PyroGenesis Inc. (“PyroGenesis”) (http://pyrogenesis.com) (TSX:

PYR) (OTCQX: PYRGF) (FRA: 8PY), a high-tech company that designs,

develops, manufactures and commercializes advanced plasma processes

and sustainable solutions which are geared to reduce greenhouse

gases (GHG) and address environmental pollutants, provides the

following comments and analysis in response to investor questions

about the impact from the upcoming change in U.S. leadership and

potential change in policy direction.

In summary, PyroGenesis is positive about the

potential economic impact the U.S. election outcome may have on the

company. The potential benefits from President-Elect Donald Trump’s

campaign promises, in particular the commitments to (i) lower

corporate taxation to stimulate business growth, (ii) reduce

regulatory burdens and bureaucracy to accelerate project approvals,

(iii) expand the energy sector to – in the campaign’s own words –

“unleash energy production from all sources, including nuclear”,

(iv) “to immediately slash inflation and power American homes,

cars, and factories with reliable, abundant, and affordable

Energy”1, are numerous and prescient, as America commits to a

future of advanced manufacturing leadership, energy

self-sufficiency, and supply chain protection.

“The expectation is that the newly-elected

administration’s initiatives will speed up capital projects, stir

innovation, increase overall capacity of the energy grid, and lower

energy costs. This could be highly beneficial to companies like

ours that supply heavy industry with the high-temperature

electricity-based solutions needed to modernize, optimize, and

compete,” said P. Peter Pascali, President and CEO of PyroGenesis.

“Furthermore, we believe that any fears associated with a rumoured

U.S. withdrawal from the Paris climate accords or repeal of the

green energy incentive-heavy Inflation Reduction Act passed by the

Biden administration will have little to no impact on our company,

due to a number of important factors (such as the scale of energy

transition, rising demand for lightweight metals, power grid

expansion and resurgence of nuclear power, continued impact from

initiatives started by the inflation reduction act, and our

solution/geographic diversification) that I am pleased to outline

below.”

Understanding Energy

Transition

There have been concerns that the change in

American leadership will disrupt the business opportunities

inherent in the energy transition movement.

We believe that these concerns represent a

fundamental misunderstanding of what energy transition is and where

associated business opportunities lie.

Energy transition at an industrial level is not

just about replacing one form of energy with another, such as

finding substitutions for oil and gas to reduce carbon

footprint.

It is also largely about reducing handling,

shipping, and storage requirements and costs for fuels, improving

the efficiency of heating applications, improving the rate or speed

of heating, improving factory working conditions such as air

quality, reducing dangerous environments, and reducing injury

potential related to combustible or explosive materials.

It is also about finding new uses for existing

energy forms, and reducing the variety of different fuel sources

used at a particular facility in the process, both of which always

made practical sense to do so but were not considered possible

until recently.

For companies in industries such as aluminum,

where electricity has long been the major source of power, having

to utilize gas, oil, or diesel in certain heating or melting

applications is an added burden logistically. Reducing the

energy/fuel types used across an aluminum facility makes logical

sense but is only justifiable where quality and cost are not

negatively impacted. With advances in electricity-based technology

from companies like PyroGenesis, those goals are now more within

reach.

With a multitude of criteria driving industrial

energy transition, any U.S. reduction in carbon-specific

initiatives is only impacting a portion of the overall

decision-making benchmarks.

Rising Demand for Lightweight Metals:

Our Strength in Aluminum and Titanium

Lightweight metal industries showcase perhaps

the best example of the scale of opportunities available in energy

transition, as well as the impact these industries are having in

other areas – impact that is necessitating change that further

benefits PyroGenesis.

PyroGenesis has long had business strength in

lightweight metals. The aluminum industry is a major source of

revenue for the company’s business and is growing. Separately, the

company is pushing to have its titanium metal powders produced by

its patented NexGen plasma atomization metal powder production

system breakthrough in the additive manufacturing market.

