TIDMJCGI

RNS Number : 5521U

JPMorgan China Growth & Income PLC

03 December 2021

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN CHINA GROWTH & INCOME PLC

FINAL RESULTS FOR THE YEARED 30TH SEPTEMBER 2021

Legal Entity Identifier: 549300S8M91P5FYONY25

Information disclosed in accordance with DTR 4.2.2

The Directors announce the Company's results for the year ended

30th September 2021.

CHAIRMAN'S STATEMENT

I have great pleasure in presenting the Annual Report of

JPMorgan China Growth and Income plc ('the Company') for the year

ended 30th September 2021.

Despite volatile market conditions throughout the period, the

Company's total return on net assets over the year was +4.1%. This

represents the change in net asset value ('NAV') with dividends

reinvested and compares favourably with an -11.2% fall in the MSCI

China Index. The Company delivered a return to Ordinary

shareholders of -2.9%, reflecting a widening in the discount at

which the shares traded over the 12 month period, despite the

shares having traded at a premium for much of the year.

These performance statistics mask what has been another

significant year for the Company. Our share price, which began the

year at 552.0p and ended the year at 518.0p, peaked at 860.0p on

the 16th February 2021. This sharp increase followed a strong

performance by the China market with the price of the Company's

shares moving from a discount to NAV to a premium in early October

2020, which was sustained for the most part until July 2021. While

trading at a premium, we were able to issue nearly 10.5 million

shares, raising GBP77.9 million, which enabled our investment team

to take advantage of investment opportunities in the volatile

market conditions.

Through the last quarter of the 2021 financial year and into the

current year there have been a series of regulatory changes in

China affecting several market sectors, including those in which we

have been invested. These have combined with some concerns about a

slowing economy in China, worries about fragility in the property

sector and geopolitical concerns to cause some negative sentiment

towards investment in China in the short term.

Investment Approach and Performance

With the market rotating from growth to value stocks during the

year, the importance of our Investment Managers' disciplined

investment process and conviction in the structural growth

opportunities in China has enabled them to deliver consistent

outperformance. Reiterating the point that I made last year,

underpinning the investment management process is the breadth and

depth of the team of investment research analysts who, although

unable to visit companies in China as regularly as usual, have

maintained close contact with the companies and their management

teams.

While the Board have been unable to visit Asia again this year,

we have once again held a virtual Asia visit. This has enabled us

to have detailed discussions with analysts in Shanghai, Hong Kong

and Taiwan covering key sectors of our portfolio.

The Investment Managers' Review provides a good perspective on

the drivers of investment performance in 2021 and their assessment

of the investment outlook.

Environment, Social and Governance ('ESG') considerations

We provide a full description of how ESG is integrated into the

investment management process later in this report. The investment

managers' report describes the developments in the ESG process that

have taken place during the year together with examples of how

these are implemented in practice. There is also a separate ESG

section under Documents on our website that provides a standalone,

comprehensive report covering ESG metrics.

Distribution Policy

At the Annual General Meeting in February 2020, shareholders

approved a resolution to change the Company's dividend policy (with

effect from 1st April 2020) which now aims to pay, in the absence

of unforeseen circumstances, a target annual dividend of 4% of the

Company's NAV as at the end of the preceding financial year. This

is paid by way of four equal interim dividends on the first

business day in December, March, June, and September. Any shortfall

on the dividend income received from the underlying investments of

the portfolio is paid out of the capital growth of the portfolio.

For the year ended 30th September 2021 dividends paid totalled 22.8

pence (2020: 7.4 pence).

Gearing

In July 2021, the Company extended its GBP50 million loan

facility (with an option to increase to GBP60 million) with

Scotiabank for a further two years.

During the year the Company's gearing ranged from 7.6% to 12.9%

(based on daily data) and, at the time of writing, was 12.6%. The

Investment Managers have the flexibility to manage the gearing

facility within a range set by the Board of 10% net cash to 20%

geared.

Share Issues and Repurchases

The Directors have authority to issue new Ordinary shares for

cash and to repurchase shares in the market for cancellation or to

hold in Treasury. The Board believes that its policy of share

repurchase and share issuance helps to reduce the volatility in

discounts and premiums. We are therefore seeking approval from

shareholders to renew the share issuance and repurchase authorities

at the AGM.

During the year, the Company did not repurchase any Ordinary

shares into Treasury (2020: nil) or for cancellation. However,

5,211,777 shares were re-issued from Treasury at a premium to NAV

and 5,287,500 new Ordinary shares were issued.

The Board

In November 2021, the Board, through its Nomination Committee,

carried out a comprehensive evaluation of the Board, its

Committees, the individual Directors and the Chairman. Topics

evaluated included the size and composition of the Board, Board

information and processes, shareholder engagement and training and

accountability. The evaluation confirmed the efficacy of the

Board.

Oscar Wong retired from the Board in July 2021. He joined the

Board in August 2014 and made a significant contribution to the

Board and the performance of the Company during his tenure. On

behalf of the Board, I would like to thank Oscar for his valuable

contribution to the Company over the years.

Coinciding with Oscar's retirement the Board decided to increase

the size of the Board back to five directors; we believe this is an

optimal number and appropriate for the growing size of the Company.

As part of the succession programme, the Board appointed Joanne

Wong and May Tan, both Hong Kong residents each with considerable

years of experience in the investment industry. Aditya Sehgal was

also appointed to the Board following the year-end; until recently,

he was a senior executive with Reckitt Benckiser with extensive

experience building and managing businesses for them in China. The

new Directors have already started to make a strong contribution to

the Board discussions, and I would urge shareholders to support

their appointments at the forthcoming AGM.

In accordance with the UK Corporate Governance Code, David

Graham and Alexandra Mackesy retire at the forthcoming AGM and,

being eligible, will offer themselves for reappointment by

shareholders.

I will be retiring from the board after the AGM in January 2022.

The Board has agreed unanimously that my successor as Chairman of

the Company should be Alexandra Mackesy.

Review of services provided by the Manager

During the year the Board, through its Management Engagement

Committee, carried out a thorough review of the investment

management, secretarial and marketing services provided to the

Company by the Manager, as well as the Depositary and Registration

services provided to the Company by the outsourced service

providers. Following this review, the Board has concluded that the

continued appointment of the Manager and the outsourced service

providers on the terms agreed is in the interests of the

shareholders as a whole.

The Company's ongoing charges for the financial year, as a

percentage of the average of the daily net assets during the year,

were 0.99% (2020: 1.00%).

Shareholder Engagement

The Company has for many years had a high proportion of retail

investors and over the last 18 months to the end of June 2021 this

has increased by 50% to 91.30 % (31st December 2019: 60.42%).

