Frenkel Topping Group PLC Director/PDMR Shareholding (1190O)

27 Mayo 2020 - 9:08AM

UK Regulatory

TIDMFEN

RNS Number : 1190O

Frenkel Topping Group PLC

27 May 2020

Frenkel Topping Group plc

("Frenkel Topping" or "the Company")

Director/PDMR Dealing

Frenkel Topping (AIM: FEN), a specialist independent financial

advisor and asset manager focused on asset protection for

vulnerable clients, announces that the wife of Richard Fraser,

Chief Executive Officer of the Company, has sold 505,841 ordinary

shares of 0.5p each in the capital of the Company ("Ordinary

Shares") from her SIPP for tax planning purposes.

Following the sale of these shares Mr. Fraser and persons

closely associated ("PCAs") to him will be interested in 2,062,574

Ordinary Shares of the Company, representing approximately 2.73 per

cent. of the Company's issued share capital.

The information set out below is provided in accordance with the

requirements of Article 19(3) of the EU Market Abuse Regulation No

596/2014.

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Norma Fraser

-------------------------------- ------------------------------------------

2. Reason for the Notification

----------------------------------------------------------------------------

a) Position/status PCA of Richard Fraser, Chief Executive

Officer

-------------------------------- ------------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name Frenkel Topping Group plc

-------------------------------- ------------------------------------------

b) LEI 213800I5L3K7AT7A4R20

-------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

----------------------------------------------------------------------------

a) Description of the Financial Ordinary Shares

instrument, type of instrument

Identification code GB00B01YXQ71

-------------------------------- ------------------------------------------

b) Nature of the transaction Sale of Ordinary Shares

-------------------------------- ------------------------------------------

c) Price(s) and volume(s) Volume(s) Prices (pence)

205,841 36.38

---------------

-------------------------------- ------------------------------------------

d) Aggregated information:

* Aggregated volume 205,841 Ordinary Shares sold at 36.38

pence per Ordinary Share

* Price

-------------------------------- ------------------------------------------

e) Date of the transaction 26 May 2020

-------------------------------- ------------------------------------------

f) Place of the transaction London Stock Exchange, AIM Market (XLON)

-------------------------------- ------------------------------------------

1. Details of the person discharging managerial responsibilities

/ person closely associated

----------------------------------------------------------------------------

a) Name Norma Fraser

-------------------------------- ------------------------------------------

2. Reason for the Notification

----------------------------------------------------------------------------

a) Position/status PCA of Richard Fraser, Chief Executive

Officer

-------------------------------- ------------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name Frenkel Topping Group plc

-------------------------------- ------------------------------------------

b) LEI 213800I5L3K7AT7A4R20

-------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

----------------------------------------------------------------------------

a) Description of the Financial Ordinary Shares

instrument, type of instrument

Identification code GB00B01YXQ71

-------------------------------- ------------------------------------------

b) Nature of the transaction Sale of Ordinary Shares

-------------------------------- ------------------------------------------

c) Price(s) and volume(s) Volume(s) Prices (pence)

300,000 37.4063

---------------

-------------------------------- ------------------------------------------

d) Aggregated information:

* Aggregated volume 300,000 Ordinary Shares sold at 37.4063

pence per Ordinary Share

* Price

-------------------------------- ------------------------------------------

e) Date of the transaction 22 May 2020

-------------------------------- ------------------------------------------

f) Place of the transaction London Stock Exchange, AIM Market (XLON)

-------------------------------- ------------------------------------------

For further information:

Frenkel Topping Group plc www.frenkeltopping.co.uk

Richard Fraser, Chief Executive Officer Tel: 0161 886 8000

finnCap Ltd Tel: 020 7220 0500

Carl Holmes/James Thompson (Corporate Finance)

Tim Redfern / Richard Chambers (ECM)

frenkeltopping@tbcardew.com

TB Cardew

Tom Allison Tel: 0207 930 0777

Shan Shan Willenbrock

Olivia Rosser

About Frenkel Topping Group: www.frenkeltopping.co.uk

The financial services firm consists of Frenkel Topping Limited,

Ascencia Investment Management, Obiter Wealth Management and

Equatas Accountants.

The group of companies specialises in providing financial advice

and asset protection services to clients at times of financial

vulnerability, with particular expertise in the field of personal

injury and clinical negligence.

With more than 30 years' experience in the industry, Frenkel

Topping Group has earned a reputation for commercial astuteness

underpinned by a strong moral obligation to its clients, employees

and wider society, with a continued focus on its Environmental,

Social and Governance (ESG) impact.

Through its core business, Frenkel Topping Limited, the firm

supports litigators pre-settlement in achieving maximum damages, by

providing expert witness services, and post-settlement to achieve

the best long-term financial outcomes for clients after injury. It

boasts a client retention rate of 99%.

The Group's discretionary fund manager, Ascencia, provides

bespoke financial portfolios for clients in unique circumstances.

In recent years Ascencia has diversified its portfolios to include

a Sharia-law-compliant portfolio and a number of ESG portfolios in

response to increased interest in socially responsible investing

(SRI).

Obiter provides a generalist wealth management service -

including advice on Savings; Tax planning; Life Insurance; Critical

Illness and Income protection; Endowment advice and Keyman

Insurance, with a particular specialism in financial advice on

pensions and pension sharing orders for the clients of divorce and

family lawyers. Obiter applies the same core principles of honesty,

transparency, responsibility and reliability to individuals,

regardless of background or situation.

In 2019, Frenkel Topping launched its accountancy arm, Equatas ,

to assist clients with tax planning and move closer to providing a

full end-to-end service under the Group brand, improving the

experience for clients and maintaining the Group's standards

throughout the client journey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHZDLFLBELBBBE

(END) Dow Jones Newswires

May 27, 2020 10:08 ET (14:08 GMT)

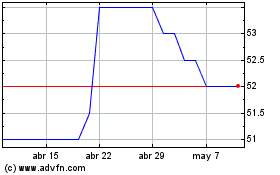

Frenkel Topping (LSE:FEN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Frenkel Topping (LSE:FEN)

Gráfica de Acción Histórica

De May 2023 a May 2024