Hammerhead Energy Inc. ("Hammerhead") (TSX: HHRS ; NASDAQ: HHRS) is

pleased to announce that it has entered into a definitive

arrangement agreement (the "Arrangement Agreement") with Crescent

Point Energy Corp. (“Crescent Point”) (TSX: CPG ; NYSE: CPG)

pursuant to which Crescent Point has agreed to acquire all of the

issued and outstanding Class A common shares of Hammerhead

("Hammerhead Shares") for total consideration of C$21.00 per

Hammerhead Share (the "Purchase Price"). The proposed transaction

(the "Transaction") is to be completed by way of a plan of

arrangement under the Business Corporations Act (Alberta) and is

expected to close in late December 2023.

Pursuant to the Transaction, each Hammerhead

Share will be exchanged for C$15.50 of cash consideration and

C$5.50 in value in the form of common shares of Crescent Point,

based on the offering price of the concurrent equity offering

announced by Crescent Point.

Scott Sobie, President and CEO of Hammerhead

notes “We are exceptionally proud of having built a business that

has proven to be a top tier asset that has delivered significant

organic growth. A combination of asset quality, exceptional people

and a solid business plan has positioned the company to be an

attractive acquisition target that will benefit from a lower cost

of capital inside of a larger enterprise. Since going public in

early 2023, we have delivered attractive equity returns for our

shareholders, and the ability to maintain a share position in

Crescent Point provides our shareholders with the ability to

benefit from the continued growth of the business.”

Robert Tichio, Chairman of the Board of

Hammerhead notes “On behalf of my fellow Board members and all

shareholders, I want to personally congratulate the Hammerhead team

for the exceptional performance they have delivered over many years

that has resulted in this excellent outcome. Riverstone first

invested in Hammerhead in 2014 as a 1,100 boe/d producer, and

subsequently invested additional capital over the last nine years

to support the company’s leadership, their skills, and these

assets. The delivery of superior operational and financial results

for all shareholders is a testament to our management team partners

and all Hammerhead employees.”

Strategic Rationale:

-

Attractive Value for Hammerhead Shareholders. The

Purchase Price implies an enterprise value for Hammerhead of

approximately C$2.55 billion, inclusive of assumed net debt. This

represents a 17% premium over the five-day volume weighted average

trading price of the Hammerhead Shares based on trading on all

exchanges as of the close of markets on November 3, 2023.

-

Continued Upside Exposure: The Transaction also

provides Hammerhead shareholders with continued ownership in

Crescent Point, a leading Canadian producer offering an attractive

total return to shareholders through return of capital and growth.

Crescent Point ownership offers enhanced scale, asset

diversification, liquidity in financial markets and a long-term

sustainable return of capital framework underpinned by a deep

portfolio of high-quality inventory.

-

Increasing Size and Scale: The Transaction will

create the seventh-largest E&P in Canada with production

weighted 65% to oil and liquids. Pro-forma Crescent Point

production is expected to total over 200,000 boe/d in 2024, with

significant drilling inventory in place to deliver additional

long-term organic growth. Crescent Point will immediately become

the largest owner of land in the volatile oil fairway in the

Alberta Montney, in addition to already controlling the largest

amount of land in the condensate-rich Kaybob Duvernay play. This

increased scale is expected to allow Crescent Point to continue to

improve its cost of capital.

Transaction Approvals:

Hammerhead will seek approval of the Transaction

by its shareholders (the "Hammerhead Shareholders") at a special

meeting expected to be held in late December 2023 (the

"Meeting").

The Transaction is subject to customary closing

conditions, including receipt of court approval, Hammerhead

Shareholder approval by at least 66 2/3% of the votes cast at the

Meeting and customary regulatory and stock exchange approvals,

including under the Competition Act (Canada). Upon closing of the

Transaction, the Hammerhead Shares will be de-listed from the TSX

and NASDAQ.

Certain affiliates of Riverstone Holdings LLC

(collectively “Riverstone”), who own in aggregate approximately 82%

of the Hammerhead Shares (on a non-diluted basis), have entered

into voting support agreements with Crescent Point and have agreed

to support and vote in favor of the Transaction, subject to the

provisions of such support agreements.

All of the directors and executive officers of

Hammerhead have also entered into voting support agreements

pursuant to which they have agreed, among other things, to vote

their Hammerhead Shares in favour of the Transaction, subject to

the provisions of such support agreements.

The Arrangement Agreement includes customary

deal protection provisions, including that Hammerhead has agreed

not to solicit or initiate any discussions regarding any other

transaction, subject to customary "fiduciary out" rights to respond

to a superior proposal. Hammerhead has also granted Crescent Point

a right-to-match any superior proposal and will pay a termination

fee of C$85 million to Crescent Point if the Arrangement Agreement

is terminated in certain circumstances. Crescent Point has also

agreed to pay a termination fee of C$85 million to Hammerhead if

the Arrangement Agreement is terminated in certain

circumstances.