Numerous PyroGenesis technologies targeting

lightweight metals are already deployed in the field or in

development. From PyroGenesis’ Drosrite™ aluminum metal dross

recovery systems [see image below] installed around the world, to

plasma torch burners currently being developed with/for

multi-billion dollar entities for various heating and melting

applications in reverberatory/holding furnaces and tanks, to

burners for carbon anode baking furnaces, dross residue

valorization, and spent pot lining recovery and valorization. And

more applications are under development.

PyroGenesis’ growing position in this sector is

key, as aluminium demand is expected to increase by almost 40 per

cent by 2030 and the aluminum sector will need to produce an

additional 33.3 Mt to meet demand growth in all industrial sectors

– from 86.2 Mt in 2020 to 119.5 Mt in 2030.2 Further out, other

estimates see a demand increase of 80% by 2050.3

Currently, industrial output in the aluminum

industry exists outside of the U.S. political sphere of influence.

Once one of the top producers in the world, peaking at 30 smelters

in the 1980s, the U.S. now has very few aluminum producers, with

only four active smelters for primary aluminum remaining on U.S.

soil.4

Additionally, the global shift to renewable

energy that continues to occur will only further impact demand for

aluminum. Everything from lightweight electric vehicles, to wind

turbines, to solar panels, to the cabling used to transmit the

power generated from these renewable sources to national grids

requires aluminum as a critical raw material.

For example, aluminium is the single most widely

used mineral material in solar photovoltaic [PV] applications,

accounting for more than 85% of the mineral material demand for

solar PV components. Electric vehicles utilize aluminum components

extensively for weight reduction, both in the structural and

battery elements. EV batteries often utilize aluminum housings, and

growing momentum exists of a potential future for aluminum-ion

batteries.5

As further testament to the global aluminum

demand brought about just by these three products related to the

renewable economy, China’s three fastest-growing exports, in

dollar-value terms, are cars, solar panels, and batteries.6

Rising aluminum demand produces two additional

issues that PyroGenesis also sees as beneficial to its future:

- Primary aluminum production itself is a power-intensive

process. To prevent offsetting the decarbonization and efficiency

gains achieved through the use of lightweight aluminum, product

manufacturers will require the production of aluminum to adapt and

reduce its carbon footprint and use of fossil fuels where possible.

PyroGenesis plasma-torch burners in heating and remelting furnaces

and tanks are well positioned for just such a task, especially as

the aluminum industry is expected to turn more aggressively to

secondary (scrap) metal as an alternative source, as it uses 95%

less energy than primary aluminum to produce.7The net result

is that aluminum offers both the lightweight strength desired by

manufacturers, and a route to decarbonization, via use of recycled

metals and a reduction in energy types achieved by expanding

electricity-based technologies across the factory application

spectrum. Once again, this provides PyroGenesis with a global

business opportunity notwithstanding any U.S. policy shifts.

- The move to more renewable energy and a powering-up of advanced

manufacturing will require an expansion of the power grid. As a

company producing electricity-based technology solutions, any

additional increase to the grid is of great benefit to PyroGenesis

and its clients.

The Trump administration has specifically

highlighted power grid expansion in its campaign platform and, as

outlined below, the expected grid expansion worldwide –

particularly with nuclear energy as a key component – is expected

to have long-lasting benefits, both for those who require the

additional energy and for those like PyroGenesis who contribute

solution infrastructure. PyroGenesis looks forward to such a

rollout in the years ahead, no matter the energy source mix.

PyroGenesis Benefits from Impending Grid

Expansion and Resurgence of Nuclear Power

Energy consumption is rising fast due to a

broad-based electrification effort in homes and factories, changes

to weather mandating more widespread interior cooling technologies,

industrial requirements, and especially the vast needs of data

centers powering the development of artificial intelligence and

cryptocurrency mining.

Electricity consumption from data centres,

artificial intelligence (AI) and the cryptocurrency sector could

double by 2026. Data centres are significant drivers of growth in

electricity demand in many regions. After globally consuming an

estimated 460 terawatt-hours (TWh) in 2022, data centres’

total electricity consumption could reach more than 1,000 TWh

in 2026. This demand is roughly equivalent to the electricity

consumption of Japan.8

To prepare, energy grid investment globally

needs to double to more than $600 billion a year by 2030 if nations

are to meet climate targets, according to the International Energy

Agency.9

Existing renewable energy is not enough to

accomplish this goal. All energy sources will need to be considered

including, as President-Elect Trump has outlined, more oil and gas,

and more nuclear. This of course must include more renewable energy

to not only aid in the overall grid supply, but also to provide

manufacturers with the types of energy they need for their

manufacturing goals as outlined above.

