Alaris Equity Partners Income Trust (together, as applicable, with

its subsidiaries, “

Alaris” or the

"

Trust") is pleased to announce its results for

the three and six months ended June 30, 2024. The results are

prepared in accordance with IFRS Accounting Standards as issued by

the International Accounting Standards Board. All amounts below are

in Canadian dollars unless otherwise noted.

In January 2024, Alaris determined that it met

the definition of an investment entity, as defined by IFRS 10,

Consolidated financial statements. This change in status has

fundamentally changed how Alaris prepares, presents and discusses

its financial results relative to prior periods. IFRS requires that

this change in accounting be made prospectively and as a result

prior periods are not restated to reflect the change in Alaris’

investment entity status. Accordingly, the readers of this press

release, Alaris’ second quarter interim MD&A and unaudited

condensed consolidated interim financial statements should exercise

significant caution in reviewing, considering, and drawing

conclusions from period-to-period comparisons and changes, as the

direct comparisons between dates or across periods can be

inappropriate if not carefully considered in this context.

Highlights:

-

For the three months ended June 30, 2024 Alaris generated $0.36 per

unit of additional book value, improving this metric to

$22.01;

-

For the three months ended June 30, 2024 the Trust, together with

its wholly owned subsidiaries (the “Acquisition

Entities”), earned a total of $42.1 million of revenue,

including, $41.6 million of Partner Distribution revenue net of

foreign exchange, and $0.5 million of transaction fee income, which

was ahead of previous guidance of $39.3 million, and compares to

$36.9 million of Partner Revenue in Q2 2023, an increase of

14%;

-

During the quarter the Trust, via the Acquisition Entities,

invested $69.8 million of capital including: US$20.0 million in a

new partner Cresa, LLC (“Cresa”), US$27.5 million

to facilitate an acquisition by The Shipyard, LLC

(“Shipyard”) along with smaller follow on

investments into existing partners. This incremental investment

brings the total capital deployed for the six months ended June 30,

2024 to $77.5 million;

-

Alaris net distributable cash flow (6) for the six months ended

June 30, 2024 of $55.2 million or $1.21 per unit increased by 14%

and 13% respectively, from $48.5 million and $1.07 per unit in the

six months ended June 30, 2023 after adjusting the comparable

period for non-recurring settlement and litigation costs that

occurred in 2023;

-

The Actual Payout Ratio (2) for the Trust, based on Alaris net

distributable cash flow (8) for the six months ended June 30, 2024

was 56%;

- The

current weighted average combined Earnings Coverage Ratio (3) for

Alaris’ Partners remains at approximately 1.5x with ten of nineteen

Partners greater than 1.5x. In addition, eleven of our partners

have either no debt or less than 1.0x Senior Debt to EBITDA on a

trailing twelve-month basis.

“Another positive quarter for our company.

Stable portfolio performance, a low payout ratio and ample room on

our balance sheet set us up for continued growth in the second half

of the year. Deployment opportunities into both current and

prospectively new partners are in various stages of their processes

and we continue to be encouraged by the current deal

environment. Having declining borrowing costs in Canada while

being able to invest in a higher rate, higher growth environment in

the U.S. is an excellent position to be in for Alaris.”” said Steve

King President and CEO.

Results of Operations

Note where the financial information for Q2 2024

is comparable to specific information from the prior period Q2 2023

condensed consolidated interim financial statements, amounts have

been provided for comparative purposes. As noted above, users of

this press release, interim management discussion and analysis and

the unaudited condensed consolidated interim financial statements

to which it relates should exercise significant caution in

reviewing, considering and drawing conclusions from

period-to-period comparisons and changes.

