FirstGroup PLC Business and liquidity update

24 Abril 2020 - 1:00AM

UK Regulatory

TIDMFGP

FIRSTGROUP PLC

BUSINESS AND LIQUIDITY UPDATE

Further to the announcements made on 23 March and 3 April 2020, FirstGroup plc

('FirstGroup' or the 'Group') today provides further updates on its response to

the COVID-19 ('coronavirus') pandemic.

* Liquidity further enhanced through GBP300m issuance under UK government's

Covid Corporate Financing Facility ('CCFF') scheme; committed headroom and

free cash increases to c.GBP800m

* Greyhound uniquely positioned to access a significant share of the $326m in

CARES Act funding allocated to US states in support of intercity bus

services

* North American contract businesses making continued progress in agreeing

revenue recovery; ongoing UK government support for critical bus and rail

transportation services

* Further cost control measures embedded across the Group; Executive

Directors and Board have volunteered a 20% reduction in salaries and fees,

with salary reductions and deferrals across wider senior management

* Triennial valuations agreed with trustees of First Bus pension schemes,

with lower overall deficit payments for year to 31 March 2021

* The Group's full year results reporting calendar will be extended in

recognition of present challenges in producing audited accounts, consistent

with recent statements from UK regulators

Our people

We are deeply saddened to report that we have now seen colleagues from within

each of our five divisions across North America and the UK tragically lose

their lives as a result of the coronavirus outbreak. We offer our heartfelt

condolences and support to their families, friends and co-workers and we keep

in our thoughts all those affected by this global health crisis. The Group's

first priority is to safeguard the health and wellbeing of our employees and

our customers, and across our businesses we are following the guidance of

governments and health authorities.

Supporting our communities

The Group's operations are part of the critical infrastructure providing

essential transportation services, which enable key workers to travel to their

destinations and perform their vitally important roles. We are extremely proud

of our people who are playing such an important part in delivering these

much-needed services.

In addition, many of our colleagues and teams are also providing support and

assistance right at the heart of their communities during this challenging

time. We are grateful for and inspired by their actions, including the many

drivers at First Student and First Transit in North America who are delivering

food supplies to vulnerable members of the community as well as curriculum

support materials to school children. Greyhound is supporting first responder

and frontline medical professional volunteers by providing free transport to

those travelling to another town or city to provide assistance during the

outbreak. Greyhound are also delivering vital medical supplies and safety

equipment in partnership with the American Red Cross. In the UK we are making

space available at our bus terminals and railway stations for community

initiatives such as key worker food collection points or mobile blood donation

banks. In First Rail, we were pleased the Rail to Refuge scheme with Women's

Aid went nationwide in April, following the successful trial in GWR. Where we

have a catering offer, our rail companies have been donating food from on-board

shops to NHS teams and charities. Finally, the Group is proud to team up with

Action for Children in the UK, our charity of choice partner, to support some

of the most vulnerable children and families in the UK. We are particularly

pleased to support their Coronavirus Emergency appeal through the deployment of

the matched funding proceeds raised from our partnership in the last year to

this important fund.

Update on liquidity including CCFF draw down

As anticipated in our update on 23 March 2020, the Group has been confirmed as

an eligible issuer for the UK Government's CCFF scheme, with an issuer limit of

GBP300m based on its credit ratings under the terms of the scheme as published by

the Bank of England. Yesterday we requested a GBP300m issuance of commercial

paper through the scheme to further enhance our robust level of liquidity.

As at 21 April 2020 (i.e. prior to the drawings made under the CCFF facility

announced today), the Group's undrawn committed headroom and free cash had

increased to c.GBP 500m. This comprised GBP190m in free cash and GBP310m of undrawn

committed bank revolving credit facilities and represents an improvement of c.GBP

100m compared with the position at the end of February 2020. Therefore, with

the drawings under the CCFF facility announced today, the Group has undrawn

committed headroom and free cash of c.GBP800m.

The Group's committed bank facilities include the GBP800m revolving credit

facility which matures in November 2023 and a GBP250m bank bridge facility for

the refinancing of the April 2021 bond. The Group's free cash is in addition to

the ring-fenced cash inside our rail franchise operations. In addition to

vehicle leasing facilities, the Group also has access to a GBP150m accordion

feature on the bank revolving credit facility and available supplier financing

arrangements of more than $100m.