Retail investors hold their shares in different ways, direct,

through wealth managers and on investment platforms and not all of

these make it easy to participate through voting at the Annual

General Meeting. I would urge you all to ensure your voice is heard

by ensuring your holding is voted at the AGM.

Annual General Meeting

Unfortunately, COVID-19 restrictions prevented the holding of

the Company's AGM in February 2021 in the usual format. The

Directors were disappointed not to be able to have the usual

interaction with shareholders at this forum. However, current

indications are that a more traditional format for the AGM may be

permissible in January 2022 and, to that end, the Company's

twenty-seventh AGM is scheduled to be held on Friday, 28th January

2022 at 11.30 a.m. at 60 Victoria Embankment, London EC4Y 0JP. The

Board hopes to welcome as many shareholders as possible.

We do of course strongly advise all shareholders to consider

their own personal circumstances before attending the AGM in

person. For shareholders wishing to follow the AGM proceedings but

choosing not to attend, we will be able to welcome you through

conferencing software. Details on how to register together with

access details can be found on the Company's website:

www.jpchinagrowthandincome.co.uk, or by contacting the Company

Secretary at invtrusts.cosec@jpmorgan.com.

As is normal practice, all voting on the resolutions will be

conducted on a poll. Due to technological reasons, shareholders

viewing the meeting via conferencing software will not be able to

vote on the poll and we therefore encourage all shareholders, and

particularly those who cannot attend physically, to exercise their

votes in advance of the meeting by completing and submitting their

form of proxy. Shareholders are encouraged to send any questions

ahead of the AGM to the Board via the Company Secretary at the

email address above. We will endeavour to answer relevant questions

at the meeting or via the website depending on arrangements in

place at the time.

If there are any changes to the above AGM arrangements, the

Company will update shareholders through the Company's website and,

as appropriate, through an announcement on the London Stock

Exchange.

Conclusion

It has been an honour to serve as the Chairman and to have the

opportunity to work with the investment team in Asia, all the many

people at JPMorgan Asset Management who help support the Company

and last, but not least, the current Board, as well as those that

have retired. During my time as Chairman the NAV per share and the

share price have grown by 152% and the Company (in terms of

Shareholders' funds) has grown from GBP 267 million to GBP473

million. We have refocused the investment objective and benchmark

to invest into the A share market, have implemented a new dividend

policy and seen the share price move back to a premium in the last

year. It has been a privilege to witness the growth in the Company

and the strong outperformance of the JPMorgan investment team. In

JPMorgan we have an investment manager with the investment skills,

disciplines and depth of resources to deliver consistent

performance.

Outlook

The volatility we have experienced during the past year reminds

us of the challenges of investing in China. This is a market where

long-term capital growth is best achieved through sector allocation

and bottom-up stock selection which our investment team have the

experience to deliver. ESG continues to grow in importance in the

investment process and by embedding these factors into their

investment process I believe JPMorgan will be able to deliver

sustainable growth in one of the world's most challenging markets.

Investing in China continues to grow in importance and the Company

is well placed to deliver long-term outperformance.

John Misselbrook

Chairman

3rd December 2021

INVESTMENT MANAGERS' REPORT

Over the year to 30th September 2021, the Company's return on

net assets was +4.1%, significantly outperforming its benchmark,

the MSCI China index, which declined by 11.2% GBP over the period.

The Company's return to shareholders (including dividends) was

-2.9%, which reflects the widening of the discount from 2.4% to

9.0%.

Setting the scene

There is never a dull moment in investing in China and the past

financial year was a particularly eventful one. Market sentiment

swung from exuberance at the beginning of the year, to caution, and

even scepticism, towards the end of it.

In the first half of the year, the Chinese economy recovered

strongly, thanks to prompt COVID containment measures, and Chinese

manufacturers benefited from a surge in orders from other major

economies whose manufacturing sectors were struggling to deal with

the impact of the pandemic. As in all other major markets, news of

the arrival of viable vaccines in late 2020 saw attention in the

Chinese market rotate from growth to value stocks, as investors

anticipated a recovery in more economically sensitive, cyclical

sectors such as energy, utilities and financials. The MSCI China

index (GBP) rose 23.8% between 30th September 2020 and its peak in

February 2021, and then tumbled after the Chinese New Year on fears

of a tightening in domestic liquidity and rising 10-year US

Treasury yields.

China's Manufacturing PMI stood firmly in expansionary territory

for most time of the year, thanks in large part to persistent

export demand. The strength of the recovery, combined with China's

restrained monetary stance, saw the Renminbi appreciate against USD

over the year. It touched a three-year high in May 2021. The

central bank (PBOC) raised the foreign exchange reserve requirement

to dampen speculative activity and the exchange rate has since

stabilised at a lower level. More recently, however, the index

dropped below 50% in September 2021, signalling contracting

activity, due to commodity price inflation, high shipping costs,

power rationing and the shortage in tech components, especially

semiconductors.

COVID remains a threat to the economic outlook. China approved

its first domestic vaccine in December 2020 and well-organised

vaccination programmes ensured that by September 2021, 78% of the

population had been vaccinated. A few scattered outbreaks of the

virus have been quickly contained. However, while China's success

in controlling COVID is applaudable, it remains one of the few

countries in the world still committed to a COVID-zero policy that

has kept external borders closed. It is unclear when borders will

re-open to tourists and business travellers and this has cast a

shadow over the outlook for the domestic service sector.

Since recovering from the initial shock of the pandemic, China

has maintained a neutral monetary policy aimed at stabilising

credit expansion. The implementation of strict controls on

borrowing by property developers, to curtail speculative activity,

is a key part of this policy. These measures, together with

restrictions on homebuyers, contributed to the de facto defaults of

several developers in September 2021, including Evergrande, one of

the country's largest private property companies. The government

plans to deal with these problems at the individual project level,

rather than via corporate level bailouts, in part to avoid

encouraging reckless commercial behaviour by developers. In our

view, and that of other local investors, this is not China's

'Lehman Brothers moment', and is unlikely to trigger systemic

ructions. Most of the debt is backed by land and does not involve

the kind of complex financial derivatives whose high contagion

risks sparked the 2008 global financial crisis.

Chinese regulatory crackdowns on other sectors have also been

creating headlines around the world. The emphasis of government

policy seems to have shifted from growth-centred policies to

regulatory crackdowns designed to achieve more balanced growth. The

digital economy and other socially sensitive industries such as

education and health care have been most impacted. The shift began

in November last year with the high-profile suspension of the Ant

Group initial public offering (IPO), due to concerns about its

capital structure, its ballooning consumer finance business and

conflict with regulators. Then, in July 2021, regulators announced

a flurry of new restrictions, including on the private tutoring

industry, whose business model was essentially destroyed by the

crackdown.

