UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

(Mark One)

þ

Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the fiscal year ended

December 31, 2018

OR

☐ Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934 (No Fee Required)

For the transition period from ___to ___

Commission file number 001-00035

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

THE

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

General Electric Company

44 Farnsworth Street

Boston, MA

THE

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Financial Statements and Supplemental Schedule

December 31, 2018

and

2017

(With Report of Independent Registered Public Accounting Firm Thereon)

THE

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

December 31, 2018

and

2017

Table of Contents

|

|

|

|

|

|

|

Page

Number(s)

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

3

|

|

|

|

|

Financial Statements:

|

|

|

Statements of Net Assets Available for Plan Benefits

as of December 31, 2018 and 2017

|

4

|

|

|

|

|

Statements of Changes in Net Assets Available for Plan Benefits

for the Years Ended December 31, 2018 and 2017

|

5

|

|

|

|

|

Notes to Financial Statements

|

6 - 13

|

|

|

|

|

Supplemental Schedule:

(i)

|

|

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

as of December 31, 2018

|

14

|

(i)

Schedules required by Form 5500 which are not applicable have not been included.

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

The

Middle River Aircraft Systems Hourly Savings Plan

:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of The

Middle River Aircraft Systems Hourly Savings Plan

(the "Plan") as of

December 31, 2018

and

2017

, the related statements of changes in net assets available for plan benefits for the years then ended, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of

December 31, 2018

and

2017

, and the changes in net assets available for plan benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm

registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of

December 31, 2018

, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s

financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information

is fairly stated, in all material respects, in relation to the

financial statements as a whole.

We have served as the Plan's auditor since 1998.

Albany, New York

June 26, 2019

THE

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Statements of Net Assets Available for Plan Benefits

December 31, 2018

and

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

Assets:

|

|

|

|

|

Investments at fair value (notes 3 and 4)

|

$

|

20,787,488

|

|

|

$

|

22,395,648

|

|

|

Notes receivable from participants

|

1,072,388

|

|

|

941,837

|

|

|

Accrued dividends and interest

|

5,973

|

|

|

22,938

|

|

|

|

|

|

|

|

Net assets available for plan benefits

|

$

|

21,865,849

|

|

|

$

|

23,360,423

|

|

See accompanying notes to financial statements.

THE

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Statements of Changes in Net Assets Available for Plan Benefits

Years Ended

December 31, 2018

and

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

Additions (reductions) to net assets attributed to:

|

|

|

|

|

Investment income:

|

|

|

|

|

Net depreciation in fair value of investments

|

$

|

(2,707,672

|

)

|

|

$

|

(601,147

|

)

|

|

Dividend and interest income

|

437,933

|

|

|

552,901

|

|

|

|

(2,269,739

|

)

|

|

(48,246

|

)

|

|

|

|

|

|

|

Interest on notes receivable from participants

|

46,109

|

|

|

39,425

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

Employee

|

1,960,770

|

|

|

1,457,045

|

|

|

Employer

|

748,786

|

|

|

478,364

|

|

|

|

2,709,556

|

|

|

1,935,409

|

|

|

|

|

|

|

|

Total additions

|

485,926

|

|

|

1,926,588

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

Benefits paid to participants

|

1,973,381

|

|

|

3,116,184

|

|

|

Expenses and loan fees

|

7,119

|

|

|

3,462

|

|

|

Total deductions

|

1,980,500

|

|

|

3,119,646

|

|

|

|

|

|

|

|

Net decrease

|

(1,494,574

|

)

|

|

(1,193,058

|

)

|

|

|

|

|

|

|

Net assets available for plan benefits at:

|

|

|

|

|

Beginning of year

|

23,360,423

|

|

|

24,553,481

|

|

|

End of year

|

$

|

21,865,849

|

|

|

$

|

23,360,423

|

|

See accompanying notes to financial statements.

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

|

|

|

|

(1)

|

Description of the Plan

|

The

Middle River Aircraft Systems Hourly Savings Plan

(the “Plan”) is a defined contribution plan sponsored by MRA Systems, LLC (the “Company”), formerly MRA Systems, Inc., an affiliate of General Electric Company (“GE”). The Plan is for employees covered by collective bargaining agreements after completing thirty days of service (“participant”)

.