|

Per Unit Results |

Three months ended |

Six months ended |

|

Period ending June 30 |

|

2024 |

|

2023 |

% Change |

|

2024 |

|

2023 |

% Change |

|

Partner related changes in net gain on Corporate Investment |

$ |

0.91 |

$ |

1.02 |

-10.8 |

% |

$ |

1.95 |

$ |

1.84 |

+6.0 |

% |

| Adjusted

EBITDA |

$ |

0.79 |

$ |

0.98 |

-19.4 |

% |

$ |

1.65 |

$ |

1.64 |

+0.6 |

% |

|

Alaris net distributable cashflow |

$ |

0.70 |

$ |

0.23 |

+204.3 |

% |

$ |

1.21 |

$ |

0.77 |

+57.1 |

% |

| Fully

diluted earnings |

$ |

0.69 |

$ |

0.61 |

+13.1 |

% |

$ |

2.30 |

$ |

0.74 |

+210.8 |

% |

|

Weighted average basic units (000’s) |

|

45,498 |

|

45,487 |

|

|

45,498 |

|

45,423 |

|

During the three months ended June 30, 2024, Partner related

changes in net gain on Corporate Investments (5), decreased by

10.8% as compared to the three months ended June 30, 2023.

Preferred Partner Distribution revenue increased by 7.5% during the

three months ended Q2 2024, driven by new investments in Federal

Management Partners, LLC (“FMP”), Shipyard and

Cresa, as well as LMS Management LP and LMS Reinforcing Steel USA

LP (collectively, “LMS”) paying full Distributions

as compared to 2023, when LMS had deferred Distributions for the

first half of the year. These increases were partially offset by a

reduction in Partner Distributions in Q2 2024 due to the redemption

of Brown & Settle Investments, LLC and a subsidiary thereof

(collectively, “Brown & Settle”), which

occurred in April 2024, and Heritage deferring Distributions to

support cashflow flexibility. Common distributions received from

Partner investments also increased in the quarter. These increases

were offset by a net impact of realized and unrealized loss on

Partner investments of $0.2 million, which is made up of varying

increases and decreases to the fair value of Partner investments.

During the six months ended June 30, 2024, Partner related changes

in net gain on Corporate Investments (5), increased by 6.0% as

compared to the six months ended June 30, 2023. This increase is

reflective of net increases in revenue and income from Partners,

partially offset by a lower net gain to the realized and unrealized

fair value on Partner investments. Net realized and unrealized

gains on Partner investments decreased in the six months ended June

30, 2024 to $8.4 million, as compared to $10.8 million in the prior

period.

For the three months ended June 30, 2024,

Adjusted EBITDA (1) per unit decreased by 19.4% compared to Q2 2023

primarily due to the net realized and unrealized loss to the fair

value of Partner investments in Q2 2024 and a net realized and

unrealized gain in the prior quarter. Partially offsetting the

decrease in Adjusted EBITDA (1) per unit was an increase in Partner

Distribution revenue in Q2 2024. During the six months ended June

30, 2024, Adjusted EBITDA (1) per unit remained relatively

consistent with a nominal increase year over year. Higher Partner

Distribution revenue in the six months ended June 30, 2024 was

partially offset by a lower net realized and unrealized gain to the

fair value of Partner investments as compared to the prior

year.

Alaris’ net distributable cashflow (6) provides

a summary of third-party cash receipts less operating cash outflows

by the Trust in combination with the Acquisition Entities. Alaris’

net distributable cashflow (6) per unit increased by 57.1% in the

six months ended June 30, 2024 as compared to Q2 2023. The increase

is primarily due to the Sandbox settlement in the prior year and

associated legal costs, as well as higher Partner Distribution

revenue during the current year. These increases in the current

period’s per unit Alaris net distributable cashflow (6) are

partially offset by higher total cash interest paid in in the

period as a result of the senior credit facility having a higher

realized interest rate on a larger average amount of debt

outstanding as compared to Q2 2023. The Actual Payout Ratio (2) for

the Trust, based on Alaris net distributable cashflow (6) for the

six months ended June 30, 2024, is 56%.

As of at June 30, 2024, net book value (4)

increased by $0.90 per unit to $22.01 per unit as compared to

$21.12 per unit at December 31, 2023. The increase in per unit net

book value (4) is the result of the $2.32 basic earnings per unit

in the six months ended June 30, 2024, less the earnings impact of

the gain on reclassification of the translation reserve of $0.74

per unit, and further reduced by the quarterly dividends declared

and paid a total of $0.68 per unit.

Outlook

During the six months ended June 30, 2024, the

Trust, through its Acquisition Entities invested approximately

$77.5 million, which was used in follow-on Partner investments and

the addition of Cresa as a new partner. Also, during the quarter,

the Trust’s investment in Brown & Settle was fully redeemed.