Since then, Chinese regulators have announced tighter controls

on anti-competitive behaviour, data security and companies

employing gig workers, and non-compliance has been swiftly

punished. In the health care sector, we have long championed

structural trends such as import substitution and the increasing

availability of advance therapeutics, and these are playing out

nicely. However, certain sub-sectors such as medical devices and

equipment are facing increasing pressure from government

procurement policies to cut prices. This is in part intended to

reduce corrupt pricing practices which benefit suppliers,

distributors and hospital administrators, and should be welcomed by

investors. Nonetheless, these regulatory shocks have triggered a

selloff in stocks in the property, internet, education and

healthcare sectors, all of which are popular with foreign

investors.

The crackdowns may seem abrupt and severe, but in our view,

controls on many sectors lagged regulations imposed by the EU and

US authorities, and China is simply playing catch-up. Some

restrictions have also been motivated by the government's recent

promotion of 'common prosperity'. This has raised concerns among

investors and observers that China is intent on 'soaking the rich',

but we disagree with this assessment. On the contrary, China has

one of the highest levels of income inequality among the world's

major economies, and a more balanced distribution of wealth is

critical to ensuring long-term growth.

Environmental regulations are also generating some public

concern and criticism. In September 2020, President Xi committed

China to achieving 'net zero' carbon emissions by 2060. However, a

year on from this pledge, efforts to reduce carbon emissions are

being blamed for contributing to recent widespread power shortages.

High coal prices and an inflexible power pricing mechanism have

also played a role in the shortages, which have been particularly

damaging for energy intensive industries such as steelmaking and

cement, adding to inflation in basic material prices. The power

shortages caused a public outcry that alarmed officials, leading to

some retuning of energy policy, although the government remains

committed to its net zero target.

Elsewhere, the US Federal Reserve has become increasingly

hawkish, due to higher-than-expected inflation, and this has put

upward pressure on the US dollar. Trade tensions between China and

the US have eased under the Biden administration. However,

fundamental differences on trade and other issues persist between

the two countries and taking a tough stance against China has

bipartisan support in the US.

Performance Commentary

We are pleased that the Company outperformed its benchmark and

delivered positive returns in a volatile year. Positive

contributions to performance came from several sectors including

Consumer Discretionary (+5.8%), Information Technology (+3.4%),

Industrials (+2.3%) and Health Care (+1.8%). At the stock level,

positions in new energy, electric vehicles (EVs), semiconductor

production and internet companies contributed the most. In this

section, we highlight some of the sector and stock stories that

most impacted portfolio performance.

Within Consumer Discretionary , our internet stock selection was

the largest contributor, thanks to our underweight in internet

retailer Alibaba (which we had reduced over concerns of its

profitability following the regulatory crackdown) , and overweights

in its competitor Pinduoduo and in gaming and multimedia company

Bilibili , which possess better growth prospects. Our investment in

Xpeng , the EV manufacturer, also performed well. The collapse of

the private tutoring companies had a limited impact on performance,

as we had reduced exposure prior to the regulation and exited the

remaining position upon the regulation announcement.

In Information Technology , outperformance was mainly due to our

positions in Silergy and Starpower , two semiconductor component

producers benefiting from import substitution and global shortages

in this sector. Our position in LONGi Green Energy was another top

10 contributor to returns over the year. LONGi is the world's

largest producer of solar panel wafers, supplying around half the

market.

In Industrials , the largest positive contribution came from

Contemporary Amperex Technology (CATL) . CATL is China's leading EV

lithium battery maker, supplying about half the domestic market.

Its share price rallied due to better-than-expected industry EV

sales volumes and the company's deepening links with international

vehicle component suppliers. Yunnan Energy New Material , a

supplier of EV components, also performed well during the period.

These gains helped offset the drag on performance from not owning

EV makers Nio and BYD.

Despite widespread and deep price cuts imposed by government

procurement policies, our overweight in Health Care made a positive

return in the period, thanks mainly to our holdings of two contract

research organisations (CROs), Wuxi Biologics and Hangzhou Tigermed

, and service provider Aier Eye Hospital , which are not subject to

government price cuts. Outperformance thanks to these positions was

only partially offset by the adverse impact of Venus Medtech , a

medical devices company specialising in heart valves. It delivered

decent results, but investors are worried that the government will

impose prices cuts on its products, while demand has been hit by

pandemic-related delays to elective surgery.

Performance was also hurt by our underweight and stock selection

in value sectors such as Energy, Financials and Utilities , as

these sectors outperformed during the rotation from growth to

value. We had zero weightings in oil, coal and shipping stocks, as

investment in these sectors is not consistent with our long-term,

growth-oriented strategy. One of our largest Financials holdings,

Ping An Insurance , underperformed, as several factors weighed on

the share price. Investors have been disappointed by delays to

reforms intended to boost productivity of its sales force. In

addition, recent events in the property sector pose risks to its

property investments. These developments prompted us to sell this

company. We also exited Ping An Bank due to concerns about

potential capital constraints imposed by its parent company.

Sector allocation and trades

The sudden surge in regulatory restrictions imposed over the

review period has not derailed our growth-oriented investment

strategy. We have not made any major changes to our sector

preferences - our largest overweights remain in Information

Technology , Health Care and Consumer Staples , areas which we

believe have the greatest growth potential. Our key holdings are

also largely unchanged, and include Tencent , Wuxi Biologics ,

Meituan , Pinduoduo , and Alibaba . Our top 10 holdings include

CATL , China Merchants Bank , Country Garden Services , the

country's largest property management company, and two enterprise

software companies Baosight Software and Kingdee International . We

have, however, made adjustments to some of these sectoral and stock

positions, which we discuss below.

While the portfolio structure and key holdings remained broadly

unchanged during the past year, we continued our search for China's

best long-term growth stories. The opportunities we see are being

driven by several investment themes.

One major theme is the automation and digitalisation of Chinese

enterprises. The government has implemented incentives to encourage

the adoption of these technologies, as penetration has so far been

low. Consequently, our exposures to Industrials and Information

Technology - sectors likely to gain from the introduction of more

advanced production methods - saw the largest increases over the

past year. For example, we bought several companies focused on

industrial automation, including Zhejiang Supcon , OPT Machine

Vision , Shenzhen Inovance and Han's Laser . We also added

positions in semiconductor manufacturers Starpower and Maxscend and

in Baosight Software and two other IT infrastructure companies,

Sangfor and Beijing Kingsoft Office . These additions were

partially funded by reducing exposures to lower conviction IT names

such as Venustech Group and Kingsoft Cloud .