The Plan is subject to applicable provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Ascensus Trust Company (the “Trustee”) is the Plan’s custodian and trustee, and Mid-Atlantic Trust Company is the sub-custodian with respect to the GE Common Stock Fund. Ascensus, Inc. (“Ascensus”) is the recordkeeper for the Plan.

Effective January 1, 2017, the Plan was amended to reduce the waiting period to become eligible from 90 days to 30 days. In addition, new hires are automatically enrolled once the 30 day period has been satisfied.

The following description of the Plan is provided for general information purposes only. The complete terms of the Plan are provided in The Middle River Aircraft Systems Hourly Savings Plan Document. Information concerning the Plan, including benefits and vesting provisions, is also included in the Summary Plan Description (“SPD”) and other material distributed to participants.

Employee Contributions and Investment Options

Participants are permitted to allocate their account balances in increments of 1% to one or more of the following investment options:

|

|

|

|

(a)

|

GE Common Stock Fund

- This fund is invested primarily in GE common stock, with the remainder held in cash or cash equivalents to provide for the GE Common Stock Fund’s estimated liquidity needs.

|

|

|

|

|

(b)

|

State Street Institutional Income Fund - This fund managed by State Street Global Advisors ("SSGA") seeks a high interest rate of return over a long-term period consistent with the preservation of capital by investing at least 80% of its net assets in debt securities.

|

|

|

|

|

(c)

|

State Street Institutional U.S. Equity Fund

- This fund managed by SSGA seeks long-term growth of capital and income by investing at least 80% of its net assets in equity securities of U.S. companies, such as common and preferred stocks.

|

|

|

|

|

(d)

|

State Street Institutional Strategic Investment Fund - This fund managed by SSGA seeks maximum total return (total return includes both income and capital appreciation) by investing primarily in a combination of U.S. and Non-U.S. equity and debt securities and cash. This fund was liquidated and eliminated as an investment option effective November 20, 2017.

|

|

|

|

|

(e)

|

Harbor International Fund - This fund invests primarily in common and preferred stocks of foreign large cap companies, including those located in countries with emerging markets.

|

|

|

|

|

(f)

|

American Funds Growth Fund of America - This fund seeks growth of capital by investing in companies with a history of rapidly growing earnings and generally higher price-to-earnings ratios.

|

|

|

|

|

(g)

|

American Funds New Perspective Fund - This fund seeks long-term growth of capital and future income as its secondary objective. The fund normally invests in stocks of companies located around the world to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships.

|

|

|

|

|

(h)

|

Vanguard Institutional Index Fund - This fund seeks to track the performance of the S&P 500 Index (the “Index”). The fund invests primarily in stocks in the Index in proportion to their weightings in the Index.

|

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

|

|

|

|

(i)

|

Vanguard Target Retirement Funds - The Vanguard Target Retirement Funds are a series of registered investment companies (“mutual funds”) that separately invest in up to five other Vanguard mutual funds. Because they invest in other mutual funds, rather than individual securities, each fund is considered a “fund of funds”. The suite of Target Retirement Funds include the following:

|

Vanguard Target Retirement Income Fund

Vanguard Target Retirement 2015 Fund

Vanguard Target Retirement 2020 Fund

Vanguard Target Retirement 2025 Fund

Vanguard Target Retirement 2030 Fund

Vanguard Target Retirement 2035 Fund

Vanguard Target Retirement 2040 Fund

Vanguard Target Retirement 2045 Fund

Vanguard Target Retirement 2050 Fund

Vanguard Target Retirement 2055 Fund

Vanguard Target Retirement 2060 Fund

Vanguard Target Retirement 2065 Fund

The Vanguard Target Retirement Income Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors currently in retirement. The other Vanguard Target Retirement Funds invest in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of the target year. These funds’ asset allocations will become more conservative over time as the target retirement date draws closer.

|

|

|

|

(j)

|

Stephens Mid Cap Growth Fund - This fund seeks long-term growth of capital. The fund invests at least 80% of its net assets primarily in common stock of U.S. companies with medium market capitalizations.

|

|

|

|

|

(k)

|

Vanguard Total Bond Market Index Admiral Fund - This fund seeks to track the performance of a benchmark index by investing in a wide spectrum of public, investment-grade, taxable fixed income securities in the United States. At least 80% of the fund’s assets will be invested in bonds held by the benchmark index.

