1,992 | | | 4,407 | | 4,021 | |

| Non-U.S. | | 3,620 | | 3,678 | | | 7,266 | | 7,370 | |

| Specialty Products | | | | | | |

| United States | | 1,538 | | 1,542 | | | 3,007 | | 3,110 | |

| Non-U.S. | | 3,115 | | 3,095 | | | 6,265 | | 6,384 | |

| Corporate and Financing | | 25 | | 3 | | | 49 | | 12 | |

| Corporate total | | 89,986 | | 80,795 | | | 170,397 | | 164,439 | |

| | | | | | |

| Intersegment Revenue | | | | | | |

| Upstream | | | | | | |

| United States | | 5,545 | | 5,044 | | | 11,533 | | 10,000 | |

| Non-U.S. | | 11,043 | | 8,412 | | | 21,023 | | 17,811 | |

| Energy Products | | | | | | |

| United States | | 6,537 | | 5,074 | | | 13,095 | | 10,525 | |

| Non-U.S. | | 6,395 | | 6,988 | | | 13,147 | | 13,957 | |

| Chemical Products | | | | | | |

| United States | | 1,950 | | 2,084 | | | 3,815 | | 3,872 | |

| Non-U.S. | | 998 | | 977 | | | 2,023 | | 1,754 | |

| Specialty Products | | | | | | |

| United States | | 634 | | 684 | | | 1,289 | | 1,364 | |

| Non-U.S. | | 151 | | 169 | | | 315 | | 268 | |

| Corporate and Financing | | 71 | | 64 | | | 150 | | 128 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Geographic Sales and Other Operating Revenue | | | | | | |

| (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| United States | | 36,895 | | 31,335 | | | 67,551 | | 62,626 | |

| Non-U.S. | | 53,091 | | 49,460 | | | 102,846 | | 101,813 | |

| Total | | 89,986 | | 80,795 | | | 170,397 | | 164,439 | |

| | | | | | |

Significant Non-U.S. revenue sources include: (1) | | | | | | |

| Canada | | 8,126 | | 6,825 | | | 15,182 | | 13,546 | |

| United Kingdom | | 5,036 | | 5,242 | | | 10,196 | | 12,253 | |

| Singapore | | 3,985 | | 3,758 | | | 8,003 | | 7,489 | |

| France | | 3,512 | | 3,494 | | | 6,985 | | 6,978 | |

| Australia | | 2,450 | | 2,392 | | | 4,875 | | 4,820 | |

| Germany | | 2,448 | | 2,256 | | | 4,795 | | 4,549 | |

| Belgium | | 2,302 | | 2,410 | | | 4,709 | | 5,059 | |

| | | | | | |

(1) Revenue is determined by primary country of operations. Excludes certain sales and other operating revenues in non-U.S. operations where attribution to a specific country is not practicable. |

Revenue from Contracts with Customers

Sales and other operating revenue include both revenue within the scope of ASC 606 and outside the scope of ASC 606. Trade receivables in Notes and accounts receivable – net reported on the Balance Sheet also includes both receivables within the scope of ASC 606 and those outside the scope of ASC 606. Revenue and receivables outside the scope of ASC 606 primarily relate to physically settled commodity contracts accounted for as derivatives. Contractual terms, credit quality, and type of customer are generally similar between those revenues and receivables within the scope of ASC 606 and those outside it.

| | | | | | | | | | | | | | | | | | | | |

Sales and other operating revenue (millions of dollars) | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenue from contracts with customers | | 64,181 | | 63,322 | | | 122,600 | | 127,626 | |

| Revenue outside the scope of ASC 606 | | 25,805 | | 17,473 | | | 47,797 | | 36,813 | |

| Total | | 89,986 | | 80,795 | | | 170,397 | | 164,439 | |

Note 9. Divestment Activities

Through June 30, 2024, the Corporation realized proceeds of approximately $1.6 billion and net after-tax earnings of $0.4 billion from its divestment activities. This included the sale of the Santa Ynez Unit and associated facilities in California, certain conventional and unconventional assets in the United States, as well as other smaller divestments.

In 2023, the Corporation realized proceeds of approximately $4.1 billion and recognized net after-tax earnings of approximately $0.6 billion from its divestment activities. This included the sale of the Aera Energy joint venture, Esso Thailand Ltd., the Billings Refinery, certain unconventional assets in the United States, as well as other smaller divestments.

In February 2022, the Corporation signed an agreement with Seplat Energy Offshore Limited for the sale of Mobil Producing Nigeria Unlimited. The agreement is subject to certain conditions precedent and government approvals. In mid-2022, a Nigerian court issued an order to halt transition activities and enter into arbitration with the Nigerian National Petroleum Company. In June 2024, the court order was lifted and arbitration suspended. The closing date and any loss on sale will depend on resolution of the conditions precedent and government approvals.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

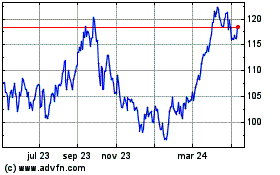

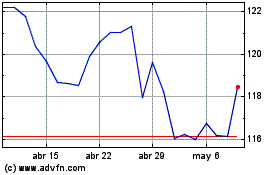

Second quarter crude prices were essentially unchanged versus the first quarter, near the middle of the 10-year historical range (2010-2019), as the market remains relatively balanced. Natural gas prices declined due to lower demand from milder weather, though remained toward the middle of the 10-year range. Industry refining margins declined from the top of the 10-year range to the lower half of the range, as increased supply more than met record global demand in the second quarter. Chemical margins showed a slight improvement compared to the first quarter of 2024, although margins remained at bottom-of-cycle conditions and well below the 10-year range, as capacity additions outpaced demand growth.

