Boralex Inc. (“Boralex” or the “Company”) (TSX: BLX), a leader in

renewable energy, today announced it has completed the acquisition

of EDF Renewables North America’s (“EDF Renewables”) interest in

five operating wind farms with a total installed capacity of 894

megawatts (MW), located in Texas and New Mexico. EDF Renewables’

interest represents 447 MW of installed capacity. With this

acquisition, Boralex's total installed capacity worldwide will

increase to 2,956 MW, marking a significant step towards achieving

Boralex’s 2025 Strategic Plan.

"Located in one of the United States’ most

robust wind resources areas, these wind farms will grow and

diversify our presence in the United States. This acquisition

represents Boralex's entry into the ERCOT (Electric Reliability

Council of Texas) and SPP (Southwest Power Pool) markets,” said

Patrick Decostre, President and Chief Executive Officer of Boralex.

“This acquisition highlights the strategic, creative, and

persistent approach to acquisitions our reputation is built upon. I

am extremely proud of the Boralex team who worked together to make

this a reality.”

“Considering EDF Renewables’ extensive

development capabilities throughout North America, divestures

provide an opportunity to rebalance our portfolio of owned assets,"

said Luis Silva, Chief Financial Officer, EDF Renewables. “We are

grateful to have worked constructively with the local stakeholders

in Texas and New Mexico over the last decade and are pleased to

partner with Boralex on this transfer of ownership.”

Financial Highlights

- Purchase Price, net of cash, and

certain production tax credits receivable: CA$[339.7]M

(US$[249.8]M), subject to customary post-Closing adjustments.1

- Boralex will fund the Purchase

Price from available cash resources.

- There is no existing project debt

and the existing tax equity investors will continue to monetize the

remaining production tax credits.

- The portfolio includes two projects

with 13-year busbar power purchase agreements (“PPAs”) and one

project with a 3-year hub-settled PPA; for a remaining weighted PPA

average life of [10] years. Additionally, the portfolio includes

two fully merchant projects.

- Expected 2023 contribution to

Boralex combined EBITDA (US GAAP) of approximately CA$[39]M

(US$[28]M). The acquisition will be accounted for as an investment

in a joint venture in consolidated financial statements.

- Immediately accretive to

discretionary cash flow (AFFO), with a 2023 contribution of

approximately CA$[25]M (US$[18]M) or CA$[0.24] per share, a [19]%

increase over the consolidated amount generated by Boralex in

2021.

Boralex has a history of optimizing the life

cycle of its sites, as such these wind farms will benefit from

years of experience in operation, maintenance, and repowering.

Furthermore, this acquisition perfectly pairs with Boralex's

organic development activities in the United States. In recognition

of its expertise, Boralex will become the managing member of the

partnership.

Commissioned between 2014 and 2016, EDF

Renewables developed and built all five wind farms utilizing Tier 1

turbine manufacturers. The acquisition will balance Boralex’s

current United States mix of solar and hydro power generation

capacity.

Three of the wind farms have long-term PPAs that

are well structured with well-established off-takers. The PPAs do

not contain fixed shape hedges that have caused recent difficulties

in these markets. The other two wind farms are in strong and stable

merchant markets, and with current condition of inflation, some

merchant exposure will be complementary to the PPAs.

Description of the Assets

Hereford

- Installed capacity: 200 MW

- Commissioned in: 2014

- Power sold merchant

- Location: Deaf Smith County, Texas

Longhorn

- Installed capacity: 200 MW

- Commissioned in: 2015

- Power purchase agreement: 3 years remaining

- Location: Floyd and Briscoe Counties, Texas

Spinning Spur 3

- Installed capacity: 194 MW

- Commissioned in: 2015

- Power purchase agreement: 13 years remaining

- Location: Oldham County, Texas

Milo

- Installed capacity: 50 MW

- Commissioned in: 2016

- Power sold merchant

- Location: Roosevelt County, New Mexico

Roosevelt

- Installed capacity: 250 MW

- Commissioned in: 2015

- Power purchase agreement: 13 years remaining

- Location: Roosevelt County, New Mexico

Location of the Assets

For more information on the acquisition and assets, please see

the official fact sheet.

Advisors

The following service providers assisted Boralex

on this transaction: J.P. Morgan acted as the exclusive buy side

financial advisor; Amis, Patel and Brewers was deal counsel; DNV

served as the independent engineer; Aurora served as the power

market consultant; nFront served as the congestion risk consultant;

Aon provided insurance consulting services; KPMG advised on tax

matters, and Triton Advisory served as accounting advisor.

Conference Call – Thursday, December 29, 2022, at 10:00

a.m. ET

Financial analysts and investors are invited to

attend a conference call today, at 10:00 a.m. ET, during which

Boralex will give more detailed information on the transaction.