Further details with respect to the Transaction

will be included in the information circular to be mailed to the

Hammerhead Shareholders in connection with the Meeting. A copy of

the Arrangement Agreement, the voting support agreements and the

information circular will be filed on Hammerhead's SEDAR+ profile

and will be available for viewing at www.sedarplus.ca.

Recommendation of the Board and Special

Committee:

Based on the unanimous recommendation of the

Special Committee of the Hammerhead Board of Directors, which was

comprised solely of independent directors and did not include any

directors associated with Riverstone or management, the Fairness

Opinions (as defined below) and consultations with its financial

and legal advisors, among other considerations, the Hammerhead

Board of Directors has unanimously: (i) determined that the

Transaction is fair to Hammerhead Shareholders and in the best

interests of Hammerhead; and (ii) resolved to recommend that the

Hammerhead Shareholders vote in favour of the Transaction.

Advisors:

CIBC Capital Markets (“CIBC”) is acting as

Financial Advisor to Hammerhead. CIBC has also provided a verbal

opinion (“CIBC Fairness Opinion”) to Hammerhead’s Board of

Directors to the effect that, as of the date of such opinion and

based upon and subject to the assumptions, limitations and

qualifications set forth therein, the consideration to be received

by Hammerhead Shareholders pursuant to the Arrangement Agreement,

is fair from a financial point of view, to Hammerhead Shareholders.

Burnet Duckworth & Palmer LLP is acting as Canadian counsel to

Hammerhead and Paul, Weiss, Rifkind, Wharton & Garrison LLP is

acting as U.S. counsel to Hammerhead. ATB Capital Markets and

Stifel Canada are acting as Strategic Advisors to Hammerhead.

Peters & Co. Limited (“Peters & Co.”) is

acting as Financial Advisor to the Special Committee of the

Hammerhead Board of Directors. Peters & Co. has also provided a

verbal opinion (“Peters & Co. Fairness Opinion” and, together

with CIBC Fairness Opinion, the “Fairness Opinions”) to the Special

Committee of the Hammerhead Board of Directors to the effect that,

as of the date of such opinion and based upon and subject to the

assumptions, limitations and qualifications set forth therein, the

consideration to be received by Hammerhead Shareholders pursuant to

the Transaction, is fair from a financial point of view, to

Hammerhead Shareholders. Blake, Cassels & Graydon LLP is acting

as counsel to the Special Committee of the Hammerhead Board of

Directors.

Bennett Jones LLP and Vinson & Elkins LLP

are acting as counsel to Riverstone.

About Hammerhead Energy

Inc.

Hammerhead is a Calgary, Canada-based energy

company, with assets and operations in Alberta targeting the

Montney formation. Hammerhead Resources Inc., the predecessor

entity to Hammerhead Resources ULC, a wholly owned subsidiary of

Hammerhead, was formed in 2009.

Contacts:

For further information, please contact:

Scott SobiePresident

& CEOHammerhead Energy Inc.403-930-0560

Mike KohutSenior Vice President &

CFOHammerhead Energy Inc.403-930-0560

Kurt MolnarVice President Capital

Markets & Corporate PlanningHammerhead Energy

Inc.403-930-0560

READER ADVISORY

Currency

All amounts in this press release are stated in Canadian dollars

(C$) unless otherwise specified.

Forward Looking Statements

Certain information contained herein may

constitute forward-looking statements and information

(collectively, “forward-looking statements”) within the meaning of

applicable securities legislation, including Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, that involve known and

unknown risks, assumptions, uncertainties and other factors. Undue

reliance should not be placed on any forward-looking statements.

Forward-looking statements may be identified by words like

“anticipates”, “estimates”, “expects”, “indicates”, “forecast”,

“intends”, “may”, “believes”, “could”, “should”, “would”, “plans”,

“proposed”, “potential”, “will”, “target”, “approximate”,

“continue”, “might”, “possible”, “predicts”, “projects” and similar

expressions, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements in

this press release include but are not limited to: the Transaction

and the timing and benefits thereof; the consideration expected to

be received by Hammerhead Shareholders pursuant to the Transaction;

the timing of the Meeting; and the anticipated benefits of the

Transaction, including in respect of production, drilling

inventory, growth, cost of capital and liquidity.