On 1 April 2020 Fitch Ratings maintained its long-term Issuer Default Rating

(IDR) at BBB- whilst revising the outlook to negative from stable.

Update on operations in North America

Throughout the business we continue to operate our services at levels required

to support critical transportation activities. As a leader in transportation

services, we have continued to reinforce the importance of maintaining the

appropriate level of operational capability both during the current situation

and as economies begin to reopen. In this area we have been very actively

engaged with our customers, both directly and through industry bodies, and

across all levels of government in North America. The US federal stimulus

package ('CARES Act') signed into law on 27 March 2020 provides substantial

funding to the states, municipal and local authorities including school boards

in support of critical transportation and educational services.

In particular, the CARES Act specifically allocates $326m in emergency funds to

US states to support continued intercity bus transportation on a cost per mile

basis via Title 49 section 5311(f) of the US Code. Given the unique nature of

its scale as the only provider of a national network of coach services across

44 US states, Greyhound is expected to be a major recipient of this funding.

Greyhound's revenues have fallen by c.80% since the start of the coronavirus

outbreak, and the business is operating just over a third of its pre-outbreak

timetabled mileage at present, sufficient to ensure that the community-critical

transportation network that it provides is maintained through the present

situation. Greyhound is well advanced in the processes to access the CARES Act

funding support in each state. 18 of these states already have pre-existing

arrangements where only small amendments to contracts are required before

Greyhound's submissions can be processed. Where new or additional arrangements

are required, Greyhound is working with the states to expedite this process.

As all North American schools are closed First Student is currently operating

no home-to-school and only minimal charter services. To date the division has

agreed terms to receive either full or partial payment from customers

representing c.70% of our bus fleet, based on which we presently anticipate

recovering c.53% of the home-to-school revenue expected prior to the crisis. A

number of customers have reduced the amount of revenue reimbursement to reflect

our ability to mitigate certain labour and fuel-related costs while no services

are running. Adjusting for this, our effective recovery rate is c.61% of our

pre-crisis expectations, based on the agreements reached with customers so far.

At this point First Transit's activity levels vary considerably between its

different sub-segments, but on average the division is operating at

approximately 60% of its activity levels prior to the outbreak. Of those

contracts with a material reduction in service, we have agreed terms to date

with the result that we currently expect to recover the equivalent of 75% of

the divisional revenue expected prior to the crisis.

Negotiations continue with many of our customers in First Student and First

Transit in light of the federal emergency funding that is now becoming

available to them and we anticipate that the revenue recovery levels will

increase further as a result.

Update on operations in the UK

First Bus is currently operating a level of service equivalent to approximately

40% of normal capacity, broadly in accordance with the industry-wide funding

support agreement with the UK Government announced on 3 April 2020. Passenger

volumes are approximately 90% lower but the agreement (coupled with other

commitments regarding continued payment of Bus Service Operator's Grant,

concessionary fares and contract tenders at pre-crisis levels) enables First

Bus to run mileage in excess of customer demand to support key workers' needs.

We welcome Transport for Scotland's commitment to maintain concessionary fares,

Bus Service Operators Grant and tender revenues through to March 2021 and the

Welsh Government's hardship fund for the bus sector.

All of the Group's First Rail franchises are operating under the Emergency

Measures Agreements announced on 23 March 2020, under which the Government has

waived each operator's revenue, cost and contingent capital risk until at least

20 September 2020 and during which time the operators will be paid a fixed

management fee. On 29 March 2020 we announced that our Hull Trains open access

business would suspend operations for an initial eight week period.

Cost control measures

In light of the very substantially reduced passenger volumes across all our

divisions, we continue to take proactive steps to prioritise cash flow. In

doing so, our objective is to protect the Group for the long term, while

ensuring we maintain critical services now and remain well positioned to raise

capacity rapidly when appropriate. Previously announced cost control measures

are now embedded, with a substantial proportion of our total workforce in North

America and the UK on furlough with the assistance of various government

schemes, and significant reductions in all non-essential operating and capital

expenditures. In certain areas it has been necessary to reduce headcount,

particularly where customers have chosen not to support employee retention by

maintaining some level of contractual payments during this time. The Group is

also utilising the tax payment holidays and other emergency measures announced

by governments to assist companies in managing their costs during this time.

