TIDMPSDL

RNS Number : 8255M

Phoenix Spree Deutschland Limited

24 September 2021

Phoenix Spree Deutschland Limited

(the "Company" or "PSD")

Interim Results for the half-year to 30 June 2021

Phoenix Spree Deutschland (LSE: PSDL.LN), the UK listed

investment company specialising in German residential real estate,

announces its Interim Results for the six months ended 30 June

2021.

Financial Summary

EUR million (unless otherwise Six months Six months 12 months 12 months

stated) to June to to December to December

2021 June 2020 2020 2019

Gross rental income(1) 12.9 12.0 23.9 22.6

----------- ---------- ------------ ------------

Profit before tax 20.4 15.3 37.9 28.6

----------- ---------- ------------ ------------

Dividend (EUR cents (GBP pence)) 2.35 (2.02) 2.35 (2.1) 7.50 (6.75) 7.50 (6.3)

----------- ---------- ------------ ------------

Portfolio valuation 777.7 746.7 768.3 730.2

----------- ---------- ------------ ------------

EPRA NTA per share (EUR) 5.42 5.06 5.28 4.92

----------- ---------- ------------ ------------

EPRA NTA per share (GBP)(2) 4.66 4.60 4.76 4.16

----------- ---------- ------------ ------------

EPRA NTA per share total return

(EUR per cent) 3.6 3.9 8.8 9.1

----------- ---------- ------------ ------------

Net LTV (per cent)(3) 33.7 33.0 33.1 32.6

----------- ---------- ------------ ------------

Portfolio valuation per sqm

(EUR) 4,075 3,839 3,977 3,741

----------- ---------- ------------ ------------

Annual like-for-like rent per

sqm growth (per cent) 4.6 4.1 4.1 5.6

----------- ---------- ------------ ------------

EPRA Vacancy (per cent) 1.3 4.3 2.1 2.8

----------- ---------- ------------ ------------

Condominium sales notarised 4.3 3.0 14.6 8.8

----------- ---------- ------------ ------------

(1 -) (Rental income is disclosed under IAS 18, therefore rent

recovered from tenants after the removal of the Mietendeckel is

included in the 2021 figures)

(2 - GBP:EUR FX rate 1:1.163 as at 30 June 2021)

(3 - Net LTV uses nominal loan balances as per note 17 rather

than the loan balance on the Consolidated Statement of Financial

Position which consider Capitalised Finance Arrangement Fees in the

balance.)

Financial and operational highlights

-- EPRA NTA per share up 2.7 per cent in H1 2021 to EUR5.42;

EPRA NTA per share total return of 3.6 per cent.

-- Like-for-like Portfolio value, adjusted for acquisitions and

disposals, increased by 2.5 per cent in H1 2021.

-- Like-for-like rental income per sqm increased by 4.6 per cent

versus prior year, reflecting the reversionary potential within the

portfolio.

o New Leases in Berlin signed at an average 35.8 per cent

premium to passing rents.

-- Condominium sales notarised during H1 2021 of EUR4.3 million,

a 45.1 per cent increase versus H1 2020.

o Average achieved value per sqm of EUR4,821 for residential

units, a 25.4 per cent premium to book value and 18.3 per cent to

the Portfolio average value per sqm as at 30 June 2020.

o 74 per cent of Portfolio assets legally split into

condominiums, up from 70 per cent as at 31 December 2020.

Applications representing a further 11 per cent of the Portfolio

are underway, over half of which are in the final stages of the

process.

o A further EUR3.9 million of condominium sales notarised in Q3

at an average sales price of EUR5,655 per sqm.

-- New construction project representing seven new residential

units underway, with completion expected in early 2022.

-- Recognition of commitment to sustainability reporting at EPRA

Sustainability Best Practice Recommendations (sBPR) Awards 2021:

EPRA sBPR Silver Medal and EPRA sBPR Most Improved Award.

Share buy-backs and dividend

-- Following positive Mietendeckel ruling, the Company has

adopted a more proactive buyback strategy in order to take

advantage of the valuation discount.

-- Since proactive share buyback programme announced on 2 June

2021, a further 3.2 per cent of shares in issue have been

repurchased to 23 September 2021 at an average discount to trailing

EPRA NTA of 12%

-- Discount to EPRA NTA has narrowed from 30 per cent to 12 per

cent during the first half of the financial year.

-- Unchanged interim dividend of 2.35 cents. Dividend increased

or maintained since listing in June 2015.

Update on COVID-19 and Mietendeckel

-- Collection of backdated Mietendeckel rents progressing well;

as at 23 September 2021 over 91 per cent past due rents

collected.

-- EPRA vacancy of 1.3 per cent at a record low; reduction in

supply of available rental accommodation created by Mietendeckel

has yet to be reversed.

-- Continued limited impact on rent collection from COVID-19.

Over 97 per cent of rents collected during H1 2021, with the

collection rate remaining consistent in H2 2021 to date.

Outlook

-- Outcome of German election on 26 September remains uncertain,

with several coalition permutations possible.

-- Long-term Berlin demographic trends expected to remain positive:

o Decreased availability of rental stock, exacerbated by the

recently removed Mietendeckel, continues to support market

rents;

o Net inward migration expected to strengthen when restrictions

associated with COVID-19 are permanently removed.

-- Potential for further valuation creation through condominium

projects and sales - condominium pricing expected to remain strong,

particularly for centrally located Berlin apartments.

-- Significant reversionary potential underpins future rental

growth - increased capex anticipated to drive acceleration in

reversionary rental income growth.

-- Robust business model, a strong balance sheet and good levels

of liquidity mean PSD remains well positioned to reinvest in its

Portfolio.

o The Company continues to monitor the best use of funds to

generate shareholder value including, amongst other options, share

buy-backs versus potential acquisitions.

Robert Hingley, Chairman of Phoenix Spree Deutschland,

commented:

"I am pleased to report another period of solid performance and

growth. Despite the further market disruption caused by the

combined effects of COVID-19, the Mietendeckel and its subsequent

reversal, the Portfolio delivered further valuation gains

reflecting the strong demand for living space in Berlin.

Berlin market dynamics remain positive and affordability

comparisons with other German cities are still favourable. Despite

the uncertainty ahead of the outcome the German Federal Election,

it is expected that Berlin demographic trends, particularly net

inward migration, will further strengthen when restrictions

associated with COVID-19 are permanently removed. This will provide

further support for PSD's reversionary strategies and allow us to

continue to deliver value to shareholders."

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda +44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow +44 (0)20 7353 4200

CHAIRMAN'S STATEMENT

I am pleased to report that, during the first half of the

financial year, PSD has delivered further increases in property

values and rental revenues. As at 30 June 2021, the Portfolio was

valued at EUR777.7 million by Jones Lang LaSalle GmbH, a

like-for-like increase of 2.5 per cent since 31 December 2020.

The first six months of the financial year were characterised by

significant market disruption caused by the combined effects of

COVID-19, the Mietendeckel and its subsequent reversal.

Notwithstanding this, the Company was able to deliver a total

return per share of 3.6 per cent.

Although the Mietendeckel did not cause transaction values in

the Berlin residential property market to fall during the period in

which it was in place, equity markets attached a significant risk

premium to the valuation of listed Berlin residential property

businesses. The removal of the Mietendeckel and the uncertainty it

created, combined with our proactive share buyback programme (at an

average discount to 2020 yearend NAV of 19.0 per cent over first

sixth months of the year) and the notarisation of condominiums for

sale (at an average premium to book value of 25.4 per cent over the

first six months of the year), has underpinned a positive

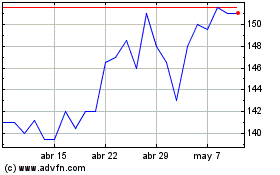

performance for the Company. Against this backdrop, PSD's share

price outperformed the FTSE All-Share index by 16 per cent and the

FTSE 350 Real Estate Investment Services Sector by 17 per cent

during the first half of the financial year.

