West Red Lake Gold Mines Ltd. (“West Red

Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG)

(OTCQB: WRLGF) is pleased to report initial drill

results from the

Upper 8 Target (“Upper 8”) from

its 100% owned Madsen Property located in the Red Lake Gold

District of Northwestern Ontario, Canada.

The drill results featured in this news release

are focused on the Upper 8 target, which is a

shallower geologic analog to the well known high-grade

8-Zone. The Upper 8 target is hosted within the same

lithologic unit (Russet Lake Ultramafic) approximately 750m

up-plunge from the main 8-Zone deposit (Figure 3). Its location in

ultramafic rocks, its style of mineralization, and its

exceptionally high grades make the 8 Zone geologically unique from

the main Madsen deposit. The 8 Zone currently contains an

Indicated mineral resource of 87,700 ounces (“oz”) grading

18 grams per tonne (“g/t”) gold (“Au”), with an additional

Inferred resource of 18,200 oz grading 14.6 g/t

Au.

These are the first drill results announced from

an ongoing 10,000m surface exploration drilling program designed to

test a number of high-priority targets across the Madsen property

(Figures 1 and 2). Details and target descriptions for this program

were outlined in a previous news release dated August 10, 2024.

UPPER 8 HIGHLIGHTS:

- Hole

WRL24-002 Intersected 4.1m @ 14.20 g/t

Au, from 354.8m to 358.9m, Including 1.3m @ 44.17

g/t Au, from 357.0m to 358.3m.

- Hole

WRL24-003 Intersected 1.85m @ 6.33 g/t

Au, from 332.45m to 334.30m, Including 0.5m @

20.63 g/t Au, from 333.8m to 334.3m.

Will Robinson, Vice President of Exploration,

stated, “The initial results from Upper 8 drilling are quite

encouraging and not only demonstrate proof-of-concept for our

regional targeting model, but also reinforce our thesis that there

is very real potential for discovery of another 8-Zone type deposit

on our highly prospective Madsen property. The relatively shallow

position of Upper 8 allows for us to drill this target effectively

from surface with a high degree of accuracy. With two out of three

of the initial holes drilled at Upper 8 returning high-grade gold

mineralization where projected, we are planning to add a second

drill in the coming weeks dedicated to drilling at Upper 8. The

team is very excited to return to this area to continue defining

and growing this shallower 8-Zone analog.”

Plan maps and sections for the Upper 8 drilling

outlined in this release are provided in Figures 1 through 4.

TABLE 1. Significant intercepts (>1 g/t Au) from

drilling at Upper 8 Target.

|

Hole ID |

Target |

From (m) |

To (m) |

Length (m)* |

Au (g/t) |

|

WRL24-001 |

Upper 8 |

286.65 |

287.15 |

0.50 |

1.26 |

|

WRL24-002 |

Upper 8 |

333.41 |

337.41 |

4.00 |

1.66 |

|

Incl. |

336.91 |

337.41 |

0.50 |

5.07 |

|

AND |

Upper 8 |

341.05 |

341.55 |

0.50 |

2.40 |

|

AND |

Upper 8 |

347.45 |

348.07 |

0.62 |

1.15 |

|

AND |

Upper 8 |

350.21 |

351.13 |

0.92 |

5.20 |

|

AND |

Upper 8 |

354.80 |

358.90 |

4.10 |

14.20 |

|

Incl. |

357.00 |

358.30 |

1.30 |

44.17 |

|

WRL24-003 |

Upper 8 |

287.60 |

289.10 |

1.50 |

2.11 |

|

Incl. |

288.10 |

288.60 |

0.50 |

4.28 |

|

AND |

Upper 8 |

332.45 |

334.30 |

1.85 |

6.33 |

|

Incl. |

333.80 |

334.30 |

0.50 |

20.63 |

*The “From-To” intervals in Table 1 are denoting

overall downhole length of the intercept. True thickness has not

been calculated for these intercepts but is expected to be ≥ 70% of

downhole thickness based on intercept angles observed in the drill

core. Internal dilution for composite intervals does not exceed 1m

for samples grading <0.1 g/t Au.