|

|

|

|

|

(l)

|

Vanguard Extended Market Index Admiral Fund - This fund seeks to track the performance of a benchmark index that measures the investment return of small- and mid-capitalization stocks.

|

|

|

|

|

(m)

|

Vanguard Total International Stock Index Admiral Fund - This fund seeks to track the performance of a benchmark index by investing in stocks issued by companies located in developed and emerging markets, excluding the United States. The benchmark index includes approximately 5,500 stocks located in 46 countries.

|

|

|

|

|

(n)

|

Galliard Capital Management Stable Value Fund - This stable value fund’s primary objective is to preserve principal while achieving a rate of return competitive with rates earned over an extended period of time by comparable fixed income investment products. This fund invests primarily in pooled investment contracts with short-term maturities. This fund was an investment option through June 26, 2017.

|

|

|

|

|

(o)

|

Wells Fargo Stable Value Fund - This stable value fund’s primary objective is to preserve principal and provide the potential to achieve returns higher than other conservative investments. This fund invests primarily in instruments issued by highly rated financial institutions, such as guaranteed investment contracts, bank investment contracts, and security-backed investment contracts. This fund became an investment option on June 26, 2017.

|

Audited financial statements and prospectuses or other disclosure documents of the registered investment companies (“mutual funds”) are made available to participants.

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

Participants may elect to defer up to 17% of their eligible compensation on a pre-tax or after-tax basis, subject to limitations imposed by law. Participants may also contribute amounts as “rollover” provisions representing distributions from other qualified defined benefit or defined contribution plans of a former employer.

The United States Internal Revenue Code (“IRC”) limits the amount of pre-tax contributions that can be made each year. The limit for participants under age 50 was generally $18,500 and $18,000 in

2018

and

2017

, respectively. For participants who were at least age 50 during the year, the limit was generally $24,500 and $24,000 in

2018

and

2017

, respectively.

Employer Contributions

The Plan generally provides for employer matching contributions in an amount equal to 50% of participant contributions for eligible employees of up to 6% of their eligible compensation. Effective January 1, 2013, the Plan was amended to give certain eligible employees hired or rehired on or after January 1, 2013 a Company Retirement Contribution (“CRC”), equal to 3% of eligible compensation. In addition, for certain eligible employees hired or rehired on or after January 1, 2013, the Plan was amended to provide employer matching contributions of 50% of participant contributions up to 8% of eligible compensation.

Vesting

Participants are immediately fully vested in their employee contributions, any employer matching contributions and related investment results. Participants receiving CRCs and related earnings become 100% vested in the contributions when they reach age 65 while employed with the Company or after reaching 3 years of eligible service.

Participant Accounts

Each participant’s account is credited with the participant’s contributions and CRCs (as applicable) and allocation of (a) employer matching contributions and (b) investment results. The benefit to which a participant is entitled is the value of the participant’s vested account.

Notes Receivable from Participants

The Plan permits participants, under certain circumstances, to borrow a minimum of $500 from their participant accounts (except with respect to amounts attributable to any CRCs, which are not available for loans). Subject to certain IRC and Plan limits, a participant may not borrow more than the lesser of $50,000 minus the highest outstanding balance of loans from any plan sponsored by the Company, GE or any of its affiliates during the past 12 months or 50% of their vested account balance. There is a $50 charge for each loan.

The term of any loan is up to 4.5 years from the effective date of the loan unless the loan is used to acquire a principal residence for which a term of up to 15 years may be permissible. Loans are secured by the remaining balance in the participant’s account. The interest rate applicable to participant notes receivable is 1% above the prime interest rate in effect as of the last business day before the loan is requested. Loans are repaid with interest in equal payments over the term of the loan by payroll deductions, personal check or other methods as may be required. Participants may repay the principal amount with written notice and without penalty.

In the event of a loan default, the amount of the outstanding balance will be reported to the Internal Revenue Service in the year of default as ordinary income.

