Rio Alto-Change of Year End & Release of First Quarter Results

10 Noviembre 2011 - 11:38AM

Marketwired

Rio Alto Mining Limited ("Rio Alto" or the "Company") (TSX

VENTURE:RIO)(OTCQX:RIOAF)(BVLAC:RIO)(DB Frankfurt:MS2) reports that

it has filed its first quarter interim report under International

Financial Reporting Standards (IFRS) and announces that it will

change its financial year-end from May 31 to December 31. During

the quarter construction and development activities were carried

out and continue at the La Arena Gold Mine.

Highlights of preproduction activities for the three-month

period ended August 31, 2011 include:

-- The La Arena Gold Mine poured 9,385 ounces of gold;

-- Sales of gold amounted to 6,909 ounces at an average price of $1,554 per

ounce;

-- Deliveries under the gold prepayment agreement amounted to 1,467 ounces

satisfying delivery requirements; to-date, 3,421 ounces of gold have

been delivered satisfying delivery requirements through January 2012;

-- Additions to plant and equipment amounted to $9.1 million and mine

development expenditures were $7.1 million for a total of $16.2 million,

which was partially offset by preproduction cash receipts of $10.7

million;

-- The accounting loss for the period was $10.3 million including non-cash

charges of $9.1 million;

-- Non-cash accounting entries include an $8.5 million charge for a

hypothetical increase in the derivative liability, an accretion charge

of $0.4 million for eventual asset retirement obligations, and stock-

based compensation expense of $0.2 million.

Construction and development activities underway include leach

pad expansion and process plant expansion to accommodate daily ore

production of 24,000 tonnes and completion of infrastructure

projects. Management expects that daily production capacity of

24,000 tonnes of ore to pad will be achieved in November 2011.

Subsequent to August 31, 2011 the Company increased the size of

the gold prepayment facility to $50 million from $25 million and

drew down the incremental amount. Gold delivery obligations under

this facility for the February 2012 to October 2014 period will

range between 48,702 to 65,890 ounces depending on the gold price

at the time of delivery. In addition, the Company drew, on

September 2, 2011, the $3 million available under a pre-existing

operating loan facility.

On November 8, 2011, the board of directors resolved to change

the Company's financial year-end to December 31 from May 31. This

change will align the consolidated accounts with those of La Arena

S.A., which under Peruvian law has a calendar year-end, and will

result in Rio Alto providing its continuous disclosure information

on a more comparable basis with most other mining companies. The

Company's next filing of financial information will include audited

consolidated financial statements for the seven-month period ended

December 31, 2011 that will be filed before March 30, 2012.

This news release contains certain forward-looking information

including statements concerning the expected timing for the

achievement of ore production rates and the filing of financial

information. All statements included herein, other than statements

of historical fact, are forward-looking information and such

information involves various risks and uncertainties. There can be

no assurance that such information will prove to be accurate, and

actual results and future events could differ materially from those

anticipated in such information. A description of assumptions used

to develop such forward-looking information and a description of

risk factors that may cause actual results to differ materially

from forward-looking information can be found in Rio Alto's

disclosure documents on the SEDAR website at www.sedar.com. Rio

Alto does not undertake to update any forward-looking information

except in accordance with applicable securities laws.

To learn more about Rio Alto Mining Limited, please visit:

www.rioaltomining.com or Rio Alto's SEDAR profile at

www.sedar.com.

ON BEHALF OF THE BOARD OF

RIO ALTO MINING LIMITED

Anthony Hawkshaw, Chief Financial Officer

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts the responsibility for the adequacy or

accuracy of this release.

Contacts: Rio Alto Mining Limited Anthony Hawkshaw +51 1 625

9900 +1 778 389 5907tonyh@rioaltomining.com Rio Alto Mining Limited

Alejandra Gomez Investor Relations +1 604 628 1401 +1 866 393 4493

(FAX)alejandrag@rioaltomining.comwww.rioaltomining.com

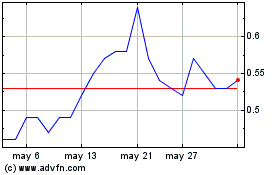

Rio2 (TSXV:RIO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rio2 (TSXV:RIO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024