Such statements reflect the current views of

Hammerhead and Crescent Point, as applicable, with respect to

future events and are subject to certain risks, uncertainties and

assumptions that could cause results to differ materially from

those expressed in the forward-looking statements. These risks and

uncertainties include but are not limited to: that the Transaction

is not completed on the timing anticipated or at all; the

occurrence of any event, change or other circumstances that could

give rise to the termination of the definitive agreements relating

to the Transaction; the inability to complete the Transaction due

to the failure to obtain approval of Hammerhead Shareholders, the

court, regulatory bodies or stock exchanges, as required; the risk

that pro forma Crescent Point may not be able to realize the

anticipated benefits of the Transaction, including with respect to

increased production, long-term organic growth and improved cost of

capital; risks related to capital market liquidity and long-term

return of capital; risks related to the retention or recruitment,

or changes required in, officers, key employees or directors

following completion of the Transaction; geopolitical risks and

changes in applicable laws or regulations; the possibility that

Hammerhead, Crescent Point and/or pro forma Hammerhead may be

adversely affected by other economic, business, and/or competitive

factors; the impact of general economic conditions; volatility in

market prices for crude oil and natural gas; industry conditions;

currency fluctuations; imprecision of reserve estimates;

liabilities inherent in crude oil and natural gas operations;

environmental risks; incorrect assessments of the value of

acquisitions and exploration and development programs; the lack of

availability of qualified personnel, drilling rigs or other

services; changes in income tax laws or changes in royalty rates

and incentive programs relating to the oil and gas industry

including abandonment and reclamation programs; hazards such as

fire, explosion, blowouts, and spills, each of which could result

in substantial damage to wells, production facilities, other

property and the environment or in personal injury; ability to

access sufficient capital from internal and external sources;

Hammerhead’s success in retaining or recruiting, or changes

required in, its officers, key employees or directors; operational

risks; litigation and regulatory enforcement risks, including the

diversion of management time and attention and the additional costs

and demands on resources; general economic and business conditions;

risks related to the oil and natural gas industry, such as

operational risks in exploring for, developing and producing crude

oil and natural gas and market demand; pricing pressures and supply

and demand in the oil and gas industry; fluctuations in currency

and interest rates; risks related to debt agreements and access to

capital; inflation; risks of war, hostilities, civil insurrection,

pandemics and epidemics, and general political and economic

instability; severe weather conditions and risks related to climate

change; terrorist threats; risks associated with technology;

changes in laws and regulations, including environmental,

regulatory and taxation laws, and the application of such changes

to pro forma Crescent Point's future business; availability of

adequate levels of insurance; and difficulty in obtaining necessary

regulatory approvals and the maintenance of such approvals. Readers

are cautioned that the foregoing list is not exhaustive of all

possible risks and uncertainties.

With respect to forward-looking statements

contained in this press release, Hammerhead and Crescent Point, as

applicable, have made assumptions regarding, among other things:

the satisfaction of the conditions to completion of the

Transaction, including the timely receipt of required Hammerhead

Shareholder, court, regulatory and stock exchange approvals, as

required; the ability of Crescent Point to realize benefits and

efficiencies with respect to the Transaction; future capital

expenditure levels; future oil and natural gas prices; future oil

and natural gas production levels; future currency exchange rates

and interest rates; ability to obtain equipment and services in a

timely manner to carry out development activities; ability to

market oil and natural gas successfully to current and new

customers; the impact of competition; the general stability of the

economic and political environments in which Hammerhead and

Crescent Point operate; the ability to obtain qualified staff,

equipment and services in a timely and cost efficient manner; that

Crescent Point, Hammerhead and/or pro forma Crescent Point will

have sufficient cash flow, debt or equity sources or other

financial resources required to fund the expenses in connection

with the Transaction, capital and operating expenditures and other

requirements as needed; that pro forma Crescent Point's conduct and

results of operations will be consistent with its expectations;

that pro forma Crescent Point will have the ability to develop its

oil and gas properties in the manner currently contemplated; the

estimates of production volumes and the assumptions related thereto

(including commodity prices and development costs) are accurate in

all material respects; the ability to add production and reserves

through development and exploration activities; and other matters.

Although Hammerhead believes that the expectations reflected in the

forward-looking statements contained in this press release, and the

assumptions on which such forward-looking statements are made, are

reasonable, there can be no assurance that such expectations will

prove to be correct. Readers are cautioned that the foregoing list

is not an exhaustive list of all assumptions which have been

considered.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this press release in order to provide shareholders

with a more complete perspective on Hammerhead's current and future

operations and such information may not be appropriate for other

purposes. Hammerhead's actual results, performance or achievement

could differ materially from those expressed in, or implied by,

these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Hammerhead will derive. The forward-looking statements

contained in this press release speak only as of the date of this

press release. Accordingly, forward-looking statements should not

be relied upon as representing Hammerhead’s views as of any

subsequent date, and except as expressly required by applicable

securities laws, Hammerhead does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

Oil and Gas Information

The term "Boe" means a barrel of oil equivalent

on the basis of 6 Mcf of natural gas to 1 barrel of oil ("bbl").

Boe’s may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6:1, utilizing a conversion ratio at 6:1 may be

misleading as an indication of value.

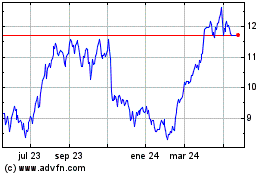

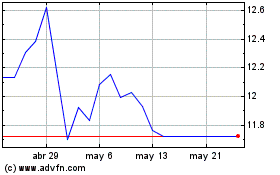

Crescent Point Energy (TSX:CPG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Crescent Point Energy (TSX:CPG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024