The development of renewable energy sources is integral to the

realisation of the government's 'net zero' carbon emissions target,

and we expect this sector to experience strong growth as the

transition to renewable energy gathers pace. New energy is thus

another investment theme driving portfolio activity. We added to

solar names, including Xinyi Solar and Tongwei , and also increased

our holding in LONGi Green Energy Technology . Automation and

software names, including our exposures to Zhejiang Supcon and

Baosight Software , will also benefit from the pursuit of the net

zero target, as their products enable energy intensive industries

to increase energy efficiency and thus cut carbon emissions.

Two further and inter-related themes have motivated other

acquisitions over the past year. Rising commodity and energy prices

suggest that companies with strong pricing power will outperform as

inflation pressures build. Many companies with this capacity will

also benefit from the consumer upgrade trend. This is a recognised

and significant feature of Chinese society, driven by households

improving their homes, and upgrading cars and other possessions as

their incomes rise. The market correction during the second half of

2021 provided us with the opportunity to add exposure to Consumer

names we expect to benefit from both these trends. Purchases

included home improvement companies Haier Smart Home and Oppein

Home , and auto components suppliers Fuyao Glass and Changzhou

Xinyu .

In addition to the sales of Ping An Insurance and Ping An Bank ,

within Internet , we reduced our weighting in Alibaba . Investor

support has been dented by concerns related to a sexual harassment

case, and its prospects appear to be deteriorating. However, we

added to Pinduoduo , Alibaba's rival, which we believe has greater

growth potential, and to Bilibili , due to its unique and varied

content offering, catering to children and young adults. Towards

the end of the review period, we began reducing our exposure in EV

battery companies, taking profits on CATL and Yunnan Energy New

Material . These companies have performed well, and we see limited

further upside. Within Consumer , we exited the education sector

prior to the crackdown on this sector. We also closed our position

in Kweichow Moutai , an alcoholic beverages producer, due to our

dissatisfaction with its corporate governance practices.

ESG engagement over the year

Our investment philosophy centres on identifying quality

companies with sustainable growth potential. We strongly believe

that Environmental, Social and Governance (ESG) considerations

(particularly Governance) should be the foundation of any long-term

investment process. In our view, corporate policies at odds with

such considerations are not sustainable over time. We therefore

believe that integrating ESG factors into the investment process is

critical to its success.

In the past financial year, JPMAM has continued to strengthen

its ESG research capability. Its dedicated Sustainable Investment

(SI) team now consists of three sub-teams focused respectively on

data and research, client solutions and stewardship. The

stewardship team now includes three Hong Kong-based members, two of

whom are Chinese speakers. This team's primary responsibilities

include proxy voting oversight, pro-active company engagement and

ESG reporting, and it works closely with JPMAM's investment

managers. In addition, the Emerging Markets and Asia Pacific

Equities (EMAP) team has appointed senior investment managers to

lead ESG projects, in coordination with the SI team. JPMAM has also

updated and expanded its risk profile and materiality

questionnaire, which now provides a consistent ESG research

framework for use by all JPM AM's equity analysts and investment

managers globally. This should improve cross regional references

and comparisons.

The following are a few examples of how we have worked with the

SI team in the past year to address ESG issues in our portfolio

companies:

-- In August 2021 we engaged with Alibaba on several matters,

including a recent high-profile accusation of a sexual assault

within the company. Although the allegations were not supported by

a police investigation, the company has implemented new

anti-harassment guidelines and set up a working environment

committee led by senior female employees, intended to provide

employees with a more transparent and supportive complaints

process. We also discussed Alibaba's intended response to China's

forthcoming data privacy law. Alibaba appears to support the new

law stating that in spirit, it is very similar to the general data

protection regulations already in place in the UK and the European

Union. We highlighted the importance of empowering users to opt-out

of data collection. We also sought an update on the board's ESG

oversight processes and its approach to ESG disclosures and were

pleased to learn that Alibaba is looking to recruit a chief

sustainability officer, and is also preparing its ESG report.

-- Prior to NetEase's AGM, we met with the company's Chief

Finance Officer to express our concerns about the lack of board

refreshment, as all five of NetEase's independent directors have

held their positions since the company went public more than two

decades ago. At the AGM, we voted against the re-election of the

nomination committee chair, to express our dissatisfaction with his

failure to take steps to improve the board's independence.

-- We met with representatives of Baosight Software , which is

assisting domestic steelmakers reduce energy usage. The purpose of

the meeting was to increase our understanding of the environmental

impact of the company's work. We learned that the company is seeing

new demand for its services and expanding its client base beyond

its BaoSteel parent group, as steel producers strive to comply with

the government's net zero carbon emissions target. Following the

meeting, we increased our holding.

Outlook

The world is recovering from COVID disruptions and major

economies are returning to normal, although some bottlenecks have

emerged in global supply chains. A year ago, it was difficult to

imagine the world would soon be confronted with supply shortages of

an array of products, from semiconductors to clothing, and

widespread inflation pressures. We expect inflation to persist in

the short term, until pandemic-related obstacles within supply

chains are removed and pent-up demand for basic materials and

manufactured goods dissipates. Major central banks will gradually

wind back the extremely generous monetary stimulus implemented to

support activity during the pandemic, but they are still faced with

the difficult task of timing future interest rate increases to

dampen inflation pressures, without unduly damaging activity.

In China, we believe the recent regulatory crackdowns are

ultimately designed to achieve more sustainable and equitable

growth. In our view, they do not represent any wavering in the

government's commitment to improving living standards, opening the

economy and delivering the benefits of technological innovation to

consumers and businesses. For example, the government's efforts to

limit property prices have wide public support and are essential to

achieving a more balanced economy. The drive for common prosperity,

if executed well, may lead to greater domestic consumption in the

long run.

However, although we agree with the thrust of the regulatory

changes, we are not complacent about the associated investment

risks. These policies will continue to adversely impact certain

companies and industries in the near term and alter the competitive

dynamics of some sectors. We will therefore continue to assess

regulatory risks on a company-by-company and sector-by-sector basis

and review our investment thesis accordingly.

In relation to other aspects of government policy, China has

sufficient fiscal and monetary policy head room to support growth

if needed, and the recent weakening in manufacturing activity and

consumption, if it persists, has increased the chances that some

stimulatory measures will be announced in coming quarters. Looking

further ahead, the Central Committee of the Communist Party met at

the end of 2020 to discuss China's medium and long-term economic

strategies. In response to ongoing tensions between China and the

US and its western allies, over trade policy and territorial

issues, the committee emphasised the need to foster economic

self-sufficiency and technological innovation. It also endorsed

efforts to boost consumer demand and continuing 'supply-side'

structural reforms. We will continue to seek investment

opportunities in those sectors best placed to benefit from the

government's long-term economic strategies.

