BoJ Keeps Monetary Policy Steady; Cuts Inflation Outlook

22 Enero 2019 - 6:33PM

RTTF2

The Bank of Japan kept its monetary policy unchanged on

Wednesday, but downgraded the inflation forecasts, primarily driven

by a sharp fall in oil prices.

The Policy Board of the BoJ voted 7-2 to purchase government

bonds so that the yield of 10-year JGBs will remain at around zero

percent.

The board maintained interest rate at -0.1 percent on current

accounts that financial institutions maintain at the bank.

The central bank said it will conduct purchases of Japanese

government bonds in a flexible manner so that the outstanding

amount will increase at an annual pace of about JPY 80

trillion.

The bank asserted that it will maintain the current extremely

low interest rates for an extended period of time, reflecting the

uncertain economic outlook and prices, including the impact of the

consumption tax hike scheduled for October next year.

The BoJ said it will continue with "Quantitative and Qualitative

Monetary Easing with Yield Curve Control" policy, aimed to attain

the inflation goal of 2 percent, and to maintain that target in a

stable manner.

The bank reiterated that it will continue expanding the monetary

base until the year-on-year rate of increase in the observed

consumer price index, or CPI, exceeded 2 percent and stayed above

the target in a stable manner.

In its quarterly outlook report, the BoJ said "the momentum

toward achieving the price stability target of 2 percent is

maintained but is not yet sufficiently firm, and thus developments

in prices continue to warrant careful attention."

The BoJ noted that the Japanese economy was "expanding

moderately", with risks to economic activity and prices skewed to

the downside.

The central bank said the Japanese economy is projected to

continue its expanding trend through fiscal 2020.

Overseas economies would continue expansion as a whole, although

various developments of late, warrant attention such as the trade

friction between the United States and China.

The central bank revised down the real GDP growth outlook for

the fiscal year ending March this year to 0.9 from 1.4 percent.

The projection for the fiscal year ending March 2020 was revised

up to 0.9 percent from 0.8 percent and that for fiscal year ending

March 2021 was lifted to 1.0 percent from 0.8 percent.

But the bank downgraded the projection for both headline and

core inflation for the fiscal year ending March 2019 to 0.8 percent

from 0.9 percent.

The headline inflation forecast for the fiscal year ending March

2020 was trimmed to 1.1 percent from 1.6 percent, and the core

inflation outlook was slashed to 0.9 percent from 1.4 percent.

For the fiscal year ending March 2021, the headline inflation

projection was cut to 1.5 percent from 1.6 percent and the core

inflation forecast was trimmed to 1.4 percent from 1.5 percent.

The Bank of Japan is likely to keep its short-term policy rate

and 10-year yield target unchanged beyond next year, Marcel

Thieliant, an economist at Capital Economics, said.

The analyst believed that the BoJ's policy tightening remained a

very distant prospect given sharp downward revision to its

inflation forecasts for this year and next.

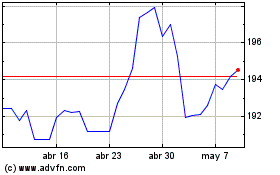

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024