The Berlin Mietendeckel

PSD and its legal advisors were always firmly of the opinion

that the Mietendeckel was unconstitutional. The Company therefore

welcomed the ruling by the German Federal Court on 15 April 2021,

that the Mietendeckel was unlawful and should be struck out in its

entirety. A more detailed update on the impact of the Mietendeckel

is contained within the report of the Property Advisor.

Share buy-backs

Notwithstanding the removal of the Mietendeckel, PSD's shares

continued to trade at a material discount to Net Asset Value in the

weeks after the court ruling. The Board believed that this discount

did not reflect the record and performance of the underlying

Portfolio and the positive outlook following the removal of the

Mietendeckel. For this reason, on 2 June 2021, the Company

announced its intention to adopt a more proactive buyback strategy

to take advantage of the valuation discount and to seek to ensure

that the share price better reflected the underlying Net Asset

Value. A material allocation of capital has been made available to

fund the buy-back programme through a combination of existing cash

balances, refinancing, condominium sale proceeds and the disposal

of non-core assets.

COVID-19

The Company's overriding priority is the health and wellbeing of

its tenants, work colleagues and wider stakeholders during what has

been a period of significant disruption. Where appropriate, the

Company continues to support its tenants, both residential and

commercial, through agreeing, on a case-by-case basis, the payment

of monthly rents or deferring rental payments.

I am nevertheless pleased to report that the impact of COVID-19

on PSD's rent collection has been very limited, with the level of

rent arrears in line with pre-COVID levels. I am confident that, as

the current restrictions and disruptions created by COVID-19

recede, PSD will be well placed to continue to deliver its

investment objectives. The Company will continue to closely monitor

any future potential impacts of COVID-19 on both the Berlin economy

and PSD.

Our Environmental, Social, and Corporate Governance (ESG)

progress

The Board believes that taking a sustainable and socially

responsible approach to our business delivers long-term success and

benefits for all of our stakeholders. As a member of EPRA, we want

to contribute to greater transparency in reporting. Therefore, in

2020, we strengthened our commitment to delivering against our

environmental and social impacts by introducing EPRA's

Sustainability Best Practices Recommendations and capturing our ESG

measurements within their framework.

I am delighted to report that this commitment has been

recognised at the EPRA Sustainability Awards 2021, with PSD

receiving both a Silver and Most Improved award in recognition of

the Company's commitment to best practice in its reporting. This

recognition further encourages us to continue to approach the

future in a consistent, ethical, safe and environmentally friendly

way.

Our charitable initiatives

PSD takes a strategic approach to its charitable giving which is

guided by our Community Investment Policy and focuses on supporting

charities where there is a connection with either 'homelessness' or

'families.' Since February 2019, we have provided support to a

women's refuge (The Intercultural Initiative) that helps women

affected by domestic violence, providing emergency shelter, advice

and counselling to the women and their children. I am pleased to

report that, during the first half of 2021, PSD has committed to

supporting an additional Berlin charity, Laughing Hearts. This

charity supports children living in children's homes and social

care.

Dividend

The Board is pleased to declare an unchanged interim dividend of

2.35 cents per share (2.02 pence per share) for the first half of

the year (six months to 30 June 2020: 2.35 cents, 2.1 pence). The

dividend is expected to be paid on or around 29 October 2021 to

shareholders on the register at the close of business on 8 October

2021, with an ex-dividend date of 7 October 2021.

Since listing on the London Stock Exchange in June 2015 and

including the announced dividend for 2021 and bought-back shares

held in treasury up to 23 September 2021, EUR75.9 million has been

returned to shareholders of which EUR41.8 million relates to

dividends and EUR34.1 million to share buybacks. The Board is

committed to continuing to provide shareholders with a secure

dividend over the medium term.

REPORT OF THE PROPERTY ADVISOR

Federal Court rules against the legality of the Berlin

Mietendeckel

On 15 April 2021 the German Federal Constitutional Court, the

highest court in Germany, ruled that the Mietendeckel was unlawful

and thus void.

The uncertainty created during the period in which the

Mietendeckel was in place significantly disrupted the Berlin

residential market. One consequence was to reduce significantly the

supply of available rental accommodation, as rental stock was

withdrawn from the market, causing record-low vacancy rates. This

trend has been reflected across PSD's portfolio and has persisted

in the months since the Mietendeckel was removed.

Another consequence was to reduce significantly the investment

in the stock of Berlin housing. PSD's reversionary rental strategy

which, before the introduction of the Mietendeckel, had delivered

consistently strong rental growth since listing in 2015, was partly

reliant on high levels of capital expenditure which could not be

justified under the Mietendeckel rules. The removal of rent

controls will allow the Company to restore the level of investment

into the Portfolio to pre-Mietendeckel levels.

The Portfolio has continued to demonstrate significant

reversionary potential, as evidenced by the fact that, during the

first half of the current financial year, new lettings in Berlin

were signed at an average premium of 35.8 per cent to passing

rents. This reversionary gap should underpin rental growth in the

medium term, irrespective of market rental growth. The Company will

also continue with its strategy of crystallising condominium

reversionary value within the Portfolio through the selective sale

of individual units as condominiums at a premium to book value.

Prior to the Mietendeckel ruling, all rental agreements had been

structured to revert to pre-Mietendeckel rent levels and to allow

for the back-payment of higher rents now legally due for the period

during which the Mietendeckel was in place. The Company had

previously estimated that the amount of back-dated rent which could

be claimed from tenants for the period in which the Mietendeckel

was in place to be approximately EUR2.1 million, of which EUR0.8

million related to backdated rents from 2020.

As at 30 June, 86 per cent of rents (EUR1.8 million) had been

collected, and; as at 23 September 2021, 92 per cent of rents

(EUR2.0 million) had been collected. Tenants had been advised by

the Berlin government to set aside appropriate reserves, and the

Company will continue to work on a case-by-case basis with any

tenants suffering hardship as it collects the remainder of

back-dated rents due.

Financial results

Table: Financial highlights for the six-month period to 30 June

2021

EUR million (unless otherwise 6 months 6 months Year to Year to

stated) to 30-Jun-21 to 30-Jun-20 31-Dec-20 31-Dec-19

Gross rental income 12.9 12.0 23.9 22.6

-------------- -------------- ----------- -----------

Investment property fair

value gain 16.0 17.0 41.5 41.5

-------------- -------------- ----------- -----------

Profit before tax (PBT) 20.4 15.3 37.9 28.6

-------------- -------------- ----------- -----------

EPS (EUR) 0.17 0.12 0.31 0.22

-------------- -------------- ----------- -----------

Investment property value 777.7 746.7 768.3 730.2

-------------- -------------- ----------- -----------

Net debt(1) 261.8 246.3 254.4 237.8

-------------- -------------- ----------- -----------

Net LTV (per cent)(1) 33.7 33.0 33.1 32.6

-------------- -------------- ----------- -----------

IFRS NAV per share (EUR) 4.54 4.29 4.48 4.23

-------------- -------------- ----------- -----------

IFRS NAV per share (GBP)(2) 3.90 3.90 4.04 3.58

-------------- -------------- ----------- -----------

EPRA NTA per share (EUR) 5.42 5.06 5.28 4.92

-------------- -------------- ----------- -----------

EPRA NTA per share (GBP)(2) 4.66 4.60 4.76 4.16

-------------- -------------- ----------- -----------

Dividend per share (EUR cents) 2.35 2.35 7.5 7.5

-------------- -------------- ----------- -----------

Dividend per share (GBP pence)

(2) 2.02 2.1 6.75 6.3

-------------- -------------- ----------- -----------

EPRA NTA per share total

return for period (EUR per

cent) 3.6 3.9 8.8 9.1

-------------- -------------- ----------- -----------

EPRA NTA per share total

return for period (GBP per

cent) (1.1) 11.5 16.0 2.9

-------------- -------------- ----------- -----------

(1 - Net LTV and net debt uses nominal loan balances as per note

17 rather than the loan balances on the Consolidated Statement of

Financial Position which consider Capitalised Finance Arrangement

Fees in the balance as per IAS 23.)

