Princess Private Equity Holding Ltd New Investment Management Agreement (2099U)

28 Julio 2020 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 2099U

Princess Private Equity Holding Ltd

28 July 2020

News Release

Guernsey, 28 July 2020

Princess Private Equity Holding Limited ("Princess" or "the

Company") announces it has entered into a new Investment Management

Agreement ("the new IMA") with Partners Group AG ("the Investment

Manager") with effect from 1 July 2020. The agreement replaces the

previous agreement (the "Original IMA") with Princess Management

Limited ("PML"), a wholly owned subsidiary of Partners Group AG,

under which PML had engaged Partners Group to provide investment

services to the Company under a separate investment advisory

agreement.

The key terms of the new IMA are as follows:

Management fees: In consideration of the investment services

provided by the Investment Manager, the company shall pay to the

Investment Manager a management fee equal to 0.375% per quarter of

the Private Equity Asset Value, being the higher of (i) the

Company's net asset value and (ii) the value of the Company's

assets less any temporary investments made for the purposes of

liquidity management, plus the amount of unfunded commitments.

In order to achieve its investment objective the Company may

make commitments to investment programs or other pooling vehicles

(collectively "Pooling Vehicles") managed by the Investment Manager

or its affiliates. For the purposes of calculating the value of the

Company's assets and unfunded commitments, the Company's pro rata

share of investments and commitments made by such Pooling Vehicles

is included, but the Company's commitments to invest in such

Pooling Vehicles are excluded.

The rate of 0.375% per quarter remains unchanged compared to the

Original IMA. However, the definition of Private Equity Asset Value

excludes two items which were included under the Original IMA,

thereby reducing the Management fees that would have been payable

by the Company under the Original IMA:

i) Unfunded commitments in respect of Primary and Secondary investments are excluded.

ii) For the purposes of liquidity management, the Company may

invest in the open-ended Partners Group Global Senior Loan Master

Fund SICAV managed by the Investment Manager. Under the New IMA,

investments in the Partners Group Global Senior Loan Master Fund

are excluded from the definition of Private Equity Asset Value.

Instead, they incur a lower effective management fee of 0.6% per

annum.

Incentive fees: Incentive fees remain unchanged compared to the

Original IMA. For Direct and Secondary investments, the Investment

Advisor shall receive 15% and 10% per Direct and Secondary

investment respectively, whether or not such investments are made

through a Pooling Vehicle, subject in each case to an 8% preferred

return for the Company.

For the avoidance of doubt, no second layer of Management or

Incentive fees is payable by the Company in respect of any

commitments to Pooling Vehicles managed by the Investment Manager

or its affiliates.

Termination: The agreement will remain in effect for an initial

term of two calendar years (the "Initial Term"), and thereupon may

be terminated by either party at the end of the Initial Term and

each calendar year thereafter upon two years' prior written notice

by either party. The existing term of the Original IMA

automatically renews every ten years, with a three-year notice

period.

Richard Battey, Chairman, comments "Following a review by the

Company's Management Engagement Committee, the Board is pleased to

have agreed a new Investment Management Agreement on improved

terms, which it believes is aligned with the interests of

shareholders. Partners Group, the Investment Manager, is a

well-established investor in private equity with a global team of

over 100 direct private equity professionals including local

investment teams, in-house operators and Industry Value Creation

specialists who bring significant sector experience and help to

create value in portfolio companies. An investment in the Company

enables shareholders to invest alongside the Investment Manager's

institutional clients and to access a global portfolio of leading

private companies that would otherwise not be accessible to

investors in public equity markets."

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is advised in its investment

activities by Partners Group, a global private markets investment

management firm with EUR 96 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about, and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGREDLFLBDLBBBX

(END) Dow Jones Newswires

July 28, 2020 02:00 ET (06:00 GMT)

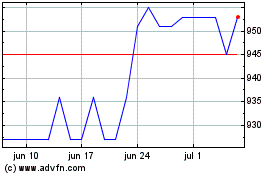

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

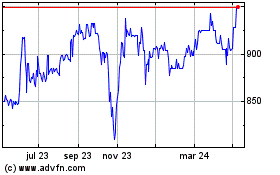

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024