Boralex Inc. (“Boralex” or the “Company”) (TSX: BLX) is pleased to

report increased earnings, significant progress on certain projects

under construction or at the ready-to-build stage, and the addition

of new projects to its pipeline in the third quarter of 2023.

“The increase in earnings for the quarter is

mainly attributable to the contribution of the wind assets acquired

in the United States for the North American sector and the wind and

solar farms commissioned in France for the European sector. The

European sector also benefited from favorable production for

comparable wind assets. These elements more than offset the

pressure on earnings from particularly unfavourable wind conditions

in Canada,” said Patrick Decostre, President and Chief Executive

Officer of Boralex. “The third quarter was also marked by the

progress made on three major projects under construction or at the

ready-to-build stage: the Apuiat wind farm in Quebec, the two

storage projects in Ontario and the Limekiln wind farm in Scotland.

Those projects have high expected returns surpassing our threshold

and are progressing on schedule.”

Commenting on what lies ahead for Boralex in the

coming quarters, Mr. Decostre added: "We remain very confident in

the future of our industry and our ability to grow our business in

our target markets, where demand is stronger than ever, thanks in

particular to governments' commitment to reducing their carbon

footprint and the competitiveness of renewable energies over other

forms of energy production. Our discipline and agility have enabled

us to adapt quickly to the challenges faced by the industry as a

whole in recent months. We are still adding many projects to our

pipeline and they are maintaining high returns, with the prices of

the most recent power purchase agreements significantly up and

reflecting the current supply situation and financing costs.”

|

1 |

|

EBITDA(A) is a

total of segment measures.For more details, see the Non-IFRS and

other financial measures section of this press release. |

| 2 |

|

Combined, Cash Flow from operations, Discretionary Cash Flows

and available cash resources and authorized financing facilities

are non-GAAP financial measures and do not have a standardized

definition under IFRS. Therefore, these measures may not be

comparable to similar measures used by other companies. For more

details, see the Non-IFRS financial measures and other financial

measures section of this press release. |

| 3 |

|

Figures in brackets indicate results on a Combined basis as

opposed to a Consolidated basis. |

3rd quarter highlights

Three-month periods

ended September

30

|

|

Consolidated |

Combined 1 |

|

(in millions of Canadian dollars, unless otherwise specified)