(2 - GBP:EUR FX rate 1:1.163 as at 30 June 2021)

Revenue for the six-month period was EUR12.9 million (six months

to 30 June 2020: EUR12.0 million). Profit before taxation was

EUR20.4 million (six months to 30 June 2020: EUR15.3 million) which

was positively affected by a revaluation gain of EUR16.0 million

(30 June 2020: EUR17.0 million), an increase in revenue collected

after the removal of the Mietendeckel, a reduction in property and

administrative costs and a positive movement in our interest rate

swaps. Reported earnings per share for the period were 17 cents

(six months to 30 June 2020: 12 cents).

Reported EPRA NTA per share rose by 2.7 per cent in the first

half of 2021 to EUR5.42 (GBP4.66) (31 December 2020: EUR5.28

(GBP4.76)). After taking into account the 2020 final dividend of

5.15 cents (4.65 pence), which was paid in June 2021, the EUR EPRA

NTA total return in the first half of 2021 was 3.6 per cent (H1

2020: 3.9 per cent). The GBP EPRA NTA total return for the same

period was -1.1 per cent, reflecting the strengthening of the GBP

against the EUR in the first six months of the year.

The Board is pleased to declare an unchanged interim dividend of

2.35 cents per share (2.02 pence per share) for the first half of

the year (six months to 30 June 2020: 2.35 cents, 2.1 pence). The

dividend is expected to be paid on or around 28 October 2021 to

shareholders on the register at the close of business on 8 October

2021, with an ex-dividend date of 7 October 2021.

Like-for-like portfolio value increase of 2.5 per cent

As at 30 June 2021, the Portfolio was valued at EUR 777.7

million (31 December 2020: EUR768.3 million). This represents a 1.2

per cent increase over the six-month period. On a like-for-like

basis, excluding the impact of disposals, the Portfolio value

increased by 2.5 per cent . This reflects a reversion to market

rents following the removal of the Mietendeckel, f urther progress

in condominium splitting and improvements in the micro locations of

certain assets.

Following the ruling of the Federal court, the interim Portfolio

valuation undertaken by Jones Lang LaSalle GmbH (JLL) for the

half-year ended 30 June 2021, now assumes market (as opposed to

Mietendeckel) rents for the full Discounted Cashflow (DCF) period

after the Mietendeckel was declared unconstitutional.

Table: Portfolio valuation and breakdown

30-Jun-21 30-Jun-20 31-Dec-20 31-Dec-19

Total sqm ('000) 190.8 194.5 193.2 195.2

---------- ---------- ---------- ----------

Valuation (EUR million) 777.7 746.7 768.3 730.2

---------- ---------- ---------- ----------

Like-for-like valuation growth

(%) 2.5 2.6 6.3 7.1

---------- ---------- ---------- ----------

Value per sqm (EUR) 4,075 3,839 3,977 3,741

---------- ---------- ---------- ----------

Fully occupied gross yield

(%) 2.9 2.8 2.4 2.9

---------- ---------- ---------- ----------

Number of buildings 97 98 98 98

---------- ---------- ---------- ----------

Residential units 2,586 2,634 2,618 2,537

---------- ---------- ---------- ----------

Commercial units 139 141 139 142

---------- ---------- ---------- ----------

Total units 2,725 2,775 2,757 2,679

---------- ---------- ---------- ----------

(1 - Net LTV and net debt uses nominal loan balances as per note

17 rather than the loan balances on the Consolidated Statement of

Financial Position which consider Capitalised Finance Arrangement

Fees in the balance as per IAS 23.)

(2 - GBP:EUR FX rate 1:1.163)

The Berlin residential property market has remained stable in

the first half of the financial year and, although transaction

volumes remained below peak levels, investment demand observed by

JLL continues to support increased pricing, reflecting the fact

that market participants placed a high probability on the

Mietendeckel being struck out. JLL has conducted a RICS Red Book

property-by-property analysis and has provided a Portfolio

valuation, tied back to comparable market transaction values.

The valuation as at 30 June 2021 represents an average value per

square metre of EUR4,075 (31 December 2020: EUR3,977), at a gross

fully-occupied yield of 2.9 per cent (31 December 2020: 2.4 per

cent). Included within the Portfolio are eight properties valued as

condominiums, with an aggregate value of EUR43.4 million (31

December 2020: nine properties, aggregate value EUR52.4

million).

The previous Portfolio valuation for the financial year ended 31

December 2020 had assumed that the Mietendeckel would be fully

implemented for its entire five-year lifespan and therefore

incorporated the negative impact on rental income caused by the

Mietendeckel.

Table: Rental income and vacancy rate

30 June 30 June 31 December 31 December

2021 2020 2020 2019

Total sqm ('000) 190.8 194.5 193.2 195.2

-------- -------- ------------ ------------

Gross in place rent per

sqm (EUR) 9.5 9.1 9.3 9.0

-------- -------- ------------ ------------

Like-for-like rent per

sqm growth 4.6 4.1 4.1 5.6

-------- -------- ------------ ------------

Vacancy (%) 7.7 8.0 6.8 6.7

-------- -------- ------------ ------------

EPRA Vacancy per cent

(%) 1.3 4.3 2.1 2.8

-------- -------- ------------ ------------

Like-for-like rental income per square metre growth of 4.6 per

cent

After considering the impact of acquisitions and disposals,

like-for-like rental income per square metre grew 4.6 per cent

compared with 30 June 2020. Like-for-like rental income grew 4.3

per cent over the same period.

Gross in-place rent was EUR9.5 per sqm as at 30 June 2021, an

increase of 4.3 per cent compared with 30 June 2020 and an increase

of 2.0 per cent on 31 December 2020.

EPRA vacancy at record low

Reported vacancy at 30 June 2021 was 7.7 per cent (30 June 2020:

8.0 per cent). On an EPRA basis, which adjusts for units undergoing

development and made available for sale, the vacancy rate was 1.3

per cent (30 June 2020: 4.3 per cent). Although the Mietendeckel

has been removed, the decline in the availability of rental

property it caused has yet to be reversed.

Berlin reversionary re-letting premium of 35.8 per cent

During the year to 30 June 2021, 102 new leases were signed,

representing a letting rate of approximately 4.3 per cent of

occupied units. The average rent achieved on all new lettings was

EUR11.7 per sqm, a 7.6 per cent increase on the prior year, and an

average premium of 23.5 per cent to passing rents. This compares to

an 18.7 per cent premium in the period to 30 June 2020.

The reversionary premium is negatively impacted by the inclusion

of re-lettings from the acquisition in Brandenburg in 2020, where

rents are lower than those achieved in central Berlin. Looking

solely at the Berlin portfolio, which represents 91.5 per cent of

total residential lettable space, the reversionary premium achieved

was 35.8 per cent, down from 37.0 per cent in the prior period.

Limited impact from COVID-19 on rent collection

The prolonged duration of the COVID-19 outbreak and the

restrictions and uncertainty it has caused have had a limited

impact on rent collection levels. Excluding collection of

back-dated rents, over 97 per cent of rents due had been collected

during the first six months of the financial year.