Payment of Benefits

Participants’ withdrawals are permitted under the plan subject to certain restrictions. Participants are allowed to withdraw all or a portion of their after-tax contributions, including earnings thereon. Generally, before-tax contributions and rollovers may not be withdrawn while employed by the Company prior to age 59½. Employer matching contributions and CRCs may not be withdrawn while a participant is employed by the Company prior to age 70½. In the case of a hardship, a participant may elect to withdraw, as applicable, all or a portion of pre-tax contributions, excluding earnings thereon, and after-tax contributions and rollover contributions, including earnings thereon. In order to make a hardship withdrawal, a

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

participant must first withdraw the maximum after-tax contributions and nontaxable loans. A participant who makes a hardship withdrawal will be suspended from making contributions to the Plan for six months after the hardship distribution.

On termination of employment, a participant may elect to receive either a lump-sum amount equal to the value of the participant’s vested interest in his or her account, installment payments, or a direct rollover.

Plan Termination and Amendment

Although the Company has not expressed any intent to do so, it has the right under the Plan, to the extent permitted by law, to discontinue its contributions and to terminate the Plan in accordance with the provisions of ERISA. If the Plan is terminated, each participant’s interest will be payable in full according to Plan provisions. The Company also has the right under the Plan, to the extent permitted by law, to amend or replace the Plan for any reason.

Administrative and Investment Advisory Costs

Expenses related to the administration of the Plan, including recordkeeping expenses and Trustee’s fees, are liabilities of the Plan. However, the Company may choose to pay these expenses (see note 2(f)). For the registered investment companies, investment advisors are reimbursed for costs incurred or receive a management fee for providing investment advisory services. These reimbursed costs and management fees are reflected in the net appreciation (depreciation) in the fair value of investments on the statement of changes in net assets available for plan benefits.

(2)

Summary of Significant Accounting Policies

The accompanying financial statements of the Plan have been prepared on the accrual basis of accounting.

Plan investments are reported at fair value. See notes 3 and 4 for additional information.

Investment transactions are recorded on a trade date basis. Dividends are recorded on the ex-dividend date. Interest income is recorded on the accrual basis. The net appreciation (depreciation) in the fair value of investments consists of the realized gains or losses on the sales of investments and the net unrealized appreciation (depreciation) of investments. Earnings from the stable value fund are reinvested in the fund and reflected in dividends and interest.

|

|

|

|

(c)

|

Fair Value Measurements

|

For financial assets and liabilities, fair value is the price the Plan would receive to sell an asset or pay to transfer a liability in an orderly transaction with a market participant at the measurement date. In the absence of active markets for the identical assets and liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1 - Quoted prices for identical investments in active markets.

Level 2 - Quoted prices for similar investments in active markets; quoted prices for identical or similar investments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 - Significant inputs to the valuation model are unobservable.

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

When available, quoted market prices are used to determine the fair value of investment securities, and they are included in Level 1. Level 1 securities include common stock, registered investment companies and interest-bearing cash.

See note 4 for additional information.

|

|

|

|

(d)

|

Notes Receivable from Participants

|

Loans to participants are recorded at the outstanding principal balance plus accrued interest.

Benefit payments are recorded when paid to participants.

Substantially all expenses related to administration of the Plan are paid by the Company or out of the Plan’s forfeiture account at the discretion of the Plan sponsor, with the exception of the Plan’s loan expenses, which are paid by the Plan’s Trustee out of the respective participant’s investment fund’s assets.

|

|

|

|

(g)

|

Management Estimates and Assumptions

|

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management of the Plan to make estimates and assumptions that affect the reported amount of assets, liabilities and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

The Plan’s investments at

December 31, 2018

and

2017

follow.

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

1,248,921

|

|

|

$

|

2,834,543

|

|

|

Registered investment companies

|

13,252,095

|

|

|

13,335,836

|

|

|

Interest-bearing cash

|

93,494

|

|

|

120,349

|

|

|

Stable value fund

|

6,192,978

|

|

|

6,104,920

|

|

|

Total investments

|

$

|

20,787,488

|

|

|

$

|

22,395,648

|

|

The Plan holds investments in a stable value fund, which consists primarily of guaranteed investment contracts, bank investment contracts and security-backed investment contracts. These contracts are investment contracts issued by insurance companies or other financial institutions, backed by a portfolio of bonds. The stable value fund may also invest in collective trust funds with investment objectives that are consistent with its’ investment strategy. In addition, the stable value fund may hold a position in a daily short-term investment fund.