These transactions, along with Alaris’ total investment portfolio

are included in Run Rate Revenue (7) for the next twelve months,

which is expected to be approximately $163 million as detailed in

the outlook below. This includes current contracted amounts, an

additional US$0.5 million from Ohana related to Distributions

deferred during the COVID-19 pandemic, and an estimated $12.5

million of common dividends. In Q2 2024, the Trust together with

its Acquisition Entities earned $42.1 million, $41.6 million in

Partner Distributions net of foreign exchange and $0.5 million of

third party transaction fee revenue, which was ahead of previous

guidance of $39.3 million, primarily due to Shipyard’s follow on

investments that occurred subsequent to Q1 2024 as well a higher

exchange rate on US denominated distributions. Alaris expects total

revenue from its Partners in Q3 2024 of approximately $38.7

million.

The Run Rate Cash Flow (8) table below outlines

the Trust and its Acquisitions Entities combined expectation for

Partners Distribution revenue, transaction fee revenue, general and

administrative expenses, third party interest expense, tax expense

and distributions to unitholders for the next twelve months. The

Run Rate Cash Flow (8) is a forward looking supplementary financial

measure and outlines the net cash from operating activities, less

the distributions paid, that Alaris is expecting to generate over

the next twelve months. The Trust’s method of calculating this

measure may differ from the methods used by other issuers.

Therefore, it may not be comparable to similar measures presented

by other issuers.

Run rate general and administrative expenses are

currently estimated at $16.5 million and include all public company

costs incurred by the Trust and its Acquisition Entities. The

Trust’s Run Rate Payout Ratio (9) is expected to be within a range

of 65% and 70% when including Run Rate Revenue (7), overhead

expenses and its existing capital structure. The table below sets

out our estimated Run Rate Cash Flow (8) as well as the after-tax

impact of positive net investment, the impact of every 1% increase

in Secure Overnight Financing Rate (“SOFR”) based

on current outstanding USD debt and the impact of every $0.01

change in the USD to CAD exchange rate.

|

Run Rate Cash Flow ($ thousands except per

unit) |

Amount ($) |

$ / Unit |

|

Run Rate Revenue, Partner Distribution

revenue |

$ |

162,600 |

|

$ |

3.57 |

|

|

General and administrative expenses |

|

(16,500 |

) |

|

(0.36 |

) |

|

Third party Interest and taxes |

|

|

(56,100 |

) |

|

(1.23 |

) |

|

Net cash from operating activities |

$ |

90,000 |

|

$ |

1.98 |

|

|

Distributions paid |

|

|

(61,900 |

) |

|

(1.36 |

) |

|

Run Rate Cash Flow |

|

$ |

28,100 |

|

$ |

0.62 |

|

|

|

|

|

|

|

Other considerations (after taxes and

interest): |

|

|

|

New investments |

Every $50

million deployed @ 14% |

|

+2,325 |

|

|

+0.05 |

|

|

Interest rates |

Every 1.0%

increase in SOFR |

|

-2,400 |

|

|

-0.05 |

|

|

USD to CAD |

Every $0.01 change of USD to CAD |

+/- 900 |

+/- 0.02 |

Alaris’ financial statements and MD&A are available on

SEDAR+ at www.sedarplus.ca and on our website at

www.alarisequitypartners.com.

Earnings Release Date and Conference

Call Details

Alaris management will host a conference call at

9am MT (11am ET), Friday, August 2, 2024 to discuss the financial

results and outlook for the Trust.

Participants must register for the call using

this link: Q2 2024 Conference Call. Pre-register to receive the

dial-in numbers and unique PIN to access the call seamlessly. It is

recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call). Participants can access the webcast here: Q2 Webcast. A

replay of the webcast will be available two hours after the call

and archived on the same web page for six months. Participants can

also find the link on our website, stored under the “Investors”

section – “Presentations and Events”, at

www.alarisequitypartners.com.

An updated corporate presentation will be posted

to the Trust’s website within 24 hours at

www.alarisequitypartners.com.