At COP 28, the United Nations Climate Conference

held in Dubai in 2023, more than 110 countries committed to triple

renewable energy capacity worldwide by 2030, while 22 countries –

including Canada – agreed to triple nuclear energy capacity by

2050.10

Around the world, countries are once again

making nuclear power a critical part of their energy strategies and

nuclear generation is forecast to grow by close to 3% per year on

average through 2026. France and Japan are conducting maintenance

work and restarts on nuclear production at several plants. China,

India, Korea, and Europe all have new reactors beginning commercial

operations. Canada has developed a small modular reactor action

plan and roadmap.11 Its most populous province Ontario has

already begun the refurbishment of 10 reactors over 15 years. The

Canadian federal government revised its Green Framework to

explicitly permit “the deployment of nuclear energy” that was

previously excluded from earlier drafts of the Framework.12 In

November 2024, a Canadian firm was awarded a contract to deploy the

country’s CANDU nuclear reactor technology for two reactor builds

in Romania, the first since 2007.13

The United States has significant plans for

nuclear expansion as well. In August 2024, President-Elect Trump

vowed to dramatically increase energy production, generation, and

supply to reduce electricity costs and deliver more electricity to

the industries that require it, by not only adding to the country’s

oil and gas production, but also fast tracking the production of

new power plants and modular nuclear reactors: “Starting on day

one, I will approve new drilling, new pipelines, new refineries,

new power plants, new reactors and we will slash the red tape. We

will get the job done. We will create more electricity, also for

these new industries that can only function with massive

electricity.”14

Former U.S. Interior Secretary David Bernhardt,

after reviewing the Republican’s official plan, said the

President-Elect aims to “support nuclear energy production by

modernizing the Nuclear Regulatory Commission, working to keep

existing power plants open and investing in innovative small

modular reactors.” Bernhardt added, “President Trump will fully

modernize the electric grid to prepare it for the next 100

years, implement rapid approvals for energy projects, and

greenlight the construction of hundreds of new power plants to pave

the way for an enormous growth in American wealth”.15

Energy grid upgrades over the next few years in

the United States and around the world are likely to be

significant. As a result, grid infrastructure expansion and

upgrading are unlikely to be negatively impacted by any policy

changes. In fact, they will likely receive beneficial incentives or

fast-tracking due to demand across different energy types and

industries, for both private and public sectors, and across

corporate and individual end users.

In many aspects, PyroGenesis views all-electric

plasma systems [PyroGenesis plasma torch image below] as an

extension of grid infrastructure, at least with respect to

final-mile industrial grid upgrades. The company has plans to work

with clients to include plasma technology as part of grid

infrastructure initiatives and to seek exceptions where needed

under these auspices.

Grid infrastructure and power equipment,

including transmission lines, transformers, and peripherals for

both renewables and fossil fuels, will doubtless benefit from

preferred status as grid expansion initiatives take hold.

This understanding of rising power demand and

its ramifications perhaps provides a more rounded perspective of

the fate of existing energy or green technology-focused policy

measures. This leads to a closer look at the state of the U.S.

Inflation Reduction Act:

The Impact and Future of the U.S.

Inflation Reduction Act

The U.S. Inflation Reduction Act (IRA) includes

~$500 billion and potentially up to $1 trillion in federal funding

for climate-related efforts and provides funds toward the

decarbonization of the U.S. economy, including tax credits,

incentives, grants, and loan guarantees. This funding is spread

across replacing energy infrastructure, incentives for private

investment in clean energy, transport, and manufacturing, and

consumer incentives.

President-Elect Trump was highly critical of the

IRA at various points during his campaign. However, going so far as

to repeal the IRA in its entirety is doubtful, notably due to the

reasons outlined above, but also due to the following:

First, the United

States simply needs more power.

