Life's Time Capsule (LTCP) Acquires New York Post Publishing, Inc.

17 Noviembre 2017 - 5:00AM

InvestorsHub NewsWire

Life’s Time Capsule

(LTCP) Acquires New York Post Publishing,

Inc.

Miami, FL -- November 17, 2017 -- InvestorsHub

Newswire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Life’s Time Capsule Services, Inc.

(OTC

Pink: LTCP).

- Partnered with Amazon.com (NASDAQ:

AMZN)

- Acquired All Assets of New

York Post Publishing, Inc.

- Access to 4 Million card

users, Millions in Revenue

- 20%

Conversion

- To meet listing requirements

to be listed on NASDAQ

- Could be a Great Acquisition

Facebook (NASDAQ:

FB)

We believe Life’s Time

Capsule Services, Inc. (OTC

Pink: LTCP) has what Facebook is missing.

LTCP may

not be at these levels much longer.

See the Full Press Release and other stories on Life’s Time Capsule

Services, Inc. (OTC

Pink: LTCP) at EmergingGrowth.com

http://emerginggrowth.com/?s=ltcp

Life’s Time Capsule Services, Inc. (OTC

Pink: LTCP) just announced the acquisition of all of the assets

of New York Post Publishing, Inc., including its online website and

fifty percent of the Towers Financial Corporation’s victims’

restitution claims against the New York Post Newspaper.

With its newly

acquired assets, Management believes it will be able to proceed to

meet requirements to be listed on NASDAQ.

Life’s Time Capsule (OTC

Pink: LTCP) also announced, in the same press release, the

acquisition of all of Towers Investors.com, Inc.’s interest in the

Christ Card System. See the full press release on EmergingGrowth.com. http://emerginggrowth.com/?s=ltcp

Both of these assets, acquired from Towers Investors.com, Inc.,

Management believes that we

will have over four million card users and millions in revenue in

2018 and cross-selling of other services will be another source of

revenues for LTCP. The valuation per card user and the revenue

component should raise the overall valuation of LTCP significantly

during the coming year.

"We now have substantial

assets, key relationships and technical expertise in place to

execute upon our plan to build a multibillion-dollar company. This

acquisition is the first phase of transitioning LTCP from a social

media and data storage provider to a technology holding company

with a multitude of products and services collectively integrated

under one entity to build shareholder value," said Frank Brady,

Chief Executive Officer of Life's Time Capsule Services, Inc.

(LTCP).

Life’s Time Capsule (OTC

Pink: LTCP) also recently announced the launch of

“MarketPlace”. Read the full press release on Emerging Growth.com.

Marketplace, priced at $3.97

per month, will provide a substantial residual revenue stream with

the highest margins from our suite of services. We are projecting a

$1M per month revenue stream by the third quarter of 2018, which is

based on our goal of 250,000 subscribers over the next twelve

months, followed by over 500,000 subscribers over a period of 24

months.

Life’s Time Capsule Services, Inc. (OTC

Pink: LTCP), Life's Time

Capsule Services, Inc., is an innovative company positioned in the

social media and online secure data storage space with unique

services built to capture, preserve and share your digital legacy

for present and future generations to add to and pass along for

centuries to come.

To ensure a lifetime of

safekeeping and sharing of your digital legacy, Life’s Time Capsule

Services, Inc., has partnered with Amazon (NASDAQ:

AMZN) to utilize its renowned cloud storage

infrastructure.

LTCP just announced the integration of over a quarter million

subscribers from the customer database of its archival brands,

formerly owned by Halitron, Inc. (OTC

Pink: HAON)

This is probably the only thing Facebook (NASDAQ:

FB) is missing. Facebook showcases all aspects of its

user’s daily lives. But when happens after life?

Facebook needs a “Time capsule” model like this.

Life’s Time Capsule Services, Inc. (OTC

Pink: LTCP) is soon to introduce new platforms servicing both

the consumer and commercial markets.

LTCP may

not be at these levels much longer.

See the Full Press Release and other stories on Life’s Time Capsule

Services, Inc. (OTC Pink: LTCP) at EmergingGrowth.com

http://emerginggrowth.com/?s=ltcp

Other Emerging Growth

News

Vet Online Supply, Inc.

Shares of Vet Online Supply,

Inc. (OTC

Pink: VTNL) have declined 80% over the past six trading

sessions. Prior to that, the company’s trading was

practically dormant. The decline initiated with the filing of

the company’s 10-Q on November 8 of this year, and market

capitalization has declined to under $600,000.00. On November

10, 2017, the company announced the launch of a national

distribution program. Shares hit a new low the next

day.

Have a look at Life’s Time Capsule Services, Inc. (OTC Pink:

LTCP)

All State Property

Holdings, Inc.

Skull and Crossbones company

All State Properties Holdings, Inc. (OTC:

ATPT) has been the subject of conversation since mid-October

when this dormant publically traded asset went from zero to four

hundred million shares in a single day. Since, shares have

increased 700% when only yesterday both candlesticks and Bollinger

Bands indicated a downturn. The company also strangely filed

a notice of late filing and its 10-Q both this past

Monday.

Have a look at Life’s Time Capsule Services, Inc. (OTC

Pink: LTCP)

Fannie Mae

Shares of Fannie Mae (OTCQB:

FNMA) seem to have built a base around the $3.00 mark after

having a dramatic fall from its 52-week high of almost $5.00 per

share in mid-February 2017. It’s going to be very interesting

to watch not only this stock, but also the housing and real estate

companies fare if property tax and mortgage interest are lost with

the upcoming tax plan.

Have a look at Life’s

Time Capsule Services, Inc. (OTC

Pink: LTCP)

About

EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

All information contained

herein as well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should not

be construed as an offer or solicitation to buy or sell securities.

The information may include certain forward-looking statements,

which may be affected by unforeseen circumstances and / or certain

risks. This report is not without bias. EmergingGrowth.com has motivation

by means of either self-marketing or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. Full details about which can be found in our full

disclosure, which can be found here, http://www.emerginggrowth.com/58276837-2/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares

it will sell those shares. In addition, please make sure you read

and understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com

website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: info@EmergingGrowth.com

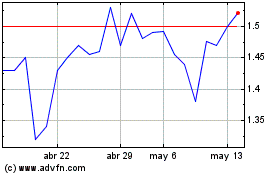

Fannie Mae (QB) (USOTC:FNMA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Fannie Mae (QB) (USOTC:FNMA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024