Where appropriate, PSD continues to support its tenants, both

residential and commercial, by agreeing, on a case-by-case basis,

the payment of monthly rents or deferring rental payments. In

addition, PSD has in place a Vulnerable Tenant Policy which it will

continue to monitor and apply to relevant tenants.

Portfolio investment

During the first half of 2021, a total of EUR2.7 million was

invested across the Portfolio (H1 2020: EUR2.2 million). These

items are recorded as capital expenditure in the Financial

Statements. A further EUR0.6 million was spent on maintaining the

assets and is expensed through the profit and loss account.

Following the legal ruling against the Mietendeckel, it is

anticipated that capital expenditure will rise significantly in the

second half of the financial year as projects which had been

postponed or cancelled pending a final ruling on the legality of

the Mietendeckel are reinstated.

Condominium sales at a premium to book value

PSD's condominium strategy involves the division and resale of

selected properties as single apartments. This is subject to full

regulatory approval and involves the legal splitting of the

freeholds in properties that have been identified as being suitable

for condominium conversion.

During the first half of 2021, 13 condominium units were

notarised for sale for an aggregate value of EUR4.3 million (H1

2020: EUR3.0 million). The average achieved notarised value per sqm

for the residential units was EUR4,821, representing a 25.4 per

cent premium to book value and a 18.3 per cent premium to the

average residential portfolio value as at 30 June 2021.

Since the reporting date, the Company has notarised for sale a

further 11 condominium units with total value EUR3.9 million and at

a price per square metre of EUR5,655. This represents a 25.3 per

cent premium to book value and a 38.8 per cent premium to the

average residential portfolio value as at 30 June 2021.

As at 23 September 2021, 74 per cent of the Portfolio had been

registered as condominiums, providing opportunities for the

implementation of further sales projects where appropriate. A

further 11 per cent are in application, over half of which are in

the final stages of the process. We believe this gives PSD greater

strategic flexibility to respond to changes in market conditions

than its peer group.

Condominium notarisations during the second quarter of 2021 were

impacted by COVID-19 and the legacy impact of the Mietendeckel. The

"second wave" of COVID made the viewing of occupied apartments more

difficult. Additionally, record low vacancy rates caused by the

Mietendeckel have continued, reducing the number of vacant

apartments which can be made available for sale. As the

Mietendeckel is no longer in place and the COVID vaccination

programme in Germany is now progressing well, it is anticipated

that the slowdown in condominium sales will be temporary.

Condominium construction

Prior to the removal of the Mietendeckel, the Property Advisor

had completed an exercise to examine the financial viability of the

creation of new condominium units within the footprint of the

existing Portfolio.

The first project involves building out the attic and renovating

existing commercial units to create seven new residential units in

an existing asset bought in 2007. Construction on this project is

underway and the first units are projected to be available for sale

or rental in the first half of 2022. The total construction budget

for this project is EUR3.9 million.

The second project is for the construction of a new 23-unit

apartment block located in the footprint of a property acquired in

2018. Alongside this, the undeveloped attic of the same property

will be built out with the creation of four new units for sale as

condominiums, or for rental

The Company also has building permits to renovate attics in 20

existing assets to create a further 49

units for sale as condominiums or as rental stock.

Debt and gearing1

As at 30 June 2021, PSD had gross borrowings of EUR290.2 million

(31 December 2020: EUR291.4 million) and cash balances of EUR28.4

million (31 December 2020: EUR37.3 million), resulting in net debt

of EUR261.8 million (31 December 2020: EUR254.4 million) and a net

loan to value on the Portfolio of 33.7 per cent (31 December 2020:

33.1 per cent). The increase in net debt in the period is a result

of the cash used in the share buyback programme, offset slightly by

debt repayments made upon sale of condominiums.

1 Section uses nominal loan balances as per note 17 rather than

the loan balances on the Consolidated Statement of Financial

Position which consider Capitalised Finance Arrangement Fees in the

balance.

Nearly all PSD's debt interest rates have been fixed through

hedging and, as at 30 June 2021, the blended interest rate of PSD's

loan book was 2.0 per cent (31 December 2020: 2.0 per cent). The

average remaining duration of the loan book at 30 June 2021 had

decreased to 5.3 years (31 December 2020: 6.0 years).

The Company is actively continuing to review its balance sheet

and is looking for additional opportunities to add liquidity to

further the Company's investment objectives.

Outlook

Predictably, the uncertainty created by the Mietendeckel has

significantly disrupted the Berlin residential market. This has

been reflected by a reduction in Berlin transaction activity (but

not values) from prior peak levels, a significant reduction in the

availability of rental accommodation for tenants, record low

vacancy, and a decline in new investment in the Berlin housing

market. Although it will take some time for these effects to be

reversed, the removal of the Mietendeckel should alleviate these

negative market consequences.

The Company is well placed to resume its reversionary rental

strategy and the removal of the Mietendeckel will allow the Company

to restore the level of investment into the Portfolio to

pre-Mietendeckel levels. The fact that new lettings in Berlin for

the first six months of 2021 were signed at an average premium of

35.8 per cent to passing rents should underpin rental growth in the

medium term, irrespective of market rental growth.

PSD will also continue with its strategy of crystallising

condominium reversionary value within the Portfolio through the

selective sale of individual units as condominiums at a premium to

book value. Exceptionally among its listed peers, over 74 per cent

of the Company's Berlin portfolio has already been legally split

into condominiums, with a further 11 per cent in application. The

Property Advisor is confident that, as and when the current

restrictions and disruptions created by COVID-19 recede, it will be

well placed to continue to deliver on its condominium strategy.

The German Federal Elections are due to be held on 26 September

2021. Prior to these elections there was a "Grand Coalition" led by

Angela Merkel between the CDU and the SPD which had been in power

since the previous Federal Elections in 2017. Ahead of the

elections, there remains a degree of uncertainty as to the outcome,

with a number of coalition permutations possible after polling day.

It may take some time before any coalition agreement is struck and

any new policy initiatives relating to German residential real

estate are agreed.

The Company notes that the Federal Government has previously

discussed the introduction of legislation that may limit the

ability of landlords to split their properties into condominiums.

The implementation of any such measures would be likely to reduce

the stock of apartments available on the market. Given the high

proportion of the Portfolio already split into condominiums, any

valuation impact on the Company's Portfolio would be expected to be

positive.

During its 15 years of operation, the Company has adapted its

business model many times to the changing regulatory environment

while continuing to deliver positive returns to shareholders. The

Property Advisor believes that the Company has a flexible enough

business model to adapt to new regulations caused by a change in

Government.

The monetary policy pursued by the European Central Bank in the

wake of the COVID-19 pandemic has been extremely accommodating.

While interest rates remain at low levels, relatively higher yields

from residential real estate will remain attractive to

institutional investors, such as insurance companies, pension funds

and wealth managers, who are increasingly looking favourably on

multi-family housing as an alternative to government bonds and

other long-dated fixed income instruments.

Low interest rates will continue to benefit the Condominium

market as well. Favourable mortgage rates, coupled with a lack of

available rental properties, and favourable mortgage versus market

rent dynamics, will continue to provide a tailwind for Condominium

pricing.

The Property Advisor remains confident in the long-term outlook

for PSD. Berlin market dynamics remain attractive and affordability

comparisons with other German cities are still favourable. It is

expected that Berlin demographic trends, particularly net inward

migration, will further strengthen when restrictions associated

with COVID-19 are permanently removed, providing further support to

the reversionary rental strategy which has historically served

investors and other key stakeholders in our business well.