(unaudited) |

|

2023 |

|

2022 |

|

Change |

2023 |

|

2022 |

|

Change |

|

|

|

|

|

|

$ |

|

% |

|

|

|

|

|

$ |

|

% |

|

|

Power production (GWh)2 |

|

1,110 |

|

1,019 |

|

91 |

|

9 |

|

1,522 |

|

1,159 |

|

363 |

|

31 |

|

|

Revenues from energy sales and feed-in premium |

|

171 |

|

101 |

|

70 |

|

70 |

|

194 |

|

116 |

|

78 |

|

67 |

|

|

Operating income |

|

13 |

|

(31 |

) |

44 |

|

>100 |

|

29 |

|

(25 |

) |

54 |

|

>100 |

|

|

EBITDA(A)3 |

|

91 |

|

50 |

|

41 |

|

82 |

|

113 |

|

63 |

|

50 |

|

82 |

|

|

Net earnings (loss) |

|

(2 |

) |

(56 |

) |

54 |

|

96 |

|

(2 |

) |

(56 |

) |

54 |

|

96 |

|

|

Net earnings attributable to shareholders of Boralex |

|

(3 |

) |

(44 |

) |

41 |

|

94 |

|

(3 |

) |

(44 |

) |

41 |

|

94 |

|

|

Per share - basic and diluted |

($0.03 |

) |

($0.44 |

) |

$0.41 |

|

93 |

|

($0.03 |

) |

($0.44 |

) |

$0.41 |

|

93 |

|

|

Net cash flows related to operating activities |

|

1 |

|

90 |

|

(89 |

) |

(99 |

) |

— |

|

— |

|

— |

|

— |

|

|

Cash flows from operations1 |

|

67 |

|

40 |

|

27 |

|

67 |

|

— |

|

— |

|

— |

|

— |

|

|

Discretionary cash flows1 |

|

21 |

|

1 |

|

20 |

|

>100 |

|

— |

|

— |

|

— |

|

— |

|

In the third quarter of 2023, Boralex produced

1,110 GWh (1,522 GWh) of electricity, 9% (31%) more than the 1,019

GWh (1,159 GWh) produced in the same quarter of 2022. The increase

on a Consolidated basis is attributable to the commissioning of

wind and solar farms and the good performance of comparable wind

sites in France. The increase on a Combined basis is primarily due

to the integration of the wind farms acquired in the United States

in late 2022 as well as from elements contributing to the increase

on a Consolidated basis. The diversification of the Corporation's

activities both by region and by technology enabled Boralex to

partly compensate for the highly unfavourable wind conditions in

Canada during the quarter. Boralex thus ended the quarter with

total production 9% (7%) below anticipated production4.

For the three-month period ended September 30,

2023, revenues from energy sales and feed-in premiums totalled $171

million ($194 million), 70% (67%) more than in the third quarter of

2022. EBITDA(A)3 amounted to $91 million ($113 million), up 82%

(82%) compared to the third quarter of 2022. It should be noted

that EBITDA(A) for the third quarter of 2022 included an amount of

$28 million attributable to certain contracts for which Boralex had

to record a provision following the enactment of the 2022

Supplementary Budget Act in France. Operating income amounted to

$13 million ($29 million), which compares to an operating loss of

$31 million ($25 million) for the same quarter of 2022. The net

loss for the quarter was $2 million, a $54 million improvement

compared to the net loss of $56 million for the same quarter of

2022.

|

1 |

|

Combined, Cash Flow from operations and Discretionary Cash Flows

are non-GAAP financial measures and do not have a standardized

definition under IFRS. Therefore, these measures may not be

comparable to similar measures used by other companies. For more

details, see the Non-IFRS financial measures and other financial

measures section of this press release. |

| 2 |

|

Power production includes the

production for which Boralex received financial compensation

following power generation limitations imposed by its customers

since management uses this measure to evaluate the Corporation’s

performance. This adjustment facilitates the correlation between

power production and revenues from energy sales and feed-in

premium. |

| 3 |

|

EBITDA(A) is a total of sector

measures. For more details, see the Non-IFRS financial measures and

other financial measures section of this press release. |

| 4 |

|

Anticipated production is an

additional financial measure, For more details see the Non-IFRS

financial measures and other financial measures section of this

press. |

Nine-month periods

ended September

30

|

|

Consolidated |

Combined1 |

|

(in millions of Canadian dollars, unless otherwise specified) |

|

2023 |

|

2022 |

Change |

2023 |

|

2022 |

|

Change |

|

|

|

|

|

$ |

|

% |

|

|

|

|

|

$ |

|

% |

|

|

Power production (GWh)2 |

|

4,159 |

|

3,998 |

161 |

|

4 |

|

5,670 |

|

4,486 |

|

1,184 |

|

26 |

|

|

Revenues from energy sales and feed-in premium |

|

679 |

|

496 |

183 |

|

37 |

|

759 |

|

549 |

|

210 |

|

38 |

|

|

Operating income |

|

128 |

|

105 |

23 |

|

22 |

|

192 |

|

133 |

|

59 |

|

45 |

|

|

EBITDA(A)3 |

|

381 |

|

344 |

37 |

|

11 |

|

448 |

|

379 |

|

69 |

|

18 |

|

|

Net earnings |

|

75 |

|

15 |

60 |

|

>100 |

|

75 |

|

15 |

|

60 |

|

>100 |

|

|

Net earnings attributable to shareholders of Boralex |

|

59 |

|

16 |

43 |

|

>100 |

|

59 |

|

16 |

|

43 |

|

>100 |

|

|

Per share - basic and diluted |

|

$0.57 |

|

$0.16 |

$0.41 |

|

>100 |

|

$0.57 |

|

$0.16 |

|

$0.41 |

|

>100 |

|

|

Net cash flows related to operating activities |

|

389 |

|

324 |

65 |

|

20 |

|

— |

|

— |

|

— |

|

— |

|

|

Cash flows from operations1 |

|

284 |

|

262 |

22 |

|

8 |

|

— |

|

— |

|

— |

|

— |

|

|

|

As atSept.

30 |

As atDec.

31 |

Change |

|

|

As atSept.

30 |

As atDec.

