Verde AgriTech Ltd (TSX: “

NPK”)

("

Verde” or the “

Company”) is

pleased to announce that it has secured 16.2 million Canadian

Dollars (“

C$”) - 60 million Brazilian Reais

(“

R$”) - in debt financing facility from Banco do

Brasil S.A. (“

Banco do Brasil”) and Banco Bradesco

S.A. (“

Bradesco”), the two largest Brazilian banks

(the “

Financing”). The funds raised will be used

to replace existing debt that were at higher interest rates and

provide the Company with more favorable terms, including 6 months

of grace period for Bradesco’s loan and 12 months for Banco do

Brasil’s loan. This will enable Verde to offer financing solutions

to potential customers, whilst fostering growth and financial

stability. The Financing consists of C$10.8 million in debt from

Banco do Brasil, Brazil's largest bank (R$40 million), of which the

Brazilian Federal Government retains a 50% share; and C$5.4 million

from Bradesco (R$20 million), the second largest financial group in

Brazil (the “

Banks”). Additionally, Verde

currently has C$20 million (R$74 million) pre-approved credit with

banks in Brazil.

The loan granted by Banco do Brasil received a

Sustainability Certificate (the “Certificate”)

distinguishing it as a sustainable financial operation. The

Certificate is awarded to financing activities included in Banco do

Brasil’s1 evaluated against a diverse array of national and

international standards and taxonomies. The purpose of BB's

Sustainable Business Portfolio is to encourage the expansion of

enterprises and initiatives that directly contribute to Brazil’s

sustainable development, by offering services and resources aimed

at addressing social-environmental issues.

The Certificate awarded to Verde falls under the

Environmental category, which encompasses projects like forest

restoration, low-carbon agriculture, and the rehabilitation of

degraded areas, all of which are undertaken by the Company, which

integrates sustainable practices throughout its operational process

as a core value.

For a transaction to receive Banco do Brasil's

approval within the Sustainable Credit framework, it undergoes a

rigorous evaluation encompassing Environmental, Governance, and

Social dimensions. This assessment entails:

- Analyzing the sustainability of production processes;

- Ensuring the Company's financial statements undergo third-party

auditing;

- Gauging the brand’s reliability and reputation;

- Verifying compliance with national and international quality

standards;

- Reviewing the competence of the management squad;

- Checking for any recorded discrepancies with government

agencies;

- Assessing transparency in the Company's communications.

“We are encouraged to count on the backing of

two of the largest banks in Latin America2 to support our growth.

The loans will increase our cash reserves and replace existing

high-interest debt along with better terms, and provide financing

to potential customers, allowing us to extend essential financial

support to farmers in the agricultural sector, who require

post-harvest input payments. These two loans reflect significant

confidence in our business and in the partnership between Verde and

these reputable institutions", stated Cristiano Veloso, Verde’s

Founder and CEO.

The Financing transactions were structured as

follows:

- Banco do Brasil: C$10.8 million loan (R$40

million), with an interest rate of CDI3 + 3.60%. The loan term

extended to 36 months, including a grace period of 12 months.

Payment was scheduled with three annual instalments of principal

and interest, due in August 2024, August 2025, and August

2026.

- Bradesco: C$5.4 million loan (R$20 million),

with an interest rate of CDI + 3,61%. The loan term was set at 24

months, featuring a grace period of 6 months. The payment schedule

included the first 6 months with monthly interest, followed by 4

semesters payments of principal in March and October for the next

two years.

Out of the total Financing secured, C$9.5

million (R$35 million) has been allocated towards the settlement of

six existing loans.

BRAZILIAN INTEREST RATES

OUTLOOK:

The Central Bank of Brazil, on August 5, 2023,

announced a reduction in the SELIC rate from 13.75% to 13.25%,

marking a significant shift following a series of 12 consecutive

rate hikes. Subsequently, on October 11, 2023, the SELIC rate was

further adjusted, reaching 12.75%.4 These adjustments reflect the

Central Bank's commitment to managing the nation's monetary policy

in response to changing economic conditions.

