Nova Leap Health Corp. Announces Non-Brokered Private Placement of Common Shares

23 Agosto 2022 - 3:30PM

NOVA LEAP HEALTH CORP. (TSXV: NLH) (OTC: NVLPF) (“Nova Leap”

or the “Company”), a growing home health care organization, will

undertake a non-brokered private placement to raise up to $2.5

million (the “Offering”) through the issuance of up to 7,142,857

common shares of the Company (“Common Shares”) at a price of $0.35

per Common Share.

The Offering subscription price of $0.35

represents a premium of 9.4% to the August 23, 2022 closing price

of $0.32 for the Common Shares on the TSX Venture Exchange.

Insiders are expected to subscribe for up to

$1,960,000 of the Offering.

In connection with the Offering, Nova Leap may

pay a cash finder’s fee of up to 6% of any non-insider proceeds

raised from the Offering. The proceeds from the Offering will be

used for working capital, acquisition and expansion purposes.

President & CEO’s

Comments

“This financing sets the Company up well as we

enter the latter part of the year,” said Chris Dobbin, President

& CEO of Nova Leap. “There are several reasons why we are

undertaking the financing at this time.

“The capital markets have been challenging for

smaller companies, particularly in the micro-cap space. Regardless

of current market conditions, this insider led financing being done

at a premium to the market, with no risk of warrant overhang,

demonstrates the commitment and confidence in the long-term

trajectory of the Company by our directors, executive team and

other insiders. The financing may serve as a catalyst to attract

other long-term investors who share our view of a compelling

investment opportunity.

“In my Q2 remarks, I alluded to some of the

operational changes we have made to the business to address the

current environment. We expect those changes to benefit the Company

with improved financial performance and cash flow.

“For Nova Leap, a little goes a long way. While

this is a small financing, four out of the five bank acquisition

facilities that we took on during a significant period of growth

from 2017-2018, will be fully repaid between September 2022 and

September 2023. As the four debt facilities are being extinguished

in Q3 2022, Q1 2023, Q2 2023 and Q3 2023 respectively, we expect a

meaningful improvement to cash flows and further access to leverage

for acquisitions, where circumstances warrant.

“The opportunity for acquisitions and expansion

remains as compelling as it has since we started the business.”

Closing of the Offering is expected to occur on

or about September 2, 2022. The Offering is subject to certain

conditions including, but not limited to, the receipt of all

necessary regulatory and stock exchange approvals, including the

approval of the TSX Venture Exchange. The Common Shares issued

pursuant to the Offering will be subject to a four month hold

period in accordance with applicable Canadian securities laws.

The securities being offered have not been, nor

will they be, registered under the United States Securities Act of

1933, as amended, and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from the registration

requirements. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the securities in any State in which such offer,

solicitation or sale would be unlawful.

About Nova Leap

Nova Leap is an acquisitive home health care

services company operating in one of the fastest-growing industries

in the U.S. & Canada. The Company performs a vital role within

the continuum of care with an individual and family centered focus,

particularly those requiring dementia care. Nova Leap achieved the

#42 ranking on the 2021 Report on Business ranking of Canada’s Top

Growing Companies, the #2 ranking on the 2020 Report on Business

ranking of Canada’s Top Growing Companies and the #10 Ranking in

the 2019 TSX Venture 50™ in the Clean Technology & Life

Sciences sector. The Company is geographically diversified with

operations in 11 different U.S. states within the New England,

Southeastern, South Central and Midwest regions as well as in Nova

Scotia, Canada.

FORWARD LOOKING

INFORMATION:

Certain information in this press release may

contain forward-looking statements, such as statements regarding

the expected closing of and the anticipated use of the proceeds

from the Offering, expected benefits of the Company’s operational

changes, acquisition and expansion plans, and future access to

leverage for acquisitions. This information is based on current

expectations and assumptions, including assumptions described

elsewhere in this release and those concerning general economic and

market conditions, obtaining necessary approvals for the Offering,

and the availability of desirable acquisition targets and financing

to fund such acquisitions, that are subject to significant risks

and uncertainties that are difficult to predict. Actual results

might differ materially from results suggested in any

forward-looking statements. Risks that could cause results to

differ from those stated in the forward-looking statements in this

release include those relating to the ability to complete the

Offering on the terms described above, the impact of the COVID-19

pandemic or any recurrence, staff and supply shortages, regulatory

changes affecting the home care industry or government programs

utilized by the Company, other unexpected increases in operating

costs and competition from other service providers. All

forward-looking statements, including any financial outlook or

future-oriented financial information, contained in this press

release are made as of the date of this release and included for

the purpose of providing information about management's current

expectations and plans relating to the future, and these statements

may not be appropriate for other purposes. The Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those reflected in

the forward-looking statements unless and until required by

securities laws applicable to the Company. Additional information

identifying risks and uncertainties is contained in the Company's

filings with the Canadian securities regulators, which filings are

available at www.sedar.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information:

Chris Dobbin, CPA, CA, ICD.D

Director, President and CEO Nova Leap Health Corp.

T: 902 401 9480

E:cdobbin@novaleaphealth.com

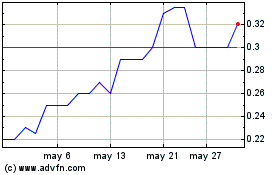

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

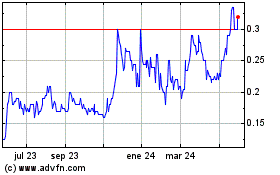

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024