By Greg Ip

Steep taxes on the ultra-wealthy are, for some, not a means to

an end but an end itself. They see the very existence of extreme

wealth as inimical to economic growth, middle-class prosperity and

democracy. "Every billionaire is a policy failure," goes one

progressive meme.

Sen. Elizabeth Warren doesn't go that far. Yet her tax plans are

in the same spirit. Her wealth tax of up to 6% a year, coupled with

several other levies, would serve to shrink the fortunes of many

billionaires and multimillionaires. It would disincentivize the

accumulation of fortunes above $1 billion much as a cigarette tax

discourages smoking. (They are called "Pigovian" taxes, after the

economist Arthur Pigou, who proposed using taxes to discourage

undesirable behavior.)

Ms. Warren and her supporters are all for Jeff Bezos, Bill Gates

and Larry Ellison creating successful companies such Amazon.com

Inc., Microsoft Corp. and Oracle Corp. But they claim these men's

fortunes are far larger than needed to spur innovation and business

excellence and have simply become a source of entrenched privilege.

A wealth tax, they argue, would repurpose the money to more

socially beneficial purposes such as universal health care and

eliminating student debt.

Virtually all Democrats want to raise billionaires' taxes, and

it isn't hard to see why. The ultra-rich already control

near-record shares of the country's wealth and income yet have had

their taxes slashed, directly and indirectly, by President Trump,

driving the budget deficit sharply higher.

But should they be taxed to the point that they are no longer

billionaires? That's a tougher case to make. In a 2016 book,

economist Caroline Freund, now global director of trade at the

World Bank, found that countries with a lot of billionaires per

capita had higher incomes per capita. She also found a country's

share of the world's billionaires, as compiled by Forbes,

corresponded closely to its share of the world's largest, most

successful companies. While this doesn't mean billionaires make an

economy successful, it does show the two go hand in hand.

How a billionaire earns his or her fortune matters, of course.

Some are "rent seekers," meaning they skim off the productive

efforts of others via corruption, royal prerogative or control of

some valuable market or resource. That's why Russia is an outlier

in Ms. Freund's research: lots of oligarchs, with not much economic

benefit to show for it.

That, however, is rare in Western democracies, where the more

important distinctions are between inherited and earned wealth. Ms.

Freund says countries with less self-made and more inherited wealth

do seem to grow more slowly, although the ranks of hereditary

billionaires are shrinking while those of self-made billionaires

are growing.

There is little economic benefit to the unlimited tax-free

growth of inherited wealth. Democrats, and a few Republicans, have

proposed personal, capital gains and estate tax changes to counter

it.

By contrast a wealth tax, also embraced by presidential

candidates Sen. Bernie Sanders (up to 8%) and billionaire Tom

Steyer (1%), makes no distinction between when or how the wealth

was acquired. It would hit not only Walmart Inc. founder Sam

Walton's children, but also future Sam Waltons; not just Bezos

today, but Bezos when he became a billionaire in 1998 and Amazon

sold just books and music.

No one knows exactly how billionaires would respond, but it

seems certain they would, somehow. A recent study by Enrico

Moretti, an economist at University of California, Berkeley and

Daniel Wilson at the Federal Reserve Bank of San Francisco notes

that billionaires were once largely insulated from state-level

estate taxes by a federal credit. After the credit was eliminated

in 2001, the number of billionaires in states with estate taxes

fell 35% relative to stateswithout. Whether the wealth was

inherited or self-made didn't seem to matter. In another study, the

authors found that star scientists -- the kind that power

technology or biotech companies -- tend to leave states with

relatively higher personal or corporate income taxes.

Gabriel Zucman, an economist at the University of California,

Berkeley said unlike a state tax, American billionaires couldn't

avoid Ms. Warren's wealth tax, which he helped design, by moving,

even abroad. And he said the tax wouldn't deter entrepreneurs from

taking risks and building companies, because they are not mainly

motivated by money and taxes. Mr. Gates founded Microsoft, he

noted, when corporate, personal and estate taxes were far higher

than today. Nor would a 6% wealth tax matter much to someone like

Facebook Inc. founder Mark Zuckerberg, whose wealth has grown 40% a

year since 2008, he added. A wealth tax, he said, would mean the

Forbes 400 would have more self-made billionaires like Mr.

Zuckerberg and fewer hereditary billionaires.

But Mr. Zuckerberg is exceptional. For many billionaires, Ms.

Warren's taxes could easily eat up most if not all his or her

returns. Founders would have to steadily sell off their holdings to

pay their taxes, shrinking their stake. "To say you can't have that

wealth means you can't own your company," Ms. Freund said.

That's a problem, she said: The founder is often a more

successful and committed chief executive than an outsider. "They

really, really care and need to have controlling interest to make

decisions," she said. Indeed, many billionaires use the wealth from

one venture to start another: After selling Electronic Data Systems

to General Motors, Ross Perot later used the proceeds to start

Perot Systems. Mr. Bezos is selling Amazon shares to finance Blue

Origin, his space company.

This isn't a reason not to tax billionaires; it's a reason to be

careful about how it's done.

Write to Greg Ip at greg.ip@wsj.com

(END) Dow Jones Newswires

November 20, 2019 11:40 ET (16:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

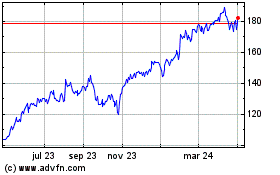

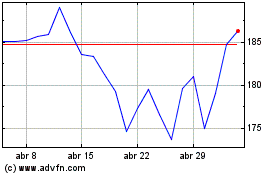

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024