To attend the conference

Webcast link:

https://edge.media-server.com/mmc/p/tpsfbu96

To attend the

event by phone: Click here to register for the earnings

call. Once you have completed your registration, you will receive a

confirmation email containing the link and your personal PIN to

connect to the call. If you lose this link and your PIN, you will

be able to register again. You must register if you wish to

attend the call by phone.

Media and other interested individuals are

invited to listen to the conference and view a presentation which

will be broadcasted live and on a deferred basis on Boralex’s

website at www.boralex.com. A full replay will also be available on

Boralex’s website until December 29, 2023.

Caution Regarding Forward-Looking

Statements

Some of the statements contained in this press

release, including those regarding the transaction with EDF

Renewables, the benefits from the transaction and the acquired

interests, the accretion to discretionary cash flows, the expected

EBITDA contribution from the interests acquired, the expected

synergies from the transaction, the expected expiry dates of the

PPAs are forward-looking statements based on current expectations,

within the meaning of securities legislation. The forward-looking

statements are based on material assumptions, including the

following: assumptions about the performance the Company will

obtain from the interests to be acquired, based on management’s

estimates and expectations with respect to factors related to

production and other factors; assumptions made about EBITDA

margins; assumptions made about the situation in the sector and the

economic situation in general, competition and the availability of

financing. Although Boralex believes that the expectations

reflected by the forward-looking statements presented in this news

release are reasonable, Boralex would like to point out that, by

their very nature, forward-looking statements involve risks and

uncertainties such that its results or the measure it adopts could

differ materially from those indicated by or underlying these

statements, or could have an impact on the degree of realization of

a particular forward looking statement. Unless otherwise specified

by the Company, the forward-looking statements do not take into

account the possible impact on its activities, transactions,

non-recurring items or other exceptional items announced or

occurring after the statements are made. There can be no assurance

as to the materialization of the results, performance or

achievements as expressed or implied by forward-looking statements.

The reader is cautioned not to place undue reliance on such

forward-looking statements. Unless required to do so under

applicable securities legislation, Boralex management does not

assume any obligation to update or revise forward-looking

statements to reflect new information, future events or other

changes.

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As a

leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to 3 GW. We are developing a portfolio of close to 4 GW in wind and

solar projects and close to 800 MW in storage projects, guided by

our values and our corporate social responsibility (CSR) approach.

Through profitable and sustainable growth, Boralex is actively

participating in the fight against global warming. Thanks to our

fearlessness, our discipline, our expertise and our diversity, we

continue to be an industry leader. Boralex’s shares are listed on

the Toronto Stock Exchange under the ticker symbol BLX.

For more information, visit www.boralex.com or

www.sedar.com. Follow us on Facebook, LinkedIn and Twitter.

About EDF Renewables

EDF Renewables North America is a market leading

independent power producer and service provider with over 35 years

of expertise in renewable energy. EDF Renewables delivers

grid-scale power: wind (onshore and offshore), solar photovoltaic,

and storage projects; distributed solutions: solar and storage; and

asset optimization: technical, operational, and commercial

expertise to maximize performance of generating projects. EDF

Renewable’s PowerFlex subsidiary offers a full suite of onsite

energy solutions for commercial and industrial customers: solar,

storage, EV charging, energy management systems, and microgrids.

EDF Renewables’ North American portfolio consists of 24 GW of

developed projects and 13 GW under service contracts. EDF

Renewables North America is a subsidiary of EDF Renouvelables, the

dedicated renewable energy affiliate of the EDF Group. For more

information visit: http://edf-re.com.

For more information:

|

Media – Canada |

Investor Relations |

|

Camille LaventureAdvisor, External CommunicationsBoralex

Inc.438-883-8580camille.laventure@boralex.com |

Stéphane MilotSenior Director – Investor RelationsBoralex Inc.514

213-1045stephane.milot@boralex.com |

|

|

|

|

Media – United StatesDarren SuarezVice President,

Public Affairs and Communications, North AmericaBoralex Inc.518

728-4187darren.suarez@boralex.com |

|

|

|

|

Source: Boralex Inc.

1 The transaction includes CA$16 US$[11.1]M of

cash, and CA$16.6 US$[12.1]M of New Mexico refundable production

tax credits that were generated in 2021 and 2022 that will be

received in Q1 2023 and Q1 2024, respectively; CA$ based on [1.36]

USD/CAD conversion rate at market closing on December 28, 2022.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2e7d3c85-ac94-4315-b333-8b00860b6060

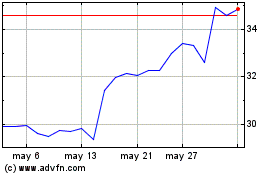

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025