U.S. electric load is

growing significantly faster than grid planners previously

expected, led by new manufacturing and industry and the growth of

data centers for AI and crypto mining, as well as contributions

from electrification, hydrogen production and severe weather.

During 2023, U.S. grid planners doubled their 5-year load growth

forecast, from the 2.6% originally forecasted in 2022 to 4.7%

growth over the next five years, as reflected in 2023 Federal

Energy Regulatory Commission (FERC) filings.16

Matching this load

growth with grid growth will be almost impossible to do without

many of the renewable energy measures that the IRA instigates.

Second, support for

clean energy is widespread, even on the political right, owing to

the impact on the local economies where clean energy projects are

sited: lower energy bills; energy security; and, most importantly,

jobs.

Of the more than $200

billion in cleantech manufacturing investments announced in 185

House districts up to June 2024, 65% to 80% of those investments

went to Republican held states, with 9 of the top 10 congressional

districts for cleantech investments represented by Republicans.

Third, of the top 25

congressional districts for announced cleantech manufacturing

investment, 21 are Republican held. Those 21 districts alone

account for an aggregate $119 billion of investment — more than

half the national total — and more than 80,000 jobs of the 200,000

total jobs.17

There are now 900

manufacturing plants in the United States’ clean energy industries,

60% of which are located in Republican-led states and congressional

districts.18 As recently as October 22, 2024, the Department of

Energy announced $428 million funding for 14 clean energy

manufacturing projects in 15 U.S. communities with decommissioned

coal facilities.19

Last but not least,

while cleantech and renewable energy manufacturing is responsible

for significant job growth, the same cannot be said of the oil and

gas sector.

The industry’s

historical boom and bust cycle and relentless focus on efficiency

has resulted in fewer workers needed to produce more oil.

Despite U.S. oil and

gas production hitting record highs, the industry employs 73,000

fewer people than it did in 2019. The drop is more precipitous

after 2014 and the shale-oil boom, when more than 600,000 people

worked to produce oil and gas. By August 2024, that number was down

to 380,000 people producing 45% more gas and 47% more oil – even

while pumping an average of 13.4 million barrels a day, a new crude

production record.20

All told, employment

in the oil sector is down nearly 20 percent from pre-pandemic

levels.

This helps outline

the important difference between legacy and new energy industries.

The latter is heavily focused on manufacturing and assembly plants

that employ thousands of personnel at each factory location, which

further emphasizes the appeal of green energy projects to

Republican-held jurisdictions – even those who initially opposed

the IRA.

Overall, the IRA energy initiatives are arguably

far enough along that resistance from President-Elect Trump could

hurt local American economies. Given the extent of red-state

initiatives, curtailment of these projects would likely face

opposition from within the Republican party.

Significant changes to IRA tax credits and

industrial or manufacturing incentives and reversing corporate tax

cuts of any type may prove unpopular in both parties and will meet

opposition. One possible outcome is a “levelling of the playing

field” approach, where oil and gas producers receive similar tax

incentives, and where the emphasizing of energy independence brings

oil, gas, renewables, and nuclear together as equals for the

greater good of the grid.

If President-Elect Trump’s promises to increase

oil and gas production come to pass, they will be most beneficial

to expansion of the energy grid. However, with the U.S. already

having become the world’s largest oil and gas producer21, the

impact on jobs and local economies may be low relative to those

impacted by green energy projects.

For the reasons above, PyroGenesis does not

anticipate changes, if any, to the IRA under the Trump

administration will have an adverse effect on the company’s

business.

PyroGenesis’ Advantage in

Diversification of Solutions and Geographies

Diversification has long been a theme for

PyroGenesis, where a “multi-legged stool” approach built around a

solution-set with interconnected technology has helped to insulate

the company from risks that might affect any one product or

solution line.

Similarly, as the company has expanded, its

customer base has become less centered in any one geographic

region.

Moreover, while a Canadian company with roots

and facilities in Quebec, PyroGenesis’ value chain is U.S. based.

