Cameco Considers Early Redemption of $300 Million Debentures Due 2015

10 Junio 2014 - 8:00AM

Marketwired

Cameco Considers Early Redemption of $300 Million Debentures Due

2015

SASKATOON, SASKATCHEWAN--(Marketwired - Jun 10, 2014) -

ALL AMOUNTS ARE STATED IN CDN $ (UNLESS NOTED)

Cameco (TSX:CCO)(NYSE:CCJ) announced today it is considering the

early redemption, in whole or in part, of its Canadian dollar

denominated $300 million 4.70% Senior Unsecured Series C Debentures

(Series C Debentures) due September 16, 2015 (CUSIP No. 13321LAF5).

The Series C Debentures were issued in September 2005. The

redemption price would be based on the Government of Canada yield,

as defined in the September 16, 2005 supplemental trust indenture

between Cameco and CIBC Mellon Trust Company pursuant to which the

Series C Debentures were issued.

Cameco would finance the redemption either through funds

available under its unsecured credit facility, or use cash on hand,

or use the proceeds from a debt financing that may be undertaken,

in whole or part, to refinance the Series C Debentures if market

conditions are favourable. Unanticipated developments or

circumstances beyond Cameco's control could result in a decision

not to redeem the Series C Debentures and there is no assurance

that a redemption will be completed.

Profile

Cameco is one of the world's largest uranium producers, a

significant supplier of conversion services and one of two CANDU

fuel manufacturers in Canada. Our competitive position is based on

our controlling ownership of the world's largest high-grade

reserves and low-cost operations. Our uranium products are used to

generate clean electricity in nuclear power plants around the

world. We also explore for uranium in the Americas, Australia and

Asia. Our shares trade on the Toronto and New York stock exchanges.

Our head office is in Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and Statements

The statements contained in this news release regarding Cameco's

consideration of an early redemption of the Series C Debentures and

the source of the funds that may be used for the redemption are

forward-looking information or forward-looking statements under

Canadian and U.S. securities laws. They are subject to the risk

that the redemption and any new financing to be undertaken will not

be completed. We have assumed that if the redemption proceeds, it

will be successfully completed in accordance with the redemption

provisions of the Series C Debentures and any refinancing

transaction that is undertaken will be successfully completed. We

will not necessarily update this information unless we are required

to by securities laws.

Although Cameco believes that the assumptions inherent in the

forward-looking statements are reasonable, undue reliance should

not be placed on these statements, which only apply as of the date

of this report. Cameco disclaims any intention or obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

Cameco - Investor inquiries:Rachelle Girard(306) 956-6403Media

inquiries:Rob Gereghty(306) 956-6190

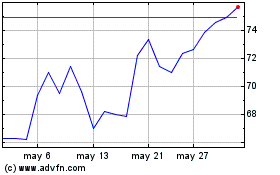

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024