31 |

|

Change |

|

|

|

|

|

|

|

$ |

|

% |

|

|

|

|

|

$ |

|

% |

|

|

Total assets |

|

6,557 |

|

6,539 |

18 |

|

— |

|

7,215 |

|

7,188 |

|

27 |

|

— |

|

|

Debt - principal balance |

|

3,313 |

|

3,346 |

(33 |

) |

(1 |

) |

3,727 |

|

3,674 |

|

53 |

|

1 |

|

|

Total project debt |

|

2,820 |

|

3,007 |

(187 |

) |

(6 |

) |

3,234 |

|

3,335 |

|

(101 |

) |

(3 |

) |

|

Total corporate debt |

|

493 |

|

339 |

154 |

|

45 |

|

492 |

|

339 |

|

153 |

|

45 |

|

For the nine-month period ended September 30,

2023, Boralex produced 4,159 GWh (5,670 GWh) of power, which

represents an increase of 4% (26%) compared to the 3,998 GWh (4,486

GWh) produced in the same period in 2022. Revenues from energy

sales and feed-in premiums for the nine-month period ended

September 30, 2023, amounted to $679 million ($759 million), up

$183 million ($210 million) or 37% (38%) from the same period in

2022.

EBITDA(A) was $381 million ($448 million), up

$37 million ($69 million) or 11% (18%) from the same period last

year. Operating income totalled $128 million ($192 million),up $23

million (up $59 million) from the same period in 2022. Overall, for

the nine- month period ended September 30, 2023, Boralex posted net

earnings of $75 million ($75 million) compared to net earnings of

$15 million ($15 million) for the same period in 2022.

Outlook

Boralex’s 2025 Strategic Plan is built around

the same four strategic directions as the plan launched in 2019 –

growth, diversification, customers and optimization – and six

corporate targets. The details of the plan, which also sets out

Boralex’s corporate social responsibility strategy, are found in

the Company’s annual report. Highlights of the main achievements

for the quarter ended September 30, 2023, in relation to the 2025

Strategic Plan can be found in the 2023 Interim Report 3, available

in the Investors section of the Boralex website.

In the coming quarters, Boralex will continue to

work on its various initiatives under the strategic plan, including

project development, analysis of acquisition targets and

optimization of power sales and operating costs.

Finally, to pursue its organic growth, the

Company has a pipeline of projects at various stages of development

defined on the basis of clearly identified criteria, totalling 6.4

GW of wind, solar and energy storage projects.

Dividend declaration

The Company’s Board of Directors has authorized

and announced a quarterly dividend of $0.1650 per common share.

This dividend will be paid on December 15, 2023, to shareholders of

record at the close of business on November 30, 2023. Boralex

designates this dividend as an “eligible dividend” pursuant to

paragraph 89 (14) of the Income Tax Act (Canada) and all provincial

legislation applicable to eligible dividends.

|

1 |

|

Combined and Cash Flow from operations are non-GAAP financial

measures and do not have a standardized definition under IFRS.

Therefore, these measures may not be comparable to similar measures

used by other companies. For more details, see the Non-IFRS

financial measures and other financial measures section of this

press release. |

| 2 |

|

Power production includes the

production for which Boralex received financial compensation

following power generation limitations imposed by its customers

since management uses this measure to evaluate the

Corporation’s performance. This adjustment facilitates the

correlation between power production and revenues from energy sales

and feed-in premium. |

| 3 |

|

EBITDA(A) is a total of sector

measures. For more details, see the Non-IFRS financial measures and

other financial measures section of this press release. |

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As a

leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to over 3 GW. We are developing a portfolio of projects in

development and construction of close to 6.4 GW in wind, solar and

storage projects, guided by our values and our corporate social

responsibility (CSR) approach. Through profitable and sustainable

growth, Boralex is actively participating in the fight against

global warming. Thanks to our fearlessness, our discipline, our

expertise and our diversity, we continue to be an industry leader.

Boralex’s shares are listed on the Toronto Stock Exchange under the

ticker symbol BLX.

For more information, visit www.boralex.com or

www.sedarplus.ca. Follow us on Facebook, LinkedIn and Twitter.

Non-IFRS measuresPerformance

measures

In order to assess the performance of its assets

and reporting segments, Boralex uses performance measures.