Key Performance Indicators

PSD has chosen a number of Key Performance Indicators (KPIs),

which the Board believes will help investors understand the

performance of PSD and the underlying property Portfolio.

-- The value of the Portfolio grew by 2.5 per cent on a

like-for-like for basis for the first half of the year (H1 2020:

2.6 per cent). This increase was driven a like-for-like average

rent per let sqm of 4.6 per cent (H1 2020: 4.1 per cent).

-- The EPRA vacancy of the Portfolio stood at 1.3 per cent (31 December 2020: 2.0 per cent).

-- The Group continued with its targeted condominium programme,

notarising sales of EUR4.3 million in the half year to 30 June 2021

(H1 2020: EUR3.0 million).

-- EPRA NTA per share increased by 2.7 per cent to EUR5.42 as at

30 June 2021 (31 December 2020: EUR5.28).

-- The declared dividend for the half year 2021 was EUR2.35 cents (GBP2.02 pence) per share.

Statement of Director's Responsibilities

The important events that have occurred during the period under

review, the key factors influencing the condensed consolidated

financial statements and the principal factors that could impact

the remaining six months of the financial year are set out in the

Chairman's statement and the Property Advisor Report.

With the exception of the continuing uncertainty around

coronavirus (Covid-19) and the upcoming German elections as set out

in the outlook section of the Property Advisor's Report, the

Directors consider that the principal risks and uncertainties

facing PSD are substantially unchanged since the date of the annual

report for the year ended 31 December 2020 and continue to be as

set out in that report.

Risks faced by the Group include, but are not limited to:

- Legal risk

- Tenant / Letting and Political risk

- Market risk

- Financial risk

- Outsourcing risk

- IT and Cyber Security risk

- Lack of Investment Opportunity

Condensed Consolidated Statement

of Comprehensive Income

For the period from 1 January

2021 to 30 June 2021

Six months Six months

ended ended Year ended

Notes 30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Continuing operations

Revenue 12,925 12,024 23,899

Property expenses 5 (7,391) (8,053) (16,437)

Gross profit 5,534 3,971 7,462

Administrative expenses 6 (1,586) (1,915) (3,263)

Gain on disposal of investment

property (including investment

property held for sale) 7 577 693 2,178

Investment property

fair value gain 10 15,987 16,959 41,458

Performance fee due

to property advisor 20 - 1,923 439

Operating profit 20,512 21,631 48,274

Net finance charge 8 (78) (6,361) (10,417)

Profit before taxation 20,434 15,270 37,857

Income tax expense 9 (4,198) (2,949) (7,550)

Profit after taxation 16,236 12,321 30,307

Other comprehensive - - -

income

Total comprehensive

income for the period 16,236 12,321 30,307

============ =============== ===========

Total comprehensive

income attributable

to:

Owners of the parent 16,208 12,134 29,788

Non-controlling interests 28 187 519

---------------

16,236 12,321 30,307

============ =============== ===========

Earnings per share attributable

to the owners of the parent:

From continuing

operations

Basic (EUR) 22 0.17 0.12 0.31

Diluted (EUR) 22 0.17 0.12 0.30

============ =============== ===========

Condensed Consolidated Statement

of Financial Position

At 30 June 2021

As at As at As at

Notes 30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

ASSETS

Non-current assets

Investment properties 12 763,960 736,745 749,008

Property, plant and

equipment 31 51 42

Other financial

assets

at amortised cost 14 919 888 901

Deferred tax asset 9 2,303 2,891 2,880

767,213 740,575 752,831

Current assets

Investment properties

- held for sale 13 13,720 9,975 19,302

Other financial

assets

at amortised cost 14 - 1,622 -

Trade and other

receivables 15 12,746 10,878 8,414

Cash and cash

equivalents 28,393 37,259 36,996

54,859 59,734 64,712

Total assets 822,072 800,309 817,543

============ =============== ===========

EQUITY AND

LIABILITIES

Current liabilities

Borrowings 16 1,085 1,386 1,018

Trade and other payables 17 10,548 9,984 9,018

Other financial

liabilities 19 - 7,520 -

Current tax 9 513 8 550

12,146 18,898 10,586

Non-current

liabilities

Borrowings 16 285,525 278,298 286,531

Derivative financial

instruments 18 14,554 18,269 18,197

Deferred tax liability 9 71,897 64,177 68,273

371,976 360,744 373,001

Total liabilities 384,122 379,642 383,587

============ =============== ===========

Equity

Stated capital 21 196,578 196,578 196,578

Treasury shares (19,705) (13,087) (17,206)

Share based payment

reserve 20 - 4,885 6,369

Retained earnings 257,519 229,093 244,685

Equity attributable

to owners of the

parent 434,392 417,469 430,426

Non-controlling interest 3,558 3,198 3,530

Total equity 437,950 420,667 433,956

------------ --------------- -----------

Total equity and

liabilities 822,072 800,309 817,543

============ =============== ===========

Condensed Consolidated Statement

of Changes in Equity

For the period from 1 January

2021 to 30 June 2021

Attributable to the owners of

the parent

Stated Treasury Share Retained Total Non-controlling Total

capital Shares based earnings interest equity

payment

reserve

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1 January

2020 196,578 (11,354) 6,808 221,859 413,891 3,011 416,902

Comprehensive income:

Profit for the period - - - 12,134 12,134 187 12,321

Other comprehensive - - - - - - -

income

Total comprehensive

income for the period - - - 12,134 12,134 187 12,321

Transactions with

owners -

recognised directly

in equity:

Issue of shares - - - - - - -

Dividends paid - - - (4,900) (4,900) - (4,900)

Performance fee - - (1,923) - (1,923) - (1,923)

Acquisition of treasury

shares - (1,733) - - (1,733) - (1,733)

Balance at 30 June

2020 (unaudited) 196,578 (13,087) 4,885 229,093 417,469 3,198 420,667

Comprehensive income:

Profit for the period - - - 17,654 17,654 332 17,986

Other comprehensive - - - - - - -

income

Total comprehensive

income for the period - - - 17,654 17,654 332 17,986

Transactions with

owners -

recognised directly

in equity:

Dividends paid - - - (2,062) (2,062) - (2,062)

Performance fee - - 1,484 - 1,484 - 1,484

Acquisition of treasury

shares - (4,119) - - (4,119) - (4,119)

Balance at 31 December

2020 (audited) 196,578 (17,206) 6,369 244,685 430,426 3,530 433,956

Comprehensive income:

Profit for the period - - - 16,208 16,208 28 16,236

Other comprehensive - - - - - - -

income

Total comprehensive

income for the period - - - 16,208 16,208 28 16,236

Transactions with

owners -

recognised directly

in equity:

Dividends paid - - - (5,207) (5,207) - (5,207)

Performance fee - - - - - - -

Settlement of performance

fee using treasury

shares 4,536 (6,369) 1,833 - -

Acquisition of treasury

shares - (7,035) - - (7,035) - (7,035)

Balance at 30 June

2021 (unaudited) 196,578 (19,705) - 257,519 434,392 3,558 437,950

============= =========== ======= ======== ============ =============== ===========

The share based payment reserve had been established in relation

to the issue of shares for the payment of the performance fee

of the property advisor.

Treasury shares comprise the accumulated cost of shares

acquired on-market.

