ExxonMobil to Proceed with Liza Phase 2 Development Offshore Guyana

03 Mayo 2019 - 1:00PM

Business Wire

- Liza Phase 2 received government and

regulatory approvals and remains on track for mid-2022, producing

up to 220,000 barrels of oil per day

- Phase 1 on schedule for first oil by

first quarter of 2020

- Guyanese direct and indirect workforce

more than doubled in 2018 to more than 1,000

ExxonMobil said today it has funded the Liza Phase 2 development

offshore Guyana after it received government and regulatory

approvals. Liza Phase 2 will produce up to 220,000 barrels of oil

per day and further capitalize on the significant development

potential of the Stabroek Block, where ExxonMobil estimates

producing more than 750,000 barrels of oil per day by 2025.

A total of six drill centers are planned as well as

approximately 30 wells, including 15 production, nine water

injection and six gas injection wells. Phase 2 startup is expected

in mid-2022 and will develop approximately 600 million barrels of

oil. Liza Phase 2 is expected to cost $6 billion, including a lease

capitalization cost of approximately $1.6 billion, for the Liza

Unity floating production, storage and offloading (FPSO)

vessel.

“With the government of Guyana and our partners, ExxonMobil is

bringing industry-leading upstream capabilities to build upon Phase

1 and further develop the shared value of Guyana’s resources,” said

Liam Mallon, president of ExxonMobil Upstream Oil & Gas

Company. “We are actively pursuing significant development

potential from numerous discoveries in the Stabroek Block.”

Liza Phase 1 remains on track to achieve first oil by the first

quarter of 2020. It will produce up to 120,000 barrels of oil per

day at peak rates utilizing the Liza Destiny FPSO, which is

expected to arrive offshore Guyana in the third quarter of

2019.

Pending government and regulatory approvals, a final investment

decision is expected later this year for a third phase of

development, Payara, which is expected to produce between 180,000

and 220,000 barrels per day with startup as early as 2023.

ExxonMobil is evaluating additional development potential in other

areas of the Stabroek Block, including at the Turbot area and

Hammerhead.

By the end of 2019 ExxonMobil will have four drillships

operating offshore Guyana. Following well completion activities at

the recently announced Yellowtail discovery, the Noble Tom Madden

will move to the Hammerhead-2 well. The Stena Carron is completing

a well test at the Longtail-1 discovery, and will then move to the

Hammerhead-3 well.

Later in 2019, the Stena Carron will drill a second well at the

Ranger discovery. The Noble Bob Douglas drillship is completing

development drilling operations for Liza Phase 1. ExxonMobil will

add another exploration drillship, the Noble Don Taylor, in the

fourth quarter of 2019.

As the projects proceed, the partners’ investment in the

Guyanese economy continues to increase. The number of Guyanese

nationals supporting project activities more than doubled in 2018

to more than 1,000. ExxonMobil and its co-venturers spent nearly

$60 million with more than 500 Guyanese vendors in 2018. More than

1,500 Guyanese companies are registered with the Centre for Local

Business Development, which was founded by ExxonMobil and its

co-venturers in 2017 with the mission of supporting local

businesses to become globally competitive.

The Stabroek Block is 6.6 million acres, or 26,800 square

kilometers. Current discovered recoverable resources are estimated

at more than 5.5 billion barrels of oil equivalent. The 13

discoveries on the block to date have established the potential for

at least five FPSO vessels producing more than 750,000 barrels of

oil per day by 2025. ExxonMobil affiliate Esso Exploration and

Production Guyana Limited is operator and holds 45 percent interest

in the Stabroek Block. Hess Guyana Exploration Ltd. holds 30

percent interest and CNOOC Petroleum Guyana Limited, a wholly-owned

subsidiary of CNOOC Limited, holds 25 percent interest.

Cautionary Note:

Statements that reference future events or conditions in this

press release are forward-looking statements. Actual future

results, including project plans, costs, and schedules, production

rates, and resource recoveries may differ significantly from the

forecasts, depending on changes in long-term oil or gas prices and

other market or economic factors that affect the petroleum

industry; the timely completion of development programs and the

outcome of future exploration programs; reservoir performance;

unexpected technical difficulties or other technical or operating

factors; the actions of governmental authorities or regulatory

agencies, including obtaining necessary permits and approvals; the

outcome of commercial negotiations; and other factors listed under

the heading “Factors Affecting Future Results” on the Investor page

at the ExxonMobil website at www.exxonmobil.com and in Item 1A of

ExxonMobil’s most recent Form 10-K. References to recoverable

resources and other quantities of oil or gas in this release

include volumes that are not yet classified as proved reserves

under SEC definitions, but that are expected to be ultimately

recoverable. The term “project” in this release may refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

About ExxonMobil

ExxonMobil, the largest publicly traded international oil and

gas company, uses technology and innovation to help meet the

world’s growing energy needs. ExxonMobil holds an industry-leading

inventory of resources, is the largest refiner and marketer of

petroleum products, and its chemical company is one of the largest

in the world. Follow ExxonMobil on Twitter at

www.twitter.com/exxonmobil.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190503005254/en/

ExxonMobil Media Relations972-940-6007

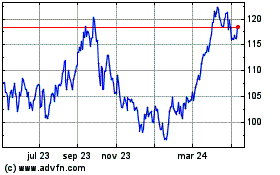

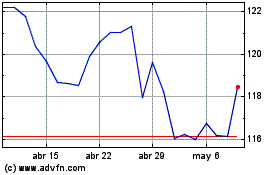

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024