Management believes that these measures are widely accepted

financial indicators used by investors to assess the operational

performance of a company and its ability to generate cash through

operations. The non-IFRS and other financial measures also provide

investors with insight into the Corporation’s decision making as

the Corporation uses these non-IFRS financial measures to make

financial, strategic and operating decisions. The non-IFRS and

other financial measures should not be considered as substitutes

for IFRS measures.

These non-IFRS financial measures are derived

primarily from the audited consolidated financial statements, but

do not have a standardized meaning under IFRS; accordingly, they

may not be comparable to similarly named measures used by other

companies. Non-IFRS and other financial measures are not audited.

They have important limitations as analytical tools and investors

are cautioned not to consider them in isolation or place undue

reliance on ratios or percentages calculated using these non-IFRS

financial measures.

|

Non-IFRS financial

measures |

|

Specific

financialmeasure |

Use |

Composition |

Most directlycomparable

IFRSmeasure |

|

Financial data - Combined (all disclosed financial data) |

To assess the operating performance and the ability of a company to

generate cash from its operations.The Interests represent

significant investments by Boralex. |

Results from the combination of the financial information of

Boralex Inc. under IFRS and the share of the financial information

of the Interests.Interests in the Joint Ventures and associates,

Share in earnings (losses) of the Joint Ventures and associates and

Distributions received from the Joint Ventures and associates are

then replaced with Boralex’s respective share in the financial

statements of the Interests (revenues, expenses, assets,

liabilities, etc.) |

Respective financial data - Consolidated |

|

Cash flows from operations |

To assess the cash generated by the Company's operations and its

ability to finance its expansion from these funds. |

Net cash flows related to operating activities before changes in

non-cash items related to operating activities. |

Net cash flows related to operating activities |

|

Discretionary cash flows |

To assess the cash generated from operations and the amount

available for future development or to be paid as dividends to

common shareholders while preserving the long-term value of the

business. |

Net cash flows related to operating activities before "change in

non-cash items related to operating activities,” less (i)

distributions paid to non-controlling shareholders, (ii) additions

to property, plant and equipment (maintenance of operations), (iii)

repayments on non-current debt (projects) and repayments to tax

equity investors; (iv) principal payments related to lease

liabilities; (v) adjustments for non- operational items; plus (vi)

development costs (from the statement of earnings). |

Net cash flows related to operating activities |

|

|

Corporate objectives for 2025 from the strategic plan. |

|

|

|

Non-IFRS financial

measures |

|

Specific

financialmeasure |

Use |

Composition |

Most directlycomparable

IFRSmeasure |

|

Available cash and cash equivalents |

To assess the cash and cash equivalents available, as at balance

sheet date, to fund the Corporation's growth. |

Represents cash and cash equivalents, as stated on the balance

sheet, from which known short-term cash requirements are

excluded. |

Cash and cash equivalents |

|

Available cash resources and authorized financing |

To assess the total cash resources available, as at balance sheet

date, to fund the Corporation's growth. |

Results from the combination of credit facilities available to fund

growth and the available cash and cash equivalents. |

Cash and cash equivalents |

|

Other financial

measures - Total

of segments

measure |

|

Specific financial

measure |

Most directly

comparable IFRS

measure |

|

EBITDA(A) |

Operating income |

|

Other financial

measures -

Supplementary Financial

Measures |

|

Specific financial

measure |

Composition |

|

Anticipated production |

Production that the Company anticipates for the oldest sites based

on adjusted historical averages, commissioning and planned

shutdowns and, for other sites, based on the production studies

carried out. |

|

Credit facilities available for growth |

The credit facilities available for growth include the unused

tranche of the parent company's credit facility, apart from the

accordion clause, as well as the unused tranche of the construction

facility. |

CombinedThe following tables reconcile

Consolidated financial data with data presented on a Combined

basis:

|

|

2023 |

|

2022 |

|

|

(in millions of Canadian dollars) (unaudited) |

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

|

Three-month periods

ended September

30: |

|

|

|

|

|

|

|

|

|

Power production (GWh)(2) |

1,110 |

|

412 |

|

1,522 |

|

1,019 |

|

140 |

|

1,159 |

|

|

Revenues from energy sales and feed-in premium |

171 |

|

23 |

|

194 |

|

101 |

|

15 |

|

116 |

|

|

Operating income |

13 |

|

16 |

|

29 |

|

(31 |

) |

6 |

|

(25 |

) |

|

EBITDA(A) |

91 |

|

22 |

|

113 |

|

50 |

|

13 |

|

63 |

|

|

Net earnings |

(2 |

) |

— |

|

(2 |

) |

(56 |

) |

— |

|

(56 |

) |

|

Nine-month periods

ended September

30: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Power production (GWh)(2) |

