Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated

financial and operating results for the third quarter ended

September 30, 2018 in accordance with International Financial

Reporting Standards (IFRS).

“Our results and the updates to our outlook reflect the impact

of our decision to extend the shutdown at McArthur River/Key Lake,

and the tax case ruling that was unequivocally in our favour,” said

Tim Gitzel, Cameco’s president and CEO. “As a result of the updates

to our outlook, we expect a strong finish in the fourth

quarter.

“The uranium market is showing a marked improvement compared to

a year ago, in fact relative to the first half of the year, but

there is still a long way to go. There are a lot of moving parts in

the market right now, largely driven by market access and trade

policy issues, and there continues to be a lack of acceptable

long-term contracting opportunities.

“We are effectively navigating the current market developments,

and are making the decisions necessary to keep the company strong

and viable for the long-term.”

- Net earnings of $28 million; adjusted net earnings of

$15 million: Results were impacted by care and maintenance

costs of $65 million, which includes severance costs of $27 million

related to the permanent layoffs at McArthur River/Key Lake,

severance costs of $13 million related to the workforce reductions

at corporate office, and the reversal of the $61 million provision

on our balance sheet related to our dispute with Canada Revenue

Agency (CRA). Adjusted net earnings are a non-IFRS measure,

see page 3.

- CRA tax dispute: On September 26, 2018, the

Tax Court of Canada ruled unequivocally in our favour in our case

for the 2003, 2005 and 2006 tax years. On October 26, 2018, CRA

filed an appeal with the Federal Court of Appeal seeking to

overturn the decision. We believe there is nothing in the decision

that would warrant a materially different outcome on appeal, or for

subsequent tax years. For more information, see Transfer Pricing

Dispute in our third quarter MD&A.

- Updated outlook for 2018 and 2019: We have

updated the outlook provided for 2018 and 2019 to reflect changes

in the exchange rates, the decision in our tax case with CRA, and

the additional purchase and sales activities undertaken to date.

For more information on the changes, see Outlook for 2018 in our

third quarter MD&A.

- Annual dividend declared: For 2018, an annual

dividend of $0.08 per common share has been declared, payable on

December 14, 2018, to shareholders of record on November 30, 2018.

In 2017, our board of directors reduced the planned dividend to

$0.08 per common share to be paid annually. The decision to declare

a dividend by our board is based on our cash flow, financial

position, strategy and other relevant factors including appropriate

alignment with the cyclical nature of our earnings.

| |

| Consolidated financial

results |

|

|

|

|

|

|

|

|

|

| |

|

THREE MONTHS |

|

NINE MONTHS |

|

| CONSOLIDATED HIGHLIGHTS |

ENDED SEPTEMBER 30 |

|

ENDED SEPTEMBER 30 |

|

| ($ MILLIONS EXCEPT WHERE

INDICATED) |

2018 |

|

2017 |

|

CHANGE |

2018 |

2017 |

|

CHANGE |

| Revenue |

488 |

|

486 |

|

- |

|

1,260 |

1,348 |

|

(7 |

)% |

| Gross profit (loss) |

(6 |

) |

51 |

|

>(100 |

%) |

89 |

199 |

|

(55 |

)% |

| Net earnings (losses)

attributable to equity holders |

28 |

|

(124 |

) |

>100 |

% |

6 |

(143 |

) |

>100 |

% |

| |

$ per common share (basic) |

0.07 |

|

(0.31 |

) |

>100 |

% |

0.02 |

(0.36 |

) |

>100 |

% |

| |

$ per common share (diluted) |

0.07 |

|

(0.31 |

) |

>100 |

% |

0.02 |

(0.36 |

) |

>100 |

% |

| Adjusted net earnings (non-IFRS,

see page 3) |

15 |

|

(50 |

) |

>100 |

% |

9 |

(122 |

) |

>100 |

% |

| |

$ per common share (adjusted and

diluted) |

0.04 |

|

(0.13 |

) |

>100 |

% |

0.02 |

(0.31 |

) |

>100 |

% |

| Cash provided by operations

(after working capital changes) |

278 |

|

154 |

|

81 |

% |

610 |

276 |

|

>100 |

% |

The financial information presented for the three months and

nine months ended September 30, 2017 and September 30, 2018 is

unaudited.