About the Trust:

Alaris’ investment and investing activity refers

to providing, through the Acquisition Entities, alternative equity

to private companies (“Partners”) to meet their

business and capital objectives, which includes management buyouts,

dividend recapitalization, growth and acquisitions. Alaris achieves

this by investing its unitholder capital, as well as debt, through

the Acquisition Entities, in exchange for distributions, dividends

or interest (collectively, “Distributions”) as

well as capital appreciation on both preferred and common equity,

with the principal objectives of generating predictable cash flows

for distribution payments to its unitholders and growing net book

value through returns from capital appreciation. Distributions,

other than common equity Distributions, from the Partners are

adjusted annually based on the percentage change of a “top-line”

financial performance measure such as gross margin or same store

sales and rank in priority to common equity position.

Non-GAAP and Other Financial

Measures

The terms Adjusted Earnings, components of

Corporate investments, EBITDA, Adjusted EBITDA, Extended group net

distributable cashflow, Earnings Coverage Ratio, Run Rate Payout

Ratio, Actual Payout Ratio, Run Rate Revenue, Run Rate Cash Flow,

and Per Unit amounts (collectively, the “Non-GAAP and Other

Financial Measures”) are financial measures used in this

MD&A that are not standard measures under International

Financial Reporting Standards (“IFRS”) . The

Trust’s method of calculating the Non-GAAP and Other Financial

Measures may differ from the methods used by other issuers.

Therefore, the Trust’s Non-GAAP and Other Financial Measures may

not be comparable to similar measures presented by other

issuers.

(1) “Adjusted EBITDA” and

“EBITDA: are Non-GAAP financial measures and refer

to earnings determined in accordance with IFRS, before depreciation

and amortization, interest expense (finance costs) and income tax

expense. EBITDA is used by management and many investors to

determine the ability of an issuer to generate cash from

operations. “Adjusted EBITDA” and

“Adjusted EBITDA per unit”, which is a non-GAAP

ratio that removes the impact from unrealized fluctuations in

exchange rates and their impact on the Trust’s investments at fair

value, as well as one time items and the impact of finance costs

and taxes included within the net gain on Corporate Investments

incurred by the Acquisition Entities and, on a per unit basis, is

and the same amount divided by weighted average basic units

outstanding. Management believes Adjusted EBITDA, EBITDA and

Adjusted EBITDA per unit are useful supplemental measures from

which to determine the Trust’s ability to generate cash available

for servicing its loans and borrowings, income taxes and

distributions to unitholders. The Trust’s method of calculating

these Non-GAAP financial measures may differ from the methods used

by other issuers. Therefore, they may not be comparable to similar

measures and ratios presented by other issuers.