4,159 |

|

1,511 |

|

5,670 |

|

3,998 |

|

488 |

|

4,486 |

|

|

Revenues from energy sales and feed-in premiums |

679 |

|

80 |

|

759 |

|

496 |

|

53 |

|

549 |

|

|

Operating income |

128 |

|

64 |

|

192 |

|

105 |

|

28 |

|

133 |

|

|

EBITDA(A) |

381 |

|

67 |

|

448 |

|

344 |

|

35 |

|

379 |

|

|

Net earnings |

75 |

|

— |

|

75 |

|

15 |

|

— |

|

15 |

|

|

|

As at September

30, 2023 |

|

As at December

31, 2022 |

|

|

Total assets |

6,557 |

|

658 |

|

7,215 |

|

6,539 |

|

649 |

|

7,188 |

|

|

Debt - Principal balance |

3,313 |

|

414 |

|

3,727 |

|

3,346 |

|

328 |

|

3,674 |

|

|

(1) |

|

Includes the respective contribution of joint ventures and

associates as a percentage of Boralex's interest less adjustments

to reverse recognition of these interests under IFRS. This

contribution is attributable to wind power sites in North America

segment and includes corporate expenses of $1 million in EBITDA(A)

for the nine- month period ended September 30, 2023 ($2 million as

at September 30, 2022). |

| (2) |

|

Includes financial compensation

following electricity production limitations imposed by

customers. |

EBITDA(A)

EBITDA(A) is a total of segment financial

measures and represents earnings before interest, taxes,

depreciation and amortization, adjusted to exclude other items such

as acquisition costs, other loss (gains), net loss (gain) on

financial instruments and foreign exchange loss (gain), the last

two items being included under Other.

EBITDA(A) is used to assess the performance of

the Corporation's reporting segments.

EBITDA(A) is reconciled to the most comparable

IFRS measure, namely, operating income, in the following table:

|

|

2023 |

|

2022 |

|

Change2023 vs

2022 |

|

(in millions of Canadian dollars) (unaudited) |

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

Consolidated |

|

Reconciliation(1) |

|

Combined |

|

Consolidated |

|

Combined |

|

|

Three-month periods

ended September

30: |

|

|

|

|

EBITDA(A) |

91 |

|

22 |

|

113 |

|

50 |

|

13 |

|

63 |

|

41 |

|

50 |

|

|

Amortization |

(73 |

) |

(14 |

) |

(87 |

) |

(84 |

) |

(6 |

) |

(90 |

) |

11 |

|

3 |

|

|

Other gains |

— |

|

3 |

|

3 |

|

2 |

|

— |

|

2 |

|

(2 |

) |

1 |

|

|

Share in earnings (loss) of joint ventures and Associates |

(2 |

) |

2 |

|

— |

|

3 |

|

(3 |

) |

— |

|

(5 |

) |

— |

|

|

Change in fair value of a derivative included in the share of the

joint ventures |

(3 |

) |

3 |

|

— |

|

(2 |

) |

2 |

|

— |

|

(1 |

) |

— |

|

|

Operating income |

13 |

|

16 |

|

29 |

|

(31 |

) |

6 |

|

(25 |

) |

44 |

|

54 |

|

|

|

|

|

|

|

|

Nine-month periods

ended September

30: |

|

|

|

|

|

|

|

EBITDA(A) |

381 |

|

67 |

|

448 |

|

344 |

|

35 |

|

379 |

|

37 |

|

69 |

|

|

Amortization |

(218 |

) |

(41 |

) |

(259 |

) |

(228 |

) |

(18 |

) |

(246 |

) |

10 |

|

(13 |

) |

|

Impairment |

— |

|

— |

|

— |

|

(3 |

) |

(1 |

) |

(4 |

) |

3 |

|

4 |

|

|

Other gains |

— |

|

3 |

|

3 |

|

2 |

|

2 |

|

4 |

|

(2 |

) |

(1 |

) |

|

Share in earnings of joint ventures and associates |

(47 |

) |

47 |

|

— |

|

(31 |

) |

31 |

|

— |

|

(16 |

) |

— |

|

|

Change in fair value of a derivative included in the share of the

joint ventures |

12 |

|

(12 |

) |

— |

|

21 |

|

(21 |

) |

— |

|

(9 |

) |

— |

|

|

Operating income |

128 |

|

64 |

|

192 |

|

105 |

|

28 |

|

133 |

|

23 |

|

59 |

|

|

(1) |

|

Includes the respective contribution of joint ventures and

associates as a percentage of Boralex's interest less adjustments

to reverse recognition of these interests under IFRS. |

Cash flow

from operations

and discretionary

cash flows

The Corporation computes the cash flow from operations and

discretionary cash flows as follows:

|

|

Consolidated |

|

|

Three-month periods ended |

Twelve-month periods ended |

|

(in millions of Canadian dollars) (unaudited) |

September 30,2023 |

|

September 30,2022 |

|

September 30,2023 |

|

December 31,2022 |

|

|

Net cash flows

related to

operating activities |

1 |

|

90 |

|

578 |

|

513 |

|

|

Change in non-cash items relating to operating activities |

66 |

|

(50 |

) |

(153 |

) |

(110 |

) |

|

Cash flows from

operations |

67 |

|

40 |

|

425 |

|

403 |

|

|

Repayments on non-current debt (projects)(1) |

(44 |

) |

(38 |

) |

(229 |

) |

(212 |

) |

|

Adjustment for non-operating items(2) |

3 |

|

3 |

|

3 |

|

7 |

|

|

|

26 |

|

5 |

|

199 |

|

198 |

|

|

Principal payments related to lease liabilities |

(3 |

) |

(2 |

) |

(17 |

) |

(15 |

) |

|

Distributions paid to non-controlling shareholders(3) |

(9 |

) |

(6 |

) |

(43 |

) |

(37 |

) |

|

Additions to property, plant and equipment (maintenance of

operations) |

(1 |

) |

(5 |

) |

(11 |

) |

(12 |

) |

|

Development costs (from statement of earnings) |

8 |

|

9 |

|

37 |

|

33 |

|

|

Discretionary cash

flows |

21 |

|

1 |

|

165 |

|

167 |

|

|

(1) |

|

Excluding VAT bridge financing, early debt repayments and

repayments under the construction facility - Boralex Energy

Investments portfolio. |

| (2) |

|

For the twelve-month period ended

September 30, 2023, favourable adjustment of $2 million consisting

mainly of acquisition, integration and transaction costs. For the

year ended December 31, 2022, favourable adjustment of $7 million

consisting mainly of acquisition and transaction costs. |

| (3) |

|

Comprises distributions paid to

non-controlling shareholders as well as the portion of

discretionary cash flows attributable to the non-controlling

shareholder of Boralex Europe Sàrl. |

Available cash

and cash

equivalents and

available cash

resources and authorized

financing

The Corporation defines available cash and cash equivalents as

well as available cash resources and authorized financing as

follows:

|

|

Consolidated |

|

(in millions of Canadian dollars) (unaudited) |

As at September 30 |

|

As at December 31 |

|

|

2023 |

|

2022 |

|

|

Cash and cash equivalents |

476 |

|

361 |

|

|

Cash and cash equivalents held by entities subject to project debt

agreements(1) |

(405 |

) |

(279 |

) |

|

Bank overdraft |

(8 |

) |

(12 |

) |

|

Available cash

and cash

equivalents |

63 |

|

70 |

|

|

Credit facilities available for growth |

329 |

|

424 |

|

|

Available cash

resources and

authorized financing |

392 |

|

494 |

|

|

(1) |

|

This cash can be used for the operations of the respective

projects, but is subject to restrictions for non-project related

purposes under the credit agreements. |

Disclaimer regarding forward-looking

statementsCertain statements contained in this release,

including those related to results and performance for future

periods, installed capacity targets, EBITDA(A) and discretionary

cash flows, the Corporation's strategic plan, business model and

growth strategy, organic growth and growth through mergers and

acquisitions, obtaining an investment grade credit rating, payment

of a quarterly dividend, the Corporation’s financial targets, the

partnership with Énergir and Hydro-Québec for the elaboration of

three 400 MW projects for which the development will depend on

Hydro-Québec's changing needs, the portfolio of renewable energy

projects, the Corporation’s Growth Path and its Corporate Social

Responsibility (CSR) objectives are forward-looking statements

based on current forecasts, as defined by securities legislation.