NET EARNINGS

The following table shows what contributed to the change in net

earnings and adjusted net earnings (non-IFRS measure, see page 3)

in the third quarter and first nine months of 2018, compared to the

same period in 2017.

| |

|

|

| CHANGES IN EARNINGS |

THREE MONTHS ENDED |

NINE MONTHS ENDED |

| ($ MILLIONS) |

SEPTEMBER 30 |

SEPTEMBER 30 |

| |

IFRS |

ADJUSTED |

IFRS |

ADJUSTED |

| Net losses –

2017 |

(124 |

) |

(50 |

) |

(143 |

) |

(122 |

) |

| Change in gross profit by segment |

|

|

|

|

| (We calculate gross profit by

deducting from revenue the cost of products and services sold, and

depreciation and amortization (D&A)) |

|

Uranium |

Higher sales volume |

8 |

|

8 |

|

13 |

|

13 |

|

|

|

Higher (lower) realized prices ($US) |

(30 |

) |

(30 |

) |

27 |

|

27 |

|

|

|

Foreign exchange impact on realized prices |

7 |

|

7 |

|

(22 |

) |

(22 |

) |

|

|

Higher costs |

(45 |

) |

(45 |

) |

(109 |

) |

(109 |

) |

| |

Change – uranium |

(60 |

) |

(60 |

) |

(91 |

) |

(91 |

) |

|

Fuel services |

Lower sales volume |

- |

|

- |

|

(2 |

) |

(2 |

) |

|

|

Higher (lower) realized prices ($Cdn) |

4 |

|

4 |

|

(3 |

) |

(3 |

) |

|

|

Higher costs |

(3 |

) |

(3 |

) |

(3 |

) |

(3 |

) |

| |

Change – fuel services |

1 |

|

1 |

|

(8 |

) |

(8 |

) |

| Lower administration expenditures |

1 |

|

1 |

|

19 |

|

19 |

|

| Lower impairment charges |

111 |

|

- |

|

111 |

|

- |

|

| Lower exploration expenditures |

3 |

|

3 |

|

7 |

|

7 |

|

| Change in reclamation provisions |

(14 |

) |

- |

|

(65 |

) |

- |

|

| Higher earnings from equity-accounted investee |

2 |

|

2 |

|

6 |

|

6 |

|

| Change in gains or losses on derivatives |

- |

|

16 |

|

(86 |

) |

38 |

|

| Change in foreign exchange gains or losses |

15 |

|

15 |

|

46 |

|

46 |

|

| Gain on restructuring of JV Inkai in 2018 |

- |

|

- |

|

49 |

|

- |

|

| Gain on customer contract restructuring in 2018 |

- |

|

- |

|

6 |

|

6 |

|

| Reversal of tax provision related to CRA

dispute |

61 |

|

61 |

|

61 |

|

61 |

|

| Change in income tax recovery or expense |

23 |

|

17 |

|

76 |

|

29 |

|

| Other |

9 |

|

9 |

|

18 |

|

18 |

|

| Net earnings –

2018 |

28 |

|

15 |

|

6 |

|

9 |

|

Adjusted net earnings (non-IFRS measure)

Adjusted net earnings are a measure that does not have a

standardized meaning or a consistent basis of calculation under

IFRS (non-IFRS measure). We use this measure as a meaningful way to

compare our financial performance from period to period. We believe

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors use this information to evaluate our

performance. Adjusted net earnings are our net earnings

attributable to equity holders, adjusted to reflect the underlying

financial performance for the reporting period. The adjusted

earnings measure reflects the matching of the net benefits of our

hedging program with the inflows of foreign currencies in the

applicable reporting period, and has also been adjusted for

impairment charges, reclamation provisions for our Rabbit Lake and

US operations, which had been impaired, the gain on restructuring

of JV Inkai, and income taxes on adjustments.