Many of our systems or components are already manufactured in the

U.S. and have been for years.

In addition, PyroGenesis recently changed its

name to PyroGenesis Inc. from PyroGenesis Canada Inc. (and

simultaneously to PyroGenèse Inc. from PyroGenèse Canada Inc. in

French). As Mr. Pascali said at the time, the change was a subtle

but important one that better reflects the global impact of the

company, with sales across 21 countries and counting, and was part

of an initiative to better express in all areas of communication

that PyroGenesis is an internationally focused company with global

reach.

This global approach and perspective provide

significant advantages for the company.

Clients in some regions are afforded advantages

by utilizing carbon offsets, reducing carbon penalties, or

receiving eco-grants to help purchase PyroGenesis technologies. In

areas where these incentives are lacking, it is important to note

that the economics with respect to all-electric plasma-based

systems have improved dramatically over time. The price of the

technology has become more in-line with the legacy technology it is

replacing while offering a variety of gains including efficiency,

speed, safety, and air quality, amongst others, that negate

resistance to the technology on a head-to-head basis vs.

legacy.

Whether the U.S. scales back or withdraws from

climate-focused initiatives such as the IRA or the Paris Climate

Accords, institutes tariffs against certain foreign manufacturing,

or systemically favours oil and gas, PyroGenesis believes it will

remain relatively unaffected for all of the reasons noted

above.

In conclusion, specific to the recent U.S.

election, PyroGenesis is encouraged by the economic and stimulus

policy measures announced by President-Elect Trump during the

campaign and is confident that the company is well positioned to

take advantage of the business- and heavy industry-friendly

benefits that may arise from Trump administration’s policies going

forward.

About PyroGenesis Inc.

PyroGenesis Inc., a high-tech company, is a

proud leader in the design, development, manufacture and

commercialization of advanced plasma processes and sustainable

solutions which reduce greenhouse gases (GHG) and are economically

attractive alternatives to conventional “dirty” processes.

PyroGenesis has created proprietary, patented and advanced plasma

technologies that are being vetted and adopted by multiple

multibillion dollar industry leaders in four massive markets: iron

ore pelletization, aluminum, waste management, and additive

manufacturing. With a team of experienced engineers, scientists and

technicians working out of its Montreal office, and its 3,800 m2

and 2,940 m2 manufacturing facilities, PyroGenesis maintains its

competitive advantage by remaining at the forefront of technology

development and commercialization. The operations are ISO 9001:2015

and AS9100D certified, having been ISO certified since 1997. For

more information, please visit: www.pyrogenesis.com.

Cautionary and Forward-Looking

Statements

This press release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. In some cases, but not necessarily in all cases,

forward-looking statements can be identified by the use of

forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”, “is

positioned”, “estimates”, “intends”, “assumes”, “anticipates” or

“does not anticipate” or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur” or

“be achieved”. In addition, any statements that refer to

expectations, projections or other characterizations of future

events or circumstances contain forward-looking statements.

Forward-looking statements are not historical facts, nor guarantees

or assurances of future performance but instead represent

management’s current beliefs, expectations, estimates and

projections regarding future events and operating performance.

Forward-looking statements are necessarily based

on a number of opinions, assumptions and estimates that, while

considered reasonable by PyroGenesis as of the date of this

release, are subject to inherent uncertainties, risks and changes

in circumstances that may differ materially from those contemplated

by the forward-looking statements. Important factors that could

cause actual results to differ, possibly materially, from those

indicated by the forward-looking statements include, but are not

limited to, the risk factors identified under “Risk Factors” in

PyroGenesis’ latest annual information form, and in other periodic

filings that it has made and may make in the future with the

securities commissions or similar regulatory authorities, all of

which are available under PyroGenesis’ profile on SEDAR+ at

www.sedarplus.ca. These factors are not intended to represent a

complete list of the factors that could affect PyroGenesis.

However, such risk factors should be considered carefully. There

can be no assurance that such estimates and assumptions will prove

to be correct. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

release. PyroGenesis undertakes no obligation to publicly update or

revise any forward-looking statement, except as required by

applicable securities laws.

