Boralex announces closing of the agreement with Energy Infrastructure Partners to support the implementation of its Strategic Plan in France

29 Abril 2022 - 7:05AM

Boralex Inc. (“Boralex” or the “Company”) (TSX: BLX) is pleased to

announce the closing of February’s reported agreement for the

investment by Energy Infrastructure Partners (“EIP”) in a 30% stake

in Boralex’s assets and development pipeline in France.

Boralex will record this transaction in its

financial statements as of today. Results of Boralex in France will

be consolidated at 100% into Boralex Inc. with a 30% minority

interest and combined results will be equivalent to consolidated

results.

This partnership will strengthen Boralex’s

position in this market and enable it to accelerate its growth to

meet the ambitious objectives in its Strategic Plan which are, for

France, to increase installed capacity to 1.8 GW in 2025 and up to

3 GW in 2030.

Boralex sought a partner with a long-term

vision, able to invest in the Company’s future development in wind

and solar power, as well as storage. EIP has all the qualities

needed for Boralex to continue to stand out in the French

market.

Transaction highlights

- Boralex is

entering into a long-term partnership with EIP, a Switzerland-based

global investment manager specialized in the energy sector, which

is acquiring a 30% stake in Boralex’s operations in France.

- This partnership

includes French assets in operation, 1.1 GW to date, as well as a

1.5 GW portfolio of projects in the French market.

- Boralex’s

operations in France generated EBITDA(A)1 of €134M ($199M CAD2) in

2021.

- Cash proceeds to

Boralex at transaction close is €532M ($717M CAD3) and €17M ($23M

CAD3) thereof will be invested into Boralex operations in France

(through a capital increase).

- Boralex remains

the majority shareholder and manager of its assets in France.

Disclaimer regarding forward-looking

statements

Certain statements contained in this press

release, including those relating to the transaction and the

profits resulting from the transaction, are forward-looking

statements based on current expectations within the meaning of

securities legislation. Forward-looking statements are based on

certain assumptions, including assumptions on the performance of

the business based on management’s expectations and production

estimates and other factors; assumptions about EBITDA(A) margins;

and assumptions about the current industry environment and the

general economic environment, competition and financing

availability. Although Boralex believes that the expectations

reflected in the forward-looking statements contained in this press

release are reasonable, Boralex wishes to clarify that, by their

very nature, forward-looking statements involve risks and

uncertainties, and that its results, or the measures it adopts,

could be significantly different from those indicated or underlying

those statements, or could affect the degree to which a given

forward-looking statement is achieved. Unless otherwise specified

by the Corporation, forward looking statements don’t take into

account the effect that transactions, non-recurring items or other

exceptional items announced or occurring after such statements have

been made may have on the Corporation’s activities. There is no

guarantee that the results, performance or accomplishments, as

expressed or implied in the forward-looking statements, will

materialize. Readers are therefore urged not to rely unduly on

these forward-looking statements. Unless required by applicable

securities legislation, Boralex’s management assumes no obligation

to update or revise forwardlooking statements in light of new

information, future events or other changes.

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As a

leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to 2.5 GW. We are developing a portfolio of more than 3 GW in wind

and solar projects and nearly 200 MW in storage projects, guided by

our values and our corporate social responsibility (CSR) approach.

Through profitable and sustainable growth, Boralex is actively

participating in the fight against global warming. Thanks to our

fearlessness, our discipline, our expertise and our diversity, we

continue to be an industry leader. Boralex’s shares are listed on

the Toronto Stock Exchange under the ticker symbol BLX.

For more information, visit www.boralex.com or

www.sedar.com. Follow us on Facebook, LinkedIn and Twitter.

About Energy Infrastructure Partners AG

Energy Infrastructure Partners AG (EIP) is a

Switzerland-based manager of collective assets focused on high

quality, large-scale renewables and system-critical energy

infrastructure assets. With over CHF 4 billion under management,

EIP leverages an extensive industry network, broad transaction

experience and close partnerships with energy suppliers and the

public sector in order to develop and manage investment solutions

for institutional investors globally. These clients, primarily

pension funds, insurances and large family offices, seek

investments in long-term, visible cash flow-generating assets that

also contribute to security of energy supply, positive economic,

ecological and social development, and the retirement provision of

the population.

For more information:

| Media |

Investor Relations |

| Isabelle FontaineDirector, Public

Affairs and CommunicationsBoralex

inc.819 345-0043isabelle.fontaine@boralex.com |

Stéphane MilotSenior

Director – Investor RelationsBoralex Inc.514

213-1045stephane.milot@boralex.com |

| |

|

| Media –

France (Agency)Anne MassonAgency DirectorOxygen06 07 58 76

37anne@oxygen-rp.com |

|

| |

|

Source: Boralex

Inc.___________________________________________________________________________________________________

1 EBITDA(A) is a total of sector measures. For more details, see

the Non-IFRS financial measures and other financial measures

section of the 2021 Annual Report2 Average rate of 20213 Daily

closing rate of April 28, 2022

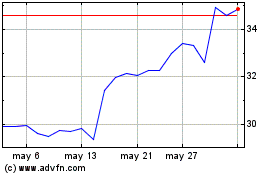

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024