Adjusted net earnings are non-standard supplemental

information and should not be considered in isolation or as a

substitute for financial information prepared according to

accounting standards. Other companies may calculate this measure

differently, so you may not be able to make a direct comparison to

similar measures presented by other companies.

The following table reconciles adjusted net earnings with net

earnings for the third quarter and first nine months of 2018 and

compares it to the same periods in 2017.

|

|

|

|

|

|

|

|

THREE MONTHS |

NINE MONTHS |

| |

|

ENDED SEPTEMBER 30 |

ENDED SEPTEMBER 30 |

| ($ MILLIONS) |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

| Net earnings (losses)

attributable to equity holders |

28 |

|

(124 |

) |

6 |

|

(143 |

) |

| Adjustments |

|

|

|

|

|

|

Adjustments on derivatives |

(24 |

) |

(40 |

) |

18 |

|

(106 |

) |

|

|

Impairment charges |

- |

|

111 |

|

- |

|

111 |

|

|

|

Reclamation provision adjustments |

5 |

|

(9 |

) |

50 |

|

(15 |

) |

|

|

Gain on restructuring of JV Inkai |

- |

|

- |

|

(49 |

) |

- |

|

| |

Income taxes on adjustments |

6 |

|

12 |

|

(16 |

) |

31 |

|

| Adjusted net earnings

(losses) |

15 |

|

(50 |

) |

9 |

|

(122 |

) |

Every quarter we are required to update the reclamation

provisions for all operations based on new cash flow estimates,

discount and inflation rates. This normally results in an

adjustment to an asset retirement obligation asset in addition to

the provision balance. When the assets of an operation have been

written off due to an impairment, as is the case with our Rabbit

Lake and US ISR operations, the adjustment is recorded directly to

the statement of earnings as “other operating expense (income)”.

See note 10 of our interim financial statements for more

information. This amount has been excluded from our adjusted net

earnings measure.

Selected segmented highlights

|

|

|

|

THREE MONTHS |

|

NINE MONTHS |

|

| |

|

|

ENDED SEPTEMBER 30 |

|

ENDED SEPTEMBER 30 |

|

| HIGHLIGHTS |

2018 |

|

2017 |

CHANGE |

2018 |

2017 |

CHANGE |

|

Uranium |

Production volume (million lbs) |

|

1.5 |

|

3.1 |

(52 |

)% |

6.8 |

16.9 |

(60 |

)% |

|

|

Sales volume (million lbs) |

|

10.6 |

|

9.2 |

15 |

% |

22.5 |

21.0 |

7 |

% |

|

|

Average realized price |

($US/lb) |

30.18 |

|

32.42 |

(7 |

)% |

35.05 |

34.15 |

3 |

% |

|

|

|

($Cdn/lb) |

39.49 |

|

41.66 |

(5 |

)% |

45.08 |

44.86 |

- |

|

|

|

Revenue ($ millions) |

|

418 |

|

385 |

9 |

% |

1,014 |

943 |

8 |

% |

| |

Gross profit (loss) ($ millions) |

|

(9 |

) |

51 |

(118 |

)% |

89 |

179 |

(50 |

)% |

|

Fuel services |

Production volume (million kgU) |

|

0.8 |

|

0.6 |

33 |

% |

7.0 |

5.4 |

30 |

% |

|

|

Sales volume (million kgU) |

|

2.1 |

|

2.5 |

(16 |

)% |

6.6 |

6.9 |

(4 |

)% |

|

|

Average realized price |

($Cdn/kgU) |

29.20 |

|

27.27 |

7 |

% |

29.25 |

29.94 |

(2 |

)% |

|

|

Revenue ($ millions) |

|

61 |

|

69 |

(12 |

)% |

194 |

206 |

(6 |

)% |

| |

Gross profit ($ millions) |

|

4 |

|

4 |

- |

|

34 |

42 |

(19 |

)% |

Management's discussion and analysis and financial

statementsThe third quarter MD&A and unaudited

condensed consolidated interim financial statements provide a

detailed explanation of our operating results for the three and

nine months ended September 30, 2018, as compared to the same

periods last year. This news release should be read in conjunction

with these documents, as well as our audited consolidated financial

statements and notes for the year ended December 31, 2017, first

quarter, second quarter and annual MD&A, and our most recent

annual information form, all of which are available on our website

at cameco.com, on SEDAR at sedar.com, and on EDGAR at

sec.gov/edgar.shtml.