Projections indicate a steady decline in the

SELIC rate over the coming years, with expectations of reaching

11.75% by the close of 2023, followed by a reduction to 9.0% in

2024 and a further decrease to 8.5% in 2025 and 2026.5 These

adjustments align with the broader economic indicators with annual

inflation easing to 4.86% in 2023.

If the projected reduction in the SELIC interest

rate materializes in the coming years, it would result in

significant interest expense savings for the Company. These

potential savings are estimated to reach C$1.1 million (R$4

million) by the end of 2024 and a total accumulated savings of

C$2.7 million (R$9.9 million) by the end of Q4 2026.

ABOUT BANCO DO BRASIL:

Banco do Brasil is a Brazilian bank,

incorporated as a mixed capital company, with the Federal

Government of Brazil holding 50% of the shares (as of October 18,

2023)6, being one of the five state-owned banks of the Brazilian

government, traded on the B3 as BBAS3.

The bank was established in 1808, is a key

player in Brazil's financial landscape. Originally founded to

promote manufacturing businesses during colonial Brazil, it later

evolved into one of the country's largest banks, primarily owned by

the government. Today, it actively contributes to Brazil's economic

and social growth, supporting sectors like rural credit and

offering a range of financial services, including low-interest

loans and insurance. Its multifaceted involvement in culture,

sports, and various economic sectors solidifies its role in shaping

Brazil's future.7

BB was recognized by the Corporate Knights'

Global 100 ranking as the world's most sustainable bank four times,

first in 2019 at the World Economic Forum in Davos. It was the only

Brazilian entity in the top 100, ranking 15th among over 6,000

companies.

The bank is part of several indices including

the Dow Jones Sustainability Index (DJSI) since 2012, the Corporate

Sustainability Index (ISE) of the São Paulo Stock Exchange since

2005, and the FTSE4 Good Index Series since 2016. It was included

in the Silver Class of the S&P Global and RobecoSAM AG 2022

Yearbook. In 2021, the Transparency Observatory listed the bank

among the Most Transparent Companies.

In 2023, Capital Finance International named BB

the most sustainable bank in South America. The bank scored a 'B'

in the 2022 CDP Climate Change Programme. It has an 'A' rating from

the Morgan Stanley Capital International (MSCI) ESG Rating since

2020.

In January 2023, the bank received the Terra

Carta Seal from the Sustainable Markets Initiative. Only 19

companies received this in its 2022 edition, with Banco do Brasil

being the sole recipient from Latin America. In 2023, the Getúlio

Vargas Foundation's Center for Sustainability Studies awarded the

bank the Gold Seal for its Corporate Greenhouse Gas (GHG)

Inventory.

ABOUT BRADESCO:

Banco Bradesco, a leading financial institution

in Brazil, boasts a rich history of serving customers since 1943.

With a comprehensive range of financial services and a vast network

of branches and ATMs across the country, Bradesco is committed to

providing top-notch customer service. The bank is dedicated to

sustainability, actively participating in social and environmental

initiatives.8

Bradesco stands out as a leading financial

institution, consistently recognized for its solidity, security,

and innovative strides in technology.

Among other recognitions, Bradesco BBI received

awards in 4 Latin American categories of the Sustainable Finance

Awards 2023: Outstanding Leadership in Green Bonds, Outstanding

Leadership in Transition/Sustainability Linked Bonds, Outstanding

Leadership in Sustainable Infrastructure Finance and Outstanding

Leadership in Project Finance (Global Finance).

Bradesco was also featured in the Top

Innovations in Finance (Global Finance) award. The bank was chosen

by the Global Finance magazine, an international publication

specialized in finance, as the best sub-custodian bank in Brazil in

the 21st annual award as the Best Subcustodian Bank.