All investment contracts held by the stable value fund are fully benefit responsive, which means that withdrawals from these investment contracts are required to be made at contract value for qualifying benefit payments, including participant-directed transfers.

Investment contracts are carried at contract value in the aggregate, which consists of the fair value of the underlying portfolio, accrued interest on the underlying portfolio assets, the fair value of the contract, and adjustment to contract value.

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

The investment contracts cannot credit an interest rate that is less than zero percent. Typically, these rates are reset quarterly, but may be reset more or less frequently.

The net value of the stable value fund is calculated daily and net investment income and realized and unrealized gains on investments are not distributed but rather reinvested and reflected in the net asset of the stable value fund. Units of the fund are issued and redeemed at the current net asset value.

|

|

|

|

(4)

|

Fair Value Measurements

|

The Plan’s investments measured at fair value on a recurring basis at

December 31, 2018

follow.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

1,248,921

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,248,921

|

|

|

Registered investment companies

|

13,252,095

|

|

|

—

|

|

|

—

|

|

|

13,252,095

|

|

|

Interest-bearing cash

|

93,494

|

|

|

—

|

|

|

—

|

|

|

93,494

|

|

|

|

$

|

14,594,510

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

14,594,510

|

|

|

Stable value fund

(a)

|

|

|

|

|

|

|

|

6,192,978

|

|

|

Total investments

|

|

|

|

|

|

|

$

|

20,787,488

|

|

|

|

|

The Plan’s investments measured at fair value on a recurring basis at December 31, 2017 follow.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

$

|

2,834,543

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

2,834,543

|

|

|

Registered investment companies

|

13,335,836

|

|

|

—

|

|

|

—

|

|

|

13,335,836

|

|

|

Interest-bearing cash

|

120,349

|

|

|

—

|

|

|

—

|

|

|

120,349

|

|

|

|

$

|

16,290,728

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

16,290,728

|

|

|

Stable value fund

(a)

|

|

|

|

|

|

|

|

6,104,920

|

|

|

Total investments

|

|

|

|

|

|

|

$

|

22,395,648

|

|

|

|

|

|

(a)

|

The stable value fund is measured at fair value using the net asset value per share (or its equivalent) as a practical expedient and is not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statements of net assets available for plan benefits.

|

Transfers in and out of levels are considered to occur at the beginning of the period. There were no transfers during

2018

or

2017

.

The following table summarizes the investments for which fair value is measured using the net asset value per share practical expedient as of December 31,

2018

and

2017

. There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption

|

|

Redemption

|

|

|

|

2018

|

|

|

2017

|

|

Frequency

|

|

Notice period

|

|

|

|

|

|

|

|

|

|

|

|

Stable value fund

|

$

|

6,192,978

|

|

|

$

|

6,104,920

|

|

|

|

Daily

|

|

|

12 months

|

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

(5)

Risk and Uncertainties

The Plan offers a number of investment options including the GE Common Stock Fund and a variety of investment funds, consisting of registered investment companies and a stable value fund. The registered investment companies invest in U.S. equities, international equities and fixed income securities. Investment securities in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur (including in the near term) and that such changes could materially affect participant account balances and amounts reported in the statements of net assets available for plan benefits.

The Plan’s exposure to a concentration of credit risk is limited by the opportunity to diversify investments across multiple participant-directed fund elections. Additionally, the investments within each participant-directed fund election are further diversified into varied financial instruments, with the exception of the GE Common Stock Fund, which primarily invests in a single security.

(6)

Related Party Transactions (Parties in Interest)

Certain fees paid to related parties for services to the Plan were paid by the Plan. Registered investment company and stable value fund operating expenses reduce the respective fund’s assets and are reflected in the fund’s share/unit price and dividends.

In addition to the recordkeepers, trustees and custodians of the Plan, which are mentioned in note 1, KPMG LLP, the auditor of the Plan’s financial statements

,

is also a party in interest as defined by ERISA.

(7)

Tax Status

The Internal Revenue Service has notified the Company by a letter dated September 30, 2013, that the Plan is qualified under the appropriate sections of the IRC and that the related trust is tax-exempt. Although the Plan has been amended since receiving the determination letter, the Plan administrator and the Plan’s counsel believe that the Plan’s current design and operations comply in all material respects with the applicable requirements of the IRC, and that the letter remains valid.