The Chief Executive and Chief Financial Officer have volunteered to take a 20%

reduction in salaries for an initial period of three months, and the Chairman

and non-executive Board directors have volunteered a corresponding reduction in

their fees for the same initial period. In addition a wider group of senior

employees across the Group have made voluntary salary reductions and deferrals

for the same period.

First Bus pension schemes

Following a productive dialogue with the scheme trustees, the Group has

recently come to an agreement on the triennial valuation of the First Bus

defined benefit scheme on a funding basis as at 1 April 2019. An updated

deficit reduction profile for the scheme has also been agreed. Coupled with the

recent finalisation of the English Local Government Pensions Scheme ('LGPS')

valuations that First Bus is a party to, the Group's overall cash contribution

to pension schemes relating to the First Bus business has reduced by more than

GBP10m for the year to 31 March 2021 compared with the previous position, after

which the overall contribution requirements remain broadly in line with recent

years.

Corporate reporting

In light of the widely publicised challenges of completing audits during the

current crisis, the Group is intending to follow UK regulatory advice to review

our full year reporting timetable. The Group will not therefore be publishing

its full year results on 28 May or convening the Annual General Meeting ('AGM')

on 28 July as previously indicated. The Group will provide an update on its

reporting plans as soon as possible, following agreement with its auditors and

other advisers on an appropriate timetable.

Matthew Gregory, FirstGroup Chief Executive said:

"I am deeply saddened that the coronavirus pandemic has now tragically claimed

the lives of colleagues from within each of our five divisions in North America

and the UK. Their families, friends and co-workers have our heartfelt

condolences and support, and the thoughts of everyone at FirstGroup are with

all those affected by the global pandemic.

"I am extremely proud of our people who are working hard to support our

communities during this time of crisis, both by maintaining critical transport

services and by providing support in their communities to the most vulnerable.

"As an organisation we have taken rapid action to manage our costs, preserve

cash and protect the Group's financial position in order to ensure we are able

to deliver the continuity of transport that is so essential to governments,

local communities and our customers both now and once the present crisis is

overcome. The support we have received from governments and our customers is

testament to the importance of the services we provide. The long-term

fundamentals of our businesses remain sound, and we will continue to take all

necessary measures to ensure that the Group emerges from this unprecedented

situation in the most robust position possible to deliver our strategic plans."

Contacts at FirstGroup:

Faisal Tabbah, Head of Investor Relations

Stuart Butchers, Group Head of Communications

corporate.comms@firstgroup.com

Contacts at Brunswick PR:

Andrew Porter / Simone Selzer, Tel: +44 (0) 20 7404 5959

Notes

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 2.2. This announcement contains inside information. The person

responsible for arranging the release of this announcement on behalf of

FirstGroup is Keith Hubber, Group General Counsel and Company Secretary.

Figures presented in this announcement are not audited. Certain statements

included or incorporated by reference within this announcement may constitute

'forward-looking statements' with respect to the business, strategy and plans

of the Group and our current goals, assumptions and expectations relating to

our future financial condition, performance and results. By their nature,

forward-looking statements involve known and unknown risks, assumptions,

uncertainties and other factors that cause actual results, performance or

achievements of the Group to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. Shareholders are cautioned not to place undue reliance on the

forward-looking statements. Notwithstanding the mitigations and emergency

measures referred to above, the overall impact COVID-19 will have on the

financial performance and prospects of the Group in the near as well as the

medium to longer term remains extremely unclear. The situation is evolving very

rapidly and while every effort has been made to verify the accuracy of the

information in this announcement figures in this announcement that relate to

the current impact COVID-19 is having on the financial performance of the Group

should be treated with extra caution because of the difficulties in such a

fast-evolving situation of obtaining accurate and up-to-date data from across

the businesses in the Group. Except as required by the UK Listing Rules and

applicable law, the Group does not undertake any obligation to update or change

any forward-looking statements to reflect events occurring after the date of

this announcement.

END

(END) Dow Jones Newswires

April 24, 2020 02:00 ET (06:00 GMT)

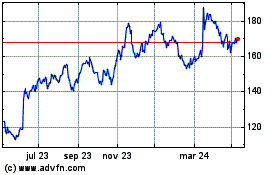

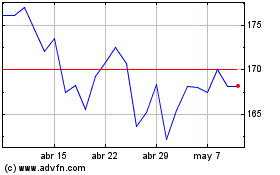

Firstgroup (LSE:FGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Firstgroup (LSE:FGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024