Condensed Consolidated Statement

of Cash Flows

For the period from 1 January

2021 to 30 June 2021

Notes Six months Six months Year ended

ended ended

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Profit before taxation 20,434 15,270 37,857

Adjustments for:

Net finance charge 78 6,391 10,417

Gain on disposal of

investment property (577) (693) (2,178)

Investment property

revaluation gain (15,987) (16,959) (41,458)

Depreciation 8 8 8

Performance fee due

to property advisor - (1,923) (439)

---------------

Operating cash flows before

movements in working capital 3,956 2,094 4,207

(Increase) / decrease in

receivables (4,332) (1,476) 2,071

Increase in payables 1,530 2,748 1,782

---------------

Cash generated from/(used

in) operating activities 1,154 3,366 8,060

Income tax paid (34) (1,364) (1,316)

---------------

Net cash generated from

operating activities 1,120 2,002 6,744

Cash flow from investing

activities

Proceeds on disposal of

investment property (net

of disposal costs) 10,198 1,894 7,213

Interest received 18 40 19

Capital expenditure on investment

property (2,729) (2,279) (4,171)

Put option settlement - - (7,542)

Repayment of shareholder

loans - - 1,622

Disposals of property, plant

and equipment 3 - 4

Net cash generated from

/ (used in) investing activities 7,490 (345) (2,855)

Cash flow from financing

activities

Interest paid on bank loans (3,663) (3,574) (7,541)

Repayment of bank loans (1,308) (16,900) (38,845)

Drawdown on bank loan facilities - 20,300 50,000

Dividends paid (5,207) (4,900) (6,962)

Acquisition of treasury

shares (7,035) (1,733) (5,956)

Net cash (used in) financing

activities (17,213) (6,807) (9,304)

Net (decrease) in cash and

cash equivalents (8,603) (5,150) (5,415)

Cash and cash equivalents

at beginning of period/year 36,996 42,414 42,414

Exchange gains / (losses)

on cash and cash equivalents - (5) (3)

Cash and cash equivalents

at end of period/year 28,393 37,259 36,996

============ =============== ===========

Reconciliation of Net Cash Flow to

Movement in Debt

For the period from 1 January

2021 to 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Cashflow from

/increase/(decrease)

in debt financing (1,308) 3,430 11,155

Non-cash changes from

increase in debt

financing 369 - 140

Movement in debt

in the period/year (939) 3,430 11,295

------------ --------------- -----------

Debt at the start

of the period/year 287,549 276,254 276,254

Debt at the end of

the period/year 16 286,610 279,684 287,549

============ =============== ===========

Dividends paid during the six months to 30 June 2021 represent

the final year dividend relating to the year end 2020.

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

1. General information

The Group consists of a Parent Company, Phoenix Spree Deutschland

Limited ('the Company'), incorporated in Jersey, Channel Islands

and all its subsidiaries ('the Group') which are incorporated

and domiciled in and operate out of Jersey and Germany. Phoenix

Spree Deutschland Limited is listed on the premium segment of

the Main Market of the London Stock Exchange.

The Group invests in residential and commercial property in

Germany.

The registered office is at 12 Castle Street, St Helier, Jersey,

JE2 3RT, Channel Islands.

2. Basis of

preparation

The interim set of condensed consolidated financial statements

has been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Conduct Authority and with IAS 34 Interim

Financial Reporting as adopted by the European Union.

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the

annual financial statements and should be read in conjunction

with the Group's annual financial statements for the year ended

31 December 2020.

As required by the Disclosure and Transparency Rules of the

Financial Conduct Authority, the financial statements have been

prepared applying the accounting policies and presentation that

were applied in the preparation of the Company's published consolidated

financial statements for the year ended 31 December 2020.

The comparative figures for the financial year ended 31 December

2020 are extracted from but do not comprise, the Group's annual

consolidated financial statements for that financial year.

The interim condensed consolidated financial statements were

authorised and approved for issue on 23 September 2021.

The interim condensed consolidated financial statements are

neither reviewed nor audited, and do not constitute statutory

accounts within the meaning of Section 105 of the Companies

(Jersey) Law 1991.

2.1 Going concern

The interim condensed consolidated financial statements have

been prepared on a going concern basis which assumes the Group

will be able to meet its liabilities as they fall due for the

foreseeable future. The Directors carried out a thorough review

of the viability of the Company in the light of the continuing

COVID-19 outbreak across Europe, the conclusion of which was

that there were no concerns regarding the viability of the Company.

These condensed consolidated financial statements have therefore

been prepared on a going concern basis.

2.2 New standards

and interpretations

The following new standards, amendments or interpretations effective

for annual periods beginning on or after 1 January 2021 have

been adopted and had no impact on the Group;

Interest Rate Benchmark Reform - Phase 2 (Amendments

to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16).

Effective 1 January 2021.

3. Critical accounting estimates and judgements

The preparation of condensed consolidated financial statements

in conformity with IFRS requires the Group to make certain critical

accounting estimates and judgements. In the process of applying

the Group's accounting policies, management has decided the

following estimates and assumptions have a significant risk

of causing a material adjustment to the carrying amounts of

assets and liabilities within the financial period;

i) Estimate of fair value of investment properties

The best evidence of fair value is current prices in an active

market of investment properties with similar leases and other

contracts. In the absence of such information, the Group determines

the amount within a range of reasonable fair value estimates.

In making its judgement, the Group considers information from

a variety of sources, including:

a) Discounted cash flow projections based on reliable estimates

of future cash flows, derived from the terms of any existing

lease and other contracts, and (where possible) from external

evidence such as current market rents for similar properties

in the same location and condition, and using discount rates

that reflect current market assessments of the uncertainty in

the amount and timing of the cash flows.

b) Current prices in an active market for properties of different

nature, condition or location (or subject to different lease

or other contracts), adjusted to reflect those differences.

c) Recent prices of similar properties in less active markets,

with adjustments to reflect any changes in economic conditions

since the date of the transactions that occurred at those prices.

For further information with regard to the movement in the fair

value of the Group's investment properties, refer to the management

report.

ii) Judgment in relation to the recognition of assets held for

sale

In accordance with the requirement of IFRS 5, Management has

made an assumption in respect of the likelihood of investment

properties - held for sale, being sold within the following

12 months. Management considers that based on historical and

current experience of market since 30 June 2021, the properties

can be reasonably expected to sell within this timeframe.

4. Segmental information

Information reported to the Board of Directors, the chief operating

decision maker, relates to the Group as a whole. Therefore,

the Group has not included any further segmental analysis within

these condensed consolidated unaudited interim financial statements.

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

5. Property expenses

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Property management

expenses 606 568 1,143

Repairs and maintenance 598 781 1,553

Cost incurred in splitting 33 - -

assets into condominiums

at the land registry

Impairment charge - trade

receivables 49 125 160

Service charges paid on

behalf of tenants 2,761 3,412 7,137

Property advisors'

fees and expenses 3,344 3,167 6,444

7,391 8,053 16,437

============ =============== ===========

Cost incurred in splitting assets into condominiums at the land

registry have been moved from Administrative expenses into Property

costs for 2021 to better reflect their nature as a cost directly

attributable to the properties. The prior year comparatives

remain set out in the Administrative expenses in note 6 on the

basis that the amounts are immaterial.

6. Administrative

expenses

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Secretarial &

administration

fees 386 434 589

Legal & professional

fees 446 595 1,509

Costs associated - 104 -

with refinancing

Cost incurred in

land registry splitting - 285 225

Directors' fees 158 145 248

Audit and accountancy

fees 525 329 630

Bank charges 53 11 32

Loss on foreign exchange 14 40 69

Depreciation 8 8 8

Other income (4) (36) (47)

1,586 1,915 3,263

============ =============== ===========

7. Gain on disposal of investment property

(including investment property held for sale)

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Disposal proceeds 10,323 3,392 9,998

Book value of disposals (9,346) (2,636) (7,479)

Disposal costs (400) (63) (341)

577 693 2,178

============ =============== ===========

Where there has been a partial disposal of a property, the net

book value of the asset sold is calculated on a per square metre

rate, based on the prior period annual valuation.