|

|

Three months ended June 30 |

Six months ended June 30 |

|

$ thousands except per unit amounts |

|

2024 |

|

|

2023 |

% Change |

|

2024 |

|

|

2023 |

% Change |

|

Earnings |

$ |

31,675 |

|

$ |

28,387 |

|

$ |

105,448 |

|

$ |

33,940 |

|

|

Depreciation and amortization |

|

135 |

|

|

55 |

|

|

261 |

|

|

111 |

|

|

Finance costs |

|

1,150 |

|

|

6,882 |

|

|

2,295 |

|

|

13,399 |

|

|

Total income tax expense |

|

585 |

|

|

4,593 |

|

|

303 |

|

|

9,291 |

|

|

EBITDA |

$ |

33,545 |

|

$ |

39,917 |

-16.0 |

% |

$ |

108,307 |

|

$ |

56,741 |

+90.9 |

% |

|

Adjustments: |

|

|

|

|

|

|

|

Gain on derecognition of previously consolidated entities |

$ |

- |

|

$ |

- |

|

$ |

(30,260 |

) |

$ |

- |

|

|

Foreign exchange |

|

(9,779 |

) |

|

3,888 |

|

|

(30,558 |

) |

|

4,103 |

|

|

Sandbox litigation and legal costs |

|

- |

|

|

576 |

|

|

- |

|

|

13,676 |

|

|

Finance costs, senior credit facility and convertible

debentures |

|

7,220 |

|

|

- |

|

|

15,231 |

|

|

- |

|

|

Acquisition Entities income tax expense - current |

|

2,000 |

|

|

- |

|

|

7,031 |

|

|

- |

|

|

Acquisition Entities income tax expense - deferred |

|

2,838 |

|

|

- |

|

|

5,163 |

|

|

- |

|

|

Adjusted EBITDA |

$ |

35,824 |

|

$ |

44,381 |

-19.3 |

% |

$ |

74,914 |

|

$ |

74,520 |

+0.5 |

% |

|

Adjusted EBITDA per unit |

$ |

0.79 |

|

$ |

0.98 |

-19.4 |

% |

$ |

1.65 |

|

$ |

1.64 |

+0.6 |

% |

(2) “Actual Payout Ratio” is a supplementary

financial measure and refers to Alaris’ total distributions paid

during the period (annually or quarterly) divided by the actual net

cash from operating activities Alaris generated for the period. It

represents the net cash from operating activities after

distributions paid to unitholders available for either repayments

of senior debt and/or to be used in investing activities.

(3) “Earnings Coverage Ratio

(“ECR”)” is a supplementary financial measure and refers

to the EBITDA of a Partner divided by such Partner’s sum of debt

servicing (interest and principal), unfunded capital expenditures

and distributions to Alaris. Management believes the earnings

coverage ratio is a useful metric in assessing our partners

continued ability to make their contracted distributions.

(4) “Net book value” and

“net book value per unit” are Non-GAAP financial

measures and represents the equity value of the company or total

assts less total liabilities and the same amount divided by

weighted average basic units outstanding. Net book value and net

book value per unit are used by management to determine the growth

in assets over the period net of amounts paid out to unitholders as

distributions. Management believes net book value and net book

value per unit are useful supplemental measures from which to

compare the Trust’s growth period over period. The Trust’s method

of calculating these Non-GAAP financial measures may differ from

the methods used by other issuers. Therefore, they may not be

comparable to similar measures presented by other issuers.

|

|

30-Jun |

31-Dec |

|

|

|

|

$ thousands except per unit amounts |

|

2024 |

|

2023 |

|

Change in |

% Change |

|

Total Assets |

$ |

1,093,177 |

$ |

1,474,894 |

|

|

|

|

Total Liabilities |

$ |

91,556 |

$ |

514,071 |

|

|

|

|

Net book value |

$ |

1,001,621 |

$ |

960,823 |

|

$ |

40,798 |

+4.2 |

% |

|

Weighted average basic units (000's) |

|

45,498 |

|

45,498 |

|

|

|

|

Net book value per unit |

$ |

22.01 |

$ |

21.12 |

|

$ |

0.90 |

+4.2 |

% |

(5) “Partner related changes in net gain on Corporate

Investments” The components of Corporate Investments are

Non-GAAP financial measures and are presented for better

comparability to prior year reporting. These amounts are reconciled

to information from note 3 of the condensed consolidated interim

financial statements below. The Trust’s method of calculating these

Non-GAAP financial measures may differ from the methods used by

other issuers. Therefore, they may not be comparable to similar

measures presented by other issuers.

|

|

Three months ended June 30 |

Six months ended June 30 |

|

$ thousands |

|

2024 |

|

|

2023 |

% Change |

|

2024 |

|

|

2023 |

|

% Change |

|

Partner Distribution revenue - Preferred, including realized

foreign exchange Note 1 |

$ |

37,848 |

|

$ |

35,204 |

+7.5 |

% |

$ |

76,041 |

|

$ |

70,700 |

|

+7.6 |

% |

|

Partner Distribution revenue - Common |

$ |

3,705 |

|

$ |

1,152 |

+221.6 |

% |

$ |

4,306 |

|

$ |

2,088 |

|

+106.2 |

% |

|

Net realized gain from Partners investments Note

2 |

$ |

7,017 |

|

$ |

49 |

+14220.4 |

% |

$ |

8,976 |

|

$ |

12,549 |

|

-28.5 |

% |

|

Net unrealized gain / (loss) on Partners investments Note

2 |

$ |

(7,218 |

) |

$ |

9,938 |

-172.6 |

% |

$ |

(543 |

) |

$ |

(1,740 |

) |

+68.8 |

% |

|

Partner related changes in net gain on Corporate

Investment |

$ |

41,352 |

|

$ |

46,343 |

-10.8 |

% |

$ |

88,780 |

|

$ |

83,597 |

|

+6.2 |

% |

|

Partner related changes in net gain on Corporate Investment per

unit |

$ |

0.91 |

|

$ |

1.02 |

-10.8 |

% |

$ |

1.95 |

|

$ |

1.84 |

|

+6.0 |

% |

Note 1 – In Q2 2023, Partner

Distribution revenue – Preferred, including realized foreign

exchange and Partner Distribution revenue - Common were presented

as one line on the face of the income statement titled “Revenues,

including realized foreign exchange gain” in the amount of $36,853

for the three months ended and $73,541 for the six months ended.