Recent Mergers and Acquisitions

On May 3, 2024, ExxonMobil acquired Pioneer Natural Resources Company (Pioneer), an independent oil and gas exploration and production company. See "Note 2. Pioneer Natural Resources Merger" of the Condensed Consolidated Financial Statements for additional information.

Selected Earnings Factor Definitions

The updated earnings factors introduced in the first quarter 2024 provide additional visibility into drivers of our business results. The company evaluates these factors periodically to determine if any enhancements may provide helpful insights to the market. Listed below are descriptions of the earnings factors:

Advantaged Volume Growth. Earnings impacts from change in volume/mix from advantaged assets, strategic projects, and high-value products.

•Advantaged Assets (Advantaged growth projects). Includes Permian (heritage Permian (1) and Pioneer), Guyana, Brazil, and LNG.

•Strategic Projects. Includes (i) the following completed projects: Rotterdam Hydrocracker, Corpus Christi Chemical Complex, Baton Rouge Polypropylene, Beaumont Crude Expansion, Baytown Chemical Expansion, Permian Crude Venture, and the 2022 Baytown advanced recycling facility; and (ii) the following projects still to be completed: Fawley Hydrofiner, China Chemical Complex, Singapore Resid Upgrade, Strathcona Renewable Diesel, ProxximaTM Venture, USGC Reconfiguration, additional advanced recycling projects under evaluation worldwide, and additional projects in plan yet to be publicly announced.

•High-Value Products. Includes performance products and lower-emission fuels. Performance products (performance chemicals, performance lubricants) refers to products that provide differentiated performance for multiple applications through enhanced properties versus commodity alternatives and bring significant additional value to customers and end-users. Lower-emission fuels refers to fuels with lower life cycle emissions than conventional transportation fuels for gasoline, diesel and jet transport.

Base Volume. Includes all volume/mix factors not included in Advantaged Volume Growth defined above.

Structural Cost Savings. After-tax earnings effect of Structural Cost Savings as defined on page 21, including cash operating expenses related to divestments that were previously in the "volume/mix" factor.

Expenses. Includes all expenses otherwise not included in other earnings factors.

Timing Effects. Timing effects are primarily related to unsettled derivatives (mark-to-market) and other earnings impacts driven by timing differences between the settlement of derivatives and their offsetting physical commodity realizations (due to LIFO inventory accounting).

(1) Heritage Permian basin assets exclude assets acquired as part of the acquisition of Pioneer that closed May 3, 2024.

Earnings (loss) excluding Identified Items

Earnings (loss) excluding Identified Items (non-GAAP) are earnings (loss) excluding individually significant non-operational events with, typically, an absolute corporate total earnings impact of at least $250 million in a given quarter. The earnings (loss) impact of an Identified Item for an individual segment in a given quarter may be less than $250 million when the item impacts several periods or several segments. Earnings (loss) excluding identified items does include non-operational earnings events or impacts that are generally below the $250 million threshold utilized for Identified Items. Management uses these figures to improve comparability of the underlying business across multiple periods by isolating and removing significant non-operational events from business results. The Corporation believes this view provides investors increased transparency into business results and trends and provides investors with a view of the business as seen through the eyes of management. Earnings (loss) excluding Identified Items is not meant to be viewed in isolation or as a substitute for net income (loss) attributable to ExxonMobil as prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

June 30, 2024 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

Earnings (loss) (U.S. GAAP) | 2,430 | | 4,644 | | | 450 | | 496 | | | 526 | | 253 | | 447 | | 304 | | | | (310) | | | 9,240 | |

| Identified Items | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total Identified Items | — | | — | | | — | | — | | | — | | — | | — | | — | | | | — | | | — | |

Earnings (loss) excluding Identified Items (Non-GAAP) | 2,430 | | 4,644 | | | 450 | | 496 | | | 526 | | 253 | | 447 | | 304 | | | | (310) | | | 9,240 | |

| | | | | | | | | | | | | | | |

Three Months Ended

June 30, 2023 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

Earnings (loss) (U.S. GAAP) | 920 | | 3,657 | | | 1,528 | | 782 | | | 486 | | 342 | | 373 | | 298 | | | | (506) | | | 7,880 | |

| Identified Items | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Tax-related items | — | | (12) | | | — | | 18 | | | — | | — | | — | | — | | | | — | | | 6 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Earnings (loss) excluding Identified Items (Non-GAAP) | 920 | | 3,669 | | | 1,528 | | 764 | | | 486 | | 342 | | 373 | | 298 | | | | (506) | | | 7,874 | |

| | | | | | | | | | | | | | | |

Six Months Ended

June 30, 2024 | Upstream | | Energy Products | | Chemical Products | Specialty Products | | | Corporate and Financing | | Total |

| (millions of dollars) | U.S. | Non-U.S. | | U.S. | Non-U.S. | | U.S. | Non-U.S. | U.S. | Non-U.S. | | | |

Earnings (loss) (U.S. GAAP) | 3,484 | | 9,250 | | | 1,286 | | 1,036 | | | 1,030 | | 534 | | 851 | | 661 | | | | (672) | | | 17,460 | |

| Identified Items | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |