Dollar Mixed After ADP Private Payrolls Data

06 Mayo 2020 - 4:23AM

RTTF2

The U.S. dollar showed mixed performance against its key

counterparts in the European session on Wednesday, after a data

showed that the nation's private sector employment nosedived in

April.

Data from payroll processor ADP showed that private sector

employment plunged by 20.236 million jobs in April after slumping

by a revised 149,000 jobs in May.

Economists had expected employment to tumble by 20.050 million

jobs compared to the loss of 27,000 jobs originally reported for

the previous month.

Investors await U.S. non-farm payrolls data for April, due on

Friday. The economy is expected to lose over 21 million jobs as the

unemployment rate surges to 16.0 percent from 4.4 percent.

The currency showed mixed trading in the Asian session. While it

fell against the yen, it gained slightly against the euro, the

franc and the pound.

The greenback dropped to 106.06 against the yen, its lowest

level since March 17. The currency is seen finding support around

the 102.00 mark.

The greenback held steady against the euro, after rising to near

a 2-week high of 1.0782 at 6:00 am ET. The pair was worth 1.0837

when it ended deals on Tuesday.

Final survey results from IHS Markit showed that the euro area

private sector experienced a record downturn in April due to the

severe disruption caused by the coronavirus, or covid-19,

pandemic.

The composite output index slid to a new series low of 13.6 from

March's 29.7. The flash score was 13.5.

The greenback appreciated to near a 2-week high of 1.2358

against the pound and traded sideways thereafter. At Tuesday's

close, the pair was valued at 1.2431.

Survey data from IHS Markit showed that the UK construction

sector contracted at the sharpest pace since the survey began in

1997 amid site closures due to the coronavirus, or covid-19,

pandemic.

The IHS Markit/Chartered Institute of Procurement & Supply

construction Purchasing Managers' Index fell to 8.2 in April from

39.3 in March. A score below 50 indicates contraction. The expected

score was 22.0.

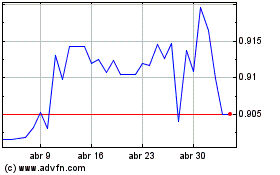

The greenback eased off to 0.9732 against the franc, from a

6-day high of 0.9759 set at 5:40 am ET. Next key support for the

greenback is likely seen around the 0.95 level.

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024