The portion of a participant’s compensation contributed to the Plan as a pre-tax contribution and the Company’s matching contribution are not subject to Federal income tax when such contributions are credited to participant accounts, subject to certain limitations. These amounts and any investment earnings may be included in the participant’s gross taxable income for the year in which such amounts are withdrawn from the Plan.

U.S. generally accepted accounting principles require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) of the Plan if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. For the years ended December 31,

2018

and

2017

, the Plan has not recognized a tax liability (or asset) related to uncertain tax positions.

The Plan is subject to routine audits by taxing jurisdictions, however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to 2015

.

(8)

Subsequent Events

Subsequent events after the statement of net assets available for plan benefits date through

June 26, 2019

, the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

On April 17, 2019, Singapore Technologies Engineering Ltd through its wholly-owned U.S. subsidiary, Vision Technologies Aerospace Incorporated, purchased MRA Systems, LLC. The investment objectives and policies of the funds will not change as a result of this transaction.

THE MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Notes to Financial Statements

December 31, 2018 and 2017

(9)

Reconciliation of Financial Statements to Form 5500

Notes receivable from participants are classified as investments per Form 5500 instructions. In addition, any deemed distributions are not considered to be plan assets per Form 5500 and are excluded from notes receivable from participants. However, these distributions remain a plan asset for purposes of these financial statements until a distributable event occurs and they are offset against plan assets.

A reconciliation of investments per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

|

|

Total investments at fair value per financial statements

|

$

|

20,787,488

|

|

|

$

|

22,395,648

|

|

|

|

|

|

|

|

Total notes receivable per financial statements

|

1,072,388

|

|

|

941,837

|

|

|

Deemed distributions

|

(3,119

|

)

|

|

(3,119

|

)

|

|

Total notes receivable per Form 5500

|

1,069,269

|

|

|

938,718

|

|

|

|

|

|

|

|

Total investments per Form 5500

|

$

|

21,856,757

|

|

|

$

|

23,334,366

|

|

A reconciliation of deductions from net assets per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

|

|

Total deductions from net assets per financial statements

|

$

|

1,980,500

|

|

|

$

|

3,119,646

|

|

|

Changes in deemed distributions

|

—

|

|

|

(304

|

)

|

|

Total expenses per Form 5500

|

$

|

1,980,500

|

|

|

$

|

3,119,342

|

|

A reconciliation of amounts per the financial statements to the annual report filed on Form 5500, Schedule H as required by the Department of Labor follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

Net assets available for plan benefits per financial statements

|

$

|

21,865,849

|

|

|

$

|

23,360,423

|

|

|

Deemed distributions

|

(3,119

|

)

|

|

(3,119

|

)

|

|

Net assets available for plan benefits per Form 5500

|

$

|

21,862,730

|

|

|

$

|

23,357,304

|

|

|

|

|

|

|

|

Total net decrease per financial statements

|

$

|

(1,494,574

|

)

|

|

$

|

(1,193,058

|

)

|

|

Changes in deemed distributions

|

—

|

|

|

304

|

|

|

Total net loss per Form 5500

|

$

|

(1,494,574

|

)

|

|

$

|

(1,192,754

|

)

|

MIDDLE RIVER AIRCRAFT SYSTEMS HOURLY SAVINGS PLAN

Schedule H, Line 4i-Schedule of Assets (Held at End of Year)

As of December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of issue, borrower, lessor, or similar party

|

|

(c) Description of investment including maturity date, rate of interest, collateral, par or maturity value