Prior period Partner Distribution revenue – Preferred, including

realized foreign exchange for the three and six months ended June

30, 2024 above has been adjusted to exclude Sono Bello’s management

fee income (Q2 2023 three months - $496, Q2 2023 six months ended -

$753) for period over period comparability, which in 2024 is

recognized in the Trust’s Management and advisory fee income.

Note 2 - The Net realized and

unrealized gain / (loss) on Partner investments, which is the sum

of Net realized gain from Partner investments and Net unrealized

gain / ( loss) on Partner Investments, for the three and six months

ended June 30, 2024 is a loss of $0.2 million and gain of $8.4

million respectively, and for the three and six months ended June

30, 2023 are gains of $10.0 million and $10.8 million

respectively.

(6) “Alaris net distributable

cashflow” is a non-GAAP measure that refers to all sources

of external revenue in both the Trust and the Acquisition Entities

less all general and administrative expenses, third party interest

expense and tax expense. Alaris net distributable cashflow is a

useful metric for management and investors as it provides a summary

of the total cash from operating activities that can be used to pay

the Trust distribution, repay senior debt and/or be used for

additional investment purposes. The Trust’s method of calculating

this Non-GAAP measure may differ from the methods used by other

issuers. Therefore, it may not be comparable to similar measures

presented by other issuers. The 2023 comparatives are presented

prior to the Trust’s change in status as a investment entity and

have been aligned with the most comparative balance in the 2024

presentation.

|

|

Six months ended June 30 |

|

$ thousands except per unit amounts |

|

2024 |

|

|

2023 |

|

% Change |

|

Partner Distribution revenue - Preferred, including realized

foreign exchange |

$ |

76,041 |

|

$ |

70,700 |

|

|

|

Partner Distribution revenue - Common |

|

4,306 |

|

|

2,088 |

|

|

|

Third party management and advisory fees |

|

1,022 |

|

|

753 |

|

|

|

|

|

|

|

|

Expenditures of the Trust: |

|

|

|

|

General and administrative |

|

(8,824 |

) |

|

(20,389 |

) |

|

|

Current income tax expense |

|

(836 |

) |

|

- |

|

|

|

Third party cash interest paid by the Trust |

|

(2,031 |

) |

|

(2,030 |

) |

|

|

|

|

|

|

|

Expenditures incurred by Acquisition Entities: |

|

|

|

|

Operating costs and other |

|

(1,759 |

) |

|

(1,118 |

) |

|

|

Transactions costs |

|

(2,153 |

) |

|

(1,511 |

) |

|

|

Acquisition Entities income tax expense - current |

|

(7,031 |

) |

|

(6,202 |

) |

|

|

Cash interest paid, senior credit facility and convertible

debentures |

|

(11,370 |

) |

|

(6,257 |

) |

|

|

|

|

|

|

|

Alaris' changes in net working capital |

|

7,816 |

|

|

(1,190 |

) |

|

|

Alaris net distributable cashflow |

$ |

55,181 |

|

$ |

34,844 |

|

+58.4 |

% |

|

Alaris net distributable cashflow per unit |

$ |

1.21 |

|

$ |

0.77 |

|

+57.1 |

% |

(7) “Run Rate Revenue” is a supplementary

financial measure and refers to Alaris’ total revenue expected to

be generated over the next twelve months based on contracted

distributions from current Partners, excluding any potential

Partner redemptions, it also includes an estimate for common

dividends or distributions based on past practices, where

applicable. Run Rate Revenue is a useful metric as it provides an

expectation for the amount of revenue Alaris can expect to generate

in the next twelve months based on information known.

