Altius Minerals Corporation (“Altius”) (ALS:TSX) is pleased to

provide an update on its Project Generation (“PG”) business

activities and its public junior equities portfolio. The market

value of the junior equities portfolio at September 30, 2018 was

$67.8 million, compared to $60.3 million at June 30, 2018. In the

same period, the S&P/ TSX Venture Diversified Metals &

Mining Index was down 14%. Most of the change in the Altius

portfolio comes from equity appreciation while new purchases and

shares received from new project vend outs account for roughly $1.5

million of the increased value. The $67.8 million value does not

include the $10 million Champion Iron Ore convertible debenture,

which is convertible to equity at $1 per share, or any in-the-money

warrants held in the portfolio. An updated list of the public

equity holdings has been posted to the Altius website at

http://altiusminerals.com/projects/junior-equities.

Project Updates and New AgreementsOn September 26th

Alderon Iron Ore Corp. (TSX:IRON) announced the results of an

updated Feasibility Study on its flagship Kami Iron Ore Project in

Western Labrador, which confirmed the strong economics of the

project based on its ability to produce a premium-quality iron ore

concentrate with high iron content and ultra-low impurities. The

Feasibility Study indicated a $1.698 billion net present value (8%

discount rate) and an IRR of 24.6%, with estimated initial capital

costs of $982.4 million. Based on the updated Feasibility Study

mine life is expected to be 23 years, with a four-year payback

period (https://www.alderonironore.com/news-releases).

Altius is a major shareholder of Alderon and holds a 3% gross sales

royalty (“GSR”) on the Kami project.

In July, Allegiance Coal Limited (ASX:AHQ) announced a target

production rate of 750,000 saleable tonnes of metallurgical coal

over a mine life of approximately 22 years during the first phase

of its Telkwa metallurgical coal project. Subsequently, in

September the company announced a private placement raising A$2.4

million with proceeds largely directed toward completion of a

definitive feasibility study and permitting. Altius is a major

shareholder of Allegiance and holds a sliding-scale royalty on the

Telkwa project.

Following the quarter end, on October 5, 2018 Excelsior Mining

Corp. (“Excelsior”) (TSX:MIN) announced it had concluded a

settlement agreement that will result in the dismissal of the

appeal filed with respect to the company's Class III underground

injection control (UIC) area permit for the Gunnison copper project

(https://www.excelsiormining.com/news/news-2018/excelsior-mining-confirms-agreement-to-dismiss-uic-permit-appeal).

Excelsior stated that with all key permits in place it will be in

position to commence construction upon the completion of its

project financing plan. Altius is an Excelsior shareholder and

holds a 1% GSR on the project and has an option to acquire a

further 0.5% GSR once a mine construction decision is

formalized.

In August, Canstar Resources Inc. (“Canstar”) (TSX-V:ROX) and

Adventus Zinc Corp. (“Adventus”) (TSX-V:ADZN) completed their Plan

of Arrangement to consolidate the Buchans VMS camp in central

Newfoundland and other prospective zinc projects in the Province.

As part of the arrangement Altius vended its Daniel’s Harbour zinc

project for 2,419,024 common shares of Canstar in addition to the

1,215,000 flow-through shares it previously acquired directly, for

a combined holding of 3,669,024 common shares. In addition to its

equity stake, Altius also holds 2% net smelter return (“NSR”)

royalties on Canstar’s Buchans, Katie, La Poile, and Daniel’s

Harbour projects.

In August, Altius amended its strategic exploration alliance

agreement with Midland Exploration Inc. (“Midland”) (TSX:MD)

relating to exploration in the James Bay area of Quebec by

exchanging its various 50% property interests for 461,487 Midland

common shares and subscribing for an additional 198,386 Midland

common shares. Altius was also granted a 1% NSR royalty on the

alliance projects as part of the revised arrangement, with Midland

receiving an equal 1% NSR royalty on the same projects. This

revised agreement expires December 31, 2019 unless extended for

another two years. The group continues to discover new base and

precious metal prospects on the alliance properties with a goal of

attracting joint venture partners.

On September 24th Altius announced its incorporation of a

private company, Adia Resources Inc. (“Adia”), to accelerate its

ongoing exploration, advancement and financing of its Lynx Diamond

Project in Manitoba. Altius will vend the project into Adia and

retain a significant equity stake as well as a 2.5% GSR on the Lynx

project. It also announced that De Beers Canada Inc. will become a

shareholder of Adia by providing in kind technical services to the

ongoing exploration program

(http://altiusminerals.com/uploads/2018-09-24-ALTIUS-TRANSFERS-LYNX-DIAMONDS-FINAL.pdf).