8. Net finance charge

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Interest income (18) (40) 6

Interest from partners'

loans - (32) (57)

Fair value (gain)

/ loss on interest

rate swap (3,643) 2,290 2,218

Finance expense on bank

borrowings* 3,739 3,574 7,659

Change in put option

liability arising

on settlement - 569 591

78 6,361 10,417

============ =============== ===========

*Contained within finance expense on bank borrowings at 30 June

2020 is an amount of EUR204k which relates to the early repayment

charge on the borrowings with Mittelbrandenburgische Sparkasse

(31 December 2020: EUR383k).

9. Income tax expense

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

The tax charge for

the period is as

follows: EUR'000 EUR'000 EUR'000

Current tax (credit)

/ charge (3) (41) 453

Deferred tax charge - origination

and reversal of temporary differences 4,201 2,990 7,097

4,198 2,949 7,550

============ =============== ===========

The tax charge for the year can be reconciled to the theoretical

tax charge on the profit in the condensed consolidated statement

of comprehensive income as follows:

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

9. Income tax expense

(continued)

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Profit before tax on continuing

operations 20,434 15,270 37,857

Tax at German income tax

rate of 15.8% (2020: 15.8%) 3,229 2,413 5,981

Income not taxable (91) - (344)

Tax effect of losses brought

forward 1,060 536 1,913

Total tax charge for

the period/year 4,198 2,949 7,550

============ =============== ===========

Reconciliation of current tax liabilities

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Balance at beginning

of period/year 550 1,413 1,413

Tax paid during the

period/year (34) (1,364) (1,316)

Current tax (credit)

/ charge (3) (41) 453

Balance at end of

period/year 513 8 550

============ =============== ===========

Reconciliation of

deferred tax

Capital Interest Total

gains rate

on swaps

properties

EUR'000 EUR'000 EUR'000

Liability Asset Net asset

Balance at 1 January

2020 (60,825) 2,529 (58,296)

Charged to the statement

of comprehensive income (3,352) 362 (2,990)

Deferred tax (liability)

/ asset at 30 June 2020 (64,177) 2,891 (61,286)

Charged to the statement

of comprehensive income (4,096) (11) (4,107)

Deferred tax (liability)

/ asset at 31 December 2020 (68,273) 2,880 (65,393)

------------ --------------- -----------

Charged to the statement

of comprehensive income (3,624) (577) (4,201)

Deferred tax (liability)

/ asset at 30 June 2021 (71,897) 2,303 (69,594)

============ =============== ===========

10. Investment

property

fair value gain

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Investment property

fair value gain 15,987 16,959 41,458

============ =============== ===========

Further information on investment properties is shown in note

12.

11. Dividends

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Amounts recognised as distributions

to equity holders in the period:

Interim dividend for the year ended

31 December 2020 of EUR2.35 cents (2.1p)

declared 15 September 2020, paid 16

October 2020 (2019: EUR2.35 cents (2.1p))

per share. - - 2,284

Final dividend for the year ended 31

December 2020 of 5.15 cents (EUR) (4.65

pence) paid 7 June 2021 (2019: 5.15

cents (EUR) (4.4 pence)) per share. 5,207 4,900 5,010

============ =============== ===========

The Board is pleased to declare an unchanged interim dividend

of 2.35 cents per share (2.02 pence per share equivalent) for

the first half of the year (six months to 30 June 2020: 2.35

cents, 2.10 pence). The dividend is expected to be paid on or

around 29 October 2021 to shareholders on the register at close

of business on 8 October 2021, with an ex-dividend date of 7

October 2021.

The proposed dividend has not been included as a liability in

these condensed consolidated financial statements. The payment

of this dividend will not have any tax consequences for the

Group.

12. Investment

properties

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

Fair Value EUR'000 EUR'000 EUR'000

Balance at beginning

of period/year 768,310 730,160 730,160

Capital expenditure 2,729 2,237 4,171

Disposals (9,346) (2,636) (7,479)

Fair value gain 15,987 16,959 41,458

------------ --------------- -----------

Investment properties at fair value

- as set out in the report by JLL 777,680 746,720 768,310

Assets considered as "Held

for Sale" (Note 13) (13,720) (9,975) (19,302)

Balance at end of

period/year 763,960 736,745 749,008

============ =============== ===========

The property portfolio was valued at 30 June 2021 by the Group's

independent valuers, Jones Lang LaSalle GmbH ('JLL'), in accordance

with the methodology described below. The valuations were performed

in accordance with the current Appraisal and Valuation Standards,

8th edition (the 'Red Book') published by the Royal Institution

of Chartered Surveyors (RICS).

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

12. Investment

properties

(continued)

The valuation is performed on a building-by-building basis and

the source information on the properties including current rent

levels, void rates and non-recoverable costs was provided to

JLL by the Property Advisors QSix Residential Limited. Assumptions

with respect to rental growth, adjustments to non-recoverable

costs and the future valuation of these are those of JLL. Such

estimates are inherently subjective and actual values can only

be determined in a sales transaction. JLL also uses data from

comparable market transactions where these are available alongside

their own assumptions.

Having reviewed the JLL report, the Directors are of the opinion

that this represents a fair and reasonable valuation of the

properties and have consequently adopted this valuation in the

preparation of the condensed consolidated financial statements.

The valuations have been prepared by JLL on a consistent basis

at each reporting date and the methodology is consistent and

in accordance with IFRS which requires that the 'highest and

best use' value is taken into account where that use is physically

possible, legally permissible and financially feasible for the

property concerned, and irrespective of the current or intended

use.

All properties are valued as Level 3 measurements under the

fair value hierarchy (see note 24) as the inputs to the discounted

cash flow methodology which have a significant effect on the

recorded fair value are not observable. Additionally, JLL perform

reference checks back to comparable market transactions to confirm

the valuation model.

The unrealised fair value gain in respect of investment property

is disclosed in the condensed consolidated statement of comprehensive

income as 'Investment property fair value gain'.

Valuations are undertaken using the discounted cash flow valuation

technique as described below and with the inputs set out as

follows:

Discounted cash flow methodology

(DCF)

The fair value of investment properties is determined using

discounted cash flows.

Under the DCF method, a property's fair value is estimated using

explicit assumptions regarding the benefits and liabilities

of ownership over the asset's life including an exit or terminal

value. As an accepted method within the income approach to valuation

the DCF method involves the projection of a series of cash flows

on a real property interest. To this projected cash flow series,

an appropriate, market-derived discount rate is applied to establish

the present value of the income stream associated with the real

property.

The duration of the cash flow and the specific timing of inflows

and outflows are determined by events such as rent reviews,

lease renewal and related lease up periods, re-letting, redevelopment,

or refurbishment. The appropriate duration is typically driven

by market behaviour that is a characteristic of the class of

real property.

Periodic cash flow is typically estimated as gross income less

vacancy, non-recoverable expenses, collection losses, lease

incentives, maintenance cost, agent and commission costs and

other operating and management expenses. The series of periodic

net operating incomes, along with an estimate of the terminal

value anticipated at the end of the projection period, is then

discounted.

The Group categorises all investment

properties in the following three ways;

Rental Scenario

Where properties have been valued under the "Discounted Cashflow

Methodology" and are intended to be held by the Group for the

foreseeable future, they are considered valued under the "Rental

Scenario" This will equal the "Investment Properties" line in

the Non-Current Assets section of the condensed consolidated

statement of financial position.