(8) “Run Rate Cash Flow” is a

Non-GAAP financial measure and outlines the net cash from operating

activities, net of distributions paid, that Alaris is expecting to

have after the next twelve months. This measure is comparable to

net cash from operating activities less distributions paid, as

outlined in Alaris’ consolidated statements of cash flows.

(9) “Run Rate Payout Ratio” is

a Non-GAAP financial ratio that refers to Alaris’ distributions per

unit expected to be paid over the next twelve months divided by the

net cash from operating activities per unit calculated in the Run

Rate Cash Flow table. Run Rate Payout Ratio is a useful metric for

Alaris to track and to outline as it provides a summary of the

percentage of the net cash from operating activities that can be

used to either repay senior debt during the next twelve months

and/or be used for additional investment purposes. Run Rate Payout

Ratio is comparable to Actual Payout Ratio as defined above.

(10) “Per Unit” values, other

than earnings per unit, refer to the related financial statement

caption as defined under IFRS or related term as defined herein,

divided by the weighted average basic units outstanding for the

period.

The terms Net Book Value, Components of

Corporate investments, EBITDA, Adjusted EBITDA, Alaris net

distributable cashflow, Earnings Coverage Ratio, Run Rate Payout

Ratio, Actual Payout Ratio, Run Rate Revenue, Run Rate Cash Flow

and Per Unit amounts should only be used in conjunction with the

Trust’s unaudited interim condensed consolidated financial

statements, complete versions of which available on SEDAR+ at

www.sedarplus.ca.

Forward-Looking Statements

This news release contains forward-looking

information and forward-looking statements (collectively,

“forward-looking statements”) under applicable securities laws,

including any applicable “safe harbor” provisions. Statements other

than statements of historical fact contained in this news release

are forward-looking statements, including, without limitation,

management's expectations, intentions and beliefs concerning the

growth, results of operations, performance of the Trust and the

Partners, the future financial position or results of the Trust,

business strategy and plans and objectives of or involving the

Trust or the Partners. Many of these statements can be identified

by looking for words such as "believe", "expects", "will",

"intends", "projects", "anticipates", "estimates", "continues" or

similar words or the negative thereof. In particular, this news

release contains forward-looking statements regarding: the

anticipated financial and operating performance of the Partners;

the attractiveness of Alaris’ capital offering; the Trust’s Run

Rate Payout Ratio, Run Rate Cash Flow, Run Rate Revenue and total

revenue; the impact of recent new investments and follow-on

investments; expectations regarding receipt (and amount of) any

common equity distributions or dividends from Partners in which

Alaris holds common equity, including the impact on the Trust’s net

cash from operating activities, Run Rate Revenue, Run Rate Cash

Flow and Run Rate Payout Ratio; the use of proceeds from the senior

credit facility; use of proceeds from Partner redemptions; impact

of future deployment; the Trust’s ability to deploy capital; the

yield on the Trust’s investments and expected resets on

Distributions; changes in SOFR and exchange rates; the impact of

deferred Distributions and the timing of repayment there of; the

Trust’s return on its investments; and Alaris’ expenses for 2024.

To the extent any forward-looking statements herein constitute a

financial outlook or future oriented financial information

(collectively, “FOFI”), including estimates

regarding revenues, Distributions from Partners (including expected

resets, restarting full or partial Distributions and common equity

distributions), Run Rate Payout Ratio, Run Rate Cash Flow, net cash

from operating activities, expenses and impact of capital

deployment, they were approved by management as of the date hereof

and have been included to provide an understanding with respect to

Alaris' financial performance and are subject to the same risks and

assumptions disclosed herein. There can be no assurance that the

plans, intentions or expectations upon which these forward-looking

statements are based will occur.