The good news for investors in China is that we believe the

sharp share price correction seen in the second half of the review

period now reflects most of the risks and uncertainties surrounding

Chinese equity markets. And despite some near-term concerns, we

remain positive about China's prospects. We expect growth to remain

underpinned by the drive to digitalise and implement other

technological innovations, by the rising aspirations of the

expanding middle class, and increasingly, by the need to reduce

carbon emissions.

We are also optimistic about the outlook for Chinese equities.

We forecast expected annualised returns over a five-year period, as

we believe this figure provides a reliable indicator of potential

market performance. Over the next five years, we expect annualised

returns to approach 20%. This is very close to an all-time high.

Five-year return projections last touched this level in late 2018,

following the sharp market sell-off sparked by Sino/US trade

tensions and slower domestic growth. Equity markets subsequently

experienced a rebound that continued virtually unabated until early

2021 and took indices to all-time highs.

If our analysis proves correct, we can look forward to a strong

recovery in Chinese equities over the next few years. We are

confident that our long-term investment philosophy, combined with

our strong research capabilities and our presence 'on the ground'

in mainland China, should help us to navigate any near-term market

turbulence and continue to deliver positive returns for our

shareholders over the longer term.

Rebecca Jiang

Howard Wang

Shumin Huang

Investment Managers

3rd December 2021

PRINCIPAL AND EMERGING RISKS

The Directors confirm that they have carried out a robust

assessment of the principal risks facing the Company, including

those that would threaten its business model, future performance,

solvency or liquidity. With the assistance of JPMF, the Audit

Committee has drawn up a risk matrix, which identifies the key

risks to the Company. These are reviewed and noted by the Board.

The risks identified and the broad categories in which they fall,

and the ways in which they are managed or mitigated are summarised

below. The AIC Code of Corporate Governance requires the Audit

Committee to put in place procedures to identify emerging risks.

The key emerging risks identified are also summarised below.

Principal Risk Description Mitigating Activities

Geopolitical Geopolitical risk arises from The Board meets advisers and gathers

uncertainty about the future prices insights from both JP Morgan and

of the Company's investments, independent sources

the ability to trade in those on a regular and ongoing basis and

investments, and the imposition of takes advice from the Manager and its

restrictions on the free professional advisers.

movement of capital. Changes in

economic or political conditions or

other factors can substantially

and potentially adversely affect the

value of investments. Geopolitical

risks could arise

from trade and political tensions

between China and the United States

and, for instance, interference

in Hong Kong and Cross Taiwan Straits

tension. All may impact the ability

of the Manager and

other service providers to carry on

business as usual in the management

of the portfolio in

Hong Kong.

-------------------------------------- --------------------------------------

Investment Underperformance An inappropriate investment decision The Board manages this risk by

may lead to sustained diversification of investments

underperformance against the through its investment restrictions

Company's and guidelines which are monitored

benchmark index and peer companies, and reported on by the Manager. The

resulting in the Company's shares Manager provides the

trading on a wider discount. Directors with timely and accurate

management information, including

performance data and

attribution analyses, revenue

estimates and transaction reports.

The Board monitors the implementation

and results of the investment process

with the investment managers, who

attend all Board meetings,

and reviews data which show

statistical measures of the Company's

risk profile. The investment

managers employ the Company's gearing

within a strategic range set by the

Board.

-------------------------------------- --------------------------------------

Strategy and Business Management An ill-advised corporate initiative, The Board discusses this on a regular

for example an inappropriate takeover and ongoing basis with the Manager

of another company and corporate advisers

or an ill-timed issue of new capital; based on information provided both at

misuse of the investment trust and between Board meetings (see above

structure, for example risk regarding

inappropriate gearing; or if the Investment Underperformance).

Company's business strategy is no

longer appropriate, may

lead to a lack of investor demand.

-------------------------------------- --------------------------------------

Loss of Investment Team or Investment A sudden departure of several members The Board seeks assurance that the

Manager of the investment management team Manager takes steps to reduce the

could result in a likelihood of such an

deterioration in investment event by ensuring appropriate

performance. succession planning and the adoption

of a team-based approach,

as well as special efforts to retain

key personnel. The Board engages with

the senior management

of the Manager in order to mitigate

this risk.

-------------------------------------- --------------------------------------

Share Price Discount A disproportionate widening of the In order to manage the Company's

discount relative to the Company's discount, which can be volatile, the

peers could result in Company operates a share

a loss of value for shareholders. repurchase programme. The Board

regularly discusses discount policy

and has set parameters

for the Manager and the Company's

broker to follow. The Board receives

regular reports and

is actively involved in the discount

management process.

-------------------------------------- --------------------------------------

Governance Changes in financial, regulatory or The Manager makes recommendations to

tax legislation, including in the the Board on accounting, dividend and

European Union, may tax policies and

adversely affect the Company. the Board seeks external advice where

appropriate. The Board receives

regular reports from

its broker, depositary, registrar and

Manager as well as its legal advisers

and the Association

of Investment Companies on changes to

governance and regulations which

could impact the

Company and its industry. The Company

monitors events and relies on the

Manager and its other

key third party providers to manage

this risk by preparing for any

changes.

-------------------------------------- --------------------------------------

Corporate Governance and Shareholder Details of the Company's compliance The Board receives regular reports

Relations with Corporate Governance best from the Manager and the Company's

practice, including information broker about shareholder

on relations with shareholders, are communications, their views and their

set out in the Corporate Governance activity. It also receives updates

Statement in the Annual from its advisors

Report. on corporate governance issues and

reviews its related policies

regularly.

-------------------------------------- --------------------------------------

Financial The financial risks faced by the Counterparties are subject to daily

Company include market price risk, credit analysis by the Manager. In

interest rate risk, liquidity addition the Board

risk and credit risk. receives reports on the Manager's

monitoring and mitigation of credit

risks on share transactions

carried out by the Company. Further

details are disclosed in note 21 in

the Annual Report.

-------------------------------------- --------------------------------------

Operational Risk and Cyber Crime Disruption to, or failure of, the Details of how the Board monitors the

Manager's accounting, dealing or services provided by the Manager, its

payments systems or the associates and

depositary's or custodian's records depositary and the key elements

may prevent accurate reporting and designed to provide effective

monitoring of the Company's internal control are included

financial position. within the Risk Management and

In addition to threatening the Internal Control section of the

Company's operations, such an attack Directors' Report in the Annual

is likely to raise reputational Report.. The threat of cyber attack,

issues which may damage the Company's in all its guises, is regarded as at

share price and reduce demand for its least as important

shares. as more traditional physical threats

to business continuity and security.