Junior Equities Portfolio HighlightsEvrim Resources Corp.

(“Evrim”) (EVM:TSX-V), continues to advance the Cuale gold project

in Mexico, where trench results include 156.2 metres grading 9.57

g/t gold, including 64.6 metres grading 20.85 g/t gold

(http://www.evrimresources.com/s/news-releases.asp?ReportID=835632).

Evrim also announced a strategic financing with Newmont Mining

Corporation at $1.50 per share for gross proceeds of ~$7.3 million

to fund further exploration at Cuale. It further announced

conversion of its property interest in the Ermitano project in

Mexico to a 2% NSR royalty in exchange for a US$1.5 million payment

from First Majestic Silver Corp

(http://www.evrimresources.com/s/news-releases.asp?ReportID=835498).

Altius is a major shareholder of Evrim holding 11,464,875 common

shares of the company in addition to 2,000,000 warrants and it

holds a 1.5% NSR royalty on precious metals and a 1.0% NSR royalty

on base metals contained within the Cuale project.

Adventus Zinc Corp. (“Adventus”) (TSX-V:ADZN) continued to

deliver strong infill drilling results from the El Domo VMS deposit

at its Curipamba copper-lead-zinc project in Ecuador, including

19.41 metres of 7.0% copper, 1.61 g/t gold, 3.0% zinc, 18.4 g/t

silver and 0.14% lead. Adventus also announced a $9,200,000

financing at a market price of 90 cents per share with Wheaton

Precious Metals Corp. during the quarter. After participation in

the financing, Altius holds 15,548,861 shares in Adventus as well

as royalties on their portfolio of zinc projects in Ireland.

Sokoman Iron Corp. (“Sokoman”) (TSX-V:SIC) announced drill

results from the Moosehead gold project in Newfoundland that

included 11.9 metres of 44.96 g/t gold from drill hole MH-18-01

(http://www.sokomaniron.com/news/2018/07/24/sokoman-assays-confirm-high-grade-gold-moosehead-project-nl).

Subsequent to this announcement Sokoman completed a $3,000,000

financing and is now well funded to execute a drill program of up

to 10,000 metres which commenced in October. Altius owns 9,182,942

common shares of Sokoman plus 1,800,000 warrants and a 1.5% NSR

royalty on the project.

Constantine Metal Resources Ltd. (CEM:TSX-V), of which Altius is

a substantial shareholder, provided an updated mineral resource

estimate for the Palmer copper-zinc-gold-silver deposit located in

Alaska on September 27, 2018 of an estimated inferred resource of

5.3 million tonnes grading 9.9% zinc equivalent

(http://constantinemetals.com/news/2018/index.php?content_id=273).

Lawrence Winter, Ph.D., P.Geo., Vice‐President of Exploration

for Altius, a Qualified Person as defined by National Instrument

43-101 - Standards of Disclosure for Mineral Projects, is

responsible for the scientific and technical data presented herein

and has reviewed, prepared and approved this release.

More information on Altius projects can be found at

http://www.altiusminerals.com/.

About AltiusAltius directly and indirectly holds

diversified royalties and streams which generate revenue from 15

operating mines. These are located in Canada and Brazil and produce

copper, zinc, nickel, cobalt, iron ore, potash, and thermal

(electrical) and metallurgical coal. The portfolio also includes

numerous predevelopment stage royalties covering a wide spectrum of

mineral commodities and jurisdictions. Altius Minerals also holds a

large portfolio of exploration stage projects which it has

generated for deal making with industry partners that results in

newly created royalties and equity and minority interests. Altius

has 43,002,726 common shares issued and outstanding that are listed

on Canada’s Toronto Stock Exchange. It is a member of both the

S&P/TSX Small Cap and S&P/TSX Global Mining Indices.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181010005223/en/

Altius Minerals CorporationChad

Wellscwells@altiusminerals.comorFlora

Woodfwood@altiusminerals.com1-877-576-2209

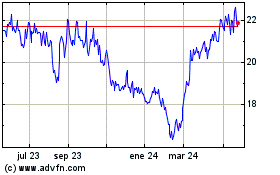

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

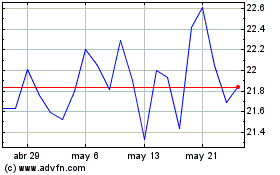

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024