TABLE 2: Drill collar summary for holes reported in this

News Release.

|

Hole ID |

Target |

Easting |

Northing |

Elev (m) |

Length (m) |

Azimuth |

Dip |

|

WRL24-001 |

Upper 8 |

434914 |

5646577 |

407 |

401.8 |

278 |

-56 |

|

WRL24-002 |

Upper 8 |

434914 |

5646577 |

407 |

500.2 |

289 |

-45 |

|

WRL24-003 |

Upper 8 |

434914 |

5646577 |

407 |

500.3 |

289 |

-49 |

DISCUSSION:

Drilling on the Upper 8 target is designed to

test the projected, near-surface extension of the mineralized shear

corridor that hosts the highly prospective 8-Zone. The Upper 8

target horizon was intercepted in only a few historic drill holes,

which encountered a zone of strong shearing, alteration and quartz

veining equivalent to 8-Zone style mineralization.

Recent drilling on the Upper 8 target by WRLG

has shown that gold mineralization is similar in geological setting

and style as the deeper 8-Zone deposit. Elevated gold at Upper 8 is

shown to occur within deformed and recrystalized blue-grey quartz

and quartz-sulphide veinlets. These veinlets are hosted within

shear domains, which are easily recognizable by their locally

intense deformation fabrics, and the presence of silica, biotite,

potassium feldspar, and amphibole alteration.

The Upper 8 shear domain is hosted within the

Russet Lake Ultramafic, which also hosts the 8-Zone deposit, and

the angle of shear emplacement of Upper 8 is sympathetic to the

structural orientation observed at 8-Zone. Recognition that the

gold mineralization at the Upper 8 target is comprised of

transposed quartz veinlets within a definable and recognizable

shear corridor provides excellent opportunity for additional

drilling and expansion potential.

High resolution versions of all the figures contained in this

press release can be found at the following web address:

https://westredlakegold.com/october-1st-news-release-maps/

FIGURE 1. Regional Targeting Map for

2024 Surface Drilling Program at Madsen.

FIGURE 2. Regional Targeting Map for

2024 Surface Drilling Program at Madsen w/ Magnetics (RTP) Tilt

Derivative Overlay.

FIGURE 3. Sectional View of Upper 8

Target relative to 8-Zone and Madsen

deposits.[1] Note the similarity

in orientation of the Upper 8 shear boundary relative to

orientation on the 8-Zone - suggests potential for sub-parallel

structures between 8-Zone and Upper 8.

[1] Mineral resources are estimated at a cut-off grade of 3.38

g/t Au and a gold price of US1,800/oz. Please refer to the

technical report entitled “Independent NI 43-101 Technical Report

and Updated Mineral Resource Estimate for the PureGold Mine,

Canada”, prepared by SRK Consulting (Canada) Inc. and dated June

16, 2023, and amended April 24, 2024. A full copy of the SRK report

is available on the Company’s website and on SEDAR+ at

www.sedarplus.ca.

FIGURE 4. Upper 8 Target section view

showing assay highlights for Holes WRL24-001 through -003 and

interpreted Upper 8 shear boundary.QUALITY

ASSURANCE/QUALITY CONTROL

Exploration drilling completed on surface at the

Madsen Mine consists of oriented NQ-sized diamond drill core. All

drill holes are systematically logged, photographed, and sampled by

a trained geologist at the Madsen Mine core processing facility.

Minimum allowable sample length is 0.5m. Maximum allowable sample

length is 1.5m. Control samples (certified standards and

uncertified blanks), along duplicates, are inserted at a target 5%

insertion rate. Results are assessed for accuracy, precision, and

contamination on an ongoing basis. The BQ-sized drill core is whole

core sampled. The NQ-sized drill core is then cut lengthwise

utilizing a diamond blade core saw along a line pre-selected by the

geologist. To reduce sampling bias, the same side of drill core is

sampled consistently utilizing the orientation line as reference.

For those samples containing visible gold (“VG”), a trained

geologist supervises the cutting/bagging of those samples, and

ensures the core saw blade is ‘cleaned’ with a dressing stone

following the VG sample interval. Bagged samples are then sealed

with zip ties and transported by Madsen Mine personnel directly to

SGS Natural Resource’s Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists

of drying at 105°C and crushing to 75% passing 2mm. A riffle

splitter is then utilized to produce a 500g course reject for

archive. The remainder of the sample is then pulverized to 85%

passing 75 microns from which 50g is analyzed by fire assay and an

atomic absorption spectroscopy (AAS) finish (SGS Code GO-FAA50V10).

Samples returning gold values > 10 g/t Au are reanalyzed by fire

assay with a gravimetric finish on a 50g sample (SGS Code

GO_FAG50V). Samples with visible gold or returning gold values >

30 g/t Au are also analyzed via metallic screen analysis (SGS code:

GO_FAS50M). For multi-element analysis, samples are sent to SGS’s

facility in Burnaby, British Columbia and analyzed via four-acid

digest with an atomic emission spectroscopy (ICP-AES) finish for

33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12).