Caution about forward-looking informationThis

news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect. Examples of forward-looking information in this news

release include: our expectations regarding fourth quarter results;

the factors affecting the future improvement of the uranium market;

that our decisions relating to market developments will keep the

company strong and viable for the long term; our belief that there

will not be a materially different outcome from the outcome of the

Tax Court of Canada’s decision for the 2003, 2005 and 2006 tax

years on appeal or for subsequent tax years; the discussion under

the heading Updated outlook for 2018 and 2019; the factors to be

considered and timing for determination of any future dividends;

and the expected date and time for the announcement of our fourth

quarter and annual consolidated financial and operating

results. Material risks that could lead to different results

include: the risk that our fourth quarter results do not meet our

expectations; the risk that developments in the uranium market will

be affected by different factors; the risk that our decisions

relating to market developments will be unsuccessful or have

unanticipated consequences; the risk that we are unsuccessful on an

appeal of the Tax Court of Canada’s decision for the 2003, 2005 and

2006 tax years, or unsuccessful in the outcome of disputes for

other years; the risk that our estimates and forecasts prove to be

incorrect, and our actual results differ from our Updated outlook

for 2018 and 2019; the risk that other factors may affect the

determination of any future dividends; and the risk we may be

delayed in announcing our fourth quarter and annual consolidated

financial and operating results. In presenting the

forward-looking information, we have made material assumptions

which may prove incorrect about our ability to achieve expected

fourth quarter results; factors affecting the uranium market; the

successful outcome of our decisions relating to market developments

and their consequences; the basis upon which the appeal of the Tax

Court of Canada’s decision for the 2003, 2005 and 2006 tax years,

and the outcome of disputes for other years, will be determined;

the factors underlying our estimates and forecasts for our Updated

outlook for 2018 and 2019; the basis on which future dividends will

be determined; and our ability to announce our fourth quarter

results when expected. Please also review the discussion in

our most recent annual and first, second and third quarter MD&A

and our most recent annual information form for other material

risks that could cause actual results to differ significantly from

our current expectations, and other material assumptions we have

made. Forward-looking information is designed to help you

understand management’s current views of our near- and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

Conference callWe invite you to join our third

quarter conference call on Friday, November 2, 2018, at 1:00 p.m.

Eastern.

The call will be open to all investors and the media. To join

the call, please dial 800-319-4610 (Canada and US) or 604-638-5340.

An operator will put your call through. The slides and a live

webcast of the conference call will be available from a link at

cameco.com. See the link on our home page on the day of the

call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, December 2, 2018, by

calling 800-319-6413 (Canada and US) or 604-638-9010 (Passcode

2589)

Fourth quarter and annual report release dateWe

plan to announce our fourth quarter and annual consolidated

financial and operating results after markets close on February 8,

2019. Announcement dates are subject to change.

ProfileCameco is one of the world’s largest

uranium producers, a significant supplier of conversion services

and one of two Candu fuel manufacturers in Canada. Our competitive

position is based on our controlling ownership of the world’s

largest high-grade reserves and low-cost operations. Our uranium

products are used to generate clean electricity in nuclear power

plants around the world. Our shares trade on the Toronto and New

York stock exchanges. Our head office is in Saskatoon,

Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

Investor inquiries: Rachelle Girard

306-956-6403

Media inquiries: Carey Hyndman 306-956-6317

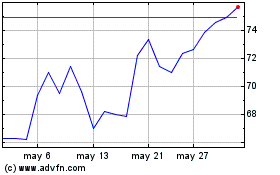

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025