Furthermore, Inovabra was recognized as one of

the best financial innovation laboratories in the world. Bradesco

is also listed among the top-rated companies in the S&P Global

Sustainability Yearbook 2023 and is included in Bloomberg’s 2023

Gender-Equality Index.9

ABOUT VERDE AGRITECH

Verde is an agricultural technology Company that

produces potash fertilizers. Our purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, we

make agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.10 Currently, the Company

is fully licensed to produce up to 2.8 million tonnes per year of

its multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®. In 2022, it became Brazil's

largest potash producer by capacity.11 Verde has a combined

measured and indicated mineral resource of 1.47 billion tonnes at

9.28% K2O and an inferred mineral resource of 1.85 billion tonnes

at 8.60% K2O (using a 7.5% K2O cut-off grade).12 This amounts to

295.70 million tonnes of potash in K2O. For context, in 2021

Brazil’s total consumption of potash in K2O was 6.57 million13.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 97% of its potash needs. In 2022, potash accounted

for approximately 3% of all Brazilian imports by dollar

value.14

CORPORATE PRESENTATION

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/nekrk8xfujzasr9x

INVESTORS NEWSLETTER

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

https://bit.ly/InvestorNL_August2023

CAUTIONARY LANGUAGE AND FORWARD-LOOKING

STATEMENTS

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of Mineral Resources and Mineral

Reserves;

- the estimated amount of CO2 removal per tonne of rock;

- the PFS representing a viable development option for the

Project;

- estimates of the capital costs of constructing mine facilities

and bringing a mine into production, of sustaining capital and the

duration of financing payback periods;

- the estimated amount of future production, both produced and

sold;

- timing of disclosure for the PFS and recommendations from the

Special Committee;

- the Company’s competitive position in Brazil and demand for

potash; and,

- estimates of operating costs and total costs, net cash flow,

net present value and economic returns from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

- the presence of and continuity of resources and reserves at the

Project at estimated grades;

- the estimation of CO2 removal based on the chemical and

mineralogical composition of assumed resources and reserves;

- the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations;

- the capacities and durability of various machinery and

equipment;

- the availability of personnel, machinery and equipment at

estimated prices and within the estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed;

- appropriate discount rates applied to the cash flows in the

economic analysis;

- tax rates and royalty rates applicable to the proposed mining

operation;

- the availability of acceptable financing under assumed

structure and costs;

- anticipated mining losses and dilution;

- reasonable contingency requirements;

- success in realizing proposed operations;

- receipt of permits and other regulatory approvals on acceptable

terms; and

- the fulfilment of environmental assessment commitments and

arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.verde.ag | www.investor.verde.ag

1 For further information, see:

https://www.bb.com.br/site/sustainability/how-banco-do-brasil-works/sustainable-credit-portfolio/

2 Source:

https://www.investopedia.com/articles/investing/111314/10-biggest-latin-american-banks.asp

3 CDI stands for Certificate of Interbank Deposit (Certificado de

Depósito Interbancário, in Portuguese). The CDI rate is an average

of interest rates on unsecured interbank short-term funding. Its

value is usually very close to the rates of repurchase agreements

of securities issued by the federal government. Available at:

https://www.bcb.gov.br/content/publicacoes/WorkingPaperSeries/wps168.pdf

4 Source: Brazilian Central Bank. Available

at: https://www.bcb.gov.br/en 5 Source: Brazilian Central

Bank. Available

at: https://www.bcb.gov.br/content/focus/focus/R20231013.pdf 6

Source:

https://ri.bb.com.br/en/banco-do-brasil/ownership-structure/ 7

Source: https://www.bb.com.br/site/sobre-nos/ 8 Source:

https://banco.bradesco/html/classic/sobre/ 9 Source:

https://www.bradescori.com.br/en/market-information/acknowledgments/

10 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9 11 See the release

at:

https://investor.verde.ag/verde-starts-ramp-up-of-plant-2s-second-stage-to-reach-production-of-2-4mtpy/

12 As per the National Instrument 43-101 Standards of Disclosure

for Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR

in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

13 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese).14

Source: Brazilian Comex Stat, available at:

http://comexstat.mdic.gov.br/en/geral

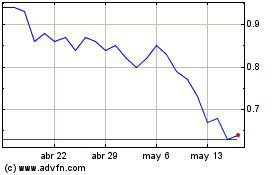

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024