SGS Natural Resources analytical laboratories operates under a

Quality Management System that complies with ISO/IEC 17025.

The Madsen Mine deposit presently hosts a

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) Indicated resource of 1.65 million ounces

(“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37

Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at

a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability. Please refer to the technical

report entitled “Independent NI 43-101 Technical Report and Updated

Mineral Resource Estimate for the PureGold Mine, Canada”, prepared

by SRK Consulting (Canada) Inc. and dated June 16, 2023, and

amended April 24, 2024 (the “Madsen Report”). The

Madsen Resource Estimate has an effective date of December 31, 2021

and excludes depletion of mining activity during the period from

January 1, 2022 to the mine closure on October 24, 2022 as it has

been deemed immaterial and not relevant for the purpose of the

Madsen Report. A full copy of the Madsen Report is available on the

Company’s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news

release has been reviewed and approved by Will Robinson, P.Geo.,

Vice President of Exploration for West Red Lake Gold and the

Qualified Person for exploration at the West Red Lake Project, as

defined by NI 43-101 “Standards of Disclosure for Mineral

Projects”.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral

exploration company that is publicly traded and focused on

advancing and developing its flagship Madsen Gold Mine and the

associated 47 km2 highly prospective land package in the Red Lake

district of Ontario. The highly productive Red Lake Gold District

of Northwest Ontario, Canada has yielded over 30 million ounces of

gold from high-grade zones and hosts some of the world's richest

gold deposits. WRLG also holds the wholly owned Rowan Property in

Red Lake, with an expansive property position covering 31 km2

including three past producing gold mines - Rowan, Mount Jamie, and

Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES

LTD.

“Shane Williams”

Shane WilliamsPresident & Chief Executive

Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Freddie LeighTel: (604) 609-6132Email: investors@wrgold.com or

visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news

release may constitute "forward-looking information” within the

meaning of applicable securities laws. Forward-looking information

generally can be identified by words such as "anticipate",

"expect", "estimate", "forecast", "planned", and similar

expressions suggesting future outcomes or events. Forward-looking

information is based on current expectations of management;

however, it is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ

materially from the forward-looking information in this news

release and include without limitation, statements relating to

plans for the potential restart of mining operations at the Madsen

Mine, the potential of the Madsen Mine; any untapped growth

potential in the Madsen deposit or Rowan deposit; timing of

pre-feasibility study and the Company’s future objectives and

plans. Readers are cautioned not to place undue reliance on

forward-looking information.

Forward-looking information involve numerous

risks and uncertainties and actual results might differ materially

from results suggested in any forward-looking information. These

risks and uncertainties include, among other things, market

volatility; the state of the financial markets for the Company’s

securities; fluctuations in commodity prices; timing and results of

the cleanup and recovery at the Madsen Mine; and changes in the

Company’s business plans. Forward-looking information is based on a

number of key expectations and assumptions, including without

limitation, that the Company will continue with its stated business

objectives and its ability to raise additional capital to proceed.

Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such forward-looking information. Accordingly,

readers should not place undue reliance on forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. Additional

information about risks and uncertainties is contained in the

Company’s management’s discussion and analysis for the year ended

November 30, 2023, and the Company’s annual information form for

the year ended November 30, 2023, copies of which are available on

SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management's

current beliefs and is based on information currently available to

the Company. The forward-looking information is made as of the date

of this news release and the Company assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For more information on the Company, investors

should review the Company’s continuous disclosure filings that are

available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/51847830-850a-42a8-baae-6f9b2c1082cb

https://www.globenewswire.com/NewsRoom/AttachmentNg/289ef7f5-2d46-447a-a50a-395f78ae0354

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ab32fc4-aaa1-490c-bf6b-ec1696f086f9

https://www.globenewswire.com/NewsRoom/AttachmentNg/4135db01-fded-470b-9b18-c7e0a78d1b10

https://www.globenewswire.com/NewsRoom/AttachmentNg/e0971838-245c-426f-8ffa-d21928ff2bca

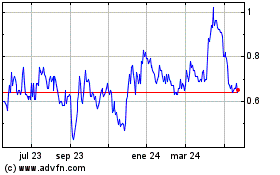

West Red Lake Gold Mines (TSXV:WRLG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

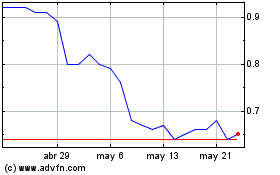

West Red Lake Gold Mines (TSXV:WRLG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024