The Company benefits

directly or indirectly from all

elements of JPMorgan's Cyber Security

programme. The information

technology controls around the

physical security of JPMorgan's data

centres, security of its

networks and security of its trading

applications are tested

independently.

The risk of fraud or other control

failures or weaknesses within the

Manager or other service

providers could result in losses to

the Company. The Audit Committee

receives independently

audited reports on the Manager's and

other service providers' internal

controls, as well as

a report from the Manager's

Compliance function. The Company's

management agreement obliges

the Manager to report on the

detection of fraud relating to the

Company's investments and

the Company is afforded protection

through its various contracts with

suppliers, of which

one of the key protections is the

Depositary's indemnification for loss

or misappropriation

of the Company's assets held in

custody.

-------------------------------------- --------------------------------------

Legal and Regulatory In order to qualify as an investment The Section 1158 qualification

trust, the Company must comply with criteria are continually monitored by

Section 1158 of the the Manager and the results

Corporation Tax Act 2010 ('Section reported to the Board each month. The

1158'). Details of the Company's Company must also comply with the

approval are given under provisions of the

'Structure of the Company' in the Companies Act 2006 and, since its

Annual Report.. Were the Company to shares are listed on the London Stock

breach Section 1158, Exchange, the UKLA

it may lose investment trust status Listing Rules, Disclosure Guidance

and, as a consequence, gains within and Transparency Rules ('DTRs') and,

the Company's portfolio as an Investment Trust,

would be subject to Capital Gains the Alternative Investment Fund

Tax. Managers Directive ('AIFMD'). A

breach of the Companies Act

2006 could result in the Company

and/or the Directors being fined or

the subject of criminal

proceedings. Breach of the UKLA

Listing Rules or DTRs could result in

the Company's shares

being suspended from listing which in

turn would breach Section 1158. The

Board relies on

the services of its Company

Secretary, JPMorgan Funds Limited and

its professional advisers

to ensure compliance with the

Companies Act 2006, the UKLA Listing

Rules, DTRs and AIFMD.

-------------------------------------- --------------------------------------

Global pandemics The emergence and spread of Time after time, markets have

coronavirus (COVID-19) is a global recovered, albeit over varying and

pandemic risk that poses a sometimes extended time periods,

significant risk to the Company's and so the Board does have an

portfolio. COVID-19 has highlighted expectation that the portfolio's

the speed and extent holdings will not suffer a

of economic damage that can arise material long-term impact and should

from a pandemic. While current recover. The Board receives reports

vaccination programme results on the business continuity

are hopeful, the risk remains that plans of the Manager and other key

new variants may not respond to service providers. The effectiveness

existing vaccines, may of these measures

be more lethal and may spread as have been assessed throughout the

global travel opens up again. course of the COVID-19 pandemic and

the Board will continue

to monitor developments as they occur

and seek to learn lessons which may

be of use in the

event of future pandemics. Should the

virus become more virulent than is

currently the case,

it may present risks to the

operations of the Company, its

Manager and other major service

providers.

Should efforts to control a pandemic

prove ineffectual or meet with

substantial levels of

public opposition, there is the risk

of social disorder arising at a

local, national or international

level. Even limited or localised

societal breakdown may threaten both

the ability of the Company

to operate, the ability of investors

to transact in the Company's

securities and ultimately

the ability of the Company to pursue

its investment objective and purpose.

-------------------------------------- --------------------------------------

Emerging Risk Description Mitigating Activities

Climate change Climate change, which barely registered with The Board is also considering the threat posed

investors a decade ago, has today become one by the direct impact on climate change on the

of the most critical issues confronting asset operations of the Manager and other major

managers and their investors. Investors can service providers.

no longer ignore the impact that the world's As extreme weather events become more common,

changing climate will have on their portfolios, the resiliency, business continuity planning

with the impact of climate change on returns now and the location strategies of our services

inevitable. providers will come under greater scrutiny.

The Board also receives ESG reports from the

Manager on the portfolio and the way ESG

considerations

are integrated into the investment

decision-making.

-------------------------------------------------- -------------------------------------------------

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

Details of the management contract are set out in the Directors'

Report in the Annual Report.. The management fee payable to the

Manager for the year was GBP4,572,000 (2020: GBP2,733,000).

Safe custody fees amounting to GBP81,000 (2020: GBP65,000) were

payable to JPMorgan Chase Bank N.A. during the year of which

GBP41,000 (2020: GBP14,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions

through group subsidiaries. These transactions are carried out at

arm's length. The commission payable to JPMorgan Securities Limited

for the year was GBP28,000 (2020: GBP15,000).

Handling charges on dealing transactions amounting to GBP42,000

(2020: GBP55,000) were payable to JPMorgan Chase Bank N.A. during

the year of which GBP20,000 (2020: GBP7,000) was outstanding at the

year end.

The Company also held cash during the year in the JPMorgan US

Dollar Liquidity Fund, which is managed by JPMorgan. At the year

end this was valued at GBPnil (2020: GBPnil). Interest amounting to

GBP8,000 (2020: GBP18,000) was receivable during the year.

Fees amounting to GBP638,000 (2020: GBP202,000) were receivable

from stock lending transactions during the year. JPMorgan Investor

Services Limited commissions in respect of such transactions

amounted to GBP71,000 (2020: GBP22,000).

At the year end, total cash of GBP36,000 (2020: GBP343,000) was

held with JPMorgan Chase Bank, N.A. in a non interest bearing

current account.

Full details of Directors' remuneration and shareholdings can be

found in the Directors' Remuneration Report and in note 6 in the

Annual Report.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

have elected to prepare the Financial Statements in accordance with

United Kingdom Generally Accepted Accounting Practice (United

Kingdom Accounting Standards, comprising FRS 102 'The Financial

Reporting Standard applicable in the UK and Republic of Ireland'

and applicable law). Under company law the Directors must not

approve the Financial Statements unless they are satisfied that,

taken as a whole, the Annual Report and Financial Statements are

fair, balanced and understandable; provide the information

necessary for shareholders to assess the Company's position,

business model and strategy; and that they give a true and fair

view of the state of affairs of the Company and of the total return

or loss of the Company for that period. In preparing these

Financial Statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable UK Accounting Standards comprising

FRS 102, have been followed, subject to any material departures

disclosed and explained in the Financial Statements;

-- make judgments and accounting estimates that are reasonable and prudent; and

-- prepare the Financial Statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

and the Directors confirm that they have done so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The accounts are published on the

www.jpmchinagrowthandincome.co.uk website, which is maintained by

the Company's Manager. The maintenance and integrity of the website

maintained by the Manager is, so far as it relates to the Company,

the responsibility of the Manager. The work carried out by the

auditor does not involve consideration of the maintenance and

integrity of this website and, accordingly, the auditor accepts no

responsibility for any changes that have occurred to the accounts

since they were initially presented on the website. The accounts

are prepared in accordance with UK legislation, which may differ

from legislation in other jurisdictions.