|

|

(d) Current value**

|

|

|

|

|

|

|

|

|

|

*

|

|

GE Common Stock

|

|

Common stock, 164,983 shares

|

|

$

|

1,248,921

|

|

|

|

|

State Street Institutional Income Fund

|

|

Registered investment company, 102,106 shares

|

|

|

928,148

|

|

|

|

|

State Street Institutional U.S. Equity Fund

|

|

Registered investment company, 66,408 shares

|

|

|

679,352

|

|

|

|

|

Harbor International Fund

|

|

Registered investment company, 27,194 shares

|

|

|

917,252

|

|

|

|

|

American Funds Growth Fund of America

|

|

Registered investment company, 25,968 shares

|

|

|

1,110,118

|

|

|

|

|

American Funds New Perspective Fund

|

|

Registered investment company, 7,112 shares

|

|

|

267,834

|

|

|

|

|

Vanguard Institutional Index Fund

|

|

Registered investment company, 19,835 shares

|

|

|

4,513,555

|

|

|

|

|

Vanguard Target Retirement Income Fund

|

|

Registered investment company, 1,332 shares

|

|

|

16,986

|

|

|

|

|

Vanguard Target Retirement 2015 Fund

|

|

Registered investment company, 12,796 shares

|

|

|

177,348

|

|

|

|

|

Vanguard Target Retirement 2020 Fund

|

|

Registered investment company, 29,339 shares

|

|

|

839,962

|

|

|

|

|

Vanguard Target Retirement 2025 Fund

|

|

Registered investment company, 56,833 shares

|

|

|

966,733

|

|

|

|

|

Vanguard Target Retirement 2030 Fund

|

|

Registered investment company, 14,157 shares

|

|

|

436,328

|

|

|

|

|

Vanguard Target Retirement 2035 Fund

|

|

Registered investment company, 11,404 shares

|

|

|

214,624

|

|

|

|

|

Vanguard Target Retirement 2040 Fund

|

|

Registered investment company, 2,234 shares

|

|

|

72,178

|

|

|

|

|

Vanguard Target Retirement 2045 Fund

|

|

Registered investment company, 9,758 shares

|

|

|

197,203

|

|

|

|

|

Vanguard Target Retirement 2050 Fund

|

|

Registered investment company, 8,708 shares

|

|

|

283,173

|

|

|

|

|

Vanguard Target Retirement 2055 Fund

|

|

Registered investment company, 4,585 shares

|

|

|

161,852

|

|

|

|

|

Vanguard Target Retirement 2060 Fund

|

|

Registered investment company, 3,866 shares

|

|

|

120,508

|

|

|

|

|

Vanguard Target Retirement 2065 Fund

|

|

Registered investment company, 1,188 shares

|

|

|

23,292

|

|

|

|

|

Stephens Mid Cap Growth Fund

|

|

Registered investment company, 53,203 shares

|

|

|

1,129,496

|

|

|

|

|

Vanguard Total Bond Market Index Admiral Fund

|

|

Registered investment company, 1,746 shares

|

|

|

18,245

|

|

|

|

|

Vanguard Extended Market Index Admiral Fund

|

|

Registered investment company, 1,764 shares

|

|

|

133,529

|

|

|

|

|

Vanguard Total International Stock Index Admiral Fund

|

|

Registered investment company, 1,749 shares

|

|

|

44,379

|

|

|

*

|

|

Mid-Atlantic Capital Group

|

|

Interest-bearing cash

|

|

|

93,494

|

|

|

|

|

Wells Fargo Stable Value Fund

|

|

Stable value fund, 115,762 shares

|

|

|

6,192,978

|

|

|

|

|

Total investments

|

|

|

|

|

20,787,488

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Notes receivable from participants (154 loans with interest rates

|

|

|

|

|

|

|

from 4.25% to 6.50% from 1 month to 15 years)

|

|

|

1,069,269

|

|

|

|

|

Total Assets (Held at End of Year)

|

|

|

|

$

|

21,856,757

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Party in interest as defined by ERISA.

|

|

|

|

|

|

|

**

|

|

Cost omitted for participant directed investments.

|

|

|

|

|

|

See accompanying Report of Independent Registered Public Accounting Firm.

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

The Middle River Aircraft Systems Hourly Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

June 26, 2019

|

|

/s/ Carol Price

|

|

|

Date

|

|

Carol Price

Lead Benefit Specialist

GE Aviation

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description of the Exhibit

|

|

|

|

|

|

|

|

Consent of Independent Registered Public Accounting Firm

|

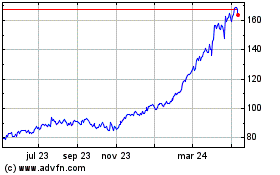

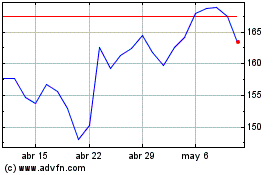

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024