By their nature, forward-looking statements

require Alaris to make assumptions and are subject to inherent

risks and uncertainties. Assumptions about the performance of the

Canadian and U.S. economies over the next 24 months and how that

will affect Alaris’ business and that of its Partners (including,

without limitation, the impact of any global health crisis, like

COVID-19, and global economic and political factors) are material

factors considered by Alaris management when setting the outlook

for Alaris. Key assumptions include, but are not limited to,

assumptions that: the Russia/Ukraine conflict, conflicts in the

Middle East, and other global economic pressures over the next

twelve months will not materially impact Alaris, its Partners or

the global economy; interest rates will not rise in a matter

materially different from the prevailing market expectation over

the next 12 months; global heath crises, like COVID-19 or variants

there of will not impact the economy or our partners operations in

a material way in the next 12 months; the businesses of the

majority of our Partners will continue to grow; more private

companies will require access to alternative sources of capital;

the businesses of new Partners and those of existing Partners will

perform in line with Alaris’ expectations and diligence; and that

Alaris will have the ability to raise required equity and/or debt

financing on acceptable terms. Management of Alaris has also

assumed that the Canadian and U.S. dollar trading pair will remain

in a range of approximately plus or minus 15% of the current rate

over the next 6 months. In determining expectations for economic

growth, management of Alaris primarily considers historical

economic data provided by the Canadian and U.S. governments and

their agencies as well as prevailing economic conditions at the

time of such determinations.

There can be no assurance that the assumptions,

plans, intentions or expectations upon which these forward-looking

statements are based will occur. Forward-looking statements are

subject to risks, uncertainties and assumptions and should not be

read as guarantees or assurances of future performance. The actual

results of the Trust and the Partners could materially differ from

those anticipated in the forward-looking statements contained

herein as a result of certain risk factors, including, but not

limited to, the following: widespread health crisis, like COVID-19

(or its variants), other global economic factors (including,

without limitation, the Russia/Ukraine conflict, conflicts in the

Middle East, inflationary measures and global supply chain

disruptions on the global economy, Trust and the Partners

(including how many Partners will experience a slowdown of their

business and the length of time of such slowdown), the dependence

of Alaris on the Partners, including any new investment structures;

leverage and restrictive covenants under credit facilities;

reliance on key personnel; failure to complete or realize the

anticipated benefit of Alaris’ financing arrangements with the

Partners; a failure to obtain required regulatory approvals on a

timely basis or at all; changes in legislation and regulations and

the interpretations thereof; risks relating to the Partners and

their businesses, including, without limitation, a material change

in the operations of a Partner or the industries they operate in;

inability to close additional Partner contributions or collect

proceeds from any redemptions in a timely fashion on anticipated

terms, or at all; a failure to settle outstanding litigation on

expected terms, or at all; a change in the ability of the Partners

to continue to pay Alaris at expected Distribution levels or

restart distributions (in full or in part); a failure to collect

material deferred Distributions; a change in the unaudited

information provided to the Trust; and a failure to realize the

benefits of any concessions or relief measures provided by Alaris

to any Partner or to successfully execute an exit strategy for a

Partner where desired. Additional risks that may cause actual

results to vary from those indicated are discussed under the

heading “Risk Factors” and “Forward Looking Statements” in Alaris’

Management Discussion and Analysis and Annual Information Form for

the year ended December 31, 2023, which is or will be (in the case

of the AIF) filed under Alaris’ profile at www.sedarplus.ca and on

its website at www.alarisequitypartners.com.

Readers are cautioned that the assumptions used

in the preparation of forward-looking statements, including FOFI,

although considered reasonable at the time of preparation, based on

information in Alaris’ possession as of the date hereof, may prove

to be imprecise. In addition, there are a number of factors that

could cause Alaris’ actual results, performance or achievement to

differ materially from those expressed in, or implied by, forward

looking statements and FOFI, or if any of them do so occur, what

benefits the Trust will derive therefrom. As such, undue reliance

should not be placed on any forward-looking statements, including

FOFI.

The Trust has included the forward-looking

statements and FOFI in order to provide readers with a more

complete perspective on Alaris’ future operations and such

information may not be appropriate for other purposes. The

forward-looking statements, including FOFI, contained herein are

expressly qualified in their entirety by this cautionary statement.

Alaris disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

For more information please contact:

Investor RelationsAlaris Equity Partners Income

Trust403-260-1457ir@alarisequity.com

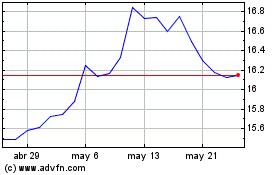

Alaris Equity Partners I... (TSX:AD.UN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alaris Equity Partners I... (TSX:AD.UN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024