Condominium scenario

Where properties have the potential, or the benefit of all relevant

permissions required to sell apartments individually (condominiums)

then we value these as a 'condominium scenario'. Expected sales

in the coming year from these assets are considered held for

sale under IFRS 5 and can be seen in note 13. The additional

value is reflected by using a lower discount rate under the

DCF Methodology. Properties which do not have the benefit of

all relevant permissions are described as valued using a standard

'rental scenario'. Included in properties valued under the condominium

scenario are properties not yet released to held for sale as

only a portion of the properties are forecast to be sold in

the coming 12 months.

Disposal Scenario

Where properties have been notarised for sale prior to the reporting

date but have not completed; they are held at their notarised

disposal value. These assets are considered held for sale under

IFRS 5 as set out in note 13.

The table below sets out the assets

valued using these 3 scenarios:

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Rental scenario 734,240 713,720 715,870

Condominium scenario 42,294 31,379 45,264

Disposal scenario 1,146 1,621 7,176

Total 777,680 746,720 768,310

============ =============== ===========

13. Investment

properties

- held for sale

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Fair value - held for sale investment

properties

At beginning of

period/year 19,302 10,639 10,639

Transferred from

investment properties 3,248 1,503 15,004

Capital expenditure 458 42 313

Properties sold (9,346) (2,636) (7,479)

Valuation gain on

apartments held for

sale 58 427 825

At end of period/year 13,720 9,975 19,302

============ =============== ===========

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

13. Investment properties - held for sale (continued)

Investment properties are re-classified as current assets and

described as 'held for sale' in three different situations:

properties notarised for sale at the reporting date, properties

where at the reporting date the Group has obtained and implemented

all relevant permissions required to sell individual apartment

units, and efforts are being made to dispose of the assets ('condominium');

and properties which are being marketed for sale but have currently

not been notarised.

Properties notarised for sale by the reporting date are valued

at their disposal price (disposal scenario), and other properties

are valued using the condominium or rental scenarios (see note

12) as appropriate. The table below sets out the respective

categories:

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Condominium scenario 12,574 8,354 12,126

Disposal scenario 1,146 1,621 7,176

13,720 9,975 19,302

============ =============== ===========

Investment properties held for sale are all expected to be sold

within 12 months of the reporting date based on Management knowledge

of current and historic market conditions.

14. Other financial assets

at amortised cost

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Balance at beginning

of period/year - 1,590 1,590

Transfer from non-current other

financial assets at amortised

cost - - -

Accrued interest - 32 32

Interest adjustment

related to prior

period - - -

Loan repayment - - (1,622)

Balance at end of

period/year - 1,622 -

============ =============== ===========

The Group entered into loan agreements with Mike Hilton and

Paul Ruddle in connection with the acquisition of PSPF. The

loans were due to be settled upon settlement of the put option

for the minority interest in PSPF. The put option liability

for the minority and these offsetting loans were settled in

cash on the 1 July 2020.

Non-current

Balance at beginning

of period/year 901 876 876

Transfer to current other financial - - -

assets at amortised cost

Accrued interest 18 12 25

Balance at end of

period/year 919 888 901

============ =============== ===========

The Group entered into a loan agreement with the minority interest

of Accentro Real Estate AG in relation to the acquisition of

the assets as share deals. This loan bears interest at 3% per

annum.

These financial assets are considered to have low credit risk

and any loss allowance would be immaterial.

None of these financial assets were either past due or impaired.

15. Trade and other

receivables

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Current

Trade receivables 920 656 707

Less: impairment

provision (138) (215) (222)

------------ --------------- -----------

Net receivables 782 441 485

Prepayments and accrued

income 795 811 16

Investment property disposal

proceeds receivable 3,944 1,477 2,444

Service charges receivable 7,033 7,531 4,895

Prepaid treasury

shares - - 104

Other receivables 192 618 470

12,746 10,878 8,414

============ =============== ===========

Prepaid treasury shares consist of a transaction for the Company's

own shares which had yet to settle at 31 December 2020.

16. Borrowings

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Current liabilities

Bank loans - NATIXIS

Pfandbriefbank AG* 284 283 217

Bank loans - Berliner Sparkasse 801 1,103 801

--------------- -----------

1,085 1,386 1,018

Non-current

liabilities

Bank loans - NATIXIS Pfandbriefbank

AG** 236,201 207,009 236,789

Bank loans - Berliner Sparkasse 49,324 71,289 49,742

285,525 278,298 286,531

286,610 279,684 287,549

============ =============== ===========

Notes to the Condensed Consolidated

Financial Statements

For the period from 1 January

2021 to 30 June 2021

16. Borrowings

(continued)

* Nominal value of the borrowings as at 30 June 2021 was EUR977,000

(31 December 2020: EUR901,000, 30 June 2020: EUR917,000).

** Nominal value of the borrowings as at 30 June 2021 was EUR239,110,000

(31 December 2020: EUR240,000,000, 30 June 2020: EUR210,300,000).

For further information on borrowings, refer to the management

report.

17. Trade and other

payables

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Trade payables 1,155 443 1,410

Accrued liabilities 1,643 1,944 2,463

Service charges payable 7,750 7,597 5,145

10,548 9,984 9,018

============ =============== ===========

18. Derivative

financial

instruments

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Interest rate swaps - carried at fair value

through profit or loss

At beginning of

period/year 18,197 15,979 15,979

(Gain) / loss in movement in fair value

through profit or loss (3,643) 2,290 2,218

At end of period/year 14,554 18,269 18,197

============ =============== ===========

The notional principal amounts of the outstanding interest rate

swap contracts at 30 June 2021 were EUR204,269,000 (December

2020: EUR204,269,000, June 2020: EUR202,932,000). At 30 June

2021 the fixed interest rates vary from 0.24% to 1.01% (December

2020: 0.24% to 1.07%, June 2020: 0.24% to 1.07%) above the main

factoring Euribor rate.

Maturity analysis of interest rate swaps

30 June 30 June 31

2021 2020 December

2020

EUR'000 EUR'000 EUR'000

Less than 1 year - - -

Between 1 and 2 years - - -

Between 2 and 5 years - - -

More than 5 years 14,554 18,269 18,197

14,554 18,269 18,197

============ =============== ===========

19. Other financial

liabilities

30 June 30 June 31

2021 2020 December

2020

(unaudited) (unaudited) (audited)

EUR'000 EUR'000 EUR'000

Current

Balance at beginning

of period/year - 6,951 6,951

Transferred from - - -

non-current

liabilities

Profit share attributable to NCI in

PSPF - 569 -

Change in put option liability on settlement - - 591

Exercise put option - - (7,542)

Balance at end of

period/year - 7,520 -

============ =============== ===========

In March 2015 the Group entered into a five-year put option

agreement to acquire the remaining 5.2% interest in Phoenix

Spree Property Fund Ltd. & Co.KG (PSPF) from the limited partners

M Hilton and P Ruddle both then Directors of PMM Partners (UK)

Limited. The options were exercised three months after on the

fifth anniversary of the majority interest acquisition, on 1

July 2020. The option was settled for EUR7,542,000 and was settled

in cash for EUR5,920,000 net of initial loans to the limited

partners of EUR1,622,000. EUR7,542,000 being 5.2% of the net

asset value of PSPF at the time of settlement, as set out in

the original 2015 agreement.

A portion of the liability (EURnil, December 2020: (EUR1,070k),

June 2020: (EUR1,175k)) is recognised to cover the tax charge

of the minority in PSPF on the proceeds of put option when exercised.

20. Share based

payment

reserve

Performance

fee

EUR'000

Balance at 1 January

2020 6,808

Fee charge for the

period (1,923)

-----------

Balance at 30 June

2020 4,885

Fee charge for the

period 1,484

-----------

Balance at 31 December

2020 6,369

Settlement of

performance

fee in shares (6,369)

Fee charge for the -

period