Neither the Toronto Stock Exchange, its

Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) nor the OTCQX Best Market

accepts responsibility for the adequacy or accuracy of this press

release.

For further information please contact: Rodayna

Kafal, Vice President, IR/Comms. and Strategic BD E-mail:

ir@pyrogenesis.com RELATED LINK: http://www.pyrogenesis.com/

1 https://rncplatform.donaldjtrump.com Official 2024

Republican Party Platform 2

https://international-aluminium.org/wp-content/uploads/2022/03/CRU-Opportunities-for-aluminium-in-a-post-Covid-economy-Report.pdf

3

https://www.reuters.com/world/china/world-aluminium-industry-must-cut-emissions-by-77-by-2050-iai-2021-03-16/#:~:text=Demand%20for%20aluminium%20is%20due,and%20power%20cabling%2C%20Bayliss%20added.

4

https://www.reuters.com/markets/europe/another-us-primary-aluminium-smelter-bites-dust-2024-01-26/

5

https://www.yeslak.com/blogs/tesla-news-insights/2025-model-y-aluminum-ion-batteries-replace-lithium?srsltid=AfmBOoqGlrZB5FmdpyHe9IlCSwY1M2d6tOX2UaYKh-VSmbqgBlQRAWnE

6

https://news.griffith.edu.au/2024/05/09/chinas-new-three-exports-dominate-the-2023-global-green-transition/

7

https://natural-resources.canada.ca/our-natural-resources/minerals-mining/mining-data-statistics-and-analysis/minerals-metals-facts/aluminum-facts/20510

8 https://www.iea.org/reports/electricity-2024/executive-summary 9

https://www.iea.org/reports/electricity-grids-and-secure-energy-transitions/executive-summary10

https://www.energy.gov/articles/cop28-countries-launch-declaration-triple-nuclear-energy-capacity-2050-recognizing-key

11 https://smractionplan.ca/ 12

https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-nuclear-power

13

https://www.insauga.com/contract-to-build-two-new-candu-nuclear-plants-in-romania-awarded-to-mississauga-company/

14

https://nypost.com/2024/08/29/us-news/trump-vows-to-make-electricity-cheap-with-hundreds-of-new-power-plants-and-modular-nuclear-reactors/

15

https://nypost.com/2024/08/29/us-news/trump-vows-to-make-electricity-cheap-with-hundreds-of-new-power-plants-and-modular-nuclear-reactors/

16

https://gridstrategiesllc.com/wp-content/uploads/2023/12/National-Load-Growth-Report-2023.pdf

17 https://www.bloomberg.com/graphics/2024-opinion-biden-ira-sends-green-energy-investment-republican-districts/

18

https://thehill.com/opinion/energy-environment/4953970-clean-energy-biden-climate-election/

19

https://www.energy.gov/articles/biden-harris-administration-announces-nearly-430-million-accelerate-domestic-clean-energy20

https://www.eenews.net/articles/oil-and-gas-jobs-decline-amid-record-breaking-production/21

https://oilprice.com/Latest-Energy-News/World-News/US-Remains-King-of-Oil-Output-Crown-for-Sixth-Year.html

Photos accompanying this announcement are

available:https://www.globenewswire.com/NewsRoom/AttachmentNg/501b0bcd-c70d-430c-9359-d2b659c4a638

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f55060e-616f-408b-82fb-d42e201470c8

https://www.globenewswire.com/NewsRoom/AttachmentNg/4a9e5e29-20bd-4ae0-b8ea-7ca0f50c564a

https://www.globenewswire.com/NewsRoom/AttachmentNg/0db3ac68-777d-4f73-8610-7471c25c7112

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e44e22d-348d-44d0-93cb-a9a076f7bd7a

https://www.globenewswire.com/NewsRoom/AttachmentNg/4dbe8515-ee18-4195-95ec-e045f7098c49

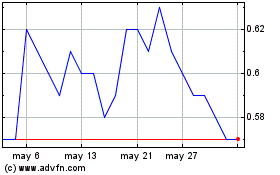

PyroGenesis (TSX:PYR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

PyroGenesis (TSX:PYR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024