Under applicable law and regulations the Directors are also

responsible for preparing a Strategic Report, a Directors' Report

and a Directors' Remuneration Report that comply with that law and

those regulations.

Each of the Directors, whose names and functions are listed in

Directors' Report confirm that, to the best of their knowledge:

-- the Company's Financial Statements, which have been prepared

in accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards, comprising FRS 102

'The Financial Reporting Standard applicable in the UK and Republic

of Ireland', and applicable law), give a true and fair view of the

assets, liabilities, financial position and profit of the Company;

and

-- the Directors' Report and the Strategic Report include a fair

review of the development and performance of the business and the

position of the Company, together with a description of the

principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial

Statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Company's performance, business model and strategy.

For and on behalf of the Board

John Misselbrook

Chairman

3rd December 2021

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30th September 2021

2021 2020

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Net gains on investments held at fair value through

profit or loss - 3,485 3,485 - 164,024 164,024

Net foreign currency gains(1) - 1,364 1,364 - 1,492 1,492

Income from investments 2,966 - 2,966 3,401 - 3,401

Other income 646 - 646 220 - 220

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Gross return 3,612 4,849 8,461 3,621 165,516 169,137

Management fee (1,143) (3,429) (4,572) (683) (2,050) (2,733)

Other administrative expenses (540) - (540) (438) - (438)

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Net return before finance costs and taxation 1,929 1,420 3,349 2,500 163,466 165,966

Finance costs (195) (580) (775) (188) (564) (752)

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Net return before taxation 1,734 840 2,574 2,312 162,902 165,214

Taxation charges (171) - (171) (166) - (166)

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Net return after taxation 1,563 840 2,403 2,146 162,902 165,048

----------------------------------------------------- --------- --------- --------- -------- --------- ---------

Return per share 1.97p 1.06p 3.03p 2.95p 224.06p 227.01p

(1) GBP2,057,000 due to an exchange gain on the loan which is

denominated in US dollars. GBP693,000 due to net exchange loss on

cash and cash equivalents (2020: GBP1,430,000 due to an exchange

gain on the loan which is denominated in US dollars. GBP62,000 due

to net exchange gains on cash and cash equivalents).

statement of changes in equity

for the year ended 30th September 2021

Called

up Exercised Capital

share Share warrant redemption Other Capital Revenue

capital premium reserve reserve reserve(1,2) reserves(2) reserve(2) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- -------- ---------- ----------- ------------- ------------ ----------- ----------

At 30th September

2019 19,481 13,321 3 581 37,392 179,059 3,276 253,113

Net return - - - - - 162,902 2,146 165,048

Dividend paid

in the year

(note 3) - - - - - (1,776) (5,422) (7,198)

------------------- -------- -------- ---------- ----------- ------------- ------------ ----------- ----------

At 30th September

2020 19,481 13,321 3 581 37,392 340,185 - 410,963

Issue of Ordinary

shares 1,322 39,111 - - - - - 40,433

Issue of shares

from Treasury - 28,613 - - - 9,007 - 37,620

Project costs

- in relation

to issue of

new shares - (94) - - - - - (94)

Net return - - - - - 840 1,563 2,403

Dividend paid

in the year

(note 3) - - - - - (16,360) (1,563) (17,923)

------------------- -------- -------- ---------- ----------- ------------- ------------ ----------- ----------

At 30th September

2021 20,803 80,951 3 581 37,392 333,672 - 473,402

------------------- -------- -------- ---------- ----------- ------------- ------------ ----------- ----------

(1) Created during the year ended 30th September 1999, following

a cancellation of the share premium account.

(2) These reserves form the distributable reserves of the

Company and may be used to fund distributions to investors.

statement of FINANCIAL POSITION

as at 30th September 2021

2021 2020

GBP'000 GBP'000

------------------------------------------------------- ---------- ----------

Fixed assets

Investments held at fair value through profit or loss 521,634 454,645

------------------------------------------------------- ---------- ----------

Current assets

Debtors 4,264 819

Cash and cash equivalents 36 343

------------------------------------------------------- ---------- ----------

4,300 1,162

Current liabilities

Creditors: amounts falling due within one year (4,206) (44,844)

------------------------------------------------------- ---------- ----------

Net current assets/(liabilities) 94 (43,682)

------------------------------------------------------- ---------- ----------

Total assets less current liabilities 521,728 410,963

Creditors: amounts falling due after one year (48,326) -

------------------------------------------------------- ---------- ----------

Net assets 473,402 410,963

------------------------------------------------------- ---------- ----------

Capital and reserves

Called up share capital 20,803 19,481

Share premium 80,951 13,321

Exercised warrant reserve 3 3

Capital redemption reserve 581 581

Other reserve 37,392 37,392

Capital reserves 333,672 340,185

Total shareholders' funds 473,402 410,963

------------------------------------------------------- ---------- ----------

Net asset value per share 569.0p 565.3p

STATEMENT OF CASH FLOWs

for the year ended 30th September 2021

2021 2020

GBP'000 GBP'000

----------------------------------------------------------------- ---------- ----------

Net cash outflow from operations before dividends and interest (5,140) (2,885)

Dividends received 2,966 3,248

Interest received 8 18

Overseas tax recovered - 1

Interest paid (801) (700)

----------------------------------------------------------------- ---------- ----------

Net cash outflow from operating activities (2,967) (318)

----------------------------------------------------------------- ---------- ----------

Purchases of investments (385,098) (174,168)

Proceeds from sale of investments 320,797 161,070

Settlement of foreign currency contracts 51 33

----------------------------------------------------------------- ---------- ----------

Net cash outflow from investing activities (64,250) (13,065)

----------------------------------------------------------------- ---------- ----------

Dividends paid (17,923) (7,198)

Issue of Ordinary shares 40,433 -

Reissue of shares from Treasury 37,620 -

Project costs - in relation to issue of new shares (94) -

Repayment of bank loans - (67)

Drawdown of bank loans 6,800 17,895

Utilisation of bank overdraft 124 -

----------------------------------------------------------------- ---------- ----------

Net cash inflow from financing activities 66,960 10,630

----------------------------------------------------------------- ---------- ----------

Decrease in cash and cash equivalents (257) (2,753)

----------------------------------------------------------------- ---------- ----------

Cash and cash equivalents at start of year 343 3,134

Unrealised losses on foreign currency cash and cash equivalents (50) (38)

Cash and cash equivalents at end of year 36 343

----------------------------------------------------------------- ---------- ----------

Decrease in cash and cash equivalents (257) (2,753)

----------------------------------------------------------------- ---------- ----------

Cash and cash equivalents consist of:

Cash at bank 36 343

----------------------------------------------------------------- ---------- ----------

36 343

----------------------------------------------------------------- ---------- ----------

Notes to the financial statements

for the year ended 30th September 2021

1. Accounting policies

Basis of accounting

The Financial Statements are prepared under the historical cost

convention, modified to include fixed asset investments at fair

value, and in accordance with the Companies Act 2006, United

Kingdom Generally Accepted Accounting Practice ('UK GAAP'),

including FRS 102 'The Financial Reporting Standard applicable in

the UK and Republic of Ireland' and with the Statement of

Recommended Practice 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts' (the 'SORP') issued by the

Association of Investment Companies in October 2019.