Positive or negative verbs such as “will,” “would,” “forecast,”

“anticipate,” “expect,” “plan,” “project,” “continue,” “intend,”

“assess,” “estimate” or “believe,” or expressions such as “toward,”

“about,” “approximately,” “to be of the opinion,” “potential” or

similar words or the negative thereof or other comparable

terminology, are used to identify such statements.

Forward-looking statements are based on major

assumptions, including those about the Corporation’s return on its

projects, as projected by management with respect to wind and other

factors, opportunities that may be available in the various sectors

targeted for growth or diversification, assumptions made about

EBITDA(A) margins, assumptions made about the sector realities and

general economic conditions, competition, exchange rates as well as

the availability of funding and partners. In particular, CSR

targets are based on a number of assumptions, including, but not

limited to, the following key assumptions: implementation of

various corporate and business initiatives to reduce direct and

indirect GHG emissions; availability of technologies to achieve

targets; absence of new business initiatives or acquisitions of

companies or technologies that would significantly increase the

expected level of performance; no negative impact resulting from

clarifications or amendments to international standards or the

methodology used to calculate our CSR performance and disclosure;

sufficient participation and collaboration of our suppliers in

setting their own targets in line with Boralex’s CSR initiatives;

the ability to find diverse and competent talent; education and

organizational engagement to help achieve our CSR targets. While

the Corporation considers these factors and assumptions to be

reasonable, based on the information currently available to the

Corporation, they may prove to be inaccurate.

Boralex wishes to clarify that, by their very

nature, forward-looking statements involve risks and uncertainties,

and that its results, or the measures it adopts, could be

significantly different from those indicated or underlying those

statements, or could affect the degree to which a given

forward-looking statement is achieved. The main factors that may

result in any significant discrepancy between the Corporation’s

actual results and the forward-looking financial information or

expectations expressed in forward-looking statements include the

general impact of economic conditions, fluctuations in various

currencies, fluctuations in energy prices, the risk of not renewing

PPAs or being unable to sign new corporate PPA, the risk of not

being able to capture the US or Canadian investment tax credit,

counterparty risk, the Corporation’s financing capacity,

cybersecurity risks, competition, changes in general market

conditions, industry regulations and amendments thereto,

particularly the legislation, regulations and emergency measures

that could be implemented for time to time to address high energy

prices in Europe, litigation and other regulatory issues related to

projects in operation or under development, as well as other

factors listed in the Corporation’s filings with the various

securities commissions.

Unless otherwise specified by the Corporation,

forward-looking statements do not take into account the effect that

transactions, non-recurring items or other exceptional items

announced or occurring after such statements have been made may

have on the Corporation’s activities. There is no guarantee that

the results, performance or accomplishments, as expressed or

implied in the forward-looking statements, will materialize.

Readers are therefore urged not to rely unduly on these

forward-looking statements.

Unless required by applicable securities

legislation, Boralex’s management assumes no obligation to update

or revise forward-looking statements in light of new information,

future events or other changes.

Percentage figures are calculated in thousands

of dollars.

| For more

information |

| |

|

| MEDIA |

INVESTOR RELATIONS |

| Camille Laventure |

Stéphane Milot |

| Advisor, Public Affairs and External Communications |

Vice President, Investor Relations |

| Boralex Inc. |

Boralex Inc. |

| 438-883-8580 |

514-213-1045 |

| camille.laventure@boralex.com |

stephane.milot@boralex.com |

| |

|

| Source : Boralex inc. |

|

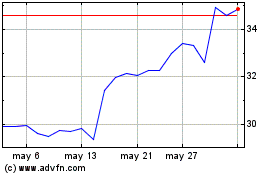

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Boralex (TSX:BLX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024