All of the Company's operations are of a continuing nature.

The Financial Statements have been prepared on a going concern

basis. In forming this opinion, the directors have considered any

potential impact of COVID-19 pandemic on the going concern and

viability of the Company. They have considered the potential impact

of COVID-19 and the mitigation measures which key service

providers, including the Manager, have in place to maintain

operational resilience particularly in light of COVID-19. The

Directors have reviewed income and expense projections and the

liquidity of the investment portfolio in making their

assessment.

The policies applied in these Financial Statements are

consistent with those applied in the preceding year.

2. Return per share

2021 2020

GBP'000 GBP'000

------------------------------------------------------------ ----------- ------------

Revenue return 1,563 2,146

Capital return 840 162,902

------------------------------------------------------------ ----------- ------------

Total return 2,403 165,048

------------------------------------------------------------ ----------- ------------

Weighted average number of shares in issue during the year 79,481,601 72,703,188

Revenue return per share 1.97p 2.95p

Capital return per share 1.06p 224.06p

------------------------------------------------------------ ----------- ------------

Total return per share 3.03p 227.01p

------------------------------------------------------------ ----------- ------------

3. Dividends

(a) Dividends paid and proposed

2021 2020

GBP'000 GBP'000

------------------------------------------------------------------------- -------- --------

Dividends paid

2019 final dividend of 2.5p per share - 1,818

2021 first quarterly interim dividend of 5.7p (2020: 3.7p) 4,144 2,690

2021 second quarterly interim dividend of 5.7p (2020: 3.7p) 4,366 2,690

2021 third quarterly interim dividend of 5.7p (2020: nil) 4,671 -

2021 fourth quarterly interim dividend of 5.7p (2020: nil) 4,742 -

------------------------------------------------------------------------- -------- --------

Total dividends paid in the period 17,923 7,198

------------------------------------------------------------------------- -------- --------

Dividends proposed

2022 first quarterly interim dividend of 5.7p (2021: 5.7p) per share(1) 4,743 4,144

------------------------------------------------------------------------- -------- --------

(1) First quarterly payment of 4% of 569.0p per share, being the

NAV per share at 30th September 2021.

The first quarterly interim dividend has been declared in

respect of the year ended 30th September 2022. In accordance with

the accounting policy of the Company, this dividend will be

reflected in the financial statements for the year ending 30th

September 2022.

(b) Dividend for the purposes of Section 1158 of the Corporation

Tax Act 2010 ('Section 1158')

The requirements of Section 1158 are considered on the basis of

the dividend proposed in respect of the financial year, shown

below.

The aggregate of the distributable reserves is GBP371,064,000

(2020: GBP377,577,000). Please note that at the Annual General

Meeting ('AGM') in February 2020, shareholders approved an

amendment to the Company's Articles of Association to allow the

Company to distribute capital as income to enable the

implementation of the Company's revised dividend policy). Please

see the Chairman's Statement in the Annual Report and Financial

Statements for further details.

2020 2019

GBP'000 GBP'000

-------------------------------------------------------- -------- --------

2021 first quarterly interim dividend of 5.7p (2020:

3.7p) 4,144 2,690

2021 second quarterly interim dividend of 5.7p (2020:

3.7p) 4,366 2,690

2021 third quarterly interim dividend of 5.7p (2020: 4,671 -

nil)

2021 fourth quarterly interim dividend of 5.7p (2020: 4,742 -

nil)

-------------------------------------------------------- -------- --------

17,923 5,380

-------------------------------------------------------- -------- --------

The aggregate of the distributable reserves after the payment of

the first quarterly dividend will amount to GBP366,321,000 (2020:

GBP373,433,000). Please see the Chairman's Statement in the Annual

Report and Financial Statements for further details.

4. Net asset value per share

2021 2020

--------------------------- ----------- ------------

Net assets (GBP'000) 473,402 410,963

Number of shares in issue 83,202,465 72,703,188

--------------------------- ----------- ------------

Net asset value per share 569.0p 565.3p

--------------------------- ----------- ------------

5. Status of results announcement

2020 Financial Information

The figures and financial information for 2020 are extracted

from the Annual Report and Financial Statements for the year ended

30th September 2020 and do not constitute the statutory accounts

for that year. The Annual Report and Financial Statements has been

delivered to the Registrar of Companies and included the Report of

the Independent Auditors which was unqualified and did not contain

a statement under either section 498(2) or section 498(3) of the

Companies Act 2006.

2021 Financial Information

The figures and financial information for 2021 are extracted

from the Annual Report and Financial Statements for the year ended

30th September 2021 and do not constitute the statutory accounts

for that year. The Annual Report and Financial Statements includes

the Report of the Independent Auditors which is unqualified and

does not contain a statement under either section 498(2) or section

498(3) of the Companies Act 2006. The Annual Report and Financial

Statements will be delivered to the Registrar of Companies in due

course.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

3rd December 2021

For further information:

Lucy Dina,

JPMorgan Funds Limited

020 7742 4000

S

A copy of the 2021 Annual Report and Financial Statements will

shortly be submitted to the FCA's National Storage Mechanism and

will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The 2021 Annual Report and Financial Statements will also

shortly be available on the Company's website at

www.jpmchinagrowthandincome.co.uk where up-to-date information on

the Company, including daily NAV and share prices, factsheets and

portfolio information can also be found.

JPMORGAN FUNDS LIMITED

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOUURAKUURAA

(END) Dow Jones Newswires

December 03, 2021 07:34 ET (12:34 GMT)

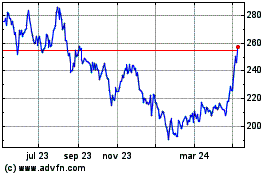

Jpmorgan China Growth & ... (LSE:JCGI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jpmorgan China Growth & ... (LSE:JCGI)

Gráfica